Key Insights

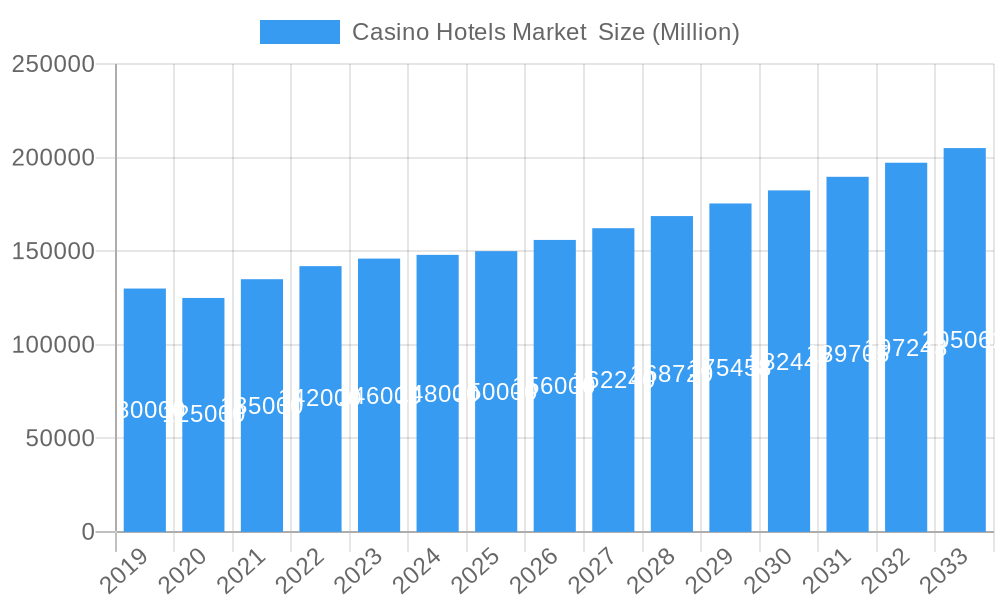

The global Casino Hotels Market is projected for substantial expansion, estimated at $83.4 billion in the base year 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.9%. This growth is propelled by increasing global disposable incomes, a rising demand for premium entertainment, and the development of integrated resorts offering diverse amenities. Growing tourism, especially in emerging economies, also presents significant opportunities. Large Integrated Casino Resorts are the dominant segment, though smaller casinos and cruise ship establishments cater to niche markets.

Casino Hotels Market Market Size (In Billion)

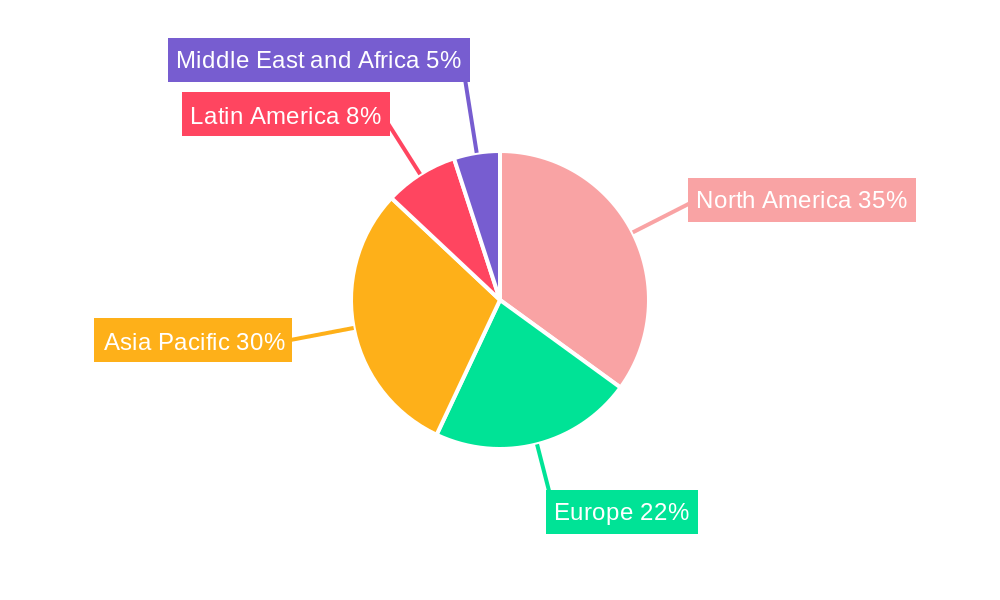

Key trends influencing the Casino Hotels Market include a focus on unique experiential offerings, encompassing entertainment, fine dining, and immersive gaming. Technological advancements, such as mobile gaming, data-driven personalization, and enhanced security, are also crucial. Market restraints include strict regulatory frameworks, licensing complexities, and the potential impact of geopolitical instability and economic downturns on leisure spending. North America and Asia Pacific are anticipated to lead market growth due to established gaming infrastructure and developing economies, respectively. Major players like Las Vegas Sands Corporation, Caesars Entertainment Corporation, and MGM Resorts International are actively pursuing strategic growth and innovation.

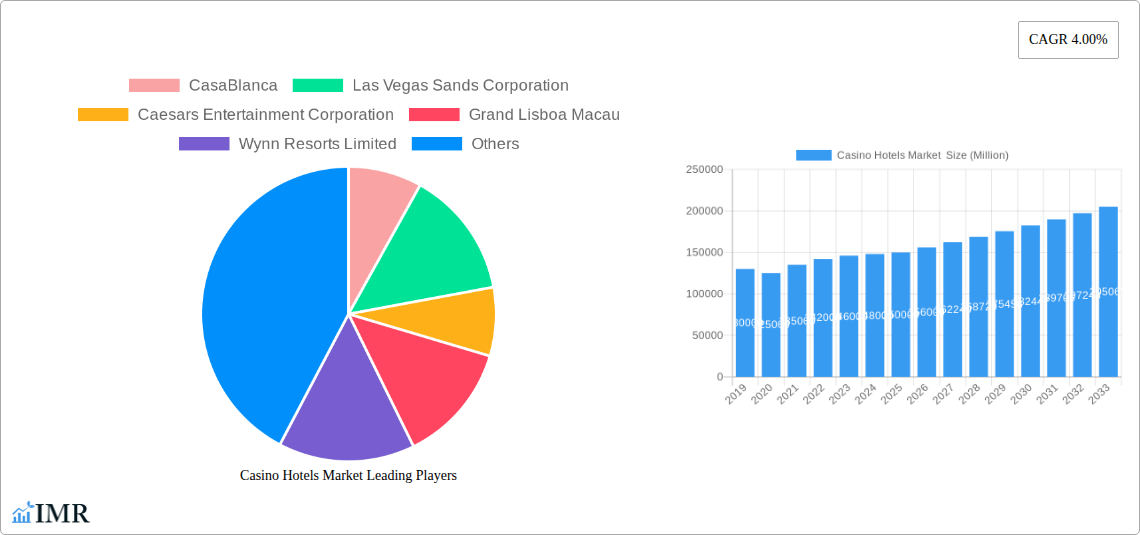

Casino Hotels Market Company Market Share

This report provides a comprehensive analysis of the Casino Hotels Market, including size, growth, and forecasts, designed for industry professionals and optimized for search engine visibility.

Casino Hotels Market: Comprehensive Analysis & Future Outlook (2019–2033)

Uncover the dynamic forces and lucrative opportunities shaping the global Casino Hotels Market. This in-depth report provides a definitive analysis of the industry's evolution, from historical performance to future projections, offering actionable insights for stakeholders. Explore market trends, competitive landscapes, and emerging opportunities within parent and child market segments.

Casino Hotels Market Market Dynamics & Structure

The casino hotels market is characterized by a moderate to high degree of concentration, with a few key players dominating the global landscape. Technological innovation remains a significant driver, focusing on enhancing guest experiences through advanced gaming technology, seamless digital integration, and personalized services. Regulatory frameworks, particularly concerning gaming licenses, taxation, and responsible gambling initiatives, play a crucial role in shaping market entry and operational strategies. Competitive product substitutes, such as online gambling platforms and alternative entertainment venues, pose a continuous challenge, necessitating continuous innovation and differentiation by casino hotel operators. End-user demographics are shifting, with an increasing demand for integrated entertainment experiences beyond traditional gaming, including luxury accommodations, fine dining, and world-class entertainment. Mergers and acquisitions (M&A) continue to be a prominent strategy for market consolidation and expansion, allowing companies to gain market share and diversify their portfolios.

- Market Concentration: Dominated by major integrated resort operators, with a significant presence of established brands.

- Technological Innovation: Driven by AI in personalized services, VR gaming experiences, and contactless technologies.

- Regulatory Landscape: Influenced by evolving gambling laws, anti-money laundering regulations, and licensing requirements in key jurisdictions.

- Competitive Landscape: Intense competition from online gaming, amusement parks, and other leisure destinations.

- End-User Preferences: Growing demand for holistic entertainment, wellness facilities, and unique event spaces.

- M&A Activity: Ongoing consolidation and strategic partnerships to enhance competitive positioning and operational efficiency.

Casino Hotels Market Growth Trends & Insights

The global casino hotels market is poised for substantial growth, driven by a confluence of evolving consumer preferences, technological advancements, and strategic expansion by key industry players. The market size is projected to witness a significant expansion, fueled by increasing disposable incomes in emerging economies and a resurgent demand for experiential travel and entertainment post-pandemic. Adoption rates for integrated resort models are accelerating, as consumers seek a one-stop destination for gaming, accommodation, dining, and entertainment. Technological disruptions are playing a pivotal role, with the integration of artificial intelligence for personalized guest experiences, the adoption of contactless payment solutions, and the exploration of virtual reality in gaming and entertainment offerings. Consumer behavior shifts are evident in the growing emphasis on wellness, sustainability, and authentic local experiences, compelling casino hotels to diversify their amenities and services beyond traditional gaming. The CAGR for the forecast period is estimated to be robust, reflecting the market's resilience and potential for sustained growth. Market penetration is expected to deepen as new integrated resorts are developed and existing ones are refurbished to cater to evolving guest expectations.

- Market Size Evolution: Expected to reach substantial valuations by 2033, driven by global tourism recovery and increased consumer spending on leisure.

- Adoption Rates: High adoption of integrated resort concepts, blending gaming with diverse hospitality and entertainment options.

- Technological Disruptions: AI for personalization, IoT for operational efficiency, and advanced analytics for customer insights are transforming operations.

- Consumer Behavior Shifts: Increased demand for unique experiences, sustainable practices, and integration with local culture.

- CAGR Projections: Healthy compound annual growth rate anticipated, indicating a strong upward trajectory for the market.

- Market Penetration: Expanding reach into new geographies and catering to diverse demographic segments, including millennials and Gen Z.

Dominant Regions, Countries, or Segments in Casino Hotels Market

Large integrated casino resorts, as a segment within the casino hotels market, are currently the primary growth engine, driven by their comprehensive offerings and appeal to a wide spectrum of consumers. These colossal establishments, often featuring multiple hotels, world-class entertainment venues, extensive dining options, and vast gaming floors, cater to both leisure and business applications, making them a dominant force. Regions with established tourism infrastructure and favorable regulatory environments, such as North America (particularly Las Vegas and Atlantic City) and Asia-Pacific (especially Macau and Singapore), are leading the market. Economic policies that promote tourism and investment, coupled with significant infrastructure development, including international airports and transportation networks, are key drivers of their dominance. The application of Leisure remains the most significant, attracting a broad range of tourists seeking entertainment and gaming. However, the Business application is also witnessing considerable growth, with integrated resorts increasingly hosting large-scale conferences, conventions, and corporate events, leveraging their extensive meeting facilities and luxury accommodations. The market share of large integrated casino resorts is substantial, reflecting their ability to generate significant revenue through diverse income streams. Their growth potential is further amplified by ongoing investments in innovative attractions and personalized guest services, ensuring continued appeal.

- Dominant Segment: Large integrated casino resorts are the primary revenue generators and growth drivers.

- Key Regions: North America (USA) and Asia-Pacific (Macau, Singapore) lead in market share and development.

- Driving Factors (Regions): Favorable economic policies, robust tourism infrastructure, and significant foreign investment.

- Primary Application: Leisure travel continues to be the largest application, attracting a global clientele.

- Growing Application: Business travel and corporate events are increasingly significant revenue streams for integrated resorts.

- Market Share Analysis: Large integrated casino resorts hold a dominant market share due to their comprehensive offerings and scale of operations.

- Growth Potential: Significant untapped potential exists in emerging markets and through diversification of entertainment and hospitality services.

Casino Hotels Market Product Landscape

The product landscape within the casino hotels market is evolving rapidly, driven by a relentless pursuit of enhanced guest experiences and operational efficiency. Innovations range from advanced slot machine technology featuring interactive elements and progressive jackpots to sophisticated table game management systems that optimize dealer performance and game integrity. Hotels within these resorts are increasingly focusing on luxury amenities, smart room technology, and personalized service offerings to attract and retain discerning travelers. Entertainment venues are showcasing world-class productions and hosting major sporting events, further solidifying their appeal. The integration of mobile applications for everything from room bookings and dining reservations to in-game betting and loyalty program management is becoming standard. Performance metrics are closely watched, with a focus on average daily rates (ADR), revenue per available room (RevPAR), gaming win percentages, and customer satisfaction scores. Unique selling propositions often revolve around iconic themes, celebrity chef restaurants, expansive spa facilities, and exclusive gaming areas.

Key Drivers, Barriers & Challenges in Casino Hotels Market

The casino hotels market is propelled by several key drivers, including the growing global tourism industry, increasing disposable incomes, and the rising popularity of integrated resorts offering a holistic entertainment experience. Technological advancements in gaming and hospitality, alongside strategic M&A activities, also fuel market expansion.

- Key Drivers:

- Global Tourism Growth: Increased international and domestic travel fuels demand for casino hotel stays.

- Disposable Income: Rising personal incomes allow for greater spending on leisure and entertainment.

- Experiential Demand: Consumers seek unique and multi-faceted entertainment experiences.

- Technological Advancements: Innovations in gaming, AI, and digital services enhance guest engagement.

- M&A and Partnerships: Strategic consolidations and collaborations drive market growth and efficiency.

However, the market faces significant barriers and challenges. Stringent and evolving regulatory frameworks across different jurisdictions can impede development and increase operational costs. Economic downturns and geopolitical instability can negatively impact tourism and consumer spending. Intense competition from online gambling platforms and other leisure alternatives necessitates continuous innovation and competitive pricing. Furthermore, supply chain disruptions and the rising cost of labor can impact profitability.

- Key Barriers & Challenges:

- Regulatory Hurdles: Complex licensing, taxation, and compliance requirements.

- Economic Volatility: Susceptibility to recessions, inflation, and currency fluctuations.

- Intense Competition: Pressure from online gaming, alternative entertainment, and other casino resorts.

- Supply Chain Disruptions: Affecting procurement of goods and services for hotel and casino operations.

- Labor Shortages & Costs: Increasing wages and difficulty in finding skilled staff.

- Sustainability Concerns: Growing pressure to adopt environmentally friendly practices.

Emerging Opportunities in Casino Hotels Market

Emerging opportunities in the casino hotels market lie in catering to the growing demand for niche gaming experiences and personalized entertainment. The expansion into emerging markets with developing tourism sectors presents significant untapped potential. Furthermore, the integration of wellness and health-focused amenities, alongside sustainable practices, is becoming increasingly important for attracting a broader demographic and aligning with evolving consumer values. The development of sophisticated loyalty programs that offer exclusive experiences and rewards beyond traditional gaming is crucial for customer retention.

- Untapped Markets: Expansion into regions with growing economies and nascent tourism industries.

- Innovative Applications: Development of unique entertainment concepts, esports arenas, and themed attractions.

- Evolving Consumer Preferences: Focus on wellness, sustainability, and authentic cultural immersion.

- Digital Integration: Leveraging AI and data analytics for hyper-personalized guest journeys and marketing campaigns.

- Hybrid Offerings: Blending physical casino experiences with advanced online gaming and virtual reality.

Growth Accelerators in the Casino Hotels Market Industry

The casino hotels market industry is witnessing several growth accelerators that are poised to drive long-term expansion. Technological breakthroughs, particularly in artificial intelligence and data analytics, are enabling more personalized guest experiences and optimized operational efficiency. Strategic partnerships between casino operators, hotel brands, and entertainment providers are creating synergistic opportunities, enhancing the overall value proposition for consumers. Market expansion strategies, including the development of new integrated resorts in high-growth regions and the refurbishment of existing properties to incorporate modern amenities and attractions, are also critical accelerators. The increasing focus on creating unique, destination-worthy experiences beyond just gaming is attracting a wider audience.

Key Players Shaping the Casino Hotels Market Market

- CasaBlanca

- Las Vegas Sands Corporation

- Caesars Entertainment Corporation

- Grand Lisboa Macau

- Wynn Resorts Limited

- Venetian Resort Hotel Casino

- Galaxy Entertainment Group

- Marina Hotel

- MGM Resorts International

- Bellagio

Notable Milestones in Casino Hotels Market Sector

- February 2023: Caesars Entertainment ("Caesars") and SL Green Realty Corp ("SL Green") announced a new Caesars Rewards partnership for local merchants in greater New York City as a part of their pursuit of a gaming license in Times Square. When Caesars Palace Times Square opens in Manhattan, Caesars Rewards members will be able to use their Reward Credits by converting them to gift cards, valid across the Caesars Rewards Gift Card Network, including participating hotels, restaurants, retailers, comedy clubs, entertainment venues and more across New York.

- May 2022: MGM Resorts International closed its transaction with Blackstone to acquire the operations of The Cosmopolitan of Las Vegas (the "property" or "The Cosmopolitan") for a cash consideration of USD 1.625 billion. With the closing of the transaction, The Cosmopolitan of Las Vegas officially joins MGM Resorts' roster of iconic brands along the Las Vegas Strip.

In-Depth Casino Hotels Market Market Outlook

The casino hotels market outlook is exceptionally promising, driven by a sustained recovery in global travel and a consumer appetite for immersive entertainment experiences. Growth accelerators, including significant investments in digital transformation, the development of integrated resorts offering diverse amenities, and strategic partnerships, are creating a robust environment for expansion. The market is expected to capitalize on emerging trends such as experiential tourism, sustainable operations, and the seamless integration of online and offline gaming platforms. Continued M&A activity and the pursuit of new gaming licenses in developing regions will further shape the competitive landscape. Strategic opportunities lie in enhancing personalized service offerings, diversifying entertainment portfolios, and leveraging data analytics to understand and cater to evolving customer preferences, ensuring continued relevance and profitability in the years ahead.

Casino Hotels Market Segmentation

-

1. Type

- 1.1. Small and medium-sized casinos

- 1.2. Large integrated casino resorts

- 1.3. Cruise ships

-

2. Application

- 2.1. Leisure

- 2.2. Business

- 2.3. Other Applications

Casino Hotels Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Casino Hotels Market Regional Market Share

Geographic Coverage of Casino Hotels Market

Casino Hotels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness

- 3.4. Market Trends

- 3.4.1. Increase In Large Integrated Casino Resort

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Casino Hotels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Small and medium-sized casinos

- 5.1.2. Large integrated casino resorts

- 5.1.3. Cruise ships

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Leisure

- 5.2.2. Business

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Casino Hotels Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Small and medium-sized casinos

- 6.1.2. Large integrated casino resorts

- 6.1.3. Cruise ships

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Leisure

- 6.2.2. Business

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Casino Hotels Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Small and medium-sized casinos

- 7.1.2. Large integrated casino resorts

- 7.1.3. Cruise ships

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Leisure

- 7.2.2. Business

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Casino Hotels Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Small and medium-sized casinos

- 8.1.2. Large integrated casino resorts

- 8.1.3. Cruise ships

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Leisure

- 8.2.2. Business

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Casino Hotels Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Small and medium-sized casinos

- 9.1.2. Large integrated casino resorts

- 9.1.3. Cruise ships

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Leisure

- 9.2.2. Business

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Casino Hotels Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Small and medium-sized casinos

- 10.1.2. Large integrated casino resorts

- 10.1.3. Cruise ships

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Leisure

- 10.2.2. Business

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CasaBlanca

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Las Vegas Sands Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Caesars Entertainment Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Grand Lisboa Macau

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wynn Resorts Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Venetian Resort Hotel Casino

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Galaxy Entertainment Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Marina Hotel**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MGM Resorts International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bellagio

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CasaBlanca

List of Figures

- Figure 1: Global Casino Hotels Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Casino Hotels Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Casino Hotels Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Casino Hotels Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Casino Hotels Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Casino Hotels Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Casino Hotels Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Casino Hotels Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Casino Hotels Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Casino Hotels Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Casino Hotels Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Casino Hotels Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Casino Hotels Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Casino Hotels Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Casino Hotels Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Casino Hotels Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Casino Hotels Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Casino Hotels Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Casino Hotels Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Casino Hotels Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Casino Hotels Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Casino Hotels Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America Casino Hotels Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Casino Hotels Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Casino Hotels Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Casino Hotels Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Casino Hotels Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Casino Hotels Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Casino Hotels Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Casino Hotels Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Casino Hotels Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Casino Hotels Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Casino Hotels Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Casino Hotels Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Casino Hotels Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Casino Hotels Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Casino Hotels Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Casino Hotels Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Casino Hotels Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Casino Hotels Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Casino Hotels Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Casino Hotels Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Casino Hotels Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Casino Hotels Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Casino Hotels Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Casino Hotels Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Casino Hotels Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Casino Hotels Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Casino Hotels Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Casino Hotels Market ?

The projected CAGR is approximately 9.9%.

2. Which companies are prominent players in the Casino Hotels Market ?

Key companies in the market include CasaBlanca, Las Vegas Sands Corporation, Caesars Entertainment Corporation, Grand Lisboa Macau, Wynn Resorts Limited, Venetian Resort Hotel Casino, Galaxy Entertainment Group, Marina Hotel**List Not Exhaustive, MGM Resorts International, Bellagio.

3. What are the main segments of the Casino Hotels Market ?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 83.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market.

6. What are the notable trends driving market growth?

Increase In Large Integrated Casino Resort.

7. Are there any restraints impacting market growth?

Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness.

8. Can you provide examples of recent developments in the market?

February 2023: Caesars Entertainment ("Caesars") and SL Green Realty Corp ("SL Green") announced a new Caesars Rewards partnership for local merchants in greater New York City as a part of their pursuit of a gaming license in Times Square. When Caesars Palace Times Square opens in Manhattan, Caesars Rewards members will be able to use their Reward Credits by converting them to gift cards, valid across the Caesars Rewards Gift Card Network, including participating hotels, restaurants, retailers, comedy clubs, entertainment venues and more across New York.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Casino Hotels Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Casino Hotels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Casino Hotels Market ?

To stay informed about further developments, trends, and reports in the Casino Hotels Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence