Key Insights

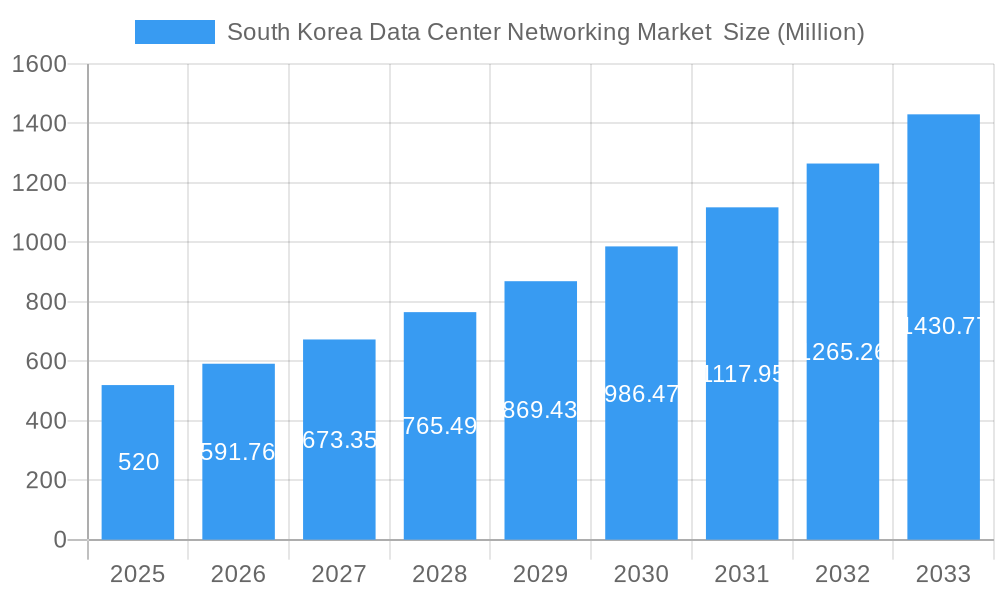

The South Korea Data Center Networking market is poised for significant expansion, projecting a market size of approximately USD 520 million in 2025, driven by robust digital transformation initiatives across various sectors. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 13.80% from 2019 to 2033, indicating a sustained and dynamic upward trajectory. Key growth drivers include the burgeoning demand for cloud computing services, the proliferation of big data analytics, and the increasing adoption of 5G technology, all of which necessitate advanced and high-performance data center networks. The IT & Telecommunication sector, alongside BFSI and government organizations, are leading the charge in investing in cutting-edge networking infrastructure to support their evolving digital operations. The market's segmentation highlights a strong focus on core networking components like Ethernet Switches and Routers, crucial for handling massive data flows. Furthermore, the increasing reliance on expert services such as Installation & Integration and Support & Maintenance underscores the complexity and strategic importance of data center network deployments.

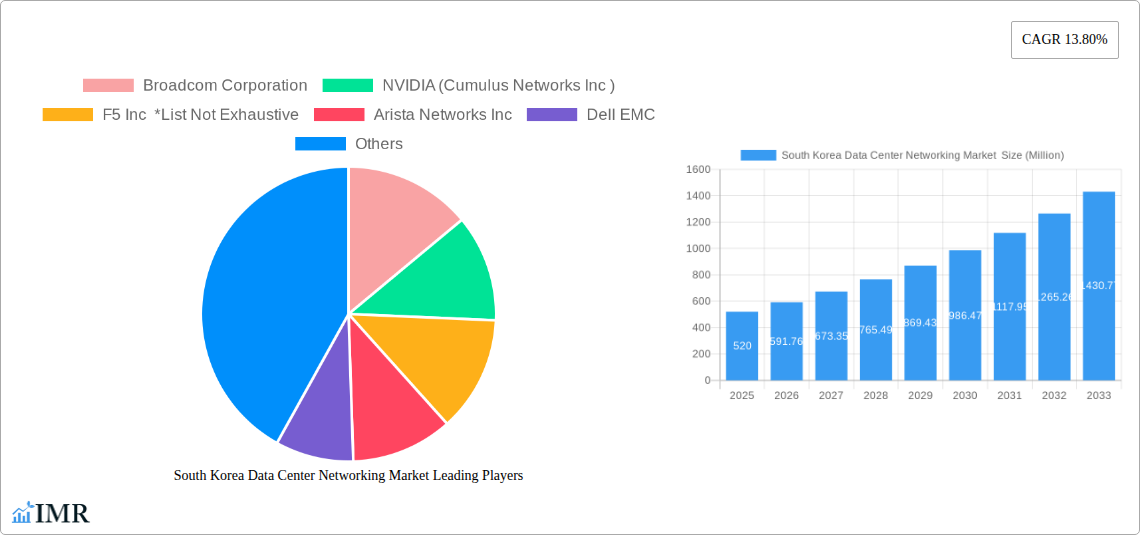

South Korea Data Center Networking Market Market Size (In Million)

Looking ahead, the forecast period from 2025 to 2033 will witness continued innovation and strategic investments in data center networking solutions in South Korea. Emerging trends like the adoption of software-defined networking (SDN) and network function virtualization (NFV) are reshaping the landscape, offering greater agility, scalability, and cost-efficiency. These advancements are essential to address the escalating traffic volumes generated by the Internet of Things (IoT) and the increasing complexity of AI and machine learning workloads. While the market is experiencing strong growth, potential restraints could include the high initial investment costs for advanced networking hardware and the need for skilled IT professionals to manage and maintain these sophisticated systems. However, the strong commitment from major players like Cisco Systems Inc., NVIDIA, and Huawei Technologies Co Ltd. to develop and deploy next-generation networking technologies, coupled with government support for digital infrastructure, will likely mitigate these challenges and ensure the continued robust growth of the South Korean data center networking market.

South Korea Data Center Networking Market Company Market Share

South Korea Data Center Networking Market: Comprehensive Analysis & Future Outlook (2019-2033)

Gain unparalleled insights into the dynamic South Korea data center networking market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis meticulously dissects market trends, technological advancements, and competitive landscapes. Explore the parent and child market segments for a holistic understanding of network infrastructure solutions driving digital transformation in South Korea. This report is essential for stakeholders seeking to capitalize on the burgeoning demand for robust and efficient data center networks. All values are presented in Million units.

South Korea Data Center Networking Market Market Dynamics & Structure

The South Korea data center networking market is characterized by a moderate level of market concentration, with several key players vying for dominance. Technological innovation remains a primary driver, fueled by the nation's advanced digital economy and a strong emphasis on next-generation technologies like 5G, AI, and IoT. Regulatory frameworks, while generally supportive of technological advancement, can sometimes present compliance challenges for new entrants, particularly concerning data localization and security standards. Competitive product substitutes are evolving rapidly, with open networking solutions and software-defined networking (SDN) gaining traction against traditional hardware-centric approaches. End-user demographics are increasingly sophisticated, with the IT & Telecommunication and BFSI sectors leading adoption, followed by government initiatives and a growing media & entertainment industry. Merger and acquisition (M&A) trends are indicative of consolidation and strategic partnerships aimed at expanding market reach and technological capabilities.

- Market Concentration: A blend of large multinational corporations and nimble domestic players.

- Technological Innovation Drivers: 5G deployment, AI/ML integration, hyperscale data center expansion, and cloud adoption.

- Regulatory Frameworks: Data privacy laws (e.g., PIPA), cybersecurity mandates, and government incentives for digital infrastructure.

- Competitive Product Substitutes: Rise of white-box switches, disaggregation models, and cloud-native networking solutions.

- End-User Demographics: High penetration in IT & Telecommunication and BFSI, with significant growth in Government and Media & Entertainment.

- M&A Trends: Strategic acquisitions for technology integration, market access, and service portfolio expansion.

South Korea Data Center Networking Market Growth Trends & Insights

The South Korea data center networking market has witnessed consistent growth over the historical period (2019-2024), propelled by an insatiable demand for digital services and an aggressive push towards digital transformation across all sectors. The market size has expanded significantly, reflecting increased investments in building and upgrading data center infrastructure to support the nation's advanced technological ecosystem. Adoption rates for high-speed networking technologies, such as 400GbE and beyond, are accelerating, driven by the need to handle massive data volumes generated by AI, big data analytics, and the burgeoning IoT landscape. Technological disruptions, including the widespread adoption of SDN and Network Functions Virtualization (NFV), are reshaping traditional networking paradigms, offering greater agility, scalability, and cost-efficiency. Consumer behavior shifts are also playing a crucial role, with an increasing reliance on cloud-based services, online entertainment, and advanced communication platforms, all of which necessitate robust and resilient data center network backbones. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is expected to remain robust, indicating sustained investment and innovation in this critical sector. Market penetration of advanced networking solutions continues to deepen, as organizations recognize the strategic imperative of having a cutting-edge data center network to maintain their competitive edge. The evolution of data center architectures, from traditional on-premises facilities to hybrid and multi-cloud environments, further necessitates adaptable and intelligent networking solutions. The push for edge computing and the proliferation of connected devices are also contributing to the demand for decentralized and high-performance networking capabilities within data centers. Furthermore, the South Korean government's commitment to fostering a digital-first economy through initiatives like the "Digital New Deal" directly fuels the expansion and modernization of data center infrastructure, consequently driving the networking segment. The increasing complexity of cyber threats also mandates more sophisticated networking solutions with enhanced security features, thus boosting the market for advanced firewalls, intrusion detection systems, and secure connectivity solutions. The report meticulously details these trends, providing quantitative metrics such as market size evolution in million USD, CAGR, and market penetration rates to offer a comprehensive understanding of the growth trajectory.

Dominant Regions, Countries, or Segments in South Korea Data Center Networking Market

The IT & Telecommunication segment stands as the undisputed leader in driving growth within the South Korea data center networking market. This dominance is underpinned by the nation's highly developed telecommunications infrastructure, the rapid expansion of 5G networks, and the continuous demand from internet service providers and mobile operators for scalable and high-performance networking solutions. These entities are at the forefront of investing in cutting-edge networking equipment to support the ever-increasing data traffic and the proliferation of connected devices. The BFSI (Banking, Financial Services, and Insurance) sector follows closely, driven by the digital transformation initiatives, the need for secure and low-latency transactions, and the adoption of cloud technologies for enhanced operational efficiency and customer service. Government initiatives aimed at fostering a smart nation and promoting digital governance also contribute significantly, with substantial investments in secure and robust networking for public services and defense.

Within the Component: By Product segment, Ethernet Switches are a primary growth engine, owing to their critical role in enabling high-speed interconnections within data centers. The demand for high-port-density, high-throughput switches is particularly strong, driven by the needs of cloud providers and large enterprises. Routers also play a pivotal role in managing network traffic and connectivity to external networks, with advancements in routing technologies supporting higher capacities and enhanced features. The Application Delivery Controller (ADC) segment is experiencing robust growth as organizations increasingly focus on optimizing application performance, ensuring availability, and enhancing security for their digital services. The Storage Area Network (SAN) component is crucial for high-performance data storage and retrieval, essential for data-intensive applications.

In terms of Component: By Services, Installation & Integration services are vital for ensuring seamless deployment of complex networking solutions, while Support & Maintenance is crucial for maintaining optimal network performance and uptime. Training & Consulting is becoming increasingly important as organizations seek to leverage the full potential of advanced networking technologies and manage their evolving infrastructure.

The End-User landscape clearly highlights IT & Telecommunication as the leading segment, followed by BFSI, Government, and Media & Entertainment. The growth potential within these segments is directly linked to their ongoing digital initiatives, the increasing adoption of cloud services, and the continuous need for upgraded and secure networking infrastructure.

- Dominant Segment: IT & Telecommunication.

- Key Drivers: 5G network expansion, cloud service growth, high data traffic demand.

- Market Share: Estimated at xx% of the total market.

- Growth Potential: High, driven by continuous infrastructure upgrades.

- Component: By Product Dominance: Ethernet Switches.

- Key Drivers: High-speed interconnectivity needs, hyperscale data center requirements.

- Market Share: Estimated at xx% of the product segment.

- Growth Potential: Sustained, with demand for higher bandwidths.

- Component: By Services Dominance: Installation & Integration.

- Key Drivers: Complexity of modern data center networks, need for expert deployment.

- Market Share: Estimated at xx% of the services segment.

- Growth Potential: Robust, tied to new infrastructure deployments.

- End-User Dominance: IT & Telecommunication.

- Key Drivers: Leading digital transformation, continuous infrastructure investment.

- Market Share: Estimated at xx% of the end-user market.

- Growth Potential: Strong, fueled by technological advancements.

South Korea Data Center Networking Market Product Landscape

The South Korea data center networking product landscape is defined by rapid innovation and a focus on high-performance, scalable, and intelligent solutions. Ethernet switches are leading the charge with advancements in speed and density, enabling 400GbE and beyond. Routers are incorporating advanced features for improved traffic management and reduced latency. Storage Area Network (SAN) solutions are becoming more efficient and integrated with software-defined capabilities. Application Delivery Controllers (ADCs) are evolving to offer advanced security, load balancing, and application acceleration. Beyond hardware, the market is witnessing a surge in networking software, including Network Operating Systems (NOS), SDN controllers, and network management platforms, offering greater automation and flexibility. These products are designed to meet the stringent demands of hyperscale data centers, enterprise private clouds, and the growing needs of colocation providers. Unique selling propositions often revolve around power efficiency, lower latency, enhanced security features, and simplified management through centralized control planes.

Key Drivers, Barriers & Challenges in South Korea Data Center Networking Market

The South Korea data center networking market is propelled by several key drivers. The nation's advanced digital economy, coupled with significant government investment in digital infrastructure, fuels demand for robust networking solutions. The rapid adoption of 5G, AI, big data, and IoT technologies necessitates high-bandwidth, low-latency connectivity. Furthermore, the increasing adoption of cloud computing and the growth of hyperscale data centers are major growth catalysts. The competitive landscape is intensified by the availability of advanced technologies, pushing vendors to continuously innovate.

However, the market also faces significant barriers and challenges. The high cost of implementing cutting-edge networking technologies can be a restraint for some smaller enterprises. Evolving cybersecurity threats require constant vigilance and investment in advanced security features, posing a continuous challenge for network administrators. Regulatory compliance, particularly concerning data privacy and security, can be complex and demanding. Supply chain disruptions, as witnessed globally, can impact the availability and pricing of critical networking components, creating operational hurdles. Intense competition among established players and the emergence of new entrants can also lead to pricing pressures and reduced profit margins.

Emerging Opportunities in South Korea Data Center Networking Market

Emerging opportunities in the South Korea data center networking market lie in the burgeoning demand for edge computing solutions, which require distributed and intelligent networking capabilities. The increasing focus on sustainability and energy efficiency within data centers presents a significant opportunity for vendors offering green networking technologies and power-optimized solutions. The growth of specialized data centers, such as those catering to AI/ML workloads or high-performance computing (HPC), opens avenues for highly specialized networking equipment and services. Furthermore, the expansion of 5G private networks for enterprises and the increasing adoption of network-as-a-service (NaaS) models offer new business avenues for networking providers. The continuous evolution of cloud-native architectures also creates opportunities for vendors offering cloud-integrated networking solutions and software-defined networking (SDN) capabilities.

Growth Accelerators in the South Korea Data Center Networking Market Industry

Long-term growth in the South Korea data center networking market is being significantly accelerated by several factors. Continuous technological breakthroughs, such as advancements in optical networking, higher-speed Ethernet, and sophisticated AI-driven network management tools, are continuously expanding the capabilities and efficiency of data center networks. Strategic partnerships between hardware vendors, software providers, and cloud service providers are crucial for delivering integrated and comprehensive solutions that meet the complex needs of modern enterprises. Market expansion strategies, including the development of new service offerings and the penetration into emerging enterprise segments, are also vital for sustained growth. The nation's strong commitment to digital transformation and innovation acts as a foundational accelerator, ensuring a consistent demand for advanced networking infrastructure.

Key Players Shaping the South Korea Data Center Networking Market Market

- Broadcom Corporation

- NVIDIA (Cumulus Networks Inc)

- F5 Inc

- Arista Networks Inc

- Dell EMC

- Cisco Systems Inc

- HP Development Company L P

- Juniper Networks Inc

- Extreme Networks Inc

- Huawei Technologies Co Ltd

- VMware Inc

Notable Milestones in South Korea Data Center Networking Market Sector

- July 2023: Broadcom Corporation revealed a groundbreaking development for enterprise data centers- Broadcom Trident 4-X7 Ethernet switch ASIC. This 4.0 Terabits/second fully programmable switch is custom-made for Top of Rack (ToR) boxes, catering to their specific demands.

- June 2023: Cisco Inc. announced its vision for Cisco Networking Cloud, an integrated management platform experience for both on-prem and cloud operating models. The new innovations include SSO, API key exchange/repository, sustainable data center networking solutions and expanded network assurance with Cisco ThousandEyes.

In-Depth South Korea Data Center Networking Market Market Outlook

The future market potential for South Korea's data center networking is exceptionally promising, driven by a confluence of technological advancements and strong market demand. Growth accelerators such as the ongoing digital transformation initiatives, the widespread adoption of AI and IoT, and the continuous expansion of 5G networks will continue to fuel investments in high-performance and scalable networking infrastructure. Strategic partnerships between key technology players and the increasing focus on sustainable data center operations present significant opportunities for innovation and market penetration. The market is poised for continued growth as South Korea solidifies its position as a global leader in digital innovation, requiring ever more sophisticated and efficient data center networking solutions.

South Korea Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Routers

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

South Korea Data Center Networking Market Segmentation By Geography

- 1. South Korea

South Korea Data Center Networking Market Regional Market Share

Geographic Coverage of South Korea Data Center Networking Market

South Korea Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. BFSI to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Routers

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Broadcom Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NVIDIA (Cumulus Networks Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 F5 Inc *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Arista Networks Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell EMC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cisco Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HP Development Company L P

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Juniper Networks Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Extreme Networks Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huawei Technologies Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 VMware Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Broadcom Corporation

List of Figures

- Figure 1: South Korea Data Center Networking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Data Center Networking Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: South Korea Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: South Korea Data Center Networking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South Korea Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: South Korea Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: South Korea Data Center Networking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Data Center Networking Market ?

The projected CAGR is approximately 13.80%.

2. Which companies are prominent players in the South Korea Data Center Networking Market ?

Key companies in the market include Broadcom Corporation, NVIDIA (Cumulus Networks Inc ), F5 Inc *List Not Exhaustive, Arista Networks Inc, Dell EMC, Cisco Systems Inc, HP Development Company L P, Juniper Networks Inc, Extreme Networks Inc, Huawei Technologies Co Ltd, VMware Inc.

3. What are the main segments of the South Korea Data Center Networking Market ?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

BFSI to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

July 2023: Broadcom Corporation revealed a groundbreaking development for enterprise data centers- Broadcom Trident 4-X7 Ethernet switch ASIC. This 4.0 Terabits/second fully programmable switch is custom-made for Top of Rack (ToR) boxes, catering to their specific demands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Data Center Networking Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Data Center Networking Market ?

To stay informed about further developments, trends, and reports in the South Korea Data Center Networking Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence