Key Insights

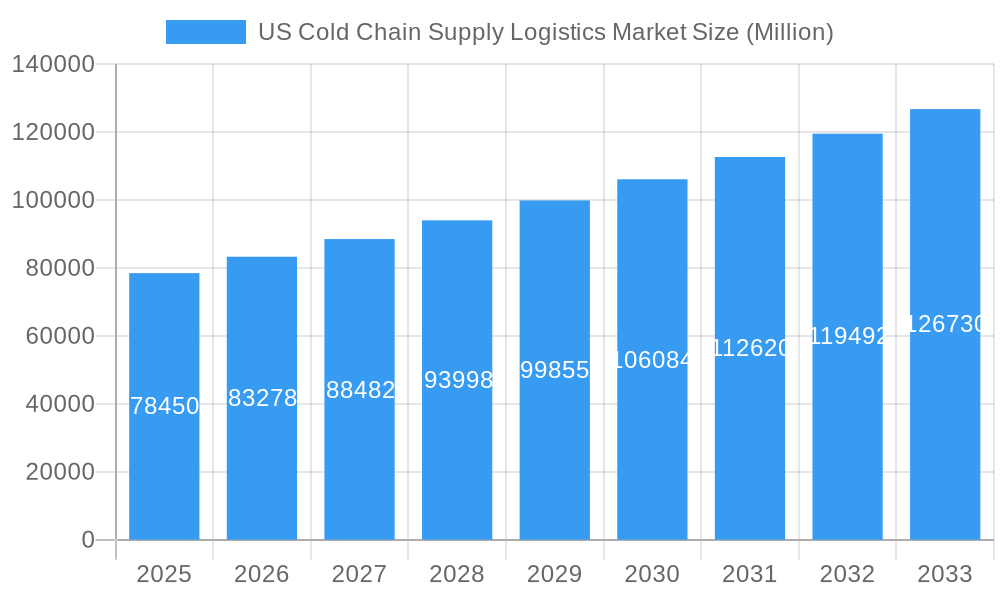

The US cold chain supply logistics market, valued at $78.45 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for perishable goods, including fresh produce, dairy, and seafood, coupled with the rising consumer preference for quality and convenience, fuels market expansion. Growth is further propelled by advancements in technology, such as improved refrigeration systems, real-time tracking solutions, and sophisticated inventory management systems. These innovations enhance efficiency, reduce spoilage, and improve overall supply chain visibility, leading to cost savings and enhanced product quality. Furthermore, the expanding e-commerce sector and the growing need for efficient last-mile delivery of temperature-sensitive products significantly contribute to market growth. The market is segmented by services (storage, transportation, value-added services), temperature type (chilled, frozen, ambient), and application (food and beverage, healthcare, etc.), each exhibiting unique growth trajectories reflecting specific industry trends and consumer demands. Major players like FedEx, DHL, and Lineage Logistics are vying for market share, investing in infrastructure upgrades and technology integration to maintain a competitive edge. Regulatory changes related to food safety and quality also influence market dynamics, driving the adoption of advanced technologies and best practices.

US Cold Chain Supply Logistics Market Market Size (In Billion)

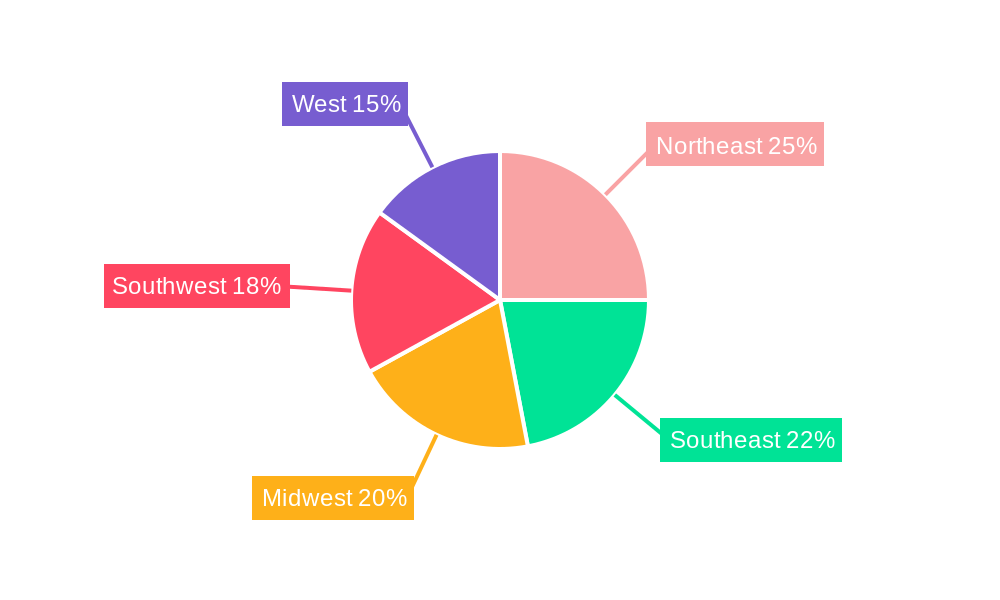

Looking forward, the market's CAGR of 5.83% from 2025 to 2033 indicates continued expansion. However, challenges such as fluctuating fuel prices, driver shortages, and the need for stringent adherence to regulatory compliance can impact growth. Nevertheless, the long-term outlook remains positive, underpinned by increasing consumer spending on premium perishable goods, technological advancements, and sustained growth in the e-commerce sector. The geographical distribution across the United States (Northeast, Southeast, Midwest, Southwest, and West) also presents opportunities for targeted expansion and regional specialization within the cold chain logistics sector. The continued focus on sustainability and reducing the environmental impact of cold chain transportation will be another key driver shaping the industry's future.

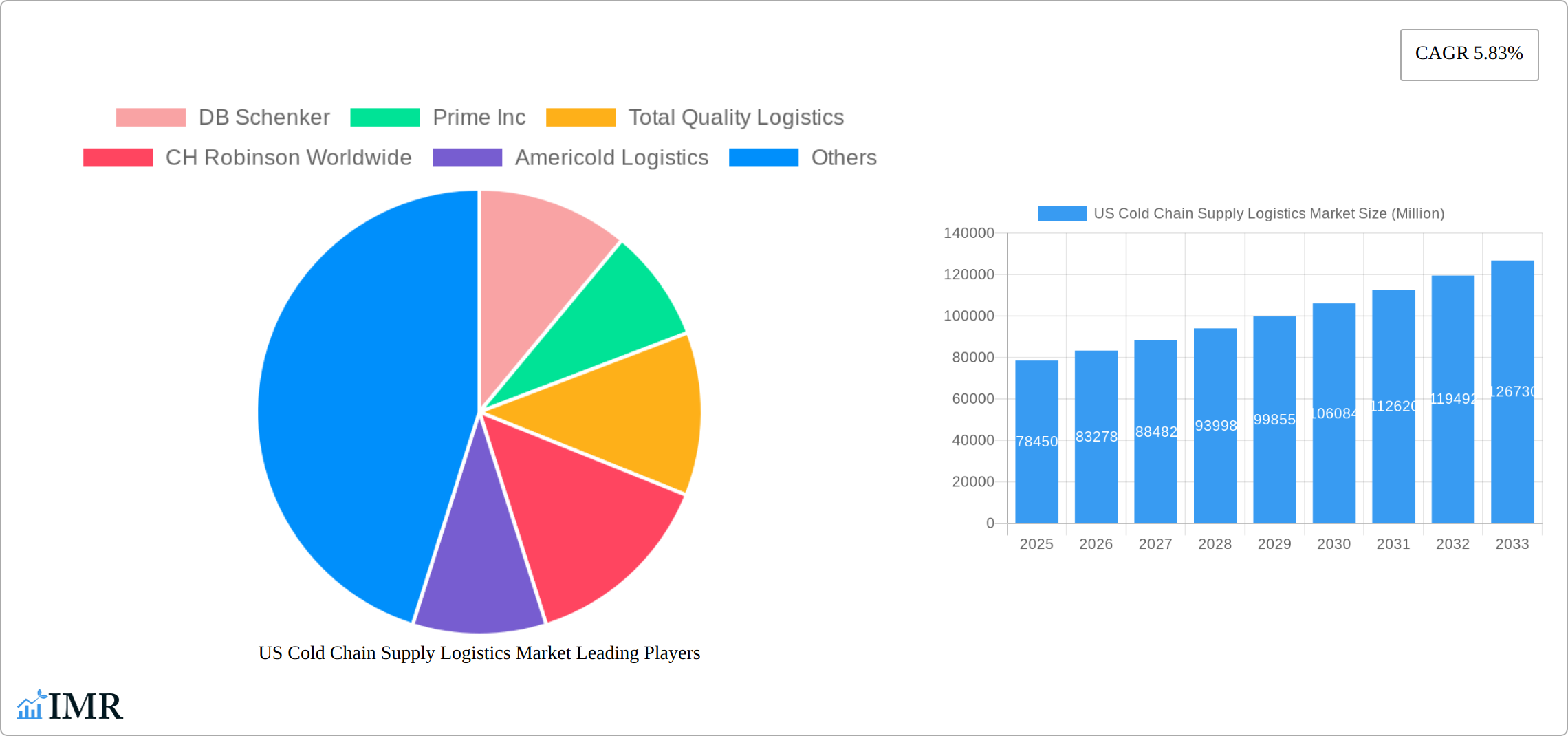

US Cold Chain Supply Logistics Market Company Market Share

US Cold Chain Supply Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the US Cold Chain Supply Logistics market, offering invaluable insights for industry professionals, investors, and strategists. The report covers the period from 2019 to 2033, with a focus on market dynamics, growth trends, key players, and future outlook. The total market size in 2025 is estimated at xx Million.

US Cold Chain Supply Logistics Market Market Dynamics & Structure

The US cold chain logistics market is a dynamic and evolving landscape, characterized by intense competition among a diverse range of players, from established giants to agile niche providers. Continuous technological innovation is a defining feature, constantly pushing the boundaries of efficiency and reliability. Alongside this, stringent and ever-evolving regulatory frameworks for food safety and pharmaceutical handling are paramount, shaping operational strategies and investments. Market concentration is moderate, with significant consolidation evident in recent years, but a healthy ecosystem of smaller companies catering to specialized needs persists. The primary engines driving this market's growth include the escalating consumer demand for perishable goods, a sustained rise in disposable incomes, and the irreversible penetration of e-commerce across various consumer segments.

- Market Concentration: The top 5 players are estimated to hold approximately 40-45% of the market share in 2025, indicating a degree of consolidation but still leaving ample room for competitive strategies.

- Technological Innovation: Automation, the Internet of Things (IoT) for real-time monitoring, and Artificial Intelligence (AI) for predictive analytics are pivotal in driving efficiency and cost reduction. However, significant barriers to implementation remain, including the substantial initial investment required and the complexities of integrating new technologies with existing legacy systems.

- Regulatory Framework: The rigorous adherence to food safety regulations, such as HACCP and FSMA, and the strict compliance requirements for pharmaceutical logistics (e.g., Good Distribution Practices - GDP) not only elevate operational costs but also serve as critical enablers for ensuring product integrity, quality, and ultimately, consumer safety.

- Competitive Product Substitutes: While direct product substitutes within the cold chain logistics service offering are limited, alternative transportation modes (e.g., slower but potentially less temperature-sensitive modes for certain goods) and innovative storage solutions (e.g., localized micro-fulfillment centers) can indirectly impact market share and service provider choices.

- End-User Demographics: The market's primary revenue streams originate from the food and beverage, healthcare, and pharmaceutical sectors. Growth within these segments is intrinsically linked to population demographics, evolving dietary habits (e.g., increased demand for organic and plant-based foods requiring precise temperature control), and the expanding market for specialized medical supplies and vaccines.

- M&A Trends: The last five years have witnessed a notable surge in M&A activity, with approximately 15-20 significant deals. These transactions have predominantly focused on expanding geographic reach, acquiring specialized service capabilities, and consolidating market share. A prime example is Honor Foods' strategic acquisition of Sunny Morning Foods, bolstering its presence in the vital Southeast region.

US Cold Chain Supply Logistics Market Growth Trends & Insights

The US cold chain logistics market is demonstrating robust and sustained growth, propelled by a synergistic interplay of powerful market forces. The market size experienced a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the historical period (2019-2024). Projections indicate a continued upward trajectory, with the market expected to reach an estimated USD 120-130 Billion by 2033, growing at a CAGR of 7-8% during the forecast period (2025-2033). This impressive growth is underpinned by several critical factors:

- Rising Demand for Perishable Goods: A growing population, coupled with significant shifts in consumption patterns—including an increased appetite for fresh produce, ready-to-eat meals, and premium dairy products—and accelerating urbanization, collectively drive the imperative for highly efficient and reliable cold chain solutions.

- E-commerce Boom: The exponential expansion of online grocery shopping, meal kit delivery services, and direct-to-consumer (DTC) frozen food sales necessitates the development and scaling of sophisticated cold chain infrastructure to maintain product integrity from origin to doorstep.

- Technological Advancements: The strategic adoption of cutting-edge technologies is revolutionizing the sector. Blockchain is increasingly being implemented for enhanced traceability and transparency, AI-powered predictive maintenance is minimizing equipment downtime, and IoT-enabled real-time monitoring is actively contributing to greater efficiency and significant waste reduction.

- Increased Focus on Food Safety and Quality: Heightened consumer awareness regarding food safety standards, coupled with increasingly stringent government regulations, are compelling businesses to make substantial investments in advanced cold chain infrastructure, sophisticated monitoring systems, and advanced technological solutions to safeguard product quality and consumer well-being.

Dominant Regions, Countries, or Segments in US Cold Chain Supply Logistics Market

The US cold chain logistics market exhibits significant geographical diversity, with notable variations in growth rates and infrastructure development across different regions. However, several key segments are consistently demonstrating strong performance and are poised for substantial expansion:

- By Services: Transportation currently commands the largest market share, estimated at around 40-45%, driven by the increasing demand for expedited delivery and specialized handling of temperature-sensitive goods. Storage follows closely, accounting for approximately 30-35% of the market, with a growing emphasis on advanced, technology-enabled warehousing solutions. Value-added services, including kitting, labeling, and customization, represent the remaining 20-25% and are experiencing robust growth as companies seek integrated supply chain solutions.

- By Temperature Type: The Frozen segment continues to dominate, representing an estimated 50-55% of the market share in 2025, largely propelled by the sustained high demand for frozen foods, ice cream, and frozen pharmaceutical products. The Chilled food segment accounts for approximately 30-35%, driven by fresh produce, dairy, and ready-to-eat meals. The Ambient segment, representing the smallest share at around 10-15%, primarily caters to products with less stringent temperature requirements but still benefits from the overall infrastructure development.

- By Application: The Food and Beverage sector remains the largest consumer of cold chain logistics services, holding a significant share of approximately 60-65%. Within this, Dairy products (around 20-25% of the total market) and Fruits and Vegetables (around 15-20%) are showing particularly strong growth due to evolving consumer preferences for fresh and healthy options. The Healthcare & Pharmaceuticals segment is a rapidly growing and highly lucrative segment, currently representing about 25-30% of the market share, fueled by the increasing demand for vaccines, biologics, and temperature-sensitive medications.

Key regional growth drivers include the presence of robust logistical infrastructure in certain areas, favorable government policies supporting agricultural productivity and food processing industries, and a high concentration of major end-users and distribution hubs in specific geographic locations.

US Cold Chain Supply Logistics Market Product Landscape

The US cold chain logistics market showcases a wide range of services, from basic transportation and storage to advanced value-added services. Technological advancements are driving innovation in areas such as temperature-controlled containers with real-time monitoring capabilities, automated warehouse systems, and specialized handling equipment for delicate products. These innovations focus on enhancing efficiency, minimizing spoilage, and ensuring product quality and safety throughout the supply chain.

Key Drivers, Barriers & Challenges in US Cold Chain Supply Logistics Market

Key Drivers:

- Persistent and growing consumer demand for fresh, high-quality, and processed foods.

- The continuous expansion of e-commerce, particularly in the online grocery and food delivery sectors, demanding more sophisticated cold chain capabilities.

- Increasingly stringent food safety regulations and a heightened focus on product integrity and traceability across the supply chain.

- The widespread adoption of technological advancements, such as IoT sensors, AI-powered route optimization, and automation, leading to significant process optimization and efficiency gains.

Barriers & Challenges:

- Significant upfront capital investment required for establishing and maintaining specialized cold chain infrastructure, including refrigerated warehouses and fleets.

- Volatility in fuel prices and evolving transportation logistics, coupled with the need for specialized refrigerated transport, pose ongoing challenges.

- Persistent labor shortages and high turnover rates within the logistics sector, particularly for qualified drivers and warehouse personnel, impact operational capacity and efficiency.

- The paramount challenge of maintaining consistent and precise temperature control across the entire, often complex, supply chain. Failures in this regard can lead to substantial financial losses, with estimated annual losses due to spoilage reaching upwards of USD 10-15 Billion across the industry.

Emerging Opportunities in US Cold Chain Supply Logistics Market

- Growth in the plant-based food market: This segment requires specialized cold chain solutions.

- Expansion into rural areas: Improving cold chain infrastructure in underserved regions presents significant opportunities.

- Increased use of sustainable practices: Demand for environmentally friendly solutions, such as energy-efficient refrigeration and alternative transportation fuels, is growing.

- Advancements in technology like AI and blockchain: This will improve efficiency, traceability, and security.

Growth Accelerators in the US Cold Chain Supply Logistics Market Industry

Technological innovations, strategic partnerships, and market expansion into underserved areas are key growth catalysts. Investments in automation, data analytics, and sustainable practices are shaping the future of the industry. This includes the increasing adoption of IoT devices to monitor temperature and location of goods in real-time, boosting efficiency and reducing waste.

Key Players Shaping the US Cold Chain Supply Logistics Market Market

- DB Schenker

- Prime Inc

- Total Quality Logistics

- CH Robinson Worldwide

- Americold Logistics

- Burris Logistics

- XPO Logistics

- FedEx

- Stevens Transport

- Expeditors

- Lineage Logistics

- United States Cold Storage

- Covenant Transportation Services

- DHL Supply Chain

- Arc Best

- JB Hunt

Notable Milestones in US Cold Chain Supply Logistics Market Sector

- June 2023: Honor Foods, a subsidiary of Burris Logistics, completed the strategic acquisition of Sunny Morning Foods, significantly expanding its operational footprint and service capabilities within the lucrative Southeast region of the United States.

- May 2023: Americold Logistics, a major player in the cold storage industry, announced a substantial expansion of its facility in Barcelona, Spain. This investment was aimed at increasing its capacity to handle a growing volume of temperature-controlled products for its European client base.

- May 2023: In a move to further solidify its global presence, Americold Logistics announced a strategic investment of USD 3.9 Million in RSA Cold Chain, a prominent player in Dubai. This acquisition is expected to enhance Americold's service offerings and network reach in the Middle Eastern market.

In-Depth US Cold Chain Supply Logistics Market Market Outlook

The US cold chain logistics market is poised for sustained growth, driven by technological advancements, evolving consumer preferences, and increasing demand for efficient and reliable supply chain solutions. Strategic partnerships, investments in sustainable practices, and expansion into new markets will play a pivotal role in shaping the industry's future. The market's potential lies in leveraging technology to optimize operations, enhance traceability, and reduce waste, ultimately ensuring the delivery of high-quality perishable goods to consumers nationwide.

US Cold Chain Supply Logistics Market Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. Application

- 3.1. Fruits and Vegetables

- 3.2. Dairy Pr

- 3.3. Fish, Meat, and Seafood

- 3.4. Processed Food

- 3.5. Healthcare & Pharmaceuticals

- 3.6. Bakery and Confectionary

- 3.7. Other Applications

US Cold Chain Supply Logistics Market Segmentation By Geography

- 1. United States

US Cold Chain Supply Logistics Market Regional Market Share

Geographic Coverage of US Cold Chain Supply Logistics Market

US Cold Chain Supply Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS

- 3.3. Market Restrains

- 3.3.1. 4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES

- 3.4. Market Trends

- 3.4.1. Rising fresh produce imports from Mexico

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Cold Chain Supply Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Fruits and Vegetables

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat, and Seafood

- 5.3.4. Processed Food

- 5.3.5. Healthcare & Pharmaceuticals

- 5.3.6. Bakery and Confectionary

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Prime Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Total Quality Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CH Robinson Worldwide

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Americold Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Burris Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 XPO Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stevens Transport

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Expeditors

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lineage Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 United States Cold Storage

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Covenant Transportation Services**List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 DHL Supply Chain

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Arc Best

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 JB Hunt

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Global US Cold Chain Supply Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: United States US Cold Chain Supply Logistics Market Revenue (Million), by Services 2025 & 2033

- Figure 3: United States US Cold Chain Supply Logistics Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: United States US Cold Chain Supply Logistics Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 5: United States US Cold Chain Supply Logistics Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 6: United States US Cold Chain Supply Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 7: United States US Cold Chain Supply Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: United States US Cold Chain Supply Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 9: United States US Cold Chain Supply Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global US Cold Chain Supply Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Cold Chain Supply Logistics Market?

The projected CAGR is approximately 5.83%.

2. Which companies are prominent players in the US Cold Chain Supply Logistics Market?

Key companies in the market include DB Schenker, Prime Inc, Total Quality Logistics, CH Robinson Worldwide, Americold Logistics, Burris Logistics, XPO Logistics, FedEx, Stevens Transport, Expeditors, Lineage Logistics, United States Cold Storage, Covenant Transportation Services**List Not Exhaustive, DHL Supply Chain, Arc Best, JB Hunt.

3. What are the main segments of the US Cold Chain Supply Logistics Market?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.45 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS.

6. What are the notable trends driving market growth?

Rising fresh produce imports from Mexico.

7. Are there any restraints impacting market growth?

4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES.

8. Can you provide examples of recent developments in the market?

June 2023: Honor Foods, the Burris Logistics food service redistribution company, purchased Sunny Morning Foods, a food service redistributor with dairy expertise located in Fort Lauderdale, FL. Sunny Morning Foods strengthens the company’s portfolio and broadens its position as a preferred food service redistributor in the Mid-Atlantic, New England, and now Southeast regions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Cold Chain Supply Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Cold Chain Supply Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Cold Chain Supply Logistics Market?

To stay informed about further developments, trends, and reports in the US Cold Chain Supply Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence