Key Insights

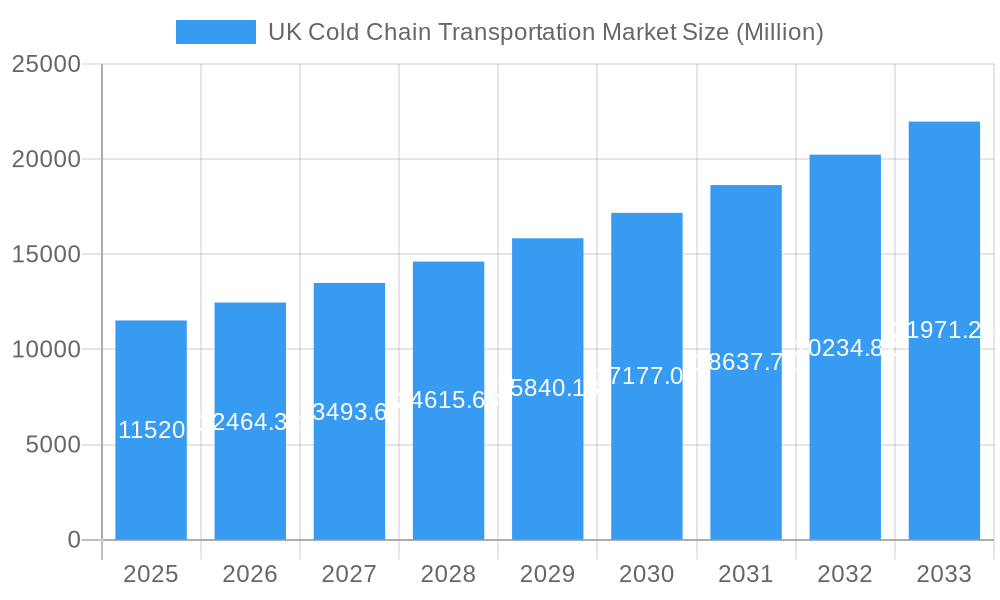

The UK cold chain transportation market, valued at £11.52 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.16% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for fresh produce, chilled and frozen foods, and pharmaceuticals is a major driver. E-commerce growth significantly contributes, demanding efficient and reliable cold chain solutions for timely delivery of temperature-sensitive goods directly to consumers. Furthermore, the rising adoption of advanced technologies, such as real-time tracking and temperature monitoring systems, enhances supply chain visibility and reduces waste, boosting market growth. Stringent regulatory frameworks concerning food safety and product quality also underpin the market's expansion, compelling businesses to invest in advanced cold chain infrastructure and logistics. The market is segmented by temperature type (chilled, frozen, ambient), application (horticulture, dairy, meat, fish, poultry, beverages, pharmaceuticals, life sciences, chemicals, and others), and services (storage, transportation, value-added services like blast freezing and inventory management). Competition is present amongst established players like Culina Group, Lineage Logistics, and smaller regional operators.

UK Cold Chain Transportation Market Market Size (In Billion)

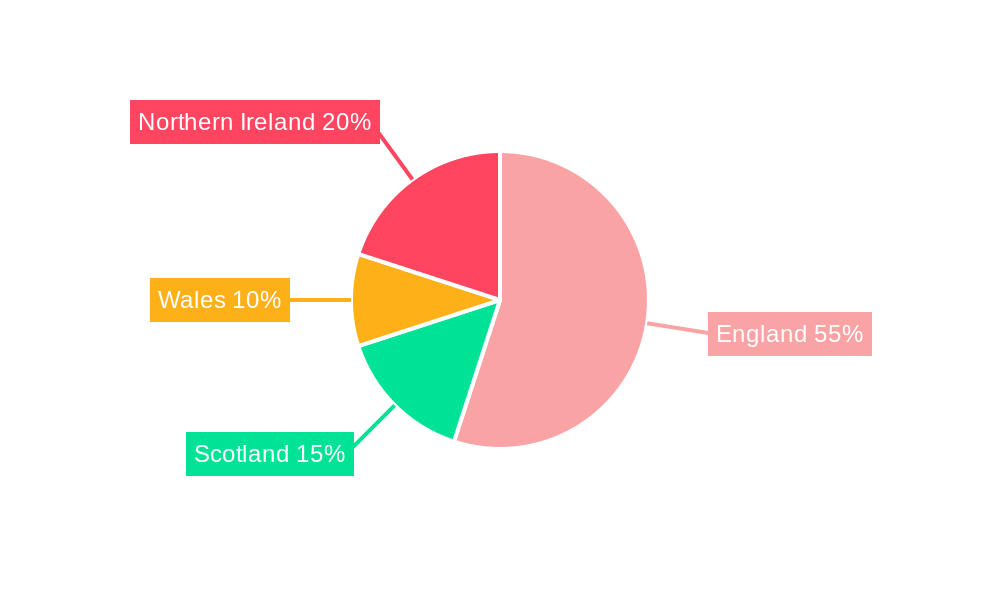

The market's growth trajectory isn't without challenges. Fluctuations in fuel prices represent a significant restraint, impacting transportation costs and overall operational profitability. Furthermore, the need for continuous investment in infrastructure, including refrigerated vehicles and warehousing facilities, can pose a considerable financial burden for businesses. Driver shortages and the complexities of maintaining precise temperature control throughout the supply chain also present hurdles to overcome. However, strategic partnerships, technological innovations in energy-efficient transportation, and a focus on sustainable practices are expected to mitigate these challenges. The regional breakdown within the UK (England, Wales, Scotland, Northern Ireland) reflects varying levels of demand and infrastructure development, creating opportunities for targeted expansion and investment. The continued growth in the UK's food and beverage sector, coupled with increased consumer awareness of food safety, suggests a promising outlook for the cold chain transportation sector in the coming years.

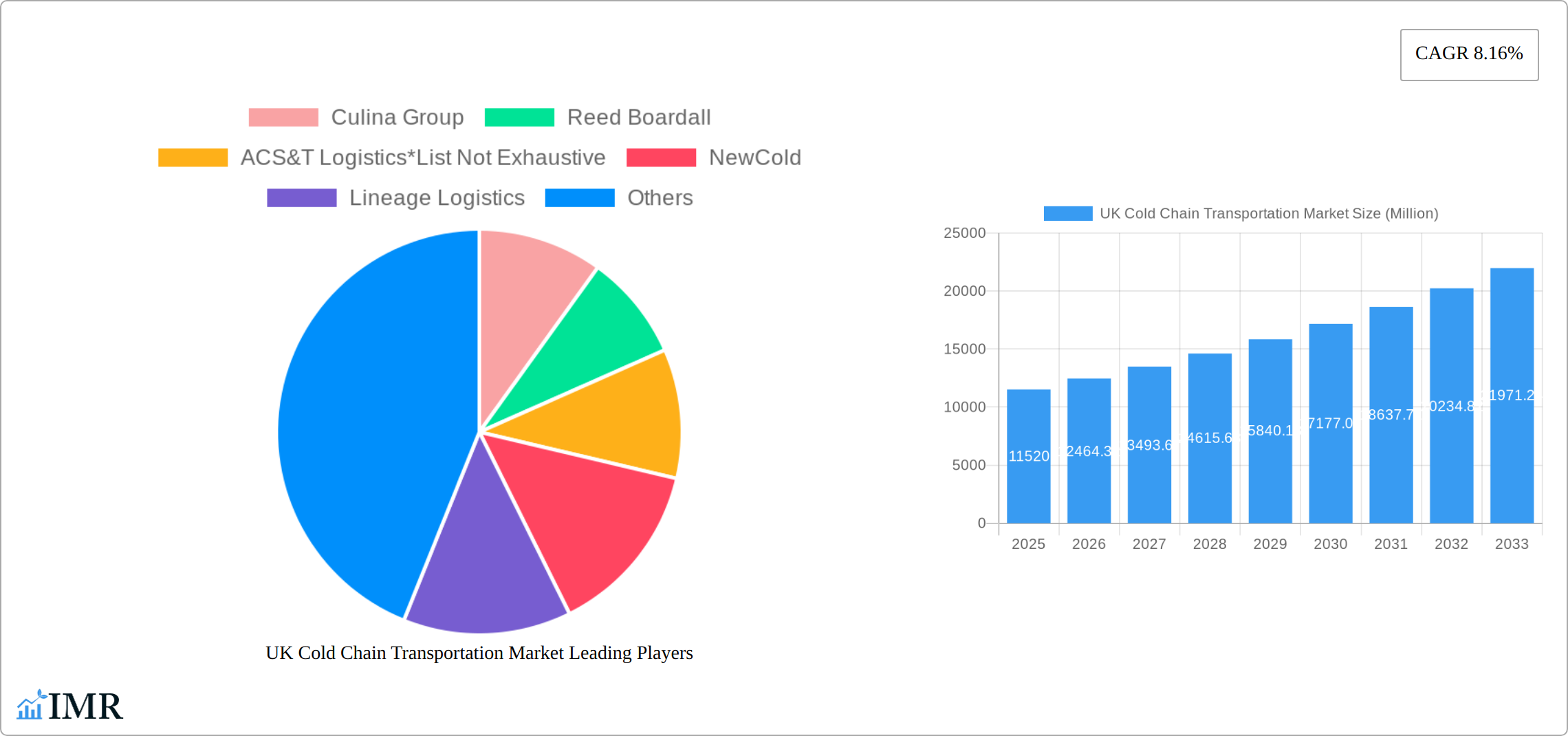

UK Cold Chain Transportation Market Company Market Share

UK Cold Chain Transportation Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UK cold chain transportation market, encompassing its dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The market is segmented by temperature type (chilled, frozen, ambient), application (horticulture, dairy, meats, fish, poultry, beverages, pharma, life sciences, chemicals, and others), and services (storage, transportation, value-added services). The market size is valued in millions of units.

UK Cold Chain Transportation Market Dynamics & Structure

The UK cold chain transportation market is characterized by a moderately concentrated landscape, with major players like Culina Group, Reed Boardall, and Lineage Logistics holding significant market share. However, a considerable number of smaller, specialized firms also contribute to the overall market volume. Technological advancements, particularly in temperature monitoring and tracking, are driving efficiency and reducing spoilage. Stringent regulatory frameworks, such as those concerning food safety and pharmaceutical handling, shape market practices and investment decisions. The market witnesses a significant level of mergers and acquisitions (M&A) activity, with companies seeking economies of scale and expanded service offerings. This is further fueled by the need to improve efficiency and enhance cold chain capabilities amid increased demand for temperature-sensitive goods.

- Market Concentration: Moderately concentrated, with top players holding xx% market share (2024).

- Technological Innovation: Strong focus on IoT, AI-powered monitoring, and sustainable transportation solutions.

- Regulatory Framework: Stringent regulations on food safety, pharmaceuticals, and environmental impact.

- M&A Activity: Significant activity driven by economies of scale and service expansion; xx deals in 2024.

- Competitive Substitutes: Limited direct substitutes, but alternative transportation methods can pose indirect competition.

- End-User Demographics: Diverse end-user base including retailers, food processors, pharmaceutical companies, and logistics providers.

UK Cold Chain Transportation Market Growth Trends & Insights

The UK cold chain transportation market experienced robust growth during the historical period (2019-2024), driven by rising consumer demand for fresh produce, processed foods, and pharmaceuticals. This trend is expected to continue, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The increasing adoption of e-commerce and the growth of online grocery shopping are major catalysts. The market is witnessing increased adoption of advanced technologies to improve supply chain efficiency and reduce losses. Consumer preferences toward healthier foods and convenience are also influencing growth. Market penetration for temperature-controlled logistics solutions is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in UK Cold Chain Transportation Market

The South East and London regions continue to be the epicenters of the UK cold chain transportation market, owing to their high population density, extensive retail networks, and sophisticated logistical infrastructure. By temperature type, the chilled segment commands the largest market share, reflecting a robust demand for fresh produce and perishable goods, closely followed by the frozen segment. Within application sectors, food and beverage, encompassing horticulture, dairy, meats, poultry, and beverages, remains the primary driver of market activity. The pharmaceutical and life sciences sector is also experiencing notable expansion due to the critical need for precise temperature control for pharmaceuticals, vaccines, and biologics.

- Geographic Dominance: South East and London benefit from high population density, advanced retail infrastructure, and significant food processing activities, creating a constant demand for cold chain logistics.

- Temperature Segments: The strong and consistent demand for fresh, unpreserved food items fuels the dominance of the chilled segment, while the frozen segment caters to longer-term storage needs.

- Application Sectors: The food and beverage industry's vast product range and consumer purchasing habits make it the most significant application, further boosted by increased retail sales and a growing appetite for convenience foods.

- Pharmaceutical & Life Sciences Growth: This segment is rapidly expanding due to the increasingly stringent regulatory requirements and the growing market for temperature-sensitive pharmaceuticals, vaccines, and specialized medical supplies.

- Government and Sustainability Focus: Government initiatives aimed at improving infrastructure, supporting sustainable practices, and ensuring regulatory compliance are crucial growth enablers, pushing towards greener cold chain solutions.

UK Cold Chain Transportation Market Product Landscape

Innovation is a key differentiator in the UK cold chain transportation market, with a strong emphasis on advanced temperature-controlled containers, sophisticated tracking and monitoring devices utilizing IoT technology, and integrated Transportation Management Systems (TMS). The deployment of AI-driven route optimization software is significantly enhancing operational efficiency, minimizing transit times, and substantially reducing product wastage. Companies are actively expanding their service portfolios beyond basic transportation to include value-added services such as blast freezing, specialized labeling, real-time inventory management, and cross-docking solutions. This strategic move allows providers to offer end-to-end solutions, thereby strengthening customer relationships and securing a competitive advantage in a dynamic market.

Key Drivers, Barriers & Challenges in UK Cold Chain Transportation Market

Key Drivers:

- Growing demand for fresh and processed food.

- Rise of e-commerce and online grocery shopping.

- Stringent regulations requiring temperature-controlled transportation.

- Technological advancements improving efficiency and reducing waste.

Challenges:

- High fuel costs and fluctuating energy prices.

- Driver shortages and labor costs.

- Stringent regulations and compliance requirements leading to increased operational costs.

- Competition from emerging market players.

Emerging Opportunities in UK Cold Chain Transportation Market

- Niche Market Expansion: Tapping into the burgeoning demand for specialized logistics for plant-based foods, organic produce, and the increasingly complex requirements of pharmaceutical and biotechnology supply chains presents significant growth avenues.

- Investment in Sustainable Technologies: Adopting and investing in electric vehicles, alternative fuels, energy-efficient warehousing, and advanced insulation technologies not only reduces the environmental footprint but also enhances brand reputation and attracts eco-conscious clients.

- Data Analytics & AI Integration: Leveraging advanced data analytics and machine learning for predictive maintenance, demand forecasting, dynamic route optimization, and real-time supply chain visibility can lead to substantial cost savings and improved service delivery.

- Enhanced Value-Added Services: Diversifying revenue streams by offering comprehensive services like product kitting, final-mile delivery consolidation, and reverse logistics for temperature-sensitive returns can create new profit centers and deeper client integration.

- Technological Integration: Further embedding IoT, blockchain, and AI across the supply chain can provide unparalleled transparency, traceability, and efficiency, addressing critical pain points for customers.

Growth Accelerators in the UK Cold Chain Transportation Market Industry

Long-term growth will be driven by increased adoption of automation and robotics, strategic partnerships to improve operational efficiency, expansion into new markets, investment in sustainable technologies to reduce carbon footprint and enhance compliance, and the growing demand for temperature sensitive goods across various sectors.

Key Players Shaping the UK Cold Chain Transportation Market Market

- Culina Group

- Reed Boardall

- ACS&T Logistics

- NewCold

- Lineage Logistics

- FreshLinc Group

- Turners (Soham) Ltd

- Gro-continental Ltd (Americold)

- Gist Ltd

- McCulla Refrigerated Transport

Notable Milestones in UK Cold Chain Transportation Market Sector

- January 2023: Constellation Cold Logistics acquires ACS&T Logistics, expanding its market presence.

- October 2022: 45% of UK logistics firms plan acquisitions to achieve economies of scale.

In-Depth UK Cold Chain Transportation Market Market Outlook

The UK cold chain transportation market is on a robust growth trajectory, propelled by sustained and increasing consumer demand for a diverse range of temperature-sensitive products, coupled with ongoing technological advancements and strategic investments in infrastructure and services. The market is ripe with opportunities for companies that can expand their value-added service offerings, invest proactively in sustainable and environmentally friendly solutions, and adeptly leverage data analytics and AI to optimize operational efficiency and minimize waste. The future prosperity of the market will be significantly influenced by the industry's ability to effectively navigate persistent challenges, such as the ongoing driver shortage and escalating fuel costs, while simultaneously capitalizing on the growing demand for highly efficient, reliable, and traceable cold chain solutions across all sectors.

UK Cold Chain Transportation Market Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. Application

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Beverages

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other Applications

UK Cold Chain Transportation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Cold Chain Transportation Market Regional Market Share

Geographic Coverage of UK Cold Chain Transportation Market

UK Cold Chain Transportation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Payments from Mobile

- 3.4. Market Trends

- 3.4.1. Brexit Pushing the Demand for Refrigerated Transportation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Cold Chain Transportation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Beverages

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America UK Cold Chain Transportation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Storage

- 6.1.2. Transportation

- 6.1.3. Value-ad

- 6.2. Market Analysis, Insights and Forecast - by Temperature Type

- 6.2.1. Chilled

- 6.2.2. Frozen

- 6.2.3. Ambient

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Horticulture (Fresh Fruits & Vegetables)

- 6.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 6.3.3. Meats, Fish, Poultry

- 6.3.4. Beverages

- 6.3.5. Pharma, Life Sciences, and Chemicals

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. South America UK Cold Chain Transportation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Storage

- 7.1.2. Transportation

- 7.1.3. Value-ad

- 7.2. Market Analysis, Insights and Forecast - by Temperature Type

- 7.2.1. Chilled

- 7.2.2. Frozen

- 7.2.3. Ambient

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Horticulture (Fresh Fruits & Vegetables)

- 7.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 7.3.3. Meats, Fish, Poultry

- 7.3.4. Beverages

- 7.3.5. Pharma, Life Sciences, and Chemicals

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe UK Cold Chain Transportation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Storage

- 8.1.2. Transportation

- 8.1.3. Value-ad

- 8.2. Market Analysis, Insights and Forecast - by Temperature Type

- 8.2.1. Chilled

- 8.2.2. Frozen

- 8.2.3. Ambient

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Horticulture (Fresh Fruits & Vegetables)

- 8.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 8.3.3. Meats, Fish, Poultry

- 8.3.4. Beverages

- 8.3.5. Pharma, Life Sciences, and Chemicals

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Middle East & Africa UK Cold Chain Transportation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Storage

- 9.1.2. Transportation

- 9.1.3. Value-ad

- 9.2. Market Analysis, Insights and Forecast - by Temperature Type

- 9.2.1. Chilled

- 9.2.2. Frozen

- 9.2.3. Ambient

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Horticulture (Fresh Fruits & Vegetables)

- 9.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 9.3.3. Meats, Fish, Poultry

- 9.3.4. Beverages

- 9.3.5. Pharma, Life Sciences, and Chemicals

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Asia Pacific UK Cold Chain Transportation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Storage

- 10.1.2. Transportation

- 10.1.3. Value-ad

- 10.2. Market Analysis, Insights and Forecast - by Temperature Type

- 10.2.1. Chilled

- 10.2.2. Frozen

- 10.2.3. Ambient

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Horticulture (Fresh Fruits & Vegetables)

- 10.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 10.3.3. Meats, Fish, Poultry

- 10.3.4. Beverages

- 10.3.5. Pharma, Life Sciences, and Chemicals

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Culina Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Reed Boardall

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ACS&T Logistics*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NewCold

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lineage Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FreshLinc Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Turners (Soham) Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gro-continental Ltd (Americold)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gist Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 McCulla Refrigerated Transport

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Culina Group

List of Figures

- Figure 1: Global UK Cold Chain Transportation Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Cold Chain Transportation Market Revenue (Million), by Services 2025 & 2033

- Figure 3: North America UK Cold Chain Transportation Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America UK Cold Chain Transportation Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 5: North America UK Cold Chain Transportation Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 6: North America UK Cold Chain Transportation Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America UK Cold Chain Transportation Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America UK Cold Chain Transportation Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America UK Cold Chain Transportation Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UK Cold Chain Transportation Market Revenue (Million), by Services 2025 & 2033

- Figure 11: South America UK Cold Chain Transportation Market Revenue Share (%), by Services 2025 & 2033

- Figure 12: South America UK Cold Chain Transportation Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 13: South America UK Cold Chain Transportation Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 14: South America UK Cold Chain Transportation Market Revenue (Million), by Application 2025 & 2033

- Figure 15: South America UK Cold Chain Transportation Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America UK Cold Chain Transportation Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America UK Cold Chain Transportation Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UK Cold Chain Transportation Market Revenue (Million), by Services 2025 & 2033

- Figure 19: Europe UK Cold Chain Transportation Market Revenue Share (%), by Services 2025 & 2033

- Figure 20: Europe UK Cold Chain Transportation Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 21: Europe UK Cold Chain Transportation Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 22: Europe UK Cold Chain Transportation Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe UK Cold Chain Transportation Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe UK Cold Chain Transportation Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe UK Cold Chain Transportation Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UK Cold Chain Transportation Market Revenue (Million), by Services 2025 & 2033

- Figure 27: Middle East & Africa UK Cold Chain Transportation Market Revenue Share (%), by Services 2025 & 2033

- Figure 28: Middle East & Africa UK Cold Chain Transportation Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 29: Middle East & Africa UK Cold Chain Transportation Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 30: Middle East & Africa UK Cold Chain Transportation Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Middle East & Africa UK Cold Chain Transportation Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East & Africa UK Cold Chain Transportation Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Cold Chain Transportation Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UK Cold Chain Transportation Market Revenue (Million), by Services 2025 & 2033

- Figure 35: Asia Pacific UK Cold Chain Transportation Market Revenue Share (%), by Services 2025 & 2033

- Figure 36: Asia Pacific UK Cold Chain Transportation Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 37: Asia Pacific UK Cold Chain Transportation Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 38: Asia Pacific UK Cold Chain Transportation Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Asia Pacific UK Cold Chain Transportation Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Asia Pacific UK Cold Chain Transportation Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Cold Chain Transportation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Services 2020 & 2033

- Table 13: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 14: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Services 2020 & 2033

- Table 20: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 21: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Services 2020 & 2033

- Table 33: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 34: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Services 2020 & 2033

- Table 43: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 44: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Application 2020 & 2033

- Table 45: Global UK Cold Chain Transportation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UK Cold Chain Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Cold Chain Transportation Market?

The projected CAGR is approximately 8.16%.

2. Which companies are prominent players in the UK Cold Chain Transportation Market?

Key companies in the market include Culina Group, Reed Boardall, ACS&T Logistics*List Not Exhaustive, NewCold, Lineage Logistics, FreshLinc Group, Turners (Soham) Ltd, Gro-continental Ltd (Americold), Gist Ltd, McCulla Refrigerated Transport.

3. What are the main segments of the UK Cold Chain Transportation Market?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.52 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used.

6. What are the notable trends driving market growth?

Brexit Pushing the Demand for Refrigerated Transportation.

7. Are there any restraints impacting market growth?

Increasing Usage of Payments from Mobile.

8. Can you provide examples of recent developments in the market?

January 2023: Constellation Cold Logistics (“Constellation”), through its wholly-owned subsidiary HSH Cold Stores Ltd (“HSH”), announced agreement for the acquisition of Associated Cold Stores & Transport Limited (ACS&T Logistics), a subsidiary of Camellia Plc. The transaction closed on January 2023 and will expand and strengthen HSH’s footprint and service offering for existing and new customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Cold Chain Transportation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Cold Chain Transportation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Cold Chain Transportation Market?

To stay informed about further developments, trends, and reports in the UK Cold Chain Transportation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence