Key Insights

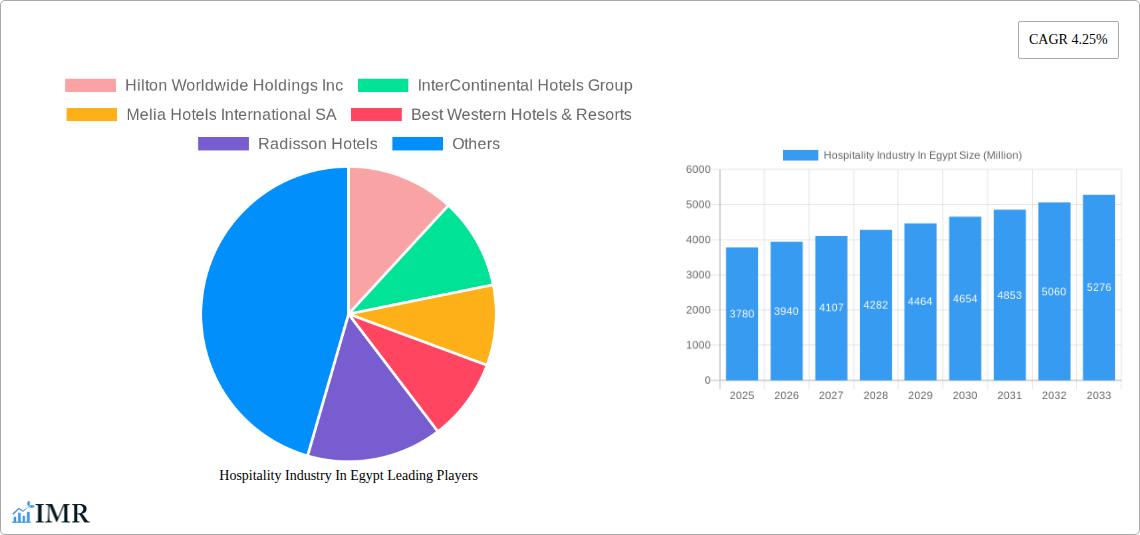

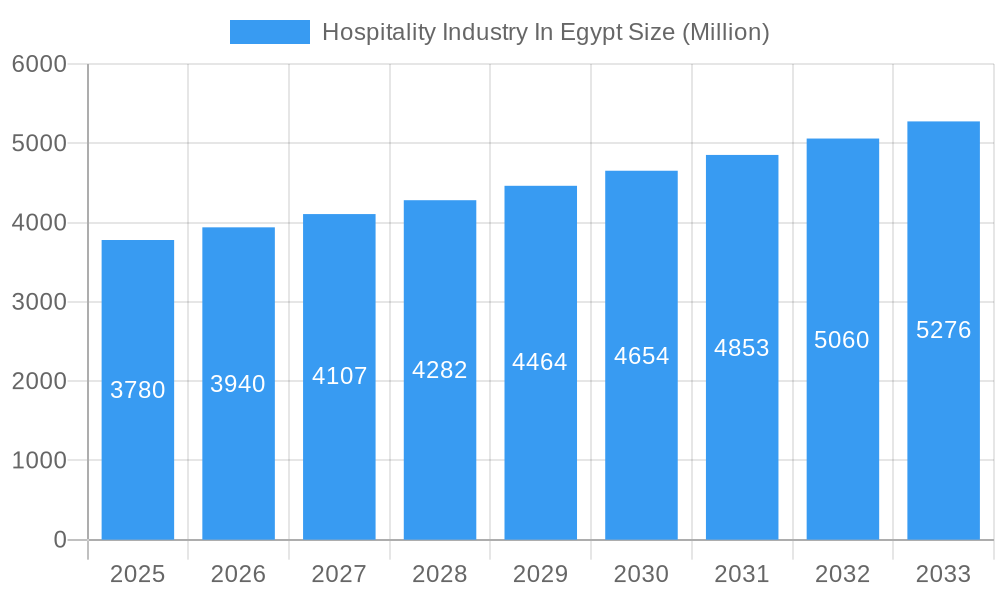

The Egyptian hospitality industry, valued at $3.78 billion in 2025, is projected to experience robust growth, driven by increasing tourism, rising disposable incomes among Egyptians, and significant investments in infrastructure development. The sector encompasses a diverse range of accommodations, from budget-friendly options to luxury hotels, catering to a broad spectrum of travelers. The 4.25% CAGR (Compound Annual Growth Rate) indicates a steady expansion over the forecast period (2025-2033). Key growth drivers include the government's focus on promoting tourism, improvements in airport infrastructure and connectivity, and the development of new attractions and entertainment venues. The industry is segmented by hotel type (service apartments, budget/economy, mid-scale, luxury) and ownership (chain vs. independent hotels), with international chains like Hilton, Marriott, and Accor playing a significant role. While challenges such as political stability and economic fluctuations exist, the overall outlook remains positive, fueled by Egypt's strategic location and rich cultural heritage, attracting both domestic and international tourists. Further growth is anticipated through the development of sustainable tourism initiatives and the adoption of advanced technologies in hospitality management.

Hospitality Industry In Egypt Market Size (In Billion)

The segment with the largest market share is likely the mid-scale hotel segment, given the balance between affordability and amenities. The chain hotels segment is expected to witness faster growth compared to independent hotels due to brand recognition, established distribution networks, and loyalty programs. While precise market share figures for each segment are unavailable, it's reasonable to expect that the luxury hotel segment, although smaller, will contribute significantly to the overall revenue due to high average daily rates. Future growth will be influenced by factors such as government policies supporting the tourism sector, investor confidence, and global economic conditions. The continued expansion of the tourism industry and strategic investments in improving the hospitality infrastructure are crucial for maintaining the projected growth trajectory.

Hospitality Industry In Egypt Company Market Share

Egypt Hospitality Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Egyptian hospitality market, covering the period 2019-2033. With a focus on market dynamics, growth trends, and key players, this report is an essential resource for investors, industry professionals, and anyone seeking to understand this dynamic sector. The report leverages extensive data analysis and incorporates recent industry developments to provide a clear and actionable outlook. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033.

Hospitality Industry In Egypt Market Dynamics & Structure

The Egyptian hospitality market, valued at xx Million in 2024, exhibits a complex interplay of factors shaping its structure and growth. Market concentration is moderate, with international chains like Hilton Worldwide Holdings Inc, InterContinental Hotels Group, Melia Hotels International SA, Best Western Hotels & Resorts, Radisson Hotels, Rotana Hotels, Mangalis Hotel Group, Hyatt International, Marriott International Inc, and Accor SA competing alongside numerous independent hotels.

- Market Concentration: International chains hold approximately 40% market share, while independent hotels comprise the remaining 60%.

- Technological Innovation: Adoption of online booking platforms and revenue management systems is accelerating, though high initial investment costs present a barrier for smaller players.

- Regulatory Framework: Government regulations related to tourism and hospitality impact investment and operational efficiency. Recent policy changes aimed at attracting more foreign investments may influence the market structure.

- Competitive Substitutes: The rise of Airbnb and other alternative accommodations presents a growing competitive threat, particularly in the budget and mid-scale segments.

- End-User Demographics: The market is driven by both domestic and international tourists, with a growing middle class fueling demand for mid-scale and luxury hotels.

- M&A Trends: The past five years have witnessed xx M&A deals in the Egyptian hospitality sector, primarily involving smaller hotel acquisitions by larger chains.

Hospitality Industry In Egypt Growth Trends & Insights

The Egyptian hospitality market is projected to experience significant growth throughout the forecast period (2025-2033). Driven by factors such as increasing tourism arrivals, rising disposable incomes, and government initiatives aimed at promoting tourism, the market is anticipated to witness a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated value of xx Million by 2033. Market penetration rates for online booking platforms are expected to increase from the current xx% to xx% by 2033. Technological disruptions, including the adoption of AI-powered hotel management systems and personalized guest experiences, are reshaping consumer expectations. Shifting consumer preferences towards sustainable and experiential travel are influencing hotel offerings.

Dominant Regions, Countries, or Segments in Hospitality Industry In Egypt

The Red Sea region, particularly Hurghada and Sharm El Sheikh, dominates the Egyptian hospitality market, commanding approximately xx% market share due to its established tourism infrastructure and popularity among international visitors. Cairo, while not as geographically dominant, maintains a significant share due to business travel and conference tourism.

By Segment:

- Luxury Hotels: This segment shows the highest growth potential (xx% CAGR), driven by increasing high-net-worth individuals.

- Mid and Upper Midscale Hotels: This segment exhibits strong growth driven by the expanding middle class, which constitutes the largest customer base.

- Budget and Economy Hotels: This segment experiences steady growth driven by the large influx of budget-conscious tourists.

- Service Apartments: This segment exhibits moderate growth, driven by the needs of business travelers and longer-stay visitors.

By Type:

- Chain Hotels: Chain hotels maintain a larger market share due to brand recognition and economies of scale.

- Independent Hotels: Independent hotels cater to niche segments offering unique experiences, but face greater challenges in competing with established brands.

Hospitality Industry In Egypt Product Landscape

The Egyptian hospitality sector displays a diverse range of products, from basic budget accommodations to luxury resorts offering extensive amenities. Innovation focuses on enhancing guest experience through technological integrations such as mobile check-in, personalized services, and smart room technologies. Unique selling propositions include themed hotels, eco-friendly initiatives, and culturally immersive experiences.

Key Drivers, Barriers & Challenges in Hospitality Industry In Egypt

Key Drivers:

- Increased tourism arrivals following improved political stability.

- Government initiatives promoting tourism and infrastructure development.

- Expanding domestic middle class with increased disposable income.

Challenges:

- Seasonal fluctuations in tourist arrivals impacting revenue stability.

- Currency fluctuations and economic instability influencing investment decisions.

- Intense competition from both international and domestic hospitality providers. This leads to pressure on pricing and profit margins.

Emerging Opportunities in Hospitality Industry In Egypt

- Growth of medical tourism: Expanding this niche segment could attract a new influx of travelers.

- Development of eco-tourism and sustainable practices: Increased demand for eco-friendly accommodations.

- Technological advancements: Implement AI and data analytics for personalized customer experiences.

Growth Accelerators in the Hospitality Industry In Egypt Industry

Strategic partnerships between international hotel chains and local developers are accelerating market expansion. Technological innovations focused on improving efficiency and guest experience are key drivers. Government initiatives aimed at boosting infrastructure and promoting sustainable tourism practices will further contribute to growth.

Key Players Shaping the Hospitality Industry In Egypt Market

Notable Milestones in Hospitality Industry In Egypt Sector

- June 2023: Accor partners with Alltheway for luggage handling solutions.

- June 2023: Radisson Hotel Group signs for Radisson Collection Resort, Marsa Alam.

- December 2023: Palm Hill Development Company partners with Marriott for a new Cairo hotel.

In-Depth Hospitality Industry In Egypt Market Outlook

The Egyptian hospitality market is poised for sustained growth, driven by robust tourism projections, infrastructure development, and a flourishing domestic market. Strategic investments in technology and sustainable practices will be crucial for maintaining competitiveness. The market offers significant opportunities for both established players and new entrants, particularly in emerging segments like medical tourism and eco-tourism.

Hospitality Industry In Egypt Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper Midscale Hotels

- 2.4. Luxury Hotels

Hospitality Industry In Egypt Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry In Egypt Regional Market Share

Geographic Coverage of Hospitality Industry In Egypt

Hospitality Industry In Egypt REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in Business Travel as a Result of Robust Economic Expansion; Rise in the Online Travel Agencies Leads to Growth of the Industry

- 3.3. Market Restrains

- 3.3.1. Government Regulatory Compliance for International Tourists

- 3.4. Market Trends

- 3.4.1. Rise in the Number of Hotel Construction Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry In Egypt Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper Midscale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry In Egypt Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper Midscale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry In Egypt Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper Midscale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry In Egypt Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper Midscale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry In Egypt Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper Midscale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry In Egypt Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper Midscale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hilton Worldwide Holdings Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 InterContinental Hotels Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Melia Hotels International SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Best Western Hotels & Resorts

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Radisson Hotels

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rotana Hotels

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mangalis Hotel Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hyatt International**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Marriott International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accor SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hilton Worldwide Holdings Inc

List of Figures

- Figure 1: Global Hospitality Industry In Egypt Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry In Egypt Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry In Egypt Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry In Egypt Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry In Egypt Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry In Egypt Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry In Egypt Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry In Egypt Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry In Egypt Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry In Egypt Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry In Egypt Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry In Egypt Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry In Egypt Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry In Egypt Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry In Egypt Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry In Egypt Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry In Egypt Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry In Egypt Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry In Egypt Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry In Egypt Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry In Egypt Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry In Egypt Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry In Egypt Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry In Egypt Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry In Egypt Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry In Egypt Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry In Egypt Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry In Egypt Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry In Egypt Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry In Egypt Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry In Egypt Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry In Egypt Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry In Egypt Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry In Egypt Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry In Egypt Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry In Egypt Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry In Egypt Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry In Egypt Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry In Egypt Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry In Egypt Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry In Egypt Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry In Egypt Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry In Egypt Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry In Egypt Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry In Egypt Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry In Egypt Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry In Egypt Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry In Egypt Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry In Egypt Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry In Egypt Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry In Egypt?

The projected CAGR is approximately 4.25%.

2. Which companies are prominent players in the Hospitality Industry In Egypt?

Key companies in the market include Hilton Worldwide Holdings Inc, InterContinental Hotels Group, Melia Hotels International SA, Best Western Hotels & Resorts, Radisson Hotels, Rotana Hotels, Mangalis Hotel Group, Hyatt International**List Not Exhaustive, Marriott International Inc, Accor SA.

3. What are the main segments of the Hospitality Industry In Egypt?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.78 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise in Business Travel as a Result of Robust Economic Expansion; Rise in the Online Travel Agencies Leads to Growth of the Industry.

6. What are the notable trends driving market growth?

Rise in the Number of Hotel Construction Projects.

7. Are there any restraints impacting market growth?

Government Regulatory Compliance for International Tourists.

8. Can you provide examples of recent developments in the market?

December 2023: Egypt's leading real estate company, Palm Hill Development Company, partnered with the US Marriott International hotel chain to construct a new hotel in Cairo.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry In Egypt," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry In Egypt report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry In Egypt?

To stay informed about further developments, trends, and reports in the Hospitality Industry In Egypt, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence