Key Insights

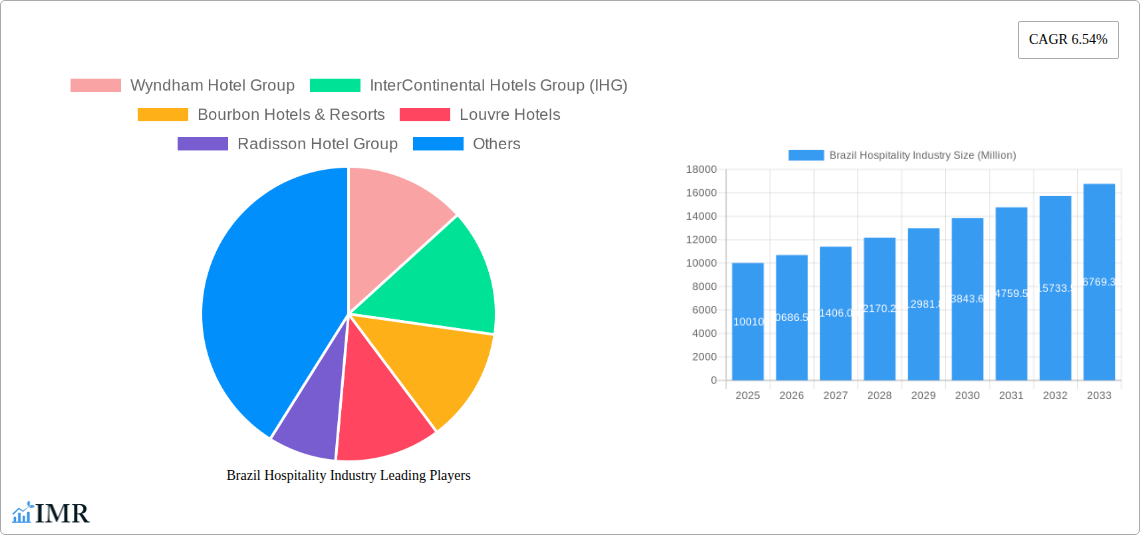

The Brazilian hospitality industry, valued at approximately $10.01 billion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 6.54% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, Brazil's burgeoning tourism sector, driven by increasing disposable incomes and a growing middle class, is significantly boosting demand for hotel accommodations across various segments. Secondly, major sporting events and infrastructural developments are attracting both domestic and international tourists, further stimulating the market. Thirdly, the increasing popularity of bleisure travel (a blend of business and leisure) contributes to sustained occupancy rates. However, economic volatility and potential inflationary pressures remain potential restraints. The industry is segmented by type (chain hotels, independent hotels, service apartments) and by scale (budget and economy, mid and upper-midscale, and luxury hotels). Chain hotels, such as Wyndham, IHG, Marriott, and Accor, currently dominate the market, leveraging their brand recognition and extensive networks. Independent hotels and service apartments are also gaining traction, catering to niche markets and offering personalized experiences. The luxury segment is expected to witness strong growth, driven by high-net-worth individuals and the increasing demand for upscale hospitality services. The forecast for 2033 anticipates continued expansion, driven by ongoing infrastructural investments and the long-term growth potential of the Brazilian economy. Competition among established players and new entrants is expected to intensify, with a focus on innovation, technology integration, and exceptional customer service.

Brazil Hospitality Industry Market Size (In Billion)

The competitive landscape is dynamic, with both international and domestic players vying for market share. Established international chains possess a significant advantage in brand recognition and operational efficiency, yet smaller, independent hotels and service apartments are attracting a discerning clientele seeking unique and personalized experiences. Future growth will likely depend on the ability of hotels to adapt to evolving customer preferences, invest in sustainable practices, and leverage technology to enhance the guest experience. The increasing adoption of online booking platforms and the growing influence of online reviews are also shaping the industry landscape. Furthermore, the industry must effectively address sustainability concerns to cater to the growing awareness of eco-conscious travelers. Success will hinge on strategic investments in technology, operational efficiency, and the ability to provide memorable and personalized guest experiences.

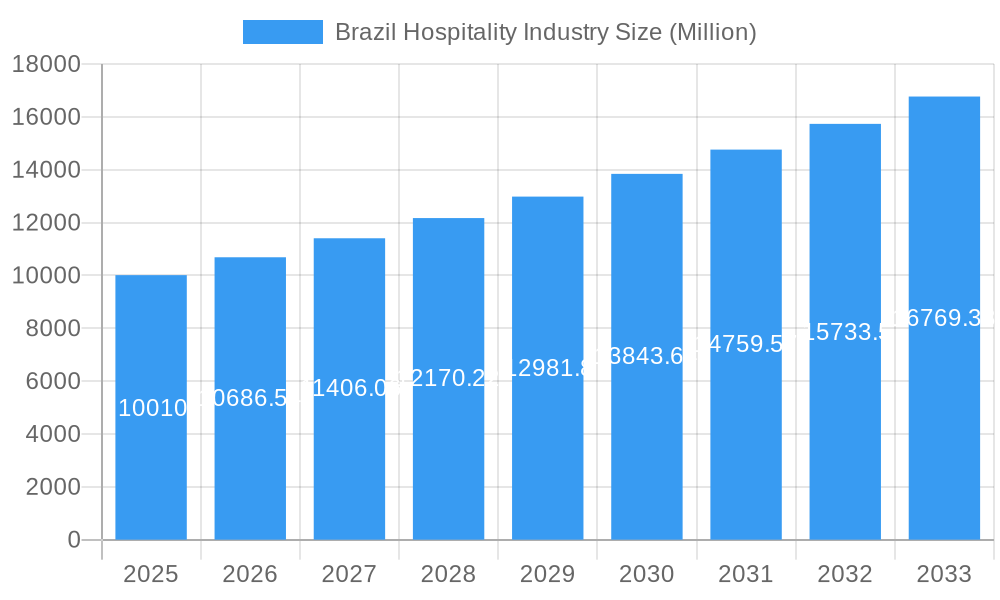

Brazil Hospitality Industry Company Market Share

Brazil Hospitality Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Brazil hospitality industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and anyone seeking to understand the vibrant and rapidly evolving Brazilian hospitality sector.

Brazil Hospitality Industry Market Dynamics & Structure

The Brazilian hospitality market, valued at xx million in 2024, exhibits a dynamic interplay of factors influencing its structure and growth. Market concentration is moderate, with a mix of international chains and domestic players. Technological innovation, driven by the increasing adoption of revenue management systems and online booking platforms, is reshaping the industry. A robust regulatory framework governs the sector, while competition from alternative accommodation options like Airbnb presents a significant challenge. The market is segmented by type (chain hotels, independent hotels, service apartments) and by segment (budget & economy, mid & upper midscale, luxury hotels). M&A activity is significant, with several high-profile deals shaping the competitive landscape.

- Market Concentration: Moderate, with both international and domestic players. International chains hold approximately xx% market share, with the remainder distributed amongst independent and smaller chains.

- Technological Innovation: Strong adoption of revenue management systems (RMS), online booking platforms, and digital marketing. Barriers include the cost of implementation and integration with legacy systems.

- Regulatory Framework: Relatively stable, with ongoing efforts to improve tourism infrastructure and promote sustainable practices.

- Competitive Substitutes: Airbnb and other alternative accommodations are impacting market share, particularly in the budget and mid-scale segments.

- End-User Demographics: A growing middle class and increasing inbound tourism are key drivers of growth, with a strong preference for diverse experiences, influencing hotel offerings.

- M&A Trends: Significant activity, particularly amongst international chains seeking to expand their presence in Brazil. The number of M&A deals from 2019-2024 totalled approximately xx.

Brazil Hospitality Industry Growth Trends & Insights

The Brazilian hospitality market experienced substantial growth during the historical period (2019-2024), though it faced challenges due to external factors such as the Covid-19 pandemic. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033), driven by robust domestic tourism, increasing foreign investment, and improvements in infrastructure. Technological disruptions like the rise of online travel agencies (OTAs) and the increasing use of data analytics are significantly influencing consumer behavior. Market penetration of digital booking channels continues to grow, enhancing convenience for travellers and improving occupancy rates for hotels. The shift towards personalized experiences and sustainable tourism practices will continue to shape future demand.

- Market Size: Projected to reach xx million by 2033.

- CAGR (2025-2033): xx%

- Market Penetration of Online Booking: xx% in 2024, projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Brazil Hospitality Industry

São Paulo and Rio de Janeiro remain the dominant regions, benefiting from robust business and leisure travel. However, growth is also evident in other key cities like Brasilia, Fortaleza, and Salvador, reflecting the expanding tourism footprint across Brazil. The chain hotel segment continues to lead market share, but independent hotels maintain a significant presence, particularly in niche markets. Within segments, the mid-scale and upper-midscale hotels demonstrate the highest growth potential.

- Leading Regions: São Paulo, Rio de Janeiro, showing sustained growth.

- Dominant Segment by Type: Chain Hotels, with a xx% market share in 2024.

- Fastest-Growing Segment by Type: Service Apartments, driven by increased business travel and longer-stay demands.

- Dominant Segment by Price: Mid-scale hotels, capturing a xx% market share in 2024.

- Key Growth Drivers: Government initiatives to boost tourism, investment in infrastructure (airports, roads, etc.), and the expanding middle class.

Brazil Hospitality Industry Product Landscape

The Brazilian hospitality industry offers a wide range of products, from budget-friendly accommodations to luxurious resorts. Innovations focus on enhanced guest experiences, including personalized services, technology integration (e.g., mobile check-in, smart room features), and sustainable practices. Unique selling propositions often highlight local cultural experiences and commitment to environmental responsibility. Technological advancements like AI-powered chatbots and data analytics are being increasingly adopted for operational efficiency and improved customer service.

Key Drivers, Barriers & Challenges in Brazil Hospitality Industry

Key Drivers: Strong domestic tourism, increasing inbound international tourism, government support for the tourism sector, and infrastructure improvements.

Challenges: Economic instability, fluctuating currency exchange rates, high operational costs, and increasing competition from alternative accommodation providers. Supply chain disruptions can also negatively impact profitability, estimated to have caused a xx% decrease in revenue for some hotels in 2022.

Emerging Opportunities in Brazil Hospitality Industry

The increasing demand for experiential travel, sustainable tourism, and wellness-focused offerings present significant opportunities. Untapped markets in smaller cities and regions offer potential for expansion, while the adoption of innovative technologies like blockchain for secure transactions and AI for personalized service further shapes future growth.

Growth Accelerators in the Brazil Hospitality Industry

Strategic partnerships, technological advancements in revenue management and guest experience, and expansion into underserved markets are key catalysts for long-term growth. Investment in sustainable practices and commitment to responsible tourism will attract environmentally conscious travellers, further driving market expansion.

Key Players Shaping the Brazil Hospitality Industry Market

- Wyndham Hotel Group

- InterContinental Hotels Group (IHG)

- Bourbon Hotels & Resorts

- Louvre Hotels

- Radisson Hotel Group

- Marriott International Inc

- Nacional Inn Hoteis e Centros de Convencoes

- Intercity Hotels

- Accor SA

Notable Milestones in Brazil Hospitality Industry Sector

- August 2023: Choice Hotels acquired Radisson Hotels Americas for USD 675 million, significantly altering the market landscape.

- February 2024: Accor partnered with IDeaS for global revenue management software services, enhancing operational efficiency.

In-Depth Brazil Hospitality Industry Market Outlook

The Brazilian hospitality market is poised for sustained growth, driven by a strengthening economy, increased tourism, and the adoption of innovative technologies. Strategic investments in infrastructure, coupled with a focus on sustainable and experiential tourism, will create significant opportunities for both established players and new entrants. The market's resilience and adaptability to evolving consumer preferences position it for continued expansion throughout the forecast period.

Brazil Hospitality Industry Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

- 1.3. Service Apartments

-

2. Segment

- 2.1. Budget and Economy Hotels

- 2.2. Mid and Upper Mid-scale Hotels

- 2.3. Luxury Hotels

Brazil Hospitality Industry Segmentation By Geography

- 1. Brazil

Brazil Hospitality Industry Regional Market Share

Geographic Coverage of Brazil Hospitality Industry

Brazil Hospitality Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism; Consistent Demand for Business Travel and Corporate Hospitality Services

- 3.3. Market Restrains

- 3.3.1 Political Instability and Uncertainty; Limited Access to Transportation

- 3.3.2 Inadequate Roads

- 3.3.3 and Insufficient Connectivity

- 3.4. Market Trends

- 3.4.1. Rising Tourism is Fueling Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Hospitality Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.1.3. Service Apartments

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Budget and Economy Hotels

- 5.2.2. Mid and Upper Mid-scale Hotels

- 5.2.3. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wyndham Hotel Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 InterContinental Hotels Group (IHG)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bourbon Hotels & Resorts

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Louvre Hotels

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Radisson Hotel Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Marriott International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nacional Inn Hoteis e Centros de Convencoes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Intercity Hotels**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Accor SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Wyndham Hotel Group

List of Figures

- Figure 1: Brazil Hospitality Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Hospitality Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Hospitality Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Brazil Hospitality Industry Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Brazil Hospitality Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Brazil Hospitality Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Brazil Hospitality Industry Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Brazil Hospitality Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Hospitality Industry?

The projected CAGR is approximately 6.54%.

2. Which companies are prominent players in the Brazil Hospitality Industry?

Key companies in the market include Wyndham Hotel Group, InterContinental Hotels Group (IHG), Bourbon Hotels & Resorts, Louvre Hotels, Radisson Hotel Group, Marriott International Inc, Nacional Inn Hoteis e Centros de Convencoes, Intercity Hotels**List Not Exhaustive, Accor SA.

3. What are the main segments of the Brazil Hospitality Industry?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism; Consistent Demand for Business Travel and Corporate Hospitality Services.

6. What are the notable trends driving market growth?

Rising Tourism is Fueling Market Growth.

7. Are there any restraints impacting market growth?

Political Instability and Uncertainty; Limited Access to Transportation. Inadequate Roads. and Insufficient Connectivity.

8. Can you provide examples of recent developments in the market?

February 2024: Accor made an agreement with IDeaS, a leading provider of hospitality revenue optimization software and services. With this partnership, IDeaS will provide Accor with global revenue management software (RMS) services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Hospitality Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Hospitality Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Hospitality Industry?

To stay informed about further developments, trends, and reports in the Brazil Hospitality Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence