Key Insights

The Middle East and Africa Military Helicopters Market is set for significant expansion, propelled by heightened geopolitical tensions, increasing demands for national security, and a strong regional focus on modernizing defense capabilities. The market is valued at 57151.2 million in the base year of 2024 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 4% through 2033. This growth is underpinned by substantial investments in advanced multi-mission and transport helicopters, crucial for troop deployment, logistics, and special operations. Key Middle Eastern nations, including Saudi Arabia and the United Arab Emirates, are spearheading procurement initiatives to enhance their air power and assert regional influence. The demand for helicopters featuring sophisticated avionics, superior firepower, and extended operational range highlights a strategic pivot towards technologically advanced aerial assets.

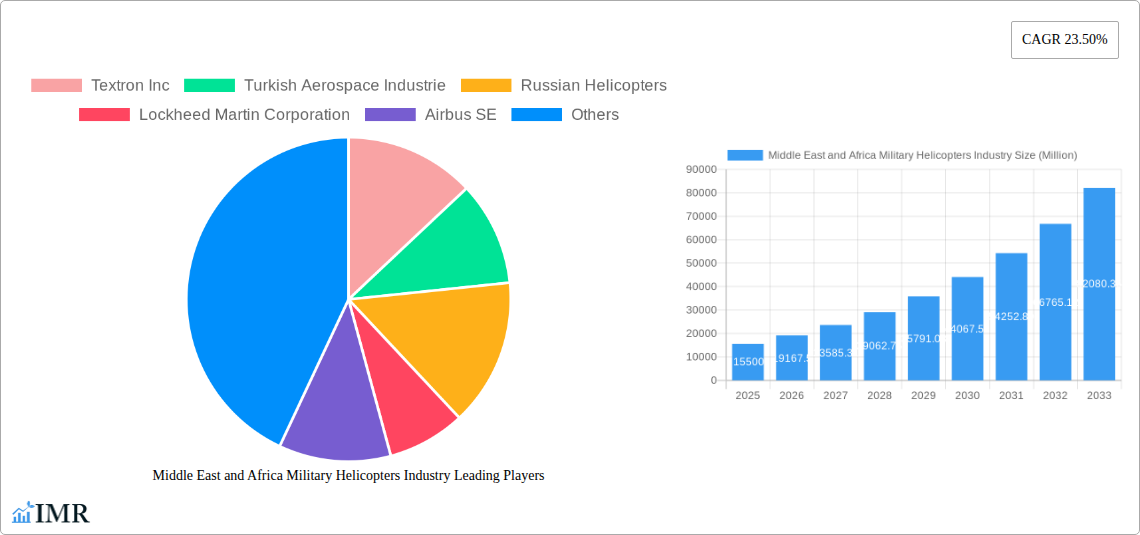

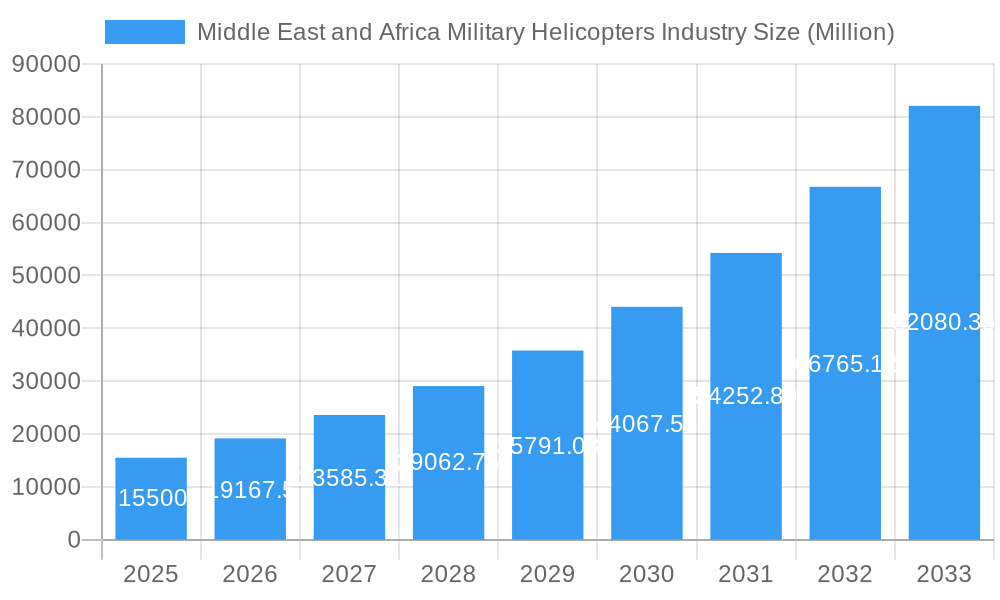

Middle East and Africa Military Helicopters Industry Market Size (In Billion)

Industry growth is further supported by ongoing fleet modernization programs and the increasing strategic importance of rotary-wing aircraft for diverse military functions such as reconnaissance, attack, and search and rescue. Major manufacturers including Lockheed Martin Corporation, Airbus SE, and The Boeing Company are prominent in this evolving market, offering a comprehensive range of advanced military helicopters. Potential market restraints include the substantial acquisition and maintenance costs of sophisticated military helicopters, alongside dynamic regulatory landscapes and the risk of economic downturns impacting defense expenditure. Nevertheless, the indispensable role of military helicopters in modern defense strategy, particularly for rapid deployment and force projection, guarantees sustained investment and innovation, positioning the Middle East and Africa as a vital and rapidly expanding segment of the global military helicopter market.

Middle East and Africa Military Helicopters Industry Company Market Share

Middle East and Africa Military Helicopters Industry: Comprehensive Market Analysis and Growth Outlook (2019–2033)

This in-depth report provides a granular analysis of the Middle East and Africa Military Helicopters Industry, covering the historical period of 2019-2024, a base year of 2025, and a comprehensive forecast through 2033. We dissect market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and strategic insights, offering a vital resource for industry stakeholders seeking to understand the evolving landscape of military rotorcraft procurement and deployment across the MEA region. The report quantifies market evolution in Million units and features analysis of parent and child markets for enhanced strategic understanding.

Middle East and Africa Military Helicopters Industry Market Dynamics & Structure

The Middle East and Africa (MEA) military helicopters market is characterized by a moderate to high level of market concentration, with a few major global players dominating the supply chain, alongside an increasing number of regional manufacturers and integrators. Technological innovation remains a primary driver, fueled by the continuous demand for enhanced combat capabilities, superior surveillance, and efficient troop/cargo transport. Regulatory frameworks, particularly those related to defense procurement and international arms trade agreements, significantly influence market entry and expansion. Competitive product substitutes, such as unmanned aerial vehicles (UAVs) and fixed-wing aircraft for specific missions, present a challenge, pushing manufacturers to innovate in multi-mission capabilities and operational efficiency. End-user demographics are diverse, ranging from national air forces and special forces to paramilitary organizations, each with unique operational requirements and budgetary constraints. Mergers and acquisitions (M&A) trends are on the rise as larger entities seek to expand their portfolios, gain market share, and integrate advanced technologies.

- Market Share (2025 Estimate): Major global OEMs expected to hold approximately 70-75% of the market share in terms of value, with regional players capturing the remaining share.

- Technological Innovation Drivers: Advanced avionics, stealth technology, enhanced armament systems, improved engine performance, and hybrid-electric propulsion concepts.

- Regulatory Frameworks: National defense policies, international export controls (e.g., ITAR), and joint venture regulations.

- Competitive Product Substitutes: Advanced UAVs for reconnaissance and armed escort roles, light attack aircraft for close air support.

- End-User Demographics: National Air Forces (40%), Special Operations Forces (30%), Border Patrol & Internal Security (20%), Others (10%).

- M&A Trends: Focus on acquiring niche technologies, expanding manufacturing capabilities, and consolidating market presence. Expected M&A deal volume in the historical period: 3-5 significant deals.

Middle East and Africa Military Helicopters Industry Growth Trends & Insights

The Middle East and Africa military helicopters market is poised for robust growth, driven by a confluence of escalating geopolitical tensions, ongoing modernization programs by various nations, and the persistent need for advanced aerial platforms for defense, security, and disaster relief operations. The market size evolution is projected to witness a steady upward trajectory, with key nations in the MEA region prioritizing the upgrade and expansion of their rotary-wing fleets. Adoption rates are being significantly influenced by a growing recognition of the strategic advantage provided by modern military helicopters, particularly in asymmetric warfare scenarios and border surveillance. Technological disruptions, such as the integration of artificial intelligence (AI) for mission planning and real-time threat assessment, advanced sensor suites, and improved survivability features, are becoming critical differentiators. Consumer behavior shifts are evident, with a greater emphasis on lifecycle cost, modularity for adaptable mission profiles, and readily available support and maintenance packages. The increasing demand for multi-role capabilities is also shaping procurement strategies, favoring platforms that can effectively perform transport, attack, reconnaissance, and casualty evacuation missions. The parent market, encompassing all military rotorcraft, is expected to see significant growth, with child markets like attack helicopters and transport helicopters showing specific areas of accelerated expansion due to regional security needs and logistical requirements.

The CAGR for the Middle East and Africa Military Helicopters Industry is projected to be XX% during the forecast period (2025-2033). The market penetration of advanced rotorcraft technology is anticipated to increase from an estimated XX% in 2025 to XX% by 2033. The total market volume is expected to grow from XXX Million units in 2025 to XXX Million units by 2033.

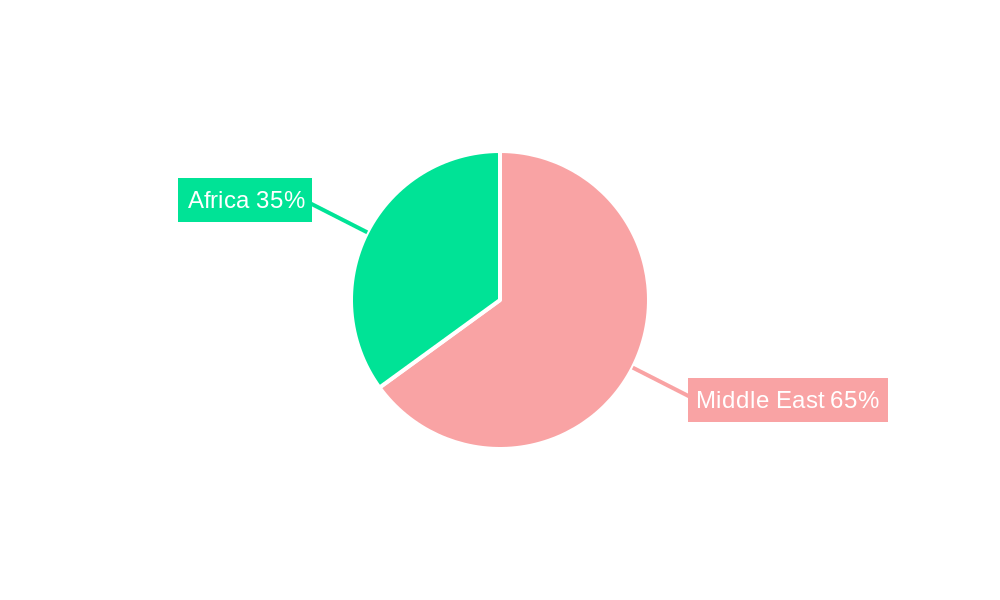

Dominant Regions, Countries, or Segments in Middle East and Africa Military Helicopters Industry

The Middle East region is anticipated to remain the dominant force in the Middle East and Africa Military Helicopters Industry. This dominance is underpinned by several critical factors, including substantial defense spending by key Gulf Cooperation Council (GCC) nations, ongoing regional security concerns, and a sustained drive towards military modernization. Countries like Saudi Arabia, the United Arab Emirates, and Qatar are actively investing in acquiring advanced military helicopters, both to replace aging fleets and to enhance their operational capabilities in diverse environments. The Multi-Mission Helicopter segment is expected to lead market growth within the MEA region. These versatile platforms offer a broad spectrum of operational utility, from troop transport and logistics support to armed reconnaissance and light attack roles, making them highly attractive to diverse military branches.

- Leading Region: Middle East, accounting for an estimated XX% of the total MEA market value in 2025.

- Leading Country: Saudi Arabia, expected to represent XX% of the Middle East market in 2025 due to significant modernization efforts.

- Dominant Segment: Multi-Mission Helicopter, projected to capture XX% of the total market volume in the MEA region by 2025.

Key drivers for Middle East dominance include:

- Economic Policies: Robust economic growth in oil-producing nations allows for sustained defense budget allocations.

- Infrastructure Development: Significant investments in military airbases and support facilities enable the integration of advanced helicopter fleets.

- Geopolitical Landscape: Regional conflicts and security threats necessitate advanced aerial capabilities for deterrence and response.

- Technological Advancement: Active pursuit and adoption of cutting-edge helicopter technologies by key military forces.

The Transport Helicopter segment also exhibits strong growth potential due to the vast geographical expanse of many MEA nations and the critical need for efficient troop and equipment mobility, especially in challenging terrain and post-disaster scenarios. The Others segment, which may include specialized platforms like training helicopters or light utility helicopters, is expected to grow at a steady pace, catering to niche operational requirements.

Middle East and Africa Military Helicopters Industry Product Landscape

The product landscape of the MEA military helicopters industry is characterized by a blend of domestically produced and internationally sourced platforms, with a clear trend towards advanced, multi-role capabilities. Manufacturers are focusing on integrating cutting-edge avionics, enhanced survivability features, modular weapon systems, and improved performance metrics for operations in diverse and often harsh environmental conditions prevalent in the region. Key product innovations include enhanced sensor suites for intelligence, surveillance, and reconnaissance (ISR) missions, advanced electronic warfare systems, and greater automation for pilot assistance. The unique selling propositions for competing helicopters often revolve around operational versatility, cost-effectiveness in lifecycle management, and the ability to be quickly reconfigured for different mission profiles. Technological advancements are also geared towards reducing the operational footprint and improving interoperability with allied forces.

Key Drivers, Barriers & Challenges in Middle East and Africa Military Helicopters Industry

The Middle East and Africa Military Helicopters Industry is propelled by several key drivers. Escalating regional security threats and ongoing border disputes necessitate enhanced aerial surveillance and rapid response capabilities, directly fueling demand for military helicopters. Government modernization programs across various MEA nations, aimed at upgrading aging fleets and acquiring state-of-the-art rotorcraft, are significant growth catalysts. Furthermore, the increasing use of helicopters for internal security operations, counter-terrorism, and disaster relief missions expands their operational relevance.

Key challenges and restraints include the high acquisition costs and complex maintenance requirements associated with advanced military helicopters, which can strain defense budgets. Economic volatility in some African nations can also impact procurement capabilities. Supply chain disruptions, geopolitical sanctions, and stringent export control regulations can hinder the timely delivery and availability of critical components and platforms. Additionally, the growing maturity of unmanned aerial vehicle (UAV) technology presents a competitive challenge for certain helicopter roles, particularly in ISR and light attack missions. The market volume for new procurements in 2025 is estimated at XXX Million units.

Emerging Opportunities in Middle East and Africa Military Helicopters Industry

Emerging opportunities within the Middle East and Africa Military Helicopters Industry are significant, driven by evolving defense doctrines and unmet operational needs. The increasing focus on special operations and rapid deployment capabilities presents a growing demand for lightweight, agile, and heavily armed helicopters. Several nations are exploring the integration of advanced targeting pods, improved night vision capabilities, and electronic countermeasure systems to enhance the operational effectiveness of their existing fleets. Furthermore, the growing emphasis on regional security cooperation and joint military exercises creates opportunities for partnerships and technology transfer, fostering the development of indigenous capabilities. The demand for specialized training helicopters and simulators also presents a burgeoning market segment as countries seek to build and maintain a skilled rotary-wing pilot cadre.

Growth Accelerators in the Middle East and Africa Military Helicopters Industry Industry

Growth accelerators for the Middle East and Africa Military Helicopters Industry are primarily centered on technological advancements and strategic market expansion. The ongoing development of next-generation helicopters, featuring enhanced performance, increased payload capacity, and superior survivability, is a key driver. Strategic partnerships and joint ventures between international manufacturers and local defense companies are fostering technology transfer and local production, thereby reducing costs and increasing accessibility. Market expansion efforts by leading manufacturers targeting emerging economies within Africa, where a significant portion of the existing fleet is aging, are also expected to accelerate growth. The increasing demand for sophisticated military helicopters equipped with advanced intelligence, surveillance, and reconnaissance (ISR) capabilities to address persistent security challenges across the region will continue to fuel this growth trajectory.

Key Players Shaping the Middle East and Africa Military Helicopters Industry Market

- Textron Inc.

- Turkish Aerospace Industrie

- Russian Helicopters

- Lockheed Martin Corporation

- Airbus SE

- Robinson Helicopter Company Inc

- Leonardo S p A

- The Boeing Company

Notable Milestones in Middle East and Africa Military Helicopters Industry Sector

- May 2023: The US State Department approved a potential sale of CH-47 Chinook helicopters, engines, and equipment worth USD 8.5 billion to Germany.

- March 2023: Boeing awarded a contract by the US government to manufacture 184 AH-64E Apache attack helicopters for the US military and international customers, including Egypt. Contract completion expected by end of 2027.

- December 2022: US Army awarded a contract to Textron Inc.'s Bell unit for next-generation helicopters as part of the "Future Vertical Lift" competition to replace UH-60 Black Hawk utility helicopters.

In-Depth Middle East and Africa Military Helicopters Industry Market Outlook

The future outlook for the Middle East and Africa Military Helicopters Industry is exceptionally promising, driven by a sustained demand for modernized aerial capabilities and ongoing geopolitical imperatives. Strategic opportunities lie in the increasing adoption of multi-role platforms that offer adaptability across diverse mission requirements, from combat operations to humanitarian aid. The report forecasts continued investment in advanced technologies, including AI-enabled systems, enhanced electronic warfare suites, and next-generation propulsion, to meet the evolving threat landscape. Furthermore, the growing emphasis on indigenous defense manufacturing and technology transfer agreements with international players will shape the long-term growth trajectory, fostering regional self-reliance and specialized capabilities. The anticipated market growth for military helicopters in the MEA region underscores the strategic importance of these platforms in maintaining regional stability and security.

Middle East and Africa Military Helicopters Industry Segmentation

-

1. Body Type

- 1.1. Multi-Mission Helicopter

- 1.2. Transport Helicopter

- 1.3. Others

Middle East and Africa Military Helicopters Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Military Helicopters Industry Regional Market Share

Geographic Coverage of Middle East and Africa Military Helicopters Industry

Middle East and Africa Military Helicopters Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Military Helicopters Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Multi-Mission Helicopter

- 5.1.2. Transport Helicopter

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Turkish Aerospace Industrie

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Russian Helicopters

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lockheed Martin Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Airbus SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robinson Helicopter Company Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leonardo S p A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Boeing Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: Middle East and Africa Military Helicopters Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Military Helicopters Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Military Helicopters Industry Revenue million Forecast, by Body Type 2020 & 2033

- Table 2: Middle East and Africa Military Helicopters Industry Revenue million Forecast, by Region 2020 & 2033

- Table 3: Middle East and Africa Military Helicopters Industry Revenue million Forecast, by Body Type 2020 & 2033

- Table 4: Middle East and Africa Military Helicopters Industry Revenue million Forecast, by Country 2020 & 2033

- Table 5: Saudi Arabia Middle East and Africa Military Helicopters Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: United Arab Emirates Middle East and Africa Military Helicopters Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Israel Middle East and Africa Military Helicopters Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Qatar Middle East and Africa Military Helicopters Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Kuwait Middle East and Africa Military Helicopters Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Oman Middle East and Africa Military Helicopters Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Bahrain Middle East and Africa Military Helicopters Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Jordan Middle East and Africa Military Helicopters Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Lebanon Middle East and Africa Military Helicopters Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Military Helicopters Industry?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Middle East and Africa Military Helicopters Industry?

Key companies in the market include Textron Inc, Turkish Aerospace Industrie, Russian Helicopters, Lockheed Martin Corporation, Airbus SE, Robinson Helicopter Company Inc, Leonardo S p A, The Boeing Company.

3. What are the main segments of the Middle East and Africa Military Helicopters Industry?

The market segments include Body Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 57151.2 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: The US State Department approved a potential sale of CH-47 Chinook helicopters, engines, and equipment worth USD 8.5 billion to Germany.March 2023: Boeing has been awarded a contract by the US government to manufacture 184 AH-64E Apache attack helicopters for the US military and international customers. The US government announced USD 1.95 million, indicating that the helicopter will be delivered to the US military and overseas buyers - specifically Australia and Egypt - as a part of the paramilitary process to the Foreign Service (FMS) from the US government. Contract completion is expected by the end of 2027.December 2022: The US Army was awarded a contract to supply next-generation helicopters to Textron Inc.'s Bell unit. The Army`s "Future Vertical Lift" competition aimed at finding a replacement as the Army looks to retire more than 2,000 medium-class UH-60 Black Hawk utility helicopters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Military Helicopters Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Military Helicopters Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Military Helicopters Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Military Helicopters Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence