Key Insights

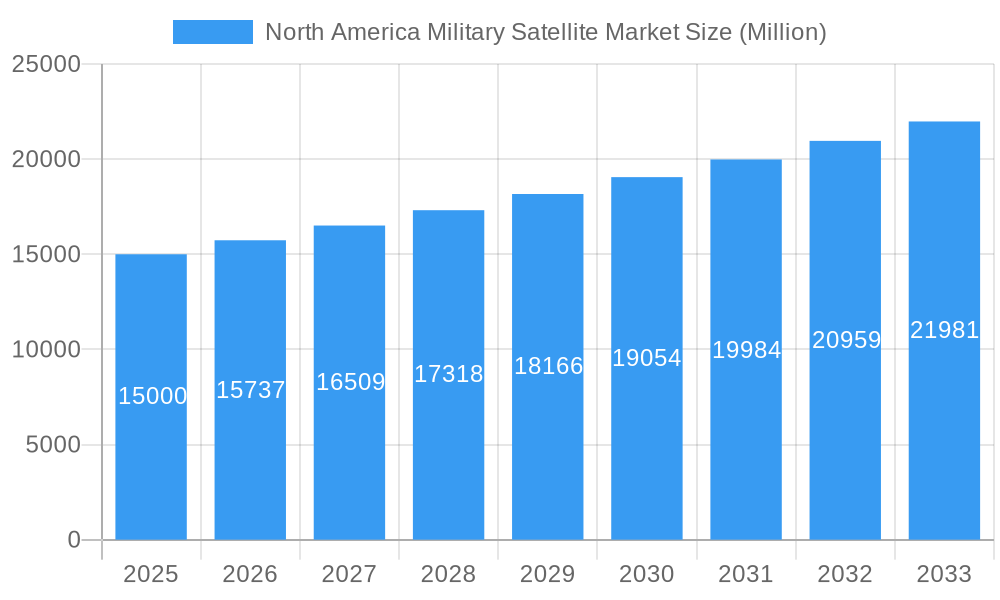

The North American military satellite market, valued at approximately $15 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 4.96% from 2025 to 2033. This expansion is fueled by increasing geopolitical tensions, the need for enhanced surveillance and reconnaissance capabilities, modernization of existing satellite constellations, and the development of advanced technologies like AI-integrated satellite systems. The market is segmented by satellite mass, orbit class, and application, with significant demand across communication, earth observation, and navigation applications. The "Below 10kg" and "100-500kg" satellite mass segments are anticipated to experience faster growth driven by miniaturization trends and the increasing use of smaller, more agile satellites for specific military tasks. The preference for Low Earth Orbit (LEO) satellites is also driving market expansion due to their improved imagery resolution and reduced latency. Major players like Raytheon Technologies, Lockheed Martin, and Northrop Grumman are actively investing in R&D and strategic partnerships to capitalize on this lucrative market.

North America Military Satellite Market Market Size (In Billion)

Within North America, the United States is the dominant market, accounting for the lion's share of the revenue, driven by substantial defense spending and a robust space program. Canada and Mexico contribute to the regional market, though on a smaller scale. The market's growth is, however, subject to budgetary constraints, technological challenges associated with advanced satellite development, and the increasing complexity of space-based operations. Competition among major aerospace and defense contractors remains intense, leading to innovation and cost optimization strategies. The long-term outlook remains positive, underpinned by continuous demand for secure and reliable military satellite systems for national security and defense operations.

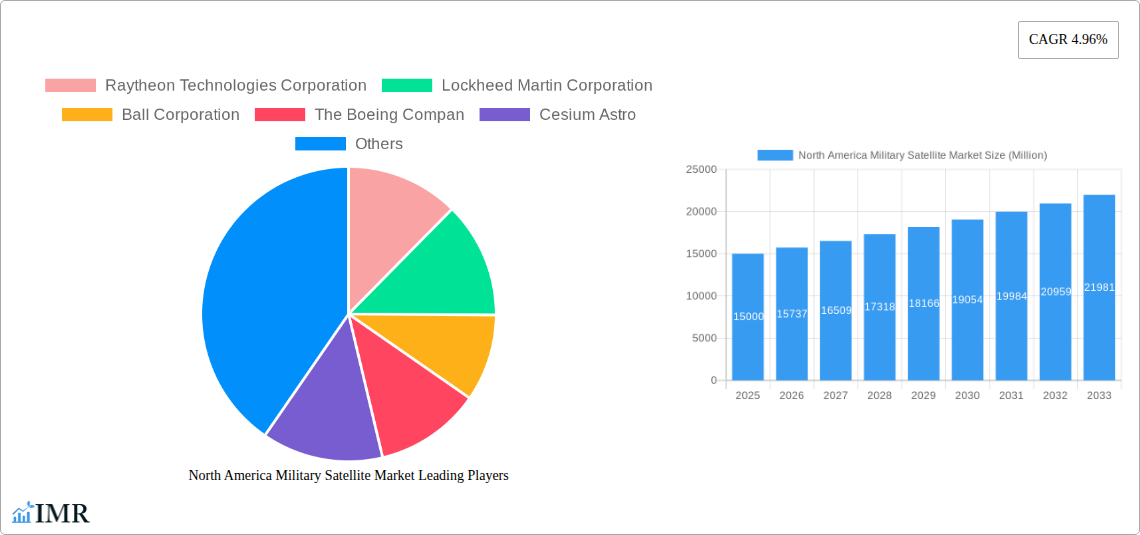

North America Military Satellite Market Company Market Share

North America Military Satellite Market: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the North America military satellite market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by satellite mass (Below 10 Kg, 10-100kg, 100-500kg, 500-1000kg, above 1000kg), orbit class (LEO, MEO, GEO), satellite subsystem (Satellite Bus & Subsystems, Propulsion Hardware and Propellant, Solar Array & Power Hardware, Structures, Harness & Mechanisms), and application (Communication, Earth Observation, Navigation, Space Observation, Others). The market size is valued in million units.

North America Military Satellite Market Dynamics & Structure

The North American military satellite market is characterized by a moderately concentrated structure, dominated by a few large players like Raytheon Technologies, Lockheed Martin, and Northrop Grumman. However, the emergence of smaller, more agile companies specializing in smallsats is increasing competition and fostering innovation. Technological advancements, particularly in miniaturization, propulsion systems, and AI-powered data analytics, are key drivers. Stringent regulatory frameworks, including export controls and security clearances, pose significant barriers to entry. The market also faces competitive pressure from commercial satellite providers offering similar capabilities. Mergers and acquisitions (M&A) activity has been relatively high, with larger players consolidating their market share and acquiring smaller companies with specialized technologies.

- Market Concentration: High (estimated at xx%), with top 3 players holding xx% market share.

- Technological Innovation: Rapid advancements in miniaturization, AI-powered analytics, and advanced propulsion systems.

- Regulatory Framework: Strict regulations regarding security and export controls.

- M&A Activity: Significant M&A activity in recent years, resulting in market consolidation.

- Innovation Barriers: High capital investment requirements, stringent regulatory approvals, and technological complexity.

North America Military Satellite Market Growth Trends & Insights

The North America military satellite market is experiencing robust growth, driven by increasing demand for advanced surveillance, communication, and navigation capabilities. The market size is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the proliferation of smallsats and constellations, are transforming the market landscape. The shift towards smaller, more affordable satellites is enabling greater accessibility and affordability for military applications. This trend is reflected in the growing adoption of LEO constellations for enhanced situational awareness and communication. Furthermore, advancements in AI and machine learning are enabling the processing and analysis of massive amounts of satellite data, significantly enhancing the operational effectiveness of military forces. The historical period (2019-2024) saw steady growth, setting the stage for the accelerated expansion forecast for the coming years.

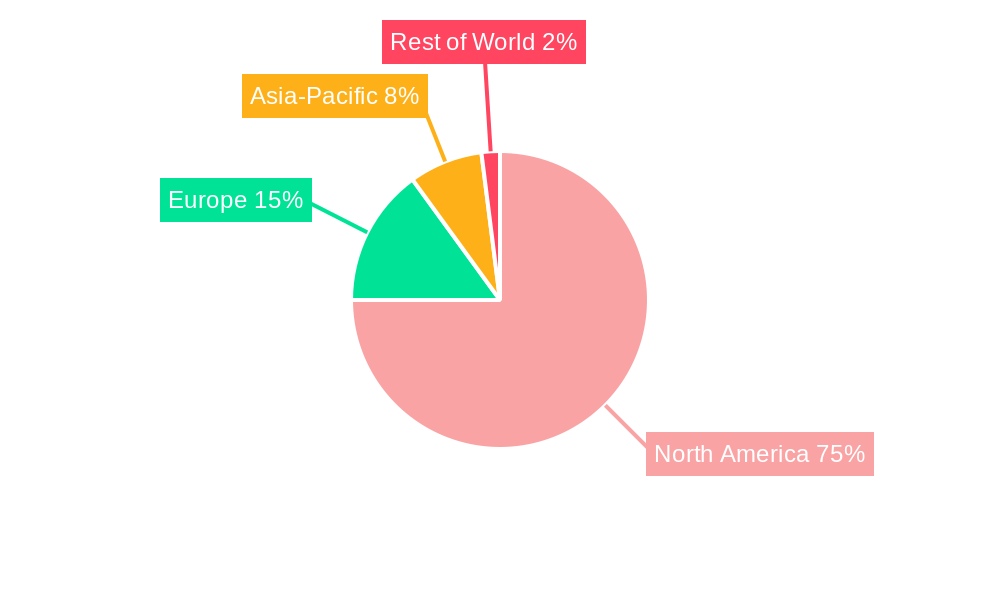

Dominant Regions, Countries, or Segments in North America Military Satellite Market

The United States dominates the North American military satellite market, accounting for the majority of spending and technological advancements. Within the United States, key regions include California, Colorado, and Virginia, which house major satellite manufacturers and government agencies. Regarding segments, the LEO orbit class exhibits significant growth potential due to the increasing adoption of smallsat constellations for communication and reconnaissance. Similarly, the 10-100kg satellite mass segment is witnessing rapid expansion because of the cost-effectiveness and technological maturity of smallsats. The Communication and Earth Observation applications segments are the largest revenue generators, driven by the need for secure communication networks and advanced reconnaissance capabilities.

- Dominant Region: United States

- Dominant Orbit Class: LEO

- Dominant Satellite Mass Segment: 10-100 kg

- Dominant Application: Communication and Earth Observation

- Key Growth Drivers: Increased defense budgets, technological advancements, and strategic geopolitical considerations.

North America Military Satellite Market Product Landscape

The military satellite market is characterized by a diverse range of products, from large GEO communication satellites to constellations of small LEO observation satellites. Recent product innovations include advanced payload sensors, improved propulsion systems, and more resilient satellite bus architectures. Key performance metrics include data transmission rates, resolution, satellite lifespan, and operational reliability. Unique selling propositions often center around enhanced resilience, superior data processing capabilities, and advanced anti-jamming technologies. Technological advancements are focused on miniaturization, enhanced data security, and improved cost-effectiveness.

Key Drivers, Barriers & Challenges in North America Military Satellite Market

Key Drivers:

- Increased defense budgets driven by geopolitical instability.

- Demand for enhanced surveillance and reconnaissance capabilities.

- Technological advancements, enabling smaller, more affordable satellites.

Key Challenges & Restraints:

- High development and launch costs.

- Stringent regulatory requirements for space operations.

- Vulnerability to cyberattacks and space-based threats.

- Supply chain disruptions impacting component availability. (Estimated impact on market growth: xx%)

Emerging Opportunities in North America Military Satellite Market

Emerging opportunities include the growing demand for space-based situational awareness, the rise of AI-powered satellite data analytics, and the development of hybrid satellite constellations integrating GEO and LEO systems. Unmanned aerial vehicles (UAV) integration with satellite networks also presents a significant opportunity. The development of new materials and propulsion technologies could reduce costs, increase lifespan, and enhance maneuverability.

Growth Accelerators in the North America Military Satellite Market Industry

Several factors are poised to accelerate long-term growth. These include breakthroughs in miniaturization and AI-powered analytics that will increase efficiency and reduce costs. Strategic partnerships between government agencies and private companies will stimulate innovation and deployment. Moreover, expansion into new applications, such as space-based internet access and environmental monitoring, will broaden the market significantly.

Key Players Shaping the North America Military Satellite Market Market

Notable Milestones in North America Military Satellite Market Sector

- November 2023: Ball Aerospace awarded contract for the Weather System Follow-on - Microwave (WSF-M) program by the US Air Force. This signifies a major win for the company and strengthens its position in the environmental monitoring satellite sector.

- February 2023: Blue Canyon Technologies (a Raytheon Technologies subsidiary) provided hardware for multiple smallsat missions on the Transporter-6 launch, highlighting the growing importance of smallsats in military applications and Raytheon's strong presence in the smallsat component market.

In-Depth North America Military Satellite Market Market Outlook

The North American military satellite market is poised for continued strong growth, driven by technological advancements, increasing defense budgets, and growing geopolitical uncertainties. Strategic partnerships, investments in R&D, and the emergence of new applications will create significant opportunities for market participants. The focus on miniaturization, enhanced resilience, and AI-powered data analytics will continue to shape the product landscape, opening new avenues for innovation and growth. The market's future potential is substantial, presenting compelling opportunities for companies to secure a leading position in this dynamic sector.

North America Military Satellite Market Segmentation

-

1. Satellite Mass

- 1.1. 10-100kg

- 1.2. 100-500kg

- 1.3. 500-1000kg

- 1.4. Below 10 Kg

- 1.5. above 1000kg

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. Satellite Subsystem

- 3.1. Propulsion Hardware and Propellant

- 3.2. Satellite Bus & Subsystems

- 3.3. Solar Array & Power Hardware

- 3.4. Structures, Harness & Mechanisms

-

4. Application

- 4.1. Communication

- 4.2. Earth Observation

- 4.3. Navigation

- 4.4. Space Observation

- 4.5. Others

North America Military Satellite Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Military Satellite Market Regional Market Share

Geographic Coverage of North America Military Satellite Market

North America Military Satellite Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Military Satellite Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.1.1. 10-100kg

- 5.1.2. 100-500kg

- 5.1.3. 500-1000kg

- 5.1.4. Below 10 Kg

- 5.1.5. above 1000kg

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 5.3.1. Propulsion Hardware and Propellant

- 5.3.2. Satellite Bus & Subsystems

- 5.3.3. Solar Array & Power Hardware

- 5.3.4. Structures, Harness & Mechanisms

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Communication

- 5.4.2. Earth Observation

- 5.4.3. Navigation

- 5.4.4. Space Observation

- 5.4.5. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Raytheon Technologies Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lockheed Martin Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ball Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Boeing Compan

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cesium Astro

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Northrop Grumman Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Raytheon Technologies Corporation

List of Figures

- Figure 1: North America Military Satellite Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Military Satellite Market Share (%) by Company 2025

List of Tables

- Table 1: North America Military Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 2: North America Military Satellite Market Revenue undefined Forecast, by Orbit Class 2020 & 2033

- Table 3: North America Military Satellite Market Revenue undefined Forecast, by Satellite Subsystem 2020 & 2033

- Table 4: North America Military Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: North America Military Satellite Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: North America Military Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 7: North America Military Satellite Market Revenue undefined Forecast, by Orbit Class 2020 & 2033

- Table 8: North America Military Satellite Market Revenue undefined Forecast, by Satellite Subsystem 2020 & 2033

- Table 9: North America Military Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: North America Military Satellite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: United States North America Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Military Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Military Satellite Market?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the North America Military Satellite Market?

Key companies in the market include Raytheon Technologies Corporation, Lockheed Martin Corporation, Ball Corporation, The Boeing Compan, Cesium Astro, Northrop Grumman Corporation.

3. What are the main segments of the North America Military Satellite Market?

The market segments include Satellite Mass, Orbit Class, Satellite Subsystem, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2023: Ball Aerospace was selected by the US Air Force's Space and Missile Systems Center (SMC) to deliver the next-generation operational environmental satellite system, Weather System Follow-on - Microwave (WSF-M), for the Department of Defense (DoD).February 2023: Blue Canyon Technologies LLC, a subsidiary of Raytheon Technologies, provided critical hardware components for several of the smallsat missions aboard the Transporter-6 launch, which pitched 114 small payloads into polar orbit.February 2023: Blue Canyon Technologies LLC, a subsidiary of Raytheon Technologies, provided critical hardware components for several of the SmallSat missions aboard the Transporter-6 launch that pitched 114 small payloads into polar orbit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Military Satellite Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Military Satellite Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Military Satellite Market?

To stay informed about further developments, trends, and reports in the North America Military Satellite Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence