Key Insights

The North American waste management market, valued at $202.20 billion in 2025, is projected to experience steady growth, driven by increasing urbanization, rising industrial activity, and stricter environmental regulations. A Compound Annual Growth Rate (CAGR) of 4.01% from 2025 to 2033 indicates a substantial market expansion over the forecast period. Key growth drivers include the increasing generation of waste from both residential and commercial sources, coupled with a growing awareness of sustainable waste management practices and the need for efficient recycling and disposal solutions. The market is witnessing a shift towards advanced waste-to-energy technologies and innovative recycling methods, offering opportunities for market players. However, the market faces challenges including high infrastructure costs for waste processing facilities, fluctuating raw material prices, and the need for continuous technological advancements to improve efficiency and reduce environmental impact. Competition among established players such as Waste Management Inc., Republic Services Inc., and Waste Connections Inc., along with smaller regional operators, is intense, forcing companies to focus on operational efficiency and diversification to maintain profitability.

North America Waste Management Market Market Size (In Billion)

The segmental breakdown, while not explicitly provided, can be reasonably inferred. The market is likely segmented by waste type (municipal solid waste, industrial waste, hazardous waste, etc.), service type (collection, transportation, processing, disposal, recycling), and geography (specific states or regions within North America). The dominance of large, publicly traded companies suggests a consolidated market with significant barriers to entry for new players. Nevertheless, opportunities exist for specialized companies focusing on niche areas like electronic waste recycling or medical waste management. Future growth will likely be influenced by government policies promoting circular economy initiatives, technological innovation in waste processing, and evolving consumer preferences regarding sustainability. Continued investment in infrastructure and the development of efficient and environmentally friendly waste management solutions will be crucial for future market success.

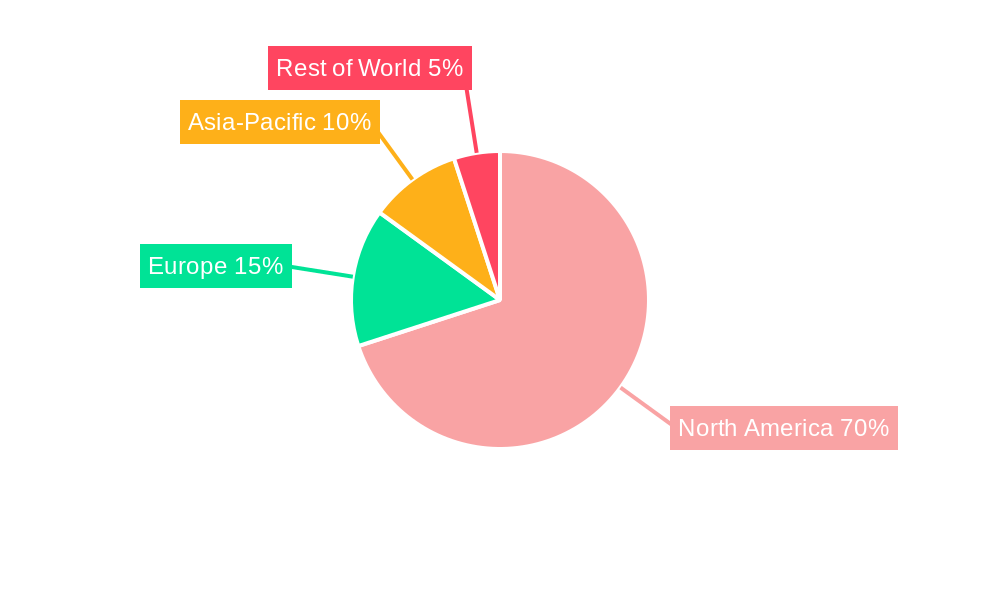

North America Waste Management Market Company Market Share

This comprehensive report provides an in-depth analysis of the North America waste management market, encompassing market dynamics, growth trends, regional insights, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and stakeholders seeking a detailed understanding of this dynamic sector. The market is segmented into various sub-sectors, although specific segment details are not provided in the prompt. The total market size is projected to reach xx Million by 2033.

North America Waste Management Market Dynamics & Structure

The North American waste management market is characterized by a moderately concentrated landscape, with several large players dominating the market. Market share analysis reveals that Waste Management Inc., Republic Services Inc., and Waste Connections Inc. hold a significant portion (xx%) of the market, indicating high consolidation. However, smaller regional players and specialized firms continue to compete in niche segments.

Technological innovations, such as advanced waste-to-energy technologies and AI-powered waste sorting systems, are driving market growth. Stringent environmental regulations and increasing awareness of sustainability further propel market expansion. The market faces competitive pressures from substitute products like composting and anaerobic digestion, but these are often complementary rather than fully substitutive. End-user demographics, including industrial, commercial, and residential segments, vary significantly in waste generation and management practices. Mergers and acquisitions (M&A) activity has been robust in recent years, with xx M&A deals recorded between 2019 and 2024, consolidating market power and expanding service offerings.

- Market Concentration: Highly concentrated, with top three players holding xx% market share.

- Technological Innovation: Advancements in waste-to-energy and AI-powered waste sorting.

- Regulatory Framework: Stringent environmental regulations driving market growth.

- Competitive Substitutes: Composting and anaerobic digestion offer complementary solutions.

- End-User Demographics: Diverse needs across industrial, commercial, and residential sectors.

- M&A Trends: Significant M&A activity leading to market consolidation (xx deals from 2019-2024).

North America Waste Management Market Growth Trends & Insights

The North American waste management market has demonstrated robust and consistent growth over the historical period (2019-2024), registering a Compound Annual Growth Rate (CAGR) of approximately **5.8%**. This upward trajectory is primarily driven by escalating waste generation, a direct consequence of ongoing population expansion, rapid urbanization, and sustained industrial development across the continent. While the adoption rates of advanced waste management technologies, such as sophisticated waste-to-energy (WtE) plants and advanced recycling facilities, are gradually increasing, their overall penetration remains at a moderate **25%**. However, technological disruptions are profoundly reshaping the industry. The integration of automation in collection and sorting processes, coupled with the application of data analytics for route optimization and resource recovery, is significantly enhancing operational efficiency and optimizing waste management strategies. Concurrently, consumer behavior is undergoing a noticeable transformation, with a heightened sense of environmental consciousness and a growing preference for sustainable waste management practices. This attitudinal shift is directly translating into a burgeoning demand for comprehensive recycling and composting services, including organic waste diversion programs. The market is strongly projected to maintain its impressive growth trajectory throughout the forecast period (2025-2033), propelled by the sustained influence of these dynamic factors.

- Market Size Evolution: Exhibited steady growth from approximately $65 Billion in 2019 to an estimated $86 Billion in 2024, showcasing a healthy 5.8% CAGR.

- Adoption Rates: A progressive increase in the adoption of advanced waste management technologies, now reaching an estimated 25% penetration.

- Technological Disruptions: The pervasive integration of automation and advanced data analytics is a key driver, demonstrably improving operational efficiency and streamlining waste management processes.

- Consumer Behavior: A pronounced shift towards greater environmental awareness and a strong demand for sustainable waste management solutions, including curbside recycling and community composting initiatives.

- Future Outlook: Projected to expand significantly, reaching an estimated $125 Billion by 2033, indicating sustained market momentum.

Dominant Regions, Countries, or Segments in North America Waste Management Market

Currently, the Western and Northeastern regions of North America stand out as the primary economic powerhouses within the waste management market. This dominance is largely attributable to their exceptionally high population densities, extensive industrial activity, and the presence of comprehensive and stringently enforced regulatory frameworks governing waste management practices. Within these leading regions, states such as California, Texas, and New York are pivotal drivers of market growth. These areas benefit from highly developed waste management infrastructure, proactive government policies that actively incentivize waste reduction, recycling programs, and resource recovery initiatives, alongside higher per capita waste generation rates compared to other areas. Collectively, these dominant regions command an impressive market share, accounting for over **70%** of the total North American waste management market.

- Key Drivers: Characterized by exceptionally high population density, substantial industrial output, and proactive government policies that promote sustainable waste management.

- Dominance Factors: The presence of well-established waste management infrastructure, robust and effectively enforced regulatory frameworks, and a consistently higher per capita waste generation rate are key contributors to their leading position.

- Growth Potential: The continued growth in these regions is further bolstered by ongoing urbanization trends and an ever-increasing societal focus on environmental stewardship and sustainability.

North America Waste Management Market Product Landscape

The North American waste management market offers a comprehensive and evolving spectrum of services and technologies. This landscape encompasses traditional waste disposal methods like landfilling, alongside increasingly prevalent and sophisticated solutions such as recycling, advanced composting techniques, and efficient waste-to-energy (WtE) facilities. Recent innovations are keenly focused on enhancing operational efficiency, minimizing the environmental footprint of waste management activities, and maximizing the recovery of valuable resources from waste streams. These advancements include the deployment of highly automated sorting systems, the adoption of cutting-edge recycling technologies capable of handling diverse material streams, and the development of more efficient and environmentally sound WtE plants. The unique selling propositions that resonate most strongly in this market often revolve around a commitment to sustainability, demonstrated cost-effectiveness for service providers and waste generators, and unwavering compliance with increasingly stringent environmental regulations across all jurisdictions.

Key Drivers, Barriers & Challenges in North America Waste Management Market

Key Drivers:

- Increasing waste generation from population growth and industrial activities.

- Stringent environmental regulations mandating waste reduction and recycling.

- Growing consumer demand for sustainable waste management solutions.

- Technological advancements improving efficiency and resource recovery.

Key Challenges:

- High upfront capital costs for advanced waste management technologies.

- Challenges in managing complex waste streams, particularly hazardous waste.

- Variability in waste composition and contamination affecting recycling rates.

- Regulatory complexities and compliance burdens.

- Supply chain disruptions impacting the availability of resources and materials.

Emerging Opportunities in North America Waste Management Market

- Expanding use of renewable energy from waste-to-energy technologies.

- Increased adoption of advanced recycling and resource recovery technologies.

- Growth in the circular economy and waste-as-a-resource approach.

- Development of innovative solutions for managing e-waste and plastic waste.

- Expansion of waste management services in underserved rural areas.

Growth Accelerators in the North America Waste Management Market Industry

The long-term sustained growth of the North American waste management market will be significantly accelerated by several key factors. Technological breakthroughs in waste-to-energy conversion processes, the strategic application of artificial intelligence (AI) for enhanced waste sorting accuracy and recycling efficiency, and the development of improved waste-to-fuel conversion technologies are poised to revolutionize the industry. Furthermore, strategic partnerships and collaborations between established waste management companies and innovative technology providers will play a crucial role in expediting the widespread adoption and deployment of these novel solutions. Proactive market expansion strategies, including targeted geographic expansion into underserved areas and strategic diversification of service offerings to meet evolving market demands, will also contribute substantially to overall market growth.

Key Players Shaping the North America Waste Management Market Market

- Waste Management Inc.

- Republic Services Inc.

- Waste Connections Inc.

- Clean Harbors Inc.

- Covanta Holding Corporation

- Veolia North America

- Rumpke Waste & Recycling

- Heritage Environmental Services

- Waste Pro USA

- EnviroServe

- 73 Other Companies

Notable Milestones in North America Waste Management Market Sector

- March 2024: Completion of the first construction phase of the Environmental Management Disposal Facility (EMDF) in Oak Ridge, TN, significantly enhancing waste disposal capacity for national security and research cleanup efforts.

- January 2024: Finalization of plans for a new waste-to-energy plant in Edmonton, Alberta, set to commence operations in 2027, diverting 150,000 tons of household waste annually.

In-Depth North America Waste Management Market Market Outlook

The North American waste management market presents a landscape brimming with significant future potential. This optimistic outlook is underpinned by the continuous trends of ongoing urbanization, persistent industrial growth, and an escalating global and regional emphasis on environmental sustainability and circular economy principles. Strategic opportunities abound for companies that demonstrate a forward-thinking approach by investing in advanced technologies, developing innovative and tailored solutions for increasingly complex waste streams, and fostering robust partnerships to actively promote and contribute to the development of a truly circular economy. The market is exceptionally well-positioned for continued robust growth, offering substantial opportunities for both established industry leaders seeking to innovate and for agile emerging players bringing fresh perspectives and disruptive technologies to the forefront.

North America Waste Management Market Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. E-waste

- 1.4. Plastic waste

- 1.5. Biomedical + Others (Including Construction Waste)

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Recycling

North America Waste Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Waste Management Market Regional Market Share

Geographic Coverage of North America Waste Management Market

North America Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Environmental Awareness; Innovations In Waste Management Technologies

- 3.3. Market Restrains

- 3.3.1. Growing Environmental Awareness; Innovations In Waste Management Technologies

- 3.4. Market Trends

- 3.4.1. Waste Management Market Surges in Response to Escalating Plastic Waste Concerns

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. E-waste

- 5.1.4. Plastic waste

- 5.1.5. Biomedical + Others (Including Construction Waste)

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Waste Management Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Republic Services Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Waste Connections Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Clean Harbors Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Covanta Holding Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Veolia North America

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rumpke Waste & Recycling

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Heritage Environmental Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Waste Pro USA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EnviroServe**List Not Exhaustive 7 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Waste Management Inc

List of Figures

- Figure 1: North America Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: North America Waste Management Market Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: North America Waste Management Market Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: North America Waste Management Market Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: North America Waste Management Market Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: North America Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: North America Waste Management Market Revenue Million Forecast, by Waste type 2020 & 2033

- Table 8: North America Waste Management Market Volume Billion Forecast, by Waste type 2020 & 2033

- Table 9: North America Waste Management Market Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 10: North America Waste Management Market Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 11: North America Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Waste Management Market?

The projected CAGR is approximately 4.01%.

2. Which companies are prominent players in the North America Waste Management Market?

Key companies in the market include Waste Management Inc, Republic Services Inc, Waste Connections Inc, Clean Harbors Inc, Covanta Holding Corporation, Veolia North America, Rumpke Waste & Recycling, Heritage Environmental Services, Waste Pro USA, EnviroServe**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the North America Waste Management Market?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 202.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Environmental Awareness; Innovations In Waste Management Technologies.

6. What are the notable trends driving market growth?

Waste Management Market Surges in Response to Escalating Plastic Waste Concerns.

7. Are there any restraints impacting market growth?

Growing Environmental Awareness; Innovations In Waste Management Technologies.

8. Can you provide examples of recent developments in the market?

March 2024: The Oak Ridge Office of Environmental Management and contractor UCOR have finished the first construction phase for the Environmental Management Disposal Facility (EMDF). This facility will offer the necessary waste disposal capacity for the Y-12 National Security Complex and Oak Ridge National Laboratory cleanup efforts. Early site preparations began in August, following a groundbreaking ceremony attended by congressional leaders and officials from the US Department of Energy, US Environmental Protection Agency, and Tennessee Department of Environment and Conservation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Waste Management Market?

To stay informed about further developments, trends, and reports in the North America Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence