Key Insights

South Africa's freight and logistics industry is a significant market, projected to reach $64.09 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.9% through 2033. Key growth drivers include substantial investments in port modernization and road infrastructure, enhancing efficiency and alleviating bottlenecks. The rapidly expanding e-commerce sector is a major catalyst, driving demand for swift last-mile delivery and expedited services, particularly within the Courier, Express, and Parcel (CEP) segment. Growth in pivotal sectors such as mining, agriculture, and manufacturing further fuels the need for robust freight solutions. Despite these positive trends, operational challenges persist, including disruptions from power outages and infrastructure limitations, which impact delivery schedules and escalate costs. Fluctuating fuel prices and a scarcity of skilled labor also contribute to inefficiencies and temper overall market expansion. The industry is segmented by end-user industries including agriculture, construction, manufacturing, oil & gas, mining, wholesale & retail, and others, as well as by logistics functions such as CEP, temperature-controlled logistics, and other services. South Africa's strategic geographic position within Africa makes it a vital transportation hub, facilitating cross-border trade and contributing to the industry's growth potential.

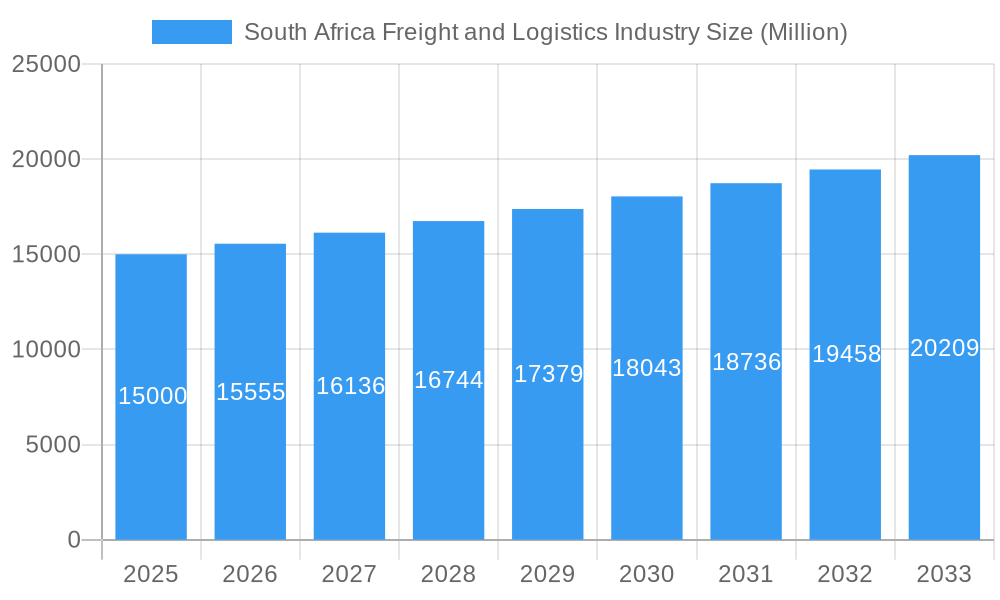

South Africa Freight and Logistics Industry Market Size (In Billion)

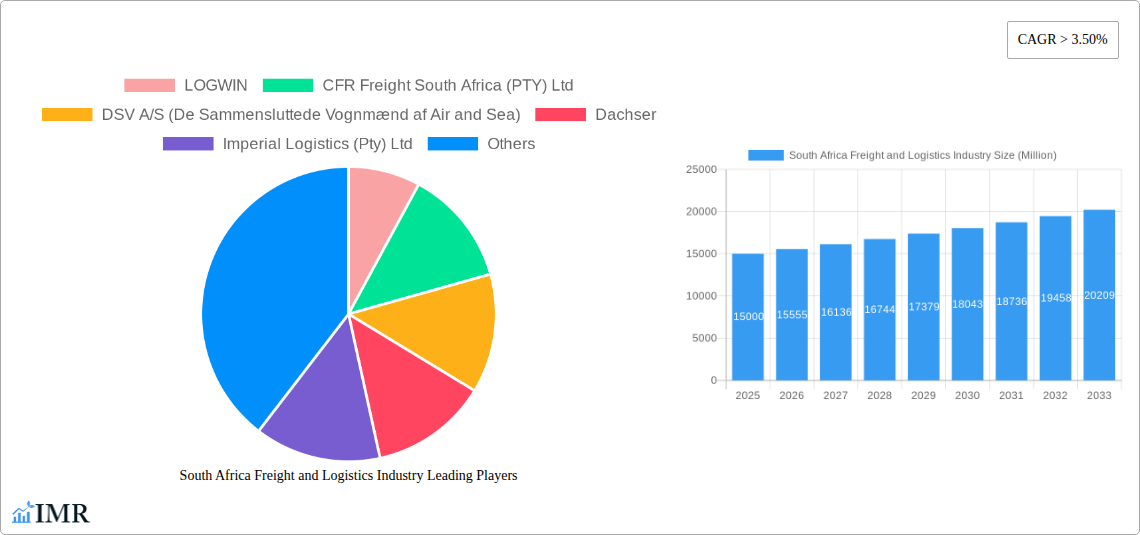

The competitive arena features global leaders like FedEx and Kuehne + Nagel, alongside prominent local operators such as Imperial Logistics and CFR Freight, fostering a diverse market with varied service offerings. The temperature-controlled logistics segment is poised for substantial growth, driven by the demand for preserving perishable goods, especially from the agricultural sector. Opportunities abound for South African logistics firms to expand into regional African markets, leveraging the nation's advanced infrastructure and established expertise. Successful regional expansion will necessitate navigating regulatory landscapes and addressing infrastructure deficits in neighboring countries. Future industry expansion will depend on strategic investments in technology, sustainable practices, and workforce development to surmount existing obstacles and harness emergent opportunities.

South Africa Freight and Logistics Industry Company Market Share

South Africa Freight and Logistics Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the South Africa freight and logistics industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on the period 2019-2033 (base year 2025), this report is essential for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic sector. The report leverages extensive data analysis to provide actionable insights and forecasts for various segments, including key players like Kuehne + Nagel, DSV, and Imperial Logistics.

South Africa Freight and Logistics Industry Market Dynamics & Structure

The South African freight and logistics market is characterized by a moderately concentrated landscape, with several large multinational players and numerous smaller, specialized companies competing for market share. Market concentration is estimated at xx% in 2025, indicating room for both consolidation and niche market expansion. Technological advancements, particularly in digitalization and automation, are significant drivers of innovation. However, barriers to innovation include high initial investment costs and limited digital infrastructure in certain areas. The regulatory framework is evolving, with ongoing efforts to improve efficiency and transparency within the sector. The market also faces competition from substitute products and services such as alternative modes of transport. End-user demographics are diverse, with varying needs and demands across sectors. The M&A landscape shows a moderate level of activity, driven by the desire to gain scale, expand service offerings, and achieve greater operational efficiency.

- Market Concentration (2025): xx%

- Key Innovation Drivers: Digitalization, Automation, Sustainability Initiatives

- Innovation Barriers: High Investment Costs, Infrastructure Gaps

- Regulatory Framework: Evolving towards improved efficiency and transparency.

- M&A Activity (2019-2024): xx deals (estimated)

South Africa Freight and Logistics Industry Growth Trends & Insights

The South African freight and logistics market exhibited a CAGR of xx% during the historical period (2019-2024). This growth is projected to continue, albeit at a moderated pace, during the forecast period (2025-2033), with a projected CAGR of xx%. This growth reflects the expansion of various sectors within the South African economy, increased cross-border trade, and rising e-commerce adoption. Technological disruptions, such as the emergence of blockchain technology and AI-powered logistics solutions, are transforming the industry, leading to enhanced efficiency and supply chain optimization. Consumer behavior shifts, notably increased demand for faster and more reliable delivery services, are further driving market expansion. Market penetration of advanced logistics technologies remains relatively low, indicating significant potential for future growth. Market size is expected to reach xx million in 2025 and xx million by 2033.

Dominant Regions, Countries, or Segments in South Africa Freight and Logistics Industry

The Gauteng province consistently demonstrates dominance in the South African freight and logistics market, driven by its concentrated industrial activity and robust infrastructure. Other major contributors include Western Cape and KwaZulu-Natal. Among end-user industries, Manufacturing, Mining and Quarrying, and Wholesale and Retail Trade are the largest segments, contributing a combined xx% of the total market value. Within logistics functions, the "Other Services" category, encompassing warehousing, freight forwarding, and value-added services, accounts for the largest market share, while the Courier, Express, and Parcel (CEP) sector demonstrates the highest growth potential due to expanding e-commerce activities.

- Dominant Region: Gauteng

- Largest End-User Segments: Manufacturing, Mining and Quarrying, Wholesale and Retail Trade

- Fastest-Growing Logistics Function: Courier, Express, and Parcel (CEP)

- Key Growth Drivers: Infrastructure development, Economic growth in key sectors, E-commerce expansion

South Africa Freight and Logistics Industry Product Landscape

The product landscape is characterized by a diverse range of services, including integrated logistics solutions, specialized transportation services (temperature-controlled, hazardous materials), and value-added services such as warehousing and inventory management. Recent innovations focus on enhancing visibility, traceability, and security within the supply chain through the use of technologies such as IoT sensors, blockchain, and AI-powered analytics. These innovations offer unique selling propositions to customers, including improved efficiency, cost reduction, and enhanced risk mitigation. The increasing demand for sustainable and environmentally friendly logistics solutions is driving the development of green logistics initiatives and technologies.

Key Drivers, Barriers & Challenges in South Africa Freight and Logistics Industry

Key Drivers:

- Increased investment in infrastructure development

- Economic growth across key sectors driving demand for logistics services.

- Technological advancements enhancing efficiency and productivity.

Key Challenges and Restraints:

- Infrastructure Deficiencies: Poor road and rail networks, particularly in rural areas, hinder efficient transportation. This results in increased transportation costs and delays.

- Regulatory Hurdles: Complex regulatory processes and bureaucratic procedures impede business operations.

- Competition: The presence of numerous players leads to intense competition, impacting profit margins and pricing strategies. Estimated impact: xx million loss in revenue annually (estimated).

Emerging Opportunities in South Africa Freight and Logistics Industry

- Growth of e-commerce and the need for last-mile delivery solutions.

- Increased demand for specialized logistics services such as cold chain logistics and hazardous materials handling.

- Development of green logistics solutions and sustainable transportation options.

- Technological advancements offering opportunities for improved efficiency and cost optimization.

Growth Accelerators in the South Africa Freight and Logistics Industry Industry

Strategic partnerships between logistics providers and technology companies are accelerating innovation and improving service offerings. Investments in infrastructure modernization and technological advancements are enhancing operational efficiency and reducing costs. Furthermore, the expanding e-commerce sector presents lucrative opportunities for specialized logistics services, boosting overall market growth. The adoption of sustainable practices and the integration of green technologies are further driving growth by attracting environmentally conscious clients.

Key Players Shaping the South Africa Freight and Logistics Industry Market

- LOGWIN

- CFR Freight South Africa (PTY) Ltd

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Dachser

- Imperial Logistics (Pty) Ltd

- FedEx

- Kuehne + Nagel

- F H Bertling Logistics (PTY) Ltd

- Savino Del Bene Sp

- Laser Group

- Megafreight Services (PTY) Ltd

- Heneways Freight Services PTY Ltd

- FPT Group (Pty) Ltd

Notable Milestones in South Africa Freight and Logistics Industry Sector

- October 2022: Imperial Logistics partners with DP World and the National Bioproducts Institute NPC (NBI) to distribute plasma-derived medicinal products across seven African countries, expanding its healthcare logistics capabilities.

- September 2023: Kuehne+Nagel and Capgemini partner to create a supply chain orchestration service, leveraging AI and data analytics to enhance efficiency for large corporations.

- January 2024: Kuehne + Nagel launches its Book & Claim insetting solution for electric vehicles, contributing to its decarbonization efforts and offering carbon offsetting options to its customers.

In-Depth South Africa Freight and Logistics Industry Market Outlook

The South African freight and logistics market holds significant long-term growth potential, driven by continuous infrastructure development, technological advancements, and the expansion of key economic sectors. Strategic partnerships, investment in sustainable solutions, and adaptation to evolving consumer demands will be crucial for sustained success within this dynamic market. The focus on digitalization and efficient supply chain management presents substantial opportunities for market players to enhance their competitiveness and capture market share. The forecast period indicates substantial growth with opportunities for both established players and new entrants to thrive through innovation and strategic positioning.

South Africa Freight and Logistics Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

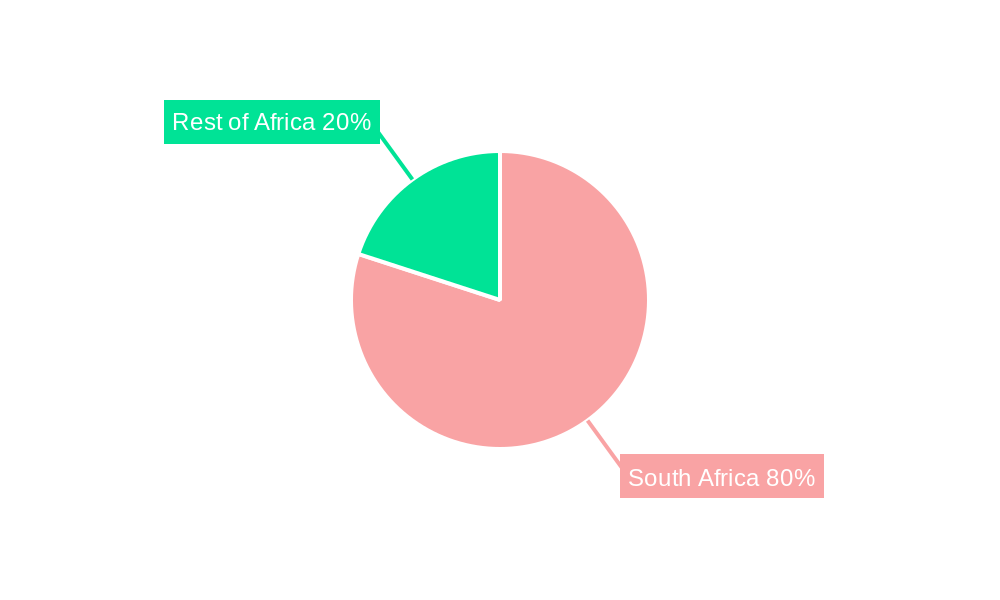

South Africa Freight and Logistics Industry Segmentation By Geography

- 1. South Africa

South Africa Freight and Logistics Industry Regional Market Share

Geographic Coverage of South Africa Freight and Logistics Industry

South Africa Freight and Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Freight and Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LOGWIN

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CFR Freight South Africa (PTY) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dachser

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Imperial Logistics (Pty) Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 F H Bertling Logistics (PTY) Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Savino Del Bene Sp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Laser Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Megafreight Services (PTY) Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Heneways Freight Services PTY Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 FPT Group (Pty) Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 LOGWIN

List of Figures

- Figure 1: South Africa Freight and Logistics Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Freight and Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Freight and Logistics Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: South Africa Freight and Logistics Industry Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 3: South Africa Freight and Logistics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Africa Freight and Logistics Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: South Africa Freight and Logistics Industry Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 6: South Africa Freight and Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Freight and Logistics Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the South Africa Freight and Logistics Industry?

Key companies in the market include LOGWIN, CFR Freight South Africa (PTY) Ltd, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Dachser, Imperial Logistics (Pty) Ltd, FedEx, Kuehne + Nagel, F H Bertling Logistics (PTY) Ltd, Savino Del Bene Sp, Laser Group, Megafreight Services (PTY) Ltd, Heneways Freight Services PTY Ltd, FPT Group (Pty) Ltd.

3. What are the main segments of the South Africa Freight and Logistics Industry?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.09 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.September 2023: Kuehne+Nagel and Capgemini have entered into a strategic agreement to create a supply chain orchestration service offering to provide end-to-end services across the supply chain network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Freight and Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Freight and Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Freight and Logistics Industry?

To stay informed about further developments, trends, and reports in the South Africa Freight and Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence