Key Insights

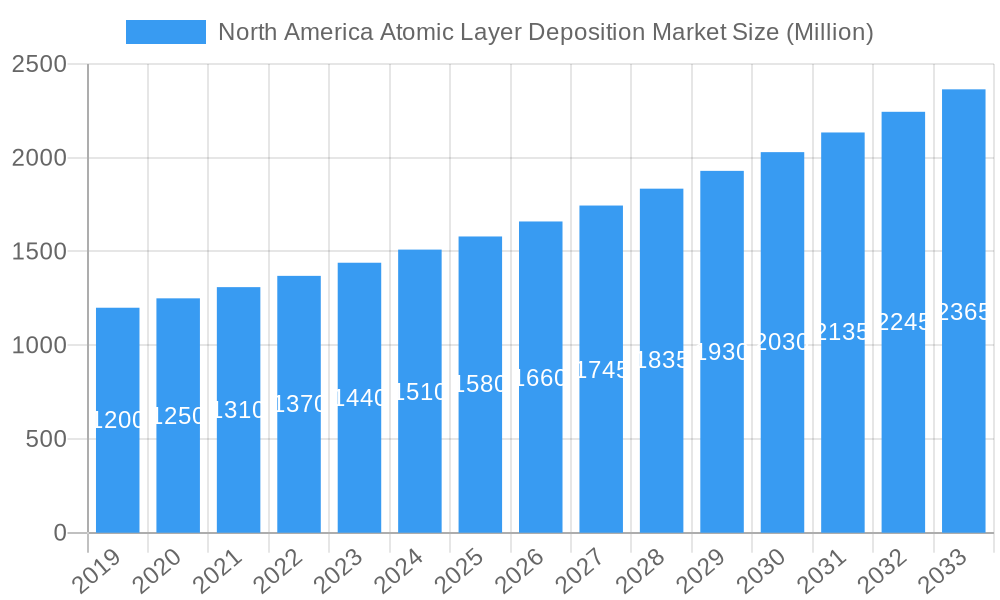

The North American Atomic Layer Deposition (ALD) market is poised for robust expansion, driven by the insatiable demand for advanced semiconductor manufacturing and the burgeoning healthcare and biomedical sectors. With a projected Compound Annual Growth Rate (CAGR) of 5.00%, the market is expected to reach an estimated XX million by 2025, growing steadily through 2033. This growth is underpinned by ALD's unique capability to deposit ultra-thin, conformal films with atomic-level precision, a critical requirement for next-generation microelectronics. The semiconductor industry's relentless pursuit of smaller, faster, and more power-efficient chips, particularly in areas like AI, 5G, and IoT, will continue to be the primary catalyst for ALD adoption. Furthermore, the increasing use of ALD in developing sophisticated medical devices, diagnostics, and drug delivery systems, where biocompatibility and precise material control are paramount, is adding significant momentum to the market. Emerging applications in automotive, such as advanced sensors and improved battery technologies, also contribute to the expanding market landscape.

North America Atomic Layer Deposition Market Market Size (In Billion)

While the North American market benefits from a strong presence of leading ALD equipment manufacturers and research institutions, several factors influence its trajectory. The rapid pace of technological innovation necessitates continuous investment in advanced ALD equipment and processes, presenting an opportunity for growth. However, the high initial cost of ALD systems and the need for specialized expertise to operate and maintain them can act as a restraint for smaller enterprises. Supply chain complexities and the availability of skilled labor are also factors that market participants will need to navigate. Despite these challenges, the inherent advantages of ALD in enabling miniaturization, enhancing performance, and creating novel functionalities across diverse industries suggest a bright future for this critical technology in North America. Key players like Lam Research Corporation, Applied Materials Inc., and Tokyo Electron US Holdings Inc. are at the forefront of driving innovation and catering to the evolving needs of this dynamic market.

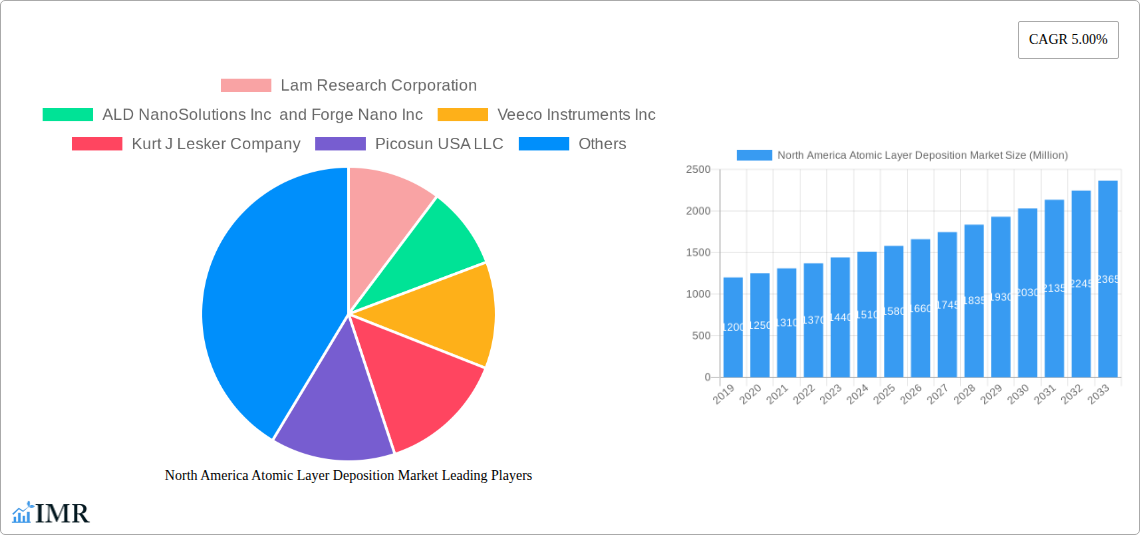

North America Atomic Layer Deposition Market Company Market Share

North America Atomic Layer Deposition Market: Comprehensive Report Description

Unlock profound insights into the burgeoning North America Atomic Layer Deposition (ALD) market. This in-depth report provides a granular analysis of ALD technology's transformative impact across critical sectors, from advanced semiconductor manufacturing to revolutionary healthcare applications and the evolving automotive industry. Discover market dynamics, growth trajectories, key player strategies, and emerging opportunities poised to shape the future of this high-tech landscape. Optimized with high-traffic keywords, this report is essential for industry professionals seeking to navigate and capitalize on the North America ALD market's immense potential.

North America Atomic Layer Deposition Market Market Dynamics & Structure

The North America Atomic Layer Deposition (ALD) market is characterized by a dynamic interplay of technological innovation, stringent regulatory frameworks, and evolving end-user demands. Market concentration is moderate, with several key players vying for dominance through continuous product development and strategic acquisitions. Technological innovation, particularly in precursor chemistry and process control, serves as a primary driver, enabling the deposition of ultra-thin, conformal films critical for next-generation electronics. Regulatory frameworks, while promoting safety and environmental standards, can also present compliance challenges for new entrants. The competitive landscape features a robust array of direct product substitutes, such as Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD), though ALD's inherent precision and conformality offer distinct advantages for specialized applications. End-user demographics are increasingly driven by the demands of the semiconductor industry for advanced node manufacturing, alongside the burgeoning requirements in healthcare for biocompatible coatings and biomedical devices. Mergers and Acquisitions (M&A) activity is a notable trend, with companies consolidating to enhance their technological portfolios and market reach.

- Market Concentration: Moderate, with significant contributions from both established giants and specialized ALD providers.

- Technological Innovation Drivers: Advancements in precursor development, plasma-enhanced ALD (PEALD), and in-situ monitoring techniques.

- Regulatory Frameworks: Focus on environmental impact, material safety, and equipment compliance, influencing process adoption.

- Competitive Product Substitutes: CVD, PVD, and other thin-film deposition techniques present alternative solutions for certain applications.

- End-User Demographics: Primarily driven by semiconductor fabrication, followed by emerging demand in healthcare and automotive sectors.

- M&A Trends: Strategic acquisitions aimed at expanding technology offerings and market access.

North America Atomic Layer Deposition Market Growth Trends & Insights

The North America Atomic Layer Deposition (ALD) market is experiencing robust growth, projected to reach $XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX.XX% from the base year 2025. This expansion is fueled by a confluence of factors, including the insatiable demand for more powerful and efficient semiconductors, the critical role of ALD in enabling advanced materials for emerging technologies, and the increasing adoption of ALD in specialized healthcare applications. The semiconductor segment continues to dominate, driven by the relentless pursuit of miniaturization and enhanced performance in integrated circuits (ICs), memory devices, and logic chips. As semiconductor nodes shrink, the requirement for highly conformal and precisely controlled thin films, achievable only through ALD, becomes paramount. Consumer behavior shifts towards devices with greater processing power, longer battery life, and enhanced functionalities further propel this demand.

Beyond semiconductors, the healthcare and biomedical application segment is a rapidly growing area. ALD's ability to deposit biocompatible, uniform coatings onto medical implants, sensors, and drug delivery systems is opening new avenues for therapeutic and diagnostic innovations. These coatings can improve biocompatibility, reduce rejection rates, and enhance the functionality of medical devices. The automotive industry is also increasingly leveraging ALD for applications such as catalytic converters, protective coatings for electronic components, and advanced battery technologies, contributing to improved fuel efficiency and enhanced vehicle performance.

Technological disruptions, such as the development of novel ALD precursors with lower toxicity and higher deposition rates, alongside advancements in equipment design for increased throughput and scalability, are key enablers of market penetration. The widespread adoption of ALD in research and development laboratories across universities and industrial R&D centers is laying the groundwork for future commercial applications. Furthermore, the growing emphasis on energy efficiency and sustainability in manufacturing processes is favoring ALD for its precise material utilization and reduced waste compared to some alternative deposition methods. The market penetration of ALD equipment and services is expected to deepen as its cost-effectiveness for high-value applications becomes more apparent, shifting it from a niche technology to a mainstream manufacturing process.

Dominant Regions, Countries, or Segments in North America Atomic Layer Deposition Market

The North America Atomic Layer Deposition (ALD) market is largely driven by the United States, which consistently accounts for the largest market share due to its robust semiconductor manufacturing ecosystem, extensive research and development activities, and significant government investment in advanced technologies. The country's established presence of leading chip manufacturers, research institutions, and a burgeoning venture capital landscape fosters rapid innovation and adoption of cutting-edge ALD solutions. Economic policies that support technological advancement, coupled with substantial investments in semiconductor fabrication plants (fabs) and R&D facilities, provide a fertile ground for ALD market growth.

Within the broader North American context, the Semiconductor application segment remains the undisputed leader. The insatiable demand for advanced microprocessors, memory chips, and other integrated circuits necessitates ALD's unparalleled precision in depositing ultra-thin, conformal dielectric and metallic layers. This is particularly crucial for enabling smaller feature sizes and enhanced device performance in next-generation logic and memory devices. The increasing complexity of semiconductor architectures, such as 3D NAND and FinFET transistors, relies heavily on ALD's ability to achieve uniform film coverage in challenging three-dimensional structures.

- Dominant Country: United States, driven by its strong semiconductor industry, advanced research infrastructure, and significant government funding for technology development.

- Dominant Segment: Semiconductor Applications, propelled by the relentless demand for advanced microelectronics, including logic, memory, and IoT devices.

- Key Drivers in the United States:

- Semiconductor Manufacturing Hub: Presence of major chip manufacturers and foundries.

- R&D Investments: Significant funding for academic and industrial research in advanced materials and nanotechnology.

- Government Initiatives: Support for domestic chip production and technological innovation.

- Emerging Technologies: Demand from AI, 5G, and high-performance computing driving advanced semiconductor needs.

- Growth Potential in the United States: Continued expansion of existing fabs and construction of new facilities, coupled with increasing demand for ALD in novel semiconductor materials and processes.

- Canada's Role: While smaller in market size compared to the US, Canada contributes significantly through its growing semiconductor research, advanced materials science, and niche applications in areas like photonics and quantum computing. Economic policies supporting innovation and a skilled workforce are key drivers for ALD adoption in Canada.

North America Atomic Layer Deposition Market Product Landscape

The North America ALD market is defined by a sophisticated product landscape featuring advanced ALD equipment and a diverse range of specialized precursors. Equipment manufacturers are continuously innovating to offer higher throughput, improved uniformity, and enhanced process control, catering to the stringent demands of semiconductor fabrication and emerging industrial applications. Notable product innovations include plasma-enhanced ALD (PEALD) systems that enable lower deposition temperatures and wider material compatibility, and spatial ALD (SALD) solutions for high-volume manufacturing. The development of compact and more cost-effective ALD systems is also expanding market accessibility. The product landscape is further enriched by a wide array of precursor chemicals, meticulously engineered for specific deposition processes, ensuring high purity and optimal reactivity for depositing materials like metal oxides, nitrides, and pure metals.

Key Drivers, Barriers & Challenges in North America Atomic Layer Deposition Market

Key Drivers:

- Technological Advancements: The relentless pursuit of miniaturization and performance enhancement in semiconductors, requiring ultra-thin, conformal films.

- Growing Demand in Emerging Sectors: Increasing adoption in healthcare for biomedical coatings and implants, and in automotive for advanced materials.

- Research and Development Intensification: Strong academic and industrial R&D activities driving new applications and material innovations.

- Government Support and Funding: Initiatives promoting domestic manufacturing and advanced technology development.

Barriers & Challenges:

- High Capital Investment: The initial cost of ALD equipment can be a significant barrier for smaller companies and research institutions.

- Process Complexity and Expertise: ALD processes require specialized knowledge and skilled personnel for operation and optimization.

- Precursor Availability and Cost: The cost and consistent supply of high-purity precursors can impact overall manufacturing economics.

- Competition from Alternative Technologies: While ALD offers unique advantages, other deposition techniques can be more cost-effective for less demanding applications.

- Supply Chain Disruptions: Global supply chain issues can affect the availability of critical components for ALD equipment and precursors.

- Scalability for Mass Production: Adapting ALD processes from research to high-volume manufacturing can present engineering challenges.

Emerging Opportunities in North America Atomic Layer Deposition Market

Emerging opportunities in the North America ALD market lie in the expansion of its application in the Internet of Things (IoT) and wearable technology, where miniaturized and power-efficient components are crucial. The development of ALD for advanced battery technologies, including solid-state batteries, presents a significant growth avenue by enabling stable electrolyte interfaces and electrode coatings. Furthermore, the increasing focus on sustainable manufacturing creates opportunities for ALD in developing eco-friendly coatings and processes with reduced material waste. The niche market of catalysis and quantum computing also offers untapped potential for ALD's precise atomic-level control.

Growth Accelerators in the North America Atomic Layer Deposition Market Industry

Several catalysts are accelerating growth in the North America Atomic Layer Deposition market. Technological breakthroughs in plasma-enhanced ALD (PEALD) and spatial ALD (SALD) are enabling faster deposition rates and broader material compatibility, making ALD more viable for high-volume manufacturing. Strategic partnerships between equipment manufacturers, precursor suppliers, and end-users are fostering collaborative innovation and faster market adoption. The increasing demand for high-performance computing and artificial intelligence necessitates advanced semiconductor nodes, directly boosting ALD demand. Furthermore, government incentives for reshoring semiconductor manufacturing and investing in critical technologies are creating a favorable environment for ALD market expansion.

Key Players Shaping the North America Atomic Layer Deposition Market Market

- Lam Research Corporation

- ALD NanoSolutions Inc

- Forge Nano Inc

- Veeco Instruments Inc

- Kurt J Lesker Company

- Picosun USA LLC

- Nano-Master Inc

- Applied Materials Inc

- ASM International

- Entegris Inc

- Tokyo Electron US Holdings Inc

Notable Milestones in North America Atomic Layer Deposition Market Sector

- 2019: Increased investment in R&D for advanced ALD precursors and novel process chemistries.

- 2020: Launch of next-generation ALD equipment designed for enhanced throughput and uniformity in semiconductor manufacturing.

- 2021: Growing adoption of ALD for critical layers in advanced logic and memory devices.

- 2022: Emergence of new ALD applications in flexible electronics and MEMS devices.

- 2023: Significant progress in developing scalable ALD solutions for biomedical applications, including implant coatings.

- 2024: Increased M&A activity as companies sought to consolidate technological expertise and market presence in the ALD sector.

In-Depth North America Atomic Layer Deposition Market Market Outlook

The future of the North America Atomic Layer Deposition market is exceptionally bright, driven by an ongoing revolution in electronics, healthcare, and energy. Growth accelerators such as continued advancements in semiconductor scaling, the burgeoning demand for personalized medicine enabled by advanced biomedical devices, and the critical role of ALD in next-generation battery technologies are setting a robust growth trajectory. Strategic partnerships and collaborative research efforts will further unlock innovative applications, while government initiatives supporting advanced manufacturing will solidify the region's leadership. The market is poised for sustained expansion, transforming from a specialized technology to a foundational pillar across multiple high-value industries.

North America Atomic Layer Deposition Market Segmentation

-

1. Application

- 1.1. Semiconductor

- 1.2. Healthcare and Biomedical Application

- 1.3. Automotive

- 1.4. Other Applications

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

-

2.1. North America

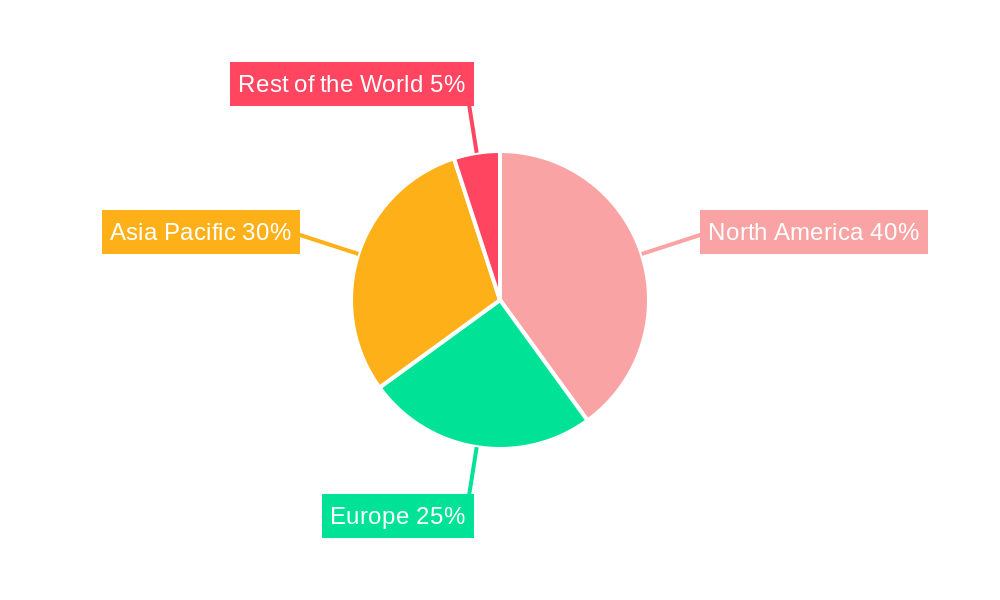

North America Atomic Layer Deposition Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America Atomic Layer Deposition Market Regional Market Share

Geographic Coverage of North America Atomic Layer Deposition Market

North America Atomic Layer Deposition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Flexible Sensors and Related Biomedical Applications; Growing R&D Activities Involving Tissue Engineering and Drug Delivery

- 3.3. Market Restrains

- 3.3.1. ; Limitation Regarding the Substrate Size and Higher Costs for the Coating Gases

- 3.4. Market Trends

- 3.4.1. Semiconductor and Electronics Segment are Expected to Hold the Largest Market Share in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Atomic Layer Deposition Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Semiconductor

- 5.1.2. Healthcare and Biomedical Application

- 5.1.3. Automotive

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lam Research Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ALD NanoSolutions Inc and Forge Nano Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Veeco Instruments Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kurt J Lesker Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Picosun USA LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nano-Master Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Applied Materials Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ASM International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Entegris Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tokyo Electron US Holdings Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Lam Research Corporation

List of Figures

- Figure 1: North America Atomic Layer Deposition Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Atomic Layer Deposition Market Share (%) by Company 2025

List of Tables

- Table 1: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Atomic Layer Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Atomic Layer Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Atomic Layer Deposition Market?

The projected CAGR is approximately 12.88%.

2. Which companies are prominent players in the North America Atomic Layer Deposition Market?

Key companies in the market include Lam Research Corporation, ALD NanoSolutions Inc and Forge Nano Inc, Veeco Instruments Inc, Kurt J Lesker Company, Picosun USA LLC, Nano-Master Inc, Applied Materials Inc, ASM International, Entegris Inc, Tokyo Electron US Holdings Inc.

3. What are the main segments of the North America Atomic Layer Deposition Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Flexible Sensors and Related Biomedical Applications; Growing R&D Activities Involving Tissue Engineering and Drug Delivery.

6. What are the notable trends driving market growth?

Semiconductor and Electronics Segment are Expected to Hold the Largest Market Share in the Forecast Period.

7. Are there any restraints impacting market growth?

; Limitation Regarding the Substrate Size and Higher Costs for the Coating Gases.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Atomic Layer Deposition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Atomic Layer Deposition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Atomic Layer Deposition Market?

To stay informed about further developments, trends, and reports in the North America Atomic Layer Deposition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence