Key Insights

The Central and Eastern European (CEE) refrigerated transport market is poised for significant expansion, driven by escalating demand for temperature-controlled logistics across key sectors. Increasing consumption of perishable goods, including fresh produce, dairy, and meats, alongside the rapid growth of e-commerce and the food processing industry, are primary growth catalysts. Emerging pharmaceutical and biopharmaceutical sectors further contribute to this upward trend. The market is projected to reach an estimated size of $113.5 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 8.3% from the base year. Strategic investments in advanced cold chain infrastructure, encompassing specialized fleets and modern warehousing, are crucial for ensuring the integrity of temperature-sensitive shipments region-wide. Leading market participants are enhancing their service portfolios with value-added solutions like blast freezing, detailed labeling, and sophisticated inventory management to meet diverse client requirements.

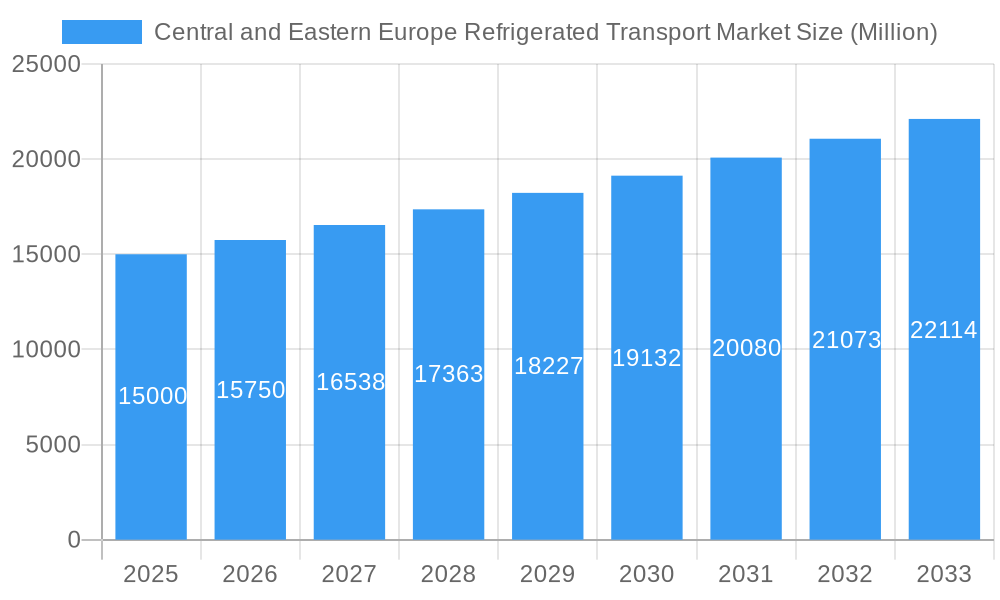

Central and Eastern Europe Refrigerated Transport Market Market Size (In Billion)

Market growth may be moderated by external factors such as volatile fuel prices, evolving regulatory landscapes, and geopolitical uncertainties. While Western European nations remain key markets, other CEE countries present substantial future opportunities owing to their developing economies and shifting consumer habits. Segmentation analysis highlights a dominant focus on chilled and frozen transport, with fruits and vegetables, dairy, and meat products leading application segments. Continued expansion in food and pharmaceutical industries, coupled with ongoing adoption of innovative cold chain technologies, underpins a positive market outlook for CEE refrigerated transport, notwithstanding potential headwinds. The competitive environment features a mix of established global logistics firms and agile regional players, indicating a robust and dynamic industry landscape.

Central and Eastern Europe Refrigerated Transport Market Company Market Share

Central and Eastern Europe Refrigerated Transport Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Central and Eastern Europe (CEE) refrigerated transport market, encompassing its dynamics, growth trends, key players, and future outlook. The report covers the parent market of Cold Chain Logistics in CEE and its child market, Refrigerated Transport. With a detailed study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The market size is estimated at xx Million units in 2025.

Central and Eastern Europe Refrigerated Transport Market Dynamics & Structure

The CEE refrigerated transport market is characterized by moderate concentration, with several large players and numerous smaller, regional operators. Technological innovation, driven by the need for improved efficiency, temperature control, and traceability, is a significant growth driver. Stringent regulatory frameworks concerning food safety and hygiene standards influence operational practices. Competitive substitutes include traditional transport methods with less sophisticated temperature control, but these are gradually being replaced by modern refrigerated solutions. End-user demographics are shifting towards increased demand for processed foods and pharmaceuticals, which fuels market expansion. Mergers and acquisitions (M&A) activity, as illustrated by the Lineage Logistics acquisition of Kloosterboer (June 2021), points to consolidation and increased market share amongst leading players.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on IoT, GPS tracking, and advanced refrigeration technologies. Barriers include high initial investment costs and integration complexities.

- Regulatory Framework: Stringent food safety regulations drive adoption of advanced technologies and quality control measures.

- M&A Activity: Increasing consolidation as larger players seek to expand geographically and service portfolios. Estimated xx M&A deals in the past 5 years.

- End-User Demographics: Growing demand for processed foods, pharmaceuticals, and temperature-sensitive products drives market growth.

Central and Eastern Europe Refrigerated Transport Market Growth Trends & Insights

The CEE refrigerated transport market has witnessed consistent growth over the historical period (2019-2024), driven primarily by increasing consumption of perishable goods and the expansion of e-commerce. The adoption rate of advanced technologies, such as telematics and temperature monitoring systems, is accelerating, improving efficiency and reducing waste. Technological disruptions, like the increased use of autonomous vehicles and drone deliveries for last-mile solutions, are poised to revolutionize the industry in the coming years. Shifts in consumer behavior, such as a preference for fresh, high-quality food products, are fostering higher demand for efficient and reliable refrigerated transport services. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is largely influenced by rising disposable incomes, improved cold chain infrastructure in many regions, and the overall expansion of the food processing and pharmaceutical industries within CEE. Market penetration of refrigerated transport within the overall logistics sector is anticipated to reach xx% by 2033.

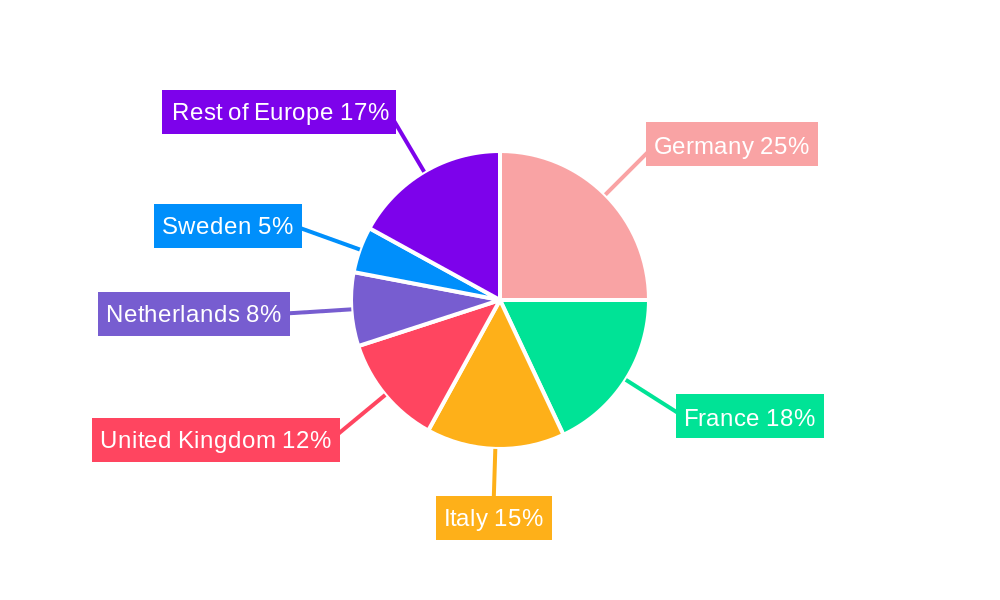

Dominant Regions, Countries, or Segments in Central and Eastern Europe Refrigerated Transport Market

Poland and the Czech Republic are currently the leading markets in the CEE region, benefiting from robust economies and advanced infrastructure. Within the segments, the refrigerated storage segment holds the largest market share due to the increasing need for warehousing and cold storage facilities to support the growing supply chain. The frozen temperature segment is experiencing faster growth than chilled, due to rising demand for frozen food products. Within applications, dairy products and processed foods are the most significant segments, with strong growth potential also observed in the pharmaceutical sector. Key drivers include expanding retail infrastructure, increased investments in logistics and warehousing, and favorable government policies supporting the food processing industry.

- Leading Countries: Poland, Czech Republic, Hungary.

- Leading Segments (by Service): Storage > Transportation > Value-added Services

- Leading Segments (by Temperature): Frozen > Chilled

- Leading Segments (by Application): Dairy Products, Processed Food, Fruits and Vegetables.

- Key Drivers: Expanding retail networks, increased food processing and pharmaceutical production, improved infrastructure investment.

Central and Eastern Europe Refrigerated Transport Market Product Landscape

The product landscape is marked by a shift towards more sophisticated, technologically advanced refrigerated transport solutions. Innovations include improved insulation, advanced temperature control systems, and real-time tracking capabilities. The integration of IoT sensors enables better monitoring of cargo conditions and ensures product integrity throughout the transport chain. Unique selling propositions of leading providers focus on improved efficiency, safety, and traceability, alongside customized solutions catering to specific customer requirements.

Key Drivers, Barriers & Challenges in Central and Eastern Europe Refrigerated Transport Market

Key Drivers: Increasing demand for temperature-sensitive products, expansion of retail infrastructure, rising disposable incomes, and government initiatives supporting the cold chain logistics sector.

Key Challenges and Restraints: High initial investment costs for advanced technologies, limited availability of skilled labor, fluctuations in fuel prices, and the potential impact of geopolitical uncertainties on supply chains. These challenges could result in increased operating costs, impacting market profitability. Regulatory compliance regarding food safety and transportation standards adds complexity and cost. Intense competition, especially in larger markets like Poland, requires continuous innovation and efficient operational practices for companies to thrive.

Emerging Opportunities in Central and Eastern Europe Refrigerated Transport Market

Untapped potential lies in smaller CEE countries with growing economies and developing cold chain infrastructure. Expansion into niche markets, such as the transport of specialized pharmaceutical products (including biopharmaceuticals) and high-value food items, represents significant growth opportunities. The growing demand for sustainable and eco-friendly transportation solutions opens doors for innovative businesses and technologies. Evolving consumer preferences towards online grocery shopping is stimulating demand for faster and more efficient refrigerated delivery services.

Growth Accelerators in the Central and Eastern Europe Refrigerated Transport Market Industry

Long-term growth will be driven by continued investments in cold chain infrastructure, technological innovations, and the expansion of the food processing and pharmaceutical industries. Strategic partnerships between logistics providers and technology companies will further accelerate market growth. Government initiatives supporting the cold chain industry and improved connectivity across borders will pave the way for greater efficiency and reach.

Key Players Shaping the Central and Eastern Europe Refrigerated Transport Market Market

- Baltic Logistic Solutions

- Beno-Trans

- Gartner KG

- Nordfrost

- Magnum Logistics OU

- PLG Logistics and Warehousing

- NewCold

- FRIGO Coldstore Logistics

- Nagel-Group

- Wilms Frozen Food Service

- List Not Exhaustive

Notable Milestones in Central and Eastern Europe Refrigerated Transport Market Sector

- March 2021: Danone Sp. z o.o. extends its cooperation with Kuehne+Nagel in Poland, opening a new 11,079 sqm distribution center with controlled temperature storage. This signifies increasing demand for temperature-controlled warehousing and logistics services within the food and beverage sector in Poland.

- June 2021: Lineage Logistics' acquisition of Kloosterboer demonstrates ongoing consolidation in the European temperature-controlled logistics sector, indicating a shift towards larger, more integrated service providers.

In-Depth Central and Eastern Europe Refrigerated Transport Market Market Outlook

The future of the CEE refrigerated transport market is promising, with substantial growth potential driven by expanding consumer demand, technological advancements, and ongoing infrastructure development. Strategic opportunities exist for companies focusing on sustainability, technological innovation, and niche market penetration. The market's evolution will be shaped by consolidation amongst major players, a growing focus on efficiency and traceability, and an increasing emphasis on environmentally friendly operations. The report projects that the market will continue to expand, exceeding xx Million units by 2033.

Central and Eastern Europe Refrigerated Transport Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Fruits and Vegetables

- 3.2. Dairy Pr

- 3.3. Fish, Meat and Poultry

- 3.4. Processed Food

- 3.5. Pharmaceutical (Including Biopharma)

- 3.6. Bakery and Confectionery

- 3.7. Other Applications

Central and Eastern Europe Refrigerated Transport Market Segmentation By Geography

- 1. Poland

- 2. Slovakia

- 3. Czech Republic

- 4. Hungary

- 5. Romania

- 6. Rest of Central and Eastern Europe

Central and Eastern Europe Refrigerated Transport Market Regional Market Share

Geographic Coverage of Central and Eastern Europe Refrigerated Transport Market

Central and Eastern Europe Refrigerated Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Industry Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Fruits and Vegetables

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat and Poultry

- 5.3.4. Processed Food

- 5.3.5. Pharmaceutical (Including Biopharma)

- 5.3.6. Bakery and Confectionery

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.4.2. Slovakia

- 5.4.3. Czech Republic

- 5.4.4. Hungary

- 5.4.5. Romania

- 5.4.6. Rest of Central and Eastern Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Poland Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Storage

- 6.1.2. Transportation

- 6.1.3. Value-ad

- 6.2. Market Analysis, Insights and Forecast - by Temperature

- 6.2.1. Chilled

- 6.2.2. Frozen

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Fruits and Vegetables

- 6.3.2. Dairy Pr

- 6.3.3. Fish, Meat and Poultry

- 6.3.4. Processed Food

- 6.3.5. Pharmaceutical (Including Biopharma)

- 6.3.6. Bakery and Confectionery

- 6.3.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Slovakia Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Storage

- 7.1.2. Transportation

- 7.1.3. Value-ad

- 7.2. Market Analysis, Insights and Forecast - by Temperature

- 7.2.1. Chilled

- 7.2.2. Frozen

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Fruits and Vegetables

- 7.3.2. Dairy Pr

- 7.3.3. Fish, Meat and Poultry

- 7.3.4. Processed Food

- 7.3.5. Pharmaceutical (Including Biopharma)

- 7.3.6. Bakery and Confectionery

- 7.3.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Czech Republic Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Storage

- 8.1.2. Transportation

- 8.1.3. Value-ad

- 8.2. Market Analysis, Insights and Forecast - by Temperature

- 8.2.1. Chilled

- 8.2.2. Frozen

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Fruits and Vegetables

- 8.3.2. Dairy Pr

- 8.3.3. Fish, Meat and Poultry

- 8.3.4. Processed Food

- 8.3.5. Pharmaceutical (Including Biopharma)

- 8.3.6. Bakery and Confectionery

- 8.3.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Hungary Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Storage

- 9.1.2. Transportation

- 9.1.3. Value-ad

- 9.2. Market Analysis, Insights and Forecast - by Temperature

- 9.2.1. Chilled

- 9.2.2. Frozen

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Fruits and Vegetables

- 9.3.2. Dairy Pr

- 9.3.3. Fish, Meat and Poultry

- 9.3.4. Processed Food

- 9.3.5. Pharmaceutical (Including Biopharma)

- 9.3.6. Bakery and Confectionery

- 9.3.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Romania Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Storage

- 10.1.2. Transportation

- 10.1.3. Value-ad

- 10.2. Market Analysis, Insights and Forecast - by Temperature

- 10.2.1. Chilled

- 10.2.2. Frozen

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Fruits and Vegetables

- 10.3.2. Dairy Pr

- 10.3.3. Fish, Meat and Poultry

- 10.3.4. Processed Food

- 10.3.5. Pharmaceutical (Including Biopharma)

- 10.3.6. Bakery and Confectionery

- 10.3.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Rest of Central and Eastern Europe Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Storage

- 11.1.2. Transportation

- 11.1.3. Value-ad

- 11.2. Market Analysis, Insights and Forecast - by Temperature

- 11.2.1. Chilled

- 11.2.2. Frozen

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Fruits and Vegetables

- 11.3.2. Dairy Pr

- 11.3.3. Fish, Meat and Poultry

- 11.3.4. Processed Food

- 11.3.5. Pharmaceutical (Including Biopharma)

- 11.3.6. Bakery and Confectionery

- 11.3.7. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Baltic Logistic Solutions

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Beno-Trans

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Gartner KG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nordfrost

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Magnum Logistics OU

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PLG Logistics and Warehousing

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 NewCold

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 FRIGO Coldstore Logistics

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Nagel-Group

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Wilms Frozen Food Service**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Baltic Logistic Solutions

List of Figures

- Figure 1: Central and Eastern Europe Refrigerated Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Central and Eastern Europe Refrigerated Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 3: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 7: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 10: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 11: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 15: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 19: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 22: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 23: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 26: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 27: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Central and Eastern Europe Refrigerated Transport Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Central and Eastern Europe Refrigerated Transport Market?

Key companies in the market include Baltic Logistic Solutions, Beno-Trans, Gartner KG, Nordfrost, Magnum Logistics OU, PLG Logistics and Warehousing, NewCold, FRIGO Coldstore Logistics, Nagel-Group, Wilms Frozen Food Service**List Not Exhaustive.

3. What are the main segments of the Central and Eastern Europe Refrigerated Transport Market?

The market segments include Service, Temperature, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 113.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Pharmaceutical Industry Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

March 2021 : Danone Sp. z o.o., part of the global food company Danone, extends its cooperation with Kuehne+Nagel in Poland for another seven years. In conjunction, a new distribution center spanning 11,079 sqm has been opened in Ruda Śląska. The facility is equipped to store goods at a controlled temperature of 4 - 6°C, including co-packing in cold and ambient chambers. While unloading and loading goods, product integrity is ensured by insulated cooling aprons, gates and platforms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Central and Eastern Europe Refrigerated Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Central and Eastern Europe Refrigerated Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Central and Eastern Europe Refrigerated Transport Market?

To stay informed about further developments, trends, and reports in the Central and Eastern Europe Refrigerated Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence