Key Insights

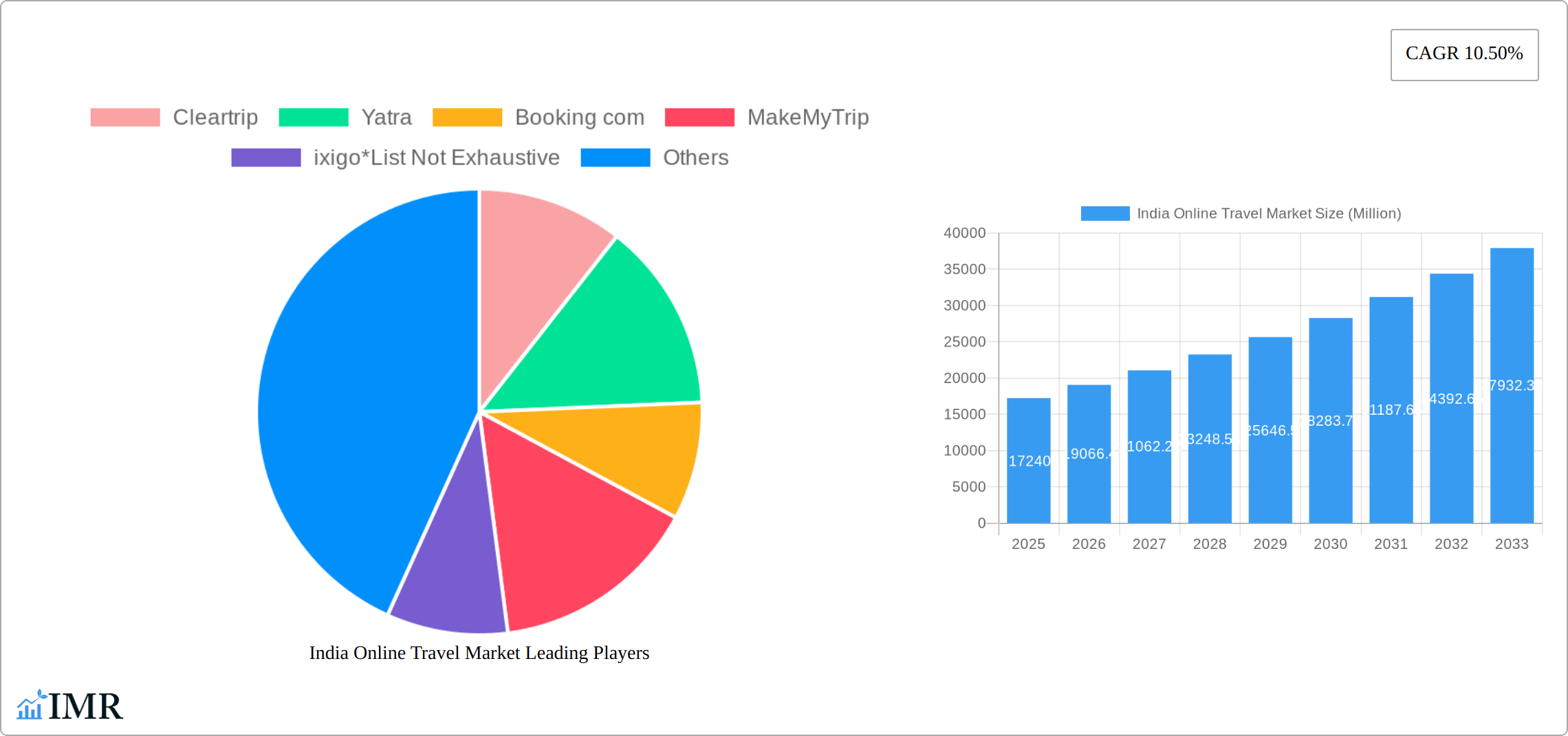

The Indian online travel market, valued at $17.24 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.50% from 2025 to 2033. This surge is fueled by several key factors. Increasing internet and smartphone penetration across India, particularly in previously underserved regions, is driving greater online adoption for travel bookings. A burgeoning middle class with rising disposable incomes is fuelling demand for both domestic and international travel, further boosting the online travel sector. The convenience and competitive pricing offered by Online Travel Agencies (OTAs) like MakeMyTrip, Cleartrip, and Booking.com are major attractions. Furthermore, the growth of budget airlines and the increasing popularity of customized travel packages are significantly contributing to the market's expansion. The market segmentation reveals strong demand across various service types (transportation, accommodation, packages), booking types (OTAs, direct suppliers), and platforms (desktop, mobile). The preference for independent travel is gradually increasing, alongside the persistent popularity of tour groups and packaged deals. While data for specific regional market shares within India (North, South, East, West) is not provided, the growth is expected to be relatively balanced across regions, reflecting India's diverse travel landscape.

India Online Travel Market Market Size (In Billion)

However, the market also faces challenges. Fluctuations in fuel prices, economic downturns, and intense competition among numerous players can influence growth trajectories. Maintaining customer trust and addressing concerns about data security are crucial for sustained growth. Furthermore, addressing infrastructural limitations in certain regions and managing seasonal demand fluctuations are key operational challenges for companies in this sector. Despite these restraints, the overall outlook for the Indian online travel market remains highly positive, driven by long-term demographic and technological trends. The market is expected to witness substantial growth in the coming years, solidifying its position as a key player in the global online travel industry.

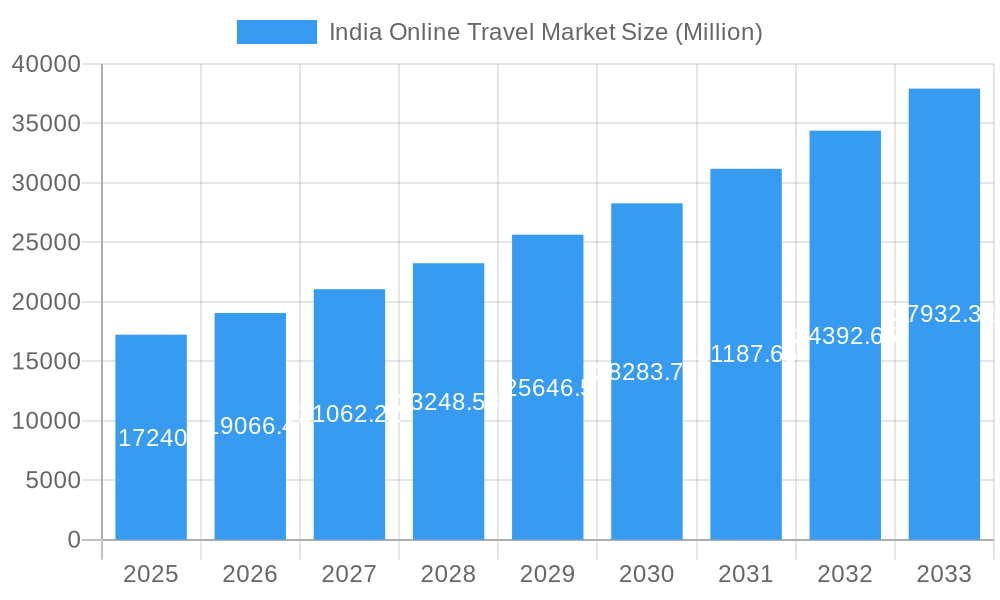

India Online Travel Market Company Market Share

India Online Travel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic India online travel market, offering invaluable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) and projected figures to deliver a clear understanding of market trends and future potential. The market is segmented by Service Type (Transportation, Travel Accommodation, Vacation Packages, Other Service Types), Booking Type (Online Travel Agencies, Direct Travel Suppliers), Platform (Desktop, Mobile), and Tour Type (Independent Traveller, Tour Group, Package Traveller). Key players analyzed include Cleartrip, Yatra, Booking.com, MakeMyTrip, ixigo, EaseMyTrip, Thomas Cook Ltd, Oyo Rooms, Expedia, Cox & Kings Ltd, and Via.com (list not exhaustive). The report projects a market size of xx Million in 2025.

India Online Travel Market Dynamics & Structure

The Indian online travel market exhibits a moderately concentrated structure, with a few dominant players alongside numerous smaller OTAs and direct suppliers. Technological innovation, particularly in mobile applications and AI-powered personalization, is a key driver. The regulatory framework, while evolving, plays a significant role in shaping market practices. Competitive substitutes include offline travel agencies and independent bookings, while end-user demographics are shifting towards younger, tech-savvy travelers. M&A activity has been moderate, with strategic acquisitions aimed at expanding service offerings and market reach.

- Market Concentration: MakeMyTrip and Cleartrip hold significant market share, estimated at xx% and xx% respectively in 2025.

- Technological Innovation: The adoption of AI for personalized recommendations and chatbots for customer service is rapidly increasing.

- Regulatory Framework: Government regulations related to data privacy and consumer protection are influencing market operations.

- Competitive Landscape: The market is witnessing increased competition from both established players and new entrants.

- M&A Activity: The number of M&A deals in the period 2019-2024 totalled xx, primarily focusing on consolidation and expansion.

India Online Travel Market Growth Trends & Insights

The Indian online travel market has witnessed robust growth over the past few years, driven by increasing internet and smartphone penetration, rising disposable incomes, and a growing preference for convenient online booking options. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Increased adoption of mobile platforms is a significant growth driver, while technological disruptions like AI-powered travel planning tools are reshaping consumer behavior. The shift towards personalized travel experiences and the rising popularity of domestic tourism are also influencing market dynamics.

- Market Size Evolution: The market witnessed a significant increase from xx Million in 2019 to xx Million in 2024.

- Adoption Rates: Mobile booking platforms are experiencing higher growth compared to desktop platforms.

- Technological Disruptions: AI-powered chatbots and personalized recommendations are gaining popularity.

- Consumer Behavior Shifts: Increased preference for domestic travel and unique experiences is observed.

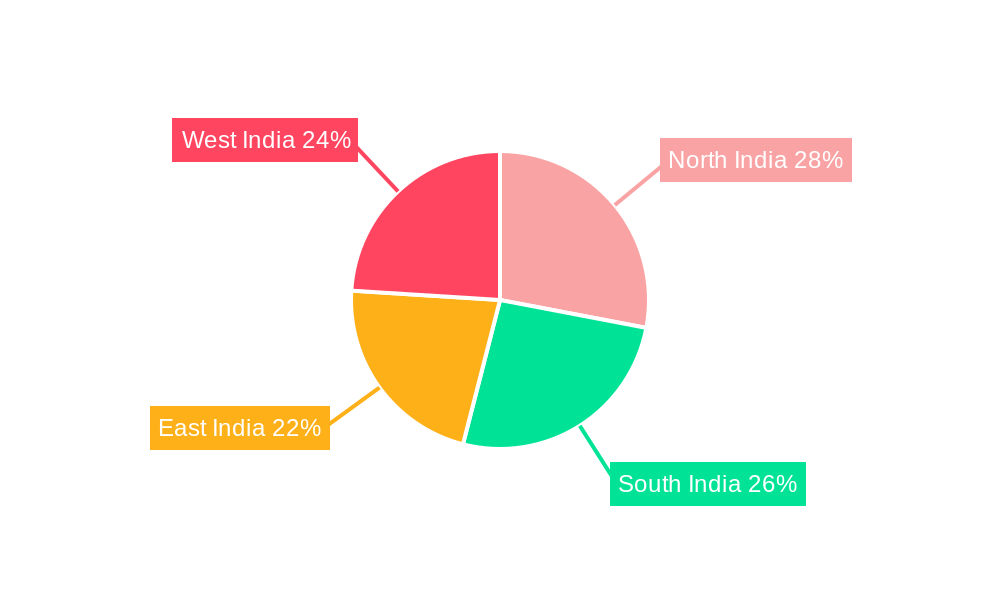

Dominant Regions, Countries, or Segments in India Online Travel Market

Metropolitan areas like Mumbai, Delhi, Bangalore, and Chennai spearhead the Indian online travel market, fueled by high internet and smartphone penetration, rising disposable incomes, and substantial populations. Air travel bookings within the transportation segment command the largest market share, followed closely by travel accommodation. Online Travel Agencies (OTAs) maintain a dominant position in the booking segment, leveraging their extensive networks and advanced technological capabilities. Mobile platforms are experiencing significantly faster growth than desktop, reflecting India's high mobile penetration rate. A considerable portion of the market is comprised of independent travelers seeking personalized experiences.

- Key Drivers: A burgeoning middle class, increasing disposable incomes, improved infrastructure, and the government's initiatives to boost tourism.

- Dominance Factors: High internet and mobile penetration, robust technological infrastructure, and a surge in consumer spending power, particularly amongst millennials and Gen Z.

- Growth Potential: Tier 2 and Tier 3 cities, along with untapped rural markets, represent significant growth opportunities for both OTAs and niche travel providers.

India Online Travel Market Product Landscape

The online travel market offers a wide array of products, from flight and hotel bookings to curated vacation packages and travel insurance. Innovative features include personalized itineraries, real-time price comparisons, and seamless mobile booking experiences. The key selling propositions are convenience, cost-effectiveness, and access to a wide range of travel options. Technological advancements like AI and blockchain are enhancing security and user experience.

Key Drivers, Barriers & Challenges in India Online Travel Market

Key Drivers:

- Rapidly increasing smartphone and internet penetration, especially in previously underserved areas.

- Expansion of the middle class with significantly higher disposable incomes and a willingness to spend on leisure and travel.

- Government initiatives designed to promote domestic and international tourism, including improved infrastructure and marketing campaigns.

- The rise of travel influencers and social media marketing, driving booking trends.

Key Challenges:

- Fierce competition among established OTAs and new entrants, leading to price wars and the need for differentiation.

- Fluctuations in fuel prices directly impacting transportation costs and overall travel packages.

- Growing concerns surrounding data security and privacy, requiring robust cybersecurity measures and transparent data handling practices.

- Navigating diverse linguistic and cultural preferences across India's vast population.

Emerging Opportunities in India Online Travel Market

- A substantial and growing demand for sustainable and eco-friendly travel options, appealing to environmentally conscious travelers.

- Increasing interest in niche tourism segments, such as adventure tourism, wellness tourism, and cultural immersion experiences.

- Significant potential for growth in rural and underserved markets by offering tailored travel packages and leveraging local partnerships.

- Expansion of travel insurance offerings to cater to a growing risk-averse consumer base.

Growth Accelerators in the India Online Travel Market Industry

Technological advancements, such as AI-driven personalization and virtual reality travel experiences, are major catalysts for growth. Strategic partnerships between OTAs and travel service providers are also expanding market reach and service offerings. Aggressive marketing strategies targeting specific demographics are driving market penetration.

Key Players Shaping the India Online Travel Market Market

- Cleartrip

- Yatra

- Booking.com

- MakeMyTrip

- ixigo

- EaseMyTrip

- Thomas Cook Ltd

- Oyo Rooms

- Expedia

- Cox & Kings Ltd

- Via.com

Notable Milestones in India Online Travel Market Sector

- August 2023: Skyscanner launched its Hindi language experience, aiming to increase market penetration and cater to a wider audience.

- August 2023: MakeMyTrip, in collaboration with the Ministry of Tourism, launched a "Travellers' Map of India," showcasing diverse destinations and promoting domestic tourism.

- [Add other relevant recent milestones here, with dates and brief descriptions]

In-Depth India Online Travel Market Market Outlook

The Indian online travel market exhibits strong potential for continued robust growth, driven by rapid technological advancements, evolving consumer preferences towards personalized and experiential travel, and consistent government support for the tourism sector. Strategic partnerships, expansion into untapped markets (especially rural areas and Tier 2/3 cities), and the adoption of innovative technologies like AI-powered personalization and virtual reality travel experiences will be pivotal for success in this dynamic and fiercely competitive landscape. A focus on personalized travel experiences, sustainable tourism practices, and leveraging mobile-first strategies will be key determinants of market leadership in the coming years.

India Online Travel Market Segmentation

-

1. Service Type

- 1.1. Transportation

- 1.2. Travel Accommodation

- 1.3. Vacation Packages

- 1.4. Other Service Types

-

2. Booking Type

- 2.1. Online Travel Agencies

- 2.2. Direct Travel Suppliers

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile

-

4. Tour Type

- 4.1. Tour Group

- 4.2. Package Traveller

India Online Travel Market Segmentation By Geography

- 1. India

India Online Travel Market Regional Market Share

Geographic Coverage of India Online Travel Market

India Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Winter Sports and Outdoor Recreation

- 3.3. Market Restrains

- 3.3.1. Unpredictable Weather Conditions

- 3.4. Market Trends

- 3.4.1. Growth of the Tourism Industry in India is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Transportation

- 5.1.2. Travel Accommodation

- 5.1.3. Vacation Packages

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online Travel Agencies

- 5.2.2. Direct Travel Suppliers

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile

- 5.4. Market Analysis, Insights and Forecast - by Tour Type

- 5.4.1. Tour Group

- 5.4.2. Package Traveller

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cleartrip

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yatra

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Booking com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MakeMyTrip

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ixigo*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EaseMyTrip

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thomas Cook Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oyo Rooms

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Expedia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cox & Kings Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Via com

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cleartrip

List of Figures

- Figure 1: India Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: India Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: India Online Travel Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 3: India Online Travel Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: India Online Travel Market Revenue Million Forecast, by Tour Type 2020 & 2033

- Table 5: India Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: India Online Travel Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 8: India Online Travel Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 9: India Online Travel Market Revenue Million Forecast, by Tour Type 2020 & 2033

- Table 10: India Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Online Travel Market?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the India Online Travel Market?

Key companies in the market include Cleartrip, Yatra, Booking com, MakeMyTrip, ixigo*List Not Exhaustive, EaseMyTrip, Thomas Cook Ltd, Oyo Rooms, Expedia, Cox & Kings Ltd, Via com.

3. What are the main segments of the India Online Travel Market?

The market segments include Service Type, Booking Type, Platform, Tour Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Winter Sports and Outdoor Recreation.

6. What are the notable trends driving market growth?

Growth of the Tourism Industry in India is Driving the Market.

7. Are there any restraints impacting market growth?

Unpredictable Weather Conditions.

8. Can you provide examples of recent developments in the market?

August 2023: Skyscanner launched its Hindi language experience across all its products and services to penetrate deeper into the Indian market. Skyscanner acts as a one-stop solution for travelers looking to compare ticket fares, hotel tariffs, and intra-city commutes by curating data from its partner Online Travel Agent (OTA) sites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Online Travel Market?

To stay informed about further developments, trends, and reports in the India Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence