Key Insights

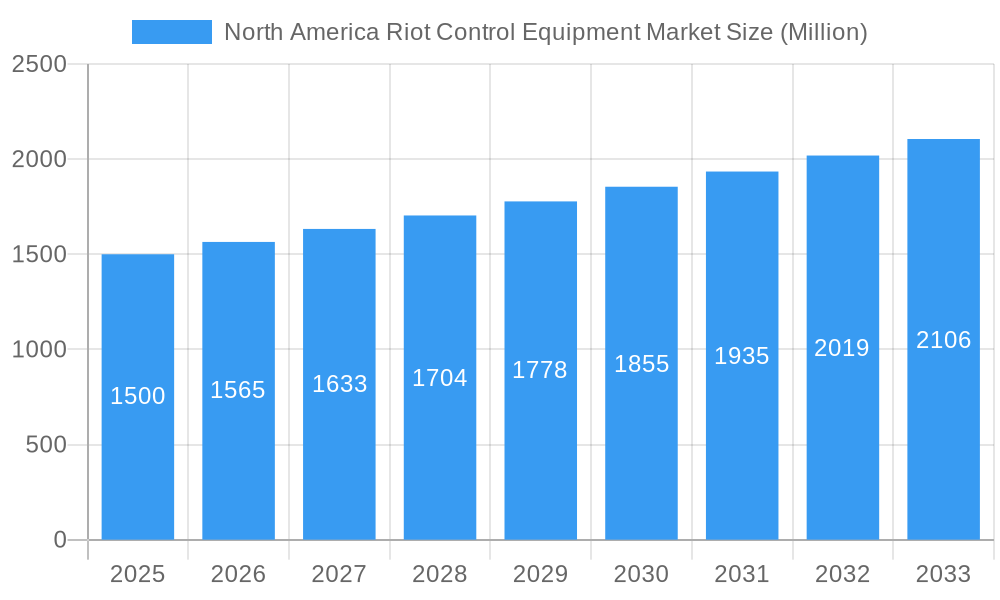

The North America Riot Control Equipment Market is poised for robust expansion, driven by a confluence of factors including increasing civil unrest, evolving security threats, and significant investments in law enforcement and military modernization. The market, estimated to be valued at approximately $1.5 billion in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) exceeding 4.30% throughout the forecast period of 2025-2033. This growth is primarily fueled by the escalating demand for advanced Personnel Protection Equipment (PPE) such as body armor, helmets, and shields, designed to safeguard law enforcement and military personnel during high-risk operations. Furthermore, the rising adoption of sophisticated Crowd Dispersal Equipment, including non-lethal projectiles, tear gas launchers, and sonic devices, to manage public disturbances with minimal casualties is a significant market catalyst. Governments across North America are prioritizing the equipping of their security forces with state-of-the-art riot control solutions, recognizing their critical role in maintaining public order and national security.

North America Riot Control Equipment Market Market Size (In Billion)

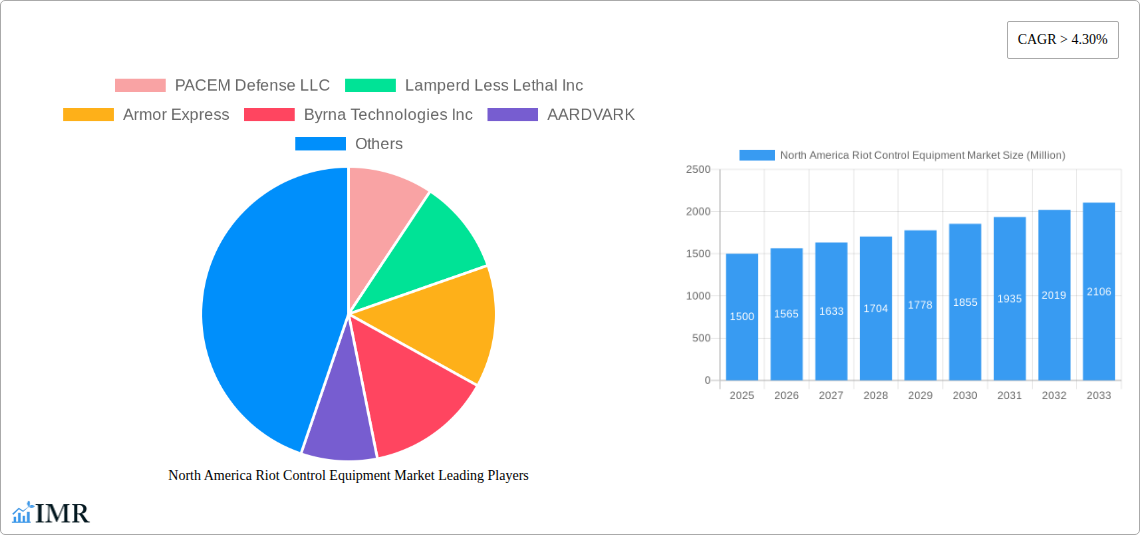

The market dynamics are further shaped by evolving technological advancements and strategic collaborations among key players. Companies are investing heavily in research and development to introduce innovative, less-lethal technologies that offer enhanced effectiveness and improved safety profiles. The competitive landscape is characterized by the presence of established manufacturers like PACEM Defense LLC, Lamperd Less Lethal Inc., and Armor Express, alongside emerging players actively seeking to capture market share. While the market presents substantial growth opportunities, it also faces certain restraints, including stringent regulatory frameworks concerning the use of certain riot control agents and equipment, as well as budgetary constraints faced by some public safety agencies. However, the overarching trend towards equipping security forces with more effective and humane riot control solutions is expected to propel sustained market growth, with North America, particularly the United States, Canada, and Mexico, serving as a primary hub for both demand and innovation in this sector.

North America Riot Control Equipment Market Company Market Share

North America Riot Control Equipment Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the North America riot control equipment market, offering critical insights into its dynamics, growth trends, and future trajectory. Covering a study period from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for manufacturers, suppliers, law enforcement agencies, military organizations, investors, and industry stakeholders seeking to understand market drivers, challenges, and opportunities. The report presents all values in Million units and integrates high-traffic keywords to maximize visibility for crucial segments like riot control gear, less-lethal weapons, police equipment, crowd control solutions, personnel protection equipment, and military riot gear.

North America Riot Control Equipment Market Market Dynamics & Structure

The North America riot control equipment market exhibits a moderately concentrated structure, with a blend of established industry giants and agile, specialized manufacturers. Technological innovation is a primary driver, fueled by the continuous demand for more effective, less-lethal, and safer solutions for law enforcement and military applications. Robust regulatory frameworks govern the development, deployment, and use of these sensitive technologies, influencing product design and market entry strategies. Competitive product substitutes, ranging from traditional kinetic options to advanced electroshock weapons and chemical irritants, constantly challenge existing market shares. End-user demographics, predominantly law enforcement agencies and military and special forces, are characterized by increasing budget allocations for modernization and enhanced operational capabilities. Mergers and acquisitions (M&A) trends are evident as companies seek to consolidate market presence, expand product portfolios, and acquire innovative technologies. For instance, recent M&A activities have focused on integrating advanced sensor technology with existing riot control systems. The market share for personnel protection equipment is estimated to be around 60%, while crowd dispersal equipment accounts for the remaining 40% in 2025. Barriers to innovation include stringent testing and certification requirements, alongside ethical considerations surrounding the use of force.

- Market Concentration: Moderately concentrated, with key players holding significant shares.

- Technological Innovation Drivers: Demand for advanced less-lethal options, improved situational awareness, and officer/public safety.

- Regulatory Frameworks: Strict oversight from government bodies on product efficacy, safety, and ethical deployment.

- Competitive Product Substitutes: Kinetic projectiles, chemical agents, electroshock weapons, acoustic devices, and advanced containment systems.

- End-User Demographics: Primarily Law Enforcement (approx. 70% of demand) and Military & Special Forces (approx. 30% of demand).

- M&A Trends: Consolidation for expanded capabilities, technology acquisition, and market penetration.

- Market Share (2025 Estimate): Personnel Protection Equipment: 60%, Crowd Dispersal Equipment: 40%.

North America Riot Control Equipment Market Growth Trends & Insights

The North America riot control equipment market is poised for robust growth, driven by escalating security concerns, increasing civil unrest incidents, and the evolving nature of law enforcement and military operations. The market size is projected to expand significantly from an estimated value of $1,500 million units in 2025 to reach $2,800 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. Adoption rates for advanced riot control solutions are on an upward trajectory, particularly for less-lethal technologies that aim to minimize casualties and de-escalate volatile situations. Technological disruptions, such as the integration of artificial intelligence for threat assessment and the development of smart protective gear, are reshaping the market landscape. Consumer behavior shifts are characterized by a growing preference for integrated systems that enhance officer safety, improve communication, and provide real-time situational intelligence. The increasing emphasis on de-escalation tactics and the reduction of deadly force incidents are also pushing law enforcement agencies to invest in sophisticated crowd control equipment. Furthermore, the persistent need for effective tools to manage large-scale public gatherings, protests, and civil disturbances will continue to fuel market demand.

- Market Size Evolution: Expected to grow from $1,500 million units (2025) to $2,800 million units (2033).

- CAGR (2025-2033): Approximately 7.5%.

- Adoption Rates: Increasing for advanced less-lethal technologies and integrated systems.

- Technological Disruptions: AI integration, smart protective gear, advanced less-lethal projectiles, and networked communication systems.

- Consumer Behavior Shifts: Demand for enhanced officer safety, de-escalation tools, and real-time situational awareness.

- Market Penetration: Growing penetration of digital and networked riot control solutions across law enforcement and military sectors.

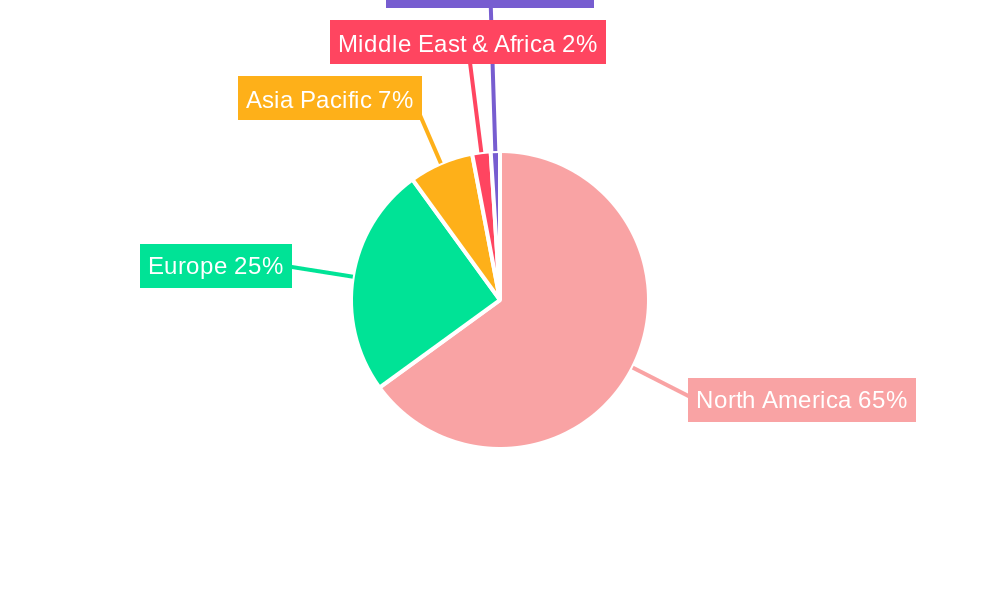

Dominant Regions, Countries, or Segments in North America Riot Control Equipment Market

Within the North America riot control equipment market, the United States emerges as the dominant country, driven by its substantial law enforcement and military expenditures, coupled with a higher frequency of public demonstrations and civil unrest incidents. The Law Enforcement end-user segment holds the lion's share of the market, accounting for an estimated 70% of the total demand in 2025. This dominance is fueled by the continuous need for officers to be equipped with effective tools for public order maintenance, crime prevention, and crowd management.

Personnel Protection Equipment, specifically body armor, shields, helmets, and protective suits, represents another dominant segment, comprising approximately 60% of the market value in 2025. This is due to the paramount importance placed on officer safety during high-risk operations. The growing sophistication of threats necessitates advanced protective gear that can withstand various forms of attack.

Key drivers for this dominance include:

- Economic Policies: Robust defense and public safety budgets in the United States allow for significant investment in advanced riot control equipment.

- Infrastructure: Well-established procurement channels and a large network of law enforcement agencies and military bases facilitate widespread adoption.

- Technological Advancement: The presence of leading technology developers in the U.S. fosters innovation and the rapid introduction of new products.

- Regulatory Environment: While stringent, regulatory frameworks within the U.S. also create demand for compliant and certified equipment.

- Market Share (2025 Estimates):

- Country: United States (~85% of North America market)

- End User: Law Enforcement (~70%), Military and Special Forces (~30%)

- Product Type: Personnel Protection Equipment (~60%), Crowd Dispersal Equipment (~40%)

The Military and Special Forces segment, while smaller, is characterized by high-value contracts and the adoption of cutting-edge technologies for specialized operations. The constant evolution of threats in both domestic and international arenas necessitates continuous upgrades to their riot control and tactical equipment. The growth potential in this segment is significant, driven by evolving geopolitical landscapes and the need for versatile crowd and riot control capabilities in diverse operational environments.

North America Riot Control Equipment Market Product Landscape

The North America riot control equipment market is characterized by a dynamic product landscape driven by innovation in both personnel protection and crowd dispersal technologies. Key product innovations include advanced materials for enhanced ballistic and impact resistance in body armor and helmets, ergonomic designs for improved mobility and comfort, and integrated communication systems. In crowd dispersal, advancements focus on less-lethal munitions with variable impact zones, non-toxic chemical agents with improved dispersal patterns, and acoustic deterrence systems designed for crowd management. The emphasis is on developing products that offer efficacy with minimal risk of severe injury, aligning with the evolving ethical considerations and operational doctrines of security forces. Unique selling propositions often lie in the integration of smart technologies, such as sensors for real-time threat assessment and biometric identification capabilities within protective gear.

Key Drivers, Barriers & Challenges in North America Riot Control Equipment Market

The North America riot control equipment market is propelled by several key drivers. Escalating concerns over public safety, increasing frequency of civil unrest, and the evolving nature of security threats are paramount. The ongoing demand for less-lethal alternatives to traditional firearms, aiming to reduce casualties and de-escalate confrontations, is a significant catalyst. Furthermore, governmental mandates for modernizing law enforcement and military equipment to enhance officer safety and operational effectiveness contribute to market growth. Technological advancements in materials science, electronics, and non-lethal projectile technology are continuously introducing more sophisticated and effective solutions.

However, the market faces significant barriers and challenges. Stringent regulatory approval processes and the need for extensive testing and certification for new products can be time-consuming and costly. Ethical considerations and public scrutiny regarding the use of force and potential misuse of riot control equipment present a significant hurdle, impacting product development and public acceptance. Supply chain disruptions, particularly for specialized components, can lead to production delays and increased costs. Competitive pressures from both established players and emerging technology firms necessitate continuous innovation and price competitiveness. Moreover, budget constraints faced by some law enforcement agencies can limit their ability to procure the latest and most advanced equipment.

Emerging Opportunities in North America Riot Control Equipment Market

Emerging opportunities in the North America riot control equipment market are largely concentrated in the integration of smart technologies and the development of more specialized, less-lethal solutions. The growing demand for wearable technology for law enforcement, including integrated communication systems, biometric sensors, and enhanced situational awareness capabilities within protective gear, presents a significant avenue for growth. There is also a burgeoning opportunity in advanced less-lethal projectile technologies that offer precise targeting and controllable impact force, minimizing collateral damage. Furthermore, the development of non-kinetic deterrents, such as advanced sonic devices and directed energy technologies, is gaining traction as authorities seek less invasive methods for crowd control. The expansion of training simulators and virtual reality-based training programs for the effective and ethical deployment of riot control equipment also represents a substantial untapped market.

Growth Accelerators in the North America Riot Control Equipment Market Industry

Several catalysts are accelerating the growth of the North America riot control equipment industry. Technological breakthroughs in areas such as advanced polymer composites for lighter and stronger protective gear, AI-powered threat detection systems for real-time situational awareness, and precision-guided less-lethal munitions are key growth accelerators. Strategic partnerships between technology providers and defense contractors are crucial for integrating novel solutions into existing systems and expanding market reach. Market expansion strategies, including the development of modular and adaptable equipment that can serve multiple tactical needs, are also driving growth. The increasing emphasis on de-escalation training and the adoption of technologies that support these strategies are further bolstering demand. Investments in research and development by leading companies are consistently pushing the boundaries of what is possible in riot control technology, ensuring a continuous pipeline of innovative products.

Key Players Shaping the North America Riot Control Equipment Market Market

- PACEM Defense LLC

- Lamperd Less Lethal Inc

- Armor Express

- Byrna Technologies Inc

- AARDVARK

- EDI-USA

- NonLethal Technologies Inc

- Paulson Manufacturing

- TASER Self-Defense (Axon Enterprise Inc)

- Aspetto Inc

- Combined Systems Inc

- Rheinmetall AG

- Safariland LLC

Notable Milestones in North America Riot Control Equipment Market Sector

- July 2022: Axon partnered with Fusus, with a vision to collectively provide holistic, mission-critical intelligence for the safety of officers, and the community. The two companies will improve operational processes for police agencies, simultaneously meeting the needs of the community.

- January 2021: Axon announced that the Los Angeles Police Department (LAPD) renewed its 5-year contract with Axon and purchased 355 Axon Body 3 cameras and 5,260 TASER 7 energy weapons. With the purchase, LAPD has 7,355 Axon body cameras and 7,530 TASER 7 energy weapons, making it the largest energy weapon deployment in the United States.

In-Depth North America Riot Control Equipment Market Market Outlook

The future outlook for the North America riot control equipment market is exceptionally promising, driven by a confluence of factors that underscore a sustained demand for advanced security solutions. Growth accelerators, such as the continuous innovation in less-lethal technologies and the increasing integration of digital and smart functionalities into protective gear, are set to redefine operational capabilities for law enforcement and military personnel. The strategic partnerships observed among key players are fostering a collaborative environment that accelerates the development and deployment of cutting-edge products. Furthermore, the growing recognition of the importance of effective crowd management and officer safety in an era of heightened public awareness and evolving security landscapes will continue to fuel market expansion. The market is anticipated to witness a significant rise in demand for integrated systems that offer enhanced situational awareness, improved communication, and sophisticated de-escalation capabilities, positioning it for continued robust growth.

North America Riot Control Equipment Market Segmentation

-

1. Product Type

- 1.1. Personnel Protection Equipment

- 1.2. Crowd Dispersal Equipment

-

2. End User

- 2.1. Law Enforcement

- 2.2. Military and Special Forces

North America Riot Control Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Riot Control Equipment Market Regional Market Share

Geographic Coverage of North America Riot Control Equipment Market

North America Riot Control Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Law Enforcement Agencies are the Biggest Consumers of Riot Control Equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Riot Control Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Personnel Protection Equipment

- 5.1.2. Crowd Dispersal Equipment

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Law Enforcement

- 5.2.2. Military and Special Forces

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PACEM Defense LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lamperd Less Lethal Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Armor Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Byrna Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AARDVARK

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EDI-USA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NonLethal Technologies Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Paulson Manufacturing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TASER Self-Defense (Axon Enterprise Inc )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aspetto Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Combined Systems Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rheinmetall A

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Safariland LLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 PACEM Defense LLC

List of Figures

- Figure 1: North America Riot Control Equipment Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Riot Control Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Riot Control Equipment Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: North America Riot Control Equipment Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: North America Riot Control Equipment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Riot Control Equipment Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: North America Riot Control Equipment Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: North America Riot Control Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Riot Control Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Riot Control Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Riot Control Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Riot Control Equipment Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Riot Control Equipment Market?

Key companies in the market include PACEM Defense LLC, Lamperd Less Lethal Inc, Armor Express, Byrna Technologies Inc, AARDVARK, EDI-USA, NonLethal Technologies Inc, Paulson Manufacturing, TASER Self-Defense (Axon Enterprise Inc ), Aspetto Inc, Combined Systems Inc, Rheinmetall A, Safariland LLC.

3. What are the main segments of the North America Riot Control Equipment Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Law Enforcement Agencies are the Biggest Consumers of Riot Control Equipment.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: Axon partnered with Fusus, with a vision to collectively provide holistic, mission-critical intelligence for the safety of officers, and the community. The two companies will improve operational processes for police agencies, simultaneously meeting the needs of the community.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Riot Control Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Riot Control Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Riot Control Equipment Market?

To stay informed about further developments, trends, and reports in the North America Riot Control Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence