Key Insights

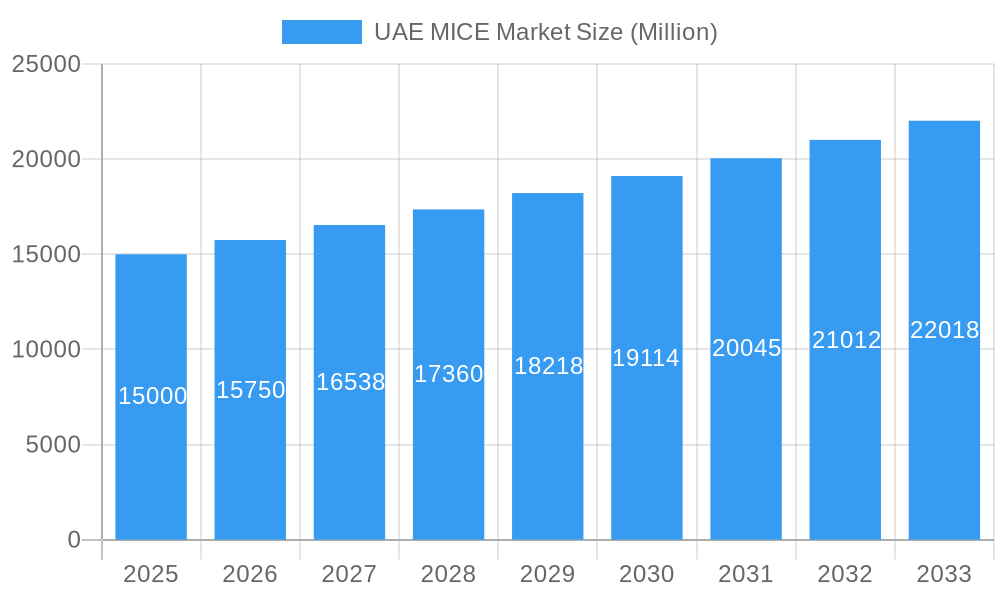

The UAE MICE (Meetings, Incentives, Conferences, and Exhibitions) market is experiencing substantial expansion, propelled by its strategic global positioning, world-class infrastructure, and supportive government policies aimed at elevating tourism and business events. The market size in the base year 2024 is estimated at 53361.9 million. Industry projections anticipate a Compound Annual Growth Rate (CAGR) of 6.6% from 2025 to 2033. Key growth drivers include the enduring impact of Expo 2020 Dubai, ongoing investment in advanced event facilities, and a strategic focus on attracting international conferences. Economic diversification and government commitment to high-value tourism further solidify the sector's long-term potential.

UAE MICE Market Market Size (In Billion)

The UAE MICE market's future outlook is highly positive, driven by escalating infrastructure investment, enhanced connectivity, a growing influx of business travelers and tourists, and a strong emphasis on sustainable event practices. The nation's reputation for safety and security, coupled with its advanced hospitality sector, significantly contributes to market success. This projected growth signifies considerable opportunities for businesses across the MICE value chain, including venue management, event planning, hospitality services, and technology providers. The development of specialized MICE hubs and the integration of innovative technologies will further bolster the UAE's global competitiveness as a premier destination for business events.

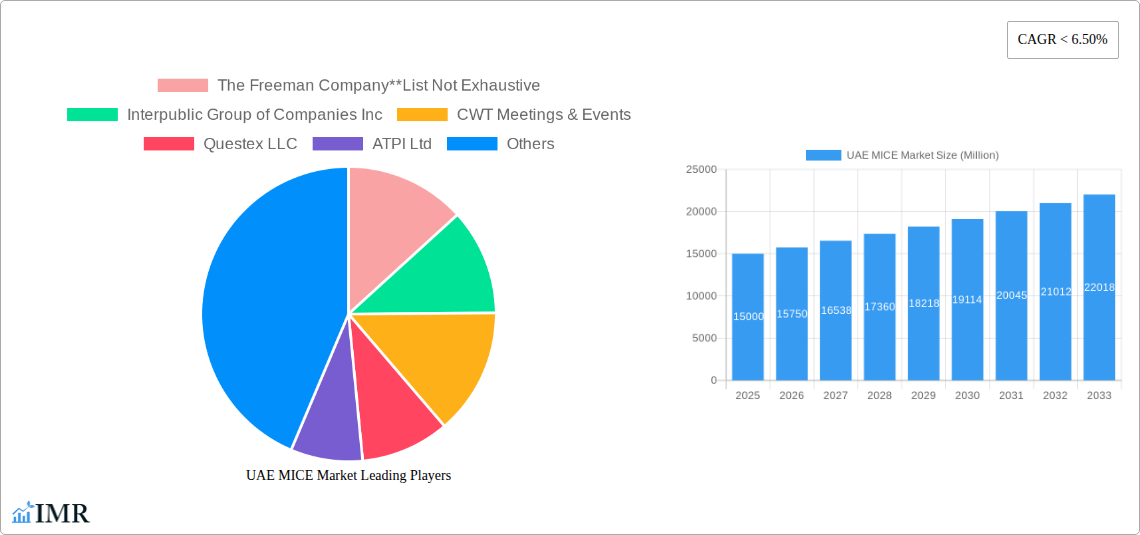

UAE MICE Market Company Market Share

UAE MICE Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE MICE (Meetings, Incentives, Conferences, and Exhibitions) market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals, investors, and anyone seeking to understand the vibrant and expanding MICE landscape in the UAE. The report analyzes the parent market of the UAE Tourism sector and its child markets, including Meetings, Incentives, Conventions, and Exhibitions.

UAE MICE Market Dynamics & Structure

This section delves into the intricate structure of the UAE MICE market, examining market concentration, technological advancements, regulatory influences, competitive dynamics, and M&A activity. The analysis incorporates both quantitative and qualitative insights to provide a holistic understanding of the market landscape.

- Market Concentration: The UAE MICE market exhibits a moderately concentrated structure, with a few large players holding significant market share. The top five players account for approximately xx% of the total market revenue in 2024 (estimated).

- Technological Innovation: The adoption of digital technologies, such as virtual and hybrid event platforms, is transforming the MICE industry. However, barriers to adoption include high initial investment costs and the need for skilled personnel.

- Regulatory Framework: The UAE government's supportive policies and initiatives aimed at boosting tourism and business events have significantly contributed to market growth. Regulatory changes impacting visa processes and event permits are closely monitored.

- Competitive Product Substitutes: The emergence of online webinars and virtual conferences presents a competitive challenge to traditional in-person events, particularly for smaller-scale meetings.

- End-User Demographics: The UAE's diverse population, comprising both local and international business communities, fuels demand for MICE services across various sectors. The analysis further segments the end-user base by industry and event type.

- M&A Trends: The past five years have witnessed xx M&A deals in the UAE MICE sector, primarily driven by consolidation among event management companies and technology providers.

UAE MICE Market Growth Trends & Insights

This section analyzes the historical and projected growth trajectory of the UAE MICE market, incorporating market size evolution, adoption rates, technological disruptions, and shifting consumer behavior. The analysis leverages a proprietary dataset (XXX) to provide detailed insights into market dynamics and future trends.

The UAE MICE market experienced significant growth during the historical period (2019-2024), with market size reaching xx million in 2024. This growth is attributed to several factors, including a rise in business tourism, supportive government initiatives, and the successful hosting of major events like Expo 2020 Dubai. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching xx million by 2033. Adoption of virtual and hybrid event formats has seen an increase, particularly since 2020, with penetration rates rising from xx% in 2019 to xx% in 2024. Consumer behavior is evolving with a demand for more immersive and personalized event experiences, necessitating innovative solutions from market players.

Dominant Regions, Countries, or Segments in UAE MICE Market

Dubai remains the dominant region within the UAE MICE market, owing to its established infrastructure, strategic location, and government support. Other emirates, such as Abu Dhabi and Sharjah, are also experiencing notable growth in the MICE sector. The segment analysis reveals that the Meetings segment currently holds the largest share of the market, followed by Exhibitions, Conventions, and Incentives.

- Key Drivers for Dubai's Dominance:

- World-class infrastructure, including state-of-the-art venues such as the Dubai World Trade Centre.

- Pro-business policies and investment in tourism infrastructure.

- Strong air connectivity and ease of visa access.

- Successful hosting of large-scale international events.

- Growth Potential in Other Emirates: Abu Dhabi and Sharjah are actively developing their MICE infrastructure and attracting a growing number of events, presenting substantial growth potential.

UAE MICE Market Product Landscape

The UAE MICE market offers a diverse range of products and services, including event planning, venue management, technology solutions (virtual event platforms), catering, and entertainment. Recent product innovations include interactive event apps, advanced audio-visual technology, and sustainable event management practices. These advancements aim to enhance attendee engagement and streamline event operations, offering unique selling propositions to clients.

Key Drivers, Barriers & Challenges in UAE MICE Market

Key Drivers: The UAE's strategic geographical location, strong government support, robust infrastructure, and focus on tourism have been instrumental in driving market growth. The Expo 2020 Dubai served as a major catalyst.

Challenges and Restraints: Competition from other regional MICE destinations, fluctuating oil prices, and potential economic downturns pose challenges to the market. Supply chain disruptions and visa processing complexities can also affect event execution.

Emerging Opportunities in UAE MICE Market

The UAE MICE market presents significant opportunities for growth in areas such as specialized niche events (e.g., medical conferences, technology summits), leveraging advanced technologies for immersive event experiences, and sustainability-focused event planning. Untapped markets within the local SME sector also hold potential.

Growth Accelerators in the UAE MICE Market Industry

The UAE's continued investment in tourism infrastructure, diversification efforts, strategic partnerships with international event organizers, and development of innovative event technologies promise to accelerate growth in the MICE sector. Government initiatives to promote sustainability within the MICE industry also play a critical role.

Key Players Shaping the UAE MICE Market Market

- The Freeman Company

- Interpublic Group of Companies Inc

- CWT Meetings & Events

- Questex LLC

- ATPI Ltd

- IBTM Events

- CIE EVENTS

- BCD Meetings and Events

- Conference Care Ltd

Notable Milestones in UAE MICE Market Sector

- 2019: Dubai World Trade Centre welcomes a record 3.57 million delegates, a 4% increase from the previous year. Dubai Business Events organized 301 meetings, conferences, and incentives, bidding for 595 events in 2020.

- 2020: Dubai's tourism sector ranks among the top 10 strongest economic share generators. Expo 2020 Dubai launches, generating significant positive impact on the MICE industry.

- 2022: Several new events are added to the calendar, reflecting a positive outlook for the sector's recovery and growth.

In-Depth UAE MICE Market Market Outlook

The UAE MICE market is poised for sustained growth over the next decade, driven by continuous investment in infrastructure, technological advancements, and a supportive policy environment. Strategic partnerships with international organizations, a focus on sustainability, and tapping into new market segments will unlock further potential, solidifying the UAE's position as a leading MICE destination. The predicted increase in business tourism and the diversification of the UAE economy will also further boost the market.

UAE MICE Market Segmentation

-

1. Event

- 1.1. Meeting

- 1.2. Incentive

- 1.3. Conventions

- 1.4. Exhibitions

UAE MICE Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

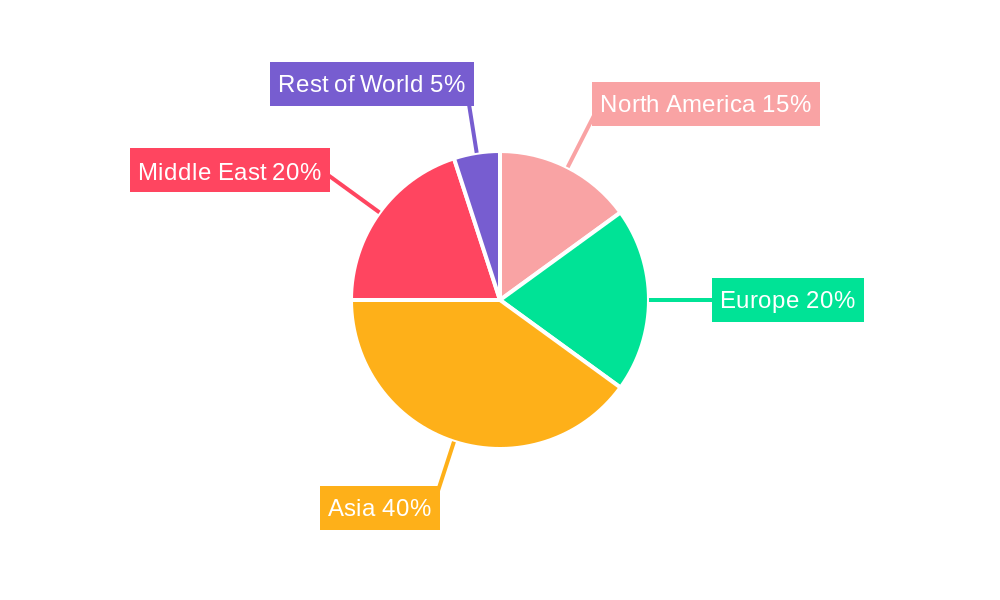

UAE MICE Market Regional Market Share

Geographic Coverage of UAE MICE Market

UAE MICE Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Social Media and Celebrity Influence; Increasing Disposable Income

- 3.3. Market Restrains

- 3.3.1. Cost of Services is a Restraining Factor for the Market; Limited Insurance Coverage is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Enabling Digitised travel Ecosystem is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE MICE Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Event

- 5.1.1. Meeting

- 5.1.2. Incentive

- 5.1.3. Conventions

- 5.1.4. Exhibitions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Event

- 6. North America UAE MICE Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Event

- 6.1.1. Meeting

- 6.1.2. Incentive

- 6.1.3. Conventions

- 6.1.4. Exhibitions

- 6.1. Market Analysis, Insights and Forecast - by Event

- 7. South America UAE MICE Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Event

- 7.1.1. Meeting

- 7.1.2. Incentive

- 7.1.3. Conventions

- 7.1.4. Exhibitions

- 7.1. Market Analysis, Insights and Forecast - by Event

- 8. Europe UAE MICE Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Event

- 8.1.1. Meeting

- 8.1.2. Incentive

- 8.1.3. Conventions

- 8.1.4. Exhibitions

- 8.1. Market Analysis, Insights and Forecast - by Event

- 9. Middle East & Africa UAE MICE Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Event

- 9.1.1. Meeting

- 9.1.2. Incentive

- 9.1.3. Conventions

- 9.1.4. Exhibitions

- 9.1. Market Analysis, Insights and Forecast - by Event

- 10. Asia Pacific UAE MICE Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Event

- 10.1.1. Meeting

- 10.1.2. Incentive

- 10.1.3. Conventions

- 10.1.4. Exhibitions

- 10.1. Market Analysis, Insights and Forecast - by Event

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Freeman Company**List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Interpublic Group of Companies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CWT Meetings & Events

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Questex LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ATPI Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IBTM Events

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CIEVENTS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BCD Meetings and Events

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Conference Care Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 The Freeman Company**List Not Exhaustive

List of Figures

- Figure 1: Global UAE MICE Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America UAE MICE Market Revenue (million), by Event 2025 & 2033

- Figure 3: North America UAE MICE Market Revenue Share (%), by Event 2025 & 2033

- Figure 4: North America UAE MICE Market Revenue (million), by Country 2025 & 2033

- Figure 5: North America UAE MICE Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UAE MICE Market Revenue (million), by Event 2025 & 2033

- Figure 7: South America UAE MICE Market Revenue Share (%), by Event 2025 & 2033

- Figure 8: South America UAE MICE Market Revenue (million), by Country 2025 & 2033

- Figure 9: South America UAE MICE Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UAE MICE Market Revenue (million), by Event 2025 & 2033

- Figure 11: Europe UAE MICE Market Revenue Share (%), by Event 2025 & 2033

- Figure 12: Europe UAE MICE Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe UAE MICE Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UAE MICE Market Revenue (million), by Event 2025 & 2033

- Figure 15: Middle East & Africa UAE MICE Market Revenue Share (%), by Event 2025 & 2033

- Figure 16: Middle East & Africa UAE MICE Market Revenue (million), by Country 2025 & 2033

- Figure 17: Middle East & Africa UAE MICE Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UAE MICE Market Revenue (million), by Event 2025 & 2033

- Figure 19: Asia Pacific UAE MICE Market Revenue Share (%), by Event 2025 & 2033

- Figure 20: Asia Pacific UAE MICE Market Revenue (million), by Country 2025 & 2033

- Figure 21: Asia Pacific UAE MICE Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE MICE Market Revenue million Forecast, by Event 2020 & 2033

- Table 2: Global UAE MICE Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global UAE MICE Market Revenue million Forecast, by Event 2020 & 2033

- Table 4: Global UAE MICE Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: United States UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Canada UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Mexico UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Global UAE MICE Market Revenue million Forecast, by Event 2020 & 2033

- Table 9: Global UAE MICE Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: Brazil UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Argentina UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Global UAE MICE Market Revenue million Forecast, by Event 2020 & 2033

- Table 14: Global UAE MICE Market Revenue million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: France UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Italy UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Spain UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Russia UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Benelux UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Nordics UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Global UAE MICE Market Revenue million Forecast, by Event 2020 & 2033

- Table 25: Global UAE MICE Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: Turkey UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Israel UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: GCC UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: North Africa UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Africa UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global UAE MICE Market Revenue million Forecast, by Event 2020 & 2033

- Table 33: Global UAE MICE Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: China UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: India UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Japan UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Korea UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Oceania UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UAE MICE Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE MICE Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the UAE MICE Market?

Key companies in the market include The Freeman Company**List Not Exhaustive, Interpublic Group of Companies Inc, CWT Meetings & Events, Questex LLC, ATPI Ltd, IBTM Events, CIEVENTS, BCD Meetings and Events, Conference Care Ltd.

3. What are the main segments of the UAE MICE Market?

The market segments include Event.

4. Can you provide details about the market size?

The market size is estimated to be USD 53361.9 million as of 2022.

5. What are some drivers contributing to market growth?

Social Media and Celebrity Influence; Increasing Disposable Income.

6. What are the notable trends driving market growth?

Enabling Digitised travel Ecosystem is driving the market.

7. Are there any restraints impacting market growth?

Cost of Services is a Restraining Factor for the Market; Limited Insurance Coverage is Restraining the Market.

8. Can you provide examples of recent developments in the market?

The Expo 2020 Dubai has brought a lot of positivity and the MICE (meetings, incentives, conferences and exhibitions) industry in the UAE and region is poised to grow with several new events added to the 2022 calendar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE MICE Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE MICE Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE MICE Market?

To stay informed about further developments, trends, and reports in the UAE MICE Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence