Key Insights

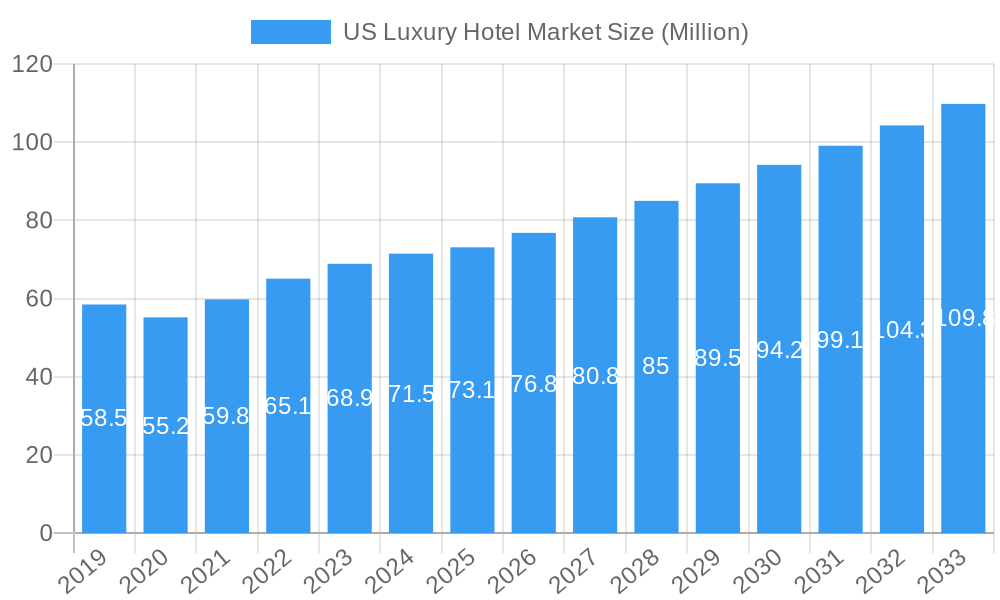

The US luxury hotel market is poised for robust growth, projected to reach an estimated \$73.10 million by 2025, driven by a compelling Compound Annual Growth Rate (CAGR) of 5.12% through 2033. This sustained expansion is fueled by several key drivers, including an increasing demand for personalized and unique travel experiences, a growing affluent consumer base with a higher disposable income, and a strong desire for exclusive amenities and services that define luxury hospitality. The market is also benefiting from a post-pandemic resurgence in travel, with consumers prioritizing high-quality, memorable stays. Furthermore, the continued innovation in service delivery, the integration of advanced technologies to enhance guest experiences, and the growing appeal of experiential travel, such as wellness retreats and curated cultural immersions, are significant contributors to market momentum. The emphasis on sustainability and eco-friendly practices within luxury accommodations is also gaining traction, attracting a segment of conscious travelers.

US Luxury Hotel Market Market Size (In Million)

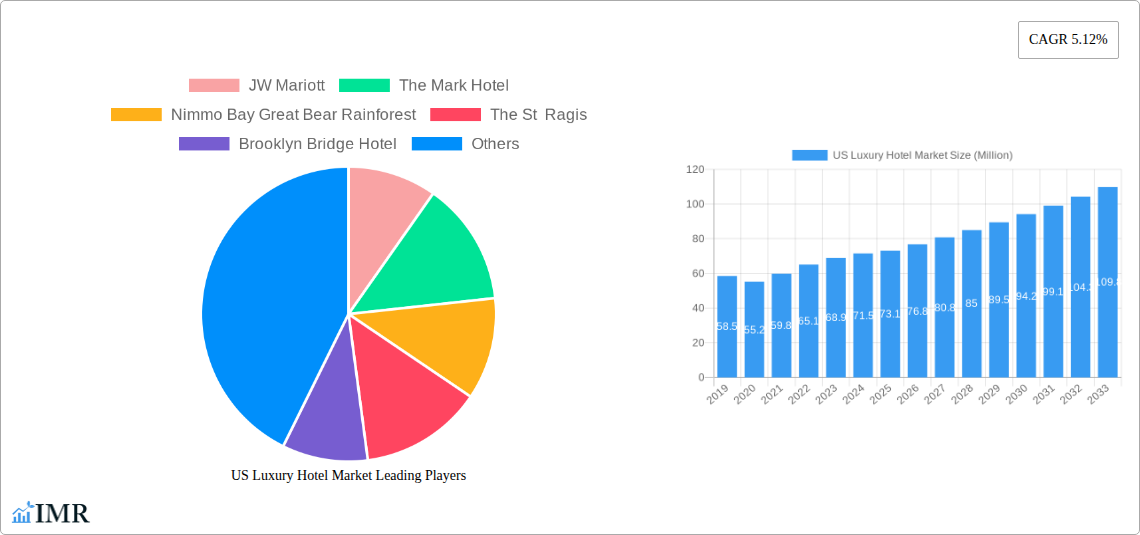

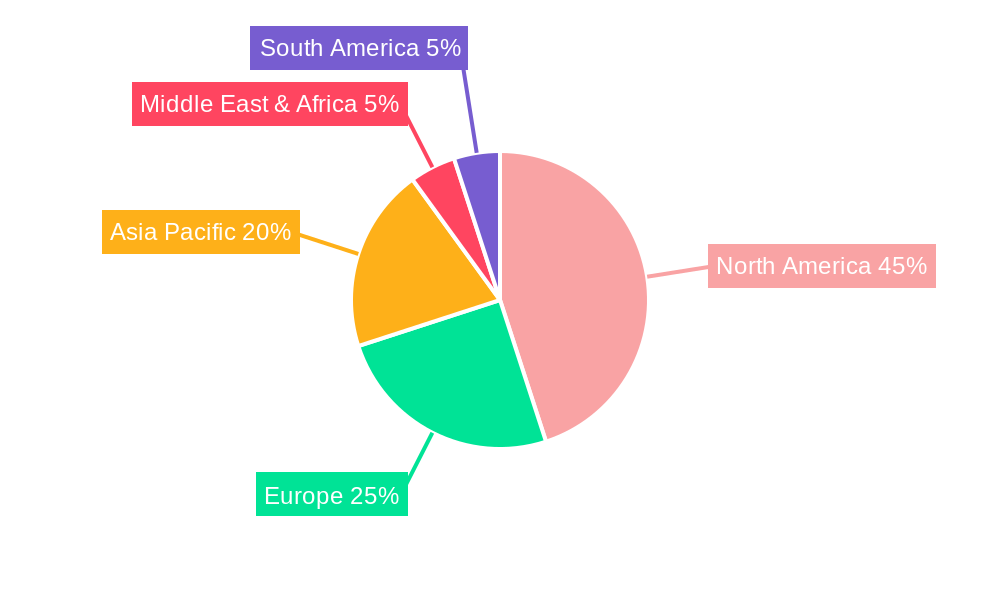

The luxury hotel landscape is diversifying across various service types, from opulent business hotels and convenient airport hotels to expansive resorts and intimate suite hotels. A significant trend is the rise of theme-driven accommodations, with heritage properties offering a glimpse into history and contemporary and modern designs attracting a sophisticated clientele. Leading companies like JW Marriott, The Mark Hotel, and Hyatt Group are actively expanding their portfolios and innovating their offerings to capture market share. Geographically, North America, led by the United States, currently holds a dominant position, though the Asia Pacific region is exhibiting substantial growth potential due to its burgeoning middle class and increasing inbound tourism. However, the market is not without its restraints. The high operational costs associated with maintaining luxury standards, potential economic downturns that could impact discretionary spending, and increasing competition from alternative luxury accommodations like high-end vacation rentals present ongoing challenges that operators must navigate.

US Luxury Hotel Market Company Market Share

Unveiling the US Luxury Hotel Market: A Comprehensive Report (2019-2033)

This in-depth report provides an exhaustive analysis of the US Luxury Hotel Market, a dynamic sector experiencing robust growth and evolving consumer preferences. Delving into parent and child market segments, this study offers critical insights for industry professionals, investors, and stakeholders. With a study period spanning from 2019 to 2033, a base and estimated year of 2025, and a forecast period from 2025 to 2033, this report meticulously examines historical trends, current dynamics, and future trajectories. Covering luxury resorts, suite hotels, business hotels, and airport hotels, alongside heritage, contemporary, and modern themes, this research equips you with actionable intelligence to navigate the competitive landscape and capitalize on emerging opportunities in the high-end hospitality sector of the United States. All values are presented in Million units.

US Luxury Hotel Market Market Dynamics & Structure

The US Luxury Hotel Market is characterized by a moderately concentrated structure, with key players like JW Marriott, Hyatt Group, and St. Regis holding significant market share. However, the landscape is increasingly dynamic due to technological innovations, particularly in guest experience personalization and operational efficiency. Regulatory frameworks, while generally supportive of business, can influence development and operational standards. Competitive product substitutes, ranging from high-end vacation rentals to boutique non-chain establishments, present constant pressure. End-user demographics are shifting towards millennials and Gen Z, demanding unique experiences, sustainability, and seamless digital integration. Mergers and acquisitions (M&A) are a notable trend, as major hospitality groups seek to expand their luxury portfolios and market reach.

- Market Concentration: Dominated by major brands, but with growing influence of independent luxury properties.

- Technological Innovation Drivers: AI-powered personalization, contactless services, smart room technology, and sustainable operational solutions are key.

- Regulatory Frameworks: Focus on health and safety standards, environmental regulations, and labor laws impact operations.

- Competitive Product Substitutes: Luxury serviced apartments, private villa rentals, and exclusive glamping experiences.

- End-User Demographics: Growing demand from affluent millennials and Gen Z for experiential travel and wellness.

- M&A Trends: Strategic acquisitions to broaden luxury offerings and geographic presence. For instance, the Marriott and MGM Resorts partnership in January 2024 signifies a major consolidation of luxury offerings.

US Luxury Hotel Market Growth Trends & Insights

The US Luxury Hotel Market is poised for significant expansion, driven by pent-up demand for travel, a growing affluent population, and evolving consumer preferences for unique and personalized experiences. The market size is projected to grow at a substantial Compound Annual Growth Rate (CAGR) of XX% during the forecast period, reaching an estimated value of $XXX million by 2033. Adoption rates of advanced technologies are increasing, enhancing guest satisfaction and operational efficiency. For example, the integration of the Dream Hotels brand into the World of Hyatt loyalty program in June 2023 has broadened Hyatt's lifestyle offerings and customer base, demonstrating the power of strategic brand integration. Technological disruptions, such as AI-driven personalized recommendations and augmented reality experiences, are reshaping guest engagement. Consumer behavior shifts are evident, with a greater emphasis on wellness, sustainability, and authentic local experiences, pushing luxury hotels to innovate beyond traditional amenities. The market penetration of specialized luxury services, like eco-tourism in resorts and high-tech business facilities in city hotels, is also on an upward trajectory. The increasing preference for curated experiences over mere accommodation is a defining characteristic of current and future growth in this sector.

Dominant Regions, Countries, or Segments in US Luxury Hotel Market

The Resorts segment within the US Luxury Hotel Market is identified as a primary growth driver, experiencing robust demand driven by increasing leisure travel and the desire for exclusive vacation experiences. Regions with strong tourism infrastructure and natural attractions, such as Florida, California, and Hawaii, continue to dominate the luxury resort landscape. The Contemporary theme is increasingly influential, appealing to a broader demographic seeking modern amenities combined with sophisticated design. Economic policies that support tourism development and infrastructure investments in key leisure destinations are vital for sustained growth in this segment. Market share within the luxury resort sector is significant, with a projected value of $XXX million in 2025, and expected to grow at a CAGR of XX% through 2033. The growth potential is further amplified by the rising popularity of wellness resorts and adventure tourism.

- Leading Segment: Resorts, driven by leisure travel and demand for exclusive experiences.

- Dominant Themes: Contemporary, appealing to modern aesthetics and integrated technology.

- Key Regions: Florida, California, Hawaii, and other prominent tourist destinations.

- Key Drivers: Strong tourism infrastructure, economic policies favoring travel, and increasing disposable incomes.

- Market Share & Growth Potential: Resorts command a substantial market share, with ongoing expansion fueled by evolving consumer preferences for wellness and experiential travel.

US Luxury Hotel Market Product Landscape

The US Luxury Hotel Market product landscape is characterized by a strong emphasis on personalized guest experiences and cutting-edge amenities. Innovations are centered around enhancing comfort, convenience, and exclusivity. This includes advanced in-room technology for seamless control of environment and entertainment, premium F&B offerings with locally sourced and sustainable ingredients, and curated wellness programs. The application of AI for personalized service delivery, from bespoke room configurations to tailored activity recommendations, is becoming a standard. Performance metrics are increasingly measured by guest satisfaction scores, repeat booking rates, and online reputation, highlighting the importance of delivering exceptional value and unique selling propositions. For example, Nimmo Bay Great Bear Rainforest and Long Beach Lodge Resort exemplify unique natural settings combined with luxury.

Key Drivers, Barriers & Challenges in US Luxury Hotel Market

The US Luxury Hotel Market is propelled by several key drivers. Technological advancements in guest experience management and operational efficiency, such as the Marriott-MGM partnership, are significant catalysts. A growing global affluent population with increased disposable income and a penchant for experiential travel further fuels demand. Economic stability and supportive government policies encouraging tourism also play a crucial role.

However, the market faces considerable barriers and challenges. Supply chain disruptions for high-quality materials and staffing shortages in the skilled hospitality workforce can impact service delivery. Escalating operational costs, including energy and labor, put pressure on profitability. Intense competition from various hospitality segments and the rising cost of prime real estate for development present significant restraints. Regulatory hurdles, particularly concerning environmental sustainability and labor practices, require continuous adaptation and investment, impacting overall market growth by an estimated XX% in certain regions.

Emerging Opportunities in US Luxury Hotel Market

Emerging opportunities in the US Luxury Hotel Market lie in the growing demand for sustainable and eco-conscious travel. Boutique luxury hotels and resorts focusing on unique, immersive experiences, such as Cavallo Point or The Mark Hotel's bespoke services, are gaining traction. The rise of wellness tourism, with hotels offering comprehensive spa, fitness, and mindfulness programs, presents a significant untapped market. Furthermore, leveraging technology for hyper-personalization, offering exclusive membership programs, and expanding into underserved luxury destinations can unlock substantial growth potential. The integration of advanced digital solutions to streamline the entire guest journey, from booking to post-stay engagement, is another critical area for innovation and expansion.

Growth Accelerators in the US Luxury Hotel Market Industry

Several growth accelerators are shaping the future of the US Luxury Hotel Market. Strategic partnerships, exemplified by the Marriott and MGM Resorts alliance, are expanding market reach and customer loyalty programs, offering a wider array of luxury accommodations. Technological breakthroughs in AI, the Internet of Things (IoT), and virtual reality are enhancing guest experiences and operational efficiencies, leading to increased customer satisfaction and revenue. Market expansion strategies, including the development of new luxury properties in emerging high-demand destinations and the acquisition of boutique luxury brands, are crucial for sustained growth. The increasing focus on personalized and experiential travel, catering to the evolving preferences of affluent consumers, acts as a powerful catalyst for innovation and service differentiation across the industry.

Key Players Shaping the US Luxury Hotel Market Market

- JW Mariott

- The Mark Hotel

- Nimmo Bay Great Bear Rainforest

- The St Ragis

- Brooklyn Bridge Hotel

- Rencho Valnecia Resort

- Mayflower Inn and Spa

- Long Beach Lodge Resort

- Hyatt Group

- Cavallo Point

Notable Milestones in US Luxury Hotel Market Sector

- January 2024: Marriott and MGM Resorts establish a 20-year partnership, integrating 17 MGM properties in the US, including those in Las Vegas, into Marriott's portfolio, enhancing reservation capabilities across both brands' sales channels.

- June 2023: Hyatt Corporation announces the successful merger of the Dream Hotels brand, The Chatwal, The Time New York, and Unscripted properties into the World of Hyatt loyalty program, expanding lifestyle stay options for members.

In-Depth US Luxury Hotel Market Market Outlook

The US Luxury Hotel Market is projected for sustained growth, driven by a convergence of favorable economic conditions, evolving consumer expectations, and strategic industry collaborations. Future market potential is immense, particularly within the boutique luxury hotels and eco-resort segments, catering to the growing demand for unique, sustainable, and experiential travel. Strategic opportunities lie in leveraging advanced technologies for hyper-personalization and operational streamlining, as well as in expanding into niche markets and underserved luxury destinations. The continued integration of loyalty programs and brand portfolios, such as the Marriott-MGM and Hyatt integrations, will further consolidate market power and enhance customer offerings, creating a more interconnected and rewarding luxury hospitality ecosystem for the foreseeable future.

US Luxury Hotel Market Segmentation

-

1. Service Type

- 1.1. Business Hotels

- 1.2. Airport Hotels

- 1.3. Suite Hotel

- 1.4. Resorts

- 1.5. Other Service Types

-

2. Theme

- 2.1. Heritage

- 2.2. Contemporary

- 2.3. Modern

- 2.4. Other Themes

US Luxury Hotel Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Luxury Hotel Market Regional Market Share

Geographic Coverage of US Luxury Hotel Market

US Luxury Hotel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend of Availing Luxurious Lifestyle While Travelling

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Preferences; Rising Operational Costs

- 3.4. Market Trends

- 3.4.1. Tourism Growth in United States is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Business Hotels

- 5.1.2. Airport Hotels

- 5.1.3. Suite Hotel

- 5.1.4. Resorts

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Theme

- 5.2.1. Heritage

- 5.2.2. Contemporary

- 5.2.3. Modern

- 5.2.4. Other Themes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America US Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Business Hotels

- 6.1.2. Airport Hotels

- 6.1.3. Suite Hotel

- 6.1.4. Resorts

- 6.1.5. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by Theme

- 6.2.1. Heritage

- 6.2.2. Contemporary

- 6.2.3. Modern

- 6.2.4. Other Themes

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. South America US Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Business Hotels

- 7.1.2. Airport Hotels

- 7.1.3. Suite Hotel

- 7.1.4. Resorts

- 7.1.5. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by Theme

- 7.2.1. Heritage

- 7.2.2. Contemporary

- 7.2.3. Modern

- 7.2.4. Other Themes

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Europe US Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Business Hotels

- 8.1.2. Airport Hotels

- 8.1.3. Suite Hotel

- 8.1.4. Resorts

- 8.1.5. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by Theme

- 8.2.1. Heritage

- 8.2.2. Contemporary

- 8.2.3. Modern

- 8.2.4. Other Themes

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East & Africa US Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Business Hotels

- 9.1.2. Airport Hotels

- 9.1.3. Suite Hotel

- 9.1.4. Resorts

- 9.1.5. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by Theme

- 9.2.1. Heritage

- 9.2.2. Contemporary

- 9.2.3. Modern

- 9.2.4. Other Themes

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Asia Pacific US Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Business Hotels

- 10.1.2. Airport Hotels

- 10.1.3. Suite Hotel

- 10.1.4. Resorts

- 10.1.5. Other Service Types

- 10.2. Market Analysis, Insights and Forecast - by Theme

- 10.2.1. Heritage

- 10.2.2. Contemporary

- 10.2.3. Modern

- 10.2.4. Other Themes

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 JW Mariott

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Mark Hotel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nimmo Bay Great Bear Rainforest

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The St Ragis

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Brooklyn Bridge Hotel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rencho Valnecia Resort

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mayflower Inn and Spa

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Long Beach Lodge Resort

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hyatt Group**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cavallo Point

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 JW Mariott

List of Figures

- Figure 1: Global US Luxury Hotel Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America US Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America US Luxury Hotel Market Revenue (Million), by Theme 2025 & 2033

- Figure 5: North America US Luxury Hotel Market Revenue Share (%), by Theme 2025 & 2033

- Figure 6: North America US Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America US Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 9: South America US Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: South America US Luxury Hotel Market Revenue (Million), by Theme 2025 & 2033

- Figure 11: South America US Luxury Hotel Market Revenue Share (%), by Theme 2025 & 2033

- Figure 12: South America US Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America US Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Europe US Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Europe US Luxury Hotel Market Revenue (Million), by Theme 2025 & 2033

- Figure 17: Europe US Luxury Hotel Market Revenue Share (%), by Theme 2025 & 2033

- Figure 18: Europe US Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe US Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Middle East & Africa US Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Middle East & Africa US Luxury Hotel Market Revenue (Million), by Theme 2025 & 2033

- Figure 23: Middle East & Africa US Luxury Hotel Market Revenue Share (%), by Theme 2025 & 2033

- Figure 24: Middle East & Africa US Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Asia Pacific US Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Asia Pacific US Luxury Hotel Market Revenue (Million), by Theme 2025 & 2033

- Figure 29: Asia Pacific US Luxury Hotel Market Revenue Share (%), by Theme 2025 & 2033

- Figure 30: Asia Pacific US Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific US Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global US Luxury Hotel Market Revenue Million Forecast, by Theme 2020 & 2033

- Table 3: Global US Luxury Hotel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global US Luxury Hotel Market Revenue Million Forecast, by Theme 2020 & 2033

- Table 6: Global US Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global US Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Global US Luxury Hotel Market Revenue Million Forecast, by Theme 2020 & 2033

- Table 12: Global US Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Global US Luxury Hotel Market Revenue Million Forecast, by Theme 2020 & 2033

- Table 18: Global US Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global US Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 29: Global US Luxury Hotel Market Revenue Million Forecast, by Theme 2020 & 2033

- Table 30: Global US Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global US Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 38: Global US Luxury Hotel Market Revenue Million Forecast, by Theme 2020 & 2033

- Table 39: Global US Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Luxury Hotel Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the US Luxury Hotel Market?

Key companies in the market include JW Mariott, The Mark Hotel, Nimmo Bay Great Bear Rainforest, The St Ragis, Brooklyn Bridge Hotel, Rencho Valnecia Resort, Mayflower Inn and Spa, Long Beach Lodge Resort, Hyatt Group**List Not Exhaustive, Cavallo Point.

3. What are the main segments of the US Luxury Hotel Market?

The market segments include Service Type, Theme.

4. Can you provide details about the market size?

The market size is estimated to be USD 73.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend of Availing Luxurious Lifestyle While Travelling.

6. What are the notable trends driving market growth?

Tourism Growth in United States is Driving the Market.

7. Are there any restraints impacting market growth?

Changing Consumer Preferences; Rising Operational Costs.

8. Can you provide examples of recent developments in the market?

In January 2024, A 20-year partnership has been established between Marriott and MGM Resorts. The Marriott brand now includes 17 MGM properties in the US, including those in Las Vegas. As per the agreement, MGM's and Marriott's sales channels can be used to make property reservations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Luxury Hotel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Luxury Hotel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Luxury Hotel Market?

To stay informed about further developments, trends, and reports in the US Luxury Hotel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence