Key Insights

Peru's logistics services market, projected to reach 513.08 million by 2024, is forecast to expand at a CAGR of 15.6% from 2024 to 2033. This significant growth is underpinned by robust e-commerce expansion, driving demand for efficient last-mile delivery and sophisticated warehousing. Key industrial sectors, including construction, manufacturing, automotive, and distributive trade, are also fueling the need for advanced freight transportation and integrated supply chain solutions. The market benefits from increasing adoption of technologies like GPS tracking and warehouse management systems, optimizing operational efficiency. Furthermore, government investments in infrastructure, such as road networks and port modernization, are poised to reduce logistical bottlenecks and accelerate market development.

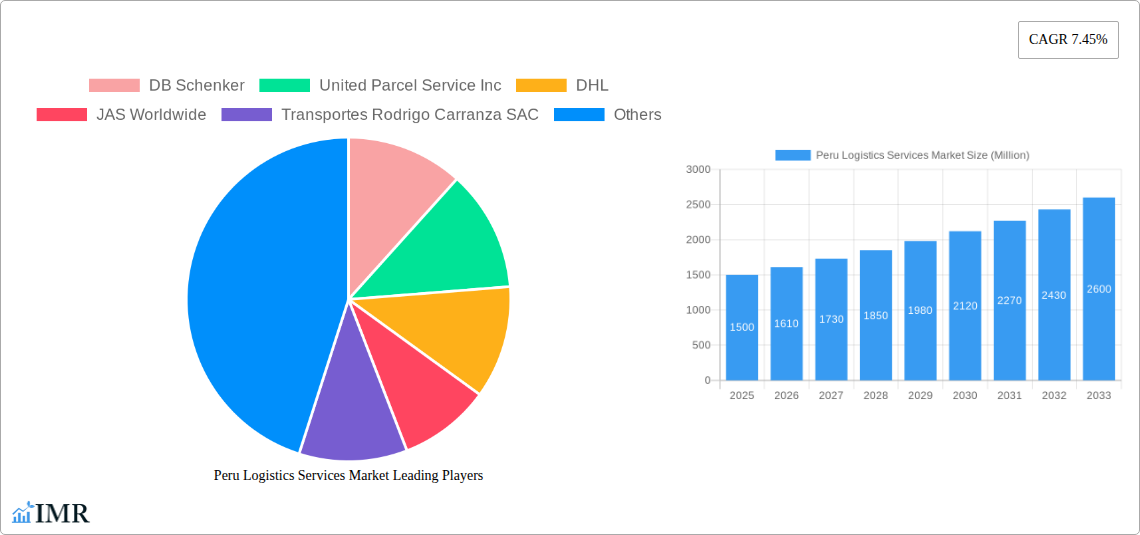

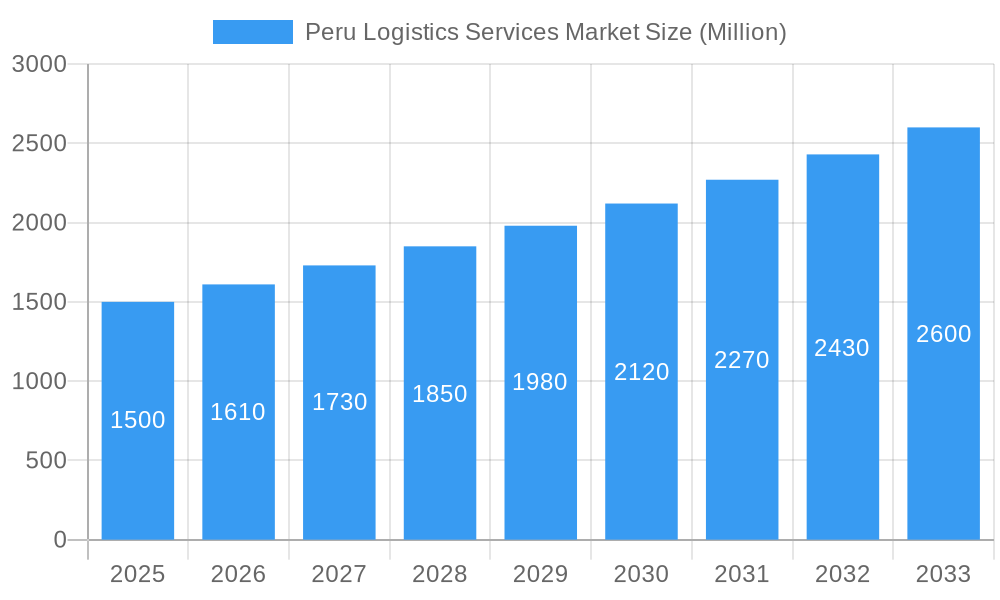

Peru Logistics Services Market Market Size (In Million)

Despite positive trends, the market confronts challenges including volatile fuel prices impacting operational expenditures and the logistical complexities inherent in Peru's diverse topography. Overcoming these obstacles through strategic infrastructure development and technological innovation is vital for sustained growth. The market is segmented by function, including freight transport, freight forwarding, warehousing, courier, express, parcel (CEP) services, and value-added services. End-user industries encompass construction, oil & gas, agriculture, manufacturing, distributive trade, and others. The competitive landscape features global leaders like DB Schenker, UPS, and DHL, alongside prominent regional players. The forecast period (2024-2033) presents substantial opportunities for logistics providers adept at meeting the dynamic demands of the Peruvian market.

Peru Logistics Services Market Company Market Share

Peru Logistics Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Peru Logistics Services market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The market is segmented by function (Freight Transport, Air Freight Forwarding, Warehousing, Courier, Express & Parcel, Value-added Services) and end-user (Construction, Oil & Gas and Quarrying, Agriculture, Fishing & Forestry, Manufacturing & Automotive, Distributive Trade, Pharmaceuticals & Healthcare). Key players analyzed include DB Schenker, United Parcel Service Inc., DHL, JAS Worldwide, Transportes Rodrigo Carranza SAC, CEVA Logistics, Agility Logistics, Avianca Cargo, Perurail SA, Servosa Gas SAC, Impala Terminals, Transaltisa SA, and other significant market participants. The market size is presented in million units.

Peru Logistics Services Market Dynamics & Structure

The Peruvian logistics services market exhibits a moderately concentrated structure, with a handful of multinational players and several significant domestic operators competing for market share. Technological innovation, particularly in areas like digital freight management and automated warehousing, is a key driver, although challenges remain in terms of digital infrastructure and adoption rates. The regulatory framework, while evolving, impacts market dynamics and presents both opportunities and challenges. The market also witnesses the presence of competitive substitutes, particularly in less specialized segments like trucking. M&A activity is gradually increasing, reflecting consolidation trends among both domestic and international players seeking to expand their reach.

- Market Concentration: xx% controlled by top 5 players in 2025.

- Technological Innovation: Significant investments in automation and digitalization are ongoing, but adoption varies across segments.

- Regulatory Framework: Government initiatives to improve infrastructure and streamline customs processes are creating new opportunities.

- Competitive Substitutes: Growing competition from smaller, specialized logistics providers.

- End-User Demographics: The manufacturing and distributive trade sectors are major drivers of market demand.

- M&A Trends: A moderate increase in merger and acquisition activities is observed, with an estimated xx deals in the past 5 years.

Peru Logistics Services Market Growth Trends & Insights

The Peruvian logistics services market has witnessed consistent growth over the historical period (2019-2024), driven by expanding domestic trade, increased foreign investment, and the growth of e-commerce. The market size is projected to reach xx million units by 2025 and is expected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of blockchain technology and the Internet of Things (IoT) for supply chain optimization, are accelerating growth. Shifts in consumer behavior, particularly the increasing preference for e-commerce and faster delivery services, are also fueling market expansion. Market penetration of various logistics services varies significantly across different regions and segments, with significant growth potential in underserved areas.

Dominant Regions, Countries, or Segments in Peru Logistics Services Market

The Lima Metropolitan Area and Callao Port are dominant regions, accounting for xx% of the market share in 2025 due to their high concentration of industries and superior infrastructure. Within the functional segments, air freight forwarding and warehousing are exhibiting the highest growth rates. The manufacturing and automotive sectors are the leading end-users of logistics services.

- Key Drivers:

- Government investment in infrastructure development (e.g., port modernization).

- Growing e-commerce sector and demand for express delivery services.

- Expansion of manufacturing and industrial activities.

- Dominance Factors:

- Strategic location and port infrastructure of Lima and Callao.

- High concentration of industries and businesses.

- Availability of skilled labor.

Peru Logistics Services Market Product Landscape

The Peruvian logistics services market features a range of traditional and innovative offerings. Traditional services like freight transport, warehousing, and freight forwarding are complemented by value-added services such as cold chain logistics, last-mile delivery, and return logistics. Technological advancements, including the implementation of GPS tracking, route optimization software, and warehouse management systems, are enhancing the efficiency and effectiveness of these offerings. Unique selling propositions focus on speed, reliability, and customized solutions for diverse customer needs.

Key Drivers, Barriers & Challenges in Peru Logistics Services Market

Key Drivers:

- Rapid growth of e-commerce

- Investment in infrastructure projects

- Government initiatives to improve logistics efficiency.

Challenges:

- Geographical challenges (mountainous terrain, limited road infrastructure) impacting transportation costs and efficiency.

- Regulatory complexities and bureaucratic hurdles (customs procedures, licensing).

- Competition from informal operators impacting the formal market.

Emerging Opportunities in Peru Logistics Services Market

Significant opportunities exist in the expansion of cold chain logistics for perishable goods, last-mile delivery solutions for e-commerce, and specialized logistics for the healthcare and pharmaceutical sectors. Untapped markets in rural areas and the development of integrated logistics platforms utilizing technology present considerable growth potential. The rising adoption of sustainable logistics practices offers another opportunity for innovation and competitive advantage.

Growth Accelerators in the Peru Logistics Services Market Industry

Technological advancements, such as the implementation of advanced analytics and automation, are central to accelerating market growth. Strategic partnerships between logistics providers and technology companies further amplify growth. Expansion into underserved markets and the development of specialized logistics solutions for emerging industries also drive growth.

Key Players Shaping the Peru Logistics Services Market Market

- DB Schenker

- United Parcel Service Inc.

- DHL

- JAS Worldwide

- Transportes Rodrigo Carranza SAC

- CEVA Logistics

- Agility Logistics

- Avianca Cargo

- Perurail SA

- Servosa Gas SAC

- Impala Terminals

- Transaltisa SA

- (List Not Exhaustive)

Notable Milestones in Peru Logistics Services Market Sector

- 2021: Government launches a national logistics development plan.

- 2022: Major port expansion projects are initiated in Callao.

- 2023: Several logistics companies invest in technological upgrades.

- 2024: A new express delivery network is established, particularly focusing on e-commerce delivery.

In-Depth Peru Logistics Services Market Market Outlook

The Peruvian logistics services market is poised for continued growth, driven by robust economic activity, infrastructure improvements, and technological innovation. Strategic investments in logistics infrastructure, coupled with the expansion of e-commerce and the adoption of advanced technologies, will significantly propel market expansion in the coming years. The focus on enhancing supply chain efficiency and providing customized solutions to diverse end-user segments will shape future market dynamics.

Peru Logistics Services Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Rail

- 1.1.3. Sea and Inland

- 1.1.4. Air

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services

-

1.1. Freight Transport

-

2. End User

- 2.1. Construction

- 2.2. Oil and Gas and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Manufacturing and Automotive

- 2.5. Distributive Trade

- 2.6. Other End Users (Pharmaceutical and Healthcare)

Peru Logistics Services Market Segmentation By Geography

- 1. Peru

Peru Logistics Services Market Regional Market Share

Geographic Coverage of Peru Logistics Services Market

Peru Logistics Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of Partnerships among Automobile Manufacturers and Logistics Partners; Growth in international trade

- 3.3. Market Restrains

- 3.3.1. Nature of Supply Chain Business

- 3.4. Market Trends

- 3.4.1. Agricultural Exports Driving Logistics Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Peru Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Rail

- 5.1.1.3. Sea and Inland

- 5.1.1.4. Air

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Construction

- 5.2.2. Oil and Gas and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Manufacturing and Automotive

- 5.2.5. Distributive Trade

- 5.2.6. Other End Users (Pharmaceutical and Healthcare)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Peru

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JAS Worldwide

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Transportes Rodrigo Carranza SAC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEVA Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Agility Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Avianca Cargo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Perurail SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Servosa Gas SAC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Impala Terminals**List Not Exhaustive 6 3 List of Other Logistics Player

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Transaltisa SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Peru Logistics Services Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Peru Logistics Services Market Share (%) by Company 2025

List of Tables

- Table 1: Peru Logistics Services Market Revenue million Forecast, by Function 2020 & 2033

- Table 2: Peru Logistics Services Market Revenue million Forecast, by End User 2020 & 2033

- Table 3: Peru Logistics Services Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Peru Logistics Services Market Revenue million Forecast, by Function 2020 & 2033

- Table 5: Peru Logistics Services Market Revenue million Forecast, by End User 2020 & 2033

- Table 6: Peru Logistics Services Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Peru Logistics Services Market?

The projected CAGR is approximately 15.6%.

2. Which companies are prominent players in the Peru Logistics Services Market?

Key companies in the market include DB Schenker, United Parcel Service Inc, DHL, JAS Worldwide, Transportes Rodrigo Carranza SAC, CEVA Logistics, Agility Logistics, Avianca Cargo, Perurail SA, Servosa Gas SAC, Impala Terminals**List Not Exhaustive 6 3 List of Other Logistics Player, Transaltisa SA.

3. What are the main segments of the Peru Logistics Services Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 513.08 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of Partnerships among Automobile Manufacturers and Logistics Partners; Growth in international trade.

6. What are the notable trends driving market growth?

Agricultural Exports Driving Logistics Growth.

7. Are there any restraints impacting market growth?

Nature of Supply Chain Business.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Peru Logistics Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Peru Logistics Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Peru Logistics Services Market?

To stay informed about further developments, trends, and reports in the Peru Logistics Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence