Key Insights

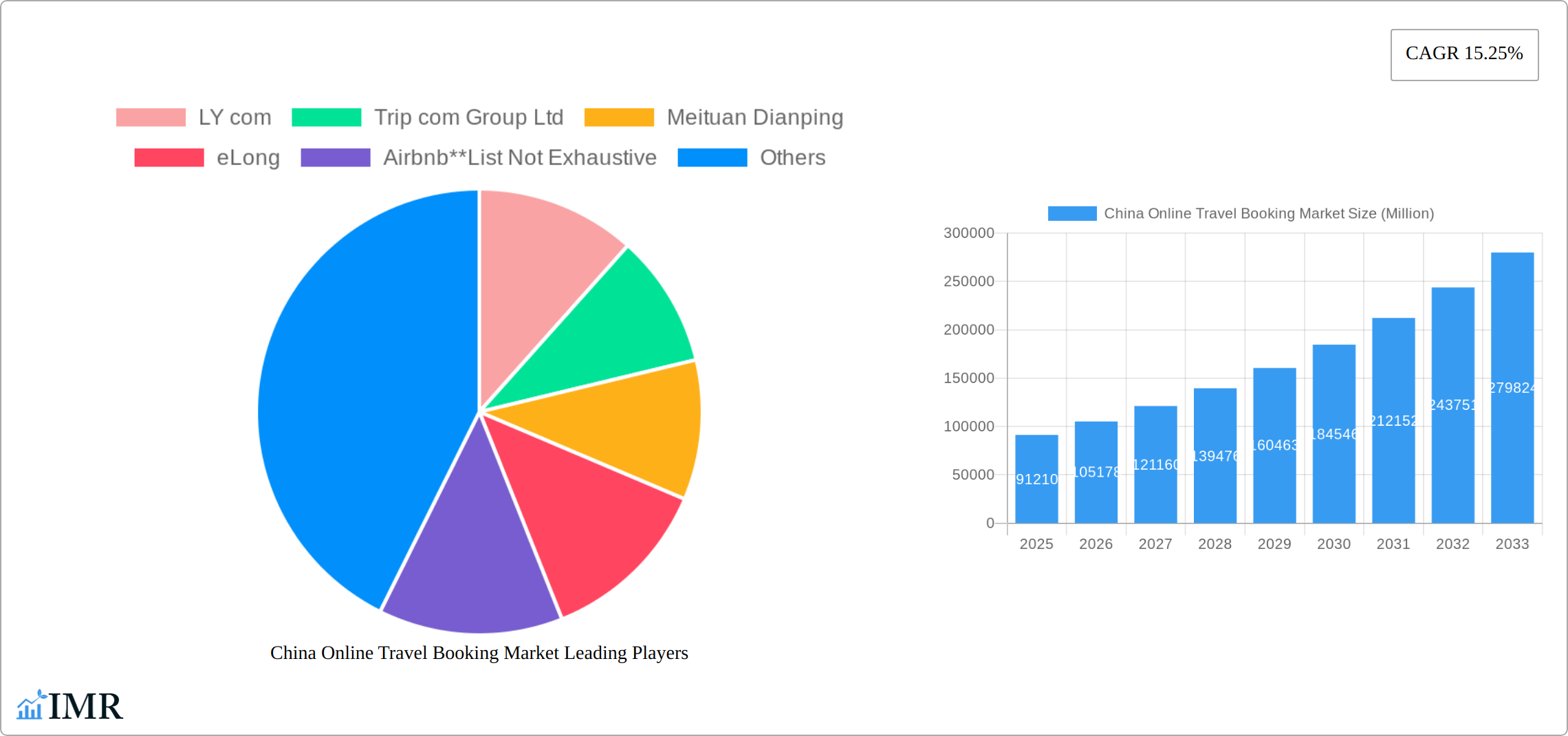

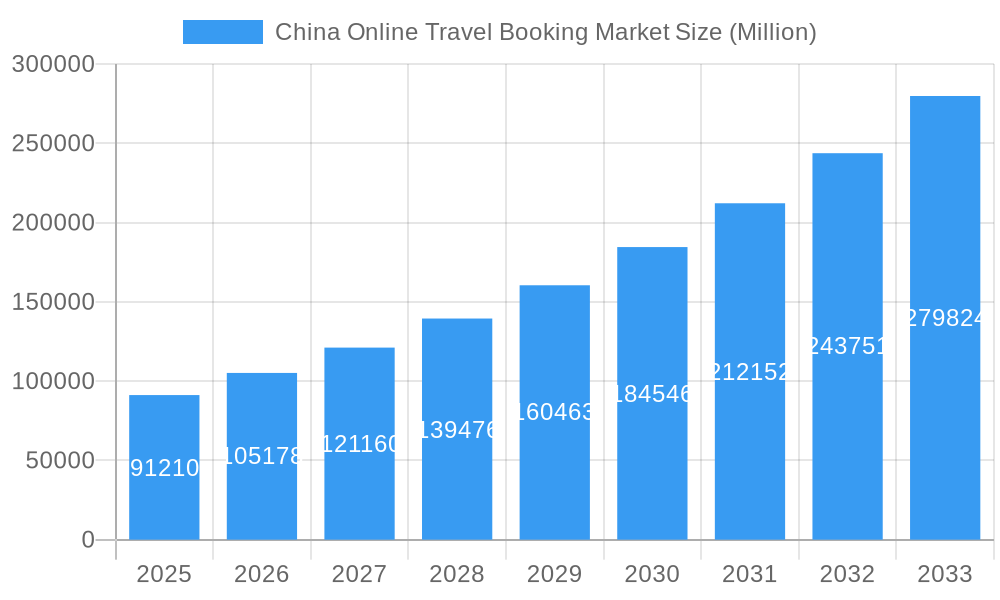

The China online travel booking market is experiencing robust growth, projected to reach a substantial size driven by increasing internet and smartphone penetration, rising disposable incomes, and a burgeoning middle class with a strong desire for domestic and international travel. The market's Compound Annual Growth Rate (CAGR) of 15.25% from 2019 to 2024 indicates significant expansion, and this momentum is expected to continue through 2033. Key market segments include accommodation booking, which benefits from the popularity of platforms like Airbnb and domestic hotel chains integrated with online booking systems, and travel ticket booking, fueled by high-speed rail expansion and increasing air travel. Holiday package bookings are also a significant segment, reflecting a preference for curated travel experiences. Direct bookings are growing, indicating increased consumer confidence in online platforms and a trend toward bypassing travel agents. However, travel agents still hold a significant market share, especially for complex or customized travel arrangements. The mobile/tablet platform dominates bookings, highlighting the importance of mobile-first strategies for companies in this sector. Competition is intense, with both large international players and a robust ecosystem of domestic companies vying for market share. This competitive landscape fosters innovation and drives prices down, benefiting consumers.

China Online Travel Booking Market Market Size (In Billion)

The market's continued expansion is supported by government initiatives promoting tourism and infrastructure development. However, potential restraints include economic fluctuations, geopolitical uncertainties, and the increasing need for sophisticated cybersecurity measures to protect sensitive user data. Companies need to adapt to evolving consumer preferences, leveraging data analytics to personalize offerings and enhance the customer journey. The focus on user experience, seamless integration of various services (flights, hotels, activities), and loyalty programs will be critical for success in this dynamic and rapidly evolving market. Furthermore, sustainable tourism practices are becoming increasingly important for consumer choice, presenting an opportunity for companies to differentiate themselves and appeal to environmentally conscious travelers.

China Online Travel Booking Market Company Market Share

China Online Travel Booking Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China online travel booking market, encompassing historical data (2019-2024), the base year (2025), and a forecast period (2025-2033). It delves into market dynamics, growth trends, key players, and emerging opportunities, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by mode of booking (direct booking, travel agents), platform (desktop, mobile/tablet), and service type (accommodation, travel tickets, holiday packages, other services). The total market size is projected to reach xx Million by 2033.

China Online Travel Booking Market Market Dynamics & Structure

The China online travel booking market is a dynamic landscape characterized by fierce competition, rapid technological innovation, and a constantly evolving regulatory environment. A few dominant players control a significant market share, creating a highly concentrated market. However, this concentration is challenged by smaller, agile players and new entrants, fostering continuous innovation and diversification of offerings. The market boasts substantial growth potential, fueled by several key factors: the widespread adoption of online booking platforms, a burgeoning middle class with rising disposable incomes, and a younger generation increasingly comfortable with digital transactions. This growth, however, is not without its complexities.

- Market Concentration & Competition: While a handful of major players (Trip.com Group Ltd, Ctrip, Meituan, Fliggy, etc.) hold a substantial portion of the market share, the competitive landscape is far from static. Smaller companies and specialized platforms are carving out niches, often focusing on specific travel segments or leveraging unique technological capabilities.

- Technological Innovation: The market is a breeding ground for technological advancements. AI-powered personalized recommendations, immersive virtual reality travel experiences, and blockchain-based secure transaction systems are transforming the customer experience and operational efficiency. However, substantial investment in infrastructure and skilled personnel is required to implement and maintain these technologies.

- Regulatory Landscape: Government regulations concerning data privacy, consumer protection, and fair competition significantly shape the operational dynamics of the market. Navigating these regulations effectively is crucial for sustained success.

- Competitive Substitutes & Disruption: While traditional travel agencies still exist, their market share is shrinking rapidly. The rise of social media influencers and niche platforms continues to pose challenges, demanding constant adaptation and innovation to remain competitive.

- End-User Demographics & Behavior: Millennials and Gen Z represent the core user base, characterized by tech-savviness, a preference for mobile booking, and a high demand for personalized and seamless travel experiences.

- Mergers & Acquisitions (M&A): The market has seen significant M&A activity in recent years, reflecting consolidation and strategic expansion by major players. This trend is likely to continue as companies seek to enhance their market position and diversify their offerings.

China Online Travel Booking Market Growth Trends & Insights

The China online travel booking market has exhibited robust growth over the historical period (2019-2024), driven by factors such as increasing internet and smartphone penetration, rising disposable incomes, and a growing preference for convenient online booking options. The market size is estimated to be xx Million in 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is further propelled by the increasing adoption of mobile booking platforms, the rise of mobile payment systems, and the expanding reach of high-speed internet access across China. Consumer behavior shifts, such as a preference for personalized travel experiences and the growing demand for unique and immersive travel options, also contribute to market growth. Technological disruptions, including the integration of AI and big data analytics, enhance personalization and improve user experience, further driving market expansion. Market penetration is currently at xx% and is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in China Online Travel Booking Market

The China online travel booking market is characterized by several key dominant segments. Mobile platforms overwhelmingly dominate due to the high smartphone penetration rate in the country, showcasing the strong preference for on-the-go booking. Direct booking is preferred, demonstrating growing consumer trust in online platforms and their competitive pricing. Accommodation booking consistently holds the largest share of the service type segment. Tier-1 cities (Beijing, Shanghai, Guangzhou, Shenzhen) are leading regional markets, followed by other major metropolitan areas and increasingly, secondary and tertiary cities.

- By Mode of Booking: Direct booking through online travel agencies (OTAs) maintains the largest market share, driven by the convenience and often lower prices offered.

- By Platform: Mobile/Tablet platforms are the dominant booking channels, reflecting the high mobile penetration and consumer preference for ease and accessibility.

- By Service Type: Accommodation bookings, encompassing hotels, hostels, and vacation rentals, constitute the largest segment, indicating the strong demand for travel and tourism experiences.

- Key Regional Growth Drivers: Government initiatives promoting domestic and international tourism, investments in transportation infrastructure, and the rising disposable incomes across different regions are all contributing to the expansion of the market beyond major metropolitan areas.

China Online Travel Booking Market Product Landscape

The online travel booking market offers a diverse range of products and services, including flight and hotel bookings, package tours, car rentals, and travel insurance. Continuous product innovation focuses on enhancing user experience through personalized recommendations, seamless booking processes, and integrated payment solutions. Key differentiators include advanced search filters, real-time price updates, loyalty programs, and customer support features. Technological advancements in AI and big data analytics improve personalization and predictive capabilities.

Key Drivers, Barriers & Challenges in China Online Travel Booking Market

Key Drivers: The market's growth is propelled by rising disposable incomes, increasing internet and smartphone penetration, rapid technological advancements (AI, VR/AR, personalized recommendations), supportive government policies promoting tourism, and the widespread consumer preference for convenient online booking.

Challenges: Despite significant growth potential, several challenges persist. Intense competition necessitates continuous innovation and adaptation. Data privacy concerns are paramount, requiring robust security measures. Fluctuating exchange rates and geopolitical uncertainties impact both consumer behavior and business operations. Cybersecurity threats and the potential for economic downturns are also critical considerations.

Emerging Opportunities in China Online Travel Booking Market

Untapped opportunities lie in niche tourism segments (e.g., eco-tourism, adventure tourism), personalized travel itineraries leveraging AI, and the integration of virtual reality experiences to enhance travel planning. The expansion into smaller cities and rural areas also presents significant growth potential.

Growth Accelerators in the China Online Travel Booking Market Industry

Sustained growth in the China online travel booking market will hinge on strategic initiatives. Strategic partnerships, technological breakthroughs (such as AI-powered chatbots for improved customer service and personalized travel planning), and expansion into less-penetrated markets are key growth accelerators. Furthermore, significant investment in enhancing security measures and data privacy protocols is essential for building and maintaining consumer trust, which is paramount in this competitive environment.

Key Players Shaping the China Online Travel Booking Market Market

- LY.com

- Trip.com Group Ltd

- Meituan Dianping

- eLong

- Airbnb

- Fliggy (Alibaba)

- Tuniu

- Didi Chuxing

- Qunar

- Mafengwo

- Lvmama

Notable Milestones in China Online Travel Booking Market Sector

- July 2021: Trip.com becomes the first OTA to offer Eurail and Interrail passes, expanding its product offerings and attracting international travelers.

- February 2022: CWT launches myCWT, a business travel platform in China, targeting corporate clients and streamlining business travel management.

In-Depth China Online Travel Booking Market Market Outlook

The China online travel booking market is poised for continued growth, driven by sustained economic expansion, technological advancements, and the increasing adoption of online travel services. Strategic partnerships, investments in innovative technologies, and expansion into new markets will further accelerate growth. The market's future hinges on addressing challenges related to data privacy, cybersecurity, and maintaining consumer trust.

China Online Travel Booking Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Services

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

China Online Travel Booking Market Segmentation By Geography

- 1. China

China Online Travel Booking Market Regional Market Share

Geographic Coverage of China Online Travel Booking Market

China Online Travel Booking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration in China is Helping in Market Expansion

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Online Travel Booking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LY com

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trip com Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meituan Dianping

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 eLong

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Airbnb**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fliggy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tuniu

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Didi Chuxing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qunar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mafengwo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lvmama

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 LY com

List of Figures

- Figure 1: China Online Travel Booking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Online Travel Booking Market Share (%) by Company 2025

List of Tables

- Table 1: China Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: China Online Travel Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: China Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: China Online Travel Booking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: China Online Travel Booking Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 7: China Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: China Online Travel Booking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Online Travel Booking Market?

The projected CAGR is approximately 15.25%.

2. Which companies are prominent players in the China Online Travel Booking Market?

Key companies in the market include LY com, Trip com Group Ltd, Meituan Dianping, eLong, Airbnb**List Not Exhaustive, Fliggy, Tuniu, Didi Chuxing, Qunar, Mafengwo, Lvmama.

3. What are the main segments of the China Online Travel Booking Market?

The market segments include Service Type, Mode of Booking, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Internet Penetration in China is Helping in Market Expansion.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

February 2022: CWT launched myCWT, a flagship platform in China aimed at simplifying business travel for companies and employees. CWT is a global B2B4E travel management specialist based in the United States. The myCWT platform offers extensive international and domestic travel content, including rail, flights, hotels, and ground transportation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Online Travel Booking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Online Travel Booking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Online Travel Booking Market?

To stay informed about further developments, trends, and reports in the China Online Travel Booking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence