Key Insights

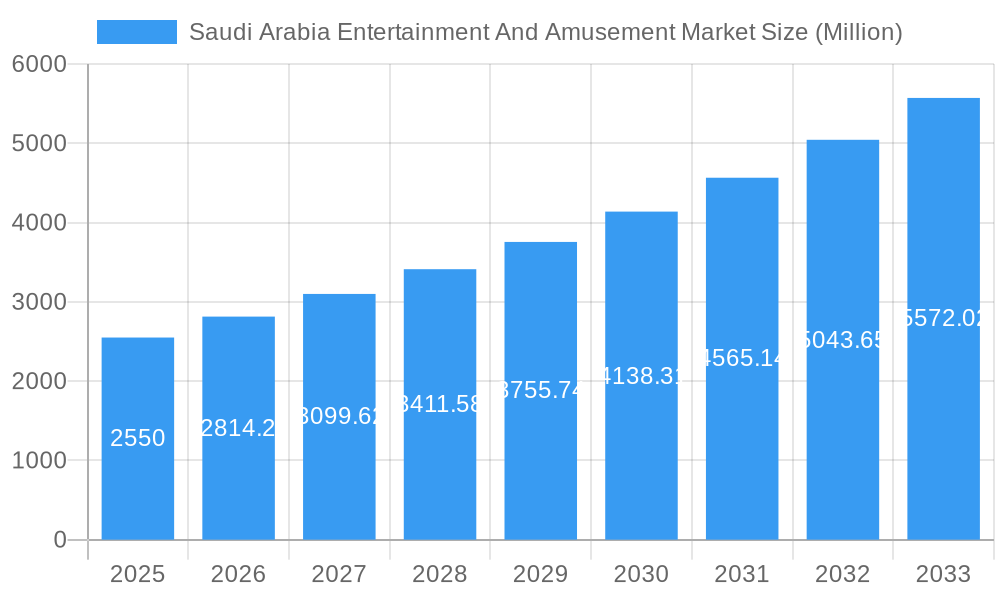

The Saudi Arabia entertainment and amusement market is experiencing robust growth, projected to reach \$2.55 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.44% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, Vision 2030, Saudi Arabia's ambitious national transformation plan, prioritizes diversification of the economy and significant investment in leisure and entertainment infrastructure. This has resulted in the development of numerous new theme parks, entertainment complexes, and cultural attractions. Secondly, a burgeoning young population with high disposable income is driving demand for diverse entertainment experiences. The government's efforts to promote tourism also contribute significantly to market growth, attracting both domestic and international visitors. Market segmentation reveals that theme parks and cinemas are major revenue contributors, alongside food and beverage sales within these venues. Riyadh, Jeddah, and Makkah are the leading cities driving market growth, reflecting higher population density and tourist footfall. Competition is intensifying with the entry of both international giants like Disney and Six Flags, alongside successful local players, leading to innovation and a wider array of entertainment options for consumers.

Saudi Arabia Entertainment And Amusement Market Market Size (In Billion)

The market's growth trajectory, however, is not without challenges. While the government's support is substantial, infrastructure development needs to keep pace with demand. Furthermore, maintaining a balance between catering to both local preferences and international tourist expectations requires careful market analysis and strategic planning. Pricing strategies need to balance accessibility for the local population with profitability. The market's future success hinges on continued investment in infrastructure, innovative entertainment offerings, and maintaining a balance between affordability and quality experiences. Successful players will likely be those who can effectively leverage technological advancements to enhance the customer experience and integrate digital marketing strategies effectively. The evolving preferences of the Saudi population also need to be carefully considered to ensure sustained market momentum.

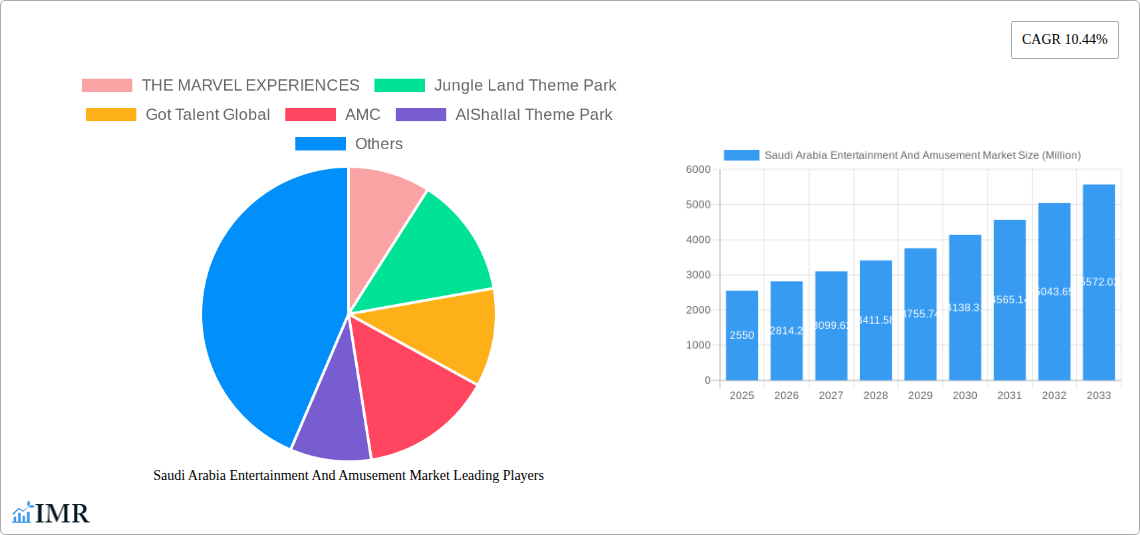

Saudi Arabia Entertainment And Amusement Market Company Market Share

Saudi Arabia Entertainment and Amusement Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Saudi Arabia entertainment and amusement market, encompassing its current state, future trajectory, and key players. With a detailed study period from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report offers invaluable insights for investors, industry professionals, and strategic decision-makers. The market is segmented by type of entertainment destination, revenue source, and city, providing a granular understanding of its diverse landscape. The total market size is projected to reach xx Million by 2033.

Saudi Arabia Entertainment And Amusement Market Dynamics & Structure

The Saudi Arabian entertainment and amusement market is experiencing rapid growth, driven by Vision 2030's initiatives to diversify the economy and boost tourism. Market concentration is currently moderate, with several large players and a growing number of smaller, specialized businesses. Technological innovation, particularly in virtual reality (VR) and augmented reality (AR) experiences, is a significant driver. The regulatory framework is increasingly supportive of the industry's growth, with streamlined licensing procedures and relaxed restrictions. Competitive product substitutes include online entertainment options, but the experiential nature of physical entertainment venues ensures strong demand. End-user demographics are diverse, encompassing families, young adults, and tourists. M&A activity is expected to increase as larger companies consolidate their market share.

- Market Concentration: Moderate, with a mix of large and small players.

- Technological Innovation: VR/AR experiences, interactive attractions are key drivers.

- Regulatory Framework: Supportive, facilitating industry growth.

- Competitive Substitutes: Online entertainment, but physical experiences retain strong demand.

- End-User Demographics: Families, young adults, and tourists.

- M&A Trends: Increasing activity as larger firms seek consolidation. Projected M&A deal volume for 2025-2033: xx deals.

Saudi Arabia Entertainment And Amusement Market Growth Trends & Insights

The Saudi Arabia entertainment and amusement market has shown significant growth over the historical period (2019-2024), fueled by increased disposable incomes, government investments, and a burgeoning tourism sector. The Compound Annual Growth Rate (CAGR) during this period was approximately xx%, and it is projected to continue its strong growth trajectory throughout the forecast period (2025-2033), with a projected CAGR of xx%. This growth is attributed to several factors, including increased government spending on infrastructure, a young and growing population with high entertainment spending, and the introduction of new and innovative entertainment options. The adoption rate of new technologies is high, with consumers readily embracing VR/AR experiences and interactive attractions. Consumer behavior is shifting toward seeking more unique and immersive experiences. The market penetration rate for theme parks is currently estimated at xx%, expected to reach xx% by 2033.

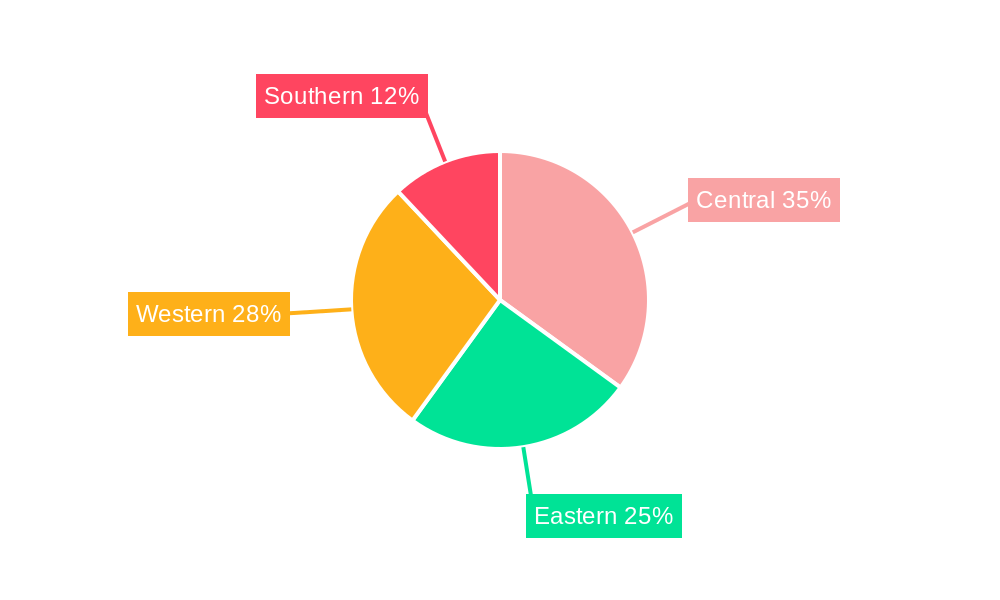

Dominant Regions, Countries, or Segments in Saudi Arabia Entertainment And Amusement Market

Riyadh consistently dominates the Saudi Arabian entertainment and amusement market due to its large population, higher disposable incomes, and concentrated infrastructure development. Jeddah follows closely as a major tourism hub. Within market segments, amusement and theme parks represent the largest share, followed by cinemas and theaters. In terms of revenue sources, ticket sales remain the primary driver, but food and beverage revenue is also substantial and growing.

- By City: Riyadh (xx Million), Jeddah (xx Million), Makkah (xx Million), Dammam (xx Million), Rest of Saudi Arabia (xx Million). Riyadh holds the largest market share.

- By Type of Entertainment Destination: Amusement and Theme Parks (xx Million), Cinemas and Theatres (xx Million), Malls (xx Million), Others (xx Million). Amusement and theme parks have the highest growth potential.

- By Source of Revenue: Tickets (xx Million), Food & Beverages (xx Million), Merchandise (xx Million), Others (xx Million). Ticket sales are the leading revenue stream.

Saudi Arabia Entertainment And Amusement Market Product Landscape

The Saudi Arabian entertainment and amusement market is characterized by a diverse range of products and services, from traditional cinemas and theme parks to cutting-edge VR/AR experiences and interactive attractions. Product innovation focuses on enhancing the immersive nature of entertainment, offering unique and memorable experiences for consumers. Key performance metrics include visitor numbers, revenue per visitor, and customer satisfaction ratings. The unique selling propositions often revolve around exclusivity, scale, and technological integration.

Key Drivers, Barriers & Challenges in Saudi Arabia Entertainment And Amusement Market

Key Drivers:

- Vision 2030's investment in entertainment and tourism.

- Rising disposable incomes among the Saudi population.

- Growing tourism sector.

- Technological advancements in entertainment experiences.

Challenges & Restraints:

- Competition from online entertainment platforms.

- Potential for oversaturation in certain segments.

- Dependence on government support and policy continuity.

- Maintaining international standards of quality and safety.

Emerging Opportunities in Saudi Arabia Entertainment And Amusement Market

- Expansion of niche entertainment offerings, such as esports and live music events.

- Growing demand for family-oriented entertainment options.

- Development of eco-tourism attractions.

- Further integration of technology to enhance guest experience.

Growth Accelerators in the Saudi Arabia Entertainment And Amusement Market Industry

Continued government support under Vision 2030, strategic partnerships between international and local players, expansion into new and underserved markets, and the ongoing introduction of innovative technologies are key catalysts for long-term market growth. These factors are expected to drive sustained expansion of the entertainment and amusement industry in Saudi Arabia.

Key Players Shaping the Saudi Arabia Entertainment And Amusement Market Market

- THE MARVEL EXPERIENCES

- Jungle Land Theme Park

- Got Talent Global

- AMC

- AlShallal Theme Park

- Cirque Du Soleil

- IMG Artists

- National geographic

- Broadway Entertainment

- AVEX

- SIX FLAGS

- Disney Frozen

- FELD ENTERTAINMENT

- Loopagoon Water Park

- List Not Exhaustive

Notable Milestones in Saudi Arabia Entertainment And Amusement Market Sector

- May 2022: Muvi Cinemas launches Muvi Studios, focusing on Saudi and Egyptian film production. This expands domestic content and strengthens the local film industry.

- September 2022: Flash Entertainment opens its KSA headquarters in Riyadh, demonstrating commitment to the Kingdom's Vision 2030 goals and supporting Saudization efforts. This signifies significant foreign investment and confidence in the market's potential.

In-Depth Saudi Arabia Entertainment And Amusement Market Market Outlook

The Saudi Arabia entertainment and amusement market is poised for continued robust growth throughout the forecast period, driven by ongoing government initiatives, increased private sector investment, and the evolving preferences of a young and increasingly affluent population. Strategic partnerships with international entertainment giants will further enhance the market's offerings and attract both domestic and international tourists. The market presents significant opportunities for companies that can deliver innovative, high-quality entertainment experiences.

Saudi Arabia Entertainment And Amusement Market Segmentation

-

1. Type of Entertainment Destination

- 1.1. Cinemas and Theatres

- 1.2. Amusement and Theme Parks

- 1.3. Gardens and Zoos

- 1.4. Malls

- 1.5. Gaming Centers

- 1.6. Others

-

2. Source of Revenue

- 2.1. Tickets

- 2.2. Food & Beverages

- 2.3. Merchandise

- 2.4. Advertising

- 2.5. Others

-

3. City

- 3.1. Riyadh

- 3.2. Jeddah

- 3.3. Makkah

- 3.4. Dammam

- 3.5. Rest of Saudi Arabia

Saudi Arabia Entertainment And Amusement Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Entertainment And Amusement Market Regional Market Share

Geographic Coverage of Saudi Arabia Entertainment And Amusement Market

Saudi Arabia Entertainment And Amusement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. High Costs is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Cinema Revolution is Expected to Drive the Market Growth in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Entertainment And Amusement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Entertainment Destination

- 5.1.1. Cinemas and Theatres

- 5.1.2. Amusement and Theme Parks

- 5.1.3. Gardens and Zoos

- 5.1.4. Malls

- 5.1.5. Gaming Centers

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.2.1. Tickets

- 5.2.2. Food & Beverages

- 5.2.3. Merchandise

- 5.2.4. Advertising

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by City

- 5.3.1. Riyadh

- 5.3.2. Jeddah

- 5.3.3. Makkah

- 5.3.4. Dammam

- 5.3.5. Rest of Saudi Arabia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type of Entertainment Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 THE MARVEL EXPERIENCES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jungle Land Theme Park

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Got Talent Global

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AMC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AlShallal Theme Park

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cirque Du Soleil

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IMG Artists

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 National geographic

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Broadway Entertainment

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AVEX

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SIX FLAGS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Disney Frozen

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 FELD ENTERTAINMENT

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Loopagoon Water Park**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 THE MARVEL EXPERIENCES

List of Figures

- Figure 1: Saudi Arabia Entertainment And Amusement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Entertainment And Amusement Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Type of Entertainment Destination 2020 & 2033

- Table 2: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 3: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by City 2020 & 2033

- Table 4: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Type of Entertainment Destination 2020 & 2033

- Table 6: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 7: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by City 2020 & 2033

- Table 8: Saudi Arabia Entertainment And Amusement Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Entertainment And Amusement Market?

The projected CAGR is approximately 10.44%.

2. Which companies are prominent players in the Saudi Arabia Entertainment And Amusement Market?

Key companies in the market include THE MARVEL EXPERIENCES, Jungle Land Theme Park, Got Talent Global, AMC, AlShallal Theme Park, Cirque Du Soleil, IMG Artists, National geographic, Broadway Entertainment, AVEX, SIX FLAGS, Disney Frozen, FELD ENTERTAINMENT, Loopagoon Water Park**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Entertainment And Amusement Market?

The market segments include Type of Entertainment Destination, Source of Revenue, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Cinema Revolution is Expected to Drive the Market Growth in the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs is Restraining the Market.

8. Can you provide examples of recent developments in the market?

May 2022: Saudi Arabia's leading theater operator Muvi Cinemas launched Muvi Studios. The new Studio will focus on developing both Saudi and Egyptian films for the Saudi public, concentrating on films for the big screen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Entertainment And Amusement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Entertainment And Amusement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Entertainment And Amusement Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Entertainment And Amusement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence