Key Insights

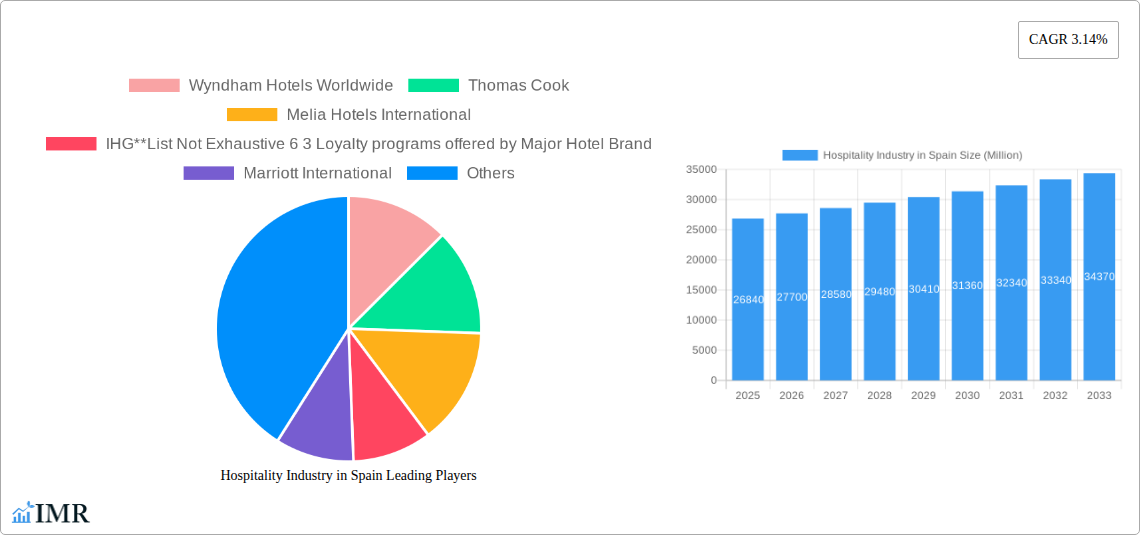

The Spanish hospitality industry, valued at €26.84 billion in 2025, is projected to experience steady growth, driven by a robust tourism sector and increasing domestic travel. The Compound Annual Growth Rate (CAGR) of 3.14% from 2025-2033 indicates a consistent expansion, albeit moderate, suggesting a mature yet dynamic market. Key segments contributing to this growth include budget and economy hotels catering to price-conscious travelers and the luxury hotel segment appealing to high-spending tourists. The rise of service apartments reflects a shift towards longer stays and blended leisure-business travel. Strong loyalty programs from major hotel brands like Marriott, Accor, and IHG are enhancing customer retention and driving repeat business, mitigating some of the challenges posed by economic fluctuations. While potential economic downturns could act as a restraint, the inherent resilience of the Spanish tourism sector and ongoing infrastructure improvements in key tourist destinations suggest continued positive growth over the forecast period. Independent hotels, while smaller in overall market share compared to chain hotels, retain a significant presence and provide unique offerings appealing to a discerning segment of travelers seeking authentic local experiences. This segment’s growth may be partially driven by the increasing popularity of boutique hotels and independently managed accommodations.

Hospitality Industry in Spain Market Size (In Billion)

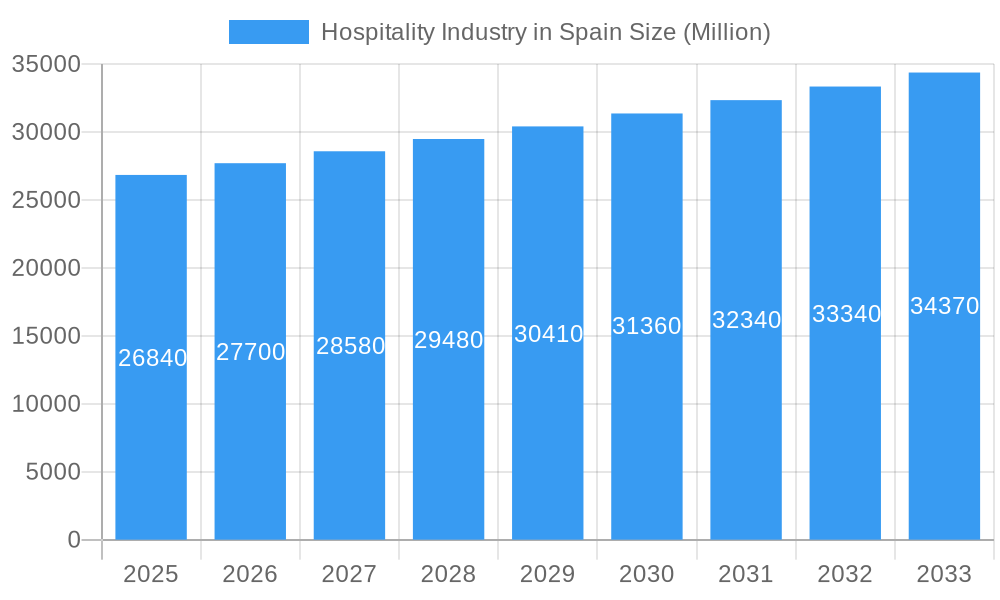

The competitive landscape is characterized by a mix of international hotel chains and local players. International chains benefit from established brand recognition and global marketing networks, while independent hotels leverage local expertise and unique character to attract guests. The continued investment in technological advancements, particularly in online booking platforms and personalized guest services, will further shape the industry's competitive dynamics. The strategic expansion of hotel brands into underserved regions within Spain, combined with ongoing renovations and upgrades in existing properties, will contribute to the overall expansion of the market. The growth in sustainable tourism practices and the increasing demand for eco-friendly accommodations present further opportunities for innovation and market differentiation within the Spanish hospitality sector. The long-term outlook remains positive, albeit subject to global economic factors and potential shifts in travel preferences.

Hospitality Industry in Spain Company Market Share

Spain's Hospitality Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of Spain's vibrant hospitality sector, encompassing market dynamics, growth trends, key players, and future prospects. With a focus on the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report is essential for industry professionals, investors, and strategic planners seeking to navigate this dynamic market. The report delves into parent markets (tourism and leisure) and child markets (budget hotels, luxury resorts, service apartments), offering granular insights for informed decision-making.

Hospitality Industry in Spain Market Dynamics & Structure

Spain's hospitality market is characterized by a complex interplay of factors influencing its growth and structure. Market concentration is moderate, with a mix of large international chains and independent hotels. Technological innovation, driven by digitalization and automation, is transforming guest experiences and operational efficiency, while regulatory frameworks (e.g., tourism taxes, sustainability regulations) play a significant role. Competitive substitutes include alternative accommodation options (e.g., Airbnb), impacting hotel occupancy. End-user demographics, with a growing segment of millennial and Gen Z travelers seeking unique experiences, further shape the market. M&A activity, as evidenced by recent deals, reflects consolidation and expansion strategies within the sector.

- Market Concentration: Moderate, with a mix of large chains (e.g., Meliá Hotels International) and independent hotels. xx% market share held by top 5 players in 2024.

- Technological Innovation: Strong influence of online booking platforms, revenue management systems, and AI-powered personalization tools.

- Regulatory Framework: Varying regional regulations impacting operational costs and sustainability initiatives.

- Competitive Substitutes: Airbnb and other alternative accommodations pose a competitive threat.

- End-User Demographics: Shifting demographics towards millennial and Gen Z travelers drive demand for unique and personalized experiences.

- M&A Trends: Increasing M&A activity points towards consolidation and expansion of major players. xx M&A deals recorded in the historical period (2019-2024).

Hospitality Industry in Spain Growth Trends & Insights

The Spanish hospitality market has experienced significant growth in recent years, fueled by a surge in international tourism and increased domestic travel. Market size (measured in revenue) expanded from €xx million in 2019 to €xx million in 2024, exhibiting a CAGR of xx%. This growth is projected to continue, albeit at a moderated pace, reaching €xx million by 2033 (CAGR of xx% from 2025 to 2033). Technology adoption rates are steadily increasing, with a focus on improving operational efficiency and enhancing the customer experience. Consumer behavior shifts towards personalized experiences and sustainability are influencing hotel offerings and marketing strategies. Technological disruptions, such as the rise of online travel agencies (OTAs) and the increasing use of mobile booking platforms, have reshaped the industry landscape.

Dominant Regions, Countries, or Segments in Hospitality Industry in Spain

The Spanish hospitality market shows regional variations in growth and dominance. Coastal areas (e.g., the Balearic Islands, Costa del Sol) and major cities (e.g., Madrid, Barcelona) dominate the market due to higher tourist footfall. The Luxury Hotel segment is experiencing rapid growth, driven by high spending tourists, while the Budget and Economy Hotel segment remains substantial due to price-sensitive travelers.

- Leading Regions: Catalonia, Balearic Islands, Andalusia.

- Leading Segments: Luxury Hotels (driven by high-spending tourists) and Budget & Economy Hotels (price sensitivity).

- Key Drivers: Strong tourism industry, favorable government policies, infrastructure development (e.g., improved airport connectivity).

- Market Share: Luxury hotels hold xx% of market share in 2024; Budget/Economy hotels hold xx%.

- Growth Potential: Strong growth potential for luxury and specialized niche segments (e.g., eco-tourism).

Hospitality Industry in Spain Product Landscape

The Spanish hospitality sector boasts a diverse product landscape encompassing chain hotels, independent hotels, service apartments, and various hotel types catering to diverse budgets and preferences. Innovation focuses on enhancing guest experiences through technological advancements like smart room technologies, personalized services, and sustainable practices. Unique selling propositions (USPs) involve offering local cultural experiences, personalized wellness programs, and eco-friendly amenities.

Key Drivers, Barriers & Challenges in Hospitality Industry in Spain

Key Drivers:

- Booming tourism industry, attracting both domestic and international travelers.

- Government initiatives promoting tourism and hospitality infrastructure.

- Technological advancements enhancing operational efficiency and customer experience.

Key Challenges & Restraints:

- Seasonality of tourism, impacting occupancy rates during off-peak seasons.

- Competition from alternative accommodation providers (e.g., Airbnb).

- Rising operational costs (e.g., labor, energy) impacting profitability. xx% increase in operating costs from 2019 to 2024.

Emerging Opportunities in Hospitality Industry in Spain

- Growth of niche tourism segments (e.g., wellness tourism, eco-tourism, adventure tourism).

- Increased demand for personalized and experiential travel.

- Opportunities for sustainable and responsible tourism practices.

Growth Accelerators in the Hospitality Industry in Spain Industry

Long-term growth in Spain's hospitality sector will be driven by strategic investments in infrastructure, technology, and sustainable practices. Strategic partnerships with OTAs and technology providers can enhance market reach and operational efficiency. Expansion into niche tourism segments and developing unique brand experiences will also be crucial for sustained growth.

Key Players Shaping the Hospitality Industry in Spain Market

- Wyndham Hotels Worldwide

- Thomas Cook

- Melia Hotels International

- IHG

- Marriott International

- Accor Hotels

- NH Hotel Group

- Barceló Hotels International

- Eurostars Hotel Company

- H10 Hotels

Notable Milestones in Hospitality Industry in Spain Sector

- December 2023: Meliá Hotels International expands its luxury brand globally, with one-third of its planned openings under luxury brands.

- November 2023: Hotelbeds partners with Barceló Hotels International, expanding Barceló's reach across Europe, the Mediterranean, and Africa.

- April 2023: Minor Hotels expands its millennial-focused Avani Hotels & Resorts brand into Europe.

In-Depth Hospitality Industry in Spain Market Outlook

The future of Spain's hospitality sector is bright, with significant growth potential driven by continued tourism expansion, technological advancements, and the development of sustainable tourism practices. Strategic investments in infrastructure, human capital, and innovative technologies will be key to maximizing market opportunities and ensuring long-term success. The focus on personalized, sustainable, and experiential travel will shape the future of the sector.

Hospitality Industry in Spain Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper Mid Scale Hotels

- 2.4. Luxury Hotels

Hospitality Industry in Spain Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry in Spain Regional Market Share

Geographic Coverage of Hospitality Industry in Spain

Hospitality Industry in Spain REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies and Regulations4.; Rise in the Number of Hotels/Restauarnts in the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Rules and Regulations for International Tourists4.; Lack of Trained and Skilled Professionals

- 3.4. Market Trends

- 3.4.1. An Increase in The Number of International Tourist Arrivals from the UK is Dominating the market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry in Spain Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper Mid Scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry in Spain Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper Mid Scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry in Spain Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper Mid Scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry in Spain Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper Mid Scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry in Spain Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper Mid Scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry in Spain Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper Mid Scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Wyndham Hotels Worldwide

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thomas Cook

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Melia Hotels International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IHG**List Not Exhaustive 6 3 Loyalty programs offered by Major Hotel Brand

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Marriott International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Accor Hotels

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NH Hotel Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Barcelo Hotels International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Eurostars Hotel Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 H10 Hotels

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Wyndham Hotels Worldwide

List of Figures

- Figure 1: Global Hospitality Industry in Spain Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry in Spain Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry in Spain Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry in Spain Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry in Spain Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry in Spain Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry in Spain Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry in Spain Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry in Spain Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry in Spain Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry in Spain Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry in Spain Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry in Spain Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry in Spain Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry in Spain Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry in Spain Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry in Spain Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry in Spain Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry in Spain Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry in Spain Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry in Spain Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry in Spain Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry in Spain Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry in Spain Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry in Spain Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry in Spain Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry in Spain Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry in Spain Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry in Spain Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry in Spain Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry in Spain Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry in Spain Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry in Spain Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry in Spain Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry in Spain Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry in Spain Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry in Spain Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry in Spain Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry in Spain Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry in Spain Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry in Spain Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry in Spain Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry in Spain Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry in Spain Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry in Spain Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry in Spain Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry in Spain?

The projected CAGR is approximately 3.14%.

2. Which companies are prominent players in the Hospitality Industry in Spain?

Key companies in the market include Wyndham Hotels Worldwide, Thomas Cook, Melia Hotels International, IHG**List Not Exhaustive 6 3 Loyalty programs offered by Major Hotel Brand, Marriott International, Accor Hotels, NH Hotel Group, Barcelo Hotels International, Eurostars Hotel Company, H10 Hotels.

3. What are the main segments of the Hospitality Industry in Spain?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.84 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies and Regulations4.; Rise in the Number of Hotels/Restauarnts in the Market.

6. What are the notable trends driving market growth?

An Increase in The Number of International Tourist Arrivals from the UK is Dominating the market..

7. Are there any restraints impacting market growth?

4.; Stringent Rules and Regulations for International Tourists4.; Lack of Trained and Skilled Professionals.

8. Can you provide examples of recent developments in the market?

In December 2023, Hotel group Meliá, Spain's largest hotel group and Europe's third largest hotel group expanded its luxury brands around the world with one in every three of its planned pipeline openings under its luxury brands. From Europe, Africa, and Central America to the world's most captivating destinations, Spain's leading hotel group brings its Spanish hospitality to all corners of the globe with each development delivering luxury experiences responsibly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry in Spain," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry in Spain report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry in Spain?

To stay informed about further developments, trends, and reports in the Hospitality Industry in Spain, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence