Key Insights

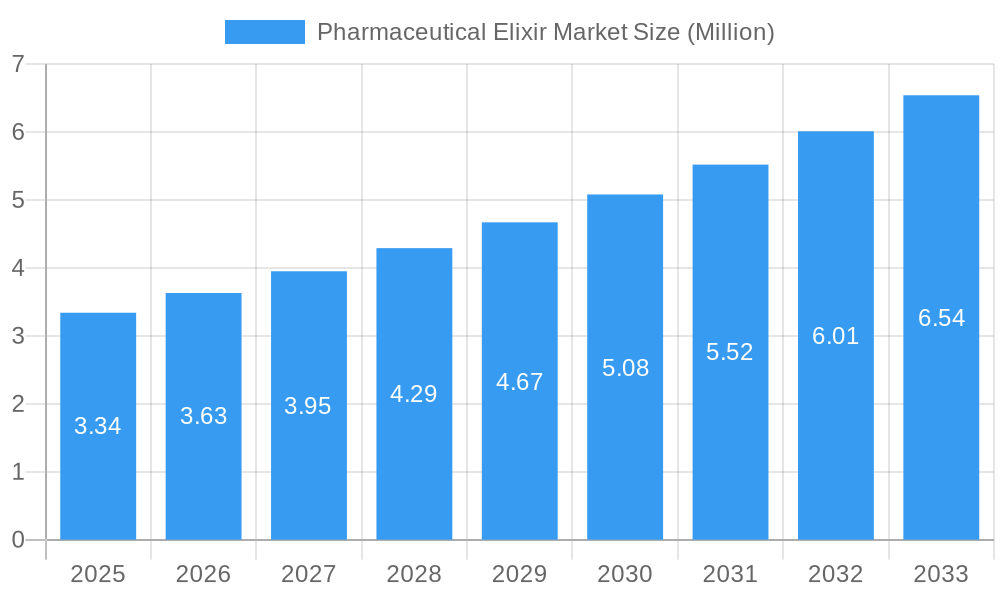

The global Pharmaceutical Elixir Market is poised for robust expansion, projected to reach an impressive USD 3.34 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 8.90%. This significant growth trajectory underscores the increasing demand for liquid-based pharmaceutical formulations, particularly among geriatric and pediatric populations who often face challenges with solid dosage forms. The market's expansion is fueled by a confluence of factors, including advancements in drug delivery technologies, the rising prevalence of chronic diseases requiring long-term medication, and a growing consumer preference for more palatable and easily digestible medicines. Key drivers include the inherent benefits of elixirs, such as rapid absorption and ease of administration, making them a preferred choice for specific patient groups. The market is segmented into medicated and non-medicated elixirs, with medicated elixirs dominating due to their therapeutic applications. Distribution channels are diverse, encompassing hospital pharmacies, retail pharmacies, and the rapidly growing online pharmacy segment, which offers convenience and accessibility. The increasing focus on patient adherence and comfort further bolsters the demand for elixir formulations across various therapeutic areas.

Pharmaceutical Elixir Market Market Size (In Million)

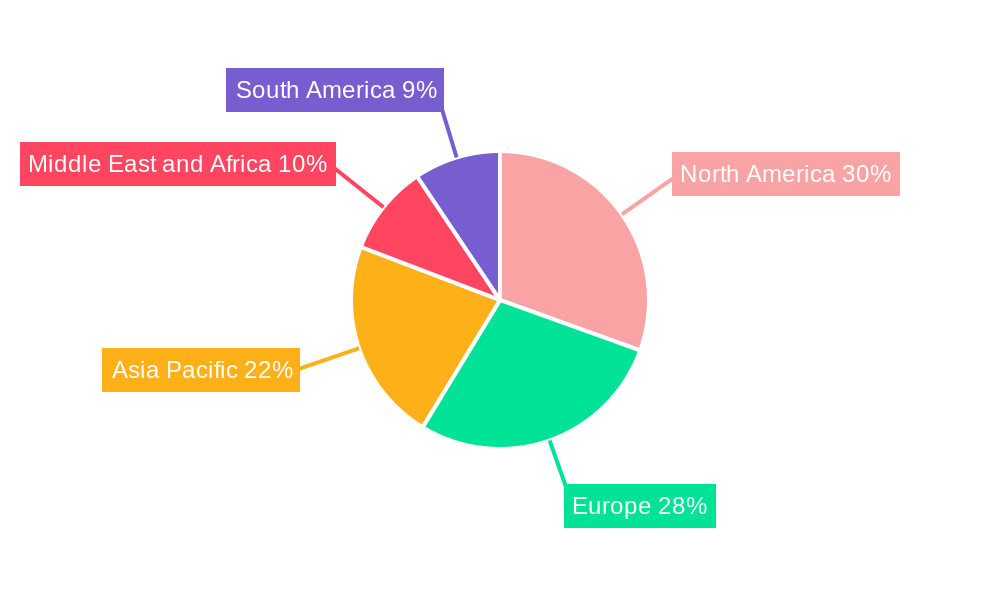

Several trends are shaping the Pharmaceutical Elixir Market. The development of novel flavorings and sweeteners is enhancing palatability, thereby improving patient compliance, especially for pediatric patients. Furthermore, the integration of advanced encapsulation techniques is leading to improved drug stability and controlled release within elixir formulations. While the market enjoys substantial growth, certain restraints exist, such as the potential for inaccurate dosing if not administered carefully and the comparatively higher manufacturing costs associated with liquid formulations. However, these challenges are being addressed through improved packaging, precise dosing devices, and continuous process optimization by leading companies like Cipla, Novartis AG, GlaxoSmithKline PLC, and Sun Pharmaceutical Industries. The market is geographically diverse, with North America and Europe currently holding significant shares, while the Asia Pacific region is anticipated to witness the fastest growth due to its large population, increasing healthcare expenditure, and a growing awareness of advanced pharmaceutical solutions.

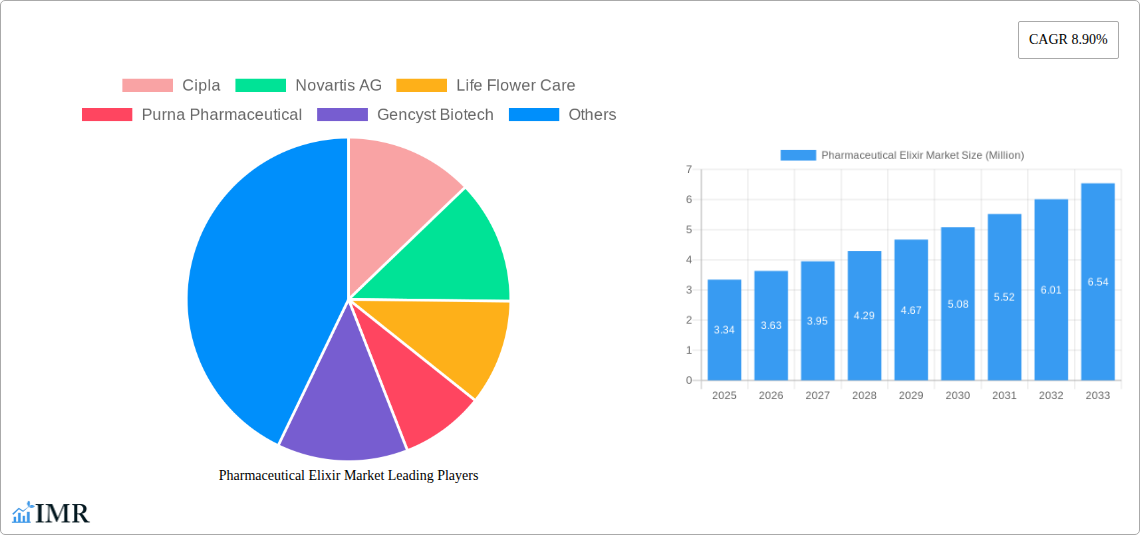

Pharmaceutical Elixir Market Company Market Share

This in-depth market research report offers a thorough analysis of the global Pharmaceutical Elixir market, providing critical insights into its growth trajectory, key drivers, competitive landscape, and future opportunities. Covering the historical period of 2019–2024 and extending to a robust forecast period of 2025–2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving dynamics of the pharmaceutical elixir industry. The study details market size evolution in Million units, adoption rates, technological disruptions, and consumer behavior shifts, presenting a clear picture of where the market is headed.

Pharmaceutical Elixir Market Market Dynamics & Structure

The Pharmaceutical Elixir market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and shifting end-user demographics. Market concentration is moderate, with key players like Cipla, Novartis AG, Johnson and Johnson, and Sun Pharmaceutical Industries holding significant shares. However, the presence of specialized and regional manufacturers, such as Life Flower Care and Purna Pharmaceutical, contributes to a diverse competitive environment. Technological innovation is a primary driver, particularly in the development of novel formulations and improved delivery mechanisms for both medicated and non-medicated elixirs.

- Market Concentration: Moderate, with a mix of large multinational corporations and specialized niche players.

- Technological Innovation Drivers: Development of patient-friendly formulations, enhanced bioavailability, and incorporation of natural or advanced ingredients.

- Regulatory Frameworks: Stringent regulations by bodies like the FDA and EMA influence product development, manufacturing, and marketing, creating barriers to entry but also ensuring product quality and safety.

- Competitive Product Substitutes: While elixirs offer unique advantages, competition exists from other oral dosage forms such as syrups, suspensions, and capsules, especially for specific therapeutic areas.

- End-User Demographics: The growing geriatric population, with its increasing need for easily consumable medications, and the pediatric segment, requiring palatable formulations, are significant demographic influences. Adult use for specialized treatments also contributes.

- M&A Trends: Mergers and acquisitions are observed as companies seek to expand their product portfolios, gain access to new technologies, or consolidate market presence. Deal volumes have seen a steady increase as larger firms look to acquire innovative startups or competitors with complementary offerings.

Pharmaceutical Elixir Market Growth Trends & Insights

The Pharmaceutical Elixir market is poised for significant expansion, driven by a confluence of factors including an aging global population, increasing prevalence of chronic diseases, and a growing consumer preference for convenient and palatable medication forms. The market size is projected to witness a substantial evolution, with strong adoption rates for both medicated and non-medicated elixirs. Technological disruptions are continuously reshaping the landscape, with advancements in drug delivery systems and formulation science enhancing efficacy and patient compliance. Consumer behavior shifts are particularly evident, with a rising interest in natural and holistic health solutions, leading to increased demand for non-medicated and herbal elixirs.

The overall market penetration of pharmaceutical elixirs is expected to climb steadily. For instance, the global pharmaceutical elixir market size is estimated to reach approximately $XX,XXX Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X.X% from the base year of 2025. This growth is underpinned by continuous product innovation. Manufacturers are focusing on developing elixirs with improved taste profiles, longer shelf lives, and targeted therapeutic actions. The shift towards personalized medicine also plays a crucial role, with elixirs offering a versatile platform for customized formulations. Furthermore, increased healthcare expenditure in emerging economies and growing awareness about the benefits of elixirs among healthcare providers and patients are significant growth catalysts. The convenience of administration, particularly for pediatric and geriatric populations who may have difficulty swallowing solid dosage forms, continues to be a primary driver for market growth. Online pharmacies are also expanding their reach, making these products more accessible and contributing to increased sales volumes. The integration of advanced manufacturing techniques is further optimizing production efficiency and cost-effectiveness, supporting market expansion.

Dominant Regions, Countries, or Segments in Pharmaceutical Elixir Market

North America currently dominates the Pharmaceutical Elixir market, driven by its advanced healthcare infrastructure, high disposable income, and robust research and development activities. The region's strong regulatory framework, coupled with a significant prevalence of chronic diseases among its aging population, further fuels demand for pharmaceutical elixirs. The United States, in particular, represents a substantial market share due to its extensive pharmaceutical industry and high patient awareness.

- Dominant Region: North America

- Key Countries: United States, Canada

The Medicated Elixir segment is the primary growth engine within the Pharmaceutical Elixir market. This segment is characterized by a wide array of therapeutic applications, including cough and cold remedies, pain management, digestive health, and vitamin and mineral supplements. The growing incidence of respiratory illnesses and the increasing demand for effective and palatable treatments for children are major contributors to the dominance of medicated elixirs.

- Dominant Segment (Type): Medicated Elixir

- Key Drivers:

- High prevalence of target ailments (e.g., cough, cold, digestive issues).

- Need for easily administrable medications for pediatric and geriatric populations.

- Continuous innovation in therapeutic formulations.

- Increasing physician recommendations for elixirs in specific treatment protocols.

Retail Pharmacies are the leading distribution channel for pharmaceutical elixirs, owing to their widespread accessibility and established consumer trust. Consumers often prefer purchasing these over-the-counter and prescription medications from familiar retail outlets.

- Dominant Distribution Channel: Retail Pharmacies

- Key Drivers:

- Extensive network and convenience for consumers.

- Trusted source for both prescription and over-the-counter medications.

- Availability of pharmacist consultations.

The Geriatric end-user segment is a significant driver of the Pharmaceutical Elixir market. As the global population ages, the demand for medications that are easy to swallow and administer increases, making elixirs a preferred choice for many elderly patients managing multiple chronic conditions.

- Dominant End User: Geriatric

- Key Drivers:

- Increasing prevalence of dysphagia and other swallowing difficulties in older adults.

- Higher incidence of chronic diseases requiring regular medication.

- Preference for liquid formulations for ease of consumption.

Pharmaceutical Elixir Market Product Landscape

The Pharmaceutical Elixir market is distinguished by a diverse product landscape, encompassing both medicated and non-medicated formulations designed to cater to a wide spectrum of health needs. Product innovation is a constant, with manufacturers focusing on enhancing taste profiles, improving bioavailability, and developing targeted therapeutic actions. Unique selling propositions often lie in the use of natural ingredients, advanced delivery technologies for improved efficacy, and specific formulations catering to sensitive populations like pediatrics and geriatrics. Technological advancements are leading to elixirs with extended shelf lives and enhanced stability, ensuring consistent product performance and greater patient adherence.

Key Drivers, Barriers & Challenges in Pharmaceutical Elixir Market

The Pharmaceutical Elixir market is propelled by several key drivers, including the increasing prevalence of chronic diseases, the growing elderly population requiring easily administered medications, and a rising consumer preference for convenient and palatable dosage forms. Technological advancements in formulation science and drug delivery are enhancing product efficacy and patient compliance, while a greater emphasis on natural and herbal remedies is boosting the non-medicated elixir segment.

- Key Drivers:

- Aging population and associated health needs.

- Demand for convenient and palatable medication forms.

- Advancements in formulation and delivery technologies.

- Growth of the natural and herbal remedies market.

Conversely, the market faces significant barriers and challenges. Stringent regulatory approvals for new formulations and the high cost of research and development can impede innovation. Intense competition from alternative dosage forms, such as tablets and capsules, poses a continuous threat. Supply chain disruptions and the need for specialized manufacturing processes can also impact market growth.

- Key Barriers & Challenges:

- Strict regulatory requirements for product approval.

- High R&D costs and lengthy development cycles.

- Intense competition from alternative dosage forms.

- Supply chain complexities and quality control demands.

Emerging Opportunities in Pharmaceutical Elixir Market

Emerging opportunities in the Pharmaceutical Elixir market are diverse and promising. The growing global demand for personalized medicine presents a significant avenue, with elixirs offering a flexible platform for customized formulations catering to individual patient needs and genetic profiles. Untapped markets in developing economies, where access to advanced healthcare is increasing, represent substantial growth potential. Furthermore, the expansion of e-commerce and online pharmacies is creating new distribution channels, making elixirs more accessible to a wider consumer base. The increasing interest in preventative healthcare and wellness is also driving demand for advanced nutritional and supplement elixirs.

Growth Accelerators in the Pharmaceutical Elixir Market Industry

Several catalysts are accelerating the long-term growth of the Pharmaceutical Elixir industry. Technological breakthroughs in encapsulation and nano-delivery systems are enhancing the bioavailability and targeted release of active ingredients, thereby improving therapeutic outcomes. Strategic partnerships and collaborations between pharmaceutical giants and smaller biotech firms are fostering innovation and accelerating product development. Market expansion strategies, including aggressive product launches in emerging economies and tailored marketing campaigns focusing on the unique benefits of elixirs for specific demographics, are also playing a crucial role in driving sustained growth.

Key Players Shaping the Pharmaceutical Elixir Market Market

- Cipla

- Novartis AG

- Life Flower Care

- Purna Pharmaceutical

- Gencyst Biotech

- GlaxoSmithKline PLC

- Johnson and Johnson

- Sun Pharmaceutical Industries

- Bell's Healthcare

- Almansour

- Zydus Cadila

Notable Milestones in Pharmaceutical Elixir Market Sector

- August 2024: Ghai Homoeo Remedies (GHR) unveiled its latest healthcare innovation, the CoughElixir Syrup, in India. This new syrup underscores GHR's steadfast dedication to quality and effectiveness. Meticulously crafted, CoughElixir Syrup combines natural ingredients such as Aconite napellus, Arsenicum album, Antimonium tartaricum, Bryonia alba, Belladonna, Ipecacuanha, and Chelidonium majus. This distinctive homeopathic formulation is designed to provide targeted relief from a diverse range of cough symptoms.

- August 2023: Awshad re-launched a cannabis-based medicated elixir in India, targeting patients seeking alternative therapeutic options. This product is part of a broader trend toward natural remedies and personalized medicine within the pharmaceutical industry, reflecting a growing consumer interest in holistic health solutions.

In-Depth Pharmaceutical Elixir Market Market Outlook

The future outlook for the Pharmaceutical Elixir market is exceptionally positive, fueled by an ongoing surge in demand from aging populations and a growing preference for user-friendly medication delivery systems. Key growth accelerators include continuous innovation in therapeutic efficacy and palatability, alongside the expanding role of online pharmacies in enhancing accessibility. Strategic market expansion into underpenetrated regions and the development of specialized elixirs for emerging health concerns, such as mental wellness and personalized nutrition, are poised to further amplify growth. The market's ability to adapt to evolving consumer preferences for natural and sustainable health solutions will also be a critical determinant of its future success.

Pharmaceutical Elixir Market Segmentation

-

1. Type

- 1.1. Medicated Elixir

- 1.2. Non-medicated Elixir

-

2. Distribution Channel

- 2.1. Hospital Pharmacies

- 2.2. Retail Pharmacies

- 2.3. Online Pharmacies

-

3. End User

- 3.1. Geriatric

- 3.2. Pediatric

- 3.3. Adult

Pharmaceutical Elixir Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pharmaceutical Elixir Market Regional Market Share

Geographic Coverage of Pharmaceutical Elixir Market

Pharmaceutical Elixir Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenient Medication; Rising Prevalence of Chronic Diseases; Rising Aging Population

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Convenient Medication; Rising Prevalence of Chronic Diseases; Rising Aging Population

- 3.4. Market Trends

- 3.4.1. Medicated Elixir Segment Expected to Hold a Significant Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Elixir Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Medicated Elixir

- 5.1.2. Non-medicated Elixir

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hospital Pharmacies

- 5.2.2. Retail Pharmacies

- 5.2.3. Online Pharmacies

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Geriatric

- 5.3.2. Pediatric

- 5.3.3. Adult

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Pharmaceutical Elixir Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Medicated Elixir

- 6.1.2. Non-medicated Elixir

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hospital Pharmacies

- 6.2.2. Retail Pharmacies

- 6.2.3. Online Pharmacies

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Geriatric

- 6.3.2. Pediatric

- 6.3.3. Adult

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Pharmaceutical Elixir Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Medicated Elixir

- 7.1.2. Non-medicated Elixir

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hospital Pharmacies

- 7.2.2. Retail Pharmacies

- 7.2.3. Online Pharmacies

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Geriatric

- 7.3.2. Pediatric

- 7.3.3. Adult

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Pharmaceutical Elixir Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Medicated Elixir

- 8.1.2. Non-medicated Elixir

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hospital Pharmacies

- 8.2.2. Retail Pharmacies

- 8.2.3. Online Pharmacies

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Geriatric

- 8.3.2. Pediatric

- 8.3.3. Adult

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Pharmaceutical Elixir Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Medicated Elixir

- 9.1.2. Non-medicated Elixir

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hospital Pharmacies

- 9.2.2. Retail Pharmacies

- 9.2.3. Online Pharmacies

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Geriatric

- 9.3.2. Pediatric

- 9.3.3. Adult

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Pharmaceutical Elixir Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Medicated Elixir

- 10.1.2. Non-medicated Elixir

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hospital Pharmacies

- 10.2.2. Retail Pharmacies

- 10.2.3. Online Pharmacies

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Geriatric

- 10.3.2. Pediatric

- 10.3.3. Adult

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cipla

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Novartis AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Life Flower Care

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Purna Pharmaceutical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gencyst Biotech

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GlaxoSmithKline PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson and Johnson

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sun Pharmaceutical Industries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bell's Healthcare

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Almansour

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zydus Cadila*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Cipla

List of Figures

- Figure 1: Global Pharmaceutical Elixir Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Pharmaceutical Elixir Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Pharmaceutical Elixir Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Pharmaceutical Elixir Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America Pharmaceutical Elixir Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Pharmaceutical Elixir Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Pharmaceutical Elixir Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America Pharmaceutical Elixir Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 9: North America Pharmaceutical Elixir Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Pharmaceutical Elixir Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Pharmaceutical Elixir Market Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Pharmaceutical Elixir Market Volume (Billion), by End User 2025 & 2033

- Figure 13: North America Pharmaceutical Elixir Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Pharmaceutical Elixir Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Pharmaceutical Elixir Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Pharmaceutical Elixir Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Pharmaceutical Elixir Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Pharmaceutical Elixir Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Pharmaceutical Elixir Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Pharmaceutical Elixir Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Europe Pharmaceutical Elixir Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Pharmaceutical Elixir Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Pharmaceutical Elixir Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 24: Europe Pharmaceutical Elixir Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 25: Europe Pharmaceutical Elixir Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: Europe Pharmaceutical Elixir Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 27: Europe Pharmaceutical Elixir Market Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Pharmaceutical Elixir Market Volume (Billion), by End User 2025 & 2033

- Figure 29: Europe Pharmaceutical Elixir Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Pharmaceutical Elixir Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Pharmaceutical Elixir Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Pharmaceutical Elixir Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Pharmaceutical Elixir Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Pharmaceutical Elixir Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Pharmaceutical Elixir Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Asia Pacific Pharmaceutical Elixir Market Volume (Billion), by Type 2025 & 2033

- Figure 37: Asia Pacific Pharmaceutical Elixir Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Pharmaceutical Elixir Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Pharmaceutical Elixir Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Pharmaceutical Elixir Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 41: Asia Pacific Pharmaceutical Elixir Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 42: Asia Pacific Pharmaceutical Elixir Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 43: Asia Pacific Pharmaceutical Elixir Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific Pharmaceutical Elixir Market Volume (Billion), by End User 2025 & 2033

- Figure 45: Asia Pacific Pharmaceutical Elixir Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Pharmaceutical Elixir Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Pharmaceutical Elixir Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Pharmaceutical Elixir Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Pharmaceutical Elixir Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Pharmaceutical Elixir Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Pharmaceutical Elixir Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Pharmaceutical Elixir Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East and Africa Pharmaceutical Elixir Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Pharmaceutical Elixir Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Pharmaceutical Elixir Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Middle East and Africa Pharmaceutical Elixir Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 57: Middle East and Africa Pharmaceutical Elixir Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East and Africa Pharmaceutical Elixir Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East and Africa Pharmaceutical Elixir Market Revenue (Million), by End User 2025 & 2033

- Figure 60: Middle East and Africa Pharmaceutical Elixir Market Volume (Billion), by End User 2025 & 2033

- Figure 61: Middle East and Africa Pharmaceutical Elixir Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa Pharmaceutical Elixir Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa Pharmaceutical Elixir Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Pharmaceutical Elixir Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Middle East and Africa Pharmaceutical Elixir Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Pharmaceutical Elixir Market Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Pharmaceutical Elixir Market Revenue (Million), by Type 2025 & 2033

- Figure 68: South America Pharmaceutical Elixir Market Volume (Billion), by Type 2025 & 2033

- Figure 69: South America Pharmaceutical Elixir Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: South America Pharmaceutical Elixir Market Volume Share (%), by Type 2025 & 2033

- Figure 71: South America Pharmaceutical Elixir Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 72: South America Pharmaceutical Elixir Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 73: South America Pharmaceutical Elixir Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 74: South America Pharmaceutical Elixir Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 75: South America Pharmaceutical Elixir Market Revenue (Million), by End User 2025 & 2033

- Figure 76: South America Pharmaceutical Elixir Market Volume (Billion), by End User 2025 & 2033

- Figure 77: South America Pharmaceutical Elixir Market Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Pharmaceutical Elixir Market Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Pharmaceutical Elixir Market Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Pharmaceutical Elixir Market Volume (Billion), by Country 2025 & 2033

- Figure 81: South America Pharmaceutical Elixir Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Pharmaceutical Elixir Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Pharmaceutical Elixir Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Pharmaceutical Elixir Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Pharmaceutical Elixir Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Pharmaceutical Elixir Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Type 2020 & 2033

- Table 25: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Pharmaceutical Elixir Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Pharmaceutical Elixir Market Volume Billion Forecast, by End User 2020 & 2033

- Table 29: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Germany Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: France Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Italy Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Spain Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Type 2020 & 2033

- Table 45: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 47: Global Pharmaceutical Elixir Market Revenue Million Forecast, by End User 2020 & 2033

- Table 48: Global Pharmaceutical Elixir Market Volume Billion Forecast, by End User 2020 & 2033

- Table 49: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: China Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Japan Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: India Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Australia Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Australia Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: South Korea Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Type 2020 & 2033

- Table 65: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 66: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 67: Global Pharmaceutical Elixir Market Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global Pharmaceutical Elixir Market Volume Billion Forecast, by End User 2020 & 2033

- Table 69: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Country 2020 & 2033

- Table 71: GCC Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: GCC Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: South Africa Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Type 2020 & 2033

- Table 78: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Type 2020 & 2033

- Table 79: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 80: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 81: Global Pharmaceutical Elixir Market Revenue Million Forecast, by End User 2020 & 2033

- Table 82: Global Pharmaceutical Elixir Market Volume Billion Forecast, by End User 2020 & 2033

- Table 83: Global Pharmaceutical Elixir Market Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Pharmaceutical Elixir Market Volume Billion Forecast, by Country 2020 & 2033

- Table 85: Brazil Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: Argentina Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Pharmaceutical Elixir Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Pharmaceutical Elixir Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Elixir Market?

The projected CAGR is approximately 8.90%.

2. Which companies are prominent players in the Pharmaceutical Elixir Market?

Key companies in the market include Cipla, Novartis AG, Life Flower Care, Purna Pharmaceutical, Gencyst Biotech, GlaxoSmithKline PLC, Johnson and Johnson, Sun Pharmaceutical Industries, Bell's Healthcare, Almansour, Zydus Cadila*List Not Exhaustive.

3. What are the main segments of the Pharmaceutical Elixir Market?

The market segments include Type, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenient Medication; Rising Prevalence of Chronic Diseases; Rising Aging Population.

6. What are the notable trends driving market growth?

Medicated Elixir Segment Expected to Hold a Significant Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Demand for Convenient Medication; Rising Prevalence of Chronic Diseases; Rising Aging Population.

8. Can you provide examples of recent developments in the market?

August 2024: Ghai Homoeo Remedies (GHR) unveiled its latest healthcare innovation, the CoughElixir Syrup, in India. This new syrup underscores GHR's steadfast dedication to quality and effectiveness. Meticulously crafted, CoughElixir Syrup combines natural ingredients such as Aconite napellus, Arsenicum album, Antimonium tartaricum, Bryonia alba, Belladonna, Ipecacuanha, and Chelidonium majus. This distinctive homeopathic formulation is designed to provide targeted relief from a diverse range of cough symptoms.August 2023: Awshad re-launched a cannabis-based medicated elixir in India, targeting patients seeking alternative therapeutic options. This product is part of a broader trend toward natural remedies and personalized medicine within the pharmaceutical industry, reflecting a growing consumer interest in holistic health solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Elixir Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Elixir Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Elixir Market?

To stay informed about further developments, trends, and reports in the Pharmaceutical Elixir Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence