Key Insights

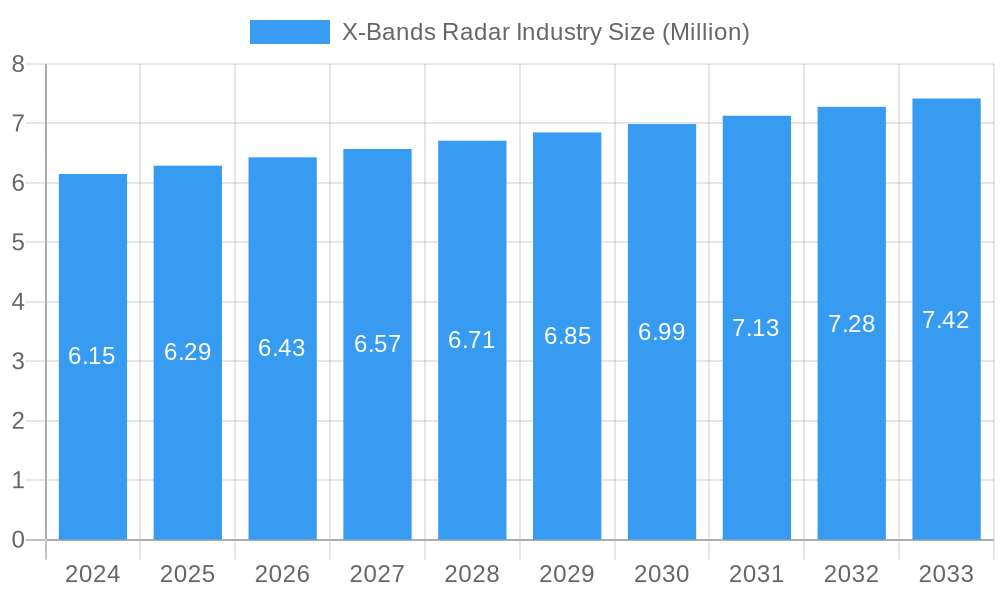

The X-Bands Radar market is poised for significant expansion, projected to reach an estimated USD 6.29 million, driven by a Compound Annual Growth Rate (CAGR) of 2.26% through 2033. This steady growth underscores the increasing demand for advanced radar technologies across diverse applications. Key market drivers include the escalating need for enhanced surveillance and reconnaissance capabilities in defense, the development of sophisticated air traffic management systems, and the growing adoption of weather monitoring and disaster management solutions. The proliferation of advanced sensor technologies and the ongoing digital transformation within critical infrastructure sectors are further fueling market expansion. Furthermore, the continuous innovation in radar signal processing and the integration of artificial intelligence and machine learning are enabling more precise and effective radar systems, thereby broadening their applicability and market appeal.

X-Bands Radar Industry Market Size (In Million)

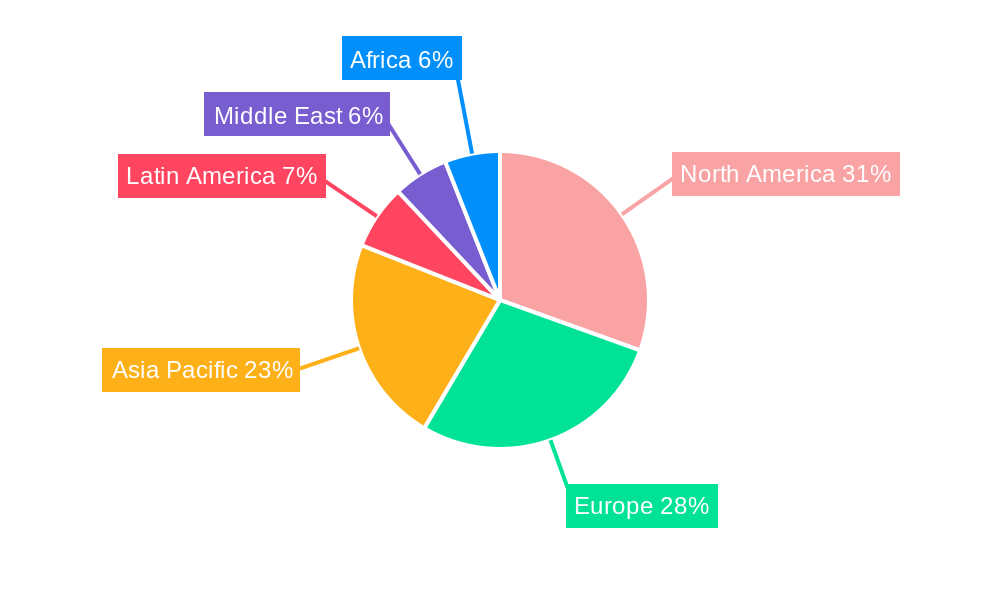

The market segmentation reveals a balanced distribution across Airborne, Terrestrial, and Naval platforms, each contributing to the overall market dynamics. Geographically, North America and Europe are expected to lead in market share, owing to robust defense spending, advanced technological infrastructure, and stringent regulations for aviation safety and environmental monitoring. The Asia Pacific region is anticipated to exhibit the highest growth potential, fueled by increasing military modernization, expanding aviation sectors, and a growing emphasis on disaster preparedness in countries like China and India. Restraints such as high initial investment costs for advanced radar systems and the complex regulatory landscape in some regions may pose challenges. However, the persistent demand for superior situational awareness, improved threat detection, and efficient resource management across both civilian and military domains will continue to propel the X-Bands Radar market forward, making it a dynamic and crucial sector in global technology adoption.

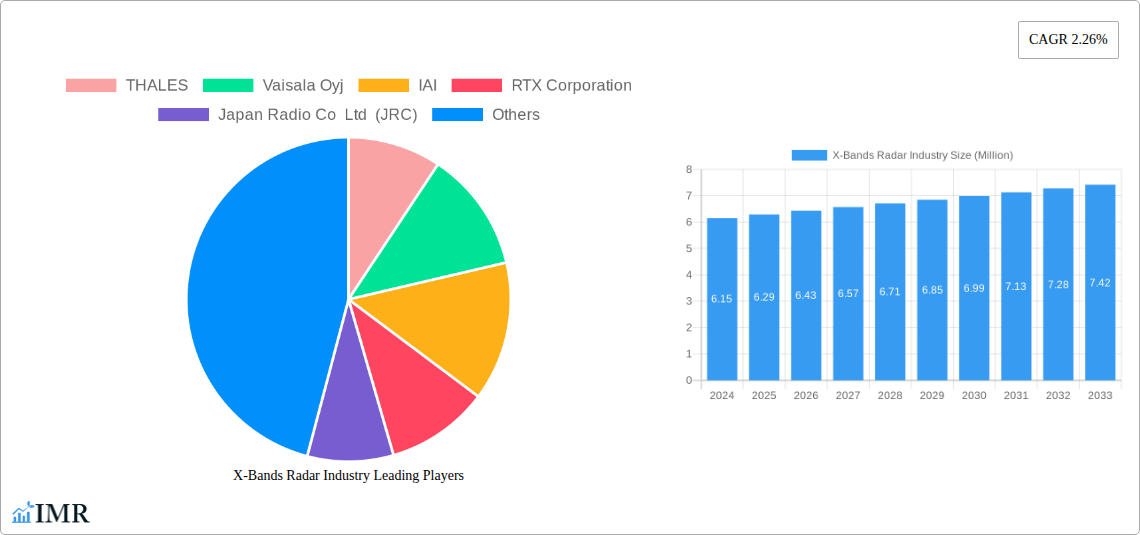

X-Bands Radar Industry Company Market Share

X-Bands Radar Industry Report Description

Unlock the future of advanced detection with our comprehensive X-Bands Radar Industry market report. Covering the period from 2019–2033, with a base and estimated year of 2025, this in-depth analysis provides critical insights into market dynamics, growth trends, regional dominance, product innovation, and key players shaping this vital sector.

This report delivers granular data and expert analysis on the global X-Bands Radar market, projecting its trajectory through 2033. With a focus on parent and child markets, we dissect critical segments like Airborne, Terrestrial, and Naval platforms, offering a detailed understanding of their individual growth drivers and interconnectedness. Our analysis includes quantitative metrics such as market share percentages, CAGR, and market penetration, alongside qualitative factors like technological innovation barriers and evolving consumer behavior.

Explore key market participants including THALES, Vaisala Oyj, IAI, RTX Corporation, Japan Radio Co Ltd (JRC), Terma Group, HENSOLDT AG, Leonardo S p A, FURUNO ELECTRIC CO LTD, Indra Sistemas S, Reutech Radar Systems, Northrop Grumman Corporation, and Saab AB. Uncover notable milestones, emerging opportunities, and growth accelerators within the X-Bands Radar industry.

This report is an indispensable resource for defense contractors, aerospace manufacturers, maritime security firms, government agencies, technology developers, and investors seeking to navigate and capitalize on the evolving X-Bands Radar landscape.

X-Bands Radar Industry Market Dynamics & Structure

The X-Bands Radar industry is characterized by a moderate market concentration, with a few key players holding significant market share. Technological innovation serves as a primary driver, fueled by continuous research and development in areas like signal processing, miniaturization, and enhanced detection capabilities for diverse applications. Robust regulatory frameworks, particularly in defense and aviation, dictate product development and deployment, ensuring compliance and safety standards. Competitive product substitutes, while present in broader radar markets, are less direct for specialized X-band applications demanding specific frequency characteristics. End-user demographics are predominantly governmental and military organizations, alongside a growing segment in weather forecasting and scientific research. Mergers and acquisitions (M&A) are strategic tools for market consolidation and technological advancement, with recent years witnessing several significant deal volumes in the xx-xx Million units range. Innovation barriers include the high cost of R&D, stringent qualification processes, and long product development cycles.

- Market Concentration: Moderate, with key players dominating specific segments.

- Technological Innovation Drivers: Advanced signal processing, miniaturization, AI integration for threat detection.

- Regulatory Frameworks: Strict compliance for defense, aviation, and maritime applications.

- Competitive Product Substitutes: Limited for specialized X-band requirements.

- End-User Demographics: Primarily government and military; growing scientific and meteorological sectors.

- M&A Trends: Strategic for market consolidation and technology acquisition, with xx deals valued at xx Million units in the historical period.

- Innovation Barriers: High R&D costs, lengthy qualification processes, integration complexities.

X-Bands Radar Industry Growth Trends & Insights

The global X-Bands Radar market is poised for substantial expansion, driven by escalating geopolitical tensions, the increasing need for advanced surveillance and reconnaissance capabilities, and the growing adoption of weather radar systems. The market size is projected to grow from approximately xx,xxx Million units in 2024 to xx,xxx Million units by 2033, exhibiting a compound annual growth rate (CAGR) of xx.xx%. Adoption rates are accelerating across naval, airborne, and terrestrial platforms as defense forces modernize their fleets and enhance their situational awareness. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) for automated target recognition and data analysis, are reshaping the industry. Consumer behavior shifts are evident in the demand for more compact, energy-efficient, and versatile radar systems that can be deployed across multiple platforms. The increasing emphasis on maritime security, border surveillance, and disaster management further propels the demand for reliable and high-resolution X-band radar solutions. The continuous evolution of threat landscapes necessitates constant upgrades and new deployments of sophisticated radar technologies, ensuring consistent market demand. Furthermore, advancements in solid-state power amplifiers (SSPAs) and phased array antenna technologies are enabling the development of smaller, more powerful, and cost-effective X-band radar systems, broadening their accessibility and application scope. The integration of X-band radar with other sensor systems, such as electro-optical and infrared (EO/IR) sensors, is also a significant trend, leading to enhanced data fusion and improved overall surveillance effectiveness. The growing sophistication of electronic warfare (EW) tactics also drives the need for X-band radars that can effectively counter jamming and spoofing attempts. The market penetration of X-band radar systems is expected to deepen across both mature and emerging economies as defense budgets increase and as non-defense applications gain traction. The forecast period of 2025–2033 is anticipated to witness a significant surge in market value, propelled by these intertwined factors.

Dominant Regions, Countries, or Segments in X-Bands Radar Industry

The Naval segment is a dominant force driving growth in the X-Bands Radar industry, significantly contributing to the overall market expansion. This dominance is underpinned by a confluence of factors, including escalating maritime security concerns, the strategic importance of naval power projection, and the critical role of X-band radar in modern naval warfare and surveillance. Nations across the globe are investing heavily in modernizing their naval fleets, equipping vessels with advanced radar systems for a comprehensive view of the maritime domain. This includes capabilities for detecting and tracking small, fast-moving surface targets, such as pirate vessels and small boats, as well as providing crucial air defense and fire control solutions. The market share attributed to the naval segment is estimated to be approximately xx% in 2025, with a projected growth rate that outpaces other segments during the forecast period.

Key drivers fueling the dominance of the naval segment include:

- Geopolitical Realities and Maritime Security: The increasing frequency of territorial disputes, piracy, and illicit activities at sea necessitates robust naval surveillance and interdiction capabilities. X-band radar's ability to provide high-resolution tracking in challenging maritime environments makes it indispensable for naval operations.

- Naval Modernization Programs: Major naval powers, including the United States, China, and European nations, are undertaking significant naval modernization programs that prioritize advanced sensor suites. These programs frequently involve the integration of new X-band radar systems on destroyers, frigates, aircraft carriers, and other surface combatants.

- Enhanced Air and Missile Defense: X-band radar plays a crucial role in advanced air and missile defense systems, offering precise tracking of incoming threats. This capability is vital for protecting naval assets and ensuring operational effectiveness in contested environments.

- Surface Surveillance and Target Acquisition: The high resolution and accuracy of X-band radar are critical for identifying and tracking a wide range of surface targets, from commercial vessels to smaller, more elusive threats, enabling effective maritime domain awareness and force protection.

- Technological Advancements in Naval Radar: Continuous innovation in naval radar technology, including the development of compact, solid-state, and multi-function X-band systems, has made them more adaptable and deployable across various naval platforms.

The North America region, particularly the United States, stands out as a dominant country in the X-Bands Radar industry. This leadership is primarily attributed to its substantial defense spending, advanced technological capabilities, and a proactive approach to national security, which necessitates sophisticated surveillance and reconnaissance tools. The US military's continuous investment in next-generation radar systems for all platforms, including naval, airborne, and ground-based applications, fuels consistent demand. Furthermore, the presence of leading defense contractors and research institutions within the US drives innovation and the rapid adoption of new technologies. The country's strategic global posture and its commitment to maintaining technological superiority in defense ensure a sustained and significant market for X-band radar systems.

X-Bands Radar Industry Product Landscape

The X-Bands Radar industry is characterized by a dynamic product landscape driven by relentless innovation. Products range from compact, deployable ground-based systems for weather monitoring and air traffic control to sophisticated airborne surveillance radars and integrated naval warfare suites. Key product innovations focus on enhanced target detection capabilities in adverse weather conditions, improved resolution for identifying smaller objects, and miniaturization for easier integration into various platforms. Performance metrics such as range, accuracy, update rate, and power efficiency are continually being optimized. Unique selling propositions include the development of solid-state transmitters for increased reliability and reduced maintenance, as well as the integration of advanced signal processing algorithms for superior clutter rejection and target discrimination. Technological advancements are leading to multi-functional radars capable of performing diverse roles, from surveillance and tracking to electronic warfare and communication.

Key Drivers, Barriers & Challenges in X-Bands Radar Industry

Key Drivers: The X-Bands Radar industry is propelled by escalating global security concerns, necessitating enhanced surveillance and threat detection capabilities. The modernization of military forces worldwide, with a particular focus on naval and airborne platforms, is a significant demand driver. Advancements in technology, including miniaturization and AI integration, are making X-band radars more versatile and effective. Furthermore, the increasing need for precise weather forecasting and atmospheric research contributes to market growth.

- Rising geopolitical tensions and defense modernization programs.

- Demand for high-resolution surveillance and reconnaissance.

- Technological advancements in signal processing and miniaturization.

- Growth in weather radar applications and scientific research.

Barriers & Challenges: Despite robust growth, the industry faces significant barriers, including the high cost of research, development, and manufacturing, which can limit accessibility for smaller players. Stringent regulatory approval processes for defense applications add to development timelines and expenses. Supply chain disruptions and the reliance on specialized components can impact production. Intense competition and the need for continuous innovation to stay ahead of evolving threats pose ongoing challenges.

- High R&D and manufacturing costs.

- Lengthy and complex regulatory approval processes.

- Supply chain vulnerabilities and component availability.

- Rapid technological evolution and the need for continuous innovation.

- Potential for electronic countermeasures and jamming.

Emerging Opportunities in X-Bands Radar Industry

Emerging opportunities within the X-Bands Radar industry lie in the expanding applications beyond traditional defense. The growing demand for advanced weather monitoring, particularly for severe weather prediction and climate research, presents a significant avenue for growth. Integration with drone technology for aerial surveillance and mapping applications is another burgeoning area. The development of compact, portable X-band radar systems for disaster response and humanitarian aid, enabling real-time situational awareness in challenging environments, is also gaining traction. Furthermore, the increasing focus on smart city initiatives and infrastructure monitoring, such as bridge and building stability assessment, offers untapped potential for specialized X-band radar deployments.

Growth Accelerators in the X-Bands Radar Industry Industry

Several key factors are accelerating growth in the X-Bands Radar industry. The continuous drive for technological superiority in defense, leading to substantial government investments in advanced radar systems, is a primary accelerator. Strategic partnerships between radar manufacturers and technology providers, particularly in areas like AI and data analytics, are fostering innovation and faster product development. Furthermore, market expansion into emerging economies with growing defense budgets and a need to enhance national security capabilities is a significant growth catalyst. The increasing adoption of modular and open-architecture radar designs is also speeding up integration and upgrades, further fueling market expansion.

Key Players Shaping the X-Bands Radar Industry Market

- THALES

- Vaisala Oyj

- IAI

- RTX Corporation

- Japan Radio Co Ltd (JRC)

- Terma Group

- HENSOLDT AG

- Leonardo S p A

- FURUNO ELECTRIC CO LTD

- Indra Sistemas S

- Reutech Radar Systems

- Northrop Grumman Corporation

- Saab AB

Notable Milestones in X-Bands Radar Industry Sector

- 2019: Launch of new, compact X-band radar for drone-based surveillance by Company X.

- 2020: Acquisition of Radar Tech Innovations by Major Defense Player Y, strengthening their X-band capabilities.

- 2021: Introduction of AI-powered target identification algorithms for naval X-band radar systems by Company Z.

- 2022: Successful integration of X-band radar with advanced missile defense systems on a new class of frigates by Country A.

- 2023: Significant advancements in solid-state transmitter technology for X-band radars announced by Research Institute B.

- 2024: Development of a weather-focused X-band radar with unprecedented resolution for early storm detection by Company C.

In-Depth X-Bands Radar Industry Market Outlook

The future outlook for the X-Bands Radar industry is exceptionally promising, driven by persistent global security imperatives and accelerating technological advancements. Growth accelerators such as increased defense spending, particularly in naval modernization and airborne surveillance, will continue to fuel demand. Strategic collaborations between established defense contractors and innovative technology firms are expected to yield breakthroughs in AI integration, data fusion, and miniaturization, leading to more capable and versatile radar systems. Furthermore, the expanding applications in non-defense sectors, including advanced weather forecasting, disaster management, and potentially even civilian infrastructure monitoring, represent significant untapped markets. The industry's ability to adapt to evolving threat landscapes and deliver highly reliable, precision-based detection solutions will solidify its critical role in national security and scientific advancement.

X-Bands Radar Industry Segmentation

-

1. Platform

- 1.1. Airborne

- 1.2. Terrestrial

- 1.3. Naval

X-Bands Radar Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. United Arab Emirates

- 6.2. Qatar

- 6.3. South Africa

- 6.4. Rest of Middle East and Africa

X-Bands Radar Industry Regional Market Share

Geographic Coverage of X-Bands Radar Industry

X-Bands Radar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Terrestrial Platform to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global X-Bands Radar Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Airborne

- 5.1.2. Terrestrial

- 5.1.3. Naval

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.2.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America X-Bands Radar Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Airborne

- 6.1.2. Terrestrial

- 6.1.3. Naval

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Europe X-Bands Radar Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Airborne

- 7.1.2. Terrestrial

- 7.1.3. Naval

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Asia Pacific X-Bands Radar Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Airborne

- 8.1.2. Terrestrial

- 8.1.3. Naval

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Latin America X-Bands Radar Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Airborne

- 9.1.2. Terrestrial

- 9.1.3. Naval

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Middle East X-Bands Radar Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. Airborne

- 10.1.2. Terrestrial

- 10.1.3. Naval

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Saudi Arabia X-Bands Radar Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Platform

- 11.1.1. Airborne

- 11.1.2. Terrestrial

- 11.1.3. Naval

- 11.1. Market Analysis, Insights and Forecast - by Platform

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 THALES

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Vaisala Oyj

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IAI

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 RTX Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Japan Radio Co Ltd (JRC)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Terma Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 HENSOLDT AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Leonardo S p A

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 FURUNO ELECTRIC CO LTD

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Indra Sistemas S

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Reutech Radar Systems

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Northrop Grumman Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Saab AB

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 THALES

List of Figures

- Figure 1: Global X-Bands Radar Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America X-Bands Radar Industry Revenue (Million), by Platform 2025 & 2033

- Figure 3: North America X-Bands Radar Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America X-Bands Radar Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America X-Bands Radar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe X-Bands Radar Industry Revenue (Million), by Platform 2025 & 2033

- Figure 7: Europe X-Bands Radar Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 8: Europe X-Bands Radar Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe X-Bands Radar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific X-Bands Radar Industry Revenue (Million), by Platform 2025 & 2033

- Figure 11: Asia Pacific X-Bands Radar Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Asia Pacific X-Bands Radar Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific X-Bands Radar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America X-Bands Radar Industry Revenue (Million), by Platform 2025 & 2033

- Figure 15: Latin America X-Bands Radar Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Latin America X-Bands Radar Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America X-Bands Radar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East X-Bands Radar Industry Revenue (Million), by Platform 2025 & 2033

- Figure 19: Middle East X-Bands Radar Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 20: Middle East X-Bands Radar Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East X-Bands Radar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Saudi Arabia X-Bands Radar Industry Revenue (Million), by Platform 2025 & 2033

- Figure 23: Saudi Arabia X-Bands Radar Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 24: Saudi Arabia X-Bands Radar Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Saudi Arabia X-Bands Radar Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global X-Bands Radar Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Global X-Bands Radar Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global X-Bands Radar Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Global X-Bands Radar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global X-Bands Radar Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Global X-Bands Radar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: France X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Germany X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Russia X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global X-Bands Radar Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 15: Global X-Bands Radar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: India X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global X-Bands Radar Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 22: Global X-Bands Radar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Brazil X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Mexico X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Latin America X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global X-Bands Radar Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 27: Global X-Bands Radar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global X-Bands Radar Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 29: Global X-Bands Radar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: United Arab Emirates X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Qatar X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa X-Bands Radar Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the X-Bands Radar Industry?

The projected CAGR is approximately 2.26%.

2. Which companies are prominent players in the X-Bands Radar Industry?

Key companies in the market include THALES, Vaisala Oyj, IAI, RTX Corporation, Japan Radio Co Ltd (JRC), Terma Group, HENSOLDT AG, Leonardo S p A, FURUNO ELECTRIC CO LTD, Indra Sistemas S, Reutech Radar Systems, Northrop Grumman Corporation, Saab AB.

3. What are the main segments of the X-Bands Radar Industry?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Terrestrial Platform to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "X-Bands Radar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the X-Bands Radar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the X-Bands Radar Industry?

To stay informed about further developments, trends, and reports in the X-Bands Radar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence