Key Insights

The Asia-Pacific MICE (Meetings, Incentives, Conferences, and Exhibitions) business tourism market is experiencing significant expansion. This growth is fueled by increased business activities, rising disposable incomes, and a surge in both domestic and international travel. The region's dynamic economies, coupled with substantial infrastructure investments and enhanced connectivity, are cultivating a conducive environment for MICE events. Key growth drivers include the burgeoning technology sector, particularly in China, India, and Singapore, which is generating a greater number of corporate conferences and product launches. Additionally, the growing adoption of incentive travel programs by multinational corporations is a major contributor to market expansion. Regional governments are actively promoting tourism through investments in state-of-the-art venues and attractive incentives for large-scale MICE events. Following a temporary impact from the global pandemic, a robust recovery is evident, driven by pent-up demand and a reinforced emphasis on in-person networking. The integration of hybrid event models is further accelerating this recovery, enabling broader participation and cost efficiencies.

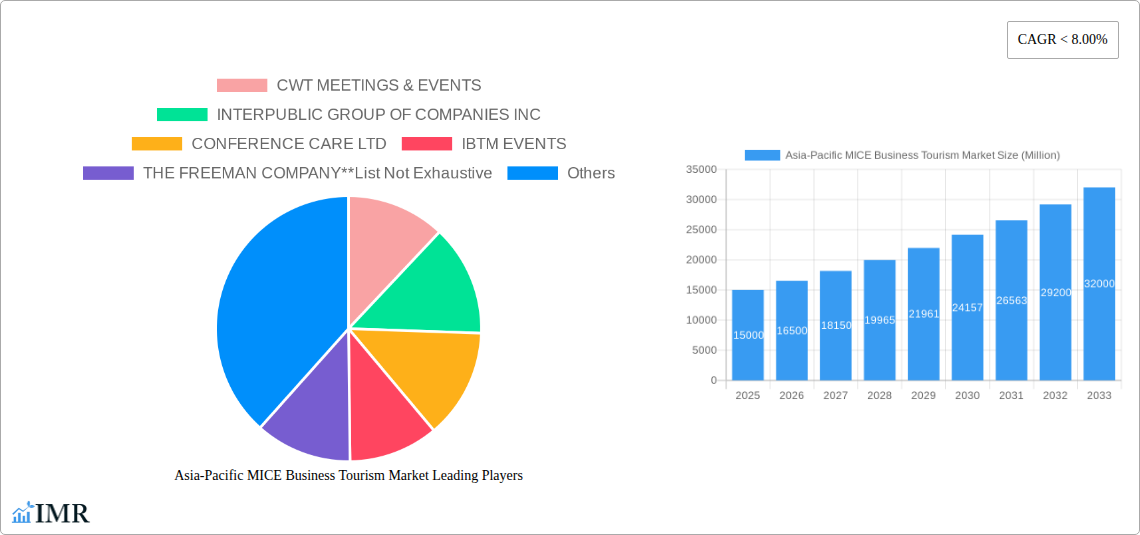

Asia-Pacific MICE Business Tourism Market Market Size (In Million)

The Asia-Pacific MICE market is projected for sustained growth. Advancements in technology, including virtual and augmented reality applications, will elevate the experience and accessibility of MICE events. However, challenges persist, such as the imperative for sustainable practices and efficient management of large-scale events to minimize environmental impact and ensure logistical efficacy. Future market success hinges on adapting to evolving participant preferences, harnessing technology effectively, and consistently delivering exceptional experiences that cater to the diverse needs of corporate clients and individuals. Strategic collaborations among government bodies, tourism boards, and private sector stakeholders will be vital for driving sustainable growth and positioning the Asia-Pacific region as a premier MICE business tourism destination. The market is forecasted to reach $1226.07 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 10.39% from the base year 2025.

Asia-Pacific MICE Business Tourism Market Company Market Share

Asia-Pacific MICE Business Tourism Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific MICE (Meetings, Incentives, Conferences, and Exhibitions) business tourism market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and strategic planners seeking to understand and capitalize on opportunities within this dynamic sector. The report segments the market by event type (Meetings, Incentives, Conventions, Exhibitions) and analyzes key players such as CWT Meetings & Events, Interpublic Group of Companies Inc, Conference Care Ltd, IBTM Events, The Freeman Company, BCD Meetings and Events, Questex LLC, Cievents, and ATPI Ltd (List Not Exhaustive). The total market value in 2025 is estimated at xx Million.

Asia-Pacific MICE Business Tourism Market Dynamics & Structure

The Asia-Pacific MICE market is characterized by moderate concentration, with several large players and numerous smaller specialized firms. Technological innovation, particularly in virtual and hybrid event platforms, is a significant driver. Regulatory frameworks related to visas, event permits, and tourism policies influence market access. The rise of virtual events presents a competitive substitute, impacting traditional in-person events. End-user demographics are shifting towards younger professionals and diverse corporate segments. M&A activity remains moderate, with consolidation expected among technology-driven companies and event management firms.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Rapid adoption of virtual event platforms and AI-powered event management tools.

- Regulatory Framework: Varied across nations, influencing ease of doing business.

- Competitive Substitutes: Virtual and hybrid events pose a growing competitive challenge.

- End-User Demographics: Shift towards younger professionals and a wider range of industries.

- M&A Trends: Moderate activity, focused on technology integration and expansion. Estimated deal volume in 2024: xx.

Asia-Pacific MICE Business Tourism Market Growth Trends & Insights

The Asia-Pacific MICE market has experienced fluctuating growth in recent years, impacted by global events. Post-pandemic recovery has been uneven, with a strong rebound anticipated in certain segments. Adoption rates for virtual and hybrid events have increased significantly, altering consumer behavior. Technological disruptions are reshaping event formats and enhancing experiences. Market size is expected to reach xx Million by 2033, exhibiting a compound annual growth rate (CAGR) of xx% during the forecast period. Market penetration for virtual events is projected to reach xx% by 2033. Specific factors like increased business travel and government support programs are impacting market growth.

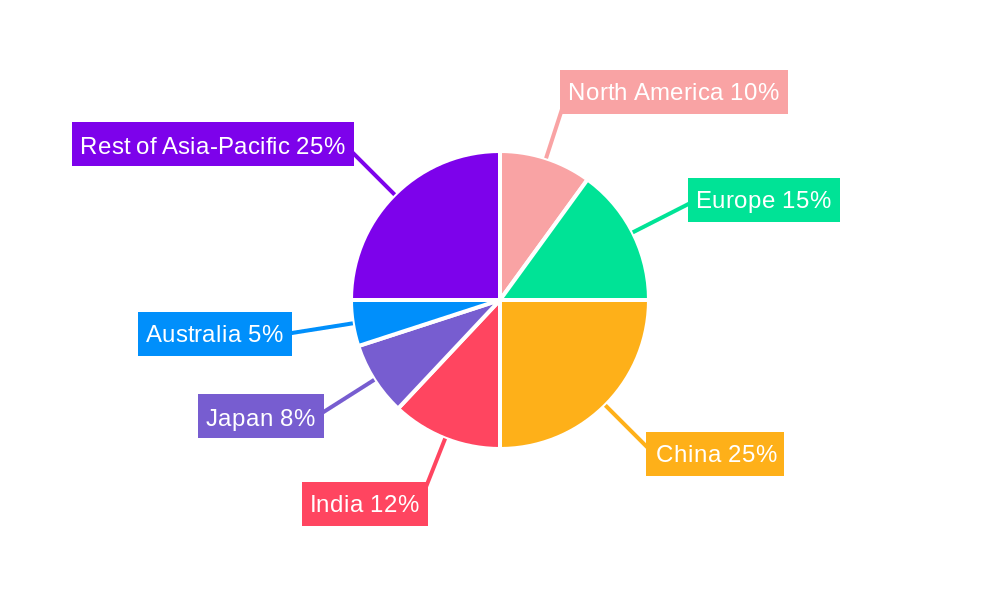

Dominant Regions, Countries, or Segments in Asia-Pacific MICE Business Tourism Market

China, followed by Singapore, Japan and Australia, are leading the market within the Asia-Pacific region. The Meetings segment currently dominates in terms of market share due to high demand from corporate sectors and increased adoption of hybrid and virtual meeting formats. Several factors contribute to regional dominance:

- China: Strong economic growth, large corporate sector, and expanding infrastructure.

- Singapore: Established MICE infrastructure, pro-business policies, and strategic location.

- Japan: Strong corporate culture and high spending on business events.

- Australia: Established tourism infrastructure and growing business events sector.

The Meetings segment's strong performance is driven by:

- Increased Corporate Spending: Growing budgets for training, conferences, and team-building events.

- Technological Advancements: Improvements in virtual meeting technologies and hybrid models.

- Government Support: Initiatives to promote business events and tourism.

Asia-Pacific MICE Business Tourism Market Product Landscape

The market offers a diverse range of products and services, from traditional event planning and venue management to cutting-edge virtual and hybrid event platforms. Innovations focus on enhanced attendee engagement, data analytics for event optimization, and sustainable practices. Key performance metrics include attendee satisfaction, cost efficiency, and event ROI. Unique selling propositions center on personalized experiences, technology integration, and seamless logistical management.

Key Drivers, Barriers & Challenges in Asia-Pacific MICE Business Tourism Market

Key Drivers:

- Strong economic growth in several countries.

- Increasing corporate focus on employee engagement and team building.

- Technological advancements in event management and virtual platforms.

- Government initiatives promoting business tourism.

Key Challenges:

- Economic uncertainty and potential downturns impact spending.

- Intense competition among event management companies.

- Infrastructure limitations in certain regions.

- Geopolitical events and travel restrictions. Impact estimated at xx Million in lost revenue in 2022.

Emerging Opportunities in Asia-Pacific MICE Business Tourism Market

- Growth in niche event segments (e.g., sustainability-focused events, experiential travel).

- Expansion into untapped markets within the region (e.g., secondary cities in Southeast Asia).

- Integration of AI and machine learning for event personalization and optimization.

- Increased demand for hybrid and virtual events, offering flexibility and cost savings.

Growth Accelerators in the Asia-Pacific MICE Business Tourism Market Industry

Strategic partnerships between event management companies and technology providers are driving growth. Investments in sustainable event practices attract environmentally conscious clients. Government support through tax incentives and infrastructure development fosters market expansion. Expansion into emerging markets with high growth potential is a key strategy for long-term success.

Key Players Shaping the Asia-Pacific MICE Business Tourism Market Market

- CWT Meetings & Events

- Interpublic Group of Companies Inc

- Conference Care Ltd

- IBTM Events

- The Freeman Company

- BCD Meetings and Events

- Questex LLC

- Cievents

- ATPI Ltd

Notable Milestones in Asia-Pacific MICE Business Tourism Market Sector

- October 2021: SITE Thailand Chapter partnered with TCEB to launch the SITE Thailand M&I Sustainability Advocate Project, focusing on sustainable practices.

- 2022: IBTM selected Singapore as the home of IBTM Asia Pacific, coupled with the first Singapore MICE Forum (SMF) X IBTM APAC.

In-Depth Asia-Pacific MICE Business Tourism Market Market Outlook

The Asia-Pacific MICE market is poised for robust growth driven by continued economic expansion, technological advancements, and a growing preference for engaging, experiential events. Strategic investments in infrastructure, sustainable practices, and technological innovation will shape the future competitive landscape. Opportunities exist in niche markets and emerging economies, offering substantial potential for expansion and market share gains.

Asia-Pacific MICE Business Tourism Market Segmentation

-

1. Event

- 1.1. Meeting

- 1.2. Incentive

- 1.3. Conventions

- 1.4. Exhibitions

-

2. Geography

- 2.1. India

- 2.2. China

- 2.3. Singapore

- 2.4. Thailand

- 2.5. Hong Kong

- 2.6. Malaysia

- 2.7. Japan

- 2.8. Rest of AP

Asia-Pacific MICE Business Tourism Market Segmentation By Geography

- 1. India

- 2. China

- 3. Singapore

- 4. Thailand

- 5. Hong Kong

- 6. Malaysia

- 7. Japan

- 8. Rest of AP

Asia-Pacific MICE Business Tourism Market Regional Market Share

Geographic Coverage of Asia-Pacific MICE Business Tourism Market

Asia-Pacific MICE Business Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Share Of Inbound Tourism; Rise In Number of 3 Star and 5 star Hotels

- 3.3. Market Restrains

- 3.3.1. Major Share Of Tourism Is Concentrated Domestically; Decline in business travel in the region affecting the market

- 3.4. Market Trends

- 3.4.1. Hybrid events

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Event

- 5.1.1. Meeting

- 5.1.2. Incentive

- 5.1.3. Conventions

- 5.1.4. Exhibitions

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. India

- 5.2.2. China

- 5.2.3. Singapore

- 5.2.4. Thailand

- 5.2.5. Hong Kong

- 5.2.6. Malaysia

- 5.2.7. Japan

- 5.2.8. Rest of AP

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Singapore

- 5.3.4. Thailand

- 5.3.5. Hong Kong

- 5.3.6. Malaysia

- 5.3.7. Japan

- 5.3.8. Rest of AP

- 5.1. Market Analysis, Insights and Forecast - by Event

- 6. India Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Event

- 6.1.1. Meeting

- 6.1.2. Incentive

- 6.1.3. Conventions

- 6.1.4. Exhibitions

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. India

- 6.2.2. China

- 6.2.3. Singapore

- 6.2.4. Thailand

- 6.2.5. Hong Kong

- 6.2.6. Malaysia

- 6.2.7. Japan

- 6.2.8. Rest of AP

- 6.1. Market Analysis, Insights and Forecast - by Event

- 7. China Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Event

- 7.1.1. Meeting

- 7.1.2. Incentive

- 7.1.3. Conventions

- 7.1.4. Exhibitions

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. India

- 7.2.2. China

- 7.2.3. Singapore

- 7.2.4. Thailand

- 7.2.5. Hong Kong

- 7.2.6. Malaysia

- 7.2.7. Japan

- 7.2.8. Rest of AP

- 7.1. Market Analysis, Insights and Forecast - by Event

- 8. Singapore Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Event

- 8.1.1. Meeting

- 8.1.2. Incentive

- 8.1.3. Conventions

- 8.1.4. Exhibitions

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. India

- 8.2.2. China

- 8.2.3. Singapore

- 8.2.4. Thailand

- 8.2.5. Hong Kong

- 8.2.6. Malaysia

- 8.2.7. Japan

- 8.2.8. Rest of AP

- 8.1. Market Analysis, Insights and Forecast - by Event

- 9. Thailand Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Event

- 9.1.1. Meeting

- 9.1.2. Incentive

- 9.1.3. Conventions

- 9.1.4. Exhibitions

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. India

- 9.2.2. China

- 9.2.3. Singapore

- 9.2.4. Thailand

- 9.2.5. Hong Kong

- 9.2.6. Malaysia

- 9.2.7. Japan

- 9.2.8. Rest of AP

- 9.1. Market Analysis, Insights and Forecast - by Event

- 10. Hong Kong Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Event

- 10.1.1. Meeting

- 10.1.2. Incentive

- 10.1.3. Conventions

- 10.1.4. Exhibitions

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. India

- 10.2.2. China

- 10.2.3. Singapore

- 10.2.4. Thailand

- 10.2.5. Hong Kong

- 10.2.6. Malaysia

- 10.2.7. Japan

- 10.2.8. Rest of AP

- 10.1. Market Analysis, Insights and Forecast - by Event

- 11. Malaysia Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Event

- 11.1.1. Meeting

- 11.1.2. Incentive

- 11.1.3. Conventions

- 11.1.4. Exhibitions

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. India

- 11.2.2. China

- 11.2.3. Singapore

- 11.2.4. Thailand

- 11.2.5. Hong Kong

- 11.2.6. Malaysia

- 11.2.7. Japan

- 11.2.8. Rest of AP

- 11.1. Market Analysis, Insights and Forecast - by Event

- 12. Japan Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Event

- 12.1.1. Meeting

- 12.1.2. Incentive

- 12.1.3. Conventions

- 12.1.4. Exhibitions

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. India

- 12.2.2. China

- 12.2.3. Singapore

- 12.2.4. Thailand

- 12.2.5. Hong Kong

- 12.2.6. Malaysia

- 12.2.7. Japan

- 12.2.8. Rest of AP

- 12.1. Market Analysis, Insights and Forecast - by Event

- 13. Rest of AP Asia-Pacific MICE Business Tourism Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Event

- 13.1.1. Meeting

- 13.1.2. Incentive

- 13.1.3. Conventions

- 13.1.4. Exhibitions

- 13.2. Market Analysis, Insights and Forecast - by Geography

- 13.2.1. India

- 13.2.2. China

- 13.2.3. Singapore

- 13.2.4. Thailand

- 13.2.5. Hong Kong

- 13.2.6. Malaysia

- 13.2.7. Japan

- 13.2.8. Rest of AP

- 13.1. Market Analysis, Insights and Forecast - by Event

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 CWT MEETINGS & EVENTS

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 INTERPUBLIC GROUP OF COMPANIES INC

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 CONFERENCE CARE LTD

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 IBTM EVENTS

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 THE FREEMAN COMPANY**List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 BCD MEETINGS AND EVENTS

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 QUESTEX LLC

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 CIEVENTS

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 ATPI LTD

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 CWT MEETINGS & EVENTS

List of Figures

- Figure 1: Asia-Pacific MICE Business Tourism Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific MICE Business Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 2: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 5: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 8: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 11: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 14: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 17: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 20: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 23: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Event 2020 & 2033

- Table 26: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 27: Asia-Pacific MICE Business Tourism Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific MICE Business Tourism Market?

The projected CAGR is approximately 10.39%.

2. Which companies are prominent players in the Asia-Pacific MICE Business Tourism Market?

Key companies in the market include CWT MEETINGS & EVENTS, INTERPUBLIC GROUP OF COMPANIES INC, CONFERENCE CARE LTD, IBTM EVENTS, THE FREEMAN COMPANY**List Not Exhaustive, BCD MEETINGS AND EVENTS, QUESTEX LLC, CIEVENTS, ATPI LTD.

3. What are the main segments of the Asia-Pacific MICE Business Tourism Market?

The market segments include Event, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1226.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Share Of Inbound Tourism; Rise In Number of 3 Star and 5 star Hotels.

6. What are the notable trends driving market growth?

Hybrid events.

7. Are there any restraints impacting market growth?

Major Share Of Tourism Is Concentrated Domestically; Decline in business travel in the region affecting the market.

8. Can you provide examples of recent developments in the market?

In 2022, IBTM has selected Singapore to be the home of IBTM Asia Pacific.It will be coupled with the first edition of Singapore MICE Forum (SMF) X IBTM APAC, in partnership with Singapore Association of Convention & Exhibition Organisers & Suppliers (SACEOS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific MICE Business Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific MICE Business Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific MICE Business Tourism Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific MICE Business Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence