Key Insights

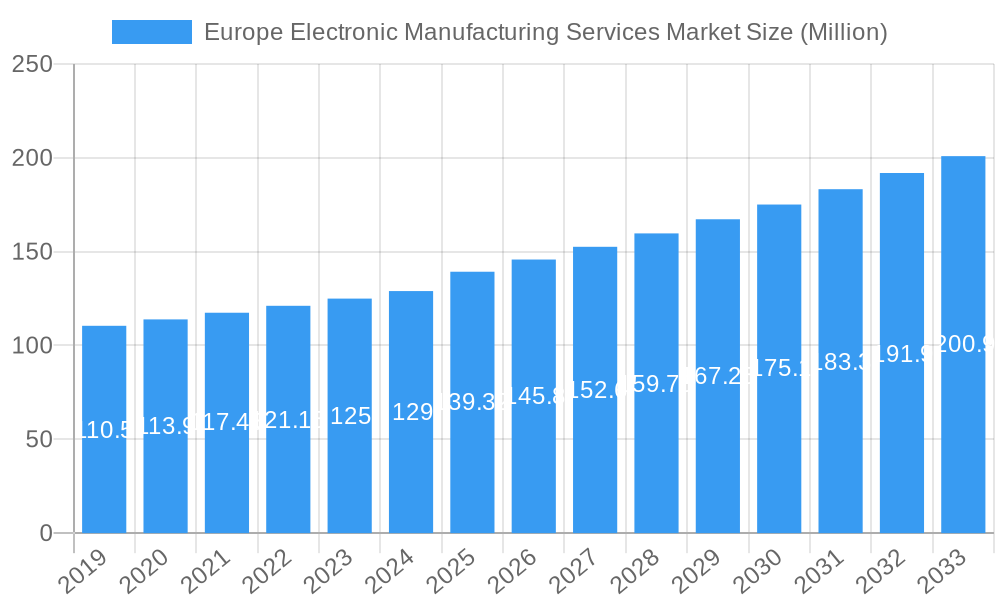

The Europe Electronic Manufacturing Services (EMS) market is poised for robust growth, projected to reach an estimated USD 139.32 million by 2025, with a steady Compound Annual Growth Rate (CAGR) of 4.70% anticipated through 2033. This expansion is driven by several key factors, including the increasing demand for sophisticated consumer electronics, the burgeoning automotive sector's embrace of advanced electronic components, and the critical role of IT and telecom infrastructure in digital transformation. Furthermore, the healthcare industry's reliance on innovative medical devices and the stringent requirements of the aerospace and defense sectors are substantial contributors to market dynamism. Emerging trends such as the rise of Industry 4.0, the growing adoption of IoT devices, and the continuous miniaturization and complexity of electronic components are fueling the need for specialized EMS. The segment of Electronics Design and Engineering is witnessing heightened importance as companies seek end-to-end solutions, from initial concept to final production.

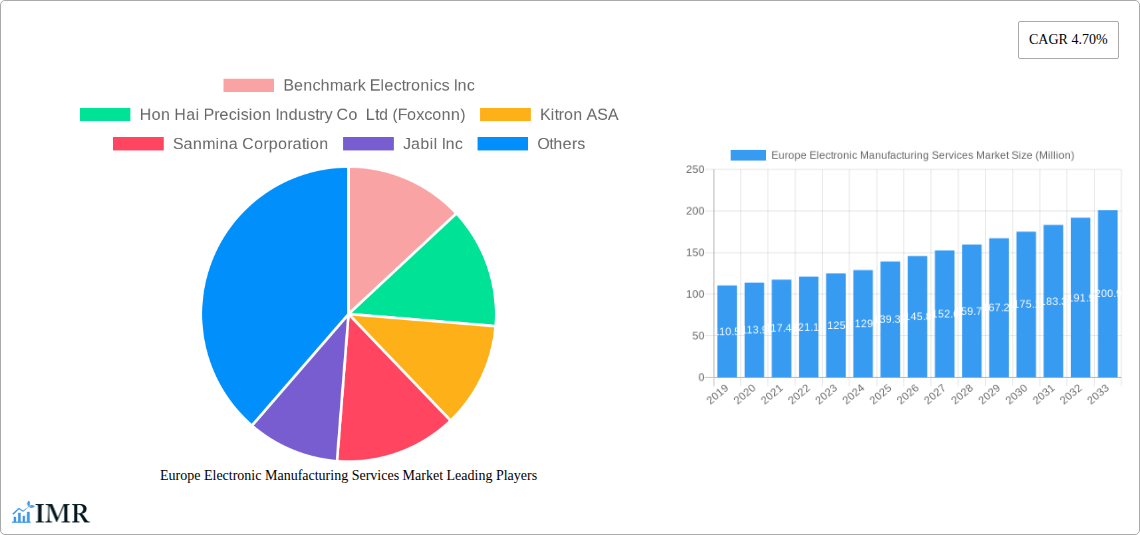

Europe Electronic Manufacturing Services Market Market Size (In Million)

The competitive landscape features prominent players like Hon Hai Precision Industry Co Ltd (Foxconn), Jabil Inc, and Sanmina Corporation, alongside established European providers such as Kitron ASA and Benchmark Electronics Inc. These companies are strategically investing in advanced manufacturing technologies, expanding their service portfolios, and focusing on sustainable practices to cater to evolving client needs and regulatory landscapes. While the market benefits from strong demand drivers and emerging trends, it faces certain restraints. These include potential supply chain disruptions, increasing raw material costs, and the constant pressure to innovate and maintain cost-competitiveness. The European region, with a focus on countries like the United Kingdom, Germany, France, and Italy, is a significant hub for EMS, benefiting from a strong industrial base and a skilled workforce. Continued investment in advanced manufacturing capabilities and a focus on niche, high-value applications will be crucial for sustained growth and market leadership.

Europe Electronic Manufacturing Services Market Company Market Share

This in-depth report provides an exhaustive analysis of the Europe Electronic Manufacturing Services (EMS) market, covering the period from 2019 to 2033, with a base year of 2025. The study delves into critical market dynamics, growth trends, regional dominance, product landscapes, and the strategic moves of key players shaping this vital sector. With a focus on high-traffic keywords such as "Europe EMS market," "electronics manufacturing Europe," "EMS providers Europe," "contract manufacturing Europe," and "electronics assembly Europe," this report is designed to offer unparalleled insights for industry professionals, investors, and decision-makers seeking to navigate the evolving landscape of electronic manufacturing in Europe. We explore both parent and child market segments to provide a holistic view of the industry's value chain and future potential, presenting all quantitative values in Million units.

Europe Electronic Manufacturing Services Market Market Dynamics & Structure

The Europe Electronic Manufacturing Services (EMS) market is characterized by a moderate to high concentration, with leading players like Hon Hai Precision Industry Co Ltd (Foxconn), Jabil Inc., and Sanmina Corporation holding significant market shares. Technological innovation is a primary driver, fueled by advancements in automation, Industry 4.0 integration, and the increasing complexity of electronic devices across various applications. Regulatory frameworks, particularly those related to environmental standards and data security, play a crucial role in shaping operational strategies. Competitive product substitutes exist, especially from lower-cost regions, but the European market's emphasis on quality, speed, and proximity to end-users creates a strong value proposition. End-user demographics are shifting towards a demand for highly customized and sophisticated electronic products, particularly in the automotive, industrial, and healthcare sectors. Mergers and acquisitions (M&A) are active, with companies consolidating to enhance capabilities, expand geographical reach, and achieve economies of scale. For instance, the past few years have seen several strategic acquisitions aimed at bolstering capabilities in areas like advanced electronics assembly and specialized design services.

- Market Concentration: Moderate to high, with top players holding substantial market share.

- Technological Innovation Drivers: Automation, Industry 4.0, advanced materials, miniaturization, AI integration.

- Regulatory Frameworks: REACH, RoHS, GDPR, WEEE Directive, influencing compliance and operational costs.

- Competitive Product Substitutes: Offshoring to Asia, nearshoring to Eastern Europe, in-house manufacturing by some OEMs.

- End-User Demographics: Increasing demand for smart devices, IoT integration, high-reliability products, and sustainable manufacturing.

- M&A Trends: Consolidation for scale, capability enhancement, and market access. Recent M&A activity has focused on acquiring specialized design and engineering expertise.

Europe Electronic Manufacturing Services Market Growth Trends & Insights

The Europe Electronic Manufacturing Services (EMS) market is projected to experience robust growth driven by several key trends. The increasing demand for sophisticated electronics in sectors like automotive (electrification, autonomous driving), industrial automation, and healthcare (medical devices, diagnostics) is a primary growth engine. Furthermore, the growing emphasis on reshoring and nearshoring initiatives, spurred by supply chain vulnerabilities exposed by recent global events, is creating significant opportunities for European EMS providers. Technological advancements, including the adoption of artificial intelligence (AI) in manufacturing processes, advanced robotics, and the Internet of Things (IoT) for enhanced traceability and efficiency, are accelerating market expansion. Consumer behavior shifts towards a preference for personalized, high-quality, and sustainably produced goods are also influencing EMS strategies, pushing providers to offer more flexible and eco-conscious manufacturing solutions. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. Market penetration for advanced EMS solutions is increasing as OEMs seek to offload complex manufacturing processes to specialized partners. The integration of digital technologies, such as digital twins and predictive maintenance, is further enhancing the value proposition of EMS providers.

Dominant Regions, Countries, or Segments in Europe Electronic Manufacturing Services Market

Within the Europe Electronic Manufacturing Services (EMS) market, Germany emerges as a dominant country, driven by its strong industrial base, significant automotive sector, and robust demand for high-end industrial electronics and advanced manufacturing solutions. The Industrial application segment is a major growth driver, encompassing automation, machinery, and power electronics, where European manufacturers hold a competitive edge in precision and reliability.

Dominant Country: Germany

- Key Drivers: Strong automotive sector, advanced industrial automation, high R&D investment, skilled workforce, stringent quality standards.

- Market Share: Germany accounts for an estimated xx% of the European EMS market revenue.

- Growth Potential: Continued investment in Industry 4.0 and sustainable manufacturing practices will fuel growth.

Dominant Application Segment: Industrial

- Key Drivers: Growth of smart factories, automation, Industry 4.0 adoption, demand for complex industrial machinery, and robust infrastructure development.

- Market Share: The Industrial segment is projected to capture xx% of the total EMS market by 2033.

- Growth Potential: The ongoing digital transformation across European industries, coupled with the need for advanced control systems and robotics, presents substantial opportunities.

Dominant Service Type: Electronics Manufacturing

- Key Drivers: Increasing outsourcing of manufacturing by OEMs, demand for high-volume production, focus on cost-efficiency and scalability.

- Market Share: Electronics Manufacturing accounts for approximately xx% of the EMS market.

- Growth Potential: As product lifecycles shorten and technological complexity increases, the demand for specialized manufacturing services is set to rise.

Europe Electronic Manufacturing Services Market Product Landscape

The Europe Electronic Manufacturing Services (EMS) market product landscape is increasingly characterized by highly integrated and intelligent electronic components and systems. Innovations are centered around miniaturization, increased power efficiency, enhanced connectivity, and specialized functionalities for niche applications. This includes advancements in printed circuit board assembly (PCBA) with advanced materials, sophisticated testing methodologies, and value-added services like configured-to-order (CTO) solutions. Performance metrics are focused on reliability, speed of production, compliance with rigorous industry standards (e.g., medical, aerospace), and sustainability. Unique selling propositions for EMS providers lie in their ability to offer end-to-end solutions, from initial design and prototyping to mass production, logistics, and after-sales support, all while maintaining high levels of quality and intellectual property protection.

Key Drivers, Barriers & Challenges in Europe Electronic Manufacturing Services Market

Key Drivers:

- Technological Advancements: The continuous evolution of electronics, including IoT, AI, and 5G, fuels demand for specialized EMS.

- Industry 4.0 Adoption: The push for smart factories and automation increases the need for integrated manufacturing solutions.

- Reshoring and Nearshoring Trends: Geopolitical shifts and supply chain resilience concerns are encouraging a return of manufacturing to Europe.

- Outsourcing by OEMs: Companies are increasingly focusing on core competencies, outsourcing complex manufacturing to specialized EMS providers.

Barriers & Challenges:

- High Labor Costs: Compared to Asian regions, labor costs in Western Europe can be a significant restraint.

- Intense Competition: Competition from global EMS providers and lower-cost manufacturing hubs.

- Regulatory Compliance: Navigating complex and evolving environmental, safety, and data privacy regulations.

- Supply Chain Disruptions: Volatility in raw material prices and availability, and logistical challenges can impact production timelines and costs.

- Talent Shortage: A growing demand for skilled engineers and technicians in advanced manufacturing.

Emerging Opportunities in Europe Electronic Manufacturing Services Market

Emerging opportunities in the Europe EMS market are largely driven by the growing demand for specialized and sustainable manufacturing. The expansion of the electric vehicle (EV) market presents a significant avenue, with increasing requirements for sophisticated battery management systems, power electronics, and in-car infotainment. The burgeoning medical device industry, particularly in areas like wearable health trackers and advanced diagnostic equipment, offers substantial growth potential. Furthermore, the increasing focus on circular economy principles is creating opportunities for EMS providers to offer repair, refurbishment, and end-of-life management services for electronic products, appealing to environmentally conscious OEMs and consumers. The development of secure and resilient supply chains is also creating opportunities for regionalized manufacturing hubs, enhancing delivery speeds and reducing logistical risks for European clients.

Growth Accelerators in the Europe Electronic Manufacturing Services Market Industry

Several catalysts are accelerating the long-term growth of the Europe Electronic Manufacturing Services market. The ongoing digital transformation across all major industries necessitates increasingly complex and interconnected electronic systems, directly benefiting EMS providers. Strategic partnerships between EMS companies and technology providers are enabling the integration of cutting-edge solutions like AI-powered quality control and advanced robotics. Government initiatives and funding programs aimed at bolstering domestic manufacturing capabilities and fostering innovation in critical sectors such as semiconductors and advanced electronics are providing significant impetus. Market expansion strategies, including mergers and acquisitions to broaden service portfolios and geographic reach, are also playing a crucial role in driving sustained growth and enhancing competitive positioning.

Key Players Shaping the Europe Electronic Manufacturing Services Market Market

- Benchmark Electronics Inc

- Hon Hai Precision Industry Co Ltd (Foxconn)

- Kitron ASA

- Sanmina Corporation

- Jabil Inc.

- SIIX Corporation

- Celestica Inc

- Integrated Micro-electronics Inc

- Wistron Corporation

- Plexus Corporation

- BMK Group

Notable Milestones in Europe Electronic Manufacturing Services Market Sector

- April 2024: Ark Electronics, a leading electronic manufacturing company, unveiled plans to expand its global factory network, introducing electronics manufacturing service (EMS) capabilities in Mexico and Europe. This strategic move aims to establish a low-cost country network, enhance customer flexibility, and offer integrated manufacturing solutions, enabling OEMs to conduct PCB Assembly in Asia and integrate it with services in Mexico or Europe for improved quality and reduced tariff costs.

- February 2024: The Semiconductor Joint Undertaking (Chips JU) unveiled EUR 216 million (~USD 231.35 million) in calls for proposals to strengthen research and innovation in semiconductors, microelectronics, and photonics. This initiative is designed to fortify collaboration within the European semiconductor industry, enhance industrial competitiveness, and facilitate the seamless transition of knowledge from research labs to production facilities.

In-Depth Europe Electronic Manufacturing Services Market Market Outlook

The future outlook for the Europe Electronic Manufacturing Services market is exceptionally promising, buoyed by continuous technological innovation and a strategic shift towards regionalized manufacturing. The escalating demand for sophisticated electronics in the automotive, industrial, and healthcare sectors, coupled with ongoing government support for domestic production, acts as a significant growth accelerant. Emerging opportunities in areas like advanced materials, IoT integration, and sustainable manufacturing are set to redefine the competitive landscape. EMS providers focusing on specialized capabilities, end-to-end solutions, and robust supply chain resilience will be best positioned to capitalize on the expanding market potential and secure long-term strategic advantages. The increasing adoption of Industry 4.0 principles and digital technologies will further enhance operational efficiency and drive value creation for both EMS providers and their OEM partners.

Europe Electronic Manufacturing Services Market Segmentation

-

1. Service Type

- 1.1. Electronics Design and Engineering

- 1.2. Electronics Assembly

- 1.3. Electronics Manufacturing

- 1.4. Other Service Types

-

2. Application

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. Industrial

- 2.4. Aerospace and Defense

- 2.5. Healthcare

- 2.6. IT and Telecom

- 2.7. Other Applications

Europe Electronic Manufacturing Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

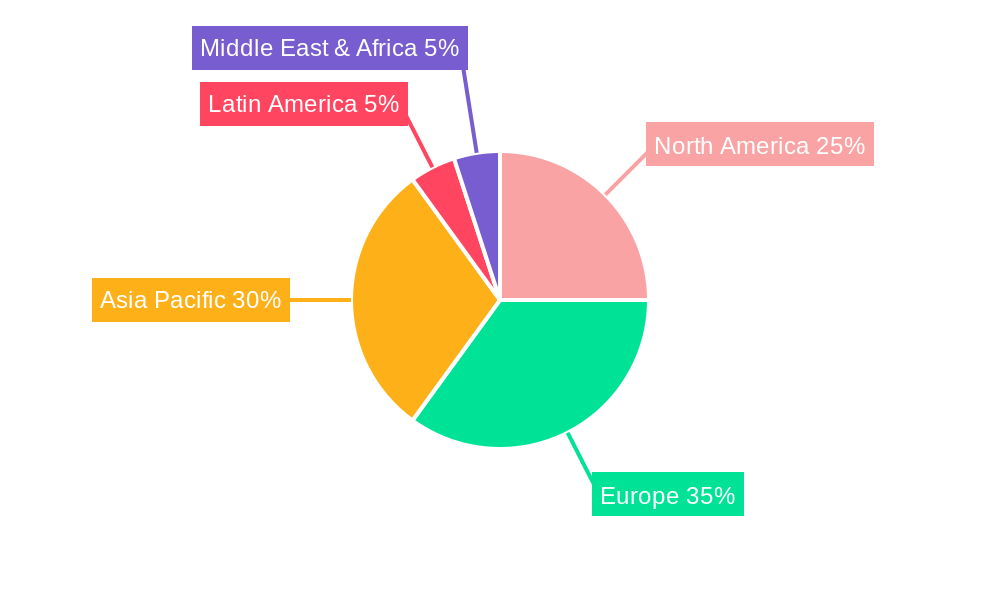

Europe Electronic Manufacturing Services Market Regional Market Share

Geographic Coverage of Europe Electronic Manufacturing Services Market

Europe Electronic Manufacturing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Digitalization and Industry 4.0 Integration; Increasing Inclination Towards Sustainability and Green Manufacturing Owing to Several Regional Government Regulations

- 3.3. Market Restrains

- 3.3.1. Increasing Digitalization and Industry 4.0 Integration; Increasing Inclination Towards Sustainability and Green Manufacturing Owing to Several Regional Government Regulations

- 3.4. Market Trends

- 3.4.1. Electronics Design and Engineering Service Type is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electronic Manufacturing Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Electronics Design and Engineering

- 5.1.2. Electronics Assembly

- 5.1.3. Electronics Manufacturing

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. Industrial

- 5.2.4. Aerospace and Defense

- 5.2.5. Healthcare

- 5.2.6. IT and Telecom

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Benchmark Electronics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hon Hai Precision Industry Co Ltd (Foxconn)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kitron ASA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sanmina Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jabil Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SIIX Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Celestica Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Integrated Micro-electronics Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wistron Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Plexus Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BMK Grou

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Benchmark Electronics Inc

List of Figures

- Figure 1: Europe Electronic Manufacturing Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Electronic Manufacturing Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Electronic Manufacturing Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Europe Electronic Manufacturing Services Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 3: Europe Electronic Manufacturing Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Europe Electronic Manufacturing Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Europe Electronic Manufacturing Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Electronic Manufacturing Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Electronic Manufacturing Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Europe Electronic Manufacturing Services Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 9: Europe Electronic Manufacturing Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Europe Electronic Manufacturing Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Europe Electronic Manufacturing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Electronic Manufacturing Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electronic Manufacturing Services Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Europe Electronic Manufacturing Services Market?

Key companies in the market include Benchmark Electronics Inc, Hon Hai Precision Industry Co Ltd (Foxconn), Kitron ASA, Sanmina Corporation, Jabil Inc, SIIX Corporation, Celestica Inc, Integrated Micro-electronics Inc, Wistron Corporation, Plexus Corporation, BMK Grou.

3. What are the main segments of the Europe Electronic Manufacturing Services Market?

The market segments include Service Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 139.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Digitalization and Industry 4.0 Integration; Increasing Inclination Towards Sustainability and Green Manufacturing Owing to Several Regional Government Regulations.

6. What are the notable trends driving market growth?

Electronics Design and Engineering Service Type is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Digitalization and Industry 4.0 Integration; Increasing Inclination Towards Sustainability and Green Manufacturing Owing to Several Regional Government Regulations.

8. Can you provide examples of recent developments in the market?

April 2024: Ark Electronics, a leading electronic manufacturing company, unveiled plans to expand its global factory network. The company will introduce electronics manufacturing service (EMS) capabilities in Mexico and Europe. This move aligns with Ark's strategy of establishing a low-cost country network, enhancing customer flexibility, and offering various manufacturing solutions. With these new capabilities, Ark Electronics enables OEMs to conduct PCB Assembly in Asia and integrate it with services in Mexico or Europe, such as configured-to-order (CTO), testing, and packaging. This integration ensures high quality and minimizes overall tariff costs for OEMs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electronic Manufacturing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electronic Manufacturing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electronic Manufacturing Services Market?

To stay informed about further developments, trends, and reports in the Europe Electronic Manufacturing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence