Key Insights

The Latin America Airport Quick-Service Restaurant (QSR) market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 5.6%. This dynamic growth, from a market size of 66.61 billion in the base year of 2025, is driven by a confluence of factors. An increasing volume of air travelers across the region is directly fueling demand for convenient and accessible food options within airport environments. Concurrently, rising disposable incomes and evolving urban lifestyles are enhancing consumer appetite for QSR choices, even in travel hubs. The competitive landscape is intensifying with the expanding presence of both global QSR brands and successful local operators, fostering innovation and a diverse range of offerings. Furthermore, strategic investments in airport infrastructure and modernization projects are creating valuable opportunities for QSR businesses to establish and scale their operations. The market is segmented by food type (meals, bakery, beverages, other), food category (vegetarian, non-vegetarian, vegan), and store type (chain, independent). While chain outlets currently lead, independent operators specializing in authentic local cuisine are also gaining traction, highlighting the region's rich culinary diversity.

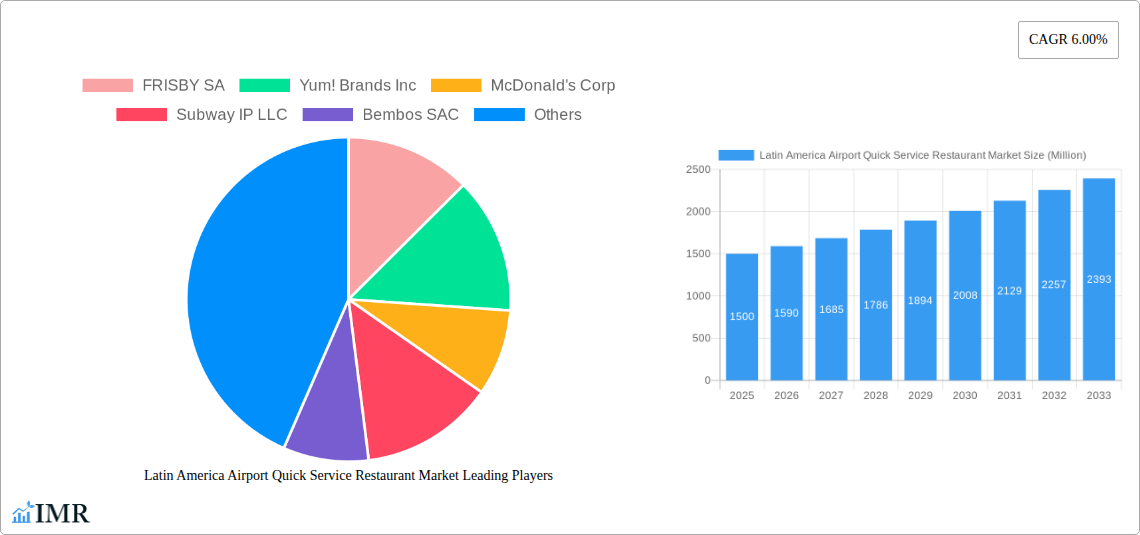

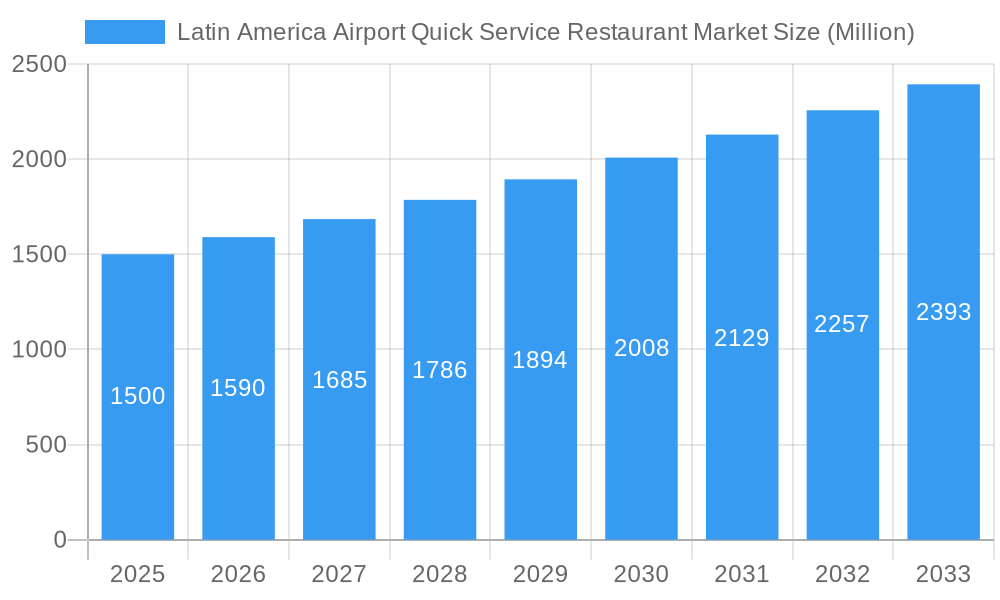

Latin America Airport Quick Service Restaurant Market Market Size (In Billion)

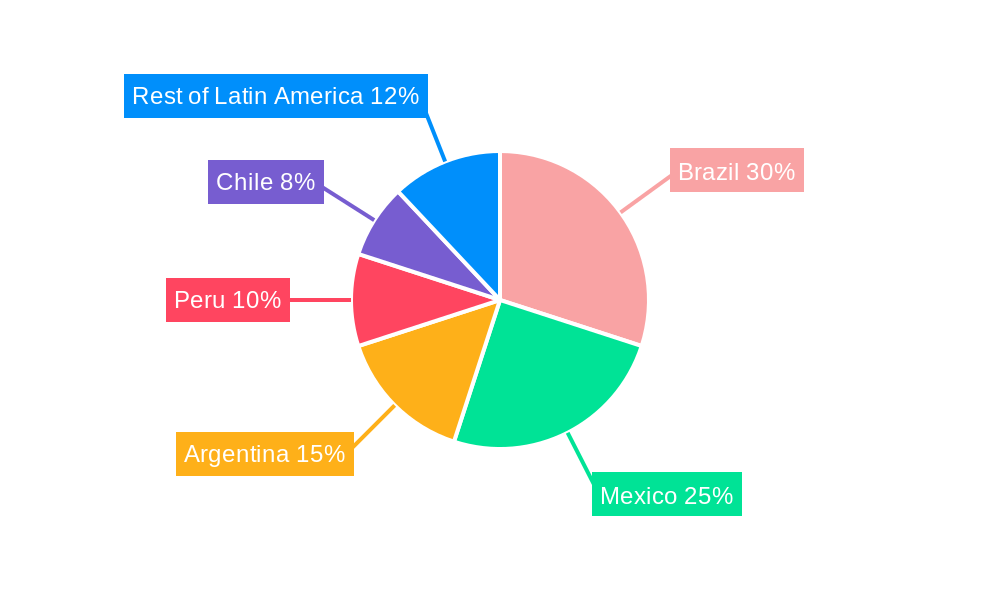

Key market dynamics reveal that the meals segment represents the largest share, followed by beverages and bakery/confectionery. Non-vegetarian options are currently dominant, though vegetarian and vegan choices are experiencing accelerated growth, aligning with global dietary shifts towards healthier and sustainable food consumption. Chain stores leverage brand recognition and operational efficiencies, while independent establishments offer distinctive regional flavors and cater to specific local tastes. Geographically, Brazil, Mexico, and Argentina are the leading markets, with substantial growth potential anticipated in other Latin American nations as economies develop and travel infrastructure matures. Success in this evolving market will hinge on operational excellence, menu development that reflects local preferences, and robust partnerships with airport authorities.

Latin America Airport Quick Service Restaurant Market Company Market Share

Latin America Airport Quick Service Restaurant Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America Airport Quick Service Restaurant (QSR) market, encompassing market dynamics, growth trends, dominant segments, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this rapidly evolving market. The parent market is the broader Latin American Food Service Industry, and the child market is specifically Airport QSR.

Latin America Airport Quick Service Restaurant Market Dynamics & Structure

This section analyzes the structure and dynamics of the Latin American Airport QSR market, encompassing market concentration, technological advancements, regulatory landscapes, competitive substitutes, and M&A activities. The market exhibits moderate concentration, with key players such as McDonald's Corp, Yum! Brands Inc, and Subway IP LLC holding significant shares. However, regional players like Bembos SAC and FRISBY SA also contribute substantially.

- Market Concentration: xx% held by top 5 players in 2025.

- Technological Innovation: Focus on digital ordering, mobile payments, and automated kiosks. Barriers include infrastructure limitations in certain airports and varying levels of technological adoption across the region.

- Regulatory Frameworks: Varying regulations across countries regarding food safety, hygiene, and licensing impact operational costs and market entry.

- Competitive Substitutes: Includes full-service restaurants, cafes, and airport lounges offering diverse food options.

- End-User Demographics: A significant portion of customers are international and domestic travelers, with varying preferences based on nationality and travel purpose.

- M&A Trends: xx M&A deals observed in the period 2019-2024, mostly focused on regional expansion and brand diversification.

Latin America Airport Quick Service Restaurant Market Growth Trends & Insights

The Latin American Airport QSR market is experiencing robust growth, driven by factors such as rising air passenger traffic, increasing disposable incomes, and the growing preference for convenient and quick meal options at airports. The market size reached xx million units in 2024 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period. Technological disruptions, such as online ordering and delivery services, are further accelerating market growth. Changing consumer preferences towards healthier options and personalized experiences are also impacting the market. Market penetration continues to rise as more airports integrate QSR outlets, catering to the needs of an increasingly mobile population.

Dominant Regions, Countries, or Segments in Latin America Airport Quick Service Restaurant Market

Brazil, Mexico, and Colombia are the dominant markets within the Latin American Airport QSR sector. These regions benefit from larger airport infrastructure, increased tourist inflow, and higher disposable incomes.

By Food Type:

- Meals: This segment holds the largest market share, driven by traveler demand for quick and filling meal options.

- Bakery & Confectionery: Significant growth, driven by increasing demand for snacks and desserts.

- Beverages: High demand for coffee, juices, and other beverages, especially during layovers.

- Other Food Types: This category encompasses various options catering to specific dietary preferences.

By Food Category:

- Non-Vegetarian Food: Holds a larger market share compared to Vegetarian and Vegan options due to prevailing dietary preferences.

- Vegetarian Food: Growing steadily in response to increasing health consciousness.

- Vegan Food: A niche but growing segment, reflecting increasing consumer demand for plant-based options.

By Store Type:

- Chain Stores: Dominate the market, leveraging brand recognition and economies of scale.

- Independent Stores: While smaller, independent stores offer unique local flavors and options.

Key Drivers:

- Expanding airport infrastructure and increased passenger traffic.

- Growing disposable income and rising tourism.

- Increasing adoption of technology and digital ordering platforms.

- Government initiatives promoting tourism and infrastructure development.

Latin America Airport Quick Service Restaurant Market Product Landscape

The Latin American Airport QSR market showcases diverse product offerings, ranging from traditional fast food to customized meal options and healthier choices. Product innovation focuses on speed of service, convenience, and catering to diverse dietary needs. Technological advancements include self-ordering kiosks, mobile payment options, and personalized menu recommendations through apps. Unique selling propositions emphasize speed, convenience, and appealing local flavor profiles.

Key Drivers, Barriers & Challenges in Latin America Airport Quick Service Restaurant Market

Key Drivers:

- Rising air passenger traffic across Latin America.

- Increased disposable income and consumer spending.

- Growing demand for convenience and on-the-go food options.

- Technological advancements improving efficiency and customer experience.

Key Challenges & Restraints:

- Fluctuations in currency exchange rates impacting import costs.

- Varying food safety regulations across countries.

- High operational costs, including rent and labor expenses.

- Intense competition from established and emerging players.

Emerging Opportunities in Latin America Airport Quick Service Restaurant Market

Emerging opportunities include expansion into smaller airports, catering to regional specificities, and introducing specialized menus catering to dietary restrictions and preferences. The growth of delivery services to gates and leveraging loyalty programs are also significant opportunities. The integration of smart technologies, like AI-powered personalized recommendations, will play a key role in customer engagement.

Growth Accelerators in the Latin America Airport Quick Service Restaurant Market Industry

Strategic partnerships with airlines and airport authorities, coupled with investments in technology, are accelerating market growth. Expansion into secondary and tertiary airports presents significant opportunities, and aggressive marketing campaigns targeting tourists are also contributing to the accelerated pace of growth.

Key Players Shaping the Latin America Airport Quick Service Restaurant Market Market

- FRISBY SA

- Yum! Brands Inc

- McDonald's Corp

- Subway IP LLC

- Bembos SAC

- Burger King Corp

- Domino's Pizza Inc

- ChurroMania International Holding LLC

- Starbucks Corp

- Juan Maestro (G&N Brands SpA)

Notable Milestones in Latin America Airport Quick Service Restaurant Market Sector

- 2021-Q3: McDonald's launches a new line of plant-based burgers across its Latin American airports.

- 2022-Q1: Yum! Brands partners with several Latin American airports to expand its KFC and Pizza Hut presence.

- 2023-Q2: Subway expands its presence in key Latin American airports through franchise agreements.

In-Depth Latin America Airport Quick Service Restaurant Market Outlook

The Latin American Airport QSR market holds significant future potential. Continued growth in air passenger traffic, coupled with the ongoing adoption of technology and evolving consumer preferences, will drive further expansion. Strategic partnerships, innovative product development, and a focus on sustainability will be critical for success in this dynamic market. The market is poised for continued expansion with the predicted rise in air travel and evolving consumer demands for convenience and diverse food options.

Latin America Airport Quick Service Restaurant Market Segmentation

-

1. Food Type

- 1.1. Meals

- 1.2. Bakery and confectionery

- 1.3. Beverages

- 1.4. Other Food Types

-

2. Food Category

- 2.1. Vegetarian Food

- 2.2. Non-Vegetarian Food

- 2.3. Vegan Food

-

3. Store Type

- 3.1. Chain Store

- 3.2. Independent Store

-

4. Geography

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Colombia

- 4.5. Rest of Latin America

Latin America Airport Quick Service Restaurant Market Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Argentina

- 4. Colombia

- 5. Rest of Latin America

Latin America Airport Quick Service Restaurant Market Regional Market Share

Geographic Coverage of Latin America Airport Quick Service Restaurant Market

Latin America Airport Quick Service Restaurant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 By Food Type

- 3.4.2 Meals is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Airport Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 5.1.1. Meals

- 5.1.2. Bakery and confectionery

- 5.1.3. Beverages

- 5.1.4. Other Food Types

- 5.2. Market Analysis, Insights and Forecast - by Food Category

- 5.2.1. Vegetarian Food

- 5.2.2. Non-Vegetarian Food

- 5.2.3. Vegan Food

- 5.3. Market Analysis, Insights and Forecast - by Store Type

- 5.3.1. Chain Store

- 5.3.2. Independent Store

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Argentina

- 5.4.4. Colombia

- 5.4.5. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Mexico

- 5.5.2. Brazil

- 5.5.3. Argentina

- 5.5.4. Colombia

- 5.5.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 6. Mexico Latin America Airport Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 6.1.1. Meals

- 6.1.2. Bakery and confectionery

- 6.1.3. Beverages

- 6.1.4. Other Food Types

- 6.2. Market Analysis, Insights and Forecast - by Food Category

- 6.2.1. Vegetarian Food

- 6.2.2. Non-Vegetarian Food

- 6.2.3. Vegan Food

- 6.3. Market Analysis, Insights and Forecast - by Store Type

- 6.3.1. Chain Store

- 6.3.2. Independent Store

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Mexico

- 6.4.2. Brazil

- 6.4.3. Argentina

- 6.4.4. Colombia

- 6.4.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 7. Brazil Latin America Airport Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 7.1.1. Meals

- 7.1.2. Bakery and confectionery

- 7.1.3. Beverages

- 7.1.4. Other Food Types

- 7.2. Market Analysis, Insights and Forecast - by Food Category

- 7.2.1. Vegetarian Food

- 7.2.2. Non-Vegetarian Food

- 7.2.3. Vegan Food

- 7.3. Market Analysis, Insights and Forecast - by Store Type

- 7.3.1. Chain Store

- 7.3.2. Independent Store

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Mexico

- 7.4.2. Brazil

- 7.4.3. Argentina

- 7.4.4. Colombia

- 7.4.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 8. Argentina Latin America Airport Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Food Type

- 8.1.1. Meals

- 8.1.2. Bakery and confectionery

- 8.1.3. Beverages

- 8.1.4. Other Food Types

- 8.2. Market Analysis, Insights and Forecast - by Food Category

- 8.2.1. Vegetarian Food

- 8.2.2. Non-Vegetarian Food

- 8.2.3. Vegan Food

- 8.3. Market Analysis, Insights and Forecast - by Store Type

- 8.3.1. Chain Store

- 8.3.2. Independent Store

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Mexico

- 8.4.2. Brazil

- 8.4.3. Argentina

- 8.4.4. Colombia

- 8.4.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Food Type

- 9. Colombia Latin America Airport Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Food Type

- 9.1.1. Meals

- 9.1.2. Bakery and confectionery

- 9.1.3. Beverages

- 9.1.4. Other Food Types

- 9.2. Market Analysis, Insights and Forecast - by Food Category

- 9.2.1. Vegetarian Food

- 9.2.2. Non-Vegetarian Food

- 9.2.3. Vegan Food

- 9.3. Market Analysis, Insights and Forecast - by Store Type

- 9.3.1. Chain Store

- 9.3.2. Independent Store

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Mexico

- 9.4.2. Brazil

- 9.4.3. Argentina

- 9.4.4. Colombia

- 9.4.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Food Type

- 10. Rest of Latin America Latin America Airport Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Food Type

- 10.1.1. Meals

- 10.1.2. Bakery and confectionery

- 10.1.3. Beverages

- 10.1.4. Other Food Types

- 10.2. Market Analysis, Insights and Forecast - by Food Category

- 10.2.1. Vegetarian Food

- 10.2.2. Non-Vegetarian Food

- 10.2.3. Vegan Food

- 10.3. Market Analysis, Insights and Forecast - by Store Type

- 10.3.1. Chain Store

- 10.3.2. Independent Store

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Mexico

- 10.4.2. Brazil

- 10.4.3. Argentina

- 10.4.4. Colombia

- 10.4.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Food Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 FRISBY SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yum! Brands Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 McDonald's Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Subway IP LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bembos SAC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Burger King Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Domino's Pizza Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ChurroMania International Holding LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Starbucks Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Juan Maestro (G&N Brands SpA)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 FRISBY SA

List of Figures

- Figure 1: Latin America Airport Quick Service Restaurant Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Airport Quick Service Restaurant Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 2: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Category 2020 & 2033

- Table 3: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Store Type 2020 & 2033

- Table 4: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 7: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Category 2020 & 2033

- Table 8: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Store Type 2020 & 2033

- Table 9: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 12: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Category 2020 & 2033

- Table 13: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Store Type 2020 & 2033

- Table 14: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 17: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Category 2020 & 2033

- Table 18: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Store Type 2020 & 2033

- Table 19: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 22: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Category 2020 & 2033

- Table 23: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Store Type 2020 & 2033

- Table 24: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 27: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Category 2020 & 2033

- Table 28: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Store Type 2020 & 2033

- Table 29: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Airport Quick Service Restaurant Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Latin America Airport Quick Service Restaurant Market?

Key companies in the market include FRISBY SA, Yum! Brands Inc, McDonald's Corp, Subway IP LLC, Bembos SAC, Burger King Corp, Domino's Pizza Inc, ChurroMania International Holding LLC, Starbucks Corp, Juan Maestro (G&N Brands SpA).

3. What are the main segments of the Latin America Airport Quick Service Restaurant Market?

The market segments include Food Type, Food Category, Store Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.61 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

By Food Type. Meals is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Airport Quick Service Restaurant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Airport Quick Service Restaurant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Airport Quick Service Restaurant Market?

To stay informed about further developments, trends, and reports in the Latin America Airport Quick Service Restaurant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence