Key Insights

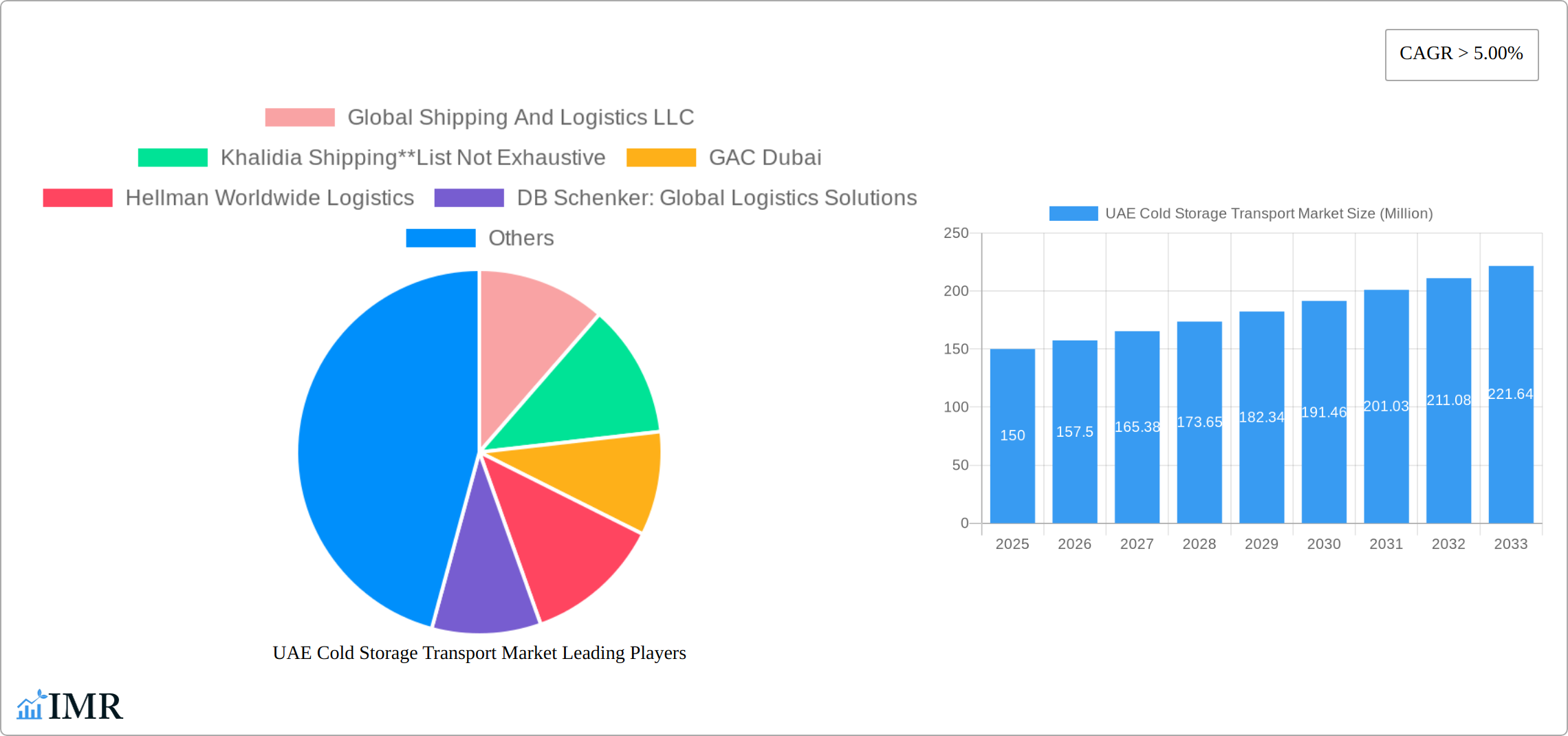

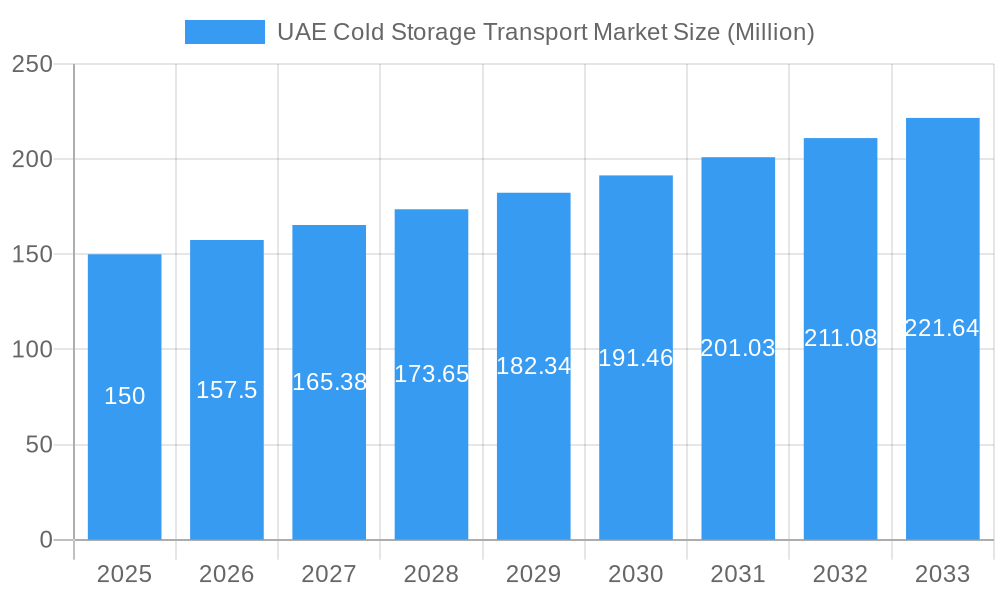

The UAE cold storage transport market is experiencing robust growth, driven by a burgeoning food and beverage sector, increasing demand for temperature-sensitive pharmaceuticals, and the expansion of e-commerce, particularly in grocery delivery. The market, estimated at $XX million in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% through 2033. This growth is fueled by several key factors. The UAE's strategic location as a major trade hub facilitates efficient import and export of perishable goods, demanding reliable and extensive cold chain logistics. Furthermore, increasing consumer preference for fresh produce and processed foods, coupled with stricter food safety regulations, necessitate advanced cold storage and transportation solutions. The segment encompassing value-added services, such as blast freezing and inventory management, is expected to witness particularly strong growth, reflecting a demand for greater efficiency and supply chain optimization within the sector. Frozen food products currently constitute a significant portion of the market, while the chilled segment is also experiencing healthy growth fueled by increasing demand for fresh produce and dairy products. Major players in the market include both international logistics giants and regional companies, indicating a competitive yet dynamic landscape.

UAE Cold Storage Transport Market Market Size (In Million)

Despite the promising outlook, challenges remain. Fluctuations in fuel prices and potential disruptions to global supply chains pose significant risks. Furthermore, maintaining consistent temperature control across the entire cold chain, from origin to final delivery, presents ongoing operational complexities. Investing in advanced technologies, such as GPS tracking and real-time temperature monitoring, is crucial for mitigating these risks and improving efficiency. Government initiatives promoting food security and supporting the development of a robust logistics infrastructure will further propel the growth trajectory of the UAE cold storage transport market. The market’s diverse end-user segments, from horticulture and dairy to pharmaceuticals, ensure a broad base of support that will continue to drive the market's expansion over the forecast period.

UAE Cold Storage Transport Market Company Market Share

UAE Cold Storage Transport Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the UAE cold storage transport market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period 2019-2033, with 2025 as the base year and a forecast period extending to 2033. The market is segmented by services (storage, transportation, value-added services), temperature type (chilled, frozen), and end-users (horticulture, dairy, meats, fish, poultry, processed food, pharma & life sciences, others). This report is essential for businesses operating in the UAE logistics, cold chain, and food & beverage sectors. The market size is projected to reach xx Million by 2033.

UAE Cold Storage Transport Market Dynamics & Structure

The UAE cold storage transport market is characterized by a moderately consolidated structure, with both large multinational players and local businesses competing. Market concentration is influenced by factors such as investment in infrastructure, technological capabilities, and regulatory compliance. Technological innovation, including temperature-controlled containers, GPS tracking, and advanced warehousing systems, drives efficiency and reduces losses. The UAE's robust regulatory framework ensuring food safety and quality standards significantly impacts market operations. Substitute products, such as alternative preservation methods, pose limited competition. End-user demographics, with a growing population and increasing demand for imported food products, fuel market growth. Mergers and acquisitions (M&A) activity, while not extensive, plays a role in market consolidation. In the period 2020-2024, xx M&A deals were recorded, resulting in a xx% market share change among top players.

- Market Concentration: Moderately Consolidated

- Technological Drivers: Temperature-controlled containers, GPS tracking, automation.

- Regulatory Framework: Stringent food safety and quality standards.

- Competitive Substitutes: Limited impact from alternative preservation methods.

- End-User Demographics: Growing population and increasing demand for imported food.

- M&A Trends: xx M&A deals (2020-2024), resulting in xx% market share change.

- Innovation Barriers: High initial investment costs for advanced technologies.

UAE Cold Storage Transport Market Growth Trends & Insights

The UAE cold storage transport market is experiencing dynamic expansion, propelled by a confluence of factors including a growing affluent population, evolving dietary preferences leaning towards convenience and a higher consumption of fresh and imported food products, and the nation's strategic role as a global trade hub. The market demonstrated a robust Compound Annual Growth Rate (CAGR) of approximately [Insert Specific CAGR for 2019-2024]% during the 2019-2024 period. This upward trajectory is poised to persist, with projections indicating a continued CAGR of around [Insert Specific CAGR for 2025-2033]% from 2025 to 2033. Technological advancements are playing a pivotal role, with innovations in cold chain management software, real-time temperature monitoring systems, and route optimization algorithms significantly enhancing operational efficiency and driving down costs. The increasing consumer demand for high-quality, safely delivered perishable goods, coupled with a preference for international culinary experiences, further fuels market growth. The penetration of sophisticated cold chain solutions is currently estimated at [Insert Specific Penetration % for current year]% and is anticipated to climb to [Insert Specific Penetration % for 2033]% by 2033. The adoption of advanced temperature-controlled containers, equipped with features like humidity control and precise temperature settings, is on the rise, thereby minimizing product spoilage and guaranteeing superior product quality throughout the supply chain. The market size was valued at approximately [Insert Specific Market Size in Million for 2025] Million in 2025 and is projected to reach an impressive [Insert Specific Market Size in Million for 2033] Million by 2033.

Dominant Regions, Countries, or Segments in UAE Cold Storage Transport Market

Key economic powerhouses within the UAE, particularly the bustling metropolises of Dubai and Abu Dhabi, spearhead the market's growth. These regions benefit from substantial population bases, thriving food and beverage sectors, and world-class logistics and transportation infrastructures that facilitate efficient cold chain operations. Within the service offerings, transportation currently commands the largest market share, estimated at [Insert Specific Transportation %]%, closely followed by storage at [Insert Specific Storage %]%, and value-added services at [Insert Specific Value-Added Services %]%. Analyzing temperature requirements, the chilled segment leads the market with a significant [Insert Specific Chilled %]% share, driven by the high demand for fresh produce, dairy products, and chilled beverages. The frozen segment accounts for the remaining [Insert Specific Frozen %]%. In terms of end-user industries, horticulture (encompassing fresh fruits and vegetables) holds the dominant market share at [Insert Specific Horticulture %]%, underscoring the UAE's reliance on imported and locally grown fresh produce. Dairy products follow with [Insert Specific Dairy %]%, and the processed food segment contributes [Insert Specific Processed Food %]%.

-

Key Growth Drivers:

- Urbanization and Population Density: The concentration of populations in Dubai and Abu Dhabi fuels demand for a wider variety of perishable goods and necessitates robust cold chain logistics.

- Thriving Food & Beverage Industry: The presence of a large and dynamic food and beverage sector, including hospitality and retail, is a primary consumer of cold storage transport services.

- Government Initiatives: Proactive government policies aimed at enhancing food security, developing advanced logistics infrastructure, and attracting foreign investment play a crucial role in market expansion.

- Strategic Location and Trade Hub: The UAE's position as a global transit hub facilitates the import and export of temperature-sensitive goods, boosting the demand for efficient cold chain solutions.

- Technological Adoption: Increased investment in and adoption of modern cold storage technologies and advanced logistics management systems.

-

Dominant Segments:

- By Services: Transportation ([Insert Specific Transportation %]%), Storage ([Insert Specific Storage %]%), Value Added Services ([Insert Specific Value-Added Services %]%).

- By Temperature: Chilled ([Insert Specific Chilled %]%), Frozen ([Insert Specific Frozen %]%).

- By End-Users: Horticulture ([Insert Specific Horticulture %]%), Dairy ([Insert Specific Dairy %]%), Processed Food ([Insert Specific Processed Food %]%).

UAE Cold Storage Transport Market Product Landscape

The product landscape of the UAE cold storage transport market is characterized by a strong emphasis on cutting-edge technologies and sustainable solutions. Key offerings include highly automated warehousing systems designed for optimal space utilization and rapid order fulfillment, advanced GPS-enabled tracking devices for real-time location monitoring, and sophisticated temperature-controlled containers featuring multi-zone climate control and remote sensing capabilities. These innovations are crucial for ensuring the integrity and safety of perishable goods, minimizing transit times, optimizing delivery routes through intelligent algorithms, and providing end-to-end visibility across the entire supply chain. Differentiators for market players often revolve around demonstrable improvements in operational efficiency, significant reductions in product wastage, and enhanced traceability for quality assurance and compliance purposes. Recent developments have seen a surge in the integration of Internet of Things (IoT) sensors and advanced data analytics platforms, enabling predictive maintenance, proactive identification of potential temperature excursions, and more effective cold chain management strategies.

Key Drivers, Barriers & Challenges in UAE Cold Storage Transport Market

Key Drivers: The increasing demand for fresh produce and imported food, coupled with government initiatives promoting food security and logistics infrastructure development, are key drivers. Technological advancements, including automation and IoT-based solutions, further enhance efficiency and reduce costs. Government regulations promoting food safety and quality standards also drive market growth.

Key Challenges: High infrastructure costs, stringent regulatory compliance requirements, and the potential for supply chain disruptions (e.g., geopolitical events, pandemics) pose significant challenges. Competitive pressures from both local and international players, as well as fluctuating fuel prices, add further complexity. The impact of these challenges is estimated to reduce market growth by xx% in the next five years.

Emerging Opportunities in UAE Cold Storage Transport Market

Emerging opportunities include the growth of e-commerce and online grocery delivery, which are creating a demand for efficient and reliable cold chain solutions. The expansion of the healthcare and pharmaceutical sectors offers further potential for specialized cold storage and transportation services. Increasing focus on sustainable and eco-friendly cold chain practices presents opportunities for companies adopting green technologies.

Growth Accelerators in the UAE Cold Storage Transport Market Industry

Several factors are acting as significant catalysts for growth within the UAE cold storage transport industry. Technological innovation remains a paramount accelerator, particularly in the adoption of IoT sensors for granular temperature and humidity monitoring, AI-powered route optimization software to enhance delivery efficiency and reduce fuel consumption, and the implementation of automated warehousing solutions to boost throughput and accuracy. Strategic collaborations and partnerships between leading logistics providers, specialized cold storage facility operators, and technology developers are fostering innovation and enabling the development of integrated, end-to-end cold chain solutions that meet the evolving needs of businesses. Furthermore, the expansion into specialized and high-value niche markets, such as the provision of tailored cold chain solutions for the pharmaceutical and life sciences sectors – requiring stringent temperature controls and regulatory compliance – presents substantial opportunities for sustained growth and market differentiation.

Key Players Shaping the UAE Cold Storage Transport Market Market

- Global Shipping And Logistics LLC

- Khalidia Shipping

- GAC Dubai

- Hellman Worldwide Logistics

- DB Schenker: Global Logistics Solutions

- CEVA Logistics

- Al-Futtaim Logistics

- Mohebi Logistics

- MH Khoory Trading & Ship Chandlers LLC

- Tameem Logistics

- RHS Logistics

[Insert Name of New Key Player] - Bringing expertise in [mention specific niche or technology, e.g., advanced pharmaceutical cold chain solutions or sustainable logistics].

[Insert Name of Another Key Player] - Expanding its network with [mention specific initiative, e.g., new state-of-the-art cold storage facilities or enhanced technology integration].

Notable Milestones in UAE Cold Storage Transport Market Sector

- April 2022: GAC Dubai wins FMCG Supply Chain of the Year at the Logistics Middle East Awards.

- March 2022: Maersk establishes its first Integrated Logistics Center in Dubai, enhancing cold chain capabilities.

In-Depth UAE Cold Storage Transport Market Outlook

The UAE cold storage transport market is poised for continued strong growth, driven by robust domestic demand, favorable government policies, and ongoing technological advancements. Strategic investments in infrastructure, coupled with the adoption of innovative technologies and sustainable practices, will shape the market landscape. The market's potential lies in catering to the growing needs of diverse sectors, including e-commerce, healthcare, and the food & beverage industry. Opportunities exist for businesses that leverage technology to optimize operations, enhance supply chain visibility, and improve service quality.

UAE Cold Storage Transport Market Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value Ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. End Users

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, and Poultry

- 3.4. Processed Food Products

- 3.5. Pharma and Life Sciences

- 3.6. Other End Users

UAE Cold Storage Transport Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Cold Storage Transport Market Regional Market Share

Geographic Coverage of UAE Cold Storage Transport Market

UAE Cold Storage Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Demand for Perishable Goods4.3.; Growth in the E-commerce Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Higher Capital Investment4.3.; Infrastructure Limitations

- 3.4. Market Trends

- 3.4.1. Dominance of 3PL Companies over Cold Chain logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Cold Storage Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value Ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, and Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma and Life Sciences

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America UAE Cold Storage Transport Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Storage

- 6.1.2. Transportation

- 6.1.3. Value Ad

- 6.2. Market Analysis, Insights and Forecast - by Temperature Type

- 6.2.1. Chilled

- 6.2.2. Frozen

- 6.2.3. Ambient

- 6.3. Market Analysis, Insights and Forecast - by End Users

- 6.3.1. Horticulture (Fresh Fruits and Vegetables)

- 6.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 6.3.3. Meats, Fish, and Poultry

- 6.3.4. Processed Food Products

- 6.3.5. Pharma and Life Sciences

- 6.3.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. South America UAE Cold Storage Transport Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Storage

- 7.1.2. Transportation

- 7.1.3. Value Ad

- 7.2. Market Analysis, Insights and Forecast - by Temperature Type

- 7.2.1. Chilled

- 7.2.2. Frozen

- 7.2.3. Ambient

- 7.3. Market Analysis, Insights and Forecast - by End Users

- 7.3.1. Horticulture (Fresh Fruits and Vegetables)

- 7.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 7.3.3. Meats, Fish, and Poultry

- 7.3.4. Processed Food Products

- 7.3.5. Pharma and Life Sciences

- 7.3.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe UAE Cold Storage Transport Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Storage

- 8.1.2. Transportation

- 8.1.3. Value Ad

- 8.2. Market Analysis, Insights and Forecast - by Temperature Type

- 8.2.1. Chilled

- 8.2.2. Frozen

- 8.2.3. Ambient

- 8.3. Market Analysis, Insights and Forecast - by End Users

- 8.3.1. Horticulture (Fresh Fruits and Vegetables)

- 8.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 8.3.3. Meats, Fish, and Poultry

- 8.3.4. Processed Food Products

- 8.3.5. Pharma and Life Sciences

- 8.3.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Middle East & Africa UAE Cold Storage Transport Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Storage

- 9.1.2. Transportation

- 9.1.3. Value Ad

- 9.2. Market Analysis, Insights and Forecast - by Temperature Type

- 9.2.1. Chilled

- 9.2.2. Frozen

- 9.2.3. Ambient

- 9.3. Market Analysis, Insights and Forecast - by End Users

- 9.3.1. Horticulture (Fresh Fruits and Vegetables)

- 9.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 9.3.3. Meats, Fish, and Poultry

- 9.3.4. Processed Food Products

- 9.3.5. Pharma and Life Sciences

- 9.3.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Asia Pacific UAE Cold Storage Transport Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Storage

- 10.1.2. Transportation

- 10.1.3. Value Ad

- 10.2. Market Analysis, Insights and Forecast - by Temperature Type

- 10.2.1. Chilled

- 10.2.2. Frozen

- 10.2.3. Ambient

- 10.3. Market Analysis, Insights and Forecast - by End Users

- 10.3.1. Horticulture (Fresh Fruits and Vegetables)

- 10.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 10.3.3. Meats, Fish, and Poultry

- 10.3.4. Processed Food Products

- 10.3.5. Pharma and Life Sciences

- 10.3.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Global Shipping And Logistics LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Khalidia Shipping**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GAC Dubai

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hellman Worldwide Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DB Schenker

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Global Shipping And Logistics LLC

List of Figures

- Figure 1: Global UAE Cold Storage Transport Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America UAE Cold Storage Transport Market Revenue (undefined), by Services 2025 & 2033

- Figure 3: North America UAE Cold Storage Transport Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America UAE Cold Storage Transport Market Revenue (undefined), by Temperature Type 2025 & 2033

- Figure 5: North America UAE Cold Storage Transport Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 6: North America UAE Cold Storage Transport Market Revenue (undefined), by End Users 2025 & 2033

- Figure 7: North America UAE Cold Storage Transport Market Revenue Share (%), by End Users 2025 & 2033

- Figure 8: North America UAE Cold Storage Transport Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America UAE Cold Storage Transport Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UAE Cold Storage Transport Market Revenue (undefined), by Services 2025 & 2033

- Figure 11: South America UAE Cold Storage Transport Market Revenue Share (%), by Services 2025 & 2033

- Figure 12: South America UAE Cold Storage Transport Market Revenue (undefined), by Temperature Type 2025 & 2033

- Figure 13: South America UAE Cold Storage Transport Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 14: South America UAE Cold Storage Transport Market Revenue (undefined), by End Users 2025 & 2033

- Figure 15: South America UAE Cold Storage Transport Market Revenue Share (%), by End Users 2025 & 2033

- Figure 16: South America UAE Cold Storage Transport Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America UAE Cold Storage Transport Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UAE Cold Storage Transport Market Revenue (undefined), by Services 2025 & 2033

- Figure 19: Europe UAE Cold Storage Transport Market Revenue Share (%), by Services 2025 & 2033

- Figure 20: Europe UAE Cold Storage Transport Market Revenue (undefined), by Temperature Type 2025 & 2033

- Figure 21: Europe UAE Cold Storage Transport Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 22: Europe UAE Cold Storage Transport Market Revenue (undefined), by End Users 2025 & 2033

- Figure 23: Europe UAE Cold Storage Transport Market Revenue Share (%), by End Users 2025 & 2033

- Figure 24: Europe UAE Cold Storage Transport Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe UAE Cold Storage Transport Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UAE Cold Storage Transport Market Revenue (undefined), by Services 2025 & 2033

- Figure 27: Middle East & Africa UAE Cold Storage Transport Market Revenue Share (%), by Services 2025 & 2033

- Figure 28: Middle East & Africa UAE Cold Storage Transport Market Revenue (undefined), by Temperature Type 2025 & 2033

- Figure 29: Middle East & Africa UAE Cold Storage Transport Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 30: Middle East & Africa UAE Cold Storage Transport Market Revenue (undefined), by End Users 2025 & 2033

- Figure 31: Middle East & Africa UAE Cold Storage Transport Market Revenue Share (%), by End Users 2025 & 2033

- Figure 32: Middle East & Africa UAE Cold Storage Transport Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa UAE Cold Storage Transport Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UAE Cold Storage Transport Market Revenue (undefined), by Services 2025 & 2033

- Figure 35: Asia Pacific UAE Cold Storage Transport Market Revenue Share (%), by Services 2025 & 2033

- Figure 36: Asia Pacific UAE Cold Storage Transport Market Revenue (undefined), by Temperature Type 2025 & 2033

- Figure 37: Asia Pacific UAE Cold Storage Transport Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 38: Asia Pacific UAE Cold Storage Transport Market Revenue (undefined), by End Users 2025 & 2033

- Figure 39: Asia Pacific UAE Cold Storage Transport Market Revenue Share (%), by End Users 2025 & 2033

- Figure 40: Asia Pacific UAE Cold Storage Transport Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific UAE Cold Storage Transport Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 2: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Temperature Type 2020 & 2033

- Table 3: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by End Users 2020 & 2033

- Table 4: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 6: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Temperature Type 2020 & 2033

- Table 7: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by End Users 2020 & 2033

- Table 8: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 13: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Temperature Type 2020 & 2033

- Table 14: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by End Users 2020 & 2033

- Table 15: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 20: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Temperature Type 2020 & 2033

- Table 21: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by End Users 2020 & 2033

- Table 22: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 33: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Temperature Type 2020 & 2033

- Table 34: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by End Users 2020 & 2033

- Table 35: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 43: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Temperature Type 2020 & 2033

- Table 44: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by End Users 2020 & 2033

- Table 45: Global UAE Cold Storage Transport Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UAE Cold Storage Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Cold Storage Transport Market?

The projected CAGR is approximately 8.92%.

2. Which companies are prominent players in the UAE Cold Storage Transport Market?

Key companies in the market include Global Shipping And Logistics LLC, Khalidia Shipping**List Not Exhaustive, GAC Dubai, Hellman Worldwide Logistics, DB Schenker: Global Logistics Solutions, CEVA Logistics, Al-Futtaim Logistics, Mohebi Logistics, MH Khoory Trading & Ship Chandlers LLC, Tameem Logistics, RHS Logistics.

3. What are the main segments of the UAE Cold Storage Transport Market?

The market segments include Services, Temperature Type, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Demand for Perishable Goods4.3.; Growth in the E-commerce Industry.

6. What are the notable trends driving market growth?

Dominance of 3PL Companies over Cold Chain logistics.

7. Are there any restraints impacting market growth?

4.; Higher Capital Investment4.3.; Infrastructure Limitations.

8. Can you provide examples of recent developments in the market?

April 2022: At the 16th annual Logistics Middle East Awards hosted at the Grosvenor House in Dubai, United Arab Emirates, GAC Dubai was recognized as the FMCG Supply Chain of the Year winner for its outstanding service to the region's dynamic Fast Moving Consumer Goods (FMCG) industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Cold Storage Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Cold Storage Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Cold Storage Transport Market?

To stay informed about further developments, trends, and reports in the UAE Cold Storage Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence