Key Insights

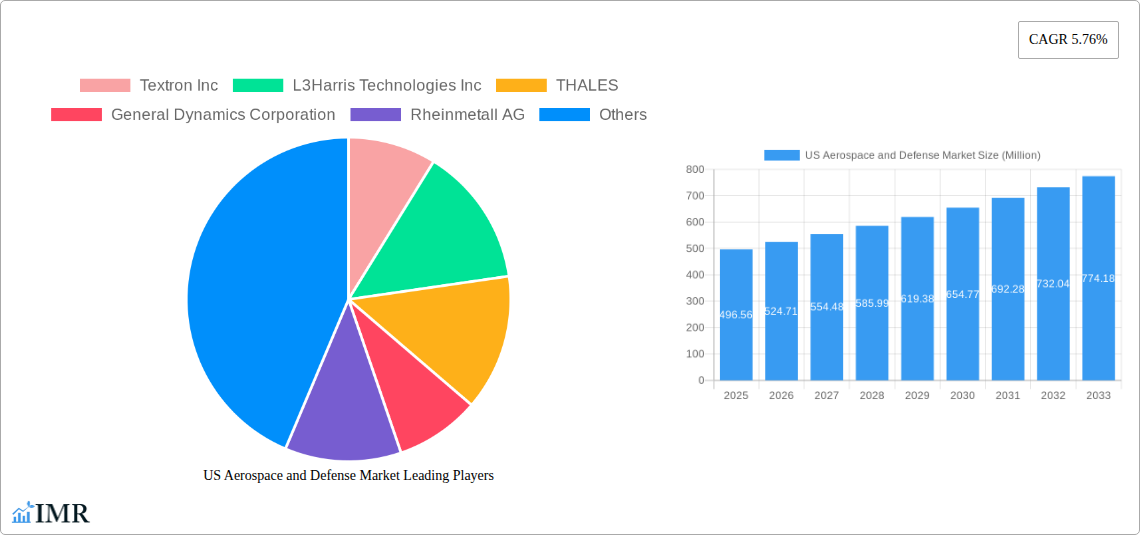

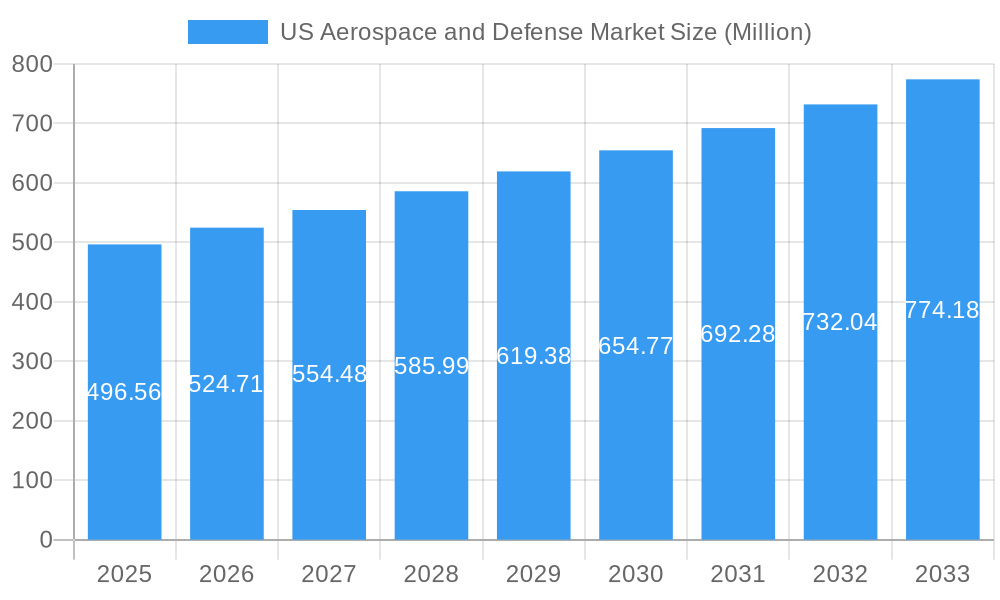

The US Aerospace and Defense market is poised for robust expansion, projected to reach approximately \$496.56 million by 2025, with a sustained Compound Annual Growth Rate (CAGR) of 5.76% through 2033. This growth is primarily propelled by significant advancements in unmanned aerial systems (UAS), the burgeoning commercial aviation sector driven by increased air traffic and passenger demand, and the critical need for modernized military aircraft and sophisticated space systems fueled by evolving geopolitical landscapes and defense spending. Investment in research and development for next-generation technologies, including AI-driven avionics, advanced materials for airframes, and enhanced engine systems, will be a key differentiator. Furthermore, the growing emphasis on space-based capabilities for both commercial and defense applications, ranging from satellite constellations for communication and observation to advancements in space exploration, will contribute significantly to market value.

US Aerospace and Defense Market Market Size (In Million)

The market's dynamism is further shaped by a complex interplay of drivers and restraints. Key growth drivers include escalating defense budgets globally, a renewed focus on strategic defense capabilities, and the increasing adoption of commercial aircraft to meet rising global travel demands. Opportunities lie in the modernization of existing fleets, the development of sustainable aviation technologies, and the expansion of space-based services. However, the market faces constraints such as stringent regulatory frameworks, complex supply chain dependencies, and the substantial capital investment required for research, development, and manufacturing. Geopolitical uncertainties, while driving some defense spending, can also lead to supply chain disruptions and shifts in procurement priorities. The competitive landscape is dominated by major global players such as Lockheed Martin, Boeing, Airbus, and RTX Corporation, who are actively investing in innovation and strategic partnerships to maintain their market share and capitalize on emerging opportunities across commercial aviation, military systems, and space technology segments.

US Aerospace and Defense Market Company Market Share

US Aerospace and Defense Market: Comprehensive Analysis and Forecast (2019-2033)

This in-depth report provides a meticulously researched analysis of the US Aerospace and Defense market, covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a comprehensive forecast period from 2025 to 2033. We delve into market dynamics, growth trends, dominant segments, product landscapes, key drivers, emerging opportunities, and the competitive ecosystem. All values are presented in million units for clarity and precision. This report is designed for industry professionals seeking critical insights into the evolution and future trajectory of the US aerospace and defense industry.

US Aerospace and Defense Market Market Dynamics & Structure

The US Aerospace and Defense market is characterized by a high degree of concentration, with a few dominant players like Lockheed Martin Corporation, RTX Corporation, Northrop Grumman Corporation, and The Boeing Company holding significant market share. Technological innovation is a primary driver, fueled by substantial R&D investments in areas such as advanced materials, AI-powered avionics, hypersonic technologies, and next-generation unmanned aerial systems (UAS). The regulatory framework, overseen by entities like the FAA and DoD, plays a crucial role in shaping market entry, product development, and defense procurement processes. While highly specialized, competitive product substitutes are emerging, particularly in areas like cybersecurity for defense systems and advanced simulation technologies for pilot training. End-user demographics within the defense sector are primarily government agencies, while commercial aviation sees a diverse range of airlines and private operators. Mergers and acquisitions (M&A) remain a significant strategy for consolidation and capability enhancement, with an average of 5-8 significant M&A deals annually over the historical period, valued at hundreds of millions to billions of dollars. Barriers to innovation include stringent certification processes, long development cycles, and the substantial capital investment required for cutting-edge research.

- Market Concentration: Dominated by a few key players, indicating a mature and consolidated industry structure.

- Technological Innovation Drivers: Focus on AI, advanced materials, hypersonic flight, and autonomous systems.

- Regulatory Framework: Strict oversight from FAA and DoD impacting market access and product approvals.

- Competitive Product Substitutes: Emergence of cybersecurity solutions and advanced simulation technologies.

- End-User Demographics: Government agencies (defense) and commercial airlines/private operators (aviation).

- M&A Trends: Consistent activity for strategic expansion and acquisition of new technologies.

US Aerospace and Defense Market Growth Trends & Insights

The US Aerospace and Defense market has demonstrated robust growth over the historical period and is poised for continued expansion through the forecast period, driven by a combination of factors influencing both commercial aviation and defense spending. The market size evolution is projected to see a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033. Adoption rates for new technologies, such as advanced composite materials in aircraft structures and AI in avionics, are steadily increasing, contributing to enhanced performance and efficiency. Technological disruptions are prominent, with the rapid advancement of Unmanned Aerial Systems (UAS) revolutionizing both military reconnaissance and commercial delivery services. Consumer behavior shifts in commercial aviation are leaning towards increased demand for fuel-efficient aircraft and enhanced passenger experiences, influencing aircraft design and cabin interior innovations. In the defense sector, evolving geopolitical landscapes and the need for modernized military capabilities are driving significant investment in next-generation combat aircraft, advanced missile systems, and resilient space-based assets. The increasing demand for air cargo and the recovery of passenger air travel post-pandemic are significant contributors to the commercial aviation segment's growth.

- Market Size Evolution: Projected CAGR of 4.5% from 2025-2033.

- Adoption Rates: Increasing integration of advanced materials and AI across segments.

- Technological Disruptions: Rapid evolution of UAS and AI impacting operational paradigms.

- Consumer Behavior Shifts: Demand for fuel efficiency, enhanced passenger experience, and advanced defense capabilities.

- Key Growth Influencers: Geopolitical stability, global air traffic recovery, and defense modernization programs.

Dominant Regions, Countries, or Segments in US Aerospace and Defense Market

The dominant segment driving growth in the US Aerospace and Defense market is undeniably Military Aircraft and Systems, followed closely by Space Systems and Equipment. Within Military Aircraft and Systems, Combat Aircraft represents a significant portion of market value due to continuous modernization programs and the development of advanced fighter jets, bombers, and reconnaissance platforms. The Defense Spending and Budget Allocation Details across the Army, Navy and Marine Corps, and Air Force consistently favor investments in advanced aerial capabilities, driving demand for structures, avionics, and missile systems. For instance, the US Air Force's ongoing procurement of next-generation fighter aircraft and strategic bombers, coupled with the Navy's focus on carrier-based aviation and maritime patrol aircraft, are substantial market drivers.

Key Drivers for Dominance:

- Geopolitical Imperatives: The prevailing global security environment necessitates continuous investment in advanced military hardware to maintain strategic superiority. This directly fuels the demand for sophisticated combat aircraft and associated systems.

- Technological Superiority: The US military's emphasis on maintaining a technological edge drives significant R&D and procurement of cutting-edge avionics, advanced airframe materials, and highly precise weaponry. Companies like Lockheed Martin Corporation and Northrop Grumman Corporation are at the forefront of these innovations.

- Sustained Defense Budgets: Consistent and substantial defense spending allocated by the US government provides a stable financial foundation for long-term procurement contracts and ambitious modernization programs.

- Unmanned Aerial Systems (UAS) Advancement: The rapid development and integration of UAS for both reconnaissance and combat roles are creating new market opportunities and driving innovation within the military aircraft segment.

The Space Systems and Equipment segment is also experiencing a surge in growth, driven by increased investments in national security space assets, commercial satellite constellations for communication and Earth observation, and the burgeoning space exploration initiatives. The segmentation by application within satellites, particularly the Military and Commercial applications, highlights the dual-purpose nature of space technology and its growing importance across various sectors.

US Aerospace and Defense Market Product Landscape

The US Aerospace and Defense market is characterized by a dynamic product landscape defined by constant innovation and the pursuit of enhanced performance. Key product categories include advanced composite airframes that offer improved fuel efficiency and durability, cutting-edge avionics systems integrating artificial intelligence for enhanced situational awareness and autonomous flight capabilities, and next-generation engine and engine systems designed for greater power and reduced emissions. In the defense sector, the development of hypersonic missiles and advanced electronic warfare systems signifies a leap in offensive and defensive capabilities. For commercial aviation, innovations focus on cabin interiors designed for passenger comfort and connectivity, alongside robust MRO (Maintenance, Repair, and Overhaul) solutions ensuring fleet readiness and longevity. The integration of advanced materials, digital technologies, and sustainable solutions are paramount across all product lines.

Key Drivers, Barriers & Challenges in US Aerospace and Defense Market

Key Drivers:

- Technological Advancement: Continuous innovation in materials science, AI, and propulsion systems fuels demand for sophisticated aerospace and defense solutions.

- Defense Modernization Programs: Government investment in upgrading military fleets and developing new defense capabilities is a primary growth engine.

- Resurgence in Air Travel: The post-pandemic recovery of commercial air travel stimulates demand for new aircraft and MRO services.

- Growing Space Exploration and Commercialization: Increased activity in satellite deployment and space missions opens new avenues for growth.

Barriers & Challenges:

- Stringent Regulatory Environment: Compliance with safety, security, and environmental regulations presents significant hurdles and adds to development costs.

- Long Development Cycles and High Costs: The complexity of aerospace and defense products leads to lengthy R&D phases and substantial financial investments, creating a high barrier to entry.

- Supply Chain Volatility: Disruptions in the global supply chain, particularly for specialized components, can impact production timelines and costs.

- Cybersecurity Threats: Protecting sensitive defense systems and commercial aviation data from cyberattacks is an ongoing and evolving challenge.

- Skilled Workforce Shortage: A persistent gap in the availability of highly skilled engineers and technicians can hinder innovation and production.

Emerging Opportunities in US Aerospace and Defense Market

Emerging opportunities in the US Aerospace and Defense market lie in the rapidly expanding domain of Unmanned Aerial Systems (UAS) for both commercial applications, such as last-mile delivery and agricultural monitoring, and military roles, including surveillance and strike missions. The commercial space sector, driven by satellite constellations for global internet connectivity, Earth observation, and burgeoning space tourism, presents significant growth potential. Furthermore, the increasing focus on sustainable aviation, including the development of electric and hybrid-electric aircraft and sustainable aviation fuels (SAFs), offers a critical opportunity for innovation and market differentiation. Advancements in additive manufacturing (3D printing) are also creating opportunities for more efficient production of complex parts and reduced lead times.

Growth Accelerators in the US Aerospace and Defense Market Industry

Several catalysts are accelerating long-term growth in the US Aerospace and Defense industry. The ongoing digital transformation, encompassing the adoption of advanced simulation and modeling tools, AI-driven analytics for predictive maintenance, and secure cloud infrastructure, is streamlining operations and enhancing decision-making. Strategic partnerships between established aerospace giants and innovative technology startups are fostering rapid development of novel solutions, particularly in areas like advanced materials and autonomous systems. Market expansion strategies, including increased exports of defense equipment and the development of integrated solutions for allied nations, are also key growth accelerators. The continuous push towards greater efficiency, reduced environmental impact, and enhanced operational capabilities across both civil and military sectors will continue to fuel investment and innovation.

Key Players Shaping the US Aerospace and Defense Market Market

- Textron Inc

- L3Harris Technologies Inc

- THALES

- General Dynamics Corporation

- Rheinmetall AG

- Lockheed Martin Corporation

- Airbus SE

- QinetiQ Group PLC

- Naval Group

- Fincantieri S p A

- Safran SA

- RTX Corporation

- Embraer SA

- Leonardo S p A

- Rolls-Royce plc

- BAE Systems plc

- Northrop Grumman Corporation

- The Boeing Company

- GKN Aerospace

Notable Milestones in US Aerospace and Defense Market Sector

- 2023: Launch of new advanced fighter jet prototypes, showcasing significant progress in next-generation combat aircraft technology.

- 2023: Major defense contractor announces a breakthrough in hypersonic missile development, enhancing strategic capabilities.

- 2023: Commercial satellite operator successfully deploys a new constellation, expanding global connectivity services.

- 2022: Aerospace manufacturer announces development of a more fuel-efficient engine for commercial aircraft, aligning with sustainability goals.

- 2022: Significant increase in M&A activity, with several key acquisitions aimed at consolidating expertise in AI and cybersecurity.

- 2021: Government announces increased defense spending allocation, focusing on modernization of naval and air forces.

- 2020: Introduction of advanced simulation and training systems for pilots, enhancing operational readiness.

- 2019: First successful demonstration of a fully autonomous cargo drone flight for commercial purposes.

In-Depth US Aerospace and Defense Market Market Outlook

The outlook for the US Aerospace and Defense market remains exceptionally strong, driven by sustained demand for both commercial and defense applications. Growth accelerators such as digital transformation, strategic partnerships, and increased global market penetration will continue to shape the industry's trajectory. The market's future potential is underscored by ongoing investments in advanced technologies, including AI-driven systems, sustainable aviation solutions, and next-generation space capabilities. Key strategic opportunities lie in leveraging these technological advancements to address evolving geopolitical challenges, meet the increasing demand for air travel and cargo, and capitalize on the burgeoning commercial space sector. The industry's commitment to innovation and adaptation positions it for continued expansion and influence on a global scale.

US Aerospace and Defense Market Segmentation

-

1. Commercial and General Aviation

- 1.1. Market Overview

-

1.2. Market Dynamics

- 1.2.1. Drivers

- 1.2.2. Restraints

- 1.2.3. Opportunities

- 1.3. Market Trends

-

1.4. Segmentation: Commercial Aircraft

- 1.4.1. Air Traffic

- 1.4.2. Training and Flight Simulators

- 1.4.3. Airport

-

1.4.4. Structures

-

1.4.4.1. Airframe

- 1.4.4.1.1. Material

- 1.4.4.1.2. Adhesives and Coatings

- 1.4.4.2. Engine and Engine Systems

- 1.4.4.3. Cabin Interiors

- 1.4.4.4. Landing Gear

-

1.4.4.5. Avionics and Control Systems

- 1.4.4.5.1. Communication System

- 1.4.4.5.2. Navigation System

- 1.4.4.5.3. Flight Control System

- 1.4.4.5.4. Health Monitoring System

- 1.4.4.6. Electrical Systems

- 1.4.4.7. Environmental Control Systems

- 1.4.4.8. Fuel and Fuel Systems

- 1.4.4.9. MRO

- 1.4.4.10. Research and Development

- 1.4.4.11. Supply C

- 1.4.4.12. Competitor Analysis

-

1.4.4.1. Airframe

- 1.5. Segmenta

-

2. Military Aircraft and Systems

- 2.1. Market Overview

-

2.2. Defense Spending and Budget Allocation Details

- 2.2.1. Army

- 2.2.2. Navy and Marine Corps

- 2.2.3. Air Force

-

2.3. Market Dynamics

- 2.3.1. Drivers

- 2.3.2. Restraints

- 2.3.3. Opportunities

- 2.4. Market Trends

- 2.5. MRO

- 2.6. Research and Development

- 2.7. Training and Flight Simulators

- 2.8. Competitor Analysis

- 2.9. Supply Chain Analysis

- 2.10. Customer/Distributor Information

-

2.11. Segmentation: Combat Aircraft

-

2.11.1. Structures

-

2.11.1.1. Airframe

- 2.11.1.1.1. Material

- 2.11.1.1.2. Adhesives and Coatings

- 2.11.1.2. Engine and Engine Systems

- 2.11.1.3. Landing Gear

-

2.11.1.1. Airframe

-

2.11.2. Avionics and Control Systems

- 2.11.2.1. General Avionics

- 2.11.2.2. Mission Specific Avionics

- 2.11.3. Missiles and Weapons

-

2.11.1. Structures

- 2.12. Segmentation: Non-Combat Aircraft

-

3. Unmanned Aerial Systems

- 3.1. Market Overview

-

3.2. Market Dynamics

- 3.2.1. Drivers

- 3.2.2. Restraints

- 3.2.3. Opportunities

- 3.3. Market Trends

- 3.4. Research and Development

- 3.5. Competitor Analysis

- 3.6. Regulatory Landscape and Future Policy Changes

-

3.7. Segmentation

- 3.7.1. Commercial

- 3.7.2. Military

-

4. Space Systems and Equipment

- 4.1. Market Overview

-

4.2. Market Dynamics

- 4.2.1. Drivers

- 4.2.2. Restraints

- 4.2.3. Opportunities

- 4.3. Market Trends

- 4.4. Research and Development

- 4.5. Competitor Analysis

- 4.6. Regulatory Landscape and Future Policy Changes

- 4.7. Customer Information

- 4.8. Segmenta

-

4.9. Segmentation: Satellites

-

4.9.1. By Subsystem

- 4.9.1.1. Command and Control System

- 4.9.1.2. Telemetr

- 4.9.1.3. Antenna System

- 4.9.1.4. Transponders

- 4.9.1.5. Power System

-

4.9.2. By Application

- 4.9.2.1. Military

- 4.9.2.2. Commercial

-

4.9.1. By Subsystem

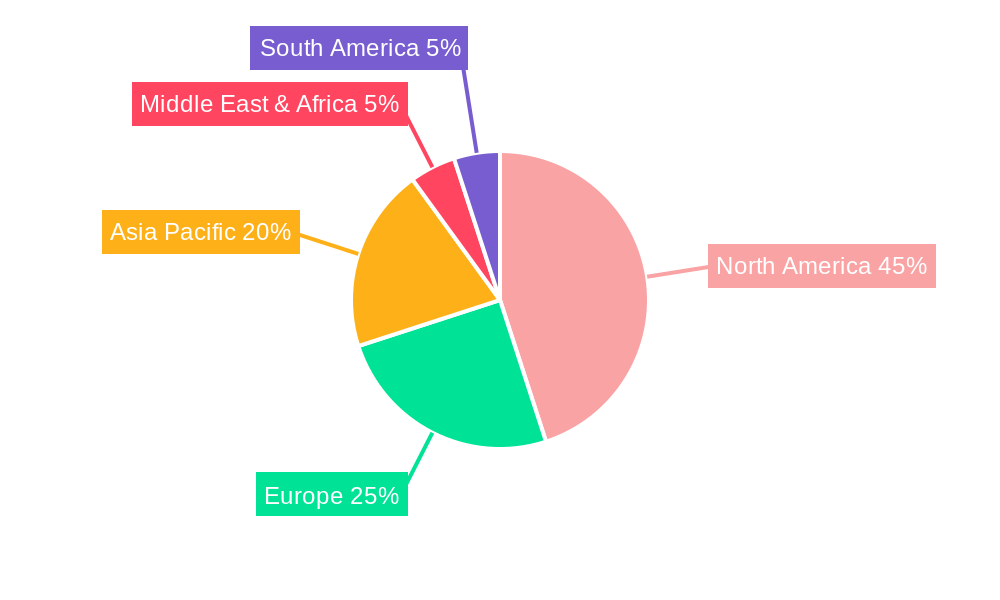

US Aerospace and Defense Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Aerospace and Defense Market Regional Market Share

Geographic Coverage of US Aerospace and Defense Market

US Aerospace and Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Space Sector is Expected to Witness the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Commercial and General Aviation

- 5.1.1. Market Overview

- 5.1.2. Market Dynamics

- 5.1.2.1. Drivers

- 5.1.2.2. Restraints

- 5.1.2.3. Opportunities

- 5.1.3. Market Trends

- 5.1.4. Segmentation: Commercial Aircraft

- 5.1.4.1. Air Traffic

- 5.1.4.2. Training and Flight Simulators

- 5.1.4.3. Airport

- 5.1.4.4. Structures

- 5.1.4.4.1. Airframe

- 5.1.4.4.1.1. Material

- 5.1.4.4.1.2. Adhesives and Coatings

- 5.1.4.4.2. Engine and Engine Systems

- 5.1.4.4.3. Cabin Interiors

- 5.1.4.4.4. Landing Gear

- 5.1.4.4.5. Avionics and Control Systems

- 5.1.4.4.5.1. Communication System

- 5.1.4.4.5.2. Navigation System

- 5.1.4.4.5.3. Flight Control System

- 5.1.4.4.5.4. Health Monitoring System

- 5.1.4.4.6. Electrical Systems

- 5.1.4.4.7. Environmental Control Systems

- 5.1.4.4.8. Fuel and Fuel Systems

- 5.1.4.4.9. MRO

- 5.1.4.4.10. Research and Development

- 5.1.4.4.11. Supply C

- 5.1.4.4.12. Competitor Analysis

- 5.1.4.4.1. Airframe

- 5.1.5. Segmenta

- 5.2. Market Analysis, Insights and Forecast - by Military Aircraft and Systems

- 5.2.1. Market Overview

- 5.2.2. Defense Spending and Budget Allocation Details

- 5.2.2.1. Army

- 5.2.2.2. Navy and Marine Corps

- 5.2.2.3. Air Force

- 5.2.3. Market Dynamics

- 5.2.3.1. Drivers

- 5.2.3.2. Restraints

- 5.2.3.3. Opportunities

- 5.2.4. Market Trends

- 5.2.5. MRO

- 5.2.6. Research and Development

- 5.2.7. Training and Flight Simulators

- 5.2.8. Competitor Analysis

- 5.2.9. Supply Chain Analysis

- 5.2.10. Customer/Distributor Information

- 5.2.11. Segmentation: Combat Aircraft

- 5.2.11.1. Structures

- 5.2.11.1.1. Airframe

- 5.2.11.1.1.1. Material

- 5.2.11.1.1.2. Adhesives and Coatings

- 5.2.11.1.2. Engine and Engine Systems

- 5.2.11.1.3. Landing Gear

- 5.2.11.1.1. Airframe

- 5.2.11.2. Avionics and Control Systems

- 5.2.11.2.1. General Avionics

- 5.2.11.2.2. Mission Specific Avionics

- 5.2.11.3. Missiles and Weapons

- 5.2.11.1. Structures

- 5.2.12. Segmentation: Non-Combat Aircraft

- 5.3. Market Analysis, Insights and Forecast - by Unmanned Aerial Systems

- 5.3.1. Market Overview

- 5.3.2. Market Dynamics

- 5.3.2.1. Drivers

- 5.3.2.2. Restraints

- 5.3.2.3. Opportunities

- 5.3.3. Market Trends

- 5.3.4. Research and Development

- 5.3.5. Competitor Analysis

- 5.3.6. Regulatory Landscape and Future Policy Changes

- 5.3.7. Segmentation

- 5.3.7.1. Commercial

- 5.3.7.2. Military

- 5.4. Market Analysis, Insights and Forecast - by Space Systems and Equipment

- 5.4.1. Market Overview

- 5.4.2. Market Dynamics

- 5.4.2.1. Drivers

- 5.4.2.2. Restraints

- 5.4.2.3. Opportunities

- 5.4.3. Market Trends

- 5.4.4. Research and Development

- 5.4.5. Competitor Analysis

- 5.4.6. Regulatory Landscape and Future Policy Changes

- 5.4.7. Customer Information

- 5.4.8. Segmenta

- 5.4.9. Segmentation: Satellites

- 5.4.9.1. By Subsystem

- 5.4.9.1.1. Command and Control System

- 5.4.9.1.2. Telemetr

- 5.4.9.1.3. Antenna System

- 5.4.9.1.4. Transponders

- 5.4.9.1.5. Power System

- 5.4.9.2. By Application

- 5.4.9.2.1. Military

- 5.4.9.2.2. Commercial

- 5.4.9.1. By Subsystem

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Commercial and General Aviation

- 6. North America US Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Commercial and General Aviation

- 6.1.1. Market Overview

- 6.1.2. Market Dynamics

- 6.1.2.1. Drivers

- 6.1.2.2. Restraints

- 6.1.2.3. Opportunities

- 6.1.3. Market Trends

- 6.1.4. Segmentation: Commercial Aircraft

- 6.1.4.1. Air Traffic

- 6.1.4.2. Training and Flight Simulators

- 6.1.4.3. Airport

- 6.1.4.4. Structures

- 6.1.4.4.1. Airframe

- 6.1.4.4.1.1. Material

- 6.1.4.4.1.2. Adhesives and Coatings

- 6.1.4.4.2. Engine and Engine Systems

- 6.1.4.4.3. Cabin Interiors

- 6.1.4.4.4. Landing Gear

- 6.1.4.4.5. Avionics and Control Systems

- 6.1.4.4.5.1. Communication System

- 6.1.4.4.5.2. Navigation System

- 6.1.4.4.5.3. Flight Control System

- 6.1.4.4.5.4. Health Monitoring System

- 6.1.4.4.6. Electrical Systems

- 6.1.4.4.7. Environmental Control Systems

- 6.1.4.4.8. Fuel and Fuel Systems

- 6.1.4.4.9. MRO

- 6.1.4.4.10. Research and Development

- 6.1.4.4.11. Supply C

- 6.1.4.4.12. Competitor Analysis

- 6.1.4.4.1. Airframe

- 6.1.5. Segmenta

- 6.2. Market Analysis, Insights and Forecast - by Military Aircraft and Systems

- 6.2.1. Market Overview

- 6.2.2. Defense Spending and Budget Allocation Details

- 6.2.2.1. Army

- 6.2.2.2. Navy and Marine Corps

- 6.2.2.3. Air Force

- 6.2.3. Market Dynamics

- 6.2.3.1. Drivers

- 6.2.3.2. Restraints

- 6.2.3.3. Opportunities

- 6.2.4. Market Trends

- 6.2.5. MRO

- 6.2.6. Research and Development

- 6.2.7. Training and Flight Simulators

- 6.2.8. Competitor Analysis

- 6.2.9. Supply Chain Analysis

- 6.2.10. Customer/Distributor Information

- 6.2.11. Segmentation: Combat Aircraft

- 6.2.11.1. Structures

- 6.2.11.1.1. Airframe

- 6.2.11.1.1.1. Material

- 6.2.11.1.1.2. Adhesives and Coatings

- 6.2.11.1.2. Engine and Engine Systems

- 6.2.11.1.3. Landing Gear

- 6.2.11.1.1. Airframe

- 6.2.11.2. Avionics and Control Systems

- 6.2.11.2.1. General Avionics

- 6.2.11.2.2. Mission Specific Avionics

- 6.2.11.3. Missiles and Weapons

- 6.2.11.1. Structures

- 6.2.12. Segmentation: Non-Combat Aircraft

- 6.3. Market Analysis, Insights and Forecast - by Unmanned Aerial Systems

- 6.3.1. Market Overview

- 6.3.2. Market Dynamics

- 6.3.2.1. Drivers

- 6.3.2.2. Restraints

- 6.3.2.3. Opportunities

- 6.3.3. Market Trends

- 6.3.4. Research and Development

- 6.3.5. Competitor Analysis

- 6.3.6. Regulatory Landscape and Future Policy Changes

- 6.3.7. Segmentation

- 6.3.7.1. Commercial

- 6.3.7.2. Military

- 6.4. Market Analysis, Insights and Forecast - by Space Systems and Equipment

- 6.4.1. Market Overview

- 6.4.2. Market Dynamics

- 6.4.2.1. Drivers

- 6.4.2.2. Restraints

- 6.4.2.3. Opportunities

- 6.4.3. Market Trends

- 6.4.4. Research and Development

- 6.4.5. Competitor Analysis

- 6.4.6. Regulatory Landscape and Future Policy Changes

- 6.4.7. Customer Information

- 6.4.8. Segmenta

- 6.4.9. Segmentation: Satellites

- 6.4.9.1. By Subsystem

- 6.4.9.1.1. Command and Control System

- 6.4.9.1.2. Telemetr

- 6.4.9.1.3. Antenna System

- 6.4.9.1.4. Transponders

- 6.4.9.1.5. Power System

- 6.4.9.2. By Application

- 6.4.9.2.1. Military

- 6.4.9.2.2. Commercial

- 6.4.9.1. By Subsystem

- 6.1. Market Analysis, Insights and Forecast - by Commercial and General Aviation

- 7. South America US Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Commercial and General Aviation

- 7.1.1. Market Overview

- 7.1.2. Market Dynamics

- 7.1.2.1. Drivers

- 7.1.2.2. Restraints

- 7.1.2.3. Opportunities

- 7.1.3. Market Trends

- 7.1.4. Segmentation: Commercial Aircraft

- 7.1.4.1. Air Traffic

- 7.1.4.2. Training and Flight Simulators

- 7.1.4.3. Airport

- 7.1.4.4. Structures

- 7.1.4.4.1. Airframe

- 7.1.4.4.1.1. Material

- 7.1.4.4.1.2. Adhesives and Coatings

- 7.1.4.4.2. Engine and Engine Systems

- 7.1.4.4.3. Cabin Interiors

- 7.1.4.4.4. Landing Gear

- 7.1.4.4.5. Avionics and Control Systems

- 7.1.4.4.5.1. Communication System

- 7.1.4.4.5.2. Navigation System

- 7.1.4.4.5.3. Flight Control System

- 7.1.4.4.5.4. Health Monitoring System

- 7.1.4.4.6. Electrical Systems

- 7.1.4.4.7. Environmental Control Systems

- 7.1.4.4.8. Fuel and Fuel Systems

- 7.1.4.4.9. MRO

- 7.1.4.4.10. Research and Development

- 7.1.4.4.11. Supply C

- 7.1.4.4.12. Competitor Analysis

- 7.1.4.4.1. Airframe

- 7.1.5. Segmenta

- 7.2. Market Analysis, Insights and Forecast - by Military Aircraft and Systems

- 7.2.1. Market Overview

- 7.2.2. Defense Spending and Budget Allocation Details

- 7.2.2.1. Army

- 7.2.2.2. Navy and Marine Corps

- 7.2.2.3. Air Force

- 7.2.3. Market Dynamics

- 7.2.3.1. Drivers

- 7.2.3.2. Restraints

- 7.2.3.3. Opportunities

- 7.2.4. Market Trends

- 7.2.5. MRO

- 7.2.6. Research and Development

- 7.2.7. Training and Flight Simulators

- 7.2.8. Competitor Analysis

- 7.2.9. Supply Chain Analysis

- 7.2.10. Customer/Distributor Information

- 7.2.11. Segmentation: Combat Aircraft

- 7.2.11.1. Structures

- 7.2.11.1.1. Airframe

- 7.2.11.1.1.1. Material

- 7.2.11.1.1.2. Adhesives and Coatings

- 7.2.11.1.2. Engine and Engine Systems

- 7.2.11.1.3. Landing Gear

- 7.2.11.1.1. Airframe

- 7.2.11.2. Avionics and Control Systems

- 7.2.11.2.1. General Avionics

- 7.2.11.2.2. Mission Specific Avionics

- 7.2.11.3. Missiles and Weapons

- 7.2.11.1. Structures

- 7.2.12. Segmentation: Non-Combat Aircraft

- 7.3. Market Analysis, Insights and Forecast - by Unmanned Aerial Systems

- 7.3.1. Market Overview

- 7.3.2. Market Dynamics

- 7.3.2.1. Drivers

- 7.3.2.2. Restraints

- 7.3.2.3. Opportunities

- 7.3.3. Market Trends

- 7.3.4. Research and Development

- 7.3.5. Competitor Analysis

- 7.3.6. Regulatory Landscape and Future Policy Changes

- 7.3.7. Segmentation

- 7.3.7.1. Commercial

- 7.3.7.2. Military

- 7.4. Market Analysis, Insights and Forecast - by Space Systems and Equipment

- 7.4.1. Market Overview

- 7.4.2. Market Dynamics

- 7.4.2.1. Drivers

- 7.4.2.2. Restraints

- 7.4.2.3. Opportunities

- 7.4.3. Market Trends

- 7.4.4. Research and Development

- 7.4.5. Competitor Analysis

- 7.4.6. Regulatory Landscape and Future Policy Changes

- 7.4.7. Customer Information

- 7.4.8. Segmenta

- 7.4.9. Segmentation: Satellites

- 7.4.9.1. By Subsystem

- 7.4.9.1.1. Command and Control System

- 7.4.9.1.2. Telemetr

- 7.4.9.1.3. Antenna System

- 7.4.9.1.4. Transponders

- 7.4.9.1.5. Power System

- 7.4.9.2. By Application

- 7.4.9.2.1. Military

- 7.4.9.2.2. Commercial

- 7.4.9.1. By Subsystem

- 7.1. Market Analysis, Insights and Forecast - by Commercial and General Aviation

- 8. Europe US Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Commercial and General Aviation

- 8.1.1. Market Overview

- 8.1.2. Market Dynamics

- 8.1.2.1. Drivers

- 8.1.2.2. Restraints

- 8.1.2.3. Opportunities

- 8.1.3. Market Trends

- 8.1.4. Segmentation: Commercial Aircraft

- 8.1.4.1. Air Traffic

- 8.1.4.2. Training and Flight Simulators

- 8.1.4.3. Airport

- 8.1.4.4. Structures

- 8.1.4.4.1. Airframe

- 8.1.4.4.1.1. Material

- 8.1.4.4.1.2. Adhesives and Coatings

- 8.1.4.4.2. Engine and Engine Systems

- 8.1.4.4.3. Cabin Interiors

- 8.1.4.4.4. Landing Gear

- 8.1.4.4.5. Avionics and Control Systems

- 8.1.4.4.5.1. Communication System

- 8.1.4.4.5.2. Navigation System

- 8.1.4.4.5.3. Flight Control System

- 8.1.4.4.5.4. Health Monitoring System

- 8.1.4.4.6. Electrical Systems

- 8.1.4.4.7. Environmental Control Systems

- 8.1.4.4.8. Fuel and Fuel Systems

- 8.1.4.4.9. MRO

- 8.1.4.4.10. Research and Development

- 8.1.4.4.11. Supply C

- 8.1.4.4.12. Competitor Analysis

- 8.1.4.4.1. Airframe

- 8.1.5. Segmenta

- 8.2. Market Analysis, Insights and Forecast - by Military Aircraft and Systems

- 8.2.1. Market Overview

- 8.2.2. Defense Spending and Budget Allocation Details

- 8.2.2.1. Army

- 8.2.2.2. Navy and Marine Corps

- 8.2.2.3. Air Force

- 8.2.3. Market Dynamics

- 8.2.3.1. Drivers

- 8.2.3.2. Restraints

- 8.2.3.3. Opportunities

- 8.2.4. Market Trends

- 8.2.5. MRO

- 8.2.6. Research and Development

- 8.2.7. Training and Flight Simulators

- 8.2.8. Competitor Analysis

- 8.2.9. Supply Chain Analysis

- 8.2.10. Customer/Distributor Information

- 8.2.11. Segmentation: Combat Aircraft

- 8.2.11.1. Structures

- 8.2.11.1.1. Airframe

- 8.2.11.1.1.1. Material

- 8.2.11.1.1.2. Adhesives and Coatings

- 8.2.11.1.2. Engine and Engine Systems

- 8.2.11.1.3. Landing Gear

- 8.2.11.1.1. Airframe

- 8.2.11.2. Avionics and Control Systems

- 8.2.11.2.1. General Avionics

- 8.2.11.2.2. Mission Specific Avionics

- 8.2.11.3. Missiles and Weapons

- 8.2.11.1. Structures

- 8.2.12. Segmentation: Non-Combat Aircraft

- 8.3. Market Analysis, Insights and Forecast - by Unmanned Aerial Systems

- 8.3.1. Market Overview

- 8.3.2. Market Dynamics

- 8.3.2.1. Drivers

- 8.3.2.2. Restraints

- 8.3.2.3. Opportunities

- 8.3.3. Market Trends

- 8.3.4. Research and Development

- 8.3.5. Competitor Analysis

- 8.3.6. Regulatory Landscape and Future Policy Changes

- 8.3.7. Segmentation

- 8.3.7.1. Commercial

- 8.3.7.2. Military

- 8.4. Market Analysis, Insights and Forecast - by Space Systems and Equipment

- 8.4.1. Market Overview

- 8.4.2. Market Dynamics

- 8.4.2.1. Drivers

- 8.4.2.2. Restraints

- 8.4.2.3. Opportunities

- 8.4.3. Market Trends

- 8.4.4. Research and Development

- 8.4.5. Competitor Analysis

- 8.4.6. Regulatory Landscape and Future Policy Changes

- 8.4.7. Customer Information

- 8.4.8. Segmenta

- 8.4.9. Segmentation: Satellites

- 8.4.9.1. By Subsystem

- 8.4.9.1.1. Command and Control System

- 8.4.9.1.2. Telemetr

- 8.4.9.1.3. Antenna System

- 8.4.9.1.4. Transponders

- 8.4.9.1.5. Power System

- 8.4.9.2. By Application

- 8.4.9.2.1. Military

- 8.4.9.2.2. Commercial

- 8.4.9.1. By Subsystem

- 8.1. Market Analysis, Insights and Forecast - by Commercial and General Aviation

- 9. Middle East & Africa US Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Commercial and General Aviation

- 9.1.1. Market Overview

- 9.1.2. Market Dynamics

- 9.1.2.1. Drivers

- 9.1.2.2. Restraints

- 9.1.2.3. Opportunities

- 9.1.3. Market Trends

- 9.1.4. Segmentation: Commercial Aircraft

- 9.1.4.1. Air Traffic

- 9.1.4.2. Training and Flight Simulators

- 9.1.4.3. Airport

- 9.1.4.4. Structures

- 9.1.4.4.1. Airframe

- 9.1.4.4.1.1. Material

- 9.1.4.4.1.2. Adhesives and Coatings

- 9.1.4.4.2. Engine and Engine Systems

- 9.1.4.4.3. Cabin Interiors

- 9.1.4.4.4. Landing Gear

- 9.1.4.4.5. Avionics and Control Systems

- 9.1.4.4.5.1. Communication System

- 9.1.4.4.5.2. Navigation System

- 9.1.4.4.5.3. Flight Control System

- 9.1.4.4.5.4. Health Monitoring System

- 9.1.4.4.6. Electrical Systems

- 9.1.4.4.7. Environmental Control Systems

- 9.1.4.4.8. Fuel and Fuel Systems

- 9.1.4.4.9. MRO

- 9.1.4.4.10. Research and Development

- 9.1.4.4.11. Supply C

- 9.1.4.4.12. Competitor Analysis

- 9.1.4.4.1. Airframe

- 9.1.5. Segmenta

- 9.2. Market Analysis, Insights and Forecast - by Military Aircraft and Systems

- 9.2.1. Market Overview

- 9.2.2. Defense Spending and Budget Allocation Details

- 9.2.2.1. Army

- 9.2.2.2. Navy and Marine Corps

- 9.2.2.3. Air Force

- 9.2.3. Market Dynamics

- 9.2.3.1. Drivers

- 9.2.3.2. Restraints

- 9.2.3.3. Opportunities

- 9.2.4. Market Trends

- 9.2.5. MRO

- 9.2.6. Research and Development

- 9.2.7. Training and Flight Simulators

- 9.2.8. Competitor Analysis

- 9.2.9. Supply Chain Analysis

- 9.2.10. Customer/Distributor Information

- 9.2.11. Segmentation: Combat Aircraft

- 9.2.11.1. Structures

- 9.2.11.1.1. Airframe

- 9.2.11.1.1.1. Material

- 9.2.11.1.1.2. Adhesives and Coatings

- 9.2.11.1.2. Engine and Engine Systems

- 9.2.11.1.3. Landing Gear

- 9.2.11.1.1. Airframe

- 9.2.11.2. Avionics and Control Systems

- 9.2.11.2.1. General Avionics

- 9.2.11.2.2. Mission Specific Avionics

- 9.2.11.3. Missiles and Weapons

- 9.2.11.1. Structures

- 9.2.12. Segmentation: Non-Combat Aircraft

- 9.3. Market Analysis, Insights and Forecast - by Unmanned Aerial Systems

- 9.3.1. Market Overview

- 9.3.2. Market Dynamics

- 9.3.2.1. Drivers

- 9.3.2.2. Restraints

- 9.3.2.3. Opportunities

- 9.3.3. Market Trends

- 9.3.4. Research and Development

- 9.3.5. Competitor Analysis

- 9.3.6. Regulatory Landscape and Future Policy Changes

- 9.3.7. Segmentation

- 9.3.7.1. Commercial

- 9.3.7.2. Military

- 9.4. Market Analysis, Insights and Forecast - by Space Systems and Equipment

- 9.4.1. Market Overview

- 9.4.2. Market Dynamics

- 9.4.2.1. Drivers

- 9.4.2.2. Restraints

- 9.4.2.3. Opportunities

- 9.4.3. Market Trends

- 9.4.4. Research and Development

- 9.4.5. Competitor Analysis

- 9.4.6. Regulatory Landscape and Future Policy Changes

- 9.4.7. Customer Information

- 9.4.8. Segmenta

- 9.4.9. Segmentation: Satellites

- 9.4.9.1. By Subsystem

- 9.4.9.1.1. Command and Control System

- 9.4.9.1.2. Telemetr

- 9.4.9.1.3. Antenna System

- 9.4.9.1.4. Transponders

- 9.4.9.1.5. Power System

- 9.4.9.2. By Application

- 9.4.9.2.1. Military

- 9.4.9.2.2. Commercial

- 9.4.9.1. By Subsystem

- 9.1. Market Analysis, Insights and Forecast - by Commercial and General Aviation

- 10. Asia Pacific US Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Commercial and General Aviation

- 10.1.1. Market Overview

- 10.1.2. Market Dynamics

- 10.1.2.1. Drivers

- 10.1.2.2. Restraints

- 10.1.2.3. Opportunities

- 10.1.3. Market Trends

- 10.1.4. Segmentation: Commercial Aircraft

- 10.1.4.1. Air Traffic

- 10.1.4.2. Training and Flight Simulators

- 10.1.4.3. Airport

- 10.1.4.4. Structures

- 10.1.4.4.1. Airframe

- 10.1.4.4.1.1. Material

- 10.1.4.4.1.2. Adhesives and Coatings

- 10.1.4.4.2. Engine and Engine Systems

- 10.1.4.4.3. Cabin Interiors

- 10.1.4.4.4. Landing Gear

- 10.1.4.4.5. Avionics and Control Systems

- 10.1.4.4.5.1. Communication System

- 10.1.4.4.5.2. Navigation System

- 10.1.4.4.5.3. Flight Control System

- 10.1.4.4.5.4. Health Monitoring System

- 10.1.4.4.6. Electrical Systems

- 10.1.4.4.7. Environmental Control Systems

- 10.1.4.4.8. Fuel and Fuel Systems

- 10.1.4.4.9. MRO

- 10.1.4.4.10. Research and Development

- 10.1.4.4.11. Supply C

- 10.1.4.4.12. Competitor Analysis

- 10.1.4.4.1. Airframe

- 10.1.5. Segmenta

- 10.2. Market Analysis, Insights and Forecast - by Military Aircraft and Systems

- 10.2.1. Market Overview

- 10.2.2. Defense Spending and Budget Allocation Details

- 10.2.2.1. Army

- 10.2.2.2. Navy and Marine Corps

- 10.2.2.3. Air Force

- 10.2.3. Market Dynamics

- 10.2.3.1. Drivers

- 10.2.3.2. Restraints

- 10.2.3.3. Opportunities

- 10.2.4. Market Trends

- 10.2.5. MRO

- 10.2.6. Research and Development

- 10.2.7. Training and Flight Simulators

- 10.2.8. Competitor Analysis

- 10.2.9. Supply Chain Analysis

- 10.2.10. Customer/Distributor Information

- 10.2.11. Segmentation: Combat Aircraft

- 10.2.11.1. Structures

- 10.2.11.1.1. Airframe

- 10.2.11.1.1.1. Material

- 10.2.11.1.1.2. Adhesives and Coatings

- 10.2.11.1.2. Engine and Engine Systems

- 10.2.11.1.3. Landing Gear

- 10.2.11.1.1. Airframe

- 10.2.11.2. Avionics and Control Systems

- 10.2.11.2.1. General Avionics

- 10.2.11.2.2. Mission Specific Avionics

- 10.2.11.3. Missiles and Weapons

- 10.2.11.1. Structures

- 10.2.12. Segmentation: Non-Combat Aircraft

- 10.3. Market Analysis, Insights and Forecast - by Unmanned Aerial Systems

- 10.3.1. Market Overview

- 10.3.2. Market Dynamics

- 10.3.2.1. Drivers

- 10.3.2.2. Restraints

- 10.3.2.3. Opportunities

- 10.3.3. Market Trends

- 10.3.4. Research and Development

- 10.3.5. Competitor Analysis

- 10.3.6. Regulatory Landscape and Future Policy Changes

- 10.3.7. Segmentation

- 10.3.7.1. Commercial

- 10.3.7.2. Military

- 10.4. Market Analysis, Insights and Forecast - by Space Systems and Equipment

- 10.4.1. Market Overview

- 10.4.2. Market Dynamics

- 10.4.2.1. Drivers

- 10.4.2.2. Restraints

- 10.4.2.3. Opportunities

- 10.4.3. Market Trends

- 10.4.4. Research and Development

- 10.4.5. Competitor Analysis

- 10.4.6. Regulatory Landscape and Future Policy Changes

- 10.4.7. Customer Information

- 10.4.8. Segmenta

- 10.4.9. Segmentation: Satellites

- 10.4.9.1. By Subsystem

- 10.4.9.1.1. Command and Control System

- 10.4.9.1.2. Telemetr

- 10.4.9.1.3. Antenna System

- 10.4.9.1.4. Transponders

- 10.4.9.1.5. Power System

- 10.4.9.2. By Application

- 10.4.9.2.1. Military

- 10.4.9.2.2. Commercial

- 10.4.9.1. By Subsystem

- 10.1. Market Analysis, Insights and Forecast - by Commercial and General Aviation

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 L3Harris Technologies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 THALES

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Dynamics Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rheinmetall AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lockheed Martin Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Airbus SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 QinetiQ Group PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Naval Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fincantieri S p A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Safran SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 RTX Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Embraer SA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Leonardo S p A

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Rolls-Royce plc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 BAE Systems plc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Northrop Grumman Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 The Boeing Company

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 GKN Aerospace

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global US Aerospace and Defense Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Aerospace and Defense Market Revenue (Million), by Commercial and General Aviation 2025 & 2033

- Figure 3: North America US Aerospace and Defense Market Revenue Share (%), by Commercial and General Aviation 2025 & 2033

- Figure 4: North America US Aerospace and Defense Market Revenue (Million), by Military Aircraft and Systems 2025 & 2033

- Figure 5: North America US Aerospace and Defense Market Revenue Share (%), by Military Aircraft and Systems 2025 & 2033

- Figure 6: North America US Aerospace and Defense Market Revenue (Million), by Unmanned Aerial Systems 2025 & 2033

- Figure 7: North America US Aerospace and Defense Market Revenue Share (%), by Unmanned Aerial Systems 2025 & 2033

- Figure 8: North America US Aerospace and Defense Market Revenue (Million), by Space Systems and Equipment 2025 & 2033

- Figure 9: North America US Aerospace and Defense Market Revenue Share (%), by Space Systems and Equipment 2025 & 2033

- Figure 10: North America US Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America US Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America US Aerospace and Defense Market Revenue (Million), by Commercial and General Aviation 2025 & 2033

- Figure 13: South America US Aerospace and Defense Market Revenue Share (%), by Commercial and General Aviation 2025 & 2033

- Figure 14: South America US Aerospace and Defense Market Revenue (Million), by Military Aircraft and Systems 2025 & 2033

- Figure 15: South America US Aerospace and Defense Market Revenue Share (%), by Military Aircraft and Systems 2025 & 2033

- Figure 16: South America US Aerospace and Defense Market Revenue (Million), by Unmanned Aerial Systems 2025 & 2033

- Figure 17: South America US Aerospace and Defense Market Revenue Share (%), by Unmanned Aerial Systems 2025 & 2033

- Figure 18: South America US Aerospace and Defense Market Revenue (Million), by Space Systems and Equipment 2025 & 2033

- Figure 19: South America US Aerospace and Defense Market Revenue Share (%), by Space Systems and Equipment 2025 & 2033

- Figure 20: South America US Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 21: South America US Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe US Aerospace and Defense Market Revenue (Million), by Commercial and General Aviation 2025 & 2033

- Figure 23: Europe US Aerospace and Defense Market Revenue Share (%), by Commercial and General Aviation 2025 & 2033

- Figure 24: Europe US Aerospace and Defense Market Revenue (Million), by Military Aircraft and Systems 2025 & 2033

- Figure 25: Europe US Aerospace and Defense Market Revenue Share (%), by Military Aircraft and Systems 2025 & 2033

- Figure 26: Europe US Aerospace and Defense Market Revenue (Million), by Unmanned Aerial Systems 2025 & 2033

- Figure 27: Europe US Aerospace and Defense Market Revenue Share (%), by Unmanned Aerial Systems 2025 & 2033

- Figure 28: Europe US Aerospace and Defense Market Revenue (Million), by Space Systems and Equipment 2025 & 2033

- Figure 29: Europe US Aerospace and Defense Market Revenue Share (%), by Space Systems and Equipment 2025 & 2033

- Figure 30: Europe US Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe US Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa US Aerospace and Defense Market Revenue (Million), by Commercial and General Aviation 2025 & 2033

- Figure 33: Middle East & Africa US Aerospace and Defense Market Revenue Share (%), by Commercial and General Aviation 2025 & 2033

- Figure 34: Middle East & Africa US Aerospace and Defense Market Revenue (Million), by Military Aircraft and Systems 2025 & 2033

- Figure 35: Middle East & Africa US Aerospace and Defense Market Revenue Share (%), by Military Aircraft and Systems 2025 & 2033

- Figure 36: Middle East & Africa US Aerospace and Defense Market Revenue (Million), by Unmanned Aerial Systems 2025 & 2033

- Figure 37: Middle East & Africa US Aerospace and Defense Market Revenue Share (%), by Unmanned Aerial Systems 2025 & 2033

- Figure 38: Middle East & Africa US Aerospace and Defense Market Revenue (Million), by Space Systems and Equipment 2025 & 2033

- Figure 39: Middle East & Africa US Aerospace and Defense Market Revenue Share (%), by Space Systems and Equipment 2025 & 2033

- Figure 40: Middle East & Africa US Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa US Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US Aerospace and Defense Market Revenue (Million), by Commercial and General Aviation 2025 & 2033

- Figure 43: Asia Pacific US Aerospace and Defense Market Revenue Share (%), by Commercial and General Aviation 2025 & 2033

- Figure 44: Asia Pacific US Aerospace and Defense Market Revenue (Million), by Military Aircraft and Systems 2025 & 2033

- Figure 45: Asia Pacific US Aerospace and Defense Market Revenue Share (%), by Military Aircraft and Systems 2025 & 2033

- Figure 46: Asia Pacific US Aerospace and Defense Market Revenue (Million), by Unmanned Aerial Systems 2025 & 2033

- Figure 47: Asia Pacific US Aerospace and Defense Market Revenue Share (%), by Unmanned Aerial Systems 2025 & 2033

- Figure 48: Asia Pacific US Aerospace and Defense Market Revenue (Million), by Space Systems and Equipment 2025 & 2033

- Figure 49: Asia Pacific US Aerospace and Defense Market Revenue Share (%), by Space Systems and Equipment 2025 & 2033

- Figure 50: Asia Pacific US Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific US Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Aerospace and Defense Market Revenue Million Forecast, by Commercial and General Aviation 2020 & 2033

- Table 2: Global US Aerospace and Defense Market Revenue Million Forecast, by Military Aircraft and Systems 2020 & 2033

- Table 3: Global US Aerospace and Defense Market Revenue Million Forecast, by Unmanned Aerial Systems 2020 & 2033

- Table 4: Global US Aerospace and Defense Market Revenue Million Forecast, by Space Systems and Equipment 2020 & 2033

- Table 5: Global US Aerospace and Defense Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global US Aerospace and Defense Market Revenue Million Forecast, by Commercial and General Aviation 2020 & 2033

- Table 7: Global US Aerospace and Defense Market Revenue Million Forecast, by Military Aircraft and Systems 2020 & 2033

- Table 8: Global US Aerospace and Defense Market Revenue Million Forecast, by Unmanned Aerial Systems 2020 & 2033

- Table 9: Global US Aerospace and Defense Market Revenue Million Forecast, by Space Systems and Equipment 2020 & 2033

- Table 10: Global US Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global US Aerospace and Defense Market Revenue Million Forecast, by Commercial and General Aviation 2020 & 2033

- Table 15: Global US Aerospace and Defense Market Revenue Million Forecast, by Military Aircraft and Systems 2020 & 2033

- Table 16: Global US Aerospace and Defense Market Revenue Million Forecast, by Unmanned Aerial Systems 2020 & 2033

- Table 17: Global US Aerospace and Defense Market Revenue Million Forecast, by Space Systems and Equipment 2020 & 2033

- Table 18: Global US Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global US Aerospace and Defense Market Revenue Million Forecast, by Commercial and General Aviation 2020 & 2033

- Table 23: Global US Aerospace and Defense Market Revenue Million Forecast, by Military Aircraft and Systems 2020 & 2033

- Table 24: Global US Aerospace and Defense Market Revenue Million Forecast, by Unmanned Aerial Systems 2020 & 2033

- Table 25: Global US Aerospace and Defense Market Revenue Million Forecast, by Space Systems and Equipment 2020 & 2033

- Table 26: Global US Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global US Aerospace and Defense Market Revenue Million Forecast, by Commercial and General Aviation 2020 & 2033

- Table 37: Global US Aerospace and Defense Market Revenue Million Forecast, by Military Aircraft and Systems 2020 & 2033

- Table 38: Global US Aerospace and Defense Market Revenue Million Forecast, by Unmanned Aerial Systems 2020 & 2033

- Table 39: Global US Aerospace and Defense Market Revenue Million Forecast, by Space Systems and Equipment 2020 & 2033

- Table 40: Global US Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global US Aerospace and Defense Market Revenue Million Forecast, by Commercial and General Aviation 2020 & 2033

- Table 48: Global US Aerospace and Defense Market Revenue Million Forecast, by Military Aircraft and Systems 2020 & 2033

- Table 49: Global US Aerospace and Defense Market Revenue Million Forecast, by Unmanned Aerial Systems 2020 & 2033

- Table 50: Global US Aerospace and Defense Market Revenue Million Forecast, by Space Systems and Equipment 2020 & 2033

- Table 51: Global US Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific US Aerospace and Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Aerospace and Defense Market?

The projected CAGR is approximately 5.76%.

2. Which companies are prominent players in the US Aerospace and Defense Market?

Key companies in the market include Textron Inc, L3Harris Technologies Inc, THALES, General Dynamics Corporation, Rheinmetall AG, Lockheed Martin Corporation, Airbus SE, QinetiQ Group PLC, Naval Group, Fincantieri S p A, Safran SA, RTX Corporation, Embraer SA, Leonardo S p A, Rolls-Royce plc, BAE Systems plc, Northrop Grumman Corporation, The Boeing Company, GKN Aerospace.

3. What are the main segments of the US Aerospace and Defense Market?

The market segments include Commercial and General Aviation, Military Aircraft and Systems, Unmanned Aerial Systems, Space Systems and Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD 496.56 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Space Sector is Expected to Witness the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Aerospace and Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Aerospace and Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Aerospace and Defense Market?

To stay informed about further developments, trends, and reports in the US Aerospace and Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence