Key Insights

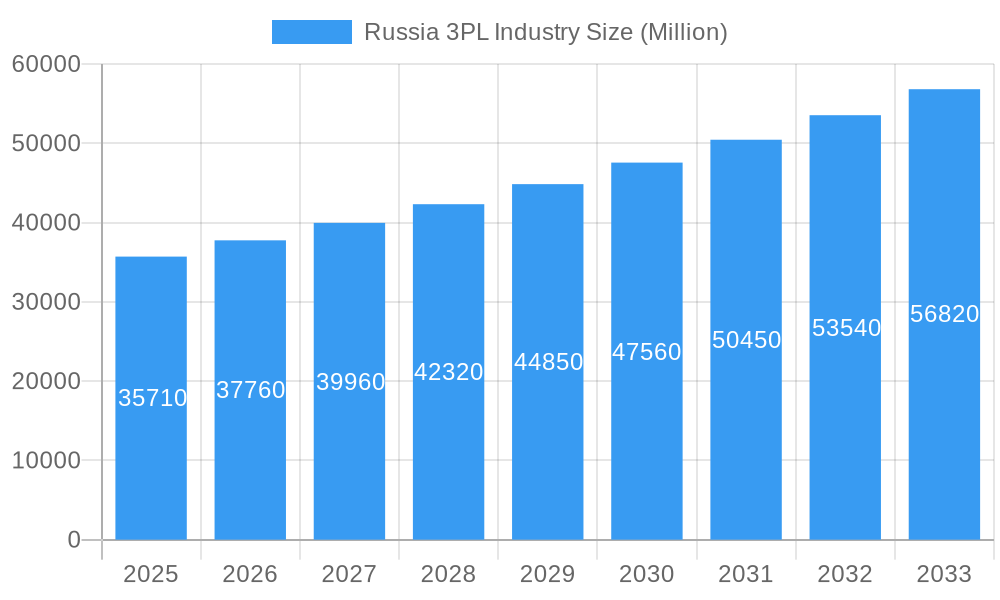

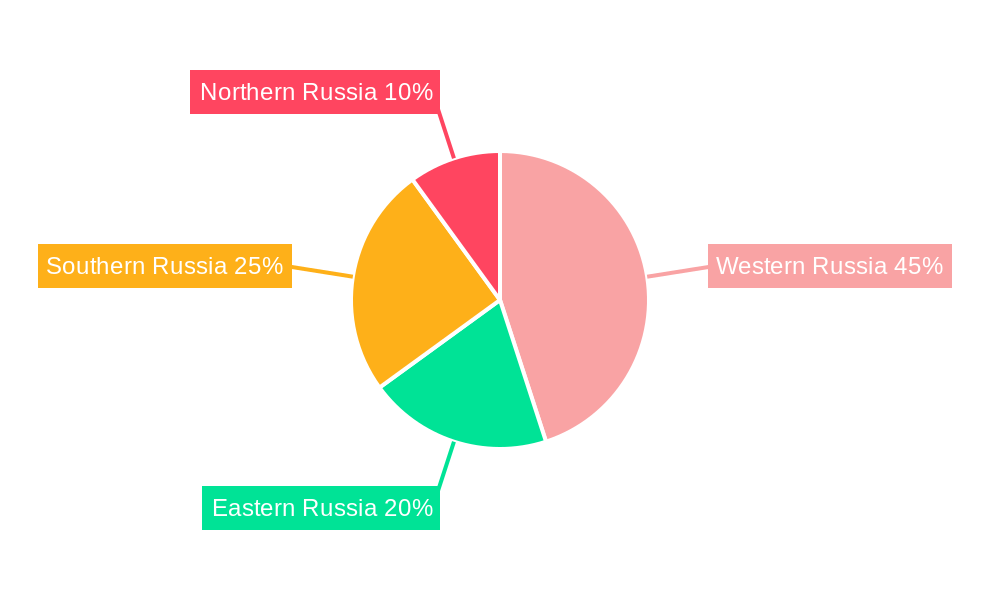

The Russian 3PL (Third-Party Logistics) market, valued at $35.71 billion in 2025, is projected to experience robust growth, driven by the increasing e-commerce penetration, expansion of manufacturing and retail sectors, and the need for efficient supply chain management within a geographically vast nation. The compound annual growth rate (CAGR) of 5.63% from 2025 to 2033 indicates a significant market expansion, reaching an estimated value of approximately $57 billion by 2033. Key growth drivers include the rising demand for warehousing and distribution services, particularly value-added solutions like inventory management and order fulfillment, catering to both domestic and international trade. The market is segmented by type, encompassing domestic and international transportation management, and value-added warehousing and distribution, and by end-users, including consumer and retail, energy and chemicals, automotive and manufacturing, life sciences and healthcare, and other sectors. Leading players such as DB Schenker, UPS, Kuehne Nagel, and DHL Supply Chain are actively shaping the market landscape through strategic investments and operational expansions. The geographical segmentation, considering Western, Eastern, Southern, and Northern Russia, reveals varied growth potential influenced by regional economic activity and infrastructure development. While Western Russia currently holds a larger market share due to higher economic activity and established logistics infrastructure, Eastern Russia presents significant untapped potential for future growth.

Russia 3PL Industry Market Size (In Billion)

Challenges for the Russian 3PL market include infrastructural limitations in certain regions, geopolitical uncertainties impacting international trade, and the need for adapting to evolving technological advancements in logistics and supply chain technologies. However, government initiatives promoting economic diversification and infrastructure upgrades are expected to mitigate some of these challenges. The ongoing shift towards digitalization within the supply chain, including the adoption of advanced technologies like AI and IoT, offers promising opportunities for 3PL providers to enhance efficiency and optimize operations. This trend is likely to attract further investment and consolidate the market, leading to a more technologically advanced and competitive landscape in the coming years. The market's diverse end-user segments will also drive specialized service offerings, creating opportunities for niche players to thrive.

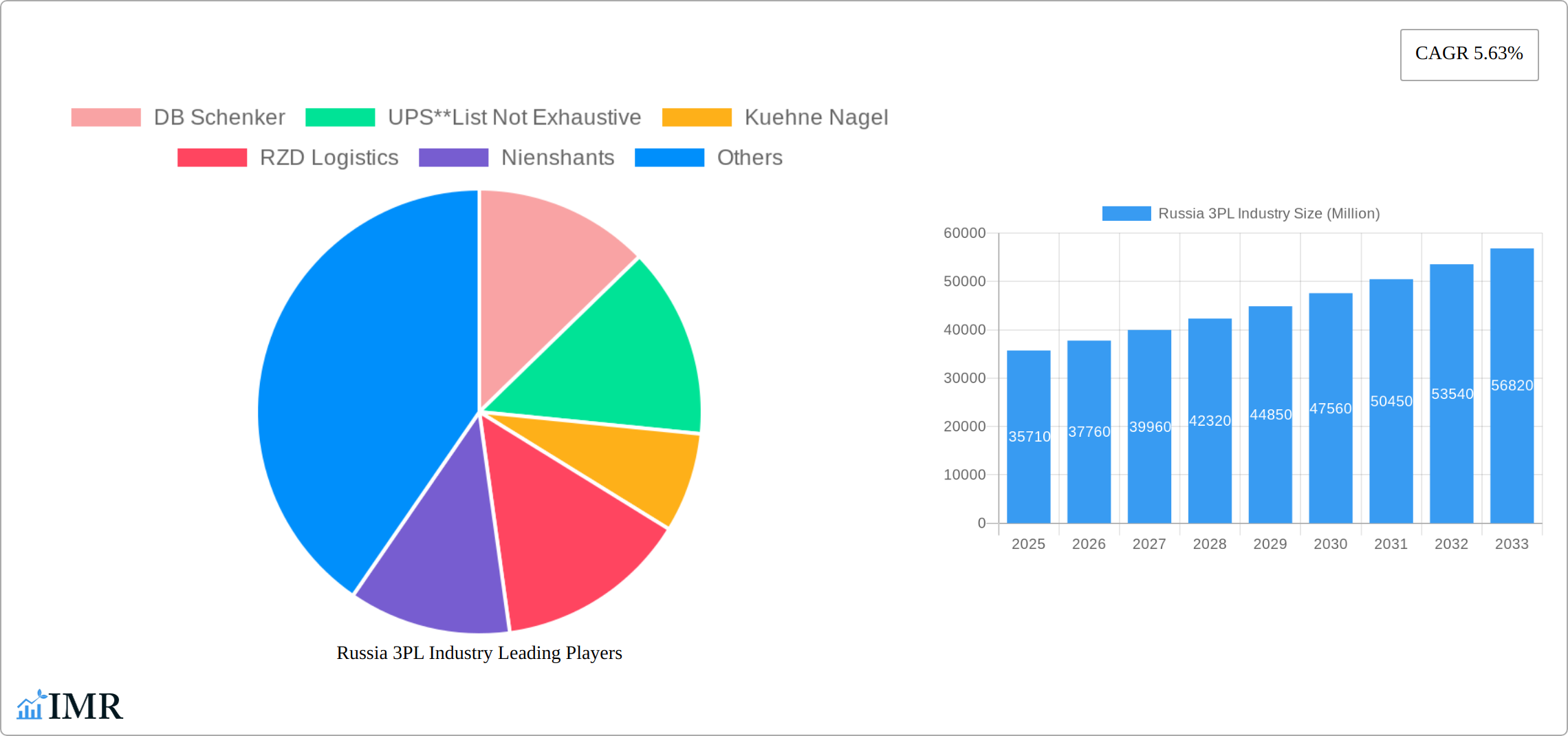

Russia 3PL Industry Company Market Share

Russia 3PL Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Russia 3PL (Third-Party Logistics) industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and forecast extending to 2033. This report is essential for industry professionals, investors, and strategic decision-makers seeking insights into this dynamic market.

Russia 3PL Industry Market Dynamics & Structure

The Russian 3PL market, a sector valued at [Insert precise 2024 market value in millions] in 2024, presents a moderately concentrated structure. A few dominant players share the market with numerous smaller, regional operators. While technological innovation is evident, particularly in warehousing automation and supply chain digitalization, its progress faces significant headwinds. These include infrastructure limitations, the ongoing impact of geopolitical sanctions, and a complex and evolving regulatory framework that directly impacts operational efficiency and investment decisions. Furthermore, the availability of product substitutes, primarily in-house logistics solutions, presents a persistent competitive challenge. The end-user demographic is remarkably diverse, reflecting the broad and varied industrial landscape of Russia, encompassing sectors such as consumer retail, energy, manufacturing, and healthcare.

Mergers and acquisitions (M&A) activity has remained relatively subdued in recent years, totaling [Insert precise 2024 M&A deal volume in millions] in 2024. This muted activity is largely attributable to the prevailing geopolitical uncertainties.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately [Insert precise percentage market share in 2024]% of the market share (2024).

- Technological Innovation: Significant strides are being made in automation within warehousing facilities and the digitalization of supply chain management processes. However, these advancements are significantly hampered by persistent infrastructure gaps and the ongoing impact of international sanctions.

- Regulatory Framework: The regulatory environment remains complex and is subject to frequent changes, leading to increased operational costs and compliance challenges for 3PL providers.

- Competitive Substitutes: In-house logistics solutions continue to serve as a substantial alternative for a significant portion of businesses, particularly those with specialized needs or high internal control requirements.

- End-User Demographics: The end-user base is exceptionally diverse, spanning a wide array of sectors, including but not limited to: consumer retail, energy, manufacturing, and healthcare. This diversity necessitates adaptable and specialized logistics solutions.

- M&A Trends: Geopolitical uncertainties have dampened M&A activity in recent years, resulting in a relatively low deal volume of [Insert precise 2024 M&A deal volume in millions] in 2024.

Russia 3PL Industry Growth Trends & Insights

The Russian 3PL market showcased a compound annual growth rate (CAGR) of [Insert precise CAGR percentage] during the period of 2019-2024. Market projections indicate a growth trajectory, with anticipated market size reaching [Insert precise projected market value in millions] by 2025 and [Insert precise projected market value in millions] by 2033. This projected growth is primarily fueled by the expansion of the e-commerce sector and the escalating demand for streamlined and efficient supply chain solutions. However, the inherent volatility created by geopolitical instability and ongoing sanctions continues to exert a considerable influence on growth trajectories, introducing uncertainty into long-term forecasts.

The adoption rate of cutting-edge technologies, such as artificial intelligence (AI) and blockchain, is gradually increasing, although the pervasive limitations in existing infrastructure continue to hinder the widespread implementation of these technologies. Furthermore, the shifting consumer behavior, increasingly favoring online shopping, is acting as a significant catalyst for growth within the last-mile delivery segment.

Dominant Regions, Countries, or Segments in Russia 3PL Industry

The Moscow and St. Petersburg regions dominate the Russian 3PL market due to their developed infrastructure and proximity to major consumption centers. Within market segments, domestic transportation management is currently the largest segment, followed by value-added warehousing and distribution. High growth is anticipated in international transportation management despite geopolitical challenges.

By Type:

- Domestic Transportation Management: Largest segment, benefiting from robust domestic consumption.

- International Transportation Management: Growth potential hampered by sanctions and geopolitical issues.

- Value-added Warehousing and Distribution: Growing steadily due to e-commerce expansion.

By End-Users:

- Consumer and Retail: Largest end-user segment, driven by e-commerce growth.

- Energy and Chemicals: Significant demand for specialized logistics solutions.

- Automotive and Manufacturing: Relatively stable demand, though subject to global economic fluctuations.

- Life Sciences and Healthcare: High demand for temperature-controlled logistics.

Russia 3PL Industry Product Landscape

The Russian 3PL market offers a comprehensive suite of services, encompassing transportation management, warehousing, distribution, and a range of value-added services such as labeling and specialized packaging solutions. Technological advancements are steadily driving the adoption of sophisticated warehouse management systems (WMS), transportation management systems (TMS), and route optimization software. A key competitive differentiator for many 3PL providers lies in their specialized expertise in handling specific commodities and their proven ability to navigate the intricate complexities of the Russian regulatory environment.

Key Drivers, Barriers & Challenges in Russia 3PL Industry

Key Drivers:

- Growing e-commerce sector

- Increasing demand for efficient supply chain solutions

- Government initiatives to improve infrastructure

Challenges:

- Geopolitical instability and sanctions: Significant impact on international trade and investment, estimated to reduce market growth by xx% in 2024.

- Infrastructure limitations: Limited access to modern warehousing facilities and transportation networks in some regions.

- Regulatory complexities: Bureaucracy and changing regulations increase operational costs and complexities.

Emerging Opportunities in Russia 3PL Industry

- Expansion into Underserved Regional Markets: Significant opportunities exist for 3PL providers to expand their service reach into less-developed regions of Russia, capitalizing on unmet demand.

- Specialized Logistics Solutions for Niche Industries: Developing tailored logistics solutions for high-growth sectors, such as e-commerce and cold chain logistics, presents substantial potential for market penetration and profitability.

- Technology-Driven Efficiency and Transparency: The strategic leveraging of technology to enhance operational efficiency and supply chain transparency is crucial for gaining a competitive edge.

- Sustainable and Green Logistics: Increasing focus on environmental sustainability presents opportunities for providers to offer green logistics solutions.

- Cross-border logistics: Facilitate trade relations and connect Russian businesses with global supply chains, particularly in regions with strong trade links.

Growth Accelerators in the Russia 3PL Industry

Long-term growth will be driven by continued improvements in infrastructure, increasing adoption of technology, and strategic partnerships between 3PL providers and major retailers and manufacturers. Focus on sustainable and environmentally friendly logistics solutions will also attract investments.

Key Players Shaping the Russia 3PL Industry Market

- DB Schenker

- UPS

- Kuehne + Nagel

- RZD Logistics

- Nienshants

- FM Logistics

- Eurosib

- DHL Supply Chain

- DP World

- STS Logistics

Notable Milestones in Russia 3PL Industry Sector

- June 2022: Russian Railways and Eurosib-SPB Transport Systems signed a Memorandum of Understanding on multimodal freight transportation cooperation focusing on the Middle East and Asia-Pacific Region (APR).

- June 2022: Kuehne+Nagel divested its Russian Federation business to its local Managing Director. This divestment reflects the challenges faced by international companies operating within the altered geopolitical landscape.

- [Add other significant milestones with dates and brief descriptions]

In-Depth Russia 3PL Industry Market Outlook

The Russian 3PL market presents significant long-term growth potential, despite current challenges. Strategic investments in technology, infrastructure, and partnerships will be crucial for success. Companies that adapt to the evolving regulatory landscape and embrace sustainable practices are poised to capture market share and drive future growth. The market is expected to see significant expansion in the next decade, fueled by the modernization of the country's logistics infrastructure and the increasing penetration of e-commerce.

Russia 3PL Industry Segmentation

-

1. Type

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-Users

- 2.1. Consumer and Retail

- 2.2. Energy and Chemicals

- 2.3. Automotive and Manufacturing

- 2.4. Life sciences and Healthcare

- 2.5. Other End-Users

Russia 3PL Industry Segmentation By Geography

- 1. Russia

Russia 3PL Industry Regional Market Share

Geographic Coverage of Russia 3PL Industry

Russia 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics

- 3.3. Market Restrains

- 3.3.1. Damaged Goods; Increasing Transportation Cost

- 3.4. Market Trends

- 3.4.1. The Rise in the E-Commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-Users

- 5.2.1. Consumer and Retail

- 5.2.2. Energy and Chemicals

- 5.2.3. Automotive and Manufacturing

- 5.2.4. Life sciences and Healthcare

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPS**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kuehne Nagel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RZD Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nienshants

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FM Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eurosib

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DHL Supply Chain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DP World

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 STS Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Russia 3PL Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: Russia 3PL Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Russia 3PL Industry Revenue Million Forecast, by End-Users 2020 & 2033

- Table 3: Russia 3PL Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Russia 3PL Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Russia 3PL Industry Revenue Million Forecast, by End-Users 2020 & 2033

- Table 6: Russia 3PL Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia 3PL Industry?

The projected CAGR is approximately 5.63%.

2. Which companies are prominent players in the Russia 3PL Industry?

Key companies in the market include DB Schenker, UPS**List Not Exhaustive, Kuehne Nagel, RZD Logistics, Nienshants, FM Logistics, Eurosib, DHL Supply Chain, DP World, STS Logistics.

3. What are the main segments of the Russia 3PL Industry?

The market segments include Type, End-Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics.

6. What are the notable trends driving market growth?

The Rise in the E-Commerce Sector.

7. Are there any restraints impacting market growth?

Damaged Goods; Increasing Transportation Cost.

8. Can you provide examples of recent developments in the market?

June 2022: Russian Railways and Eurosib-SPB Transport Systems have signed a Memorandum of Understanding on cooperation in developing optimal multimodal solutions for international freight transportation to/from the Middle East and APR. The document was signed by Viktor Golomolzin, Chief of Oktyabrskaya Railway, and Dmitry Nikitin, President of Eurosib-SPB Transport Systems, at a conference in St. Petersburg. The Memorandum envisages cooperation in developing export and import freight transportation using the railway infrastructure of the Northwest region of Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia 3PL Industry?

To stay informed about further developments, trends, and reports in the Russia 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence