Key Insights

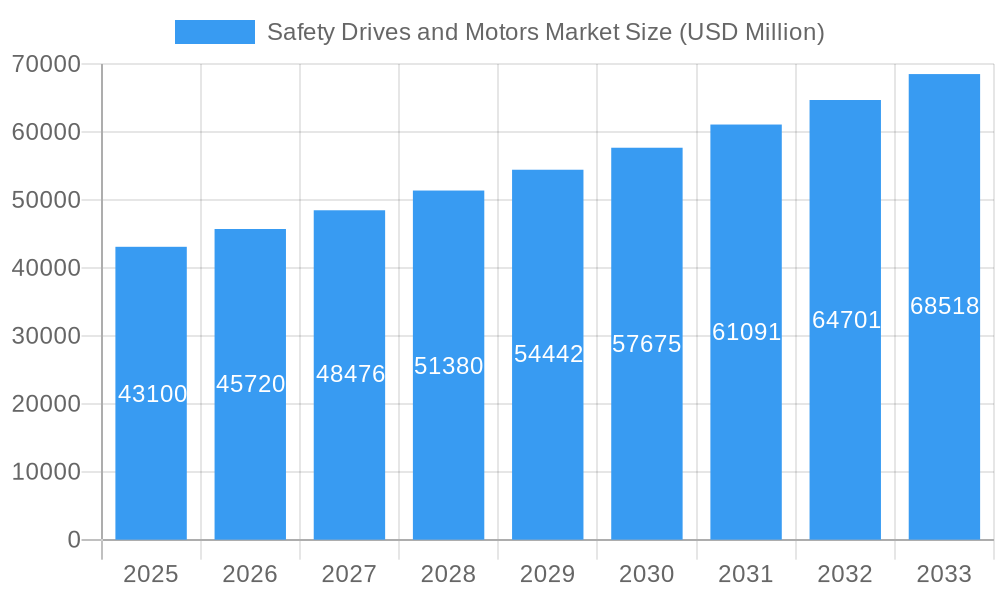

The global Safety Drives and Motors Market is projected to experience robust growth, driven by an increasing emphasis on industrial safety and automation across various sectors. The market is estimated to reach USD 43.1 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 5.8% anticipated during the forecast period of 2025-2033. This expansion is primarily fueled by the escalating adoption of sophisticated safety technologies in manufacturing, energy and power, mining, and oil and gas industries to prevent accidents, reduce downtime, and ensure regulatory compliance. Advancements in motor technology, including the integration of intelligent features and enhanced efficiency, coupled with the growing demand for AC and DC safety drives, are further propelling market momentum. The implementation of stricter safety standards and the rising awareness among businesses regarding the financial and human costs of industrial accidents are significant drivers for this market.

Safety Drives and Motors Market Market Size (In Billion)

The market's growth trajectory is further supported by emerging trends such as the increasing integration of safety drives and motors with Industrial Internet of Things (IIoT) platforms for enhanced monitoring and predictive maintenance, and the development of compact and energy-efficient solutions. While the market presents substantial opportunities, potential restraints include the high initial investment costs associated with sophisticated safety systems and a shortage of skilled professionals capable of installing and maintaining these advanced technologies. Key players like Siemens AG, ABB Ltd, and Rockwell Automation Inc. are actively investing in research and development to introduce innovative products that meet the evolving demands for reliable and efficient safety solutions. The market is segmented by type, including Drives (AC, DC) and Motors, serving critical end-user verticals like Energy and Power, Manufacturing, Mining, Oil and Gas, Chemical and Petrochemical, and Construction.

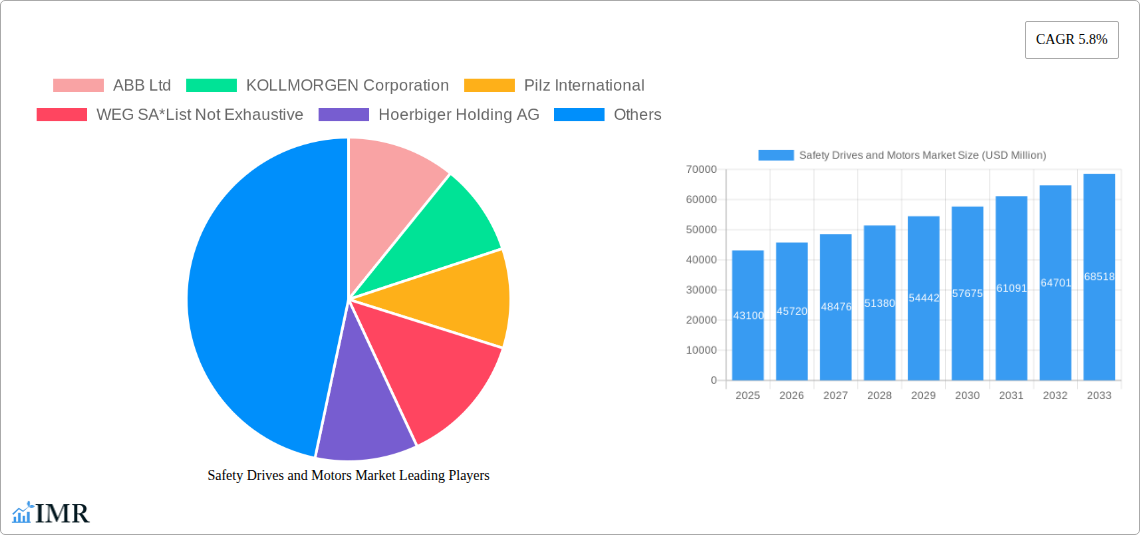

Safety Drives and Motors Market Company Market Share

This in-depth report provides a definitive analysis of the global Safety Drives and Motors Market, a critical segment within industrial automation and machinery. Spanning the study period of 2019–2033, with a base year of 2025, this comprehensive research offers unparalleled insights into market dynamics, growth trends, regional dominance, product landscapes, and the competitive ecosystem. The report forecasts a substantial market expansion, driven by increasing industrial safety regulations, the adoption of advanced automation technologies, and the growing demand for reliable and efficient machinery across diverse end-user verticals.

The Safety Drives and Motors Market is segmented into Drives (AC Drives, DC Drives) and Motors. Key end-user verticals analyzed include Energy and Power, Manufacturing, Mining, Oil and Gas, Chemical and Petrochemical, Construction, and Other End-user Verticals. This report delves into the parent market of Industrial Safety and the child market of Safety Actuators, providing a holistic view of the value chain and interconnectedness of these segments.

Safety Drives and Motors Market Dynamics & Structure

The Safety Drives and Motors Market exhibits a moderately concentrated structure, with key players like Siemens AG, ABB Ltd, and Rockwell Automation Inc. holding significant market shares. Technological innovation is a primary driver, fueled by the relentless pursuit of enhanced machine safety, predictive maintenance capabilities, and integration with Industry 4.0 technologies. Stringent regulatory frameworks, such as the Machinery Directive in Europe and OSHA standards in North America, are mandating the implementation of safety drives and motors, thus boosting market demand. Competitive product substitutes, while present in the form of conventional drives and motors, are increasingly being phased out in applications requiring enhanced safety. End-user demographics are shifting towards industries with higher automation adoption and stricter safety protocols. Mergers and Acquisitions (M&A) trends indicate strategic consolidations aimed at expanding product portfolios and geographical reach. For instance, the past five years have seen an average of 2-3 significant M&A deals per year in the industrial safety sector, with an estimated aggregate deal value of over $5 billion. Innovation barriers include the high cost of developing and implementing advanced safety features and the need for skilled personnel for integration and maintenance.

Safety Drives and Motors Market Growth Trends & Insights

The Safety Drives and Motors Market is poised for robust growth, projected to reach an estimated market size of $35.8 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period of 2025–2033. This expansion is propelled by several key trends. The increasing adoption of sophisticated safety functions, such as emergency stop, safe motion, and safe speed monitoring, is a significant market driver. Advancements in motor and drive technology, including the development of highly integrated safety controllers and compact, energy-efficient safety motors, are further stimulating market penetration. Consumer behavior is increasingly prioritizing workplace safety and operational efficiency, leading to a higher demand for certified safety solutions. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) for predictive safety analysis and the development of wirelessly controlled safety systems, are creating new avenues for growth. The market penetration of safety drives and motors, currently estimated at 45% in high-risk industrial environments, is expected to rise significantly as awareness and regulatory enforcement intensify. Historical data from 2019–2024 indicates a consistent upward trajectory, with the market size growing from approximately $22.1 billion in 2019 to an estimated $28.5 billion in 2024.

Dominant Regions, Countries, or Segments in Safety Drives and Motors Market

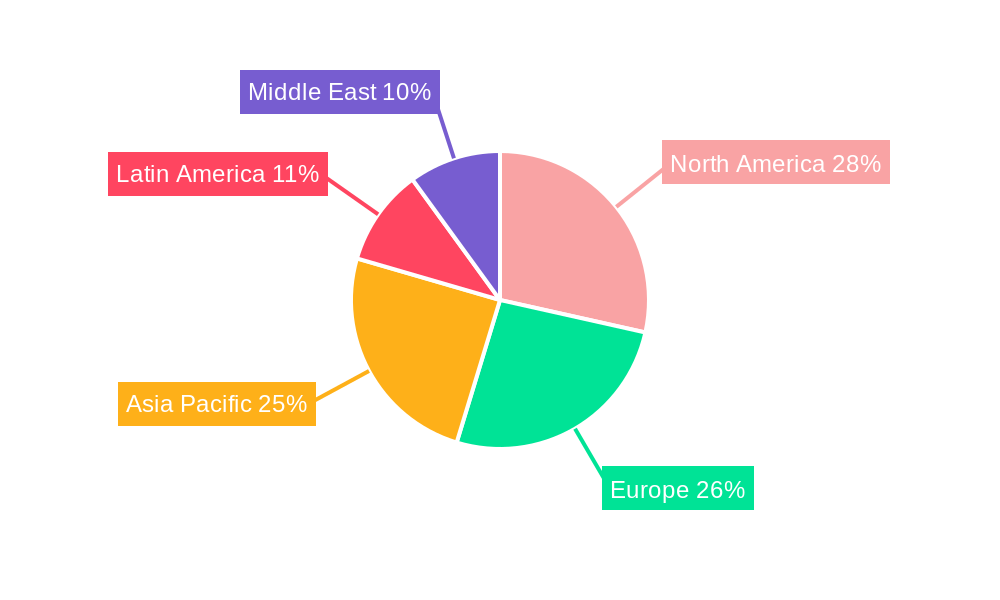

Europe stands out as the dominant region in the Safety Drives and Motors Market, driven by its stringent regulatory landscape, advanced industrial infrastructure, and early adoption of safety technologies. The Manufacturing sector, particularly automotive, electronics, and machinery manufacturing, is the leading end-user vertical, accounting for an estimated 35% of the regional market share. Key drivers for Europe's dominance include the EU's Machinery Directive and a strong emphasis on worker safety, fostering a high demand for certified safety drives and motors. Germany, as the largest industrial economy in Europe, plays a pivotal role, with a significant concentration of leading manufacturers and a robust ecosystem for industrial automation. Economic policies supporting technological innovation and investment in smart manufacturing further bolster the market.

In terms of segments, AC Drives are projected to hold the largest market share within the Drives category, owing to their widespread application in industrial processes and their ability to offer precise speed control and energy efficiency, coupled with integrated safety functionalities. The Energy and Power sector, including renewable energy generation, is also a significant growth engine, demanding reliable safety solutions for critical infrastructure.

The Manufacturing segment's dominance is attributed to the inherent risks associated with industrial machinery and the continuous drive for enhanced operational safety and productivity. Stringent safety standards in this sector mandate the integration of safety drives and motors to prevent accidents and ensure compliance. The growth potential in this segment is immense, fueled by the ongoing automation and digitalization of manufacturing processes.

Safety Drives and Motors Market Product Landscape

The Safety Drives and Motors Market is characterized by continuous product innovation focused on enhanced functionality, compact design, and seamless integration. Manufacturers are developing safety drives with advanced diagnostic capabilities, built-in safety functions, and support for various communication protocols for easy integration into complex automation systems. Safety motors are increasingly being designed with integrated encoders and safety switches, reducing external component requirements and simplifying installation. Applications range from safeguarding robotic cells and automated guided vehicles (AGVs) to ensuring safe operation of presses, conveyors, and other industrial machinery across diverse sectors. Unique selling propositions include adherence to international safety standards (e.g., ISO 13849, IEC 61508), improved energy efficiency, and reduced downtime through predictive maintenance features.

Key Drivers, Barriers & Challenges in Safety Drives and Motors Market

Key Drivers:

- Stringent Safety Regulations: Mandates for enhanced worker safety drive the adoption of certified safety drives and motors.

- Industrial Automation and Industry 4.0: The rise of smart factories and connected systems necessitates integrated safety solutions.

- Technological Advancements: Development of more intelligent, compact, and energy-efficient safety drives and motors.

- Demand for Increased Productivity: Safety solutions help minimize downtime caused by accidents, thereby boosting productivity.

- Growing Awareness of Workplace Safety: Increased emphasis on preventing industrial accidents and safeguarding personnel.

Barriers & Challenges:

- High Initial Investment Cost: The upfront cost of implementing advanced safety systems can be a deterrent for small and medium-sized enterprises (SMEs).

- Complexity of Integration: Integrating safety drives and motors with existing control systems can be challenging and require specialized expertise.

- Lack of Skilled Workforce: A shortage of trained professionals for installation, maintenance, and programming of safety systems.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability and cost of components.

- Standardization Challenges: While international standards exist, varying regional interpretations and implementation can pose challenges.

Emerging Opportunities in Safety Drives and Motors Market

Emerging opportunities in the Safety Drives and Motors Market lie in the increasing demand for customized safety solutions tailored to specific industry needs. The expansion of automation in emerging economies, particularly in Asia-Pacific, presents a significant untapped market. The development of intelligent safety systems leveraging AI and IoT for real-time risk assessment and predictive failure analysis is a promising area. Furthermore, the growing trend towards collaborative robotics (cobots) necessitates highly integrated and flexible safety solutions, creating new application avenues. The integration of safety functions directly into motor drives, reducing the need for separate safety controllers, also offers a significant growth opportunity.

Growth Accelerators in the Safety Drives and Motors Market Industry

Long-term growth in the Safety Drives and Motors Market is being accelerated by continuous technological breakthroughs in functional safety, such as the development of more powerful microprocessors and advanced algorithms for real-time safety monitoring. Strategic partnerships between drive and motor manufacturers with automation solution providers are fostering innovation and expanding market reach. Market expansion strategies are focusing on developing cost-effective solutions for SMEs and increasing awareness through educational initiatives and industry collaborations. The ongoing digitalization of industrial processes, coupled with the increasing adoption of predictive maintenance strategies, will further propel the demand for sophisticated safety drives and motors.

Key Players Shaping the Safety Drives and Motors Market Market

- ABB Ltd

- KOLLMORGEN Corporation

- Pilz International

- WEG SA

- Hoerbiger Holding AG

- Siemens AG

- KEBA Corporation

- Beckhoff Automation GmbH

- Rockwell Automation Inc

- SIGMATEK Safety Systems

Notable Milestones in Safety Drives and Motors Market Sector

- 2023: Launch of next-generation safety drives with advanced diagnostic capabilities and integrated cybersecurity features.

- 2022: Increased adoption of AI-powered predictive safety analytics for industrial machinery.

- 2021: Significant growth in the demand for safety solutions in the renewable energy sector, particularly for wind turbines and solar installations.

- 2020: Introduction of more compact and energy-efficient safety motors with integrated safety functions.

- 2019: Enhanced focus on harmonizing international safety standards for drives and motors to facilitate global market integration.

In-Depth Safety Drives and Motors Market Market Outlook

The future outlook for the Safety Drives and Motors Market is exceptionally promising, fueled by the ongoing digital transformation of industries and an unwavering commitment to workplace safety. Growth accelerators such as advanced AI integration for predictive safety, the expansion into emerging markets, and strategic alliances between technology leaders will continue to drive market expansion. The increasing demand for highly integrated, energy-efficient, and cyber-secure safety solutions will shape product development, offering substantial opportunities for companies that can innovate and adapt to evolving industry needs. The market is projected to witness sustained growth, driven by the essential role of safety in modern industrial operations.

Safety Drives and Motors Market Segmentation

-

1. Type

-

1.1. Drives

- 1.1.1. AC

- 1.1.2. DC

- 1.2. Motors

-

1.1. Drives

-

2. End-user Vertical

- 2.1. Energy and Power

- 2.2. Manufacturing

- 2.3. Mining

- 2.4. Oil and Gas

- 2.5. Chemical and Petrochemical

- 2.6. Construction

- 2.7. Other End-user Verticals

Safety Drives and Motors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Safety Drives and Motors Market Regional Market Share

Geographic Coverage of Safety Drives and Motors Market

Safety Drives and Motors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Growing Adoption of automation has Created a Need for Accurate Control of Industrial Machinery

- 3.2.2 thus Helping in Market Growth

- 3.3. Market Restrains

- 3.3.1. ; Considerable Slowdown in Mining Industry due to Regulatory Constraints is Challenging the Market Growth

- 3.4. Market Trends

- 3.4.1. Oil & Gas to Occupy the Maximum Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Safety Drives and Motors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Drives

- 5.1.1.1. AC

- 5.1.1.2. DC

- 5.1.2. Motors

- 5.1.1. Drives

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Energy and Power

- 5.2.2. Manufacturing

- 5.2.3. Mining

- 5.2.4. Oil and Gas

- 5.2.5. Chemical and Petrochemical

- 5.2.6. Construction

- 5.2.7. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Safety Drives and Motors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Drives

- 6.1.1.1. AC

- 6.1.1.2. DC

- 6.1.2. Motors

- 6.1.1. Drives

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Energy and Power

- 6.2.2. Manufacturing

- 6.2.3. Mining

- 6.2.4. Oil and Gas

- 6.2.5. Chemical and Petrochemical

- 6.2.6. Construction

- 6.2.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Safety Drives and Motors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Drives

- 7.1.1.1. AC

- 7.1.1.2. DC

- 7.1.2. Motors

- 7.1.1. Drives

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Energy and Power

- 7.2.2. Manufacturing

- 7.2.3. Mining

- 7.2.4. Oil and Gas

- 7.2.5. Chemical and Petrochemical

- 7.2.6. Construction

- 7.2.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Safety Drives and Motors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Drives

- 8.1.1.1. AC

- 8.1.1.2. DC

- 8.1.2. Motors

- 8.1.1. Drives

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Energy and Power

- 8.2.2. Manufacturing

- 8.2.3. Mining

- 8.2.4. Oil and Gas

- 8.2.5. Chemical and Petrochemical

- 8.2.6. Construction

- 8.2.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Safety Drives and Motors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Drives

- 9.1.1.1. AC

- 9.1.1.2. DC

- 9.1.2. Motors

- 9.1.1. Drives

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Energy and Power

- 9.2.2. Manufacturing

- 9.2.3. Mining

- 9.2.4. Oil and Gas

- 9.2.5. Chemical and Petrochemical

- 9.2.6. Construction

- 9.2.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Safety Drives and Motors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Drives

- 10.1.1.1. AC

- 10.1.1.2. DC

- 10.1.2. Motors

- 10.1.1. Drives

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Energy and Power

- 10.2.2. Manufacturing

- 10.2.3. Mining

- 10.2.4. Oil and Gas

- 10.2.5. Chemical and Petrochemical

- 10.2.6. Construction

- 10.2.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KOLLMORGEN Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pilz International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 WEG SA*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hoerbiger Holding AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KEBA Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Beckhoff Automation GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rockwell Automation Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SIGMATEK Safety Systems

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Safety Drives and Motors Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Safety Drives and Motors Market Share (%) by Company 2025

List of Tables

- Table 1: Safety Drives and Motors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Safety Drives and Motors Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 3: Safety Drives and Motors Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Safety Drives and Motors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Safety Drives and Motors Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 6: Safety Drives and Motors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Safety Drives and Motors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Safety Drives and Motors Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 9: Safety Drives and Motors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Safety Drives and Motors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Safety Drives and Motors Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 12: Safety Drives and Motors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Safety Drives and Motors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Safety Drives and Motors Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 15: Safety Drives and Motors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Safety Drives and Motors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Safety Drives and Motors Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 18: Safety Drives and Motors Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Safety Drives and Motors Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Safety Drives and Motors Market?

Key companies in the market include ABB Ltd, KOLLMORGEN Corporation, Pilz International, WEG SA*List Not Exhaustive, Hoerbiger Holding AG, Siemens AG, KEBA Corporation, Beckhoff Automation GmbH, Rockwell Automation Inc, SIGMATEK Safety Systems.

3. What are the main segments of the Safety Drives and Motors Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Adoption of automation has Created a Need for Accurate Control of Industrial Machinery. thus Helping in Market Growth.

6. What are the notable trends driving market growth?

Oil & Gas to Occupy the Maximum Market Share.

7. Are there any restraints impacting market growth?

; Considerable Slowdown in Mining Industry due to Regulatory Constraints is Challenging the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Safety Drives and Motors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Safety Drives and Motors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Safety Drives and Motors Market?

To stay informed about further developments, trends, and reports in the Safety Drives and Motors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence