Key Insights

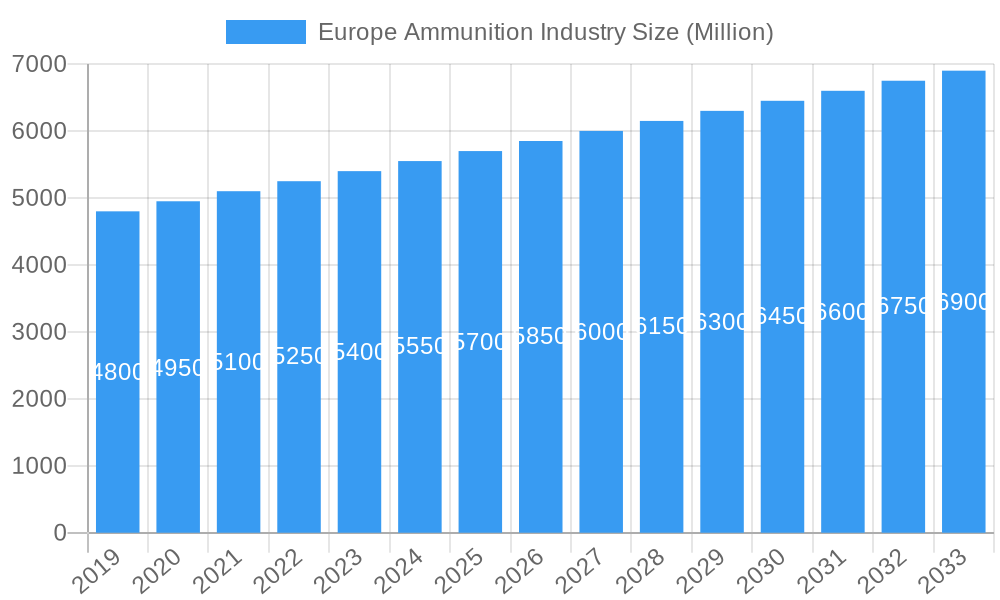

The Europe Ammunition Industry is poised for robust growth, projected to reach a market size of approximately $5,500 million by 2025, with a compound annual growth rate (CAGR) exceeding 3.00%. This expansion is primarily fueled by escalating geopolitical tensions and increased defense spending across European nations. Countries are prioritizing the modernization of their military arsenals and the replenishment of existing stockpiles, driven by a heightened sense of security and the need to meet NATO's defense commitments. Furthermore, advancements in ammunition technology, including the development of more precise, versatile, and intelligent munitions, are stimulating demand from both military and law enforcement agencies. The trend towards smart ammunition, guided projectiles, and non-lethal options is particularly noteworthy, reflecting a strategic shift towards enhanced combat effectiveness and reduced collateral damage.

Europe Ammunition Industry Market Size (In Billion)

The market dynamics are further shaped by a complex interplay of drivers and restraints. Key drivers include the persistent threat landscape, ongoing military modernization programs, and the growing demand for specialized ammunition for various operational environments. However, stringent regulatory frameworks governing the production, sale, and export of ammunition, coupled with the high costs associated with research, development, and manufacturing, present significant restraints. Despite these challenges, the industry is witnessing significant investment in production capacity expansion and technological innovation by leading companies such as General Dynamics Corporation, Rheinmetall AG, and BAE Systems plc. The consumption analysis indicates a steady demand, while import and export activities, particularly within European countries like the United Kingdom, Germany, and France, are crucial for maintaining supply chain efficiency and addressing specific military requirements. Price trends are expected to be influenced by raw material costs, production volumes, and geopolitical stability.

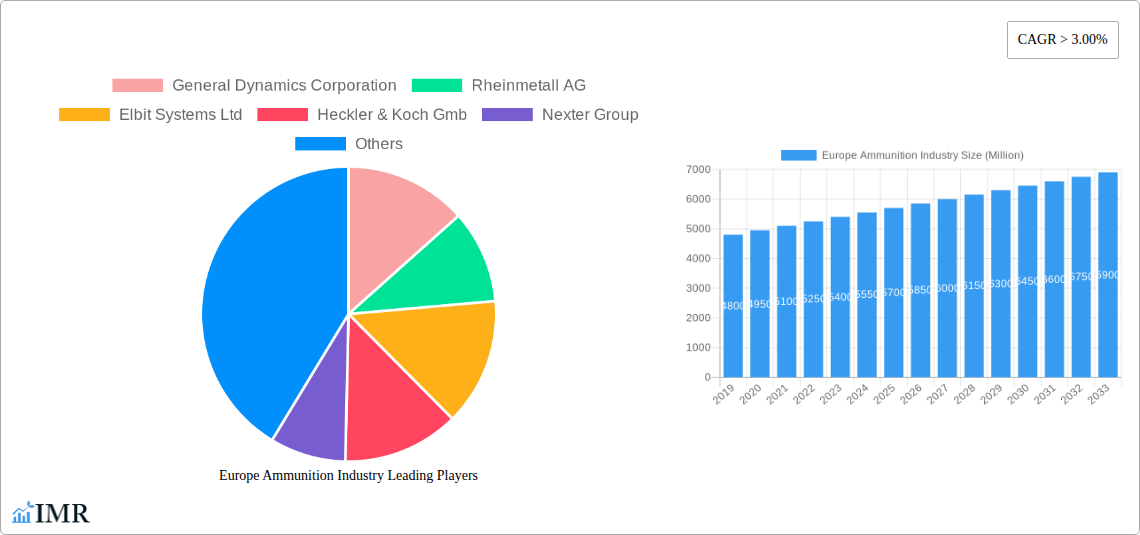

Europe Ammunition Industry Company Market Share

Europe Ammunition Industry: Market Analysis, Growth Trends, and Future Outlook (2019–2033)

This comprehensive report offers an in-depth analysis of the Europe Ammunition Industry, covering production, consumption, import/export dynamics, price trends, and key industry developments. With a study period extending from 2019 to 2033 and a base year of 2025, this report leverages critical market intelligence to provide actionable insights for stakeholders. We delve into both parent and child market segments, identifying key growth drivers, emerging opportunities, and the competitive landscape shaped by major players such as General Dynamics Corporation, Rheinmetall AG, Elbit Systems Ltd, Heckler & Koch GmbH, Nexter Group, Nammo AS, Denel PMP, BAE Systems plc, ROSTEC, and Saab AB. All volume values are presented in million units.

Europe Ammunition Industry Market Dynamics & Structure

The Europe Ammunition Industry is characterized by a concentrated market structure, driven by significant technological innovation in areas such as guided munitions and advanced propellant technologies. Regulatory frameworks, particularly stringent in NATO and EU member states, significantly influence product development and market access. Competitive product substitutes, while limited in direct military applications, emerge in the civilian and law enforcement sectors. End-user demographics are primarily government defense procurement agencies and, to a lesser extent, civilian shooting enthusiasts and security firms. Mergers and acquisitions (M&A) trends, while not voluminous, are strategic, often aimed at consolidating expertise and expanding production capabilities. For instance, key players are actively pursuing vertical integration to secure raw material supply chains. Barriers to innovation include the high cost of research and development, lengthy certification processes, and geopolitical sensitivities surrounding the transfer of advanced ordnance technology. The market's ability to adapt to evolving defense doctrines and integrate smart ammunition technologies will be crucial for sustained growth.

Europe Ammunition Industry Growth Trends & Insights

The Europe Ammunition Industry is poised for substantial growth, driven by heightened geopolitical tensions and increased defense spending across the continent. Market size evolution is directly correlated with national defense budgets and international security alliances, with a projected Compound Annual Growth Rate (CAGR) of approximately 4.5% over the forecast period (2025–2033). Adoption rates for advanced ammunition types, including precision-guided munitions and non-lethal options, are accelerating as militaries prioritize force protection and operational effectiveness. Technological disruptions are primarily centered on miniaturization, increased range, reduced collateral damage, and enhanced target acquisition capabilities. Consumer behavior shifts are evident in the growing demand for interoperable ammunition solutions that can be utilized across various platforms and allied forces. Market penetration of smart ammunition is expected to rise significantly, driven by its superior performance metrics and potential for reduced logistical burdens. The ongoing modernization of aging military arsenals across Europe and the increasing focus on territorial defense are critical factors underpinning this upward trend in market size. The integration of digital technologies into ammunition lifecycle management, from production to demilitarization, further contributes to market expansion and efficiency.

Dominant Regions, Countries, or Segments in Europe Ammunition Industry

The Production Analysis segment within the Europe Ammunition Industry is demonstrably dominated by Western European nations, with Germany, France, and the United Kingdom at the forefront. These countries benefit from established defense manufacturing infrastructure, a highly skilled workforce, and robust governmental support for domestic production.

- Key Drivers of Dominance (Production):

- Robust Defense Industrial Base: Long-standing expertise in precision engineering and advanced metallurgy.

- Governmental Procurement and R&D Support: Significant investment in indigenous defense capabilities and innovation.

- Export Orientation: Strong track record in supplying ammunition to global defense markets.

The Consumption Analysis is largely dictated by the defense spending of major European powers and NATO members. Countries like Poland, the Baltic states, and Scandinavia are showing increased consumption due to their proximity to perceived threats and their commitment to strengthening collective security.

- Key Drivers of Dominance (Consumption):

- Geopolitical Realities: Heightened security concerns and the need for rapid force projection.

- Modernization Programs: Upgrading existing military hardware necessitates increased ammunition stock.

- Military Aid and Alliances: Contributions to international defense initiatives drive consumption.

The Import Market Analysis (Value & Volume) is significantly influenced by countries seeking specialized or high-technology ammunition not produced domestically, or those looking to supplement their existing stocks rapidly. The United States remains a key supplier to Europe.

- Key Drivers of Dominance (Import):

- Technological Gaps: Accessing niche or cutting-edge ammunition types.

- Urgent Operational Requirements: Meeting immediate defense needs beyond domestic production capacity.

- Interoperability Standards: Aligning with allied nations' ammunition specifications.

The Export Market Analysis (Value & Volume) showcases Germany, France, and Sweden as leading exporters, capitalizing on their advanced manufacturing capabilities and reputation for quality. Their exports are vital to global defense supply chains.

- Key Drivers of Dominance (Export):

- Competitive Pricing and Quality: Offering reliable and cost-effective ammunition solutions.

- Strategic Partnerships: Collaborations with international defense entities.

- Reputation for Innovation: Offering advanced ammunition technologies to global buyers.

The Price Trend Analysis indicates a general upward trajectory due to inflation, rising raw material costs, and the increasing complexity of advanced ammunition. However, competitive bidding processes and economies of scale for high-volume orders can introduce price variations.

- Key Drivers of Dominance (Price):

- Raw Material Volatility: Fluctuations in the cost of metals and chemical propellants.

- Energy Costs: Impacting manufacturing and transportation expenses.

- Technological Sophistication: Higher R&D and production costs for advanced munitions.

Europe Ammunition Industry Product Landscape

The product landscape of the Europe Ammunition Industry is characterized by a strong emphasis on precision, reliability, and adaptability. Innovations are driving the development of smart munitions with integrated guidance systems, enabling enhanced accuracy and reduced collateral damage. Advanced propellants are being developed to improve range, velocity, and safety. The industry is also seeing a rise in specialized ammunition types catering to diverse operational environments, including urban warfare, anti-drone capabilities, and non-lethal options for law enforcement and crowd control. Performance metrics are increasingly focused on terminal ballistics, warhead effectiveness, and interoperability across various platforms. Unique selling propositions often lie in modular designs, advanced materials, and adherence to stringent NATO STANAG standards, ensuring seamless integration into allied defense systems.

Key Drivers, Barriers & Challenges in Europe Ammunition Industry

Key Drivers:

- Geopolitical Instability: The prevailing security environment in Europe, marked by heightened tensions and territorial defense concerns, is a primary catalyst for increased ammunition demand.

- Modernization of Defense Forces: Numerous European nations are undergoing significant military modernization programs, requiring substantial replenishment and upgrades of their ammunition stockpiles.

- Technological Advancements: The pursuit of superior battlefield capabilities, including precision-guided munitions and advanced threat mitigation, fuels innovation and drives market growth.

- Interoperability Initiatives: NATO and EU directives promoting interoperability necessitate the adoption of standardized ammunition types, fostering market expansion.

Barriers & Challenges:

- Supply Chain Vulnerabilities: Dependence on global raw material suppliers, particularly for propellants and specialized metals, poses a significant risk to production continuity.

- Regulatory Hurdles and Export Controls: Stringent regulations governing the production, sale, and international transfer of defense matériel can create complexities and delays.

- High Research and Development Costs: Developing cutting-edge ammunition technologies requires substantial investment, creating a barrier for smaller manufacturers.

- Skilled Labor Shortages: The specialized nature of ammunition manufacturing demands a skilled workforce, and shortages can impact production capacity.

- Environmental Regulations: Increasingly stringent environmental standards for manufacturing processes can add to operational costs and complexity.

- Price Pressures: While demand is high, competitive bidding processes and the need for cost-effective solutions can exert pressure on profit margins.

Emerging Opportunities in Europe Ammunition Industry

Emerging opportunities in the Europe Ammunition Industry are centered on the development and deployment of advanced, multi-role ammunition solutions. The growing threat of unmanned aerial vehicles (UAVs) presents a significant market for counter-drone ammunition and specialized interceptors. Furthermore, the increasing emphasis on modularity and adaptability in defense procurement opens doors for versatile ammunition systems that can be reconfigured for different mission profiles. The civilian market, particularly for training ammunition and less-lethal options for law enforcement, also represents an untapped segment with growth potential. Innovations in sustainable manufacturing processes and environmentally friendly propellants are also becoming increasingly important as defense organizations seek to align with broader environmental objectives.

Growth Accelerators in the Europe Ammunition Industry Industry

Several key factors are accelerating growth in the Europe Ammunition Industry. The sustained geopolitical uncertainty, particularly in Eastern Europe, is a significant catalyst, prompting increased defense spending and ammunition procurement by national governments and allied forces. Technological breakthroughs in areas such as smart ammunition, directed energy integration, and advanced materials are creating demand for next-generation ordnance, driving innovation and investment. Strategic partnerships and collaborations between European defense manufacturers are also playing a crucial role in consolidating expertise, expanding production capacity, and enhancing competitiveness in the global market. Furthermore, the ongoing trend of military modernization across the continent, including the upgrade of existing platforms and the acquisition of new weapon systems, directly translates into a greater need for a diverse range of ammunition.

Key Players Shaping the Europe Ammunition Industry Market

- General Dynamics Corporation

- Rheinmetall AG

- Elbit Systems Ltd

- Heckler & Koch GmbH

- Nexter Group

- Nammo AS

- Denel PMP

- BAE Systems plc

- ROSTEC

- Saab AB

Notable Milestones in Europe Ammunition Industry Sector

- December 2022: A European NATO customer entered into a contract with Rheinmetall to supply a maximum of 300,000 rounds of 40mm ammunition, consisting of LV (low velocity) and HV (high velocity) variants. The contract includes a first call-off of approximately 75,000 cartridges. This signifies a significant procurement for Rheinmetall and highlights demand for versatile 40mm ammunition.

- January 2022: The German Bundeswehr signed a contract with Rheinmetall AG to modernize its mortar systems and provide 120mm mortar ammunition. The contract is worth approximately EUR 27 million (USD 30 million) and will be completed by 2023. This underscores continued investment in indirect fire capabilities and long-term ammunition supply agreements.

In-Depth Europe Ammunition Industry Market Outlook

The Europe Ammunition Industry is set for robust future growth, driven by a confluence of factors including persistent geopolitical tensions and substantial defense modernization efforts across the continent. Emerging opportunities in smart munitions, counter-drone systems, and increasingly, sustainable manufacturing practices, are poised to reshape the market. Strategic alliances and investments in R&D will be critical for players to maintain a competitive edge and capture market share. The industry's ability to navigate supply chain complexities and adapt to evolving defense doctrines will be paramount in realizing its full potential and ensuring continued expansion in the coming years.

Europe Ammunition Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Ammunition Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

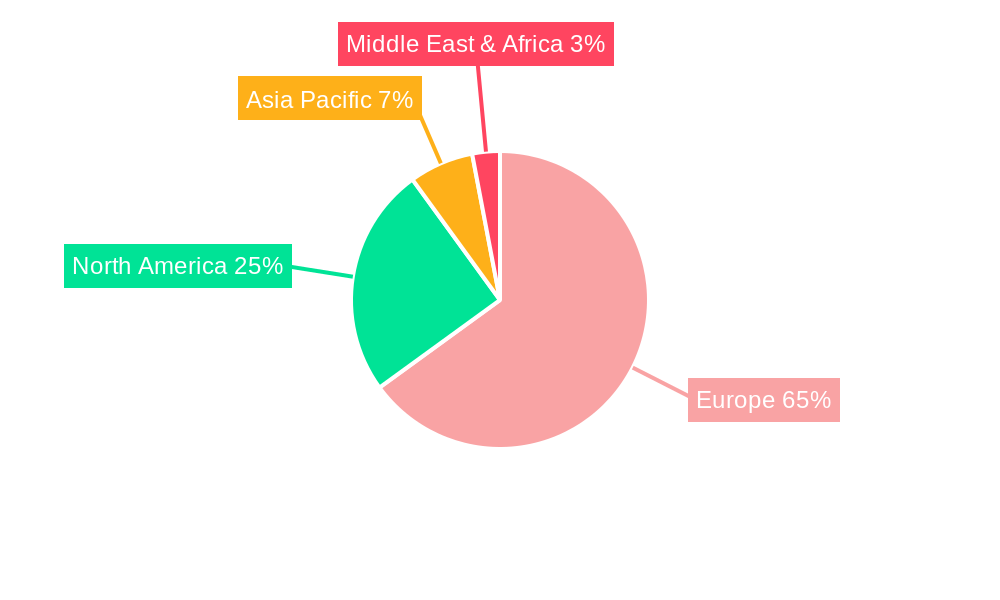

Europe Ammunition Industry Regional Market Share

Geographic Coverage of Europe Ammunition Industry

Europe Ammunition Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Military to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 General Dynamics Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rheinmetall AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elbit Systems Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Heckler & Koch Gmb

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nexter Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nammo AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Denel PMP

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BAE Systems plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ROSTEC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saab AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Europe Ammunition Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Ammunition Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Ammunition Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Ammunition Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Ammunition Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Ammunition Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Ammunition Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Ammunition Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Europe Ammunition Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Ammunition Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Ammunition Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Ammunition Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Ammunition Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Ammunition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Ammunition Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ammunition Industry?

The projected CAGR is approximately 8.64%.

2. Which companies are prominent players in the Europe Ammunition Industry?

Key companies in the market include General Dynamics Corporation, Rheinmetall AG, Elbit Systems Ltd, Heckler & Koch Gmb, Nexter Group, Nammo AS, Denel PMP, BAE Systems plc, ROSTEC, Saab AB.

3. What are the main segments of the Europe Ammunition Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Military to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

December 2022: A European NATO customer entered into a contract with Rheinmetall to supply a maximum of 300,000 rounds of 40mm ammunition, consisting of LV (low velocity) and HV (high velocity) variants. The contract includes a first call-off of approximately 75,000 cartridges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ammunition Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ammunition Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ammunition Industry?

To stay informed about further developments, trends, and reports in the Europe Ammunition Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence