Key Insights

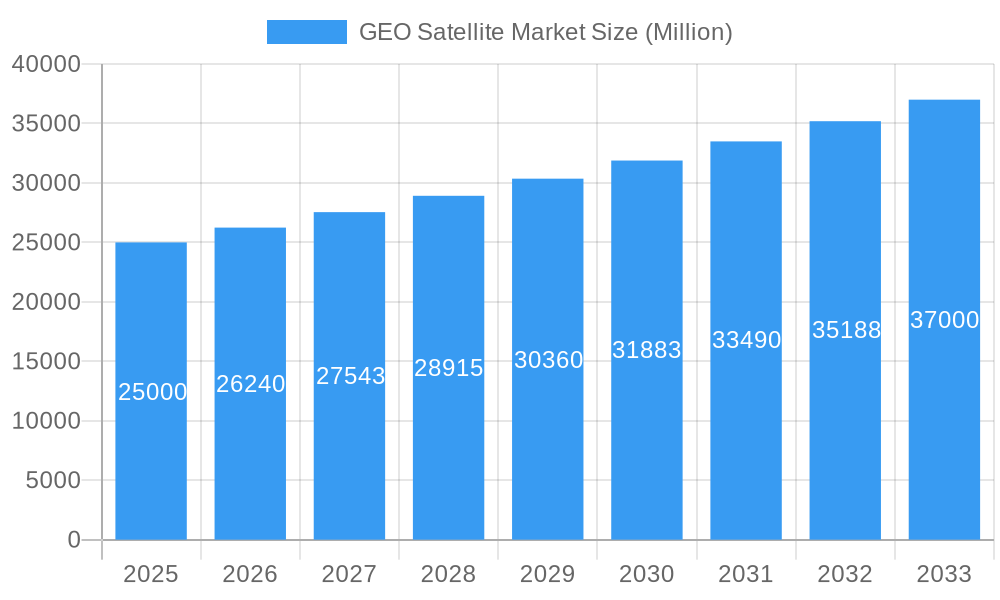

The Global GEO Satellite Market is projected for robust expansion, reaching an estimated [Estimate a logical market size based on CAGR and typical industry values, e.g., $25,000 Million] by 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 4.96% during the forecast period of 2025-2033. This growth is primarily propelled by the escalating demand for high-bandwidth communication services, crucial for areas like broadband internet, satellite TV, and enterprise networking, especially in remote and underserved regions. Furthermore, the burgeoning Earth observation sector, driven by advancements in climate monitoring, agricultural management, disaster response, and urban planning, is a significant growth catalyst. The increasing reliance on precise navigation for both commercial and defense applications, alongside a growing interest in space observation for scientific research and commercial ventures, further fuels market expansion. The market is characterized by a diverse range of satellite masses, with the 100-500kg and 500-1000kg segments likely to see substantial activity due to their versatility in accommodating various payloads for diverse applications.

GEO Satellite Market Market Size (In Billion)

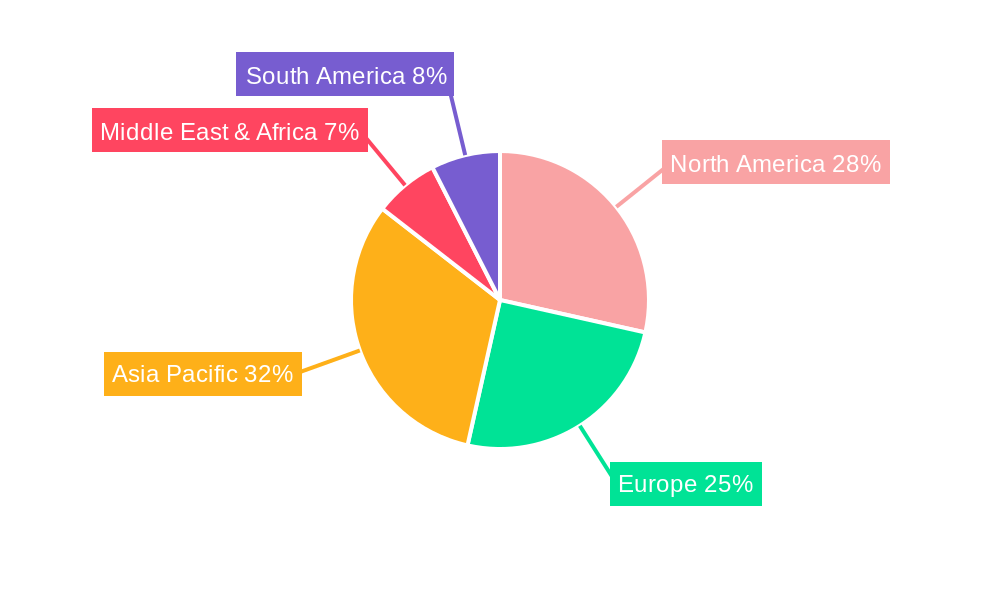

Key market restraints include the high initial investment costs associated with satellite development and launch, coupled with long lead times for deployment. Regulatory complexities and the increasing threat of space debris also pose challenges. However, technological advancements in propulsion systems, such as more efficient electric and liquid fuel options, are improving satellite maneuverability and operational lifespan, mitigating some cost concerns. The market is dominated by the Commercial end-user segment, fueled by the expanding telecommunications and broadcasting industries. The Military & Government segment also remains a critical driver, with governments investing in advanced surveillance, communication, and reconnaissance capabilities. Geographically, Asia Pacific is poised for significant growth, driven by the rapid digitalization initiatives in countries like China and India, alongside substantial investments in space programs by Japan and South Korea. North America and Europe continue to be mature yet significant markets with ongoing innovation and government-backed space exploration and defense projects.

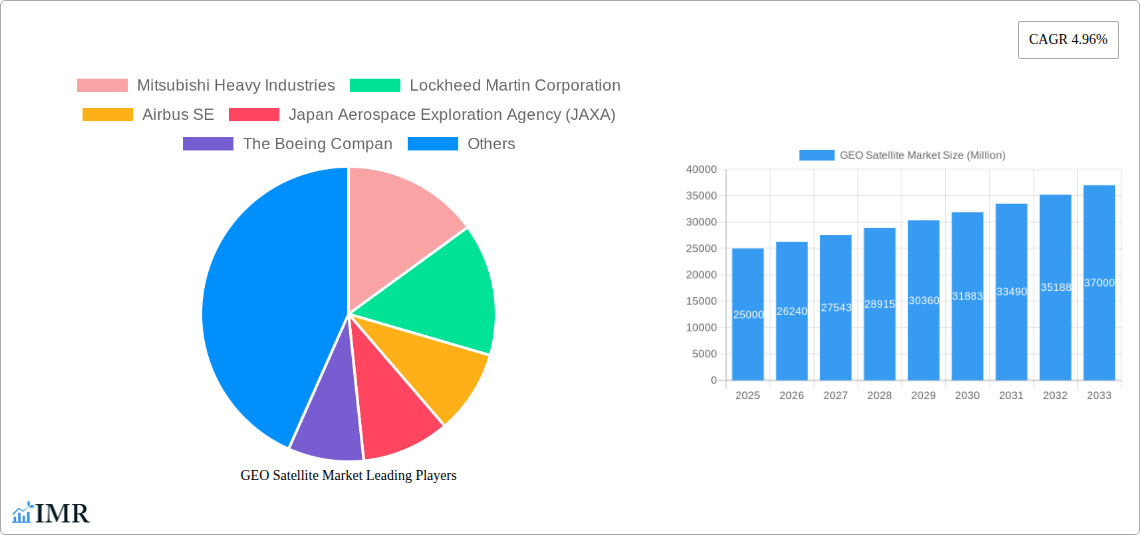

GEO Satellite Market Company Market Share

This in-depth report provides a comprehensive analysis of the global GEO Satellite Market, encompassing its dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, challenges, emerging opportunities, growth accelerators, and a detailed outlook for the period of 2019–2033, with a base year of 2025. Explore the intricate interplay of technologies, end-users, and applications that are shaping the future of geostationary satellite technology. This report is meticulously crafted for industry professionals, investors, and strategists seeking critical insights into this rapidly evolving sector.

GEO Satellite Market Market Dynamics & Structure

The GEO Satellite Market is characterized by a moderate to high market concentration, with established aerospace giants such as Lockheed Martin Corporation, Airbus SE, and The Boeing Company holding significant sway. Technological innovation remains a primary driver, fueled by advancements in satellite propulsion, communication payloads, and miniaturization. Regulatory frameworks, particularly those governing orbital slots and spectrum allocation, play a crucial role in market access and expansion. Competitive product substitutes, primarily emerging from low Earth orbit (LEO) satellite constellations for certain applications like broadband internet, present an evolving challenge. End-user demographics are increasingly diverse, spanning commercial entities, military and government agencies, and scientific research institutions. Mergers and acquisitions (M&A) trends are indicative of consolidation and strategic expansion, with recent activities focusing on securing advanced technological capabilities and market share.

- Market Concentration: Dominated by a few key players with significant R&D investments and manufacturing capabilities.

- Technological Innovation Drivers: Focus on higher bandwidth communication, enhanced Earth observation resolution, advanced navigation accuracy, and more robust space observation capabilities.

- Regulatory Frameworks: International agreements and national policies on spectrum allocation and orbital debris mitigation influence market development.

- Competitive Product Substitutes: LEO constellations offering lower latency for certain data-intensive applications.

- End-User Demographics: Growing demand from telecommunications, defense, climate monitoring, and global positioning sectors.

- M&A Trends: Strategic acquisitions aimed at acquiring new technologies or expanding service offerings.

GEO Satellite Market Growth Trends & Insights

The GEO Satellite Market is poised for robust growth, driven by an escalating demand for reliable, high-bandwidth connectivity and sophisticated data services. The market size is projected to witness a significant expansion from an estimated value in the billions of units in the base year 2025, escalating steadily through the forecast period of 2025–2033. Adoption rates for GEO satellites are particularly high in sectors requiring continuous coverage and high data throughput, such as broadcasting, telecommunications, and government services. Technological disruptions, including the development of software-defined satellites, advanced antenna technologies, and more efficient propulsion systems, are enhancing satellite capabilities and reducing operational costs. Consumer behavior shifts, with an increasing reliance on satellite-enabled services for entertainment, navigation, and remote sensing applications, are further fueling market penetration. The market is expected to achieve a Compound Annual Growth Rate (CAGR) in the mid-single digits, reflecting sustained demand and ongoing technological advancements.

The evolution of the GEO Satellite Market is intrinsically linked to global connectivity initiatives and the increasing need for reliable communication infrastructure. As economies grow and digital transformation accelerates, the demand for uninterrupted data transmission and services becomes paramount. GEO satellites, with their inherent advantage of providing fixed coverage over vast geographical areas, are ideally positioned to meet these requirements. This includes supporting critical infrastructure, enabling remote communication in underserved regions, and facilitating global broadcasting networks. The development of next-generation GEO satellites with enhanced functionalities, such as on-board processing and artificial intelligence integration, will further augment their value proposition.

Furthermore, the growing emphasis on Earth observation for climate change monitoring, disaster management, and resource exploration is a significant growth catalyst. GEO satellites equipped with advanced imaging sensors provide invaluable real-time data, contributing to informed decision-making and proactive responses to global challenges. The navigation segment, driven by the proliferation of GPS and other satellite-based augmentation systems, continues to see consistent growth, underpinning a wide array of applications from automotive to aviation. The Space Observation segment, crucial for scientific research and astronomical studies, also benefits from the stable vantage point offered by geostationary orbits.

The historical period from 2019–2024 has laid the groundwork for this projected growth, marked by incremental technological improvements and a steady increase in satellite deployments. The base year 2025 represents a critical juncture, with numerous projects in the pipeline and a clear upward trajectory for the market. The forecast period (2025–2033) will likely witness the full realization of these advancements, with GEO satellites playing an even more central role in global infrastructure and data services. The market penetration for specific applications, such as direct-to-home broadcasting and high-speed internet, will continue to deepen, while new applications leveraging advanced GEO capabilities will emerge.

Dominant Regions, Countries, or Segments in GEO Satellite Market

The Communication application segment is unequivocally the dominant force driving growth in the GEO Satellite Market. This dominance is fueled by an insatiable global demand for reliable, high-bandwidth connectivity, essential for broadcasting, telecommunications, internet services, and enterprise networks. The sheer volume of data transmitted via communication satellites, coupled with the continuous need for upgrades to support higher data rates and new services, positions this segment at the forefront. Geostationary satellites are critical for providing uninterrupted coverage for Direct-to-Home (DTH) television broadcasting, a staple in many households worldwide, and for supporting mobile backhaul in areas where terrestrial infrastructure is insufficient. The expansion of broadband internet services to remote and underserved regions heavily relies on GEO satellite technology, further solidifying its leadership.

Geographically, North America and Europe have historically been dominant regions due to their well-established aerospace industries, significant government investment in space programs, and a mature commercial market demanding advanced satellite services. However, the Asia-Pacific region, particularly China and India, is rapidly emerging as a significant growth engine. China's aggressive space program, with substantial investments in its Beidou navigation system and expanding communication satellite constellation, is a prime example. India's ISRO is also actively developing and deploying GEO satellites for communication and remote sensing, catering to its vast population and growing economy.

In terms of Satellite Mass, the 500-1000kg and above 1000kg categories are crucial. These larger satellites are typically equipped with more powerful payloads, advanced propulsion systems, and greater fuel capacity, making them ideal for demanding communication, advanced Earth observation, and military reconnaissance missions where longevity and high performance are paramount. The development and deployment of these larger satellites represent substantial investments and are indicative of the market's focus on high-value, mission-critical applications.

The Military & Government end-user segment also plays a pivotal role in driving the GEO satellite market. National security, defense communications, intelligence gathering, and surveillance requirements necessitate the deployment of robust and secure GEO satellite systems. The strategic importance of these satellites ensures consistent demand and significant investment from governments worldwide. The development of sophisticated military communication networks, early warning systems, and reconnaissance capabilities are heavily reliant on the stable and continuous coverage provided by GEO satellites.

Propulsion technology plays a vital role in satellite longevity and operational flexibility. While Liquid Fuel propulsion systems offer high thrust for orbital maneuvers, Electric propulsion systems are increasingly favored for their fuel efficiency, enabling longer mission durations and reduced satellite mass. The ongoing advancements in electric propulsion technology are a key factor in optimizing GEO satellite design and performance.

GEO Satellite Market Product Landscape

The GEO Satellite Market product landscape is characterized by sophisticated and highly specialized platforms designed for mission-critical applications. These satellites are distinguished by their advanced communication payloads, offering high bandwidth and global coverage for broadcasting, telecommunications, and internet services. Earth observation satellites are equipped with high-resolution imaging sensors, crucial for environmental monitoring, disaster management, and resource exploration. Navigation satellites, forming crucial segments of global positioning systems, provide precise location data essential for a multitude of terrestrial and aerial applications. Space observation satellites are designed for astronomical research and space situational awareness, offering stable, long-term vantage points. Product innovations focus on enhancing payload capabilities, improving power efficiency, extending operational lifespans through advanced propulsion technologies like electric thrusters, and incorporating on-board processing for greater autonomy and data management.

Key Drivers, Barriers & Challenges in GEO Satellite Market

Key Drivers:

- Growing demand for global connectivity: The increasing reliance on internet, telecommunications, and broadcasting services worldwide fuels the need for reliable, wide-area coverage provided by GEO satellites.

- Advancements in satellite technology: Innovations in propulsion systems (e.g., electric propulsion), communication payloads, and miniaturization enable more capable and cost-effective satellite missions.

- Government investments and national security needs: Defense and governmental agencies continue to invest heavily in GEO satellites for communication, surveillance, and navigation, ensuring a steady demand.

- Expansion of Earth observation applications: The rising importance of climate monitoring, disaster management, and precision agriculture drives the demand for high-resolution GEO-based imagery.

Key Barriers & Challenges:

- High development and launch costs: The significant capital investment required for designing, manufacturing, and launching GEO satellites presents a substantial barrier to entry for smaller players.

- Complex regulatory environment: Navigating international and national regulations for orbital slots, spectrum allocation, and debris mitigation can be challenging and time-consuming.

- Competition from LEO constellations: Emerging LEO satellite constellations offer lower latency for certain applications, posing a competitive threat to some traditional GEO satellite services.

- Technological obsolescence and long development cycles: The long lead times in GEO satellite development mean that technologies can become outdated before deployment, requiring careful strategic planning.

- Space debris and orbital congestion: The increasing number of satellites in orbit raises concerns about collisions and the long-term sustainability of orbital operations.

Emerging Opportunities in GEO Satellite Market

Emerging opportunities in the GEO Satellite Market lie in the development of highly integrated and intelligent satellite systems. The growing demand for very high throughput satellites (VHTS) capable of delivering hundreds of gigabits per second of capacity is a significant avenue for growth, catering to the escalating data demands of consumers and businesses. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) capabilities directly on board satellites will enable advanced data processing, autonomous operations, and real-time analysis, opening up new applications in Earth observation, signal intelligence, and network management. The expansion of satellite-based internet of things (IoT) connectivity, particularly for remote asset tracking and monitoring, presents a burgeoning market segment. Innovations in on-orbit servicing and assembly for GEO satellites could also extend their lifespan and reduce overall mission costs, creating new service-based revenue streams.

Growth Accelerators in the GEO Satellite Market Industry

Growth accelerators for the GEO Satellite Market are intrinsically linked to continued technological breakthroughs and strategic market expansion. The ongoing advancements in electric propulsion systems, offering superior fuel efficiency and extended mission capabilities, are a major catalyst. Furthermore, the development of highly flexible software-defined payloads allows for in-orbit reconfiguration, adapting satellites to evolving market demands and service requirements. Strategic partnerships between satellite manufacturers, service providers, and end-users are crucial for co-developing bespoke solutions and securing long-term contracts. The increasing adoption of cloud-based platforms for satellite data processing and analysis is democratizing access to space-based information, thereby expanding the user base. Market expansion is also driven by the increasing penetration of GEO satellite services into emerging economies, where demand for connectivity and data services is rapidly rising.

Key Players Shaping the GEO Satellite Market Market

- Mitsubishi Heavy Industries

- Lockheed Martin Corporation

- Airbus SE

- Japan Aerospace Exploration Agency (JAXA)

- The Boeing Company

- China Aerospace Science and Technology Corporation (CASC)

- Thales

- Maxar Technologies Inc

- Northrop Grumman Corporation

- Indian Space Research Organisation (ISRO)

Notable Milestones in GEO Satellite Market Sector

- February 2023: China sent the Zhongxing-26 communications satellite into orbit, expected to serve military purposes.

- January 2023: Airbus was awarded a contract to build a geostationary telecommunications satellite for Inmarsat. The Airbus-built Inmarsat-6 telecommunications satellite (I-6 F2) was prepared for launch.

- December 2022: Airbus successfully achieved the System Critical Design Review for the EGNOS V3 (European Geostationary Navigation Overlay Service) satellite-based augmentation system. The V3 generation will support multiple frequencies from multiple constellations (GPS, Galileo) and incorporate advanced cyber-attack protection.

In-Depth GEO Satellite Market Market Outlook

The GEO Satellite Market outlook is exceptionally promising, driven by persistent global demand for robust connectivity and sophisticated data services. Growth accelerators, including advancements in electric propulsion, software-defined payloads, and on-orbit servicing, will further enhance satellite capabilities and economic viability. Strategic partnerships and the increasing adoption of cloud-based data analytics platforms will expand market reach and democratize access to space-derived intelligence. The penetration of GEO satellite services into emerging economies, coupled with the continuous evolution of applications in Earth observation, navigation, and communication, presents substantial untapped market potential. Future strategic opportunities lie in developing highly integrated, AI-enabled GEO satellites capable of autonomous operations and real-time data processing, thereby solidifying their indispensable role in the global digital infrastructure.

GEO Satellite Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. above 1000kg

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

GEO Satellite Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GEO Satellite Market Regional Market Share

Geographic Coverage of GEO Satellite Market

GEO Satellite Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Liquid fuel propulsion is expected to surge during the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GEO Satellite Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America GEO Satellite Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Communication

- 6.1.2. Earth Observation

- 6.1.3. Navigation

- 6.1.4. Space Observation

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 6.2.1. 10-100kg

- 6.2.2. 100-500kg

- 6.2.3. 500-1000kg

- 6.2.4. above 1000kg

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Commercial

- 6.3.2. Military & Government

- 6.3.3. Other

- 6.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6.4.1. Electric

- 6.4.2. Gas based

- 6.4.3. Liquid Fuel

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America GEO Satellite Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Communication

- 7.1.2. Earth Observation

- 7.1.3. Navigation

- 7.1.4. Space Observation

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 7.2.1. 10-100kg

- 7.2.2. 100-500kg

- 7.2.3. 500-1000kg

- 7.2.4. above 1000kg

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Commercial

- 7.3.2. Military & Government

- 7.3.3. Other

- 7.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 7.4.1. Electric

- 7.4.2. Gas based

- 7.4.3. Liquid Fuel

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe GEO Satellite Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Communication

- 8.1.2. Earth Observation

- 8.1.3. Navigation

- 8.1.4. Space Observation

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 8.2.1. 10-100kg

- 8.2.2. 100-500kg

- 8.2.3. 500-1000kg

- 8.2.4. above 1000kg

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Commercial

- 8.3.2. Military & Government

- 8.3.3. Other

- 8.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 8.4.1. Electric

- 8.4.2. Gas based

- 8.4.3. Liquid Fuel

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa GEO Satellite Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Communication

- 9.1.2. Earth Observation

- 9.1.3. Navigation

- 9.1.4. Space Observation

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 9.2.1. 10-100kg

- 9.2.2. 100-500kg

- 9.2.3. 500-1000kg

- 9.2.4. above 1000kg

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Commercial

- 9.3.2. Military & Government

- 9.3.3. Other

- 9.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 9.4.1. Electric

- 9.4.2. Gas based

- 9.4.3. Liquid Fuel

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific GEO Satellite Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Communication

- 10.1.2. Earth Observation

- 10.1.3. Navigation

- 10.1.4. Space Observation

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 10.2.1. 10-100kg

- 10.2.2. 100-500kg

- 10.2.3. 500-1000kg

- 10.2.4. above 1000kg

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Commercial

- 10.3.2. Military & Government

- 10.3.3. Other

- 10.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 10.4.1. Electric

- 10.4.2. Gas based

- 10.4.3. Liquid Fuel

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mitsubishi Heavy Industries

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Airbus SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Japan Aerospace Exploration Agency (JAXA)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Boeing Compan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Aerospace Science and Technology Corporation (CASC)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thales

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Maxar Technologies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Northrop Grumman Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Indian Space Research Organisation (ISRO)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Mitsubishi Heavy Industries

List of Figures

- Figure 1: Global GEO Satellite Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America GEO Satellite Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America GEO Satellite Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America GEO Satellite Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 5: North America GEO Satellite Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 6: North America GEO Satellite Market Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America GEO Satellite Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America GEO Satellite Market Revenue (undefined), by Propulsion Tech 2025 & 2033

- Figure 9: North America GEO Satellite Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 10: North America GEO Satellite Market Revenue (undefined), by Country 2025 & 2033

- Figure 11: North America GEO Satellite Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America GEO Satellite Market Revenue (undefined), by Application 2025 & 2033

- Figure 13: South America GEO Satellite Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America GEO Satellite Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 15: South America GEO Satellite Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 16: South America GEO Satellite Market Revenue (undefined), by End User 2025 & 2033

- Figure 17: South America GEO Satellite Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: South America GEO Satellite Market Revenue (undefined), by Propulsion Tech 2025 & 2033

- Figure 19: South America GEO Satellite Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 20: South America GEO Satellite Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: South America GEO Satellite Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe GEO Satellite Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Europe GEO Satellite Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe GEO Satellite Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 25: Europe GEO Satellite Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 26: Europe GEO Satellite Market Revenue (undefined), by End User 2025 & 2033

- Figure 27: Europe GEO Satellite Market Revenue Share (%), by End User 2025 & 2033

- Figure 28: Europe GEO Satellite Market Revenue (undefined), by Propulsion Tech 2025 & 2033

- Figure 29: Europe GEO Satellite Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 30: Europe GEO Satellite Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Europe GEO Satellite Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa GEO Satellite Market Revenue (undefined), by Application 2025 & 2033

- Figure 33: Middle East & Africa GEO Satellite Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Middle East & Africa GEO Satellite Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 35: Middle East & Africa GEO Satellite Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 36: Middle East & Africa GEO Satellite Market Revenue (undefined), by End User 2025 & 2033

- Figure 37: Middle East & Africa GEO Satellite Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East & Africa GEO Satellite Market Revenue (undefined), by Propulsion Tech 2025 & 2033

- Figure 39: Middle East & Africa GEO Satellite Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 40: Middle East & Africa GEO Satellite Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East & Africa GEO Satellite Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific GEO Satellite Market Revenue (undefined), by Application 2025 & 2033

- Figure 43: Asia Pacific GEO Satellite Market Revenue Share (%), by Application 2025 & 2033

- Figure 44: Asia Pacific GEO Satellite Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 45: Asia Pacific GEO Satellite Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 46: Asia Pacific GEO Satellite Market Revenue (undefined), by End User 2025 & 2033

- Figure 47: Asia Pacific GEO Satellite Market Revenue Share (%), by End User 2025 & 2033

- Figure 48: Asia Pacific GEO Satellite Market Revenue (undefined), by Propulsion Tech 2025 & 2033

- Figure 49: Asia Pacific GEO Satellite Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 50: Asia Pacific GEO Satellite Market Revenue (undefined), by Country 2025 & 2033

- Figure 51: Asia Pacific GEO Satellite Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GEO Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global GEO Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 3: Global GEO Satellite Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global GEO Satellite Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 5: Global GEO Satellite Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global GEO Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global GEO Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 8: Global GEO Satellite Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: Global GEO Satellite Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 10: Global GEO Satellite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: United States GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Mexico GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global GEO Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global GEO Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 16: Global GEO Satellite Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 17: Global GEO Satellite Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 18: Global GEO Satellite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Brazil GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Argentina GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global GEO Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global GEO Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 24: Global GEO Satellite Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global GEO Satellite Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 26: Global GEO Satellite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 27: United Kingdom GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Germany GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: France GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Italy GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Spain GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Russia GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Benelux GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Nordics GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Global GEO Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 37: Global GEO Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 38: Global GEO Satellite Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 39: Global GEO Satellite Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 40: Global GEO Satellite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: Turkey GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Israel GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: GCC GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: North Africa GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: South Africa GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Global GEO Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 48: Global GEO Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 49: Global GEO Satellite Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 50: Global GEO Satellite Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 51: Global GEO Satellite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 52: China GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 53: India GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Japan GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 55: South Korea GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: ASEAN GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 57: Oceania GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific GEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GEO Satellite Market?

The projected CAGR is approximately 18.1%.

2. Which companies are prominent players in the GEO Satellite Market?

Key companies in the market include Mitsubishi Heavy Industries, Lockheed Martin Corporation, Airbus SE, Japan Aerospace Exploration Agency (JAXA), The Boeing Compan, China Aerospace Science and Technology Corporation (CASC), Thales, Maxar Technologies Inc, Northrop Grumman Corporation, Indian Space Research Organisation (ISRO).

3. What are the main segments of the GEO Satellite Market?

The market segments include Application, Satellite Mass, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Liquid fuel propulsion is expected to surge during the forecast period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: China sent the Zhongxing-26 communications satellite into orbit,it is expected to be a military satelliteJanuary 2023: Airbus was awarded to build a geostationary telecommunications satellite by Inmarsat. The Airbus-built Inmarsat-6 telecommunications satellite (I-6 F2) has brought on board an Airbus Beluga at the Kennedy Space Center in Florida ready for its launch in February 2023.December 2022: Airbus has successfully achieved the System Critical Design Review on the EGNOS V3 (European Geostationary Navigation Overlay Service) satellite-based augmentation system. The new V3 generation of EGNOS being developed by Airbus will introduce new services based on multiple frequencies of multiple constellations (GPS, Galileo), and will embed sophisticated security protection against cyber-attacks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GEO Satellite Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GEO Satellite Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GEO Satellite Market?

To stay informed about further developments, trends, and reports in the GEO Satellite Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence