Key Insights

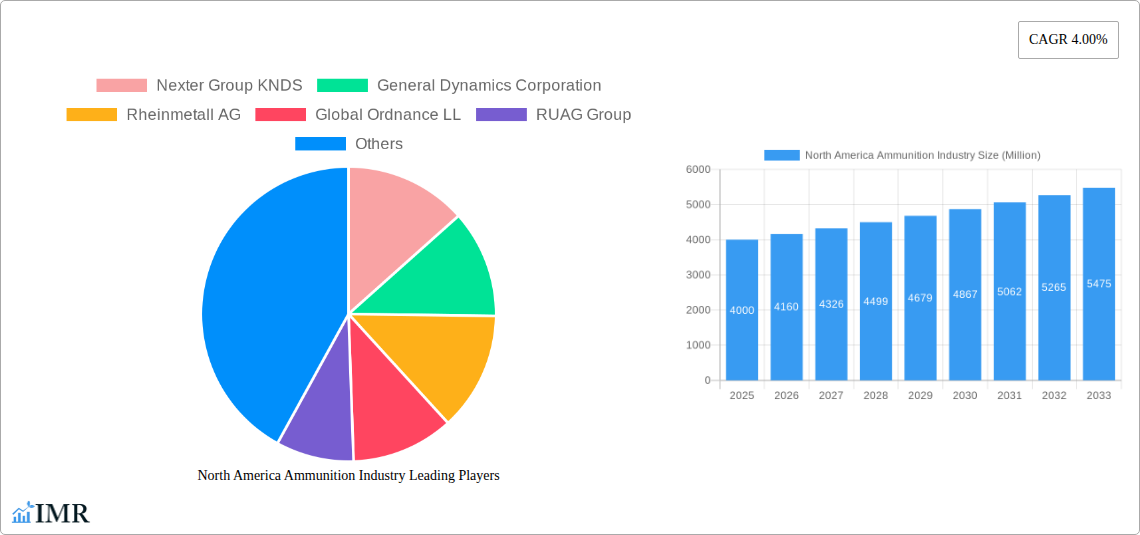

The North American ammunition market is projected for significant growth, reaching an estimated market size of 4232.6 million by 2025, with a Compound Annual Growth Rate (CAGR) of 2.3% anticipated through 2033. This expansion is driven by increased defense expenditures in the United States and Canada, influenced by geopolitical dynamics and a strengthened focus on national security. The military sector is expected to lead, propelled by ongoing modernization initiatives and consistent demand for diverse ammunition calibers. The civilian segment, serving sporting, hunting, and self-defense needs, also contributes to market vitality, with the United States being a key driver. Advances in manufacturing and the development of specialized ammunition are further shaping market trends.

North America Ammunition Industry Market Size (In Billion)

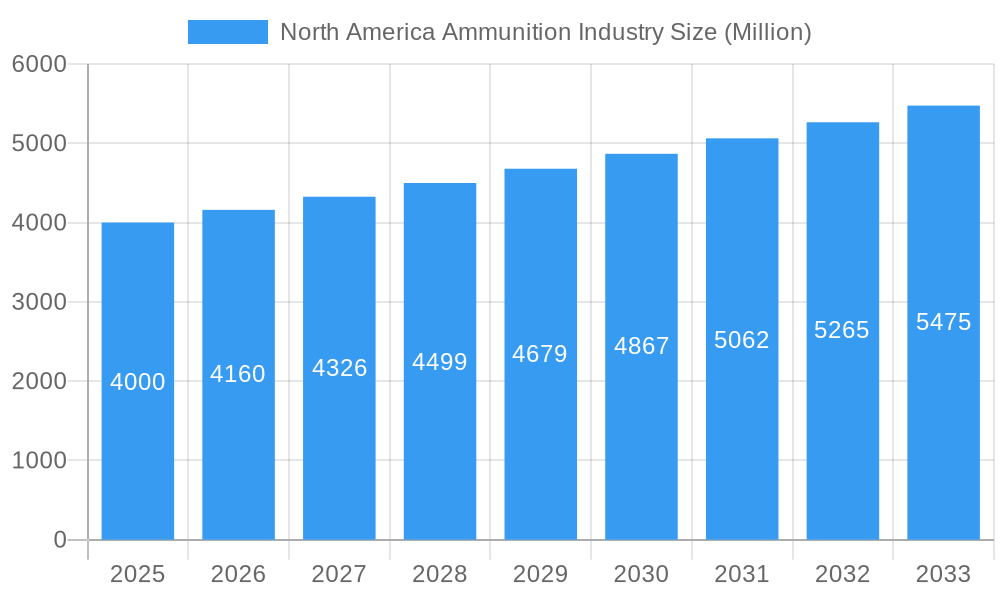

Key players in the North American ammunition industry include Nexter Group KNDS, General Dynamics Corporation, and Rheinmetall AG, who are actively engaged in research and development to improve ammunition capabilities and explore new materials. Market challenges include price volatility of raw materials such as copper and lead, and evolving environmental regulations. Supply chain disruptions also present a concern, necessitating robust inventory management and diversified sourcing strategies. Despite these hurdles, sustained demand from government and civilian sectors, alongside technological innovations, supports a positive outlook for the North American ammunition market.

North America Ammunition Industry Company Market Share

North America Ammunition Industry Market Overview: Comprehensive Report Description

This comprehensive report offers an in-depth analysis of the North America Ammunition Industry, covering market dynamics, growth trends, and future outlook from 2019 to 2033. With a base year of 2025 and a detailed forecast period from 2025 to 2033, this study provides critical insights for industry professionals, investors, and policymakers. We delve into the intricate workings of the ammunition market, from small caliber rounds to large caliber artillery, examining both civilian and military end-user segments across the United States and Canada. Leveraging high-traffic SEO keywords and a parent-child market structure, this report ensures maximum visibility and delivers actionable intelligence.

North America Ammunition Industry Market Dynamics & Structure

The North America Ammunition Industry exhibits a moderately consolidated market structure, with a few dominant players accounting for a significant share. Technological innovation serves as a key driver, fueled by advancements in materials science, propellant technology, and smart ammunition capabilities. Regulatory frameworks, particularly those governing the sale and possession of firearms and ammunition, play a crucial role in shaping market access and demand. Competitive product substitutes, while limited for core ammunition types, can emerge through alternative force projection methods or specialized defense systems. End-user demographics, encompassing both the growing civilian shooting sports and self-defense markets, and the substantial government and defense procurement, dictate market segmentation. Mergers and acquisitions (M&A) trends indicate strategic consolidation and portfolio expansion by key players aiming to enhance capabilities and market reach.

- Market Concentration: Dominated by a mix of large defense contractors and specialized ammunition manufacturers.

- Technological Innovation: Focus on enhanced accuracy, reduced collateral damage, and extended range.

- Regulatory Frameworks: Stringent import/export controls and domestic sales regulations impact market accessibility.

- Competitive Landscape: High barriers to entry due to capital investment and specialized expertise.

- End-User Diversification: Growth in both civilian recreational shooting and increasing military modernization programs.

- M&A Activity: Strategic acquisitions to bolster product lines and expand geographic presence.

North America Ammunition Industry Growth Trends & Insights

The North America Ammunition Industry is poised for robust growth, driven by a confluence of factors including escalating geopolitical tensions, increased military spending, and a sustained demand from the civilian sector for sporting and self-defense purposes. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Adoption rates for advanced ammunition technologies, such as guided munitions and environmentally friendly propellants, are on the rise, reflecting a shift towards precision and sustainability. Technological disruptions are primarily centered around miniaturization, enhanced lethality, and smart ammunition integration, enabling real-time targeting and improved mission effectiveness. Consumer behavior shifts are evident in the civilian segment, with a growing interest in specialized ammunition for competitive shooting and personal protection. This evolution underscores a mature market segment embracing innovation and customization. The industry's growth trajectory is further supported by substantial government procurement cycles and a resilient civilian market, which collectively contribute to market expansion and stability. Future insights point towards an increased emphasis on intelligent ammunition systems and advanced material applications, shaping the next generation of ammunition development and deployment.

Dominant Regions, Countries, or Segments in North America Ammunition Industry

Within the North America Ammunition Industry, the United States stands out as the dominant country, driven by its substantial military expenditures, a large civilian firearms market, and a robust manufacturing base. The Civilian end-user segment is a significant growth engine, fueled by recreational shooting, competitive sports, and self-defense needs. This segment's growth is propelled by economic policies that support firearm ownership and a culture that embraces shooting as a pastime. The Small Caliber segment (typically .22LR to .50 BMG) is the largest by volume, serving both civilian and military applications, from personal defense and hunting to infantry weapons.

Key Drivers of Dominance in the United States:

- Extensive Military Procurement: The U.S. Department of Defense remains a primary consumer, driving demand for a wide array of ammunition calibers.

- Large Civilian Firearms Market: The sheer number of firearms owned by civilians creates consistent demand for ammunition for sport, hunting, and self-defense.

- Technological Advancement: Significant investment in R&D for enhanced ammunition performance, including precision-guided munitions and advanced materials.

- Economic Resilience: Despite economic fluctuations, demand for ammunition has shown consistent resilience due to its essential nature for both defense and civilian markets.

- Manufacturing Infrastructure: A well-established and advanced manufacturing ecosystem capable of producing high-volume, high-quality ammunition.

The Military end-user segment also plays a pivotal role, with ongoing modernization programs and operational requirements sustaining demand for medium and large caliber ammunition for armored vehicles, artillery, and naval platforms. Canada, while a smaller market, contributes significantly, particularly in niche civilian segments and through its military procurement agreements. The continuous need for ammunition across these diverse applications underscores the multifaceted growth potential and the strategic importance of these dominant regions and segments within the broader North American landscape. Market share within the U.S. civilian segment is influenced by brand loyalty, product availability, and pricing. For the military segment, government contracts and technological specifications are paramount.

North America Ammunition Industry Product Landscape

The product landscape in the North America Ammunition Industry is characterized by continuous innovation aimed at enhancing performance, safety, and versatility. Advancements in propellant technology are yielding higher velocities and more consistent performance across varying environmental conditions. New material compositions for projectiles and casings are improving accuracy, reducing fouling, and offering greater terminal ballistics. The integration of smart technologies, such as self-destructing rounds for reduced collateral damage and networked ammunition for real-time battlefield awareness, represents a significant leap forward. Applications span a broad spectrum, from training and recreational shooting to precision engagement in military operations. Performance metrics are increasingly focused on reliability, accuracy at extended ranges, and specialized effects, catering to the evolving demands of both civilian and military end-users.

Key Drivers, Barriers & Challenges in North America Ammunition Industry

Key Drivers:

- Escalating Geopolitical Tensions: Increased global instability fuels defense spending and military readiness, driving demand for ammunition.

- Civilian Self-Defense and Sporting Demand: A persistent and growing market for personal protection and recreational shooting.

- Military Modernization Programs: Ongoing upgrades to armed forces worldwide necessitate continuous replenishment and advancement of ammunition stockpiles.

- Technological Advancements: Innovation in materials, propellants, and smart munitions creates new market opportunities and drives demand for next-generation products.

- Government Contracts and Long-Term Procurement Cycles: Stable, large-scale orders from defense agencies provide consistent revenue streams.

Key Barriers & Challenges:

- Strict Regulatory Environments: Navigating complex and evolving firearms and ammunition laws, particularly concerning import/export and sales, presents significant hurdles.

- Supply Chain Vulnerabilities: Reliance on global supply chains for raw materials can lead to disruptions and price volatility.

- Environmental Regulations: Increasing scrutiny on the environmental impact of ammunition production and disposal necessitates investment in sustainable practices.

- High Capital Investment: Establishing and maintaining ammunition manufacturing facilities requires substantial upfront capital, creating barriers to entry.

- Intense Competition: While consolidated, competition among established players is fierce, focusing on cost-effectiveness and technological superiority.

- Skilled Labor Shortages: A potential challenge in sourcing and retaining a skilled workforce for specialized manufacturing processes.

Emerging Opportunities in North America Ammunition Industry

Emerging opportunities in the North America Ammunition Industry lie in the development of eco-friendly ammunition, addressing environmental concerns and complying with evolving regulations. The miniaturization of ammunition for drones and smaller unmanned systems presents a rapidly growing niche. Smart ammunition with advanced targeting and communication capabilities offers significant growth potential, particularly for military applications seeking enhanced battlefield intelligence. The civilian market's demand for specialized, high-performance ammunition for competitive shooting and hunting continues to expand, creating opportunities for premium product lines. Furthermore, partnerships with technology firms to integrate AI and advanced sensors into ammunition systems can unlock novel applications and market segments.

Growth Accelerators in the North America Ammunition Industry Industry

Several key catalysts are accelerating growth in the North America Ammunition Industry. Technological breakthroughs in areas like self-healing materials for casings and advanced explosives are enhancing product performance and opening new market frontiers. Strategic partnerships and joint ventures between established manufacturers and innovative startups are fostering rapid development and commercialization of new technologies. Market expansion strategies, including increased focus on export markets and diversification into related defense technologies, are also contributing to overall growth. Furthermore, the ongoing investment in research and development by major players to create safer, more effective, and more sustainable ammunition solutions will continue to propel the industry forward.

Key Players Shaping the North America Ammunition Industry Market

- Nexter Group KNDS

- General Dynamics Corporation

- Rheinmetall AG

- Global Ordnance LL

- RUAG Group

- CBC Global Ammunition

- BAE Systems PLC

- Winchester Ammunition (Olin Corporation)

- Nammo AS

- Northrop Grumman Corporation

Notable Milestones in North America Ammunition Industry Sector

- 2023: Introduction of advanced, environmentally conscious propellant formulations by major manufacturers.

- 2022: Significant increase in defense contracts for large caliber artillery ammunition driven by global conflicts.

- 2021: Launch of next-generation smart ammunition prototypes with enhanced targeting capabilities.

- 2020: Increased investment in domestic ammunition manufacturing infrastructure by several key players.

- 2019: Expansion of civilian ammunition offerings to cater to the growing precision rifle shooting market.

In-Depth North America Ammunition Industry Market Outlook

The outlook for the North America Ammunition Industry remains exceptionally strong, driven by sustained demand from both defense and civilian sectors. Growth accelerators such as the relentless pursuit of technological superiority, evidenced by advancements in smart ammunition and material science, will continue to shape the market. Strategic partnerships and market expansion initiatives, including a focus on emerging geopolitical hotspots and expanding civilian consumer bases, will further bolster revenue streams. The industry is well-positioned to capitalize on its inherent resilience and adaptability, promising continued growth and innovation throughout the forecast period.

North America Ammunition Industry Segmentation

-

1. Type

- 1.1. Small Caliber

- 1.2. Medium Caliber

- 1.3. Large Caliber

-

2. End User

- 2.1. Civilian

- 2.2. Military

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

-

3.1. North America

North America Ammunition Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America Ammunition Industry Regional Market Share

Geographic Coverage of North America Ammunition Industry

North America Ammunition Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Small Caliber

- 5.1.2. Medium Caliber

- 5.1.3. Large Caliber

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Civilian

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nexter Group KNDS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Dynamics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rheinmetall AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Global Ordnance LL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RUAG Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CBC Global Ammunition

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BAE Systems PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Winchester Ammunition (Olin Corporation)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nammo AS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Northrop Grumman Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nexter Group KNDS

List of Figures

- Figure 1: North America Ammunition Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Ammunition Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Ammunition Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: North America Ammunition Industry Revenue million Forecast, by End User 2020 & 2033

- Table 3: North America Ammunition Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 4: North America Ammunition Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Ammunition Industry Revenue million Forecast, by Type 2020 & 2033

- Table 6: North America Ammunition Industry Revenue million Forecast, by End User 2020 & 2033

- Table 7: North America Ammunition Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 8: North America Ammunition Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States North America Ammunition Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Ammunition Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Ammunition Industry?

The projected CAGR is approximately 2.3%.

2. Which companies are prominent players in the North America Ammunition Industry?

Key companies in the market include Nexter Group KNDS, General Dynamics Corporation, Rheinmetall AG, Global Ordnance LL, RUAG Group, CBC Global Ammunition, BAE Systems PLC, Winchester Ammunition (Olin Corporation), Nammo AS, Northrop Grumman Corporation.

3. What are the main segments of the North America Ammunition Industry?

The market segments include Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4232.6 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Ammunition Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Ammunition Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Ammunition Industry?

To stay informed about further developments, trends, and reports in the North America Ammunition Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence