Key Insights

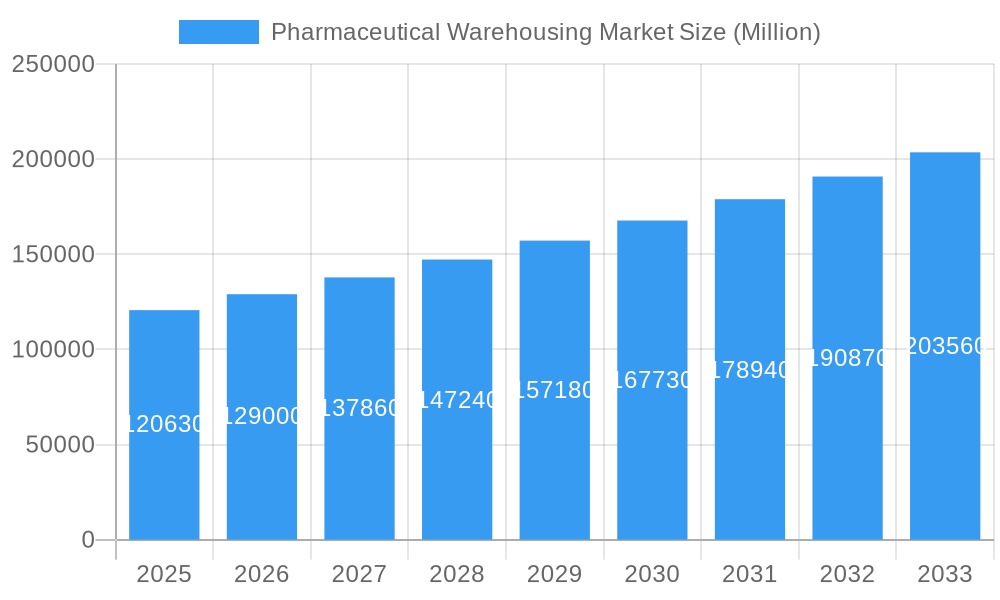

The global pharmaceutical warehousing market, valued at $120.63 billion in 2025, is projected to experience robust growth, driven by several key factors. The rising demand for temperature-sensitive pharmaceutical products, coupled with stringent regulatory requirements for storage and handling, necessitates sophisticated warehousing solutions. Growth in emerging markets, particularly in Asia-Pacific and South America, fueled by increasing healthcare spending and expanding pharmaceutical industries, further contributes to market expansion. The increasing prevalence of chronic diseases globally and the consequent rise in drug consumption also significantly impact market growth. Furthermore, technological advancements in warehouse management systems (WMS), cold chain technologies, and automation are improving efficiency and reducing operational costs, driving market adoption. The market is segmented by warehouse type (cold chain and non-cold chain) and application (pharmaceutical factories, pharmacies, hospitals, and others), reflecting diverse storage needs across the pharmaceutical supply chain. Leading players like Allen Pharma, Alloga, CEVA Logistics, and DB Schenker are investing heavily in infrastructure and technology to consolidate their market share and meet the growing demand.

Pharmaceutical Warehousing Market Market Size (In Billion)

The market's compound annual growth rate (CAGR) of 6.82% from 2025 to 2033 suggests a continuous upward trajectory. However, challenges remain, including the high capital investment required for setting up and maintaining cold chain infrastructure, particularly in developing regions. Strict regulatory compliance necessitates significant investments in quality control and data management systems, potentially restraining market growth for smaller players. Fluctuations in raw material prices and global economic uncertainties may also impact the market. Nevertheless, the long-term prospects remain positive, driven by the continued growth of the pharmaceutical industry and the increasing importance of efficient and reliable warehousing for ensuring drug quality and patient safety. Further segmentation by region reveals varying growth rates based on infrastructure development and regulatory environments.

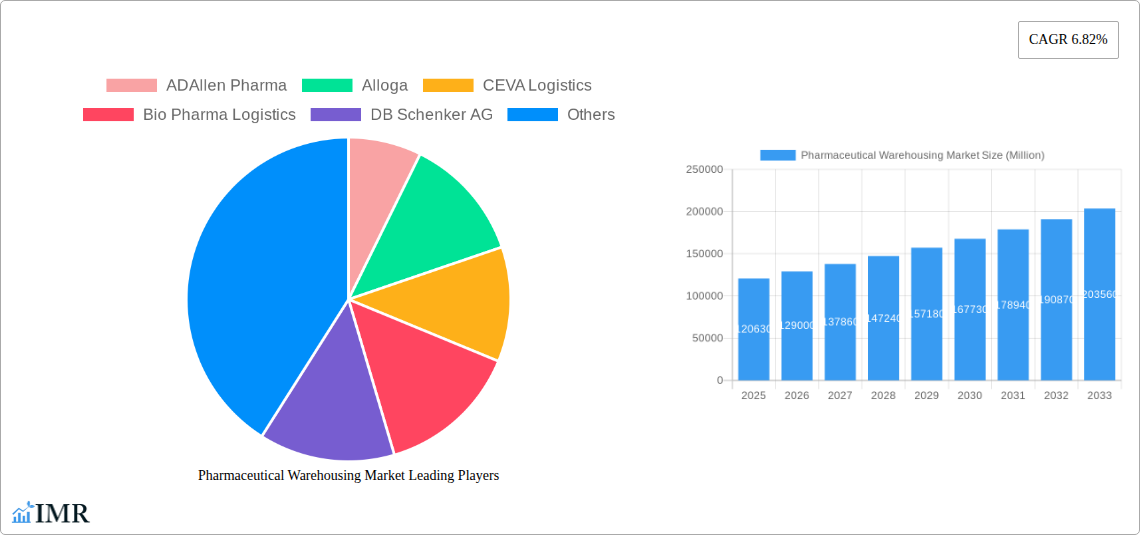

Pharmaceutical Warehousing Market Company Market Share

Pharmaceutical Warehousing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Pharmaceutical Warehousing Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report caters to pharmaceutical companies, logistics providers, investors, and regulatory bodies seeking a thorough understanding of this critical sector. The market is segmented by Type (Cold Chain Warehouse, Non-Cold Chain Warehouse) and Application (Pharmaceutical Factory, Pharmacy, Hospital, Other Applications). The total market size is projected to reach xx Million by 2033.

Pharmaceutical Warehousing Market Dynamics & Structure

The pharmaceutical warehousing market is characterized by moderate concentration, with key players holding significant market share, but also featuring numerous smaller regional operators. Technological innovation, particularly in cold chain solutions and automation, is a major driver, while stringent regulatory frameworks (e.g., GDP guidelines) and increasing demand for specialized warehousing solutions shape market dynamics. The market witnesses significant M&A activity as larger companies consolidate their position and gain access to new technologies and geographies. Competitive substitutes include third-party logistics providers offering integrated solutions.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately 65% market share in 2024.

- Technological Innovation: Strong focus on automation, robotics, AI-powered inventory management, and real-time temperature monitoring.

- Regulatory Framework: Stringent GDP (Good Distribution Practice) compliance and data security regulations drive investments in advanced systems.

- Competitive Substitutes: Growing competition from 3PL providers offering integrated logistics services.

- M&A Trends: A steady increase in mergers and acquisitions, with an average of xx deals per year during 2019-2024.

- End-User Demographics: Shifting towards specialized cold chain requirements driven by the growth of biologics and temperature-sensitive pharmaceuticals.

Pharmaceutical Warehousing Market Growth Trends & Insights

The pharmaceutical warehousing market experienced robust growth during the historical period (2019-2024), driven by factors such as the increasing global demand for pharmaceuticals, the growth of the biologics market, and technological advancements. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the rising adoption of temperature-sensitive pharmaceuticals, increasing investments in cold chain infrastructure, the expanding e-pharmacy sector, and the growing need for efficient supply chain management. Technological disruptions like AI and automation are further accelerating market growth by optimizing logistics and reducing operational costs. Consumer behavior shifts, reflecting increased preference for online pharmacies and direct-to-patient deliveries, also contribute to the market expansion. Market penetration of advanced warehousing solutions is expected to rise significantly over the forecast period.

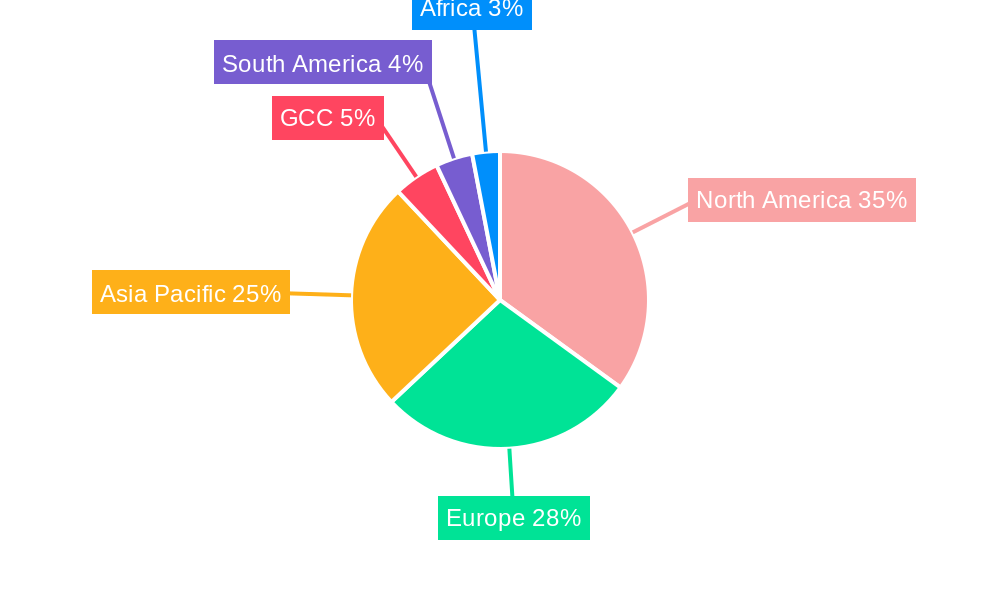

Dominant Regions, Countries, or Segments in Pharmaceutical Warehousing Market

North America and Europe currently dominate the pharmaceutical warehousing market, driven by advanced healthcare infrastructure, stringent regulatory environments and a large pharmaceutical industry presence. However, the Asia-Pacific region is expected to witness the fastest growth rate during the forecast period, driven by expanding healthcare infrastructure and the rising demand for pharmaceutical products.

By Type:

- Cold Chain Warehouse: Holds the largest market share driven by the increasing demand for temperature-sensitive drugs and biologics.

- Non-Cold Chain Warehouse: Experiences steady growth due to the continued demand for conventional pharmaceutical products.

By Application:

- Pharmaceutical Factory: Represents the largest segment due to the bulk storage and distribution needs of manufacturing facilities.

- Pharmacy: Shows significant growth with the rise of online pharmacies and home deliveries.

- Hospital: Maintains stable growth driven by the need for efficient inventory management and timely drug delivery.

Key Drivers:

- Robust pharmaceutical industry growth in major regions.

- Expansion of cold chain infrastructure, particularly in emerging markets.

- Stringent regulatory requirements demanding compliance with GDP standards.

Pharmaceutical Warehousing Market Product Landscape

The pharmaceutical warehousing market offers a range of solutions, from basic storage facilities to highly specialized cold chain warehouses with advanced temperature monitoring and control systems. Product innovations include automated storage and retrieval systems (AS/RS), robotic picking and packing systems, and warehouse management systems (WMS) integrating AI and machine learning. These advancements enhance efficiency, reduce operational costs, and improve accuracy in inventory management. The unique selling propositions of these technologies lie in their ability to ensure product integrity, improve traceability, and optimize storage space.

Key Drivers, Barriers & Challenges in Pharmaceutical Warehousing Market

Key Drivers:

The pharmaceutical warehousing market is propelled by factors such as the increasing global demand for pharmaceuticals, the growth of the biologics market, the rising adoption of temperature-sensitive pharmaceuticals, and technological advancements in cold chain solutions and automation.

Challenges & Restraints:

Stringent regulatory compliance, high infrastructure costs, particularly for cold chain facilities, and the need for skilled labor represent significant challenges. Supply chain disruptions due to geopolitical events or natural disasters and intense competition from established players pose further hurdles to market growth. These challenges may reduce the market CAGR by approximately 3% in the next few years.

Emerging Opportunities in Pharmaceutical Warehousing Market

Emerging opportunities lie in the expansion of cold chain warehousing in emerging markets, the adoption of innovative technologies such as blockchain for enhanced traceability, and the growth of specialized warehousing solutions catering to specific pharmaceutical product types (e.g., cell and gene therapies). Untapped market potential exists in personalized medicine and the expanding e-pharmacy sector.

Growth Accelerators in the Pharmaceutical Warehousing Market Industry

Long-term growth will be fueled by technological breakthroughs in temperature control and automation, strategic partnerships between pharmaceutical companies and logistics providers, and expansion into underserved regions. Investments in sustainable warehousing practices and advancements in data analytics for improved supply chain optimization are key catalysts.

Key Players Shaping the Pharmaceutical Warehousing Market Market

- ADAllen Pharma

- Alloga

- CEVA Logistics

- Bio Pharma Logistics

- DB Schenker AG

- Rhenus SE and Co

- TIBA

- Pulleyn Transport Ltd

- WH BOWKER LTD

- DACHSER Group SE

Notable Milestones in Pharmaceutical Warehousing Market Sector

- June 2023: Akums establishes a 70,186,56 sqm central warehousing facility in Haridwar, India, dedicated to finished goods storage, handling, and services. Phase I encompasses 30,610.2 sq. mt built-up area and 28,215.61 sq. mt ground coverage with 17 blocks.

- September 2022: CEVA Logistics launches the Ceva Chill Hub, a 10,000 sq ft multi-temperature facility offering complete logistics management from port of origin to last-mile delivery, accommodating 10,000 pallet positions across 7 chambers (-25°C to +16°C).

In-Depth Pharmaceutical Warehousing Market Market Outlook

The pharmaceutical warehousing market presents significant growth potential, driven by continued demand for pharmaceuticals, the expansion of the cold chain sector, and technological innovation. Strategic partnerships, expansion into new geographies, and investment in sustainable and efficient warehousing solutions will be crucial for success. The market's future hinges on overcoming challenges related to regulatory compliance and supply chain resilience, while capitalizing on the growing demand for specialized services and technological advancements.

Pharmaceutical Warehousing Market Segmentation

-

1. BY Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Other Applications

Pharmaceutical Warehousing Market Segmentation By Geography

-

1. North America

- 1.1. USA

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of the North America

-

2. Europe

- 2.1. Spain

- 2.2. Belgium

- 2.3. United Kingdom

- 2.4. Russia

- 2.5. Germany

- 2.6. France

- 2.7. Italy

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. Australia

- 3.2. China

- 3.3. India

- 3.4. Indonesia

- 3.5. Japan

- 3.6. Malaysia

- 3.7. Vietnam

- 3.8. Thailand

- 3.9. Rest of APAC

-

4. GCC

- 4.1. UAE

- 4.2. Saudi Arabia

- 4.3. Qatar

- 4.4. Rest of GCC

-

5. South America

- 5.1. Argentina

- 5.2. Brazil

- 5.3. Chile

- 5.4. Rest of South America

-

6. Africa

- 6.1. South Africa

- 6.2. Egypt

- 6.3. Rest of Africa

- 7. Rest of the World

Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of Pharmaceutical Warehousing Market

Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Population4.; Increase in Warehousing Services

- 3.3. Market Restrains

- 3.3.1. 4.; Shortage of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Technological Innovation is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. GCC

- 5.3.5. South America

- 5.3.6. Africa

- 5.3.7. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 6. North America Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by BY Type

- 6.1.1. Cold Chain Warehouse

- 6.1.2. Non-Cold Chain Warehouse

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Pharmaceutical Factory

- 6.2.2. Pharmacy

- 6.2.3. Hospital

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by BY Type

- 7. Europe Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by BY Type

- 7.1.1. Cold Chain Warehouse

- 7.1.2. Non-Cold Chain Warehouse

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Pharmaceutical Factory

- 7.2.2. Pharmacy

- 7.2.3. Hospital

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by BY Type

- 8. Asia Pacific Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by BY Type

- 8.1.1. Cold Chain Warehouse

- 8.1.2. Non-Cold Chain Warehouse

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Pharmaceutical Factory

- 8.2.2. Pharmacy

- 8.2.3. Hospital

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by BY Type

- 9. GCC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by BY Type

- 9.1.1. Cold Chain Warehouse

- 9.1.2. Non-Cold Chain Warehouse

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Pharmaceutical Factory

- 9.2.2. Pharmacy

- 9.2.3. Hospital

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by BY Type

- 10. South America Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by BY Type

- 10.1.1. Cold Chain Warehouse

- 10.1.2. Non-Cold Chain Warehouse

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Pharmaceutical Factory

- 10.2.2. Pharmacy

- 10.2.3. Hospital

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by BY Type

- 11. Africa Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by BY Type

- 11.1.1. Cold Chain Warehouse

- 11.1.2. Non-Cold Chain Warehouse

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Pharmaceutical Factory

- 11.2.2. Pharmacy

- 11.2.3. Hospital

- 11.2.4. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by BY Type

- 12. Rest of the World Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by BY Type

- 12.1.1. Cold Chain Warehouse

- 12.1.2. Non-Cold Chain Warehouse

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Pharmaceutical Factory

- 12.2.2. Pharmacy

- 12.2.3. Hospital

- 12.2.4. Other Applications

- 12.1. Market Analysis, Insights and Forecast - by BY Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 ADAllen Pharma

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Alloga

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 CEVA Logistics

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bio Pharma Logistics

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 DB Schenker AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Rhenus SE and Co

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 TIBA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Pulleyn Transport Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 WH BOWKER LTD

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 DACHSER Group SE

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 ADAllen Pharma

List of Figures

- Figure 1: Global Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 3: North America Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 4: North America Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 9: Europe Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 10: Europe Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 15: Asia Pacific Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 16: Asia Pacific Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: GCC Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 21: GCC Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 22: GCC Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 23: GCC Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: GCC Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: GCC Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 27: South America Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 28: South America Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Africa Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 33: Africa Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 34: Africa Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 35: Africa Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Africa Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Africa Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of the World Pharmaceutical Warehousing Market Revenue (Million), by BY Type 2025 & 2033

- Figure 39: Rest of the World Pharmaceutical Warehousing Market Revenue Share (%), by BY Type 2025 & 2033

- Figure 40: Rest of the World Pharmaceutical Warehousing Market Revenue (Million), by Application 2025 & 2033

- Figure 41: Rest of the World Pharmaceutical Warehousing Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Rest of the World Pharmaceutical Warehousing Market Revenue (Million), by Country 2025 & 2033

- Figure 43: Rest of the World Pharmaceutical Warehousing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 2: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 5: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: USA Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of the North America Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 12: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Germany Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 23: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Australia Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: China Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Indonesia Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Malaysia Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Vietnam Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Thailand Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 35: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: UAE Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Saudi Arabia Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Qatar Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of GCC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 42: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 43: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Argentina Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Brazil Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Chile Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Rest of South America Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 49: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 51: South Africa Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Egypt Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: Rest of Africa Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 55: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 56: Global Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Warehousing Market?

The projected CAGR is approximately 6.82%.

2. Which companies are prominent players in the Pharmaceutical Warehousing Market?

Key companies in the market include ADAllen Pharma, Alloga, CEVA Logistics, Bio Pharma Logistics, DB Schenker AG, Rhenus SE and Co, TIBA, Pulleyn Transport Ltd, WH BOWKER LTD, DACHSER Group SE.

3. What are the main segments of the Pharmaceutical Warehousing Market?

The market segments include BY Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 120.63 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Population4.; Increase in Warehousing Services.

6. What are the notable trends driving market growth?

Technological Innovation is driving the market.

7. Are there any restraints impacting market growth?

4.; Shortage of Skilled Labor.

8. Can you provide examples of recent developments in the market?

June 2023: Akums set up a central warehousing facility in the Haridwar Industrial Estate. The facility will be situated on a 70,186,56 sqm campus and will be dedicated to warehousing finished goods. It will provide warehousing, handling, and services to various plants in and around the Haridwar area. Trained stores and logistics staff will support the different plants. Phase I of the project comprises a built-up area of 30,610,2 sq. mt and a ground coverage of 28,215,61 sq. mt. This phase includes 17 standalone blocks dedicated to storing Pharma's finished goods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence