Key Insights

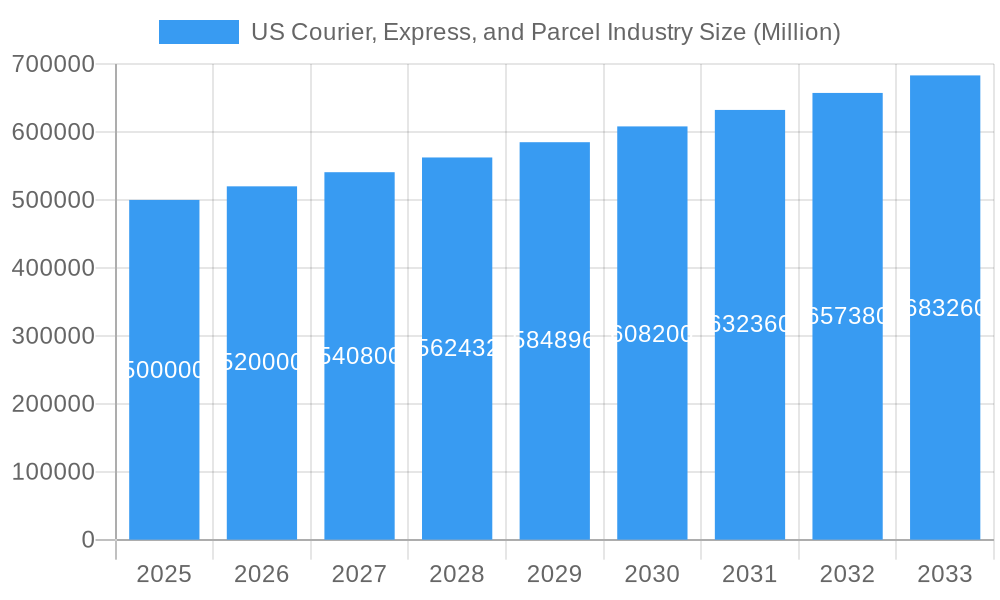

The U.S. Courier, Express, and Parcel (CEP) industry is poised for significant expansion, driven by robust e-commerce growth and evolving consumer demand for expedited delivery. This dynamic sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.6% from 2025 to 2033. The market size was valued at 130.55 billion in the base year 2025. Key growth drivers include the increasing preference for express delivery options and a rising volume of lightweight shipments across Business-to-Business (B2B), Business-to-Consumer (B2C), and Consumer-to-Consumer (C2C) segments. While established players like FedEx, UPS, and USPS maintain a strong presence, specialized niche providers are emerging, catering to specific needs like heavy-weight logistics and regional delivery, fostering a competitive environment. Higher growth rates are anticipated in densely populated regions such as the Northeast and West, owing to concentrated e-commerce activity. Challenges such as fluctuating fuel costs, infrastructure constraints, and the imperative for sustainable logistics solutions will shape the industry's future trajectory.

US Courier, Express, and Parcel Industry Market Size (In Billion)

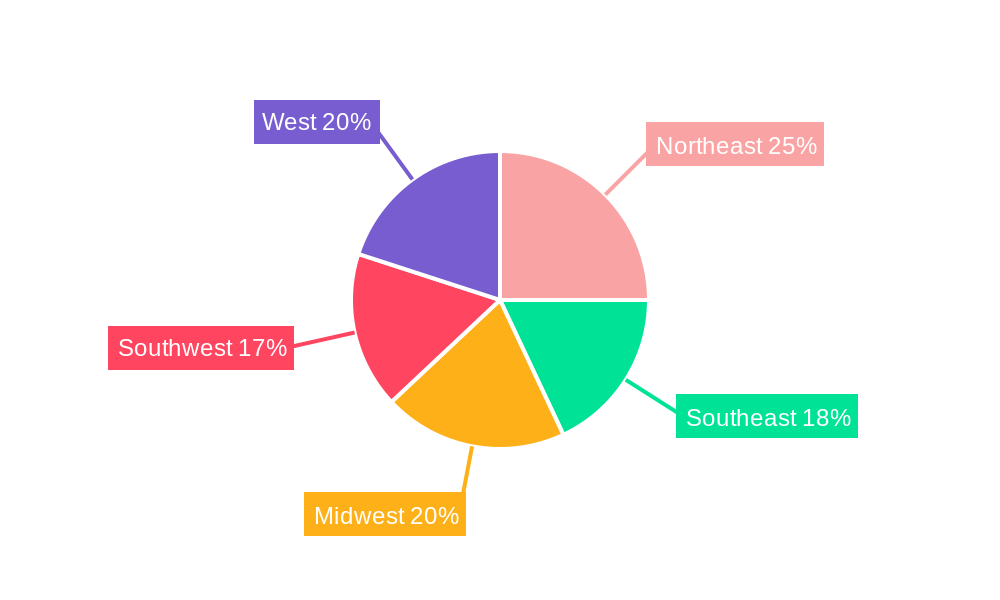

Market segmentation reveals the U.S. CEP industry's structure. The B2C segment leads, propelled by the sustained e-commerce surge. Concurrently, the B2B sector is experiencing considerable growth, driven by supply chain optimization and the demand for expedited goods and materials delivery. Transportation modes are dictated by shipment weight and urgency, with air freight dominating express services and road transport handling heavier, less time-sensitive shipments. Regional analysis highlights disparities in market size and growth potential. While the Northeast and West currently hold dominant market share due to established infrastructure and population density, the Southwest and Midwest represent emerging markets with significant untapped potential. Future expansion hinges on technological advancements, including automation and enhanced tracking systems, alongside a persistent focus on improving customer experience and addressing sustainability imperatives.

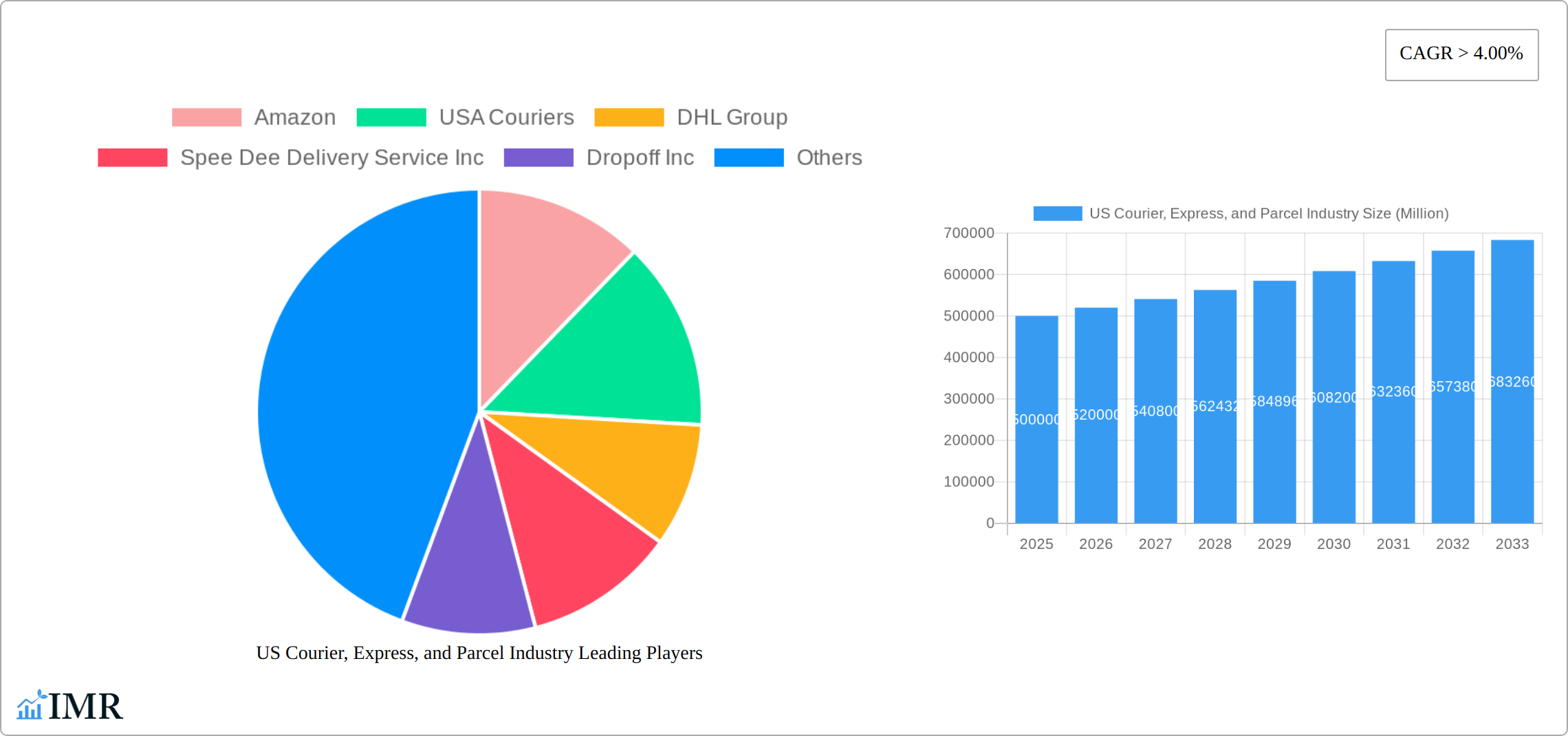

US Courier, Express, and Parcel Industry Company Market Share

US Courier, Express, and Parcel Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the US courier, express, and parcel industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and strategic decision-makers.

Keywords: US Courier Industry, Express Delivery, Parcel Shipping, E-commerce Logistics, B2B Shipping, B2C Delivery, Same-Day Delivery, DHL, FedEx, UPS, USPS, Amazon Logistics, Market Size, Market Share, Growth Forecast, Industry Trends, Competitive Landscape.

US Courier, Express, and Parcel Industry Market Dynamics & Structure

The US courier, express, and parcel industry is a highly dynamic market characterized by intense competition, rapid technological advancements, and evolving regulatory landscapes. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller companies cater to niche segments. The market size in 2025 is estimated at $xx million.

- Market Concentration: The top five players (UPS, FedEx, USPS, Amazon, and DHL) collectively account for approximately xx% of the market share in 2025, indicating moderate concentration.

- Technological Innovation: Automation, AI-powered route optimization, and drone delivery are key innovation drivers, increasing efficiency and reducing costs. However, high initial investment costs and integration challenges pose barriers to widespread adoption.

- Regulatory Framework: Regulations concerning data privacy, environmental sustainability, and labor practices significantly impact industry operations. Changes in these regulations could create opportunities or challenges for companies.

- Competitive Product Substitutes: The rise of in-house delivery solutions by e-commerce giants and the growth of crowdsourced delivery platforms are emerging as significant competitive substitutes.

- End-User Demographics: The industry caters to diverse end-users across various sectors, with e-commerce, healthcare, and manufacturing being major drivers. Shifting consumer preferences towards faster and more convenient delivery options are shaping industry dynamics.

- M&A Trends: The industry witnessed xx M&A deals in the period 2019-2024, with a focus on enhancing logistics capabilities and expanding service portfolios. Further consolidation is expected in the forecast period.

US Courier, Express, and Parcel Industry Growth Trends & Insights

The US courier, express, and parcel industry experienced significant growth during the historical period (2019-2024), fueled primarily by the exponential growth of e-commerce and the increasing demand for faster delivery options. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024. This positive trend is projected to continue in the forecast period (2025-2033), with a projected CAGR of xx%. Market penetration across various segments, particularly in less-served areas and for specialized services, remains a key driver for future growth. Technological disruptions such as automated sorting facilities and the introduction of autonomous vehicles are expected to further enhance efficiency and reduce costs. Changing consumer behavior, with an increasing preference for same-day and next-day delivery options, is also boosting industry growth. The market is predicted to reach $xx million by 2033.

Dominant Regions, Countries, or Segments in US Courier, Express, and Parcel Industry

The US courier, express, and parcel market is characterized by dynamic regional variations and a strong presence in key segments. Densely populated urban centers and regions with robust e-commerce penetration are consistently leading demand and experiencing accelerated growth. The domestic segment continues to hold the largest market share, with express delivery services also representing a significant and premium offering.

- Destination: Domestic shipments are the cornerstone of the market, projected to represent a substantial xx% of total market volume in 2025. International shipments are also on a strong growth trajectory, propelled by the expansion of global trade and the ever-increasing volume of cross-border e-commerce.

- Speed of Delivery: Express delivery services are a high-value segment, commanding a premium price and capturing an estimated xx% of the market in 2025, outpacing non-express delivery options.

- Model: The surge in online shopping has made Business-to-Consumer (B2C) shipments a dominant force in the market. However, Business-to-Business (B2B) deliveries remain critical, particularly for heavier goods and specialized logistical needs. Consumer-to-Consumer (C2C) shipments are also exhibiting a positive upward trend.

- Shipment Weight: Medium-weight shipments are currently the most common. Nevertheless, both lightweight and heavyweight shipment categories are anticipated to experience considerable expansion, driven by the diverse product offerings across e-commerce and manufacturing sectors.

- Mode of Transport: Road transportation remains the preeminent mode due to its cost-effectiveness and extensive network coverage. Air transport is essential for time-sensitive express shipments where speed is paramount.

- End-User Industry: E-commerce stands out as the leading end-user industry, contributing an estimated xx% to the overall market volume. Healthcare, financial services, and manufacturing are also vital segments with continuous growth potential, alongside the enduring importance of wholesale and retail trade.

US Courier, Express, and Parcel Industry Product Landscape

The product landscape encompasses a range of services, from standard parcel delivery to specialized handling for temperature-sensitive goods and high-value items. Innovations include real-time tracking, delivery optimization software, and advanced packaging solutions that enhance security and reduce damage. Companies are focusing on developing unique selling propositions based on speed, reliability, and specialized services. The adoption of technology, particularly AI and automation, is transforming product offerings, enabling improved efficiency and personalized customer experiences.

Key Drivers, Barriers & Challenges in US Courier, Express, and Parcel Industry

Key Drivers:

- The unprecedented and sustained growth of e-commerce is the primary engine of the industry.

- Continuous technological advancements, including the integration of automation and Artificial Intelligence (AI), are significantly enhancing operational efficiency and service delivery.

- Government initiatives focused on infrastructure development are playing a crucial role in facilitating smoother and more extensive logistics operations.

Key Challenges:

- Escalating fuel costs and persistent labor shortages are driving up operational expenses, with an estimated impact of xx% increase in operating costs by 2025.

- The highly competitive landscape compels constant innovation, aggressive cost optimization strategies, and a relentless focus on service differentiation.

- Navigating increasingly stringent regulations pertaining to data privacy and environmental compliance presents ongoing operational hurdles.

Emerging Opportunities in US Courier, Express, and Parcel Industry

- Significant growth potential exists in innovative last-mile delivery solutions, such as drone deployment and the utilization of autonomous vehicles.

- Expansion into currently underserved rural areas and specialized niche markets, including advanced cold chain logistics for temperature-sensitive goods.

- A growing emphasis on developing and implementing sustainable and eco-friendly delivery practices to address increasing environmental concerns and consumer demand for green logistics.

Growth Accelerators in the US Courier, Express, and Parcel Industry Industry

Strategic alliances and partnerships, coupled with cutting-edge technological advancements like AI-powered route optimization and the adoption of autonomous delivery vehicles, are pivotal in accelerating long-term industry growth. Furthermore, the strategic expansion into specialized niche markets, such as same-day delivery for critical industries, is a significant growth catalyst.

Notable Milestones in US Courier, Express, and Parcel Industry Sector

- December 2023: Amazon delivered 1 billion packages from Same-Day sites in the US, highlighting the increasing demand for rapid delivery.

- December 2023: Amazon launched its second same-day delivery facility in Massachusetts, expanding its reach and capacity for faster deliveries.

- July 2023: DHL Express invested USD 9.6 million in a new service point in Denver, enhancing its logistics infrastructure and operational capabilities.

In-Depth US Courier, Express, and Parcel Industry Market Outlook

The US courier, express, and parcel industry is on a trajectory for sustained and robust growth, fueled by the continued expansion of e-commerce, relentless technological innovation, and evolving consumer expectations. Companies that strategically invest in modern infrastructure, embrace transformative technologies, and prioritize sustainable practices will be best positioned to maintain a competitive edge and capitalize on the wealth of emerging opportunities. The long-term outlook for the industry remains highly positive, with substantial growth prospects anticipated across its diverse segments and geographical regions.

US Courier, Express, and Parcel Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

US Courier, Express, and Parcel Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Courier, Express, and Parcel Industry Regional Market Share

Geographic Coverage of US Courier, Express, and Parcel Industry

US Courier, Express, and Parcel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Courier, Express, and Parcel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.7.2. South America

- 5.7.3. Europe

- 5.7.4. Middle East & Africa

- 5.7.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. North America US Courier, Express, and Parcel Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Destination

- 6.1.1. Domestic

- 6.1.2. International

- 6.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 6.2.1. Express

- 6.2.2. Non-Express

- 6.3. Market Analysis, Insights and Forecast - by Model

- 6.3.1. Business-to-Business (B2B)

- 6.3.2. Business-to-Consumer (B2C)

- 6.3.3. Consumer-to-Consumer (C2C)

- 6.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 6.4.1. Heavy Weight Shipments

- 6.4.2. Light Weight Shipments

- 6.4.3. Medium Weight Shipments

- 6.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6.5.1. Air

- 6.5.2. Road

- 6.5.3. Others

- 6.6. Market Analysis, Insights and Forecast - by End User Industry

- 6.6.1. E-Commerce

- 6.6.2. Financial Services (BFSI)

- 6.6.3. Healthcare

- 6.6.4. Manufacturing

- 6.6.5. Primary Industry

- 6.6.6. Wholesale and Retail Trade (Offline)

- 6.6.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Destination

- 7. South America US Courier, Express, and Parcel Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Destination

- 7.1.1. Domestic

- 7.1.2. International

- 7.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 7.2.1. Express

- 7.2.2. Non-Express

- 7.3. Market Analysis, Insights and Forecast - by Model

- 7.3.1. Business-to-Business (B2B)

- 7.3.2. Business-to-Consumer (B2C)

- 7.3.3. Consumer-to-Consumer (C2C)

- 7.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 7.4.1. Heavy Weight Shipments

- 7.4.2. Light Weight Shipments

- 7.4.3. Medium Weight Shipments

- 7.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 7.5.1. Air

- 7.5.2. Road

- 7.5.3. Others

- 7.6. Market Analysis, Insights and Forecast - by End User Industry

- 7.6.1. E-Commerce

- 7.6.2. Financial Services (BFSI)

- 7.6.3. Healthcare

- 7.6.4. Manufacturing

- 7.6.5. Primary Industry

- 7.6.6. Wholesale and Retail Trade (Offline)

- 7.6.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Destination

- 8. Europe US Courier, Express, and Parcel Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Destination

- 8.1.1. Domestic

- 8.1.2. International

- 8.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 8.2.1. Express

- 8.2.2. Non-Express

- 8.3. Market Analysis, Insights and Forecast - by Model

- 8.3.1. Business-to-Business (B2B)

- 8.3.2. Business-to-Consumer (B2C)

- 8.3.3. Consumer-to-Consumer (C2C)

- 8.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 8.4.1. Heavy Weight Shipments

- 8.4.2. Light Weight Shipments

- 8.4.3. Medium Weight Shipments

- 8.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 8.5.1. Air

- 8.5.2. Road

- 8.5.3. Others

- 8.6. Market Analysis, Insights and Forecast - by End User Industry

- 8.6.1. E-Commerce

- 8.6.2. Financial Services (BFSI)

- 8.6.3. Healthcare

- 8.6.4. Manufacturing

- 8.6.5. Primary Industry

- 8.6.6. Wholesale and Retail Trade (Offline)

- 8.6.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Destination

- 9. Middle East & Africa US Courier, Express, and Parcel Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Destination

- 9.1.1. Domestic

- 9.1.2. International

- 9.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 9.2.1. Express

- 9.2.2. Non-Express

- 9.3. Market Analysis, Insights and Forecast - by Model

- 9.3.1. Business-to-Business (B2B)

- 9.3.2. Business-to-Consumer (B2C)

- 9.3.3. Consumer-to-Consumer (C2C)

- 9.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 9.4.1. Heavy Weight Shipments

- 9.4.2. Light Weight Shipments

- 9.4.3. Medium Weight Shipments

- 9.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 9.5.1. Air

- 9.5.2. Road

- 9.5.3. Others

- 9.6. Market Analysis, Insights and Forecast - by End User Industry

- 9.6.1. E-Commerce

- 9.6.2. Financial Services (BFSI)

- 9.6.3. Healthcare

- 9.6.4. Manufacturing

- 9.6.5. Primary Industry

- 9.6.6. Wholesale and Retail Trade (Offline)

- 9.6.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Destination

- 10. Asia Pacific US Courier, Express, and Parcel Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Destination

- 10.1.1. Domestic

- 10.1.2. International

- 10.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 10.2.1. Express

- 10.2.2. Non-Express

- 10.3. Market Analysis, Insights and Forecast - by Model

- 10.3.1. Business-to-Business (B2B)

- 10.3.2. Business-to-Consumer (B2C)

- 10.3.3. Consumer-to-Consumer (C2C)

- 10.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 10.4.1. Heavy Weight Shipments

- 10.4.2. Light Weight Shipments

- 10.4.3. Medium Weight Shipments

- 10.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 10.5.1. Air

- 10.5.2. Road

- 10.5.3. Others

- 10.6. Market Analysis, Insights and Forecast - by End User Industry

- 10.6.1. E-Commerce

- 10.6.2. Financial Services (BFSI)

- 10.6.3. Healthcare

- 10.6.4. Manufacturing

- 10.6.5. Primary Industry

- 10.6.6. Wholesale and Retail Trade (Offline)

- 10.6.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Destination

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Amazon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 USA Couriers

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Spee Dee Delivery Service Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dropoff Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yellow Corporatio

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FedEx

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 United Parcel Service of America Inc (UPS)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 USPS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Distributions Services (including GLS)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OnTrac

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Aramex

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Amazon

List of Figures

- Figure 1: Global US Courier, Express, and Parcel Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Courier, Express, and Parcel Industry Revenue (billion), by Destination 2025 & 2033

- Figure 3: North America US Courier, Express, and Parcel Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 4: North America US Courier, Express, and Parcel Industry Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 5: North America US Courier, Express, and Parcel Industry Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 6: North America US Courier, Express, and Parcel Industry Revenue (billion), by Model 2025 & 2033

- Figure 7: North America US Courier, Express, and Parcel Industry Revenue Share (%), by Model 2025 & 2033

- Figure 8: North America US Courier, Express, and Parcel Industry Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 9: North America US Courier, Express, and Parcel Industry Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 10: North America US Courier, Express, and Parcel Industry Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 11: North America US Courier, Express, and Parcel Industry Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 12: North America US Courier, Express, and Parcel Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 13: North America US Courier, Express, and Parcel Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 14: North America US Courier, Express, and Parcel Industry Revenue (billion), by Country 2025 & 2033

- Figure 15: North America US Courier, Express, and Parcel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 16: South America US Courier, Express, and Parcel Industry Revenue (billion), by Destination 2025 & 2033

- Figure 17: South America US Courier, Express, and Parcel Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 18: South America US Courier, Express, and Parcel Industry Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 19: South America US Courier, Express, and Parcel Industry Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 20: South America US Courier, Express, and Parcel Industry Revenue (billion), by Model 2025 & 2033

- Figure 21: South America US Courier, Express, and Parcel Industry Revenue Share (%), by Model 2025 & 2033

- Figure 22: South America US Courier, Express, and Parcel Industry Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 23: South America US Courier, Express, and Parcel Industry Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 24: South America US Courier, Express, and Parcel Industry Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 25: South America US Courier, Express, and Parcel Industry Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 26: South America US Courier, Express, and Parcel Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 27: South America US Courier, Express, and Parcel Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 28: South America US Courier, Express, and Parcel Industry Revenue (billion), by Country 2025 & 2033

- Figure 29: South America US Courier, Express, and Parcel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 30: Europe US Courier, Express, and Parcel Industry Revenue (billion), by Destination 2025 & 2033

- Figure 31: Europe US Courier, Express, and Parcel Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 32: Europe US Courier, Express, and Parcel Industry Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 33: Europe US Courier, Express, and Parcel Industry Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 34: Europe US Courier, Express, and Parcel Industry Revenue (billion), by Model 2025 & 2033

- Figure 35: Europe US Courier, Express, and Parcel Industry Revenue Share (%), by Model 2025 & 2033

- Figure 36: Europe US Courier, Express, and Parcel Industry Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 37: Europe US Courier, Express, and Parcel Industry Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 38: Europe US Courier, Express, and Parcel Industry Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 39: Europe US Courier, Express, and Parcel Industry Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 40: Europe US Courier, Express, and Parcel Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 41: Europe US Courier, Express, and Parcel Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 42: Europe US Courier, Express, and Parcel Industry Revenue (billion), by Country 2025 & 2033

- Figure 43: Europe US Courier, Express, and Parcel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 44: Middle East & Africa US Courier, Express, and Parcel Industry Revenue (billion), by Destination 2025 & 2033

- Figure 45: Middle East & Africa US Courier, Express, and Parcel Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 46: Middle East & Africa US Courier, Express, and Parcel Industry Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 47: Middle East & Africa US Courier, Express, and Parcel Industry Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 48: Middle East & Africa US Courier, Express, and Parcel Industry Revenue (billion), by Model 2025 & 2033

- Figure 49: Middle East & Africa US Courier, Express, and Parcel Industry Revenue Share (%), by Model 2025 & 2033

- Figure 50: Middle East & Africa US Courier, Express, and Parcel Industry Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 51: Middle East & Africa US Courier, Express, and Parcel Industry Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 52: Middle East & Africa US Courier, Express, and Parcel Industry Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 53: Middle East & Africa US Courier, Express, and Parcel Industry Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 54: Middle East & Africa US Courier, Express, and Parcel Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 55: Middle East & Africa US Courier, Express, and Parcel Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 56: Middle East & Africa US Courier, Express, and Parcel Industry Revenue (billion), by Country 2025 & 2033

- Figure 57: Middle East & Africa US Courier, Express, and Parcel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 58: Asia Pacific US Courier, Express, and Parcel Industry Revenue (billion), by Destination 2025 & 2033

- Figure 59: Asia Pacific US Courier, Express, and Parcel Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 60: Asia Pacific US Courier, Express, and Parcel Industry Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 61: Asia Pacific US Courier, Express, and Parcel Industry Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 62: Asia Pacific US Courier, Express, and Parcel Industry Revenue (billion), by Model 2025 & 2033

- Figure 63: Asia Pacific US Courier, Express, and Parcel Industry Revenue Share (%), by Model 2025 & 2033

- Figure 64: Asia Pacific US Courier, Express, and Parcel Industry Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 65: Asia Pacific US Courier, Express, and Parcel Industry Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 66: Asia Pacific US Courier, Express, and Parcel Industry Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 67: Asia Pacific US Courier, Express, and Parcel Industry Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 68: Asia Pacific US Courier, Express, and Parcel Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 69: Asia Pacific US Courier, Express, and Parcel Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 70: Asia Pacific US Courier, Express, and Parcel Industry Revenue (billion), by Country 2025 & 2033

- Figure 71: Asia Pacific US Courier, Express, and Parcel Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 4: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 11: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 19: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 20: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 21: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 22: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 23: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 24: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Brazil US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Argentina US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of South America US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 29: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 30: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 31: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 32: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 33: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 34: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 35: United Kingdom US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Germany US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: France US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Italy US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Spain US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Russia US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Benelux US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Nordics US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of Europe US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 45: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 46: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 47: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 48: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 49: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 50: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 51: Turkey US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Israel US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: GCC US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: North Africa US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Africa US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East & Africa US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 58: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 59: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 60: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 61: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 62: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 63: Global US Courier, Express, and Parcel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 64: China US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 65: India US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Japan US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 67: South Korea US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: ASEAN US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 69: Oceania US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Rest of Asia Pacific US Courier, Express, and Parcel Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Courier, Express, and Parcel Industry?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the US Courier, Express, and Parcel Industry?

Key companies in the market include Amazon, USA Couriers, DHL Group, Spee Dee Delivery Service Inc, Dropoff Inc, Yellow Corporatio, FedEx, United Parcel Service of America Inc (UPS), USPS, International Distributions Services (including GLS), OnTrac, Aramex.

3. What are the main segments of the US Courier, Express, and Parcel Industry?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 130.55 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

December 2023: Amazon has delivered 1 billion packages from Same-Day sites in the United States. The same-day delivery facilities are designed for quick deliveries, fulfillment, and sorting all from one site making delivering customer packages even faster.December 2023: Amazon has launched 2nd same-day delivery facility in Massachusetts for certain towns and cities in Central Massachusetts. It is a 200,000-square-foot, custom-built site launched in Westborough. It was a part of its plan to expand its same-day delivery services in Massachusetts.July 2023: With the USD 9.6 million investment, DHL Express acquired a location closer to the commercial core in downtown Denver. The new DHL Service Point includes nearly 56,000 sq. ft of combined warehouse and office space, along with 60 positions for vehicles to load and unload shipments around its conveyable sorting system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Courier, Express, and Parcel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Courier, Express, and Parcel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Courier, Express, and Parcel Industry?

To stay informed about further developments, trends, and reports in the US Courier, Express, and Parcel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence