Key Insights

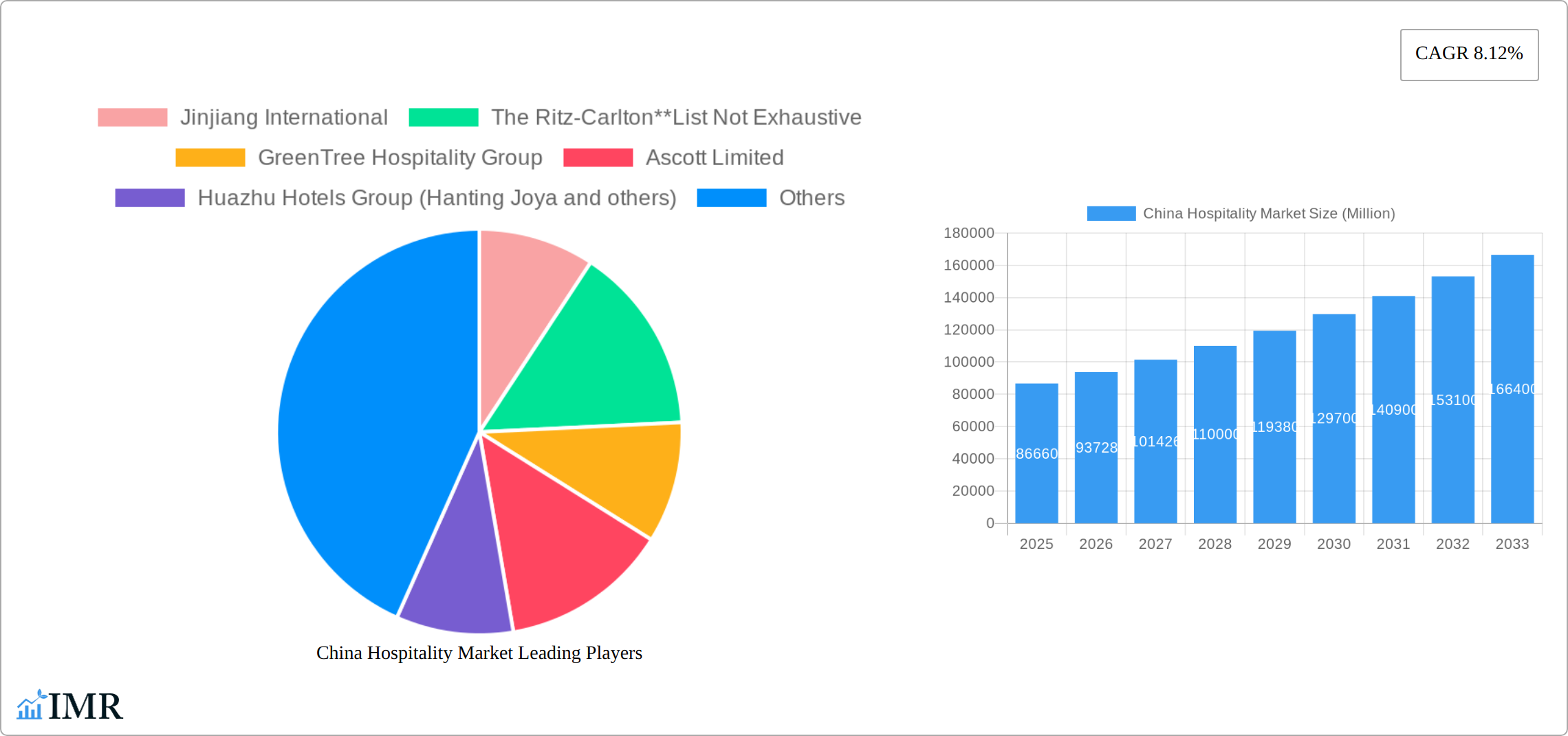

The China hospitality market, valued at $86.66 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.12% from 2025 to 2033. This expansion is fueled by several key factors. A burgeoning middle class with increasing disposable income is driving demand for both leisure and business travel. Government initiatives promoting tourism and infrastructure development further contribute to this growth. The market is segmented by accommodation type (Service Apartments, Budget & Economy Hotels, Mid & Upper Mid-scale Hotels, Luxury Hotels) and ownership (Chain Hotels, Independent Hotels). The increasing preference for branded, chain hotels offering consistent service and amenities is a significant trend. However, challenges remain. Competition within the market is intense, requiring hotels to constantly innovate and adapt to evolving consumer preferences. Fluctuations in the global economy and potential regulatory changes could also impact growth trajectories. The dominance of major players like Jinjiang International, Huazhu Hotels Group, and Marriott International Inc. highlights the consolidated nature of the market, although independent hotels continue to hold a significant share.

China Hospitality Market Market Size (In Billion)

Looking ahead, the continued growth of the Chinese economy and the increasing popularity of domestic tourism point towards a sustained expansion of the hospitality sector. Further investment in infrastructure, particularly in less-developed regions, will unlock new opportunities. The rise of online travel agencies and the increasing importance of digital marketing strategies are transforming how hotels reach and engage customers. Furthermore, sustainable tourism initiatives and a focus on enhancing guest experiences will likely influence future market dynamics. The diversification of offerings, catering to a wider range of budgets and travel styles, will remain a crucial factor for success within this competitive landscape. The emphasis on technology integration, including AI-powered services and contactless check-in/check-out processes, will also shape the future trajectory of the Chinese hospitality market.

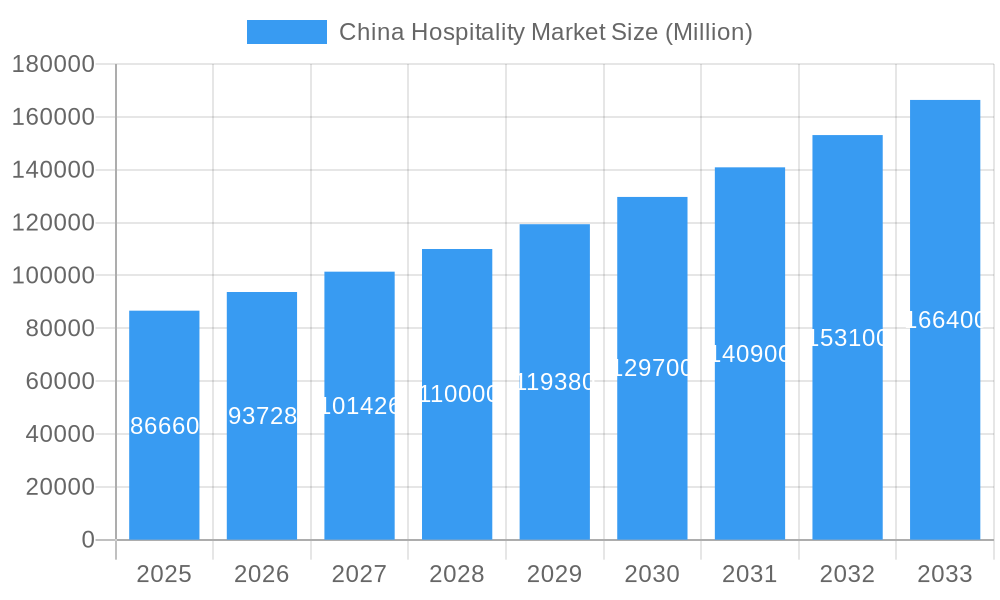

China Hospitality Market Company Market Share

China Hospitality Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China hospitality market, encompassing market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers both parent and child market segments for a holistic understanding. Market values are presented in million units.

China Hospitality Market Market Dynamics & Structure

The China hospitality market is a dynamic and rapidly evolving landscape, propelled by robust economic growth, increasing disposable incomes, and a burgeoning middle class with a strong appetite for travel. Intense competition among a mix of large international and domestic brands, alongside a significant number of independent operators, defines the market structure. Technological innovation is a paramount driver, with advancements in AI-powered guest services, seamless online booking platforms, sophisticated revenue management systems, and the integration of smart room technologies significantly enhancing operational efficiency and guest experiences. However, challenges persist, including high initial investment costs for adopting new technologies and a degree of resistance to change within some traditional establishments. The regulatory environment, encompassing stringent licensing requirements, evolving safety standards, and a growing emphasis on environmental sustainability, continues to shape market operations and business strategies. The rise of alternative accommodation options like vacation rentals and homestays presents a growing competitive pressure, compelling traditional hotels to differentiate their offerings. Evolving end-user demographics, characterized by a significant expansion of the middle class and a pronounced shift towards experiential and personalized travel, are profoundly influencing demand across all hospitality segments. Mergers and acquisitions (M&A) remain a key strategic tool, with major players actively pursuing acquisitions to expand their geographic reach, portfolio diversity, and market share.

- Market Concentration: Moderate, with the top 5 players holding approximately 30-35% market share (estimated 2024).

- Technological Innovation Drivers: Advanced AI for personalized guest services and chatbots, integrated online booking and mobile check-in platforms, IoT-enabled smart room technology for enhanced comfort and efficiency, and data analytics for dynamic pricing and personalized marketing.

- Regulatory Frameworks: Evolving licensing and operational permits, stringent health and safety protocols, increasing emphasis on green building and sustainable operational practices, and data privacy regulations.

- Competitive Substitutes: Diversified offerings from online travel agencies (OTAs) aggregating vacation rentals and homestays, serviced apartments, and boutique guesthouses focusing on unique local experiences.

- M&A Trends: Increased consolidation and strategic partnerships among major domestic and international brands, resulting in approximately 15-20 significant M&A deals in 2024, focused on expanding into tier-2 and tier-3 cities and acquiring niche brands.

- End-User Demographics: Continued growth in outbound and domestic travel by the affluent middle class, a rising demand for unique cultural experiences, wellness-focused stays, and eco-tourism, with a growing segment of Gen Z travelers prioritizing digital integration and authentic experiences.

China Hospitality Market Growth Trends & Insights

The China hospitality market experienced significant growth during the historical period (2019-2024), driven by robust economic expansion and rising disposable incomes. The market size is expected to reach xx million units by 2025, with a CAGR of xx% during the forecast period (2025-2033). This growth is influenced by factors such as increasing domestic tourism, the rise of the middle class, and government initiatives to promote tourism development. Technological disruptions, such as the proliferation of online travel agencies (OTAs) and the adoption of mobile-based booking platforms, are reshaping consumer behavior and preferences. Consumers are increasingly prioritizing convenience, personalization, and value-for-money.

Dominant Regions, Countries, or Segments in China Hospitality Market

Coastal regions and major tier-1 metropolitan areas such as Beijing, Shanghai, Guangzhou, and Shenzhen continue to be the primary drivers of market growth, benefiting from substantial tourist footfall, significant business travel volumes, and robust economic activity. Within segments, the budget and economy hotel sector historically commands the largest share, estimated at around 40-45% of the market in 2024, primarily due to their affordability and widespread accessibility catering to a broad spectrum of travelers. However, the luxury and upscale hotel segments are experiencing particularly strong growth potential, fueled by increasing per capita income, a rising demand for premium experiences, and the development of sophisticated urban centers. The chain hotel segment, encompassing both domestic and international brands, holds a dominant position with an estimated market share of 55-60% in 2024, reflecting the ongoing consolidation within the industry and the appeal of branded consistency and services.

- Key Drivers: Sustained economic development, continuous infrastructure improvements (high-speed rail, airports), government policies promoting domestic and international tourism, and the rise of new economic hubs in inland regions.

- Dominant Segments: Budget & Economy Hotels, Coastal Megacities (e.g., Guangdong, Jiangsu, Zhejiang provinces) and major business hubs.

- Growth Potential: Luxury & Upper Upscale Hotels in tier-1 and emerging tier-2 cities, boutique and lifestyle hotels catering to niche traveler preferences, and MICE (Meetings, Incentives, Conferences, and Exhibitions) focused properties in rapidly developing inland cities.

China Hospitality Market Product Landscape

The product landscape is characterized by a wide range of offerings catering to diverse needs and preferences, from budget-friendly accommodations to upscale luxury hotels. Innovation focuses on enhancing guest experience through technology, such as mobile check-in/check-out, personalized services, and smart room features. Chain hotels are increasingly leveraging loyalty programs and data analytics to improve customer retention and revenue management. Unique selling propositions include eco-friendly initiatives, cultural immersion experiences, and bespoke services tailored to individual preferences.

Key Drivers, Barriers & Challenges in China Hospitality Market

Key Drivers: Rising disposable incomes, increasing domestic and international tourism, government support for tourism infrastructure development, technological advancements in hospitality management.

Challenges: Intense competition, rising labor costs, regulatory hurdles, fluctuating currency exchange rates impacting international tourism, potential supply chain disruptions resulting in increased costs of supplies. The impact of these challenges on profitability is estimated to be xx% reduction in profit margins for smaller independent hotels in 2024.

Emerging Opportunities in China Hospitality Market

Untapped markets exist in less-developed regions and specialized niche segments such as eco-tourism and wellness retreats. Opportunities arise through expanding into smaller cities and leveraging technological advancements to improve operational efficiency and enhance customer experience. Developing sustainable and responsible tourism practices presents a strong opportunity to appeal to environmentally conscious travelers. The growth in experiential travel and niche tourism offers potential for specialized hotel concepts.

Growth Accelerators in the China Hospitality Market Industry

Several key factors are accelerating growth within the China hospitality market. Technological advancements, including the widespread adoption of digital booking channels, AI-driven personalization, and efficient property management systems, are enhancing guest satisfaction and operational efficiency. Strategic partnerships between hotel chains, technology providers, and local tourism operators are crucial for market penetration and service innovation. The ongoing expansion of hotel brands into previously underserved tier-2 and tier-3 cities, driven by improving infrastructure and rising local economies, is opening new avenues for growth. The burgeoning popularity and increasing reliability of online booking platforms and travel apps continue to simplify the booking process and expose a wider audience to diverse hospitality options. Furthermore, the growing guest preference for sustainable practices, eco-friendly operations, and integrated health and wellness facilities is becoming a significant differentiator and a strong growth driver, attracting a broader and more conscious demographic of travelers.

Key Players Shaping the China Hospitality Market Market

- Jinjiang International

- The Ritz-Carlton

- GreenTree Hospitality Group

- Ascott Limited

- Huazhu Hotels Group (Hanting Joya and others)

- BTG Homeinns

- Plateno Group (7 Days Inn)

- Holiday Inn

- The Peninsula Beijing

- Marriott International Inc

Notable Milestones in China Hospitality Market Sector

- September 2022: InterContinental Hotels Group (IHG) celebrated a significant milestone by opening its 600th hotel in Greater China, showcasing its extensive network and commitment to the market.

- November 2022: Marriott International announced ambitious expansion plans for Greater China, signaling its intent to add approximately 30 new hotels by the end of 2023, further bolstering its substantial portfolio of over 460 properties in the region.

- Early 2023: Several domestic Chinese hotel groups reported accelerated expansion plans, focusing on both the budget and mid-scale segments, often through franchising models, to capture the growing demand in emerging cities.

- Mid-2023: Increased investment and focus on the development of smart hotel technologies and AI-powered guest services were observed across major hotel brands, aiming to enhance personalization and operational efficiency.

In-Depth China Hospitality Market Market Outlook

The China hospitality market is projected for sustained and robust growth in the coming years, underpinned by China's continued economic expansion, ongoing infrastructure development connecting cities and regions, and a relentless pace of technological innovation. Strategic alliances, both within the industry and with technology firms, will be critical for navigating market complexities and enhancing guest experiences. Aggressive expansion into emerging and previously underserved tier-2 and tier-3 cities, coupled with a keen focus on developing sustainable hospitality practices and integrating comprehensive health and wellness offerings, will be pivotal for capturing market share and appealing to evolving traveler preferences. The market presents substantial opportunities for established international and domestic players to consolidate their positions, as well as for agile new entrants to carve out niches through specialization and innovation in unique hospitality concepts. The ongoing trend of M&A activity is expected to continue, leading to further industry consolidation and potentially more diversified and specialized hospitality offerings across the vast Chinese market.

China Hospitality Market Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper Mid-scale Hotels

- 2.4. Luxury Hotels

China Hospitality Market Segmentation By Geography

- 1. China

China Hospitality Market Regional Market Share

Geographic Coverage of China Hospitality Market

China Hospitality Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Long-Distances are Physically Demanding which in return Restraining the Market

- 3.4. Market Trends

- 3.4.1. The Rising Demand for Hotels is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Hospitality Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper Mid-scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jinjiang International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Ritz-Carlton**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GreenTree Hospitality Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ascott Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Huazhu Hotels Group (Hanting Joya and others)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BTG Homeinns

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Plateno Group (7 Days Inn)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Holiday Inn

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Peninsula Beijing

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Marriott International Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Jinjiang International

List of Figures

- Figure 1: China Hospitality Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Hospitality Market Share (%) by Company 2025

List of Tables

- Table 1: China Hospitality Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Hospitality Market Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: China Hospitality Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Hospitality Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: China Hospitality Market Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: China Hospitality Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Hospitality Market?

The projected CAGR is approximately 8.12%.

2. Which companies are prominent players in the China Hospitality Market?

Key companies in the market include Jinjiang International, The Ritz-Carlton**List Not Exhaustive, GreenTree Hospitality Group, Ascott Limited, Huazhu Hotels Group (Hanting Joya and others), BTG Homeinns, Plateno Group (7 Days Inn), Holiday Inn, The Peninsula Beijing, Marriott International Inc.

3. What are the main segments of the China Hospitality Market?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 86.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market.

6. What are the notable trends driving market growth?

The Rising Demand for Hotels is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Long-Distances are Physically Demanding which in return Restraining the Market.

8. Can you provide examples of recent developments in the market?

November 2022: The U.S.-based hotel chain Marriott International announced the plan to add 30 hotels in Greater China by the end of 2023. This is expected to add more than 460 properties in 120 destinations in the Greater China region to Marriott's hotel portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Hospitality Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Hospitality Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Hospitality Market?

To stay informed about further developments, trends, and reports in the China Hospitality Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence