Key Insights

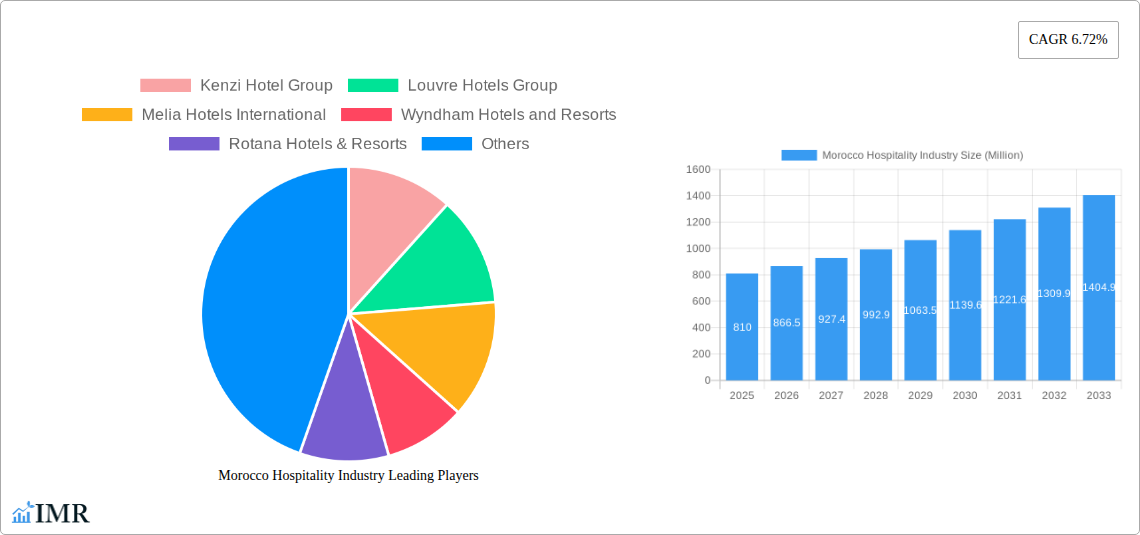

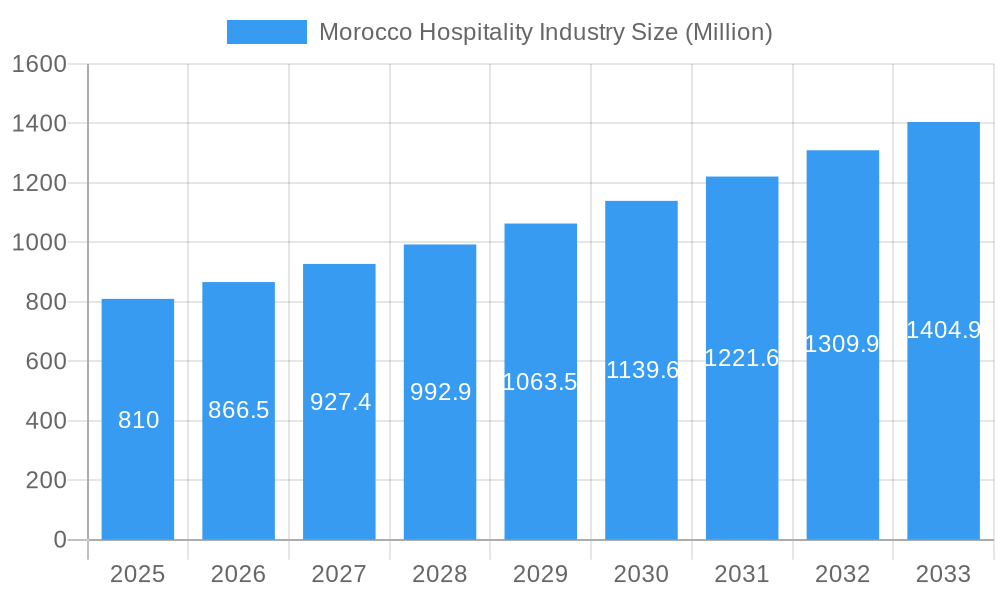

The Moroccan hospitality industry, valued at $810 million in 2025, is projected to experience robust growth, driven by increasing tourism, infrastructure development, and a rising middle class with increased disposable income. The compound annual growth rate (CAGR) of 6.72% from 2025 to 2033 signifies a promising outlook for investors and stakeholders. Key segments contributing to this growth include budget and economy hotels, catering to the price-sensitive traveler, and the mid-to-upper-mid-scale segment, appealing to a broader range of tourists seeking comfortable accommodations. The luxury hotel segment also shows potential, driven by high-spending tourists seeking premium experiences. While the industry benefits from the popularity of Morocco as a tourist destination and government initiatives to boost tourism, challenges remain, including potential economic fluctuations impacting tourism spending and the need for sustainable practices to minimize environmental impact. The competitive landscape is characterized by a mix of international hotel chains like Marriott International, Accor SA, and Wyndham Hotels & Resorts, alongside established local players such as Kenzi Hotel Group and Rotana Hotels & Resorts. This mix ensures a diverse offering catering to different preferences and budgets. The increasing popularity of service apartments also presents a significant growth opportunity within the sector. Future growth will likely hinge on continued investment in infrastructure, strategic marketing to attract international tourists, and the adoption of innovative technologies to enhance the guest experience.

Morocco Hospitality Industry Market Size (In Million)

The segmentation of the Moroccan hospitality market presents opportunities across different price points. Budget and economy hotels benefit from the influx of price-conscious travelers, while the mid-to-upper-mid-scale segment offers a balanced approach to comfort and affordability. The luxury segment caters to a niche market seeking high-end experiences. The success of individual hotels will depend on their ability to effectively target specific market segments, offer competitive pricing and value-added services, and adapt to evolving consumer preferences. The rise of online travel agencies (OTAs) and the increasing importance of online reviews highlight the need for effective digital marketing strategies. Furthermore, adapting to changing global events and maintaining operational efficiency will be critical for long-term success in this dynamic market.

Morocco Hospitality Industry Company Market Share

Morocco Hospitality Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Morocco hospitality industry, covering market dynamics, growth trends, key players, and future outlook from 2019 to 2033. With a focus on both parent and child market segments, this report is an essential resource for industry professionals, investors, and strategic planners. The base year for this analysis is 2025, with estimations for 2025 and forecasts extending to 2033.

Keywords: Morocco Hospitality Industry, Moroccan Hotels, Hotel Market Morocco, Tourism Morocco, Hospitality Market Morocco, Budget Hotels Morocco, Luxury Hotels Morocco, Chain Hotels Morocco, Independent Hotels Morocco, Service Apartments Morocco, Hotel Investment Morocco, Accor Morocco, Marriott Morocco, Kenzi Hotel Group, Fairmont Hotels Morocco, Hilton Morocco

Morocco Hospitality Industry Market Dynamics & Structure

The Moroccan hospitality market, valued at xx Million in 2024, is characterized by a moderately concentrated landscape with both international and domestic players competing across various segments. Market concentration is influenced by the presence of major international chains like Accor SA, Marriott International Inc., and Hyatt Hotels Corporation, alongside significant domestic players such as Kenzi Hotel Group and Onomo Hotels. Technological innovation, while present, faces barriers including infrastructure limitations and varying levels of digital adoption amongst businesses.

- Market Concentration: xx% market share held by top 5 players in 2024.

- Technological Innovation: Increasing adoption of online booking platforms and property management systems, but slower uptake in smaller, independent hotels.

- Regulatory Framework: Government initiatives supporting tourism development, but complexities in licensing and regulations can hinder growth.

- Competitive Substitutes: The rise of alternative accommodation options like Airbnb poses a challenge to traditional hotels.

- End-User Demographics: A growing middle class and increasing inbound tourism are key drivers of demand.

- M&A Trends: A moderate level of mergers and acquisitions activity, with larger chains expanding their footprint through acquisitions of smaller properties and brands (xx M&A deals in the historical period).

Morocco Hospitality Industry Growth Trends & Insights

The Moroccan hospitality industry demonstrates robust growth fueled by increasing tourism, infrastructure development, and economic diversification. Between 2019 and 2024, the market experienced a CAGR of xx%, reaching a value of xx Million. This growth is projected to continue, with a forecasted CAGR of xx% from 2025 to 2033, reaching an estimated value of xx Million by 2033. Consumer behavior is shifting towards online booking, experiences over merely accommodation, and a preference for diverse offerings. Technological disruptions, such as the increased use of AI in hospitality management, further drive industry transformation. Market penetration rates for online bookings are steadily increasing, reflecting a digitally inclined consumer base.

Dominant Regions, Countries, or Segments in Morocco Hospitality Industry

Market leadership is currently split between major cities like Marrakech, Casablanca, and Agadir, reflecting established tourist hubs with robust infrastructure. The Luxury Hotels segment is displaying strong growth driven by high-spending tourists and an increase in upscale tourism, while the Budget and Economy Hotels segment holds the largest market share reflecting high demand from budget-conscious travelers. Chain hotels dominate the market share due to brand recognition and established distribution networks.

- Key Drivers:

- Strong government support for tourism development and infrastructure improvements.

- Increasing disposable incomes amongst the Moroccan middle class boosting domestic tourism.

- Growth of inbound tourism, particularly from European and African markets.

- Casablanca: Holds the largest market share by revenue due to its business tourism and large population.

- Marrakech: Strong growth driven by its cultural significance and tourism appeal.

- Agadir: Significant beach tourism drives sector growth in this region.

Morocco Hospitality Industry Product Landscape

The Moroccan hospitality market offers a diversified product landscape encompassing a wide range of offerings, from budget-friendly accommodations to luxurious resorts. Innovative services like personalized concierge services, themed experiences, and sustainable practices are emerging as key differentiators. Technological advancements, including smart room technology and advanced booking systems, enhance guest experiences and operational efficiency. The unique selling proposition of many establishments emphasizes Moroccan cultural experiences, blending traditional hospitality with modern amenities.

Key Drivers, Barriers & Challenges in Morocco Hospitality Industry

Key Drivers:

- Increased inbound tourism spurred by government initiatives promoting Morocco as a tourist destination.

- Development of new infrastructure, including airports and transportation networks.

- Growing middle class with higher disposable income driving domestic tourism.

Challenges & Restraints:

- Seasonality impacting revenue streams and creating operational inconsistencies.

- Competition from alternative accommodation providers like Airbnb.

- Skills shortages within the hospitality sector affecting operational quality and efficiency. This is estimated to negatively impact growth by xx% by 2030 if unaddressed.

Emerging Opportunities in Morocco Hospitality Industry

Untapped markets include niche tourism segments such as eco-tourism, adventure tourism, and wellness tourism. Innovative applications of technology, particularly in enhancing guest experience and streamlining operations, present significant opportunities. Evolving consumer preferences towards personalized and experiential travel suggest growth potential in unique offerings like cultural immersion programs and bespoke travel packages.

Growth Accelerators in the Morocco Hospitality Industry Industry

Technological advancements in areas such as property management systems, revenue management, and guest experience platforms are key growth drivers. Strategic partnerships between international hotel chains and local developers facilitate market expansion. Diversification into niche tourism segments and effective marketing strategies targeting specific demographics contribute to long-term growth.

Key Players Shaping the Morocco Hospitality Industry Market

- Kenzi Hotel Group

- Louvre Hotels Group

- Melia Hotels International

- Wyndham Hotels and Resorts

- Rotana Hotels & Resorts

- Hyatt Hotels Corporation

- Radisson Hotel Group

- Onomo Hotels

- Marriott International Inc.

- Accor SA

Notable Milestones in Morocco Hospitality Industry Sector

- December 2022: Launch of Conrad Rabat Arzana, Hilton's first property in Morocco, introducing a modern luxury offering.

- October 2022: Katara Hospitality and Accor partner to develop the Fairmont Tazi Palace Tangier, expanding luxury offerings in the northern region.

In-Depth Morocco Hospitality Industry Market Outlook

The Moroccan hospitality market exhibits significant long-term growth potential driven by continuing infrastructure developments, government support for the tourism sector, and evolving consumer preferences. Strategic investments in technology, expansion into niche markets, and a focus on delivering exceptional guest experiences will be crucial for sustained growth. The market is expected to witness significant consolidation with increased M&A activity, resulting in a more streamlined yet diversified industry landscape.

Morocco Hospitality Industry Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper Mid-scale Hotels

- 2.4. Luxury Hotels

Morocco Hospitality Industry Segmentation By Geography

- 1. Morocco

Morocco Hospitality Industry Regional Market Share

Geographic Coverage of Morocco Hospitality Industry

Morocco Hospitality Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The number of baby-boomer tourists is expected to increase

- 3.2.2 which will fuel the growth of the worldwide amusement park market.; Incorporating energy-saving innovations like LED lighting and solar panels

- 3.3. Market Restrains

- 3.3.1. Theme parks are raising admission costs and letting guests ride every ride without waiting in queue; Theme parks utilising virtual reality are becoming more and more common.

- 3.4. Market Trends

- 3.4.1. Rising Tourist Arrivals to Morocco is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Hospitality Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper Mid-scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kenzi Hotel Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Louvre Hotels Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Melia Hotels International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wyndham Hotels and Resorts

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rotana Hotels & Resorts

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hyatt Hotels Corporation**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Radisson Hotel Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Onomo Hotels

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Marriott International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Accor SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kenzi Hotel Group

List of Figures

- Figure 1: Morocco Hospitality Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Morocco Hospitality Industry Share (%) by Company 2025

List of Tables

- Table 1: Morocco Hospitality Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Morocco Hospitality Industry Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Morocco Hospitality Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Morocco Hospitality Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Morocco Hospitality Industry Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Morocco Hospitality Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Hospitality Industry?

The projected CAGR is approximately 6.72%.

2. Which companies are prominent players in the Morocco Hospitality Industry?

Key companies in the market include Kenzi Hotel Group, Louvre Hotels Group, Melia Hotels International, Wyndham Hotels and Resorts, Rotana Hotels & Resorts, Hyatt Hotels Corporation**List Not Exhaustive, Radisson Hotel Group, Onomo Hotels, Marriott International Inc, Accor SA.

3. What are the main segments of the Morocco Hospitality Industry?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.81 Million as of 2022.

5. What are some drivers contributing to market growth?

The number of baby-boomer tourists is expected to increase. which will fuel the growth of the worldwide amusement park market.; Incorporating energy-saving innovations like LED lighting and solar panels.

6. What are the notable trends driving market growth?

Rising Tourist Arrivals to Morocco is Driving the Market.

7. Are there any restraints impacting market growth?

Theme parks are raising admission costs and letting guests ride every ride without waiting in queue; Theme parks utilising virtual reality are becoming more and more common..

8. Can you provide examples of recent developments in the market?

December 2022: The launch of Conrad Rabat Arzana, the brand's first establishment in Morocco, was announced by Hilton. The modern architecture and design of the 120-room hotel give guests a new take on modern hospitality, fine dining, and personalized service. The hotel's ideal location near the city's cultural hub, north of Harhoura, provides easy access to a variety of tourist destinations, including the Mausoleum Med V, Old Medina, Moorish Gardens, and the Zoo of Rabat.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Hospitality Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Hospitality Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Hospitality Industry?

To stay informed about further developments, trends, and reports in the Morocco Hospitality Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence