Key Insights

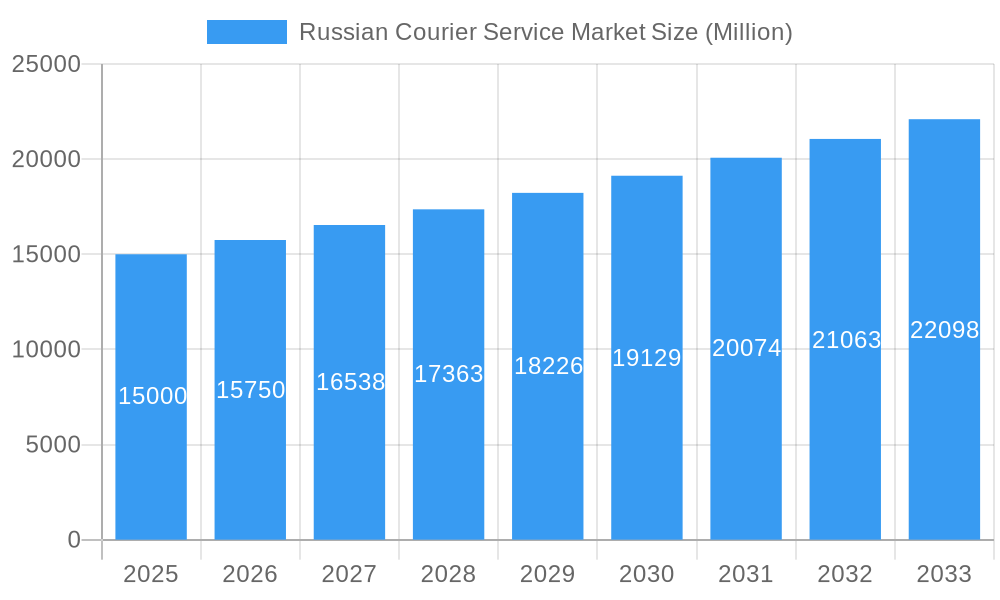

The Russian courier service market, valued at approximately [Estimate based on market size XX and value unit - e.g., $15 billion] in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 5% through 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector in Russia, particularly the growth of B2C deliveries, is a major catalyst. Furthermore, the increasing adoption of express delivery services across various sectors, including financial services, healthcare, and manufacturing, contributes significantly to market growth. Technological advancements, such as improved tracking systems and optimized delivery routes, also enhance efficiency and customer satisfaction, driving market expansion. The market is segmented by end-user industry (e-commerce dominating), destination (domestic shipments currently outpacing international), speed of delivery (express services showing strong growth), business model (B2B and B2C segments leading), and shipment weight (a balanced distribution across weight categories). Regional variations exist, with Western Russia likely exhibiting higher market penetration due to greater economic activity and population density compared to Eastern, Southern, and Northern regions. However, infrastructure development initiatives in less developed areas might accelerate growth in these regions in the coming years.

Russian Courier Service Market Market Size (In Billion)

Despite the positive outlook, certain restraints exist. Fluctuations in the Russian ruble and geopolitical uncertainties could impact market growth. Competition amongst established players like Russian Post, DHL, SDEK-Global LLC, and others, along with emerging local players, intensifies price pressures. Furthermore, logistical challenges in remote areas and the need for continuous investment in infrastructure and technology pose ongoing hurdles. However, the market's resilience and the ongoing expansion of e-commerce suggest that these challenges will be navigated effectively, contributing to sustained, albeit potentially moderated, growth in the forecast period. A clear trend is the shift towards greater automation and technological integration to improve efficiency and reduce costs, a crucial factor in maintaining profitability amidst competition.

Russian Courier Service Market Company Market Share

This in-depth report provides a comprehensive analysis of the Russian courier service market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for businesses, investors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic sector. The report segments the market across various parameters, providing granular insights into key drivers and challenges.

Russian Courier Service Market Dynamics & Structure

The Russian courier service market is characterized by a complex interplay of factors influencing its structure and growth trajectory. Market concentration is moderately high, with several key players dominating the landscape, but with numerous smaller regional operators also contributing significantly. Technological innovation, particularly in areas such as tracking and delivery optimization, is a major driver. However, regulatory frameworks and infrastructure limitations pose certain challenges. The market is highly competitive with substitutes like postal services and alternative delivery methods influencing overall market share. E-commerce growth fuels the demand for faster and more reliable courier services. Finally, M&A activity has been moderate, with consolidation expected to continue.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025 (estimated).

- Technological Innovation: Investment in AI-powered routing, automated sorting facilities, and real-time tracking systems are transforming the sector.

- Regulatory Framework: Government regulations impact pricing, licensing, and cross-border operations.

- Competitive Substitutes: Postal services and peer-to-peer delivery platforms present competitive pressure.

- End-User Demographics: The growing urban population and rising e-commerce penetration drive demand for courier services.

- M&A Trends: Consolidation is anticipated, with larger players acquiring smaller regional operators to expand their reach. The number of M&A deals in the period 2019-2024 totaled xx.

Russian Courier Service Market Growth Trends & Insights

The Russian courier service market has demonstrated a dynamic and robust growth trajectory during the historical period spanning 2019-2024, recording an impressive Compound Annual Growth Rate (CAGR) of XX%. This significant expansion is largely propelled by the explosive growth of the e-commerce sector, continuous development and enhancement of logistics networks across the nation, and a consistently rising consumer and business demand for delivery solutions that are both faster and demonstrably more reliable. Furthermore, the rapid integration of technological advancements, including sophisticated real-time tracking systems, AI-driven delivery optimization software, and automated warehousing solutions, has acted as a potent catalyst, accelerating market growth. The discernible shift in consumer behavior towards online shopping is a pivotal factor reshaping market dynamics, with an increasing preference for and expectation of express delivery options.

Looking ahead, the forecast period from 2025 to 2033 anticipates a sustained and accelerated period of growth for the Russian courier service market. This optimism is underpinned by several key factors, including further increases in internet penetration across all demographics, ongoing and planned expansions of critical infrastructure, particularly in remote and underserved regions, and the continued digitalization and modernization of the Russian economy. Market penetration is projected to reach an impressive XX% by the end of 2033, signifying a deeper integration of courier services into the daily lives and business operations of Russians. The adoption rates for express delivery services, encompassing same-day and next-day delivery options, are expected to surge significantly, driven by evolving consumer expectations for immediate gratification and efficient supply chains.

Dominant Regions, Countries, or Segments in Russian Courier Service Market

The Moscow and St. Petersburg regions represent the most dominant segments, primarily due to high population density, significant e-commerce activity, and well-developed infrastructure. However, other regions are experiencing substantial growth, particularly those with strong industrial activity or increasing e-commerce penetration.

Dominant Segments:

- End User Industry: E-commerce remains the dominant segment, accounting for xx% of the market in 2025. Wholesale and retail trade (offline) is also a major contributor.

- Destination: Domestic deliveries constitute the largest share, with international shipments growing steadily.

- Speed of Delivery: Express delivery services are experiencing higher demand and growth.

- Model: B2C is the dominant model, followed by B2B.

- Shipment Weight: Medium weight shipments form the largest segment by volume.

- Mode of Transport: Road transport dominates, with air transport utilized for express and long-distance deliveries.

Key drivers include supportive government policies promoting logistics infrastructure development, and ongoing expansion of e-commerce platforms and logistics networks across the country. Growth potential exists in less developed regions through infrastructure investment and targeted marketing strategies.

Russian Courier Service Market Product Landscape

The Russian courier service market offers a range of services tailored to different customer needs, including express and non-express options, varying shipment weights, and multiple modes of transportation. Innovation focuses on technological advancements, such as real-time tracking, automated sorting, and improved route optimization. Unique selling propositions often include faster delivery times, specialized handling for fragile goods, and integrated logistics solutions. The market also sees a gradual shift towards sustainable practices and environmentally friendly delivery options.

Key Drivers, Barriers & Challenges in Russian Courier Service Market

Key Drivers:

- E-commerce Ecosystem Expansion: The relentless and rapid growth of the online retail sector, encompassing both large marketplaces and smaller direct-to-consumer businesses, directly fuels an escalating demand for efficient and dependable courier services to fulfill online orders.

- Comprehensive Infrastructure Development: Sustained and strategic investment in the nation's transportation and logistics infrastructure, including road networks, rail connectivity, and warehousing facilities, is crucial for improving operational efficiency, reducing transit times, and enhancing overall delivery capabilities.

- Technological Integration and Innovation: The adoption of cutting-edge technologies such as advanced GPS tracking, route optimization algorithms, predictive analytics for demand forecasting, autonomous delivery vehicles, and sophisticated warehouse management systems significantly enhances operational efficiency, reduces costs, and improves customer experience.

- Growing Demand for On-Demand Services: A fundamental shift in consumer and business expectations towards instant gratification and just-in-time delivery necessitates the development and widespread availability of express and on-demand courier solutions.

Barriers & Challenges:

- Geopolitical and Economic Volatility: International geopolitical tensions, sanctions, and fluctuating economic conditions can significantly impact cross-border trade, supply chain stability, import/export regulations, and overall market predictability, posing a considerable challenge to logistics operations.

- Regional Infrastructure Disparities: Despite overall development, significant disparities in transportation and digital infrastructure persist across Russia's vast geography. Inadequate road networks, limited access to reliable internet, and a scarcity of modern warehousing facilities in certain remote or underdeveloped regions can restrict delivery reach, increase transit times, and elevate operational costs.

- Intensifying Market Competition: The Russian courier service market is characterized by fierce competition from a diverse array of players. This includes established domestic giants, emerging regional operators, the growing presence of international logistics firms, and the proliferation of smaller, agile startups, all vying for market share. This intense competition exerts considerable pressure on pricing strategies, profit margins, and the need for continuous service differentiation and innovation.

- Regulatory Hurdles and Compliance: Navigating complex and evolving regulatory frameworks, customs procedures, and compliance requirements, particularly for cross-border shipments, can present significant administrative burdens and operational challenges.

Emerging Opportunities in Russian Courier Service Market

- Last-Mile Delivery Innovation: The critical phase of last-mile delivery presents a prime area for innovation and efficiency gains. Opportunities lie in the development and widespread adoption of advanced solutions such as autonomous delivery robots, drone delivery networks in suitable urban and suburban environments, the strategic placement of micro-fulfillment centers to reduce delivery distances, and the utilization of crowd-sourced delivery models.

- Specialized and Value-Added Services: There is a growing demand for highly specialized courier services catering to niche industries with specific requirements. This includes temperature-controlled logistics for pharmaceuticals and perishables, secure and expedited delivery for high-value goods, specialized handling for sensitive equipment, and tailored solutions for the growing e-grocery sector.

- Sustainable and Green Logistics: With increasing global and domestic focus on environmental responsibility, opportunities abound in offering eco-friendly delivery solutions. This can encompass the transition to electric vehicle (EV) fleets, the implementation of optimized routing software to minimize fuel consumption and emissions, the use of sustainable packaging materials, and the development of carbon-neutral delivery options.

- Digitalization of Customer Experience: Enhancing the end-to-end customer journey through advanced digital platforms is a significant opportunity. This includes intuitive mobile applications for booking and tracking, personalized delivery options, real-time customer support, and transparent communication throughout the delivery process.

- Cross-Border E-commerce Facilitation: As cross-border e-commerce continues to grow, there is a substantial opportunity for courier services to act as facilitators, offering end-to-end solutions that include customs clearance, international shipping, and last-mile delivery in both origin and destination countries.

Growth Accelerators in the Russian Courier Service Market Industry

Long-term growth will be driven by continued e-commerce expansion, strategic partnerships between logistics providers and e-tailers, and government initiatives promoting digitalization and infrastructure development. Technological innovation will continue to play a critical role, especially in optimizing delivery routes, improving efficiency, and enhancing customer experience. Expansion into underserved regions and diversification into specialized logistics services will further fuel market growth.

Key Players Shaping the Russian Courier Service Market Market

- Garantpost

- Express Tochka Ru

- Russian Post

- DHL Group

- SDEK-Global LLC

- Delovye Linii Group

- Ural-Press (Boxberry)

- Major Express

- Pony Express

- Courier Service Express (CSE)

- Yande

- SberLogistics LLC

Notable Milestones in Russian Courier Service Market Sector

- December 2023: SberLogistics LLC strategically expanded its delivery network across numerous key regions within Russia, simultaneously introducing attractive new tariff structures for its SberCourier and SberPosylka services, enhancing its reach and affordability for a wider customer base.

- May 2023: Garantpost undertook significant operational enhancements and service improvements at its St. Petersburg branch, focusing on streamlining processes and elevating the customer experience in this vital metropolitan hub.

- March 2023: A new and innovative Sea + Railway delivery service was successfully launched, connecting China and Southeast Asia directly to major Russian cities like Moscow and St. Petersburg, offering a more efficient and potentially cost-effective route for goods originating from these regions.

- February 2023: Yandex.Lavka, a prominent player in the rapid grocery delivery segment, announced plans to integrate a new fleet of electric scooters and bicycles into its Moscow operations, signaling a commitment to greener last-mile delivery solutions.

- January 2023: Boxberry, a well-established courier company, reported a substantial increase in its parcel delivery volume for the previous year, attributing the growth to the sustained demand from online retailers and a broadening customer base.

In-Depth Russian Courier Service Market Market Outlook

The Russian courier service market is exceptionally well-positioned for sustained and robust growth in the coming years. This optimistic outlook is fueled by a confluence of powerful factors, including the relentless pace of technological advancements revolutionizing logistics operations, the continued expansion and deepening penetration of e-commerce activities across the nation, and the ongoing strategic development of vital transportation and digital infrastructure. These foundational elements are creating a fertile ground for innovation and efficiency.

Key growth avenues for market players will involve forging strategic partnerships with e-commerce platforms and retailers, diversifying service portfolios to include specialized and value-added offerings, and strategically expanding operational reach into currently underserved or emerging markets within Russia. The market is projected to exhibit a significant CAGR of XX% during the forecast period (2025-2033), with an anticipated market size reaching approximately XX million by the close of 2033. Companies that proactively embrace innovation, relentlessly optimize their operational efficiencies through technology and process improvement, and remain agile in adapting to the ever-evolving demands and expectations of consumers and businesses are best positioned to thrive and capture significant market share in this dynamic and increasingly competitive landscape.

Russian Courier Service Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

Russian Courier Service Market Segmentation By Geography

- 1. Russia

Russian Courier Service Market Regional Market Share

Geographic Coverage of Russian Courier Service Market

Russian Courier Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Courier Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Garantpost

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Express Tochka Ru

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Russian Post

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SDEK-Global LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Delovye Linii Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ural-Press (Boxberry)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Major Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pony Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Courier Service Express (CSE)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yande

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SberLogistics LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Garantpost

List of Figures

- Figure 1: Russian Courier Service Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russian Courier Service Market Share (%) by Company 2025

List of Tables

- Table 1: Russian Courier Service Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 2: Russian Courier Service Market Revenue Million Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: Russian Courier Service Market Revenue Million Forecast, by Model 2020 & 2033

- Table 4: Russian Courier Service Market Revenue Million Forecast, by Shipment Weight 2020 & 2033

- Table 5: Russian Courier Service Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Russian Courier Service Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 7: Russian Courier Service Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Russian Courier Service Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Russian Courier Service Market Revenue Million Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: Russian Courier Service Market Revenue Million Forecast, by Model 2020 & 2033

- Table 11: Russian Courier Service Market Revenue Million Forecast, by Shipment Weight 2020 & 2033

- Table 12: Russian Courier Service Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 13: Russian Courier Service Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 14: Russian Courier Service Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Courier Service Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Russian Courier Service Market?

Key companies in the market include Garantpost, Express Tochka Ru, Russian Post, DHL Group, SDEK-Global LLC, Delovye Linii Group, Ural-Press (Boxberry), Major Express, Pony Express, Courier Service Express (CSE), Yande, SberLogistics LLC.

3. What are the main segments of the Russian Courier Service Market?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services.

8. Can you provide examples of recent developments in the market?

December 2023: has expanded the number of delivery directions in the regions of Krasnodar region, Tver region, Arkhangelsk region, Amur region, Karachay-Cherkessia, The Republic of Khakassia, Tyva Republic, and Kemerovo region. Also, the new tariffs for sending parcels using SberCourier and SberPosylka services had come into effect for SberLogistics LLC from January 16, 2023.May 2023: Garantpost announced that it improved service operations at its St. Petersburg branch for courier and parcel deliveries.March 2023: The Sea + Railway delivery service is available from the main ports of China and Southeast Asia to the Russian Federation (Moscow and St. Petersburg). The option includes sea freight to the port of Riga, transshipment to a railway car, and shipment by rail to the Russian Federation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Courier Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Courier Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Courier Service Market?

To stay informed about further developments, trends, and reports in the Russian Courier Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence