Key Insights

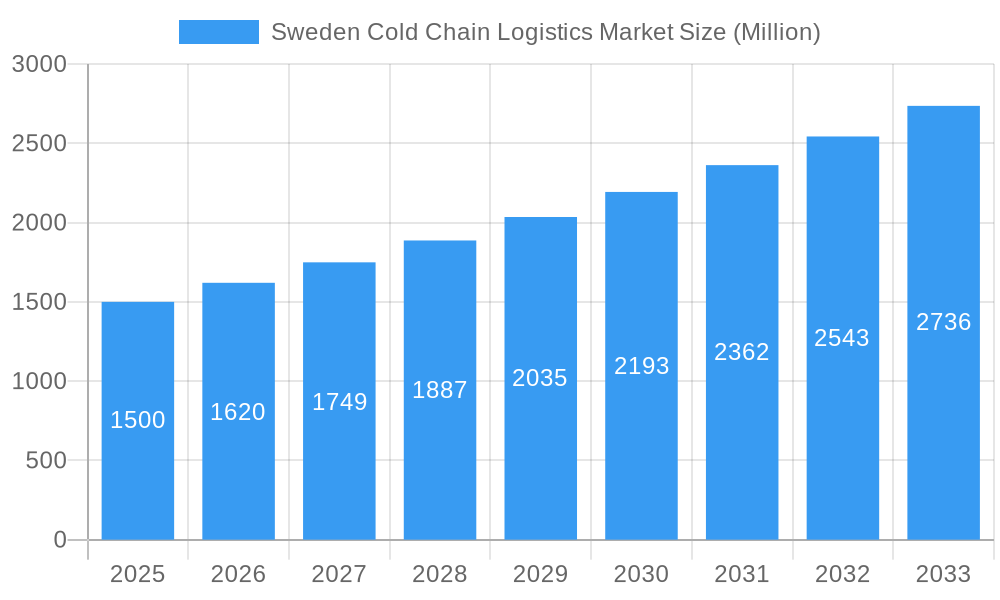

The Sweden cold chain logistics market is poised for significant expansion, driven by escalating demand for temperature-sensitive goods including pharmaceuticals, fresh produce, and dairy. The market is projected to reach a size of 1.93 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.16% from the base year 2025. Key growth drivers include evolving consumer preferences for premium, fresh, and high-quality food, the burgeoning e-commerce sector's requirement for reliable temperature-controlled delivery, and the pharmaceutical industry's increasing reliance on secure cold chain solutions for vital medications and vaccines.

Sweden Cold Chain Logistics Market Market Size (In Billion)

The market is segmented by service type (storage, transportation, and value-added services like blast freezing and inventory management), temperature requirements (chilled, frozen, and ambient), and diverse applications including horticulture, dairy, fish, meat, poultry, processed foods, and pharmaceuticals. Leading logistics providers such as DHL and DB Schenker are actively investing in advanced cold chain infrastructure and technology within Sweden, fostering a competitive and dynamic market environment. Despite potential headwinds from fluctuating energy costs and complex regulatory landscapes, the Swedish cold chain logistics market demonstrates a strong positive outlook.

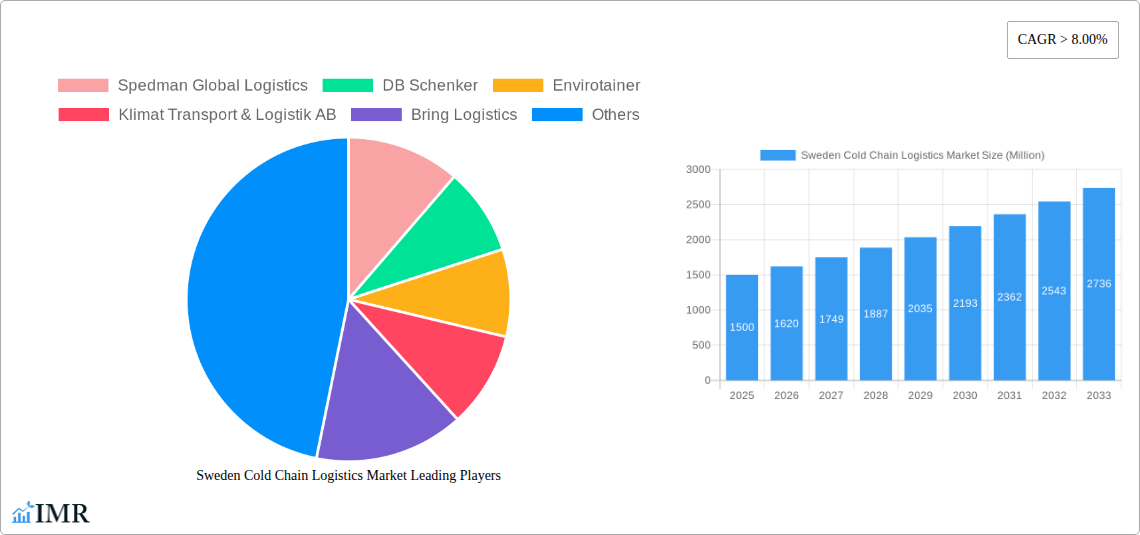

Sweden Cold Chain Logistics Market Company Market Share

Within the forecast period, value-added services are anticipated to experience accelerated growth, driven by the critical need for enhanced supply chain efficiency and traceability. The frozen segment is expected to retain a substantial market share, supported by the sustained popularity of frozen food products and the necessity for extended product preservation. Furthermore, the pharmaceutical application segment is on track for robust expansion, fueled by advancements in biotechnology and the growing demand for temperature-sensitive therapeutics. Regional analysis indicates a strong focus on domestic Swedish operations, with potential for further growth through expansion into neighboring Nordic markets. Companies are increasingly adopting cutting-edge solutions, including real-time monitoring systems, blockchain technology, and advanced packaging, to bolster the safety and efficacy of their cold chain operations, thereby reinforcing the market's upward trajectory.

Sweden Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Sweden cold chain logistics market, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The total market size in 2025 is estimated at xx Million units, showcasing significant growth potential.

Sweden Cold Chain Logistics Market Market Dynamics & Structure

The Swedish cold chain logistics market is characterized by a moderately concentrated landscape with both large multinational players and smaller, specialized companies. Market share is distributed amongst key players like DHL, DB Schenker and Bring Logistics, while niche players serve specialized segments. Technological advancements, such as IoT-enabled tracking and automation, are transforming efficiency and reducing waste. The regulatory framework emphasizes food safety and sustainability, influencing operational practices. Competitive substitutes include alternative transportation methods and storage solutions. The end-user demographics include diverse industries, with a strong focus on food and pharmaceuticals. Recent M&A activity has been relatively moderate, with a focus on consolidation and expansion within specific segments.

- Market Concentration: Moderately concentrated, with a few major players holding significant market share.

- Technological Innovation: IoT, automation, and AI are key drivers improving efficiency and traceability.

- Regulatory Framework: Stringent regulations regarding food safety and environmental impact.

- Competitive Substitutes: Alternative transportation and storage methods.

- End-User Demographics: Diverse industries, including food processing, pharmaceuticals, and horticulture.

- M&A Activity: Moderate level of mergers and acquisitions, primarily for expansion and consolidation. xx M&A deals estimated during 2019-2024.

Sweden Cold Chain Logistics Market Growth Trends & Insights

The Swedish cold chain logistics market exhibits a steady growth trajectory, driven by factors such as rising disposable incomes, changing consumer preferences towards fresh and processed foods, and increasing demand for temperature-sensitive pharmaceuticals. The market size has experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements, particularly in temperature monitoring and control, leading to improved efficiency and reduced spoilage. The adoption rate of advanced cold chain technologies is steadily increasing, reflecting the industry's commitment to optimizing operations and minimizing losses. Consumer behavior shifts towards premium, quality food products further boosts demand for robust cold chain services. The market penetration of value-added services is also rising, demonstrating the evolving service needs.

Dominant Regions, Countries, or Segments in Sweden Cold Chain Logistics Market

The Swedish cold chain logistics market shows strong growth across various segments. The transport segment dominates by volume due to the extensive distribution network needed, while storage is significantly important for maintaining product quality. The value-added services segment shows increasing importance, reflecting the rising need for specialized handling and processing of temperature-sensitive goods. Within temperature control, the chilled segment holds the largest share, driven by the demand for fresh produce and dairy products. The frozen segment shows significant growth potential due to the increasing popularity of frozen foods. In terms of application, dairy products and processed food represent the largest segments, followed by pharmaceutical and horticulture. Urban areas in southern Sweden show higher concentration of logistics infrastructure, driving regional dominance.

- Key Drivers:

- Robust infrastructure, particularly in southern Sweden.

- Government initiatives promoting food safety and sustainable practices.

- High demand for fresh and processed foods, as well as pharmaceuticals.

- Dominant Segments: Transport (xx Million units in 2025), Storage (xx Million units in 2025), Chilled, Dairy Products, Processed Food.

Sweden Cold Chain Logistics Market Product Landscape

The Swedish cold chain logistics market showcases a diverse product landscape, encompassing specialized refrigerated vehicles, temperature-controlled warehouses, and advanced tracking technologies. These products are tailored to meet stringent quality and safety requirements across different temperature ranges. Innovations in temperature monitoring, using IoT sensors, and automated handling systems are enhancing efficiency and reducing waste. Key selling propositions include improved traceability, real-time monitoring, and enhanced data analytics capabilities, enabling proactive management and reduced losses.

Key Drivers, Barriers & Challenges in Sweden Cold Chain Logistics Market

Key Drivers:

- Increasing demand for fresh produce and processed foods.

- Growing pharmaceutical sector and the need for reliable cold chain solutions.

- Technological advancements improving efficiency and traceability.

- Government regulations promoting sustainable and safe practices.

Challenges:

- Maintaining consistent temperature control throughout the supply chain, resulting in xx% of estimated product loss annually.

- Rising fuel costs and transportation complexities impacting operational profitability.

- Competition from international players and evolving customer expectations.

- Stringent environmental regulations posing operational challenges.

Emerging Opportunities in Sweden Cold Chain Logistics Market

- Growing demand for sustainable and eco-friendly cold chain solutions.

- Increased adoption of advanced technologies like AI and machine learning for improved efficiency.

- Expansion of e-commerce and the rising need for last-mile delivery solutions.

- Development of specialized services for niche products like biopharmaceuticals.

Growth Accelerators in the Sweden Cold Chain Logistics Market Industry

The long-term growth in the Swedish cold chain logistics market is driven by several factors. Strategic partnerships between logistics providers and technology companies are accelerating innovation. Government support for sustainable and efficient cold chain practices is fostering further investment. Expanding e-commerce and increasing demand for temperature-sensitive products from sectors like pharmaceuticals and food are also significant catalysts. The ongoing development of specialized logistics solutions catering to niche customer needs further contributes to growth.

Key Players Shaping the Sweden Cold Chain Logistics Market Market

- Spedman Global Logistics

- DB Schenker

- Envirotainer

- Klimat Transport & Logistik AB

- Bring Logistics

- DHL logistics

- Nordic Cold Chain Solutions

- Agility logistics

- Kyl & Frysexpressen AB

- Toll Group

List Not Exhaustive

Notable Milestones in Sweden Cold Chain Logistics Market Sector

- November 2022: DHL Supply Chain establishes a 400,000 sqm carbon-neutral real estate portfolio across six European markets, enhancing its cold chain capabilities.

- May 2022: DHL Supply Chain announces construction of a 44,000 sqm multi-user logistics center in Sipoo, Finland (opening Q1 2024), signifying investment in regional cold chain infrastructure.

In-Depth Sweden Cold Chain Logistics Market Market Outlook

The future of the Swedish cold chain logistics market is promising, driven by continuous technological advancements, expanding e-commerce, and increased demand for temperature-sensitive goods. Strategic partnerships and investments in sustainable solutions will further shape the market landscape. Opportunities exist for companies focusing on specialized services, sustainable practices, and technological innovation. The market is expected to demonstrate sustained growth, presenting significant opportunities for both established players and new entrants.

Sweden Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transport

- 1.3. Value-Ad

-

2. Temparature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. Application

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Pr

- 3.3. Fish, Meat and Poultry

- 3.4. Processed Food

- 3.5. Pharmaceutical (Including Biopharma)

- 3.6. Other Applications

Sweden Cold Chain Logistics Market Segmentation By Geography

- 1. Sweden

Sweden Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Sweden Cold Chain Logistics Market

Sweden Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics

- 3.3. Market Restrains

- 3.3.1. Damaged Goods; Increasing Transportation Cost

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Industry Demands Advanced Cold-Chain Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transport

- 5.1.3. Value-Ad

- 5.2. Market Analysis, Insights and Forecast - by Temparature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat and Poultry

- 5.3.4. Processed Food

- 5.3.5. Pharmaceutical (Including Biopharma)

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Spedman Global Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Envirotainer

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Klimat Transport & Logistik AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bring Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DHL logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nordic Cold Chain Solutions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agility logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kyl & Frysexpressen AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toll Group**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Spedman Global Logistics

List of Figures

- Figure 1: Sweden Cold Chain Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Sweden Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Temparature 2020 & 2033

- Table 3: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Temparature 2020 & 2033

- Table 7: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Cold Chain Logistics Market?

The projected CAGR is approximately 5.16%.

2. Which companies are prominent players in the Sweden Cold Chain Logistics Market?

Key companies in the market include Spedman Global Logistics, DB Schenker, Envirotainer, Klimat Transport & Logistik AB, Bring Logistics, DHL logistics, Nordic Cold Chain Solutions, Agility logistics, Kyl & Frysexpressen AB, Toll Group**List Not Exhaustive.

3. What are the main segments of the Sweden Cold Chain Logistics Market?

The market segments include Service, Temparature, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics.

6. What are the notable trends driving market growth?

Pharmaceutical Industry Demands Advanced Cold-Chain Services.

7. Are there any restraints impacting market growth?

Damaged Goods; Increasing Transportation Cost.

8. Can you provide examples of recent developments in the market?

November 2022: To serve customers' expansion needs across six European Tier 1 markets, DHL Supply Chain, the top contract logistics provider in the world, has established a 400,000 sqm carbon-neutral real estate portfolio. All of the locations, which are strategically located in logistics hubs, will have strong multi-modal transport connectivity to meet the needs of a variety of clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Sweden Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence