Key Insights

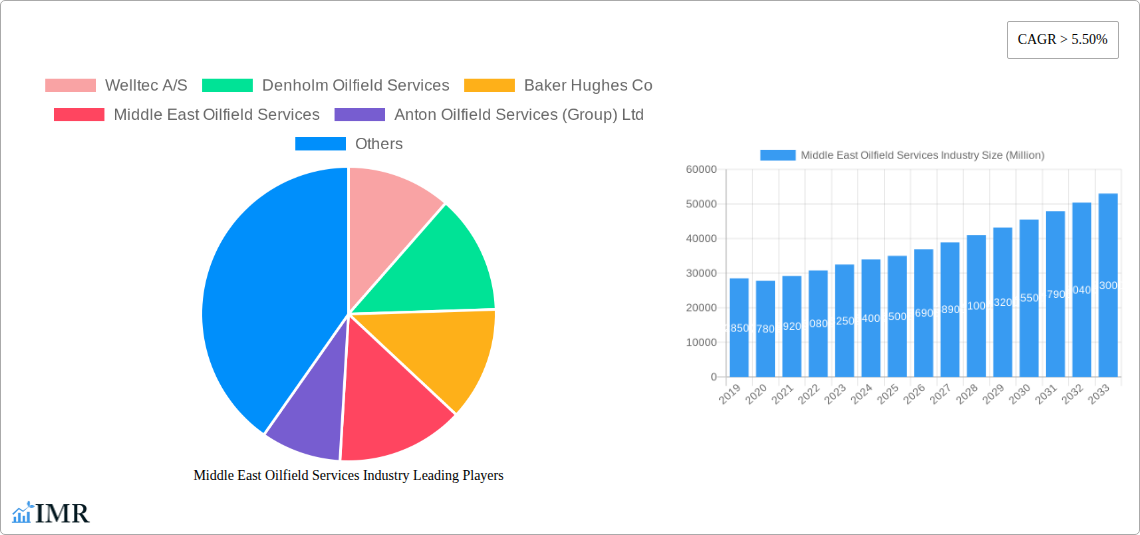

The Middle East oilfield services market is projected for substantial growth, with an estimated market size of $204.53 billion by 2025. The market is expected to witness a Compound Annual Growth Rate (CAGR) of 5.5% through 2033. This expansion is driven by continued upstream investments in exploration and production (E&P) activities across the region, essential for meeting global energy demands and leveraging extensive hydrocarbon reserves. Key growth factors include the demand for Enhanced Oil Recovery (EOR) to optimize output from existing fields, the exploration of new reserves, and the integration of advanced technologies like digital oilfield solutions and automation for enhanced operational efficiency and cost reduction. The region's commitment to maintaining and increasing production capacity, supported by favorable government policies, further solidifies this positive market outlook.

Middle East Oilfield Services Industry Market Size (In Billion)

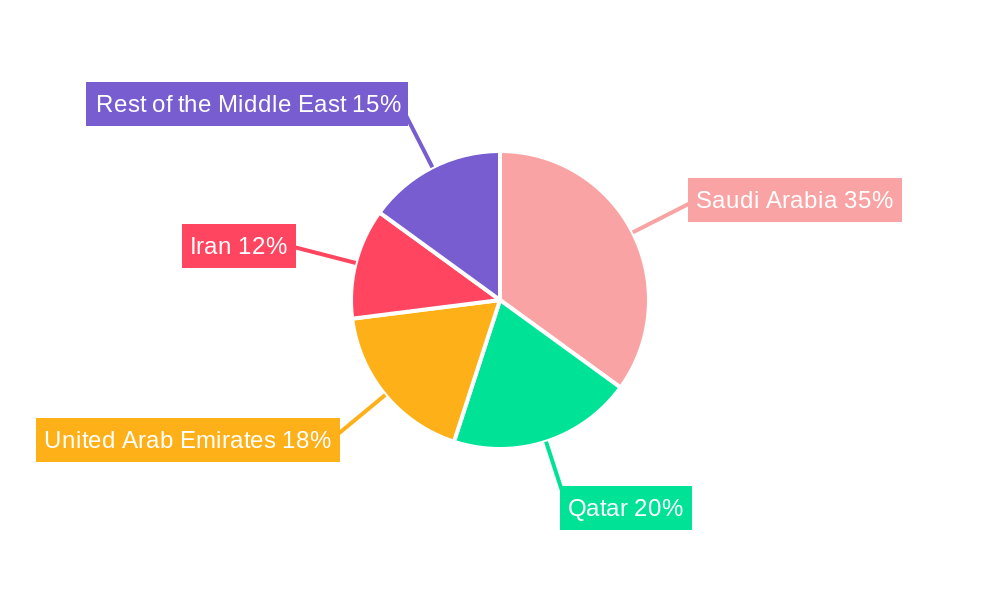

The market encompasses a variety of services, with Drilling Services and Completion and Production Services anticipated to hold significant shares due to their integral role in the oil and gas value chain. Emerging trends include a heightened focus on sustainable oilfield practices, the adoption of artificial intelligence (AI) and machine learning (ML) for predictive maintenance and reservoir management, and an increasing need for specialized services such as drilling waste management to adhere to environmental regulations. While opportunities abound, potential challenges include volatile oil prices, geopolitical instability, and the global energy transition towards renewables, which may impact long-term investment. Geographically, Saudi Arabia is expected to lead the market, followed by key producers like Qatar and the United Arab Emirates, driven by their significant oil and gas reserves and ongoing development initiatives.

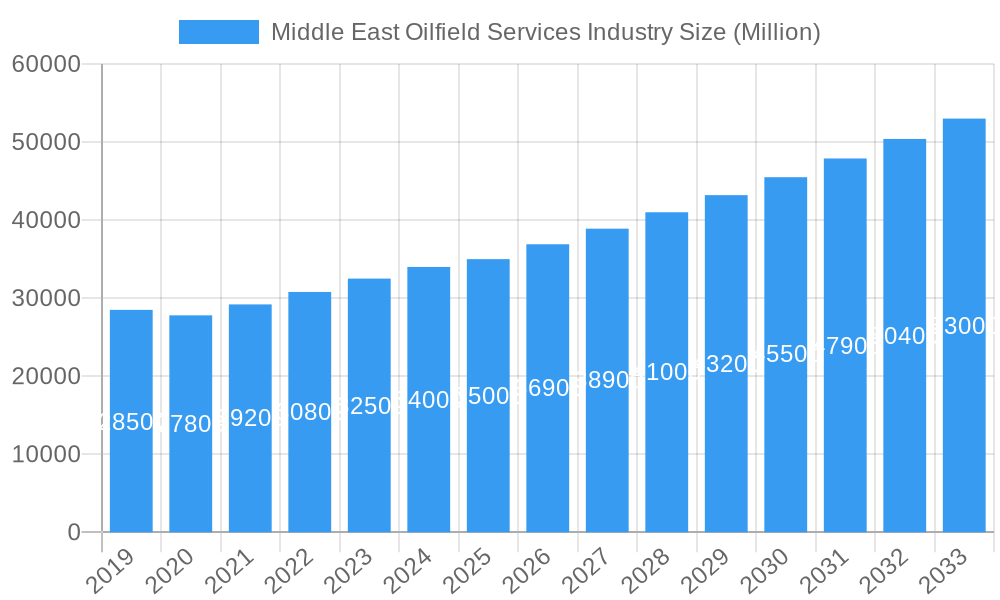

Middle East Oilfield Services Industry Company Market Share

Middle East Oilfield Services Market Report: Strategic Insights & Forecasts (2019-2033)

This comprehensive report offers an in-depth analysis of the Middle East Oilfield Services industry, providing critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and future outlook. With a study period spanning 2019–2033 and a base year of 2025, this report leverages extensive data and expert analysis to equip stakeholders with the knowledge needed to navigate this dynamic sector. We delve into parent and child market segments, offering a granular understanding of opportunities and competitive landscapes across crucial service types and geographical locations. All values are presented in million units.

Middle East Oilfield Services Industry Market Dynamics & Structure

The Middle East oilfield services market is characterized by a moderate to high level of concentration, with major global players and key regional entities vying for market share. Technological innovation is a primary driver, with continuous advancements in drilling techniques, data analytics, and automation aimed at enhancing efficiency and reducing operational costs. Regulatory frameworks, particularly those focusing on local content development and environmental standards, significantly shape market entry and operational strategies. Competitive product substitutes, while present, are often outpaced by the specialized and integrated solutions offered by established oilfield service providers. End-user demographics are dominated by national oil companies (NOCs) and international oil companies (IOCs) with substantial upstream investments. Mergers and acquisitions (M&A) are a recurring trend, driven by the desire for expanded service portfolios, geographic reach, and economies of scale.

- Market Concentration: Dominated by a few large, integrated service providers with a significant share, alongside a growing number of specialized niche players.

- Technological Innovation Drivers: Focus on digital transformation, AI-driven analytics, advanced drilling technologies (e.g., managed pressure drilling), and environmentally friendly solutions.

- Regulatory Frameworks: Increasing emphasis on local content policies, nationalization initiatives, and stringent environmental regulations.

- Competitive Product Substitutes: Limited, due to the highly specialized nature of oilfield services, but continuous improvement in efficiency and cost-effectiveness is key.

- End-User Demographics: Primarily large NOCs and IOCs with extensive exploration and production activities.

- M&A Trends: Strategic acquisitions to enhance service offerings, gain market access, and consolidate market positions. Anticipated M&A activity volume for the forecast period: 15-20 significant deals.

Middle East Oilfield Services Industry Growth Trends & Insights

The Middle East oilfield services industry is poised for robust growth, driven by sustained upstream investments in hydrocarbon exploration and production. The market size evolution is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025–2033). Adoption rates of advanced technologies, including digital oilfield solutions and AI-powered analytics, are rapidly increasing as companies strive for operational optimization and enhanced recovery rates. Technological disruptions, such as the development of more efficient and environmentally sustainable drilling fluids and waste management systems, are reshaping service offerings. Consumer behavior shifts are evident, with a growing preference for integrated service providers capable of delivering end-to-end solutions, from exploration to production and decommissioning.

The market penetration of specialized services like advanced formation evaluation and automated drilling operations is expected to surge. Historical data from 2019–2024 indicates a steady recovery and subsequent growth phase following market fluctuations. The estimated market size for 2025 is approximately USD 25,000 Million. Projections for the forecast period suggest a market size that could reach USD 42,000 Million by 2033, reflecting substantial expansion. This growth is underpinned by the region's vast hydrocarbon reserves and the ongoing strategic initiatives by governments to bolster energy production and diversification. The increasing demand for enhanced oil recovery (EOR) techniques further contributes to the growth of specialized completion and production services.

Dominant Regions, Countries, or Segments in Middle East Oilfield Services Industry

Saudi Arabia stands as the dominant country within the Middle East oilfield services industry, driven by its unparalleled oil reserves and significant ongoing investments in upstream activities. The Kingdom's strategic vision to maintain its position as a leading global energy supplier necessitates continuous exploration, development, and production, directly fueling demand for a wide array of oilfield services. Onshore operations represent the largest segment by location, accounting for a substantial portion of the service market due to the vast land-based hydrocarbon fields.

Among the service types, Drilling Services consistently emerge as the leading segment. This is intrinsically linked to the fundamental need for well construction and exploration to access hydrocarbon resources. The scale of drilling operations in Saudi Arabia, coupled with the deployment of advanced drilling technologies, makes this segment a powerhouse. The Rest of the Middle-East, encompassing countries like Kuwait, Oman, and Bahrain, collectively forms another significant market, contributing to the overall regional demand.

- Dominant Country: Saudi Arabia. Its extensive oil reserves, substantial production targets, and commitment to technological advancement in exploration and extraction make it the primary market.

- Key Drivers: Massive exploration and production (E&P) investments by Saudi Aramco; government initiatives for energy security and export maximization; significant pipeline of new field developments.

- Market Share: Estimated at 40-45% of the total Middle East oilfield services market.

- Growth Potential: High, driven by ongoing mega-projects and the pursuit of enhanced oil recovery.

- Dominant Location: Onshore. The prevalence of vast land-based oil fields, particularly in Saudi Arabia and the UAE, dictates a larger share for onshore services.

- Key Drivers: Accessibility and scale of onshore fields; development of unconventional resources; established onshore infrastructure.

- Market Share: Estimated at 55-60% of the total market.

- Dominant Service Type: Drilling Services. Essential for all upstream operations, encompassing exploration, development, and workover wells.

- Key Drivers: Continuous need for new well drilling and intervention; advancements in drilling technology (e.g., directional drilling, high-pressure/high-temperature wells); demand for efficient and cost-effective drilling solutions.

- Market Share: Estimated at 25-30% of the total market.

- Other Significant Regions: United Arab Emirates (UAE) and Qatar demonstrate strong market presence, driven by their own significant hydrocarbon reserves and ambitious production goals.

- UAE Drivers: ADNOC's strategic investment programs, focus on expanding production capacity, and significant offshore and onshore development projects.

- Qatar Drivers: Continued investment in LNG production and associated upstream services, though with a more specific focus compared to crude oil.

Middle East Oilfield Services Industry Product Landscape

The product landscape within the Middle East oilfield services industry is characterized by a relentless pursuit of efficiency, safety, and environmental sustainability. Innovations are focused on advanced drilling fluids designed for extreme conditions, sophisticated formation evaluation tools leveraging AI and machine learning for faster, more accurate reservoir characterization, and intelligent completion systems that enable real-time production optimization. Drilling waste management services are also seeing advancements, with technologies aimed at minimizing environmental impact and maximizing resource recovery from cuttings. Unique selling propositions often lie in integrated digital solutions that provide end-to-end data management and predictive maintenance capabilities, enhancing operational uptime and reducing costs.

Key Drivers, Barriers & Challenges in Middle East Oilfield Services Industry

Key Drivers:

- Sustained Global Energy Demand: The Middle East's vast hydrocarbon reserves continue to be crucial for global energy supply, driving consistent upstream investment.

- Technological Advancements: Innovations in drilling, completion, and production technologies are enhancing efficiency and unlocking new reserves.

- Government Support and Investment: National oil companies in the region are heavily investing in expanding production capacity and modernizing infrastructure.

- Focus on Enhanced Oil Recovery (EOR): Mature fields necessitate EOR techniques, driving demand for specialized services and technologies.

Barriers & Challenges:

- Price Volatility of Crude Oil: Fluctuations in global oil prices can impact investment decisions and project timelines.

- Geopolitical Instability: Regional geopolitical tensions can create uncertainty and disrupt supply chains.

- Talent Acquisition and Retention: A shortage of skilled labor, particularly specialized engineers and technicians, can hinder growth.

- Stringent Environmental Regulations: Increasing focus on environmental protection necessitates investment in greener technologies and practices, adding to operational costs.

- Supply Chain Disruptions: Global supply chain issues can affect the availability of essential equipment and spare parts, leading to project delays.

Emerging Opportunities in Middle East Oilfield Services Industry

Emerging opportunities in the Middle East oilfield services industry are primarily centered around the adoption of digital transformation and sustainability initiatives. The growing demand for data analytics, AI-driven insights for reservoir management, and the development of carbon capture, utilization, and storage (CCUS) technologies present significant growth avenues. Furthermore, the increasing focus on offshore exploration and production, particularly in deeper waters, opens doors for specialized subsea services and advanced marine support. Untapped markets within certain geographical sub-regions of the Middle East, coupled with the potential for localized manufacturing and service hubs, offer further avenues for expansion. The development of unconventional resources also presents a burgeoning opportunity for specialized hydraulic fracturing and stimulation services.

Growth Accelerators in the Middle East Oilfield Services Industry Industry

Long-term growth in the Middle East oilfield services industry will be significantly accelerated by continued investment in digital transformation and the adoption of Industry 4.0 principles. Breakthroughs in automation, remote operations, and the integration of IoT devices will enhance operational efficiency and safety. Strategic partnerships between global service providers and national oil companies will foster knowledge transfer and the development of localized expertise. Market expansion strategies, including a focus on unconventional resources and the development of integrated service models, will also act as key accelerators. The ongoing diversification of energy portfolios in the region, while a long-term trend, also presents opportunities for service providers to adapt and offer solutions related to renewable energy infrastructure development and management, leveraging existing project management expertise.

Key Players Shaping the Middle East Oilfield Services Industry Market

- Schlumberger Limited

- Baker Hughes Co

- Halliburton Company

- Weatherford International PLC

- Welltec A/S

- Denholm Oilfield Services

- Swire Oilfield Services Ltd

- Anton Oilfield Services (Group) Ltd

- OiLServ Limited

- Middle East Oilfield Services

Notable Milestones in Middle East Oilfield Services Industry Sector

- November 2022: Abu Dhabi National Oil Company (ADNOC) awarded three oilfield services contracts to ADNOC drilling, Schlumberger NV, and Halliburton Co., respectively, to increase the production capacity of 5 million barrels per day for both onshore and offshore operations by 2030. This signifies a major commitment to capacity expansion and highlights the importance of key service providers.

- October 2022: Weatherford International PLC signed a contract with Saudi Aramco to provide drilling and intervention services for the company's oil and gas operations. The agreement, covering the entire planning and execution by Weatherford for 45 wells per year over three years, underscores the company's significant role in Saudi Arabia's upstream sector.

- September 2022: Weatherford International PLC announced a five-year contract to provide oilfield services for Abu Dhabi National Oil Company (ADNOC). This contract for directional drilling and logging while drilling (LWD) services in the UAE demonstrates Weatherford's strengthened presence in a key regional market.

In-Depth Middle East Oilfield Services Industry Market Outlook

The future market outlook for the Middle East oilfield services industry is exceptionally promising, driven by sustained investments in exploration and production, coupled with a strategic push towards technological innovation and operational efficiency. Growth accelerators will include the widespread adoption of digital solutions, enhancing reservoir management and operational performance. Furthermore, the region's commitment to meeting global energy demands will continue to fuel demand for advanced drilling, completion, and production services. Strategic partnerships and the development of local content will further bolster growth, creating a robust ecosystem for service providers. The increasing emphasis on sustainability will also spur opportunities in environmentally conscious service offerings and the exploration of new energy ventures.

Middle East Oilfield Services Industry Segmentation

-

1. Service Type

- 1.1. Drilling Services

- 1.2. Drilling and Completion Fluids

- 1.3. Formation Evaluation

- 1.4. Completion and Production Services

- 1.5. Drilling Waste Management Services

- 1.6. Other Services

-

2. Location

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. Qatar

- 3.3. United Arab Emirates

- 3.4. Iran

- 3.5. Rest of the Middle-East

Middle East Oilfield Services Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. Qatar

- 3. United Arab Emirates

- 4. Iran

- 5. Rest of the Middle East

Middle East Oilfield Services Industry Regional Market Share

Geographic Coverage of Middle East Oilfield Services Industry

Middle East Oilfield Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Proven Shale Gas Reserves 4.; Technological Advancement in Horizontal Drilling and Hydraulic Fracturing

- 3.3. Market Restrains

- 3.3.1. 4.; High Exploration Cost

- 3.4. Market Trends

- 3.4.1. Completion and Production Services Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Oilfield Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Drilling Services

- 5.1.2. Drilling and Completion Fluids

- 5.1.3. Formation Evaluation

- 5.1.4. Completion and Production Services

- 5.1.5. Drilling Waste Management Services

- 5.1.6. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. Qatar

- 5.3.3. United Arab Emirates

- 5.3.4. Iran

- 5.3.5. Rest of the Middle-East

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. Qatar

- 5.4.3. United Arab Emirates

- 5.4.4. Iran

- 5.4.5. Rest of the Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Saudi Arabia Middle East Oilfield Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Drilling Services

- 6.1.2. Drilling and Completion Fluids

- 6.1.3. Formation Evaluation

- 6.1.4. Completion and Production Services

- 6.1.5. Drilling Waste Management Services

- 6.1.6. Other Services

- 6.2. Market Analysis, Insights and Forecast - by Location

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. Qatar

- 6.3.3. United Arab Emirates

- 6.3.4. Iran

- 6.3.5. Rest of the Middle-East

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Qatar Middle East Oilfield Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Drilling Services

- 7.1.2. Drilling and Completion Fluids

- 7.1.3. Formation Evaluation

- 7.1.4. Completion and Production Services

- 7.1.5. Drilling Waste Management Services

- 7.1.6. Other Services

- 7.2. Market Analysis, Insights and Forecast - by Location

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. Qatar

- 7.3.3. United Arab Emirates

- 7.3.4. Iran

- 7.3.5. Rest of the Middle-East

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. United Arab Emirates Middle East Oilfield Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Drilling Services

- 8.1.2. Drilling and Completion Fluids

- 8.1.3. Formation Evaluation

- 8.1.4. Completion and Production Services

- 8.1.5. Drilling Waste Management Services

- 8.1.6. Other Services

- 8.2. Market Analysis, Insights and Forecast - by Location

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. Qatar

- 8.3.3. United Arab Emirates

- 8.3.4. Iran

- 8.3.5. Rest of the Middle-East

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Iran Middle East Oilfield Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Drilling Services

- 9.1.2. Drilling and Completion Fluids

- 9.1.3. Formation Evaluation

- 9.1.4. Completion and Production Services

- 9.1.5. Drilling Waste Management Services

- 9.1.6. Other Services

- 9.2. Market Analysis, Insights and Forecast - by Location

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. Qatar

- 9.3.3. United Arab Emirates

- 9.3.4. Iran

- 9.3.5. Rest of the Middle-East

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Rest of the Middle East Middle East Oilfield Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Drilling Services

- 10.1.2. Drilling and Completion Fluids

- 10.1.3. Formation Evaluation

- 10.1.4. Completion and Production Services

- 10.1.5. Drilling Waste Management Services

- 10.1.6. Other Services

- 10.2. Market Analysis, Insights and Forecast - by Location

- 10.2.1. Onshore

- 10.2.2. Offshore

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. Qatar

- 10.3.3. United Arab Emirates

- 10.3.4. Iran

- 10.3.5. Rest of the Middle-East

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Welltec A/S

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Denholm Oilfield Services

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Baker Hughes Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Middle East Oilfield Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Anton Oilfield Services (Group) Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OiLServ Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Halliburton Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Weatherford International PLC*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Swire Oilfield Services Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Schlumberger Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Welltec A/S

List of Figures

- Figure 1: Middle East Oilfield Services Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East Oilfield Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East Oilfield Services Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Middle East Oilfield Services Industry Revenue billion Forecast, by Location 2020 & 2033

- Table 3: Middle East Oilfield Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Middle East Oilfield Services Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East Oilfield Services Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: Middle East Oilfield Services Industry Revenue billion Forecast, by Location 2020 & 2033

- Table 7: Middle East Oilfield Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Middle East Oilfield Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Middle East Oilfield Services Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 10: Middle East Oilfield Services Industry Revenue billion Forecast, by Location 2020 & 2033

- Table 11: Middle East Oilfield Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Middle East Oilfield Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Middle East Oilfield Services Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 14: Middle East Oilfield Services Industry Revenue billion Forecast, by Location 2020 & 2033

- Table 15: Middle East Oilfield Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Middle East Oilfield Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Middle East Oilfield Services Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 18: Middle East Oilfield Services Industry Revenue billion Forecast, by Location 2020 & 2033

- Table 19: Middle East Oilfield Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Middle East Oilfield Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Middle East Oilfield Services Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 22: Middle East Oilfield Services Industry Revenue billion Forecast, by Location 2020 & 2033

- Table 23: Middle East Oilfield Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Middle East Oilfield Services Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Oilfield Services Industry?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Middle East Oilfield Services Industry?

Key companies in the market include Welltec A/S, Denholm Oilfield Services, Baker Hughes Co, Middle East Oilfield Services, Anton Oilfield Services (Group) Ltd, OiLServ Limited, Halliburton Company, Weatherford International PLC*List Not Exhaustive, Swire Oilfield Services Ltd, Schlumberger Limited.

3. What are the main segments of the Middle East Oilfield Services Industry?

The market segments include Service Type, Location, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.53 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Proven Shale Gas Reserves 4.; Technological Advancement in Horizontal Drilling and Hydraulic Fracturing.

6. What are the notable trends driving market growth?

Completion and Production Services Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Exploration Cost.

8. Can you provide examples of recent developments in the market?

November 2022: Abu Dhabi National Oil Company (ADNOC) awarded three oilfield services contracts to ADNOC drilling, Schlumberger NV, and Halliburton Co., respectively, to increase the production capacity of 5 million barrels per day for both onshore and offshore operations by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Oilfield Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Oilfield Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Oilfield Services Industry?

To stay informed about further developments, trends, and reports in the Middle East Oilfield Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence