Key Insights

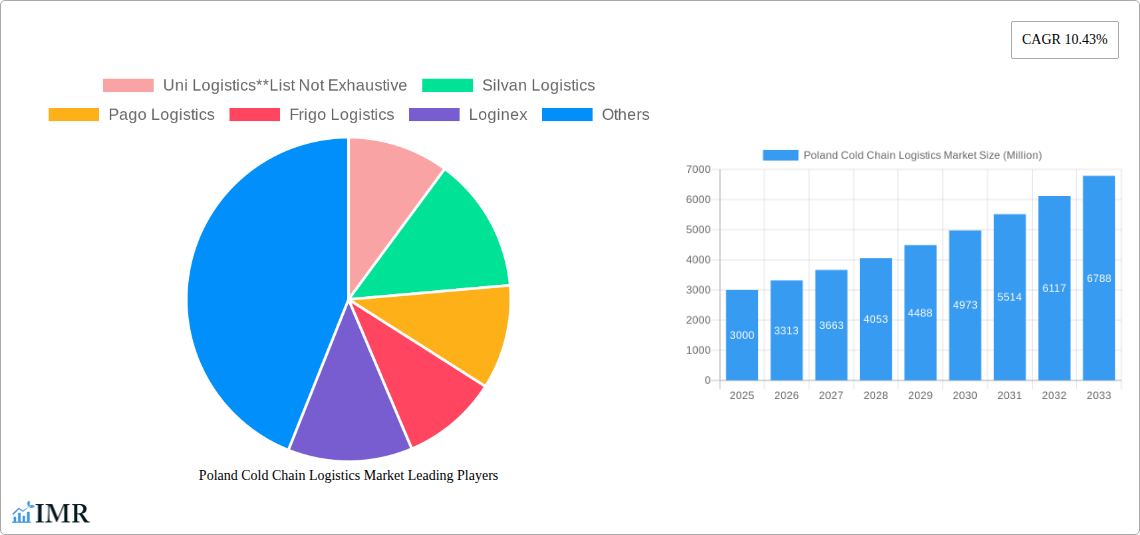

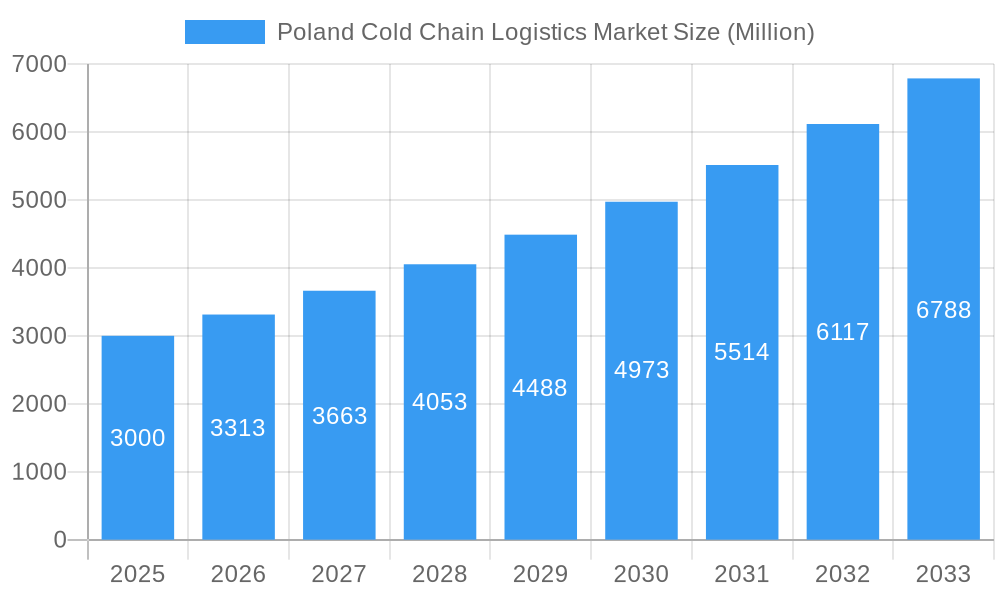

The Polish cold chain logistics market, valued at €3.0 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 10.43% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning Polish food processing and pharmaceutical sectors are driving demand for reliable and efficient cold chain solutions to maintain product quality and safety during transportation and storage. Rising consumer awareness of food safety and quality, coupled with increasing e-commerce penetration in the grocery sector, further contribute to market growth. Furthermore, investments in advanced cold chain infrastructure, including temperature-controlled warehousing and specialized transportation fleets, are enhancing the efficiency and reliability of the logistics network. Growth within specific segments, such as chilled and frozen food transportation for horticulture (fruits and vegetables) and dairy products, is particularly noteworthy, driven by increased domestic production and exports. However, challenges remain, including the need for continuous investment in technology upgrades to improve traceability and reduce waste, as well as potential disruptions related to geopolitical factors and energy price volatility.

Poland Cold Chain Logistics Market Market Size (In Billion)

The market segmentation reveals a significant share held by chilled and frozen transportation services, reflecting the dominance of perishable goods in Poland's economy. Among end-users, horticulture, dairy, and meat products constitute the largest market segments. Key players like Uni Logistics, Silvan Logistics, and Pago Logistics are actively shaping the market through strategic investments, technological advancements, and expansion of their service offerings. The forecast period (2025-2033) anticipates continued market expansion, driven by factors outlined above, with potential for further segmentation and specialization within the cold chain logistics sector as it adapts to evolving consumer preferences and industry needs. The growth trajectory, however, hinges on overcoming existing challenges and successfully navigating the evolving regulatory landscape.

Poland Cold Chain Logistics Market Company Market Share

Poland Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Poland cold chain logistics market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by service (storage, transportation, value-added services), temperature (chilled, frozen, ambient), and end-user (horticulture, dairy, meat, fish, poultry, processed food, pharma, life sciences, chemicals, and others). The report offers valuable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving market. Market size is presented in million units.

Poland Cold Chain Logistics Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Polish cold chain logistics sector. The market is characterized by a mix of large multinational players and smaller, regional operators. Market concentration is moderate, with a few dominant players holding significant market share but a large number of smaller companies also contributing significantly. Technological innovation is driven by the need for improved efficiency, reduced spoilage, and enhanced traceability. Regulatory frameworks, including EU directives on food safety and hygiene, play a crucial role in shaping industry practices. The growing demand for temperature-sensitive goods and increasing consumer awareness of food safety are key drivers. M&A activity is moderate, reflecting consolidation efforts amongst players seeking to expand their market presence.

Key Aspects:

- Market Concentration: Moderate, with a few major players alongside many smaller firms. The top 5 players likely hold approximately xx% of the market share (2025 estimate).

- Technological Innovation: Focus on automation, IoT, and data analytics for improved efficiency and temperature monitoring. Barriers to innovation include high initial investment costs and a lack of skilled workforce in certain specialized areas.

- Regulatory Framework: Compliance with EU regulations and national standards related to food safety and transportation.

- Competitive Product Substitutes: Limited direct substitutes, but improvements in traditional logistics impact market share.

- End-User Demographics: Growing urban population and increasing disposable incomes fuel demand for temperature-sensitive goods.

- M&A Trends: Moderate M&A activity, with larger players acquiring smaller firms to expand their reach and service portfolio. xx M&A deals were recorded between 2019-2024 (estimated).

Poland Cold Chain Logistics Market Growth Trends & Insights

The Poland cold chain logistics market is experiencing significant growth driven by several factors including rising demand for perishable goods, expansion of the e-commerce sector, and increasing consumer preference for fresh and high-quality products. Market size has shown consistent growth over the past five years and is projected to continue expanding at a CAGR of xx% during the forecast period (2025-2033). The adoption of advanced technologies such as temperature monitoring systems, GPS tracking, and blockchain technology has improved efficiency and reduced waste. The market is further segmented based on temperature requirements, types of services, and end-user industries.

Key Metrics:

- Market Size (2025): xx Million Units

- CAGR (2025-2033): xx%

- Market Penetration (2025): xx%

Dominant Regions, Countries, or Segments in Poland Cold Chain Logistics Market

The growth of the Polish cold chain logistics market is spread across various regions, with major urban centers and industrial hubs showcasing significant activity. Within the service segment, storage facilities show the highest demand, followed by transportation and value-added services. The chilled segment dominates in terms of temperature-controlled logistics, primarily driven by the large horticulture and dairy sectors. In terms of end-users, the horticulture sector, followed by dairy and processed food products, contributes significantly to overall market volume.

Key Drivers & Dominance Factors:

- Regions: Warsaw and surrounding areas, Lodz, Poznan, and Krakow. The proximity to major transportation infrastructure and high population density plays a crucial role.

- Service Segment: Storage services account for the largest share. Strong growth in value-added services, driven by customer demands for customized solutions.

- Temperature Segment: Chilled products lead, given the volume of horticultural and dairy produce. The frozen segment is also growing strongly.

- End-User Segment: Horticulture (fresh fruits and vegetables) enjoys a large share due to the extensive agricultural sector. The dairy and processed food sectors follow closely.

- Infrastructure Development: Investments in warehousing facilities and transportation networks are key drivers.

Poland Cold Chain Logistics Market Product Landscape

Product innovation in the Polish cold chain logistics market is focused on enhancing efficiency, safety, and sustainability. This includes advanced temperature monitoring systems, IoT-enabled solutions for real-time tracking and data analysis, and eco-friendly transportation solutions. The unique selling propositions (USPs) of these products typically revolve around improved cost-effectiveness, reduced waste, enhanced product safety, and increased traceability throughout the supply chain.

Key Drivers, Barriers & Challenges in Poland Cold Chain Logistics Market

Key Drivers:

- Growing demand for temperature-sensitive products.

- Expansion of e-commerce and online grocery shopping.

- Rising disposable incomes and consumer preference for fresh produce.

- Stringent food safety regulations and increasing traceability requirements.

Challenges and Restraints:

- High infrastructure costs, including warehouse construction and cold storage facilities.

- Fluctuating fuel prices, impacting transportation costs.

- Skilled labor shortages in specialized cold chain logistics roles.

- Competition from established players and the entry of new entrants into the market. This competition is causing pressure on pricing and profit margins.

Emerging Opportunities in Poland Cold Chain Logistics Market

- Growing demand for specialized cold chain solutions for pharmaceuticals and life sciences.

- Increased adoption of sustainable and eco-friendly cold chain practices.

- Expansion of cold chain infrastructure in rural areas.

- Increased use of technology to enhance traceability and transparency.

Growth Accelerators in the Poland Cold Chain Logistics Market Industry

Technological advancements, particularly in areas of automation, data analytics, and IoT, are significant growth drivers. Strategic partnerships between logistics providers and technology companies are facilitating the adoption of new solutions. Market expansion strategies, such as building new cold storage facilities in underserved regions and expanding into new product categories, will play a significant role in accelerating future market growth.

Key Players Shaping the Poland Cold Chain Logistics Market Market

- Uni Logistics

- Silvan Logistics

- Pago Logistics

- Frigo Logistics

- Loginex

- Chenczke Group

- Eco Containers

- Mandersloot

- Green Yard

- New Cold Logistics

Notable Milestones in Poland Cold Chain Logistics Market Sector

- June 2023: NewCold announces construction of a new EUR 112 million (USD 120.22 million) temperature-controlled warehouse near Warsaw, expanding its Polish presence.

- February 2023: Maersk introduces "Container Protect Essential," enhancing protection for shipments from Poland, Austria, and Switzerland.

In-Depth Poland Cold Chain Logistics Market Market Outlook

The Polish cold chain logistics market is poised for sustained growth, driven by several factors including rising consumer demand, technological advancements, and ongoing infrastructure development. Strategic opportunities lie in adopting innovative technologies, expanding into new market segments, and focusing on sustainable practices. The market’s future potential is significant, with continued growth expected across all segments, making it an attractive sector for investment and expansion.

Poland Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. End User

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other End Users

Poland Cold Chain Logistics Market Segmentation By Geography

- 1. Poland

Poland Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Poland Cold Chain Logistics Market

Poland Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Poland’s Foreign Trade in Agri-Food Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Uni Logistics**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Silvan Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pago Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Frigo Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Loginex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chenczke Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eco Containers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mandersloot

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Green Yard

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 New Cold Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Uni Logistics**List Not Exhaustive

List of Figures

- Figure 1: Poland Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Poland Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Poland Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Poland Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Poland Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Poland Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Poland Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Poland Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Poland Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Cold Chain Logistics Market?

The projected CAGR is approximately 10.43%.

2. Which companies are prominent players in the Poland Cold Chain Logistics Market?

Key companies in the market include Uni Logistics**List Not Exhaustive, Silvan Logistics, Pago Logistics, Frigo Logistics, Loginex, Chenczke Group, Eco Containers, Mandersloot, Green Yard, New Cold Logistics.

3. What are the main segments of the Poland Cold Chain Logistics Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.00 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Poland’s Foreign Trade in Agri-Food Products.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

June 2023: NewCold has announced the construction of a new EUR 112 million (USD 120.22 million) temperature-controlled warehouse in the city of Nowy Modlin, close to Warsaw, Poland, which will be the second NewCold facility in Poland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Poland Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence