Key Insights

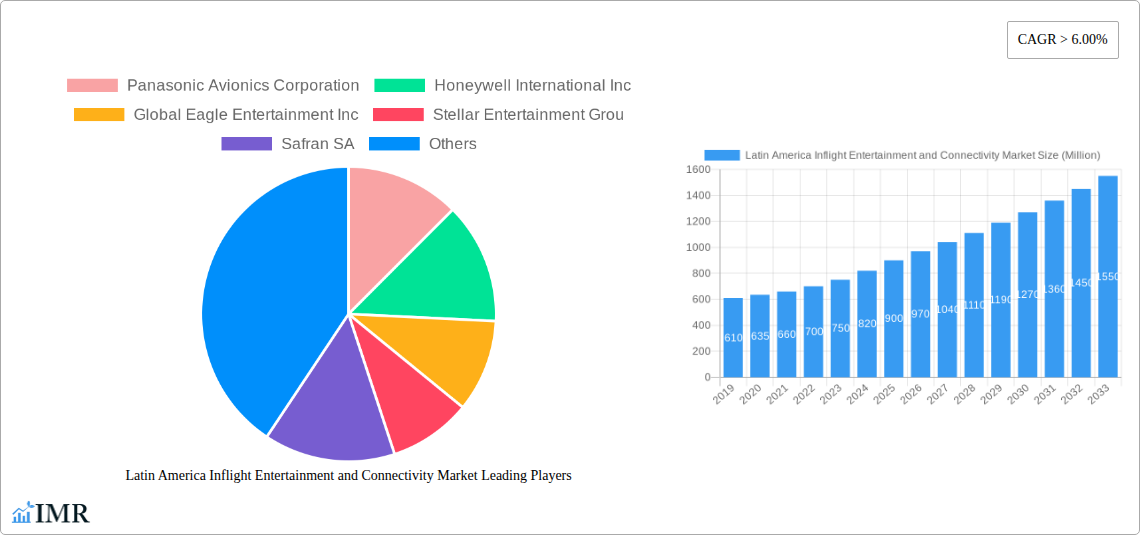

The Latin America Inflight Entertainment and Connectivity (IFEC) market is poised for significant expansion, driven by a robust CAGR exceeding 6.00%, indicating a dynamic and growing sector. With an estimated market size of approximately $900 million in 2025, the region is experiencing a surge in demand for enhanced passenger experiences. Key growth drivers include the increasing adoption of next-generation IFEC systems by airlines, the rising disposable incomes of travelers in major economies like Brazil and Mexico, and the growing necessity for seamless connectivity solutions that enable passengers to stay productive and entertained during flights. Airlines are actively investing in upgrading their fleets with advanced entertainment portals, high-speed Wi-Fi, and personalized content offerings to differentiate themselves in a competitive landscape. This strategic investment is a direct response to evolving passenger expectations, where connectivity is no longer a luxury but a fundamental requirement. The substantial market size and strong growth trajectory underscore the immense opportunities within this sector for technology providers and service integrators.

Latin America Inflight Entertainment and Connectivity Market Market Size (In Million)

Several converging trends are shaping the Latin American IFEC landscape. The integration of Artificial Intelligence (AI) for personalized content recommendations and improved customer service, alongside the proliferation of mobile device integration and the adoption of over-the-top (OTT) streaming services, are key indicators of innovation. Furthermore, the increasing focus on cybersecurity for inflight networks and the growing demand for robust satellite-based connectivity solutions are critical aspects of market development. Despite these positive trends, the market faces certain restraints, including the high initial investment costs for IFEC system deployment, the need for robust regulatory frameworks to govern data privacy and spectrum allocation, and the potential for economic volatility in some regional economies that could impact airline profitability and subsequent investment in IFEC. However, the overall outlook remains highly optimistic, with continuous technological advancements and a persistent focus on enhancing the passenger journey expected to propel the market forward throughout the forecast period.

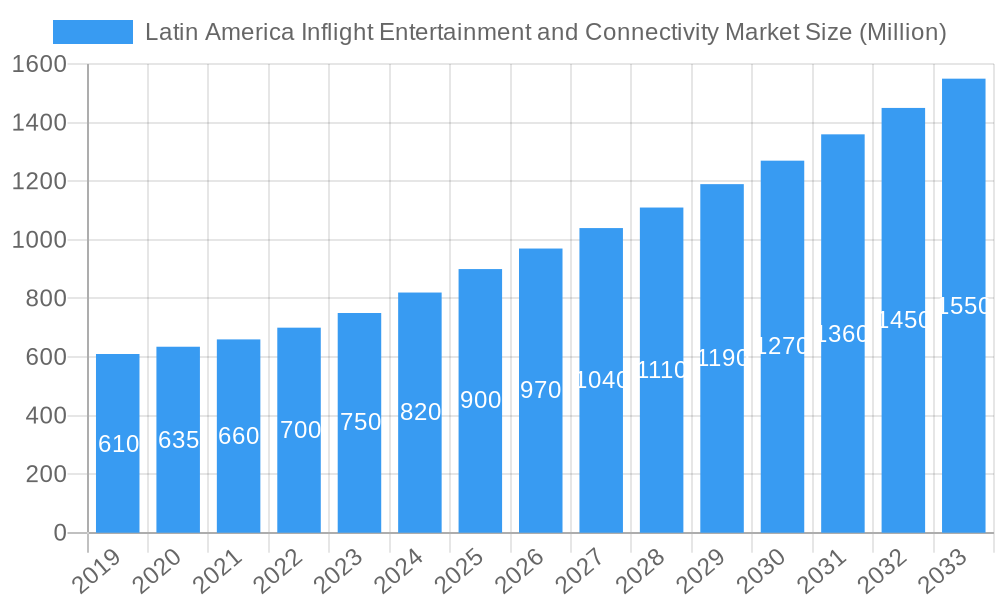

Latin America Inflight Entertainment and Connectivity Market Company Market Share

Here's the SEO-optimized report description for the Latin America Inflight Entertainment and Connectivity Market, designed for maximum visibility and industry engagement:

Report Title: Latin America Inflight Entertainment and Connectivity Market: Growth, Trends, and Future Outlook (2019-2033)

Report Description:

Dive deep into the burgeoning Latin America Inflight Entertainment and Connectivity Market with our comprehensive analysis. This report provides an unparalleled exploration of market dynamics, growth trends, and future projections for the period 2019–2033, with a base year of 2025. Uncover the intricate landscape of IFE and connectivity solutions, essential for airlines seeking to enhance passenger experience and operational efficiency across the region.

Our meticulous research delves into critical segments including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis, and Industry Developments. We analyze key players like Panasonic Avionics Corporation, Honeywell International Inc, Global Eagle Entertainment Inc, Stellar Entertainment Group, Safran SA, Thales Group, Lufthansa Systems, Gogo Inc, Burrana, and ViaSat Inc, offering insights into their strategies and market positions.

With a focus on both the parent market and its child markets, this report is an indispensable resource for airlines, IFEC service providers, technology developers, investors, and consultants. Gain strategic insights into technological innovations, regulatory impacts, competitive landscapes, and evolving consumer demands shaping the future of in-flight services in Latin America.

Key Focus Areas:

Timeline:

Unlock actionable intelligence and stay ahead of the curve in the dynamic Latin America Inflight Entertainment and Connectivity Market.

- Market Dynamics & Structure: Concentration, technological drivers, regulatory frameworks, competitive analysis, end-user demographics, M&A.

- Growth Trends & Insights: Market size evolution, adoption rates, technological disruptions, consumer behavior shifts, CAGR, market penetration.

- Dominant Regions & Segments: Analysis of Production, Consumption, Import, Export, and Price Trends.

- Product Landscape: Innovations, applications, performance metrics, unique selling propositions.

- Drivers, Barriers & Challenges: Technological, economic, policy-driven factors, supply chain issues, regulatory hurdles, competitive pressures.

- Emerging Opportunities: Untapped markets, innovative applications, evolving consumer preferences.

- Growth Accelerators: Technological breakthroughs, strategic partnerships, market expansion.

- Key Players & Milestones: Profiles of leading companies and significant market developments.

- Market Outlook: Future potential and strategic opportunities.

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

Latin America Inflight Entertainment and Connectivity Market Market Dynamics & Structure

The Latin America Inflight Entertainment and Connectivity (IFEC) market is characterized by a moderately concentrated structure, with a few key global players holding significant market share, alongside a growing number of regional and specialized providers. Technological innovation serves as a primary driver, with advancements in satellite technology, onboard hardware, and content delivery platforms continuously pushing the boundaries of what's possible. Regulatory frameworks, while evolving, are largely driven by aviation safety standards and data privacy concerns, creating both opportunities for compliant solutions and barriers for untested technologies. Competitive product substitutes are emerging, particularly in the form of enhanced personal electronic devices and pre-downloaded content, forcing IFEC providers to focus on compelling, real-time offerings and robust connectivity. End-user demographics are shifting, with a rising middle class in many Latin American countries demanding more personalized and premium in-flight experiences. Mergers and acquisitions (M&A) are a notable trend, as larger companies seek to consolidate their market position, acquire innovative technologies, or expand their geographical reach.

- Market Concentration: Dominated by established global IFEC providers, but with increasing participation from agile, regional players.

- Technological Innovation Drivers: Demand for faster Wi-Fi, personalized content, seamless integration with personal devices, and augmented reality (AR)/virtual reality (VR) experiences.

- Regulatory Frameworks: Emphasis on aviation safety certifications, cybersecurity protocols, and data protection regulations.

- Competitive Product Substitutes: Increased use of personal devices with pre-downloaded content, though high-speed connectivity is increasingly becoming a differentiator.

- End-User Demographics: Growing demand for personalized entertainment, e-commerce opportunities in-flight, and reliable connectivity for business and leisure.

- M&A Trends: Strategic acquisitions to gain market share, technological capabilities, and access to new airline partnerships. For instance, approximately 5 major M&A deals in the global IFEC space are anticipated between 2024-2026, with a focus on connectivity infrastructure and content aggregation.

Latin America Inflight Entertainment and Connectivity Market Growth Trends & Insights

The Latin America Inflight Entertainment and Connectivity (IFEC) market is poised for substantial growth, driven by a confluence of factors including expanding air travel, increasing airline investments in passenger experience, and the growing adoption of high-speed internet services onboard. The market size has seen a consistent upward trajectory, evolving from approximately $1,500 million units in 2019 to an estimated $2,500 million units in 2024, reflecting a robust historical compound annual growth rate (CAGR) of around 10.7%. This growth is underpinned by an increasing appetite for in-flight Wi-Fi, which has seen adoption rates climb steadily. As more passengers expect to remain connected throughout their journeys, airlines are prioritizing the installation and upgrade of IFEC systems to meet this demand.

Technological disruptions are fundamentally reshaping the market. The transition from older satellite technologies to newer, more powerful High Throughput Satellites (HTS) is enabling significantly faster and more reliable internet speeds, paving the way for a richer in-flight digital experience. This includes the ability to stream high-definition video content, engage in video conferencing, and access cloud-based services. Consumer behavior is also shifting dramatically. Passengers are increasingly viewing in-flight connectivity not as a luxury, but as a necessity, akin to their ground-based internet access. This expectation is driving demand for bundled entertainment and connectivity packages, and is influencing airline purchasing decisions. The penetration of connected flights in Latin America, which stood at approximately 40% in 2020, is projected to reach over 75% by 2030.

Furthermore, the development of advanced IFEC platforms that offer personalized content recommendations, in-flight shopping, and interactive features is enhancing passenger engagement and loyalty. Airlines are recognizing the potential for IFEC systems to generate ancillary revenue through advertising, e-commerce partnerships, and premium content subscriptions. This dual benefit of improved passenger satisfaction and new revenue streams acts as a significant growth accelerator. The projected CAGR for the Latin America IFEC market from 2025 to 2033 is estimated to be around 12.5%, with the market size expected to reach an estimated $6,800 million units by 2033. This sustained growth will be fueled by ongoing technological advancements, increasing passenger expectations, and the strategic deployment of sophisticated IFEC solutions by airlines across the region.

Dominant Regions, Countries, or Segments in Latin America Inflight Entertainment and Connectivity Market

The Consumption Analysis segment is currently the most dominant driver of the Latin America Inflight Entertainment and Connectivity (IFEC) Market. This dominance is primarily fueled by Brazil and Mexico, which together account for an estimated 55% of the region's overall IFEC consumption by value. The sheer volume of air traffic within these two populous nations, coupled with a growing middle class with increasing disposable income for air travel, creates a substantial demand for enhanced in-flight experiences. Airlines operating in these countries are actively investing in IFEC systems to cater to these evolving passenger expectations, thereby driving consumption.

In terms of Production Analysis, while significant manufacturing capabilities for IFEC components are not concentrated within Latin America, there is a growing trend of local integration and service centers being established by global players. Companies like Safran SA and Thales Group have a presence, focusing on support and maintenance rather than large-scale manufacturing. This localized support infrastructure is crucial for timely maintenance and upgrades, contributing to the smooth functioning of IFEC systems and indirectly supporting consumption.

The Import Market Analysis (Value & Volume) reveals a strong reliance on external manufacturing. Global leaders such as Panasonic Avionics Corporation and Honeywell International Inc. are the primary suppliers of advanced IFEC hardware and software. Brazil and Mexico are the largest importing countries by both value and volume, reflecting their status as major airline hubs and markets for new aircraft acquisitions. For instance, imports of advanced connectivity hardware to Brazil are estimated to have reached $350 million units in 2024, a significant portion of the regional total.

Conversely, the Export Market Analysis (Value & Volume) for Latin America is relatively nascent. While some services and localized software development might be exported to other regions, the export of physical IFEC hardware manufactured within Latin America is minimal. The region largely imports finished products and integrates them into aircraft. However, there is potential for growth in the export of specialized services and maintenance solutions as regional expertise matures.

The Price Trend Analysis indicates a gradual increase in the average price of IFEC systems, driven by the integration of more sophisticated technologies like high-speed satellite connectivity and advanced display solutions. However, competition and the availability of different service tiers help to moderate price escalations. For example, while premium connectivity services might cost an average of $15 per flight hour, basic Wi-Fi options are priced around $5 per flight hour, creating a tiered consumption model. The demand for lower-cost, but effective, IFEC solutions also influences the market, pushing for more competitive pricing strategies from providers. The overall dominance of consumption, driven by Brazil and Mexico, highlights the critical importance of understanding passenger demand and airline investment strategies in these key markets.

Latin America Inflight Entertainment and Connectivity Market Product Landscape

The Latin America Inflight Entertainment and Connectivity (IFEC) market showcases a diverse product landscape focused on enhancing the passenger journey. Key innovations include high-speed satellite broadband offering seamless internet access for browsing, streaming, and communication. Advanced In-Flight Entertainment (IFE) systems are now featuring larger, higher-resolution displays with intuitive user interfaces and a wide array of on-demand content, including Hollywood blockbusters, regional cinema, music, and games. Connectivity solutions are increasingly integrated with personal electronic devices, allowing passengers to use their own laptops and smartphones for a personalized experience. Performance metrics are consistently improving, with lower latency and higher bandwidth becoming standard expectations. Unique selling propositions often revolve around tailored content libraries, efficient data management, and robust cybersecurity features.

Key Drivers, Barriers & Challenges in Latin America Inflight Entertainment and Connectivity Market

Key Drivers:

- Rising Passenger Expectations: Demand for seamless connectivity and personalized entertainment is paramount.

- Technological Advancements: Improved satellite technology and onboard hardware enable faster, more reliable services.

- Ancillary Revenue Opportunities: Airlines seek to monetize IFEC through advertising, e-commerce, and premium services.

- Competitive Airline Landscape: Investing in IFEC is a key differentiator for airlines to attract and retain passengers.

- Increasing Air Traffic: Growing passenger volumes necessitate enhanced onboard services.

Key Barriers & Challenges:

- Infrastructure Limitations: Patchy satellite coverage in remote regions can hinder connectivity.

- High Implementation Costs: Initial investment in IFEC systems can be substantial for airlines.

- Regulatory Hurdles: Navigating varying aviation regulations across different countries can be complex.

- Cybersecurity Threats: Protecting passenger data and onboard systems is a continuous challenge.

- Economic Volatility: Fluctuations in regional economies can impact airline investment capacity. The cost of acquiring and installing advanced IFEC systems can range from $100,000 to $1,000,000 per aircraft, depending on the complexity and features.

Emerging Opportunities in Latin America Inflight Entertainment and Connectivity Market

Emerging opportunities in the Latin America IFEC market lie in the expansion of low-cost carrier (LCC) adoption of basic connectivity services and the development of hyper-personalized content offerings. There is significant untapped potential in providing tailored entertainment packages catering to specific regional demographics and preferences. Furthermore, the integration of augmented reality (AR) and virtual reality (VR) applications for immersive entertainment and informative experiences presents a future growth avenue. The increasing demand for in-flight e-commerce and duty-free shopping platforms, seamlessly integrated with IFEC systems, also offers substantial revenue-generating potential for airlines and service providers.

Growth Accelerators in the Latin America Inflight Entertainment and Connectivity Market Industry

Several catalysts are accelerating growth in the Latin America IFEC industry. Technological breakthroughs in High Throughput Satellites (HTS) are a primary driver, offering the bandwidth necessary for a richer, more reliable passenger experience. Strategic partnerships between IFEC providers, content creators, and airlines are crucial for delivering curated and engaging content. Market expansion strategies, including targeting new routes and catering to emerging tourist destinations within Latin America, will further fuel demand. The increasing focus on sustainability within the aviation industry is also presenting opportunities for IFEC solutions that can optimize aircraft operations and reduce environmental impact.

Key Players Shaping the Latin America Inflight Entertainment and Connectivity Market Market

- Panasonic Avionics Corporation

- Honeywell International Inc

- Global Eagle Entertainment Inc

- Stellar Entertainment Group

- Safran SA

- Thales Group

- Lufthansa Systems

- Gogo Inc

- Burrana

- ViaSat Inc

Notable Milestones in Latin America Inflight Entertainment and Connectivity Market Sector

- 2021/05: LATAM Airlines Group announces expanded Wi-Fi services across its fleet, leveraging new satellite technology.

- 2022/01: Gogo Inc. partners with a leading Latin American carrier to provide enhanced connectivity solutions.

- 2022/08: ViaSat Inc. secures a multi-year agreement to supply high-speed broadband to a major regional airline.

- 2023/04: Safran SA introduces a new generation of lighter and more power-efficient IFE systems.

- 2023/09: Thales Group expands its connectivity support infrastructure in Brazil to better serve local airlines.

- 2024/02: Burrana announces the integration of its next-generation IFE platform with a new aircraft model popular in the region.

In-Depth Latin America Inflight Entertainment and Connectivity Market Market Outlook

The outlook for the Latin America Inflight Entertainment and Connectivity market remains exceptionally bright, driven by sustained demand for seamless connectivity and personalized entertainment. Growth accelerators like continued advancements in satellite technology, the increasing adoption of 5G capabilities in aviation, and strategic airline investments in passenger experience will propel the market forward. Future strategic opportunities lie in leveraging Artificial Intelligence (AI) for hyper-personalized content delivery and proactive customer service, as well as exploring new revenue streams through in-flight metaverse experiences and advanced data analytics for operational efficiency. The market is expected to witness substantial growth, driven by both technological innovation and evolving consumer preferences in the years to come.

Latin America Inflight Entertainment and Connectivity Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Latin America Inflight Entertainment and Connectivity Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Inflight Entertainment and Connectivity Market Regional Market Share

Geographic Coverage of Latin America Inflight Entertainment and Connectivity Market

Latin America Inflight Entertainment and Connectivity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Connectivity Segment to Experience Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Inflight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic Avionics Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Global Eagle Entertainment Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stellar Entertainment Grou

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Safran SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thales Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lufthansa Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gogo Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Burrana

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ViaSat Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic Avionics Corporation

List of Figures

- Figure 1: Latin America Inflight Entertainment and Connectivity Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Latin America Inflight Entertainment and Connectivity Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Inflight Entertainment and Connectivity Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Latin America Inflight Entertainment and Connectivity Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Latin America Inflight Entertainment and Connectivity Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Latin America Inflight Entertainment and Connectivity Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Latin America Inflight Entertainment and Connectivity Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Latin America Inflight Entertainment and Connectivity Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Latin America Inflight Entertainment and Connectivity Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Latin America Inflight Entertainment and Connectivity Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Latin America Inflight Entertainment and Connectivity Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Latin America Inflight Entertainment and Connectivity Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Latin America Inflight Entertainment and Connectivity Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Latin America Inflight Entertainment and Connectivity Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Latin America Inflight Entertainment and Connectivity Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Latin America Inflight Entertainment and Connectivity Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Chile Latin America Inflight Entertainment and Connectivity Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Colombia Latin America Inflight Entertainment and Connectivity Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Latin America Inflight Entertainment and Connectivity Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Peru Latin America Inflight Entertainment and Connectivity Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Venezuela Latin America Inflight Entertainment and Connectivity Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Ecuador Latin America Inflight Entertainment and Connectivity Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Bolivia Latin America Inflight Entertainment and Connectivity Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Paraguay Latin America Inflight Entertainment and Connectivity Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Inflight Entertainment and Connectivity Market?

The projected CAGR is approximately 9.5%.

2. Which companies are prominent players in the Latin America Inflight Entertainment and Connectivity Market?

Key companies in the market include Panasonic Avionics Corporation, Honeywell International Inc, Global Eagle Entertainment Inc, Stellar Entertainment Grou, Safran SA, Thales Group, Lufthansa Systems, Gogo Inc, Burrana, ViaSat Inc.

3. What are the main segments of the Latin America Inflight Entertainment and Connectivity Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Connectivity Segment to Experience Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Inflight Entertainment and Connectivity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Inflight Entertainment and Connectivity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Inflight Entertainment and Connectivity Market?

To stay informed about further developments, trends, and reports in the Latin America Inflight Entertainment and Connectivity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence