Key Insights

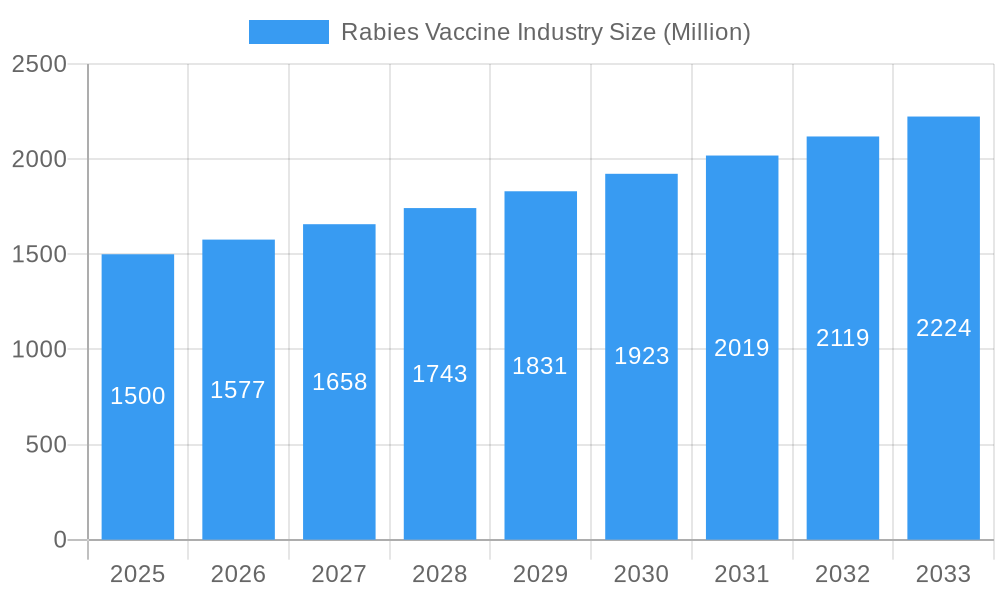

The global rabies vaccine market is projected to reach $1,221 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033. This growth is fueled by increased rabies prevention awareness, particularly in endemic regions, and expanded government-led animal vaccination programs. Technological advancements in vaccine development, such as Vero Cell Rabies Vaccines, are also driving market expansion. The rising trend of pet ownership worldwide, coupled with strong human-animal bonds, is further escalating demand for both preventive and therapeutic rabies vaccinations for companion animals, indicating a robust market outlook.

Rabies Vaccine Industry Market Size (In Billion)

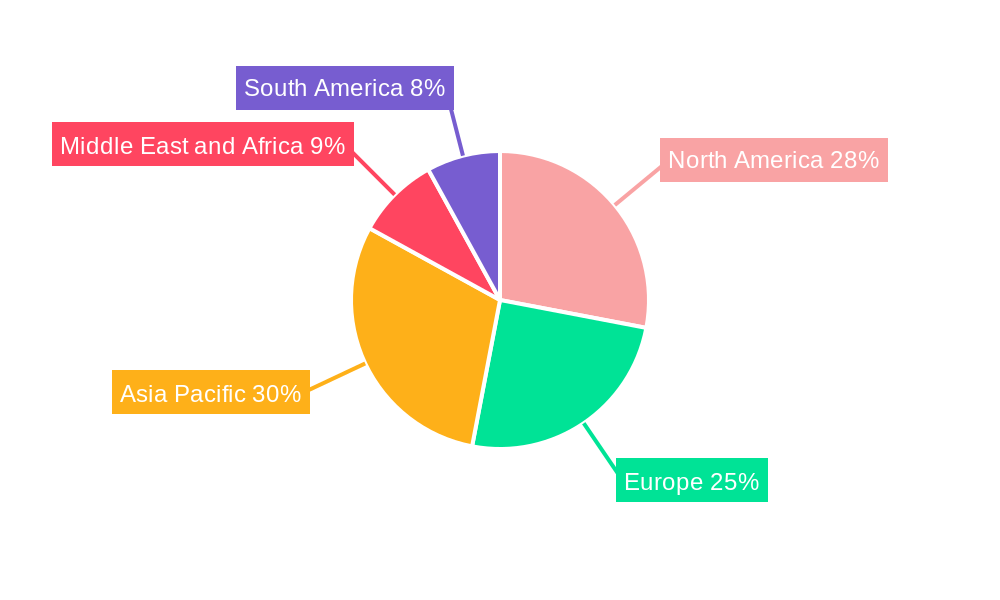

Market segmentation highlights key growth areas. While Purified Chick Embryo Cell Rabies Vaccine holds a significant share, Vero Cell Rabies Vaccine is anticipated to gain substantial traction due to its superior safety and efficacy. Post-Exposure Prophylaxis (PEP) dominates vaccination types, essential for post-exposure rabies prevention. Pre-Exposure Vaccination (PEV), especially for high-risk individuals and those in endemic areas, is steadily growing. Both animal and human vaccination segments show consistent growth. Geographically, the Asia Pacific region is a primary growth driver, attributed to its large population, rising disposable incomes, and heightened awareness of zoonotic diseases.

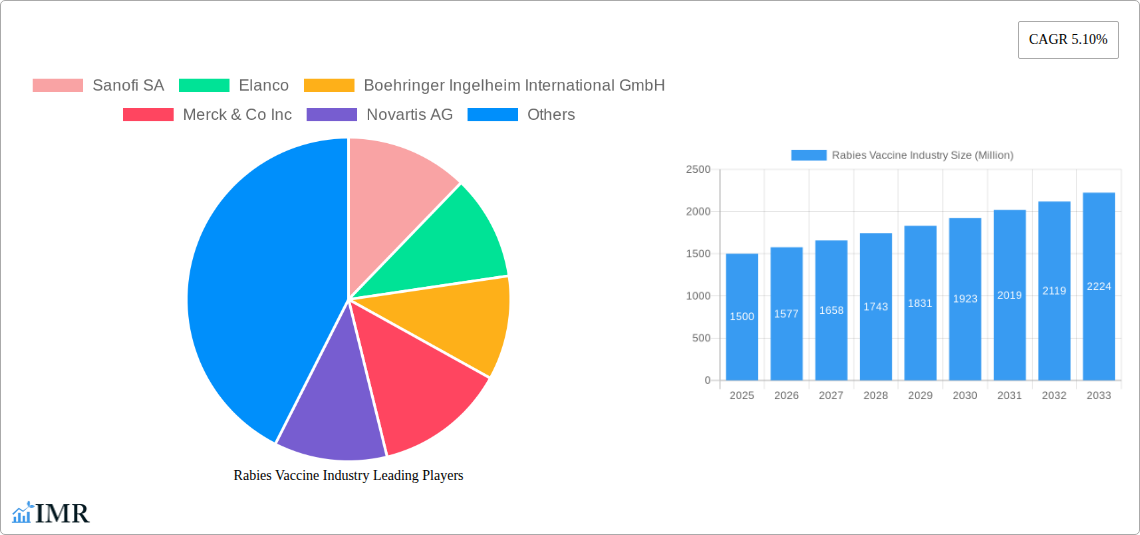

Rabies Vaccine Industry Company Market Share

Rabies Vaccine Market: Comprehensive Analysis, Growth Forecasts, and Competitive Landscape (2019–2033)

This in-depth report provides a detailed analysis of the global Rabies Vaccine market, encompassing historical trends, current dynamics, and future projections from 2019 to 2033. With a base year of 2025, the report meticulously forecasts market growth through 2033, driven by increasing awareness of rabies prevention, rising pet ownership, and evolving vaccination protocols for both humans and animals. The market is segmented by product type (BHK, Purified Chick Embryo Cell Rabies Vaccine, Vero Cell Rabies Vaccine, Other), vaccination type (Pre-Exposure Vaccination (PEV), Post-Exposure Prophylaxis (PEP)), and end-user (Animals, Humans). This report is essential for stakeholders seeking to understand market concentration, technological innovation, regulatory landscapes, competitive strategies, and emerging opportunities within the rabies vaccine industry. All values are presented in Million units.

Rabies Vaccine Industry Market Dynamics & Structure

The rabies vaccine industry is characterized by a moderately consolidated market structure, with key players investing heavily in research and development to enhance vaccine efficacy and develop novel delivery systems. Technological innovation is a primary driver, fueled by advancements in biotechnology and a growing understanding of virology, leading to the development of more efficient and safer rabies vaccines. Stringent regulatory frameworks established by global health organizations and national regulatory bodies play a crucial role in ensuring vaccine quality, safety, and accessibility. Competitive product substitutes exist, primarily in the form of alternative rabies prophylaxis methods, though vaccines remain the cornerstone of prevention. End-user demographics, including a rising global pet population and an increasing number of rabies-endemic regions requiring public health interventions, significantly influence market demand. Mergers and acquisitions (M&A) trends, while not overly aggressive, reflect strategic moves by larger companies to expand their product portfolios and geographical reach.

- Market Concentration: Dominated by a few multinational pharmaceutical and biotechnology companies, with a growing presence of regional players.

- Technological Innovation Drivers: Development of cell-culture-based vaccines, recombinant vaccines, and novel adjuvants to improve immunogenicity and reduce side effects.

- Regulatory Frameworks: Strict approval processes by agencies like the FDA, EMA, and WHO, ensuring safety and efficacy standards.

- Competitive Product Substitutes: Limited direct substitutes for post-exposure prophylaxis, but alternative management strategies for animal bites exist.

- End-User Demographics: Driven by increasing pet vaccination rates, global public health initiatives, and travel-related prophylaxis needs.

- M&A Trends: Strategic acquisitions focused on expanding market share and acquiring innovative technologies.

Rabies Vaccine Industry Growth Trends & Insights

The global rabies vaccine market is poised for robust growth, driven by a confluence of factors that are reshaping its trajectory from 2019 to 2033. During the historical period (2019–2024), the market witnessed steady expansion, buoyed by increasing awareness campaigns and a consistent demand for both human and animal rabies vaccinations. The base year of 2025 marks a significant point, with the market estimated to reach substantial value, setting the stage for accelerated growth in the forecast period (2025–2033). This expansion is underpinned by rising global pet ownership, a critical factor as domestic animals, particularly dogs, remain the primary reservoir for the rabies virus. Concurrently, public health initiatives in rabies-endemic countries are intensifying, leading to increased demand for human vaccines for post-exposure prophylaxis (PEP).

Technological disruptions are also playing a pivotal role. The shift towards cell-culture-based vaccines from older, less efficient methods has enhanced safety profiles and improved production yields. Innovations in vaccine formulation and delivery systems are further contributing to market penetration, making vaccinations more accessible and cost-effective. Consumer behavior shifts are evident, with greater emphasis on preventative healthcare for pets and a proactive approach to potential rabies exposure in humans, especially in regions with a high prevalence of the disease. The market penetration of rabies vaccines is expected to deepen, reaching new segments and geographical areas as the understanding of rabies's devastating consequences grows and vaccination becomes more integrated into routine healthcare and animal management practices. The Compound Annual Growth Rate (CAGR) projected for the forecast period reflects this sustained momentum, indicating a healthy and expanding market driven by both necessity and innovation. The estimated market size for 2025 is projected to be substantial, with further significant increases anticipated by 2033, as global efforts to eliminate rabies intensify.

Dominant Regions, Countries, or Segments in Rabies Vaccine Industry

The global rabies vaccine market's dominance is shaped by a complex interplay of regional healthcare infrastructure, economic policies, disease prevalence, and end-user demographics. Among the product types, Purified Chick Embryo Cell (PCEC) Rabies Vaccines and Vero Cell Rabies Vaccines are expected to exhibit significant market share due to their established efficacy, safety profiles, and large-scale production capabilities. These cell-culture-based vaccines have largely replaced older methods, offering superior immunogenicity and a reduced risk of allergic reactions. The demand for Pre-Exposure Vaccination (PEV) is steadily growing, particularly in regions with high rabies incidence and for individuals with occupational risks, such as veterinarians, wildlife handlers, and laboratory personnel. However, Post-Exposure Prophylaxis (PEP) remains the largest segment by volume, driven by the immediate need to prevent rabies after potential exposure.

Geographically, North America and Europe currently hold substantial market shares, attributed to advanced healthcare systems, high pet vaccination rates, and strong regulatory oversight. These regions benefit from robust distribution networks and established veterinary and public health infrastructure. However, the Asia Pacific region is emerging as a significant growth engine. This surge is fueled by rapid urbanization, a burgeoning pet population, increasing disposable incomes, and intensified government-led rabies control programs. Countries like India, China, and Southeast Asian nations are witnessing a heightened demand for both human and animal rabies vaccines. Economic policies in these regions are increasingly prioritizing public health, leading to greater investment in vaccination campaigns and improved access to vaccines. Furthermore, the higher prevalence of rabies in many parts of the Asia Pacific, Africa, and Latin America necessitates a greater focus on PEP, thereby driving the demand for vaccines in these areas. Infrastructure development in these emerging markets, including enhanced cold chain logistics and wider healthcare access, is crucial for expanding market penetration. The growth potential in these regions is immense, driven by the sheer unmet need and the commitment of international organizations and national governments to achieve rabies elimination.

Rabies Vaccine Industry Product Landscape

The rabies vaccine product landscape is characterized by continuous innovation aimed at improving efficacy, safety, and ease of administration. Purified Chick Embryo Cell (PCEC) and Vero Cell Rabies Vaccines represent the current gold standard, offering high immunogenicity and a favorable safety profile for both human and animal applications. Technological advancements are leading to the development of novel formulations, including those utilizing recombinant DNA technology and nanoparticle-based systems, which promise enhanced immune responses and potentially reduced dosing regimens. These innovations are crucial for improving compliance, especially in veterinary settings and for human PEP. The unique selling propositions of advanced rabies vaccines lie in their reduced number of doses required for prophylaxis, faster onset of immunity, and minimized adverse effects. These advancements are critical in addressing the global burden of rabies and achieving elimination goals.

Key Drivers, Barriers & Challenges in Rabies Vaccine Industry

The rabies vaccine industry is propelled by several key drivers. The increasing global pet population, coupled with rising awareness about zoonotic diseases, significantly boosts demand for animal rabies vaccines. Intensified public health initiatives in rabies-endemic regions and for at-risk human populations are crucial drivers for PEP vaccines. Technological advancements in vaccine production and formulation contribute to market growth by offering safer and more effective products.

Conversely, several barriers and challenges restrain the market. The high cost of some advanced vaccines can limit accessibility in low-income countries. Stringent and time-consuming regulatory approval processes can delay market entry for new products. Supply chain disruptions, particularly maintaining the cold chain for vaccine storage and transportation, pose a significant challenge, especially in remote or resource-limited areas. The prevalence of counterfeit vaccines and the presence of inadequate vaccination coverage in certain regions also impede market growth and public health efforts.

Emerging Opportunities in Rabies Vaccine Industry

Emerging opportunities in the rabies vaccine industry are manifold, driven by evolving healthcare needs and technological advancements. The development of single-dose or multi-year duration rabies vaccines for animals presents a significant market opportunity, promising improved compliance and cost-effectiveness. For humans, advancements in oral rabies vaccines or needle-free delivery systems could revolutionize PEP and PEV, increasing accessibility and patient comfort. Untapped markets in developing countries with high rabies prevalence offer substantial growth potential, provided affordable and accessible vaccine solutions are available. Furthermore, the increasing focus on One Health approaches, which integrate human, animal, and environmental health, opens avenues for collaborative efforts and integrated rabies control strategies, potentially leading to new product development and market expansion.

Growth Accelerators in the Rabies Vaccine Industry Industry

Several factors are accelerating the long-term growth of the rabies vaccine industry. Technological breakthroughs in vaccine platforms, such as mRNA technology, could lead to the development of rapidly deployable and highly effective rabies vaccines. Strategic partnerships between pharmaceutical companies, academic institutions, and governmental organizations are fostering innovation and expanding R&D pipelines. Market expansion strategies, including increased penetration into emerging economies through localized production and tailored distribution models, are crucial growth accelerators. Furthermore, the ongoing global push towards rabies elimination, supported by organizations like the WHO, provides a strong impetus for continued market development and investment.

Key Players Shaping the Rabies Vaccine Industry Market

- Sanofi SA

- Elanco

- Boehringer Ingelheim International GmbH

- Merck & Co Inc

- Novartis AG

- Bharat Biotech

- GlaxoSmithKline plc

- Berna Biotech Ltd

- Virbac

- Zoetis Inc

- Pfizer Inc

Notable Milestones in Rabies Vaccine Industry Sector

- April 2022: Cadila Pharmaceuticals launched a three-dose recombinant nanoparticle-based G protein rabies vaccine in Ahmedabad, marking a significant departure from the traditional five-dose regimen.

- August 2020: Bavarian Nordic A/S commenced commercial operations in the United States for Rabipur/RabAvert (Rabies Vaccine) and Encepur (Tick-Borne Encephalitis Vaccine) following their acquisition from GlaxoSmithKline plc (GSK).

In-Depth Rabies Vaccine Industry Market Outlook

The rabies vaccine industry is on a trajectory for sustained and significant growth, driven by a confluence of critical factors. The ongoing commitment to rabies elimination by global health bodies, coupled with increasing pet ownership and a heightened awareness of zoonotic disease prevention, will continue to fuel demand for both human and animal vaccines. Innovations in vaccine technology, including the exploration of novel delivery systems and potentially single-dose regimens, hold the promise of enhancing accessibility and efficacy, thereby expanding market reach into underserved regions. Strategic collaborations and investments in research and development are expected to yield next-generation rabies vaccines that are safer, more cost-effective, and easier to administer. The market's future potential is robust, with opportunities to address the persistent challenge of rabies in developing nations and to fortify preventative measures in established markets. Stakeholders are well-positioned to capitalize on these opportunities by focusing on innovative product development, strategic market penetration, and by actively participating in global efforts to control and eradicate rabies.

Rabies Vaccine Industry Segmentation

-

1. Product Type

- 1.1. Baby Hamster Kidney (BHK)

- 1.2. Purified Chick Embryo Cell Rabies Vaccine

- 1.3. Vero Cell Rabies Vaccine

- 1.4. Other Product Types

-

2. Vaccination Type

- 2.1. Pre-Exposure Vaccination (PEV)

- 2.2. Post-Exposure Prophylaxis (PEP)

-

3. End-User

- 3.1. Animals

- 3.2. Humans

Rabies Vaccine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Rabies Vaccine Industry Regional Market Share

Geographic Coverage of Rabies Vaccine Industry

Rabies Vaccine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Mortality due to Rabies; Large Population of Stray Dogs in Low and Middle Income Countries; Growing Pet Management technological Advancements and Services

- 3.3. Market Restrains

- 3.3.1. Low Immunization Rates in Dogs; Lack of Awareness and Negligence by Government and Public

- 3.4. Market Trends

- 3.4.1. The Purified Chick Embryo Cell Rabies Vaccine is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rabies Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Baby Hamster Kidney (BHK)

- 5.1.2. Purified Chick Embryo Cell Rabies Vaccine

- 5.1.3. Vero Cell Rabies Vaccine

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Vaccination Type

- 5.2.1. Pre-Exposure Vaccination (PEV)

- 5.2.2. Post-Exposure Prophylaxis (PEP)

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Animals

- 5.3.2. Humans

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Rabies Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Baby Hamster Kidney (BHK)

- 6.1.2. Purified Chick Embryo Cell Rabies Vaccine

- 6.1.3. Vero Cell Rabies Vaccine

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Vaccination Type

- 6.2.1. Pre-Exposure Vaccination (PEV)

- 6.2.2. Post-Exposure Prophylaxis (PEP)

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Animals

- 6.3.2. Humans

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Rabies Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Baby Hamster Kidney (BHK)

- 7.1.2. Purified Chick Embryo Cell Rabies Vaccine

- 7.1.3. Vero Cell Rabies Vaccine

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Vaccination Type

- 7.2.1. Pre-Exposure Vaccination (PEV)

- 7.2.2. Post-Exposure Prophylaxis (PEP)

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Animals

- 7.3.2. Humans

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Rabies Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Baby Hamster Kidney (BHK)

- 8.1.2. Purified Chick Embryo Cell Rabies Vaccine

- 8.1.3. Vero Cell Rabies Vaccine

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Vaccination Type

- 8.2.1. Pre-Exposure Vaccination (PEV)

- 8.2.2. Post-Exposure Prophylaxis (PEP)

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Animals

- 8.3.2. Humans

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Rabies Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Baby Hamster Kidney (BHK)

- 9.1.2. Purified Chick Embryo Cell Rabies Vaccine

- 9.1.3. Vero Cell Rabies Vaccine

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Vaccination Type

- 9.2.1. Pre-Exposure Vaccination (PEV)

- 9.2.2. Post-Exposure Prophylaxis (PEP)

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Animals

- 9.3.2. Humans

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Rabies Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Baby Hamster Kidney (BHK)

- 10.1.2. Purified Chick Embryo Cell Rabies Vaccine

- 10.1.3. Vero Cell Rabies Vaccine

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Vaccination Type

- 10.2.1. Pre-Exposure Vaccination (PEV)

- 10.2.2. Post-Exposure Prophylaxis (PEP)

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Animals

- 10.3.2. Humans

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sanofi SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elanco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Boehringer Ingelheim International GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck & Co Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Novartis AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bharat Biotech*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GlaxoSmithKline plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Berna Biotech Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Virbac

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zoetis Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pfizer Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Sanofi SA

List of Figures

- Figure 1: Global Rabies Vaccine Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Rabies Vaccine Industry Revenue (million), by Product Type 2025 & 2033

- Figure 3: North America Rabies Vaccine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Rabies Vaccine Industry Revenue (million), by Vaccination Type 2025 & 2033

- Figure 5: North America Rabies Vaccine Industry Revenue Share (%), by Vaccination Type 2025 & 2033

- Figure 6: North America Rabies Vaccine Industry Revenue (million), by End-User 2025 & 2033

- Figure 7: North America Rabies Vaccine Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Rabies Vaccine Industry Revenue (million), by Country 2025 & 2033

- Figure 9: North America Rabies Vaccine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Rabies Vaccine Industry Revenue (million), by Product Type 2025 & 2033

- Figure 11: Europe Rabies Vaccine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Rabies Vaccine Industry Revenue (million), by Vaccination Type 2025 & 2033

- Figure 13: Europe Rabies Vaccine Industry Revenue Share (%), by Vaccination Type 2025 & 2033

- Figure 14: Europe Rabies Vaccine Industry Revenue (million), by End-User 2025 & 2033

- Figure 15: Europe Rabies Vaccine Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Rabies Vaccine Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Rabies Vaccine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Rabies Vaccine Industry Revenue (million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Rabies Vaccine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Rabies Vaccine Industry Revenue (million), by Vaccination Type 2025 & 2033

- Figure 21: Asia Pacific Rabies Vaccine Industry Revenue Share (%), by Vaccination Type 2025 & 2033

- Figure 22: Asia Pacific Rabies Vaccine Industry Revenue (million), by End-User 2025 & 2033

- Figure 23: Asia Pacific Rabies Vaccine Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Rabies Vaccine Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Rabies Vaccine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Rabies Vaccine Industry Revenue (million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Rabies Vaccine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Rabies Vaccine Industry Revenue (million), by Vaccination Type 2025 & 2033

- Figure 29: Middle East and Africa Rabies Vaccine Industry Revenue Share (%), by Vaccination Type 2025 & 2033

- Figure 30: Middle East and Africa Rabies Vaccine Industry Revenue (million), by End-User 2025 & 2033

- Figure 31: Middle East and Africa Rabies Vaccine Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East and Africa Rabies Vaccine Industry Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Rabies Vaccine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Rabies Vaccine Industry Revenue (million), by Product Type 2025 & 2033

- Figure 35: South America Rabies Vaccine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: South America Rabies Vaccine Industry Revenue (million), by Vaccination Type 2025 & 2033

- Figure 37: South America Rabies Vaccine Industry Revenue Share (%), by Vaccination Type 2025 & 2033

- Figure 38: South America Rabies Vaccine Industry Revenue (million), by End-User 2025 & 2033

- Figure 39: South America Rabies Vaccine Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 40: South America Rabies Vaccine Industry Revenue (million), by Country 2025 & 2033

- Figure 41: South America Rabies Vaccine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rabies Vaccine Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Rabies Vaccine Industry Revenue million Forecast, by Vaccination Type 2020 & 2033

- Table 3: Global Rabies Vaccine Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 4: Global Rabies Vaccine Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Rabies Vaccine Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Global Rabies Vaccine Industry Revenue million Forecast, by Vaccination Type 2020 & 2033

- Table 7: Global Rabies Vaccine Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 8: Global Rabies Vaccine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Rabies Vaccine Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 13: Global Rabies Vaccine Industry Revenue million Forecast, by Vaccination Type 2020 & 2033

- Table 14: Global Rabies Vaccine Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 15: Global Rabies Vaccine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Spain Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Rabies Vaccine Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 23: Global Rabies Vaccine Industry Revenue million Forecast, by Vaccination Type 2020 & 2033

- Table 24: Global Rabies Vaccine Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 25: Global Rabies Vaccine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 26: China Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Japan Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: India Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Australia Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Rabies Vaccine Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 33: Global Rabies Vaccine Industry Revenue million Forecast, by Vaccination Type 2020 & 2033

- Table 34: Global Rabies Vaccine Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 35: Global Rabies Vaccine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: GCC Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Global Rabies Vaccine Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 40: Global Rabies Vaccine Industry Revenue million Forecast, by Vaccination Type 2020 & 2033

- Table 41: Global Rabies Vaccine Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 42: Global Rabies Vaccine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 43: Brazil Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Rabies Vaccine Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rabies Vaccine Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Rabies Vaccine Industry?

Key companies in the market include Sanofi SA, Elanco, Boehringer Ingelheim International GmbH, Merck & Co Inc, Novartis AG, Bharat Biotech*List Not Exhaustive, GlaxoSmithKline plc, Berna Biotech Ltd, Virbac, Zoetis Inc, Pfizer Inc.

3. What are the main segments of the Rabies Vaccine Industry?

The market segments include Product Type, Vaccination Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1221 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Mortality due to Rabies; Large Population of Stray Dogs in Low and Middle Income Countries; Growing Pet Management technological Advancements and Services.

6. What are the notable trends driving market growth?

The Purified Chick Embryo Cell Rabies Vaccine is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Low Immunization Rates in Dogs; Lack of Awareness and Negligence by Government and Public.

8. Can you provide examples of recent developments in the market?

In April 2022, Cadila Pharmaceuticals launched a three-dose recombinant nanoparticle-based G protein rabies vaccine in Ahmedabad. This is a three-dose regimen to be given over a period of one week (on day 0, day three, and day seven) after exposure to the virus. It is the first in a long list of existing rabies vaccines that require five doses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rabies Vaccine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rabies Vaccine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rabies Vaccine Industry?

To stay informed about further developments, trends, and reports in the Rabies Vaccine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence