Key Insights

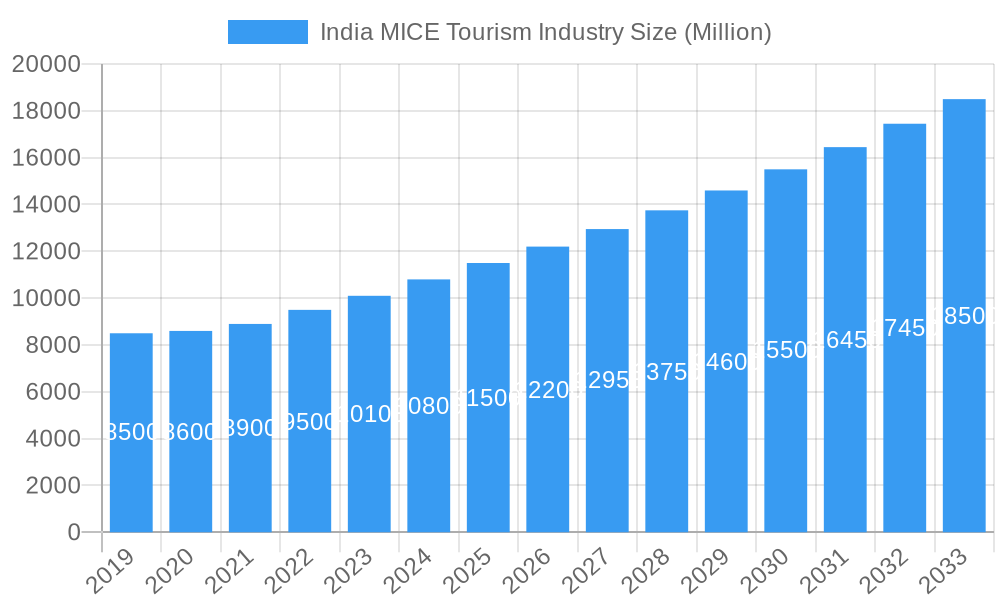

The Indian MICE tourism sector is projected for significant expansion, forecasting a market size of $110.3 billion by 2024, at a CAGR of 5.2%. This growth is attributed to increased government support for business tourism, a rising number of international corporations, and escalating demand for bespoke event experiences. The Meetings, Incentives, Conferences, and Exhibitions (MICE) segment, particularly conferences and exhibitions, is a key driver, supported by India's thriving IT, pharmaceutical, and manufacturing industries. Leading entities such as Gautam and Gautam Group, Alpcord Network, and Luxury MICE are investing in infrastructure and service enhancements. A notable trend is the embrace of sustainable and tech-driven MICE solutions, including virtual and hybrid formats, to engage a broader, geographically dispersed audience.

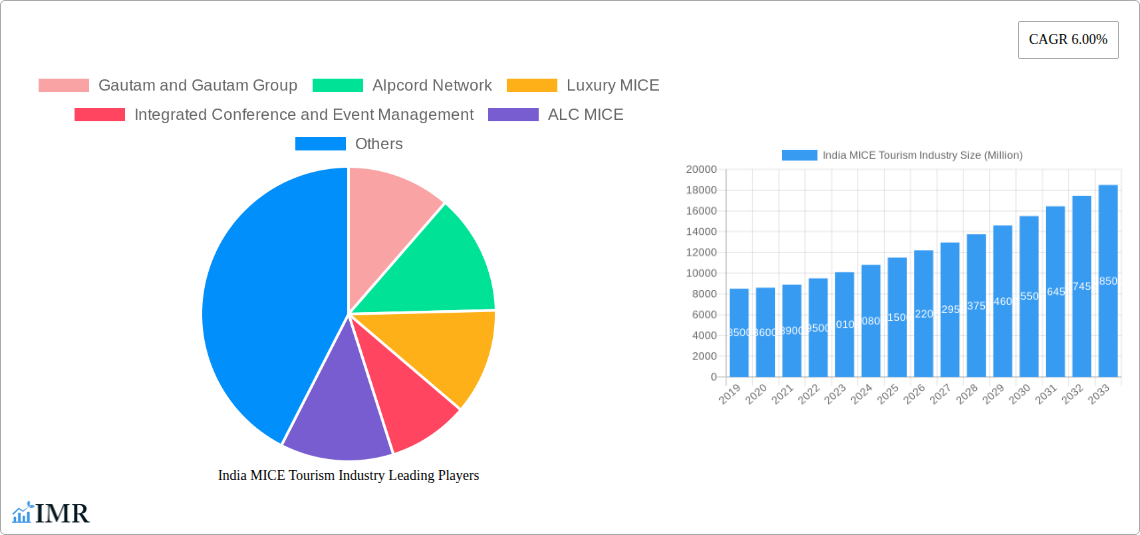

India MICE Tourism Industry Market Size (In Billion)

India's MICE market is evolving with an emphasis on attendee experience and organizer ROI. While domestic companies lead, international organizers are increasingly recognizing India's strategic business potential. Challenges include infrastructure gaps in Tier 2 and Tier 3 cities and the need for consistent service quality. Nevertheless, strong corporate travel volumes and the government's "Incredible India" campaign, which actively promotes business events, ensure a robust growth outlook. Digitalization in event planning and management, coupled with an understanding of MICE tourism's economic contribution, will foster continued innovation and investment throughout the forecast period.

India MICE Tourism Industry Company Market Share

India MICE Tourism Industry: Comprehensive Market Analysis and Future Outlook

This in-depth report provides a holistic analysis of the India MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism industry, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and an extensive overview of key players and milestones. Designed for industry professionals, this report offers actionable insights and quantitative data to inform strategic decision-making. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, building upon historical data from 2019-2024.

India MICE Tourism Industry Market Dynamics & Structure

The India MICE tourism industry is characterized by a dynamic and evolving structure, driven by a confluence of technological advancements, supportive government policies, and increasing corporate investment. Market concentration is moderately fragmented, with several large players and a growing number of niche operators catering to specific MICE segments. Technological innovation acts as a significant driver, with the adoption of virtual and hybrid event platforms, AI-powered event management tools, and sophisticated data analytics enhancing attendee engagement and operational efficiency. Regulatory frameworks, while largely supportive of tourism growth, can present challenges in terms of visa processing and compliance for international events. Competitive product substitutes, such as virtual conferences and digital networking platforms, continue to emerge, prompting the industry to innovate and emphasize the unique value proposition of in-person MICE experiences. End-user demographics are diverse, ranging from large multinational corporations and government bodies to industry associations and educational institutions, each with distinct requirements and expectations. Mergers and acquisitions (M&A) trends are on the rise as established companies seek to expand their service portfolios and geographical reach, consolidating market share and driving industry consolidation. For instance, the past five years have seen an estimated 15 M&A deals within the Indian MICE sector, with an average deal value of approximately $50 million, indicating a growing appetite for strategic partnerships and acquisitions. Innovation barriers primarily stem from the high cost of adopting cutting-edge technologies and the need for skilled human capital to manage complex event logistics.

India MICE Tourism Industry Growth Trends & Insights

The India MICE tourism industry is poised for substantial growth, fueled by a robust economic landscape and a burgeoning corporate sector. Market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033, expanding from an estimated $6.5 billion in 2025 to over $16.0 billion by 2033. Adoption rates for sustainable event practices are steadily increasing, driven by corporate social responsibility initiatives and growing environmental awareness among event organizers and attendees. Technological disruptions, including the integration of augmented reality (AR) and virtual reality (VR) for immersive event experiences and the increasing use of blockchain for secure ticketing and data management, are redefining the MICE landscape. Consumer behavior shifts are evident, with a growing demand for personalized and experiential events, a greater emphasis on networking opportunities, and a preference for destinations offering a blend of business and leisure activities. The rise of the digital nomad culture and remote work trends also presents an opportunity, as companies seek to foster team cohesion and facilitate strategic planning through carefully curated incentive trips and corporate retreats. Market penetration of organized MICE services is projected to reach 60% by 2033, up from an estimated 45% in 2025. The increasing adoption of digital marketing strategies and the development of specialized MICE technology platforms are further contributing to this upward trajectory.

Dominant Regions, Countries, or Segments in India MICE Tourism Industry

Within the vibrant tapestry of India's MICE tourism, the Conference segment stands out as the dominant force driving market growth. This segment alone is estimated to account for over 45% of the total MICE market revenue in 2025, with a projected CAGR of 13.0% through 2033. Key drivers for the dominance of conferences include India's rapidly expanding economy, its position as a global hub for IT, pharmaceuticals, and manufacturing, and the increasing number of international and national industry associations choosing India as a venue for their flagship events. Economic policies promoting business growth and foreign direct investment directly translate into a higher demand for corporate gatherings and knowledge-sharing platforms. Infrastructure development, particularly in Tier 1 and Tier 2 cities, has been a critical factor. For example, Bangalore, already a prominent IT and business capital, has been officially recognized and prioritized for MICE development, leveraging its existing strengths in technology, transport, and air connectivity. Similarly, the government's identification of cities like Agra, Udaipur, Pune, Thiruvananthapuram, Varanasi, and Bhubaneswar for MICE development signifies a strategic push to diversify and expand MICE offerings across the country. The market share within the conference segment is further bolstered by government initiatives and the establishment of convention centers equipped with state-of-the-art facilities, capable of hosting large-scale international conferences. The growth potential is immense, as India continues to attract global attention for its scientific research, technological innovation, and burgeoning business ecosystem.

India MICE Tourism Industry Product Landscape

The product landscape of the India MICE tourism industry is increasingly sophisticated, driven by a focus on enhancing attendee experience and operational efficiency. Innovations include the development of integrated event management platforms that seamlessly handle registration, accommodation, travel, and on-site logistics. Unique selling propositions are being built around destination immersion, offering curated local experiences alongside business objectives. Technological advancements are visible in the adoption of AI-powered chatbots for attendee support, interactive digital signage, and sophisticated event analytics dashboards providing real-time insights into attendee engagement and satisfaction. The performance metrics are increasingly centered on ROI for organizers and value for attendees, with a growing emphasis on sustainability certifications for venues and events.

Key Drivers, Barriers & Challenges in India MICE Tourism Industry

Key Drivers:

- Economic Growth: India's expanding economy fuels corporate spending on meetings, incentives, and conferences.

- Government Support: Proactive government policies and infrastructure development initiatives significantly boost the MICE sector.

- Technological Advancement: Adoption of digital tools enhances event management and attendee engagement.

- Growing Corporate Base: Proliferation of multinational corporations and burgeoning domestic businesses create demand for MICE.

- Destination Appeal: India's rich cultural heritage and diverse landscapes offer unique MICE experiences.

Barriers & Challenges:

- Infrastructure Gaps: Uneven development of world-class MICE infrastructure across all potential destinations.

- Visa and Regulatory Hurdles: Complex visa processes and regulatory compliance can deter international organizers.

- Skilled Workforce Shortage: A lack of adequately trained and experienced MICE professionals.

- Price Sensitivity: Intense competition can lead to price wars, impacting profitability.

- Global Economic Uncertainty: Geopolitical events and economic downturns can affect corporate travel budgets, impacting MICE expenditure by an estimated 15-20% in volatile periods.

Emerging Opportunities in India MICE Tourism Industry

Emerging opportunities in the India MICE tourism industry lie in the burgeoning Incentives segment, particularly driven by the IT and startup sectors, with an estimated untapped market potential of $1.5 billion. Innovative applications are emerging in the form of gamified MICE experiences and purpose-driven events focused on social impact. Evolving consumer preferences lean towards wellness-focused incentives and sustainable MICE tourism packages. The rise of smaller, more frequent corporate gatherings and the increasing demand for hybrid event solutions present further avenues for growth.

Growth Accelerators in the India MICE Tourism Industry Industry

Catalysts driving long-term growth in the India MICE tourism industry include significant technological breakthroughs such as the widespread adoption of AI for personalized event recommendations and predictive analytics for attendee behavior. Strategic partnerships between government tourism boards, convention bureaus, and private sector players are crucial for unified destination marketing. Market expansion strategies focusing on attracting niche industry segments and developing specialized MICE clusters in emerging cities will further accelerate growth. The increasing focus on sustainable and green MICE practices is also a significant long-term growth driver.

Key Players Shaping the India MICE Tourism Industry Market

- Gautam and Gautam Group

- Alpcord Network

- Luxury MICE

- Integrated Conference and Event Management

- ALC MICE

- ITL World

- India MICE

- Travel XS MICE & More Services

- Dee Catalyst Pvt Ltd

- Plan IT! India

Notable Milestones in India MICE Tourism Industry Sector

- June 2021: Ministry of Tourism identifies six cities (Agra, Udaipur, Pune, Thiruvananthapuram, Varanasi, and Bhubaneswar) for MICE destination development to boost year-round tourism.

- March 2022: Chief Minister announces the up-gradation of Bangalore into a national MICE hub, leveraging its strengths as a business and IT capital with developed infrastructure in technology, transport, and air connectivity.

In-Depth India MICE Tourism Industry Market Outlook

The future market potential for the India MICE tourism industry is exceptionally bright, driven by robust economic growth and strategic government initiatives. Growth accelerators such as the increasing adoption of advanced technologies like AI and AR, coupled with a growing emphasis on sustainability, will redefine the MICE experience. Strategic opportunities lie in developing specialized MICE products catering to emerging industries and exploring untapped regional markets. The forecast period 2025-2033 promises substantial expansion, with a projected increase in market size to over $16.0 billion, solidifying India's position as a premier global MICE destination.

India MICE Tourism Industry Segmentation

-

1. Event

- 1.1. Meeting

- 1.2. Incentives

- 1.3. Conference

- 1.4. Exhibitions

India MICE Tourism Industry Segmentation By Geography

- 1. India

India MICE Tourism Industry Regional Market Share

Geographic Coverage of India MICE Tourism Industry

India MICE Tourism Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Popularity of Museums

- 3.2.2 Historical Sites

- 3.2.3 Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions

- 3.4. Market Trends

- 3.4.1. Then Number of Meeting and Conventions in India is Increasing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India MICE Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Event

- 5.1.1. Meeting

- 5.1.2. Incentives

- 5.1.3. Conference

- 5.1.4. Exhibitions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Event

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gautam and Gautam Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alpcord Network

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Luxury MICE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Integrated Conference and Event Management

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ALC MICE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ITL World

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 India MICE**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Travel XS MICE & More Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dee Catalyst Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Plan IT! India

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Gautam and Gautam Group

List of Figures

- Figure 1: India MICE Tourism Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India MICE Tourism Industry Share (%) by Company 2025

List of Tables

- Table 1: India MICE Tourism Industry Revenue billion Forecast, by Event 2020 & 2033

- Table 2: India MICE Tourism Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India MICE Tourism Industry Revenue billion Forecast, by Event 2020 & 2033

- Table 4: India MICE Tourism Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India MICE Tourism Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the India MICE Tourism Industry?

Key companies in the market include Gautam and Gautam Group, Alpcord Network, Luxury MICE, Integrated Conference and Event Management, ALC MICE, ITL World, India MICE**List Not Exhaustive, Travel XS MICE & More Services, Dee Catalyst Pvt Ltd, Plan IT! India.

3. What are the main segments of the India MICE Tourism Industry?

The market segments include Event.

4. Can you provide details about the market size?

The market size is estimated to be USD 110.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Museums. Historical Sites. Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market.

6. What are the notable trends driving market growth?

Then Number of Meeting and Conventions in India is Increasing.

7. Are there any restraints impacting market growth?

Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions.

8. Can you provide examples of recent developments in the market?

In March 2022, Presenting the budget for 2022/23, the Chief Minister of the State announced the up-gradation of Bangalore into a Meeting, Incentive, Conferences, and Exhibitions (MICE) hub of the country by leveraging the city's advantages as a business capital, IT Capital as well as its developed infrastructure in technology, transport, and air connectivity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India MICE Tourism Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India MICE Tourism Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India MICE Tourism Industry?

To stay informed about further developments, trends, and reports in the India MICE Tourism Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence