Key Insights

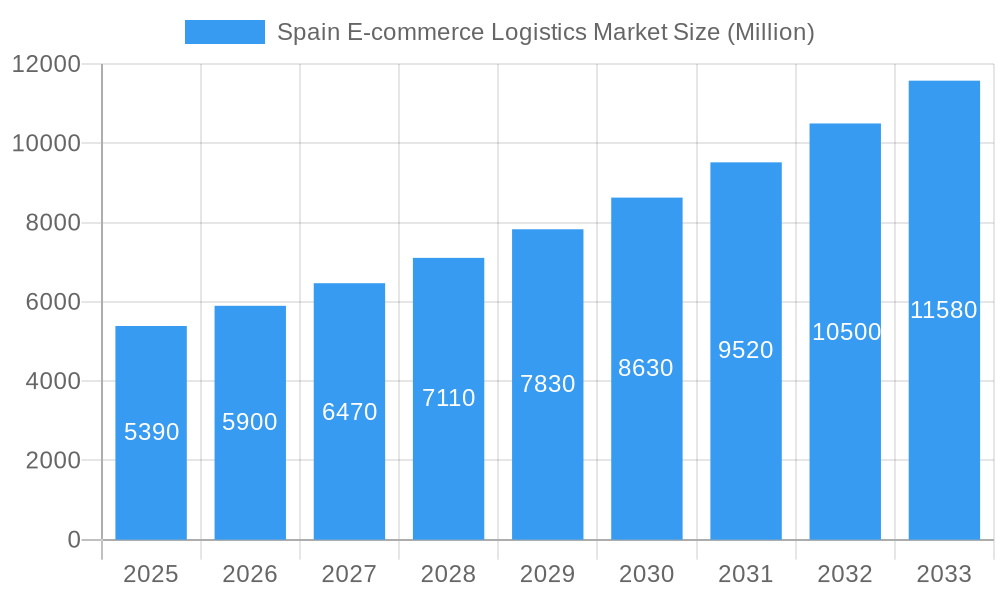

The Spain e-commerce logistics market is experiencing robust growth, projected to reach €5.39 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.41% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing penetration of e-commerce in Spain, driven by rising internet and smartphone usage, coupled with a preference for online shopping convenience, significantly contributes to market expansion. Furthermore, the growing popularity of omnichannel retail strategies, requiring seamless integration of online and offline channels, is boosting demand for efficient and reliable logistics services. Improved infrastructure investments in transportation networks and warehousing facilities further enhance operational efficiency and capacity. The market is segmented across various service types, including transportation, warehousing and inventory management, and value-added services like labeling and packaging. Business models range from B2B to B2C, catering to diverse customer needs. Geographically, the market encompasses domestic and international/cross-border logistics, with the latter segment gaining traction due to increasing global trade. Finally, diverse product categories, including fashion and apparel, consumer electronics, furniture, beauty products, and others, contribute to market breadth. Key players like Nacex, CTT Express, DHL, FedEx, UPS, Correos Express, Celeritas, Citibox, SEUR, and Amphora Logistics compete within this dynamic landscape.

Spain E-commerce Logistics Market Market Size (In Billion)

The competitive landscape is characterized by both established international players and domestic logistics providers. These companies are continuously investing in technological advancements such as advanced tracking systems, automated warehouses, and optimized delivery routes to enhance efficiency and customer satisfaction. Challenges include managing rising labor costs, maintaining consistent service quality amid fluctuating demand, and navigating regulatory complexities. However, the continued growth of e-commerce in Spain, combined with ongoing investments in infrastructure and technology, points towards a promising future for this market, with potential for further market consolidation and increased specialization within various segments. The market is expected to see further growth fueled by initiatives to improve last-mile delivery and increased adoption of sustainable logistics practices. The emergence of innovative delivery models, such as automated delivery systems and drone technology, could further reshape the market landscape in the coming years.

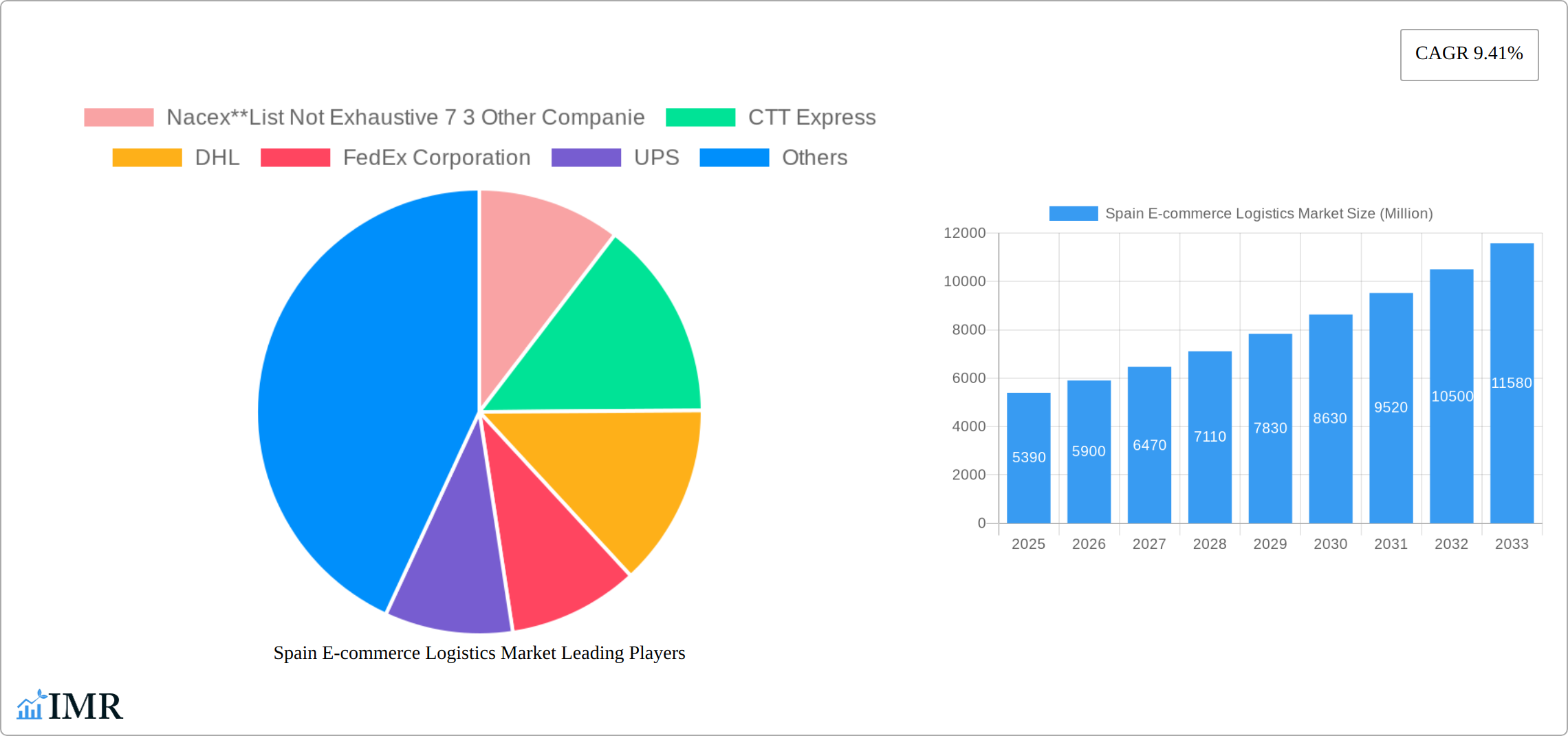

Spain E-commerce Logistics Market Company Market Share

Spain E-commerce Logistics Market: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Spain e-commerce logistics market, encompassing market size, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base year and estimated year. The forecast period spans 2025-2033, and the historical period is 2019-2024. This report is crucial for businesses operating or planning to enter the dynamic Spanish e-commerce logistics sector.

Spain E-commerce Logistics Market Market Dynamics & Structure

The Spanish e-commerce logistics market presents a dynamic landscape with a blend of established global leaders and agile domestic specialists. While dominant players such as DHL, FedEx, and UPS continue to command a significant market share (estimated at [Insert specific percentage]% combined in 2025), the presence of specialized providers like Nacex, Correos Express, and SEUR is crucial for catering to diverse customer needs and regional demands. The market is expected to maintain a moderately concentrated structure throughout the forecast period, with strategic mergers and acquisitions (M&A) acting as potential catalysts for evolution. Historically, the sector witnessed an average of [Insert specific number] M&A deals annually between 2019 and 2024, indicating ongoing consolidation efforts.

- Technological Advancement: The increasing integration of advanced technologies, including robotics and AI in warehousing and sortation, sophisticated data analytics for dynamic route optimization, and the growing demand for environmentally friendly delivery solutions, are key growth drivers. However, the substantial initial capital investment required for these innovations can present a barrier to entry, particularly for smaller enterprises.

- Evolving Regulatory Landscape: The Spanish regulatory framework is continuously adapting to the nuances of data privacy, cross-border e-commerce operations, and last-mile delivery efficiency. Adhering to these evolving regulations incurs significant operational costs, estimated to reach [Insert specific amount] million in 2025, and requires strategic planning.

- Competitive Forces and Substitutes: The emergence of innovative service models, such as crowd-sourced delivery platforms and the adoption of diverse alternative transportation methods, poses a competitive challenge to conventional logistics providers, prompting them to diversify and enhance their service offerings.

- Shifting Consumer Demographics: The escalating engagement of younger demographics with online shopping is a significant force driving the demand for speed, transparency, and convenience in delivery services, pushing logistics providers to innovate in their fulfillment and last-mile strategies.

- Strategic Consolidation (M&A) Trends: The ongoing trend of consolidation within the logistics sector is projected to persist. This is driven by the imperative for companies to bolster operational efficiencies, achieve economies of scale, and broaden their service portfolios and geographical coverage through strategic alliances and acquisitions.

Spain E-commerce Logistics Market Growth Trends & Insights

The Spanish e-commerce logistics market has experienced a robust growth trajectory, primarily fueled by the sustained expansion of the e-commerce sector, particularly within the Business-to-Consumer (B2C) segment. The market size has seen a significant increase, growing from [Insert specific amount] million in 2019 to an estimated [Insert specific amount] million in 2025, reflecting a Compound Annual Growth Rate (CAGR) of [Insert specific percentage]%. This upward trend is anticipated to continue, with projections indicating the market will reach [Insert specific amount] million by 2033, sustaining a CAGR of [Insert specific percentage]% for the forecast period (2025-2033). Key enablers of this expansion include increasing internet penetration across the population, rising disposable incomes, and a demonstrable shift in consumer preferences towards online purchasing. Furthermore, technological disruptions, such as the widespread adoption of same-day delivery services and the implementation of advanced warehousing technologies, are actively contributing to market expansion. The market penetration rate for e-commerce logistics is expected to reach [Insert specific percentage]% by 2033. The evolving consumer behavior, characterized by a preference for seamless omnichannel shopping experiences, is increasingly shaping logistics strategies, necessitating greater agility and customization in service delivery.

Dominant Regions, Countries, or Segments in Spain E-commerce Logistics Market

The Madrid and Barcelona metropolitan areas are the dominant regions in the Spain e-commerce logistics market, benefiting from higher population density and robust infrastructure. The B2C segment represents the largest market share, currently accounting for approximately xx% of the total market. Domestic deliveries constitute the majority of transactions, but the international/cross-border segment is showing the fastest growth rate (xx% CAGR during the forecast period). Within the product landscape, Fashion and Apparel, and Consumer Electronics and Home Appliances are the leading segments, driven by high consumer demand and significant online sales volume.

- Key Drivers:

- Robust e-commerce growth.

- Development of advanced logistics infrastructure.

- Favorable government policies promoting digital economy.

- Rising consumer expectations for faster and more convenient delivery.

- Dominance Factors: High population density, developed infrastructure (especially in major cities), and strong consumer demand are major factors contributing to market dominance.

Spain E-commerce Logistics Market Product Landscape

The Spanish e-commerce logistics market is witnessing innovation in various areas, including automated warehousing systems, route optimization software, and sustainable packaging solutions. Companies are increasingly offering value-added services such as labeling, packaging, and returns management. The focus is on enhancing efficiency, reducing costs, and improving customer satisfaction. Technological advancements, such as the use of drones and autonomous vehicles for last-mile delivery, are gradually gaining traction but face regulatory hurdles and limited scalability.

Key Drivers, Barriers & Challenges in Spain E-commerce Logistics Market

Key Drivers: Increasing e-commerce adoption, government initiatives to foster digital commerce, and advancements in logistics technology are propelling market growth. The growing popularity of same-day and next-day delivery options also contributes significantly.

Key Challenges: Rising fuel costs, labor shortages, and increasing competition are key challenges. Regulatory complexities related to cross-border shipments and data privacy pose operational hurdles. Supply chain disruptions caused by global events can significantly impact delivery times and costs. The estimated cost impact of supply chain disruptions in 2025 is xx million.

Emerging Opportunities in Spain E-commerce Logistics Market

The growing demand for sustainable and eco-friendly logistics solutions presents a significant opportunity. The increasing adoption of omnichannel retail strategies requires flexible and integrated logistics solutions. Furthermore, the expansion of e-commerce into rural areas offers potential for growth. The untapped market in rural areas is estimated to represent xx million in potential revenue by 2033.

Growth Accelerators in the Spain E-commerce Logistics Market Industry

The accelerating growth of the Spanish e-commerce logistics market is being propelled by several key factors. Foremost among these are technological breakthroughs such as the implementation of AI-driven route optimization algorithms that dynamically adapt to traffic and delivery demands, and the nascent development and deployment of autonomous delivery vehicles, which promise to revolutionize last-mile efficiency. Strategic alliances and partnerships formed between established logistics providers and burgeoning e-commerce platforms are also proving instrumental in streamlining operations, enhancing delivery networks, and expanding overall market reach. Additionally, the strategic expansion into underserved geographic markets and the dedicated development of specialized logistics solutions tailored for niche product categories, such as perishables or oversized items, are poised to drive sustained long-term growth for the industry.

Key Players Shaping the Spain E-commerce Logistics Market Market

- Nacex

- List Not Exhaustive 7 3 Other Companies

- CTT Express

- DHL

- FedEx Corporation

- UPS

- Correos Express

- Celeritas

- Citibox

- SEUR

- Amphora Logistics

Notable Milestones in Spain E-commerce Logistics Market Sector

- 2021: Correos Express successfully launched and expanded its nationwide same-day delivery service, setting a new benchmark for delivery speed and customer expectation.

- 2022: DHL made significant capital investments in upgrading and expanding its automated sorting facilities located in key metropolitan areas across Spain, bolstering its operational capacity and efficiency.

- 2023: A series of strategic mergers and acquisitions occurred among smaller, regional logistics providers. These consolidations aimed to enhance their collective service offerings, broaden their geographical footprint, and achieve greater economies of scale to compete more effectively in the market. (Specific details of these mergers would require further in-depth research.)

In-Depth Spain E-commerce Logistics Market Market Outlook

The outlook for the Spanish e-commerce logistics market remains exceptionally positive, with strong and sustained growth anticipated throughout the forecast period. This optimistic trajectory is underpinned by a confluence of factors, including the relentless pace of technological innovation, the continuously expanding penetration of e-commerce across various consumer segments, and the definitive rise of omnichannel retail models that blur the lines between online and offline purchasing. To thrive in this evolving environment, companies must prioritize strategic investments in automation to optimize warehouse and sorting processes, embrace sustainable logistics solutions to meet growing environmental consciousness, and continuously refine their last-mile delivery strategies for enhanced speed and customer satisfaction. Ultimately, logistics providers that demonstrate agility in adapting to evolving consumer expectations and proactively navigate the complexities of the regulatory landscape will be exceptionally well-positioned to seize the considerable opportunities present within this vibrant and rapidly developing market.

Spain E-commerce Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value-added Services (Labeling and Packaging )

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross-border

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics and Home Appliances

- 4.3. Furniture

- 4.4. Beauty and Personal Care Products

- 4.5. Other Products (Toys, Food Products, etc.)

Spain E-commerce Logistics Market Segmentation By Geography

- 1. Spain

Spain E-commerce Logistics Market Regional Market Share

Geographic Coverage of Spain E-commerce Logistics Market

Spain E-commerce Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of B2C E-commerce; Urbanization and Population Density

- 3.3. Market Restrains

- 3.3.1. Infrastructure Challenges; Last-mile Delivery Complexities

- 3.4. Market Trends

- 3.4.1. The Rise in the Number of Online Shoppers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value-added Services (Labeling and Packaging )

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross-border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics and Home Appliances

- 5.4.3. Furniture

- 5.4.4. Beauty and Personal Care Products

- 5.4.5. Other Products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nacex**List Not Exhaustive 7 3 Other Companie

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CTT Express

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FedEx Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Correos Express

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Celeritas

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Citibox

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SEUR

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amphora Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nacex**List Not Exhaustive 7 3 Other Companie

List of Figures

- Figure 1: Spain E-commerce Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Spain E-commerce Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Spain E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Spain E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: Spain E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: Spain E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Spain E-commerce Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Spain E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Spain E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: Spain E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Spain E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Spain E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain E-commerce Logistics Market?

The projected CAGR is approximately 9.41%.

2. Which companies are prominent players in the Spain E-commerce Logistics Market?

Key companies in the market include Nacex**List Not Exhaustive 7 3 Other Companie, CTT Express, DHL, FedEx Corporation, UPS, Correos Express, Celeritas, Citibox, SEUR, Amphora Logistics.

3. What are the main segments of the Spain E-commerce Logistics Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of B2C E-commerce; Urbanization and Population Density.

6. What are the notable trends driving market growth?

The Rise in the Number of Online Shoppers.

7. Are there any restraints impacting market growth?

Infrastructure Challenges; Last-mile Delivery Complexities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain E-commerce Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain E-commerce Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain E-commerce Logistics Market?

To stay informed about further developments, trends, and reports in the Spain E-commerce Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence