Key Insights

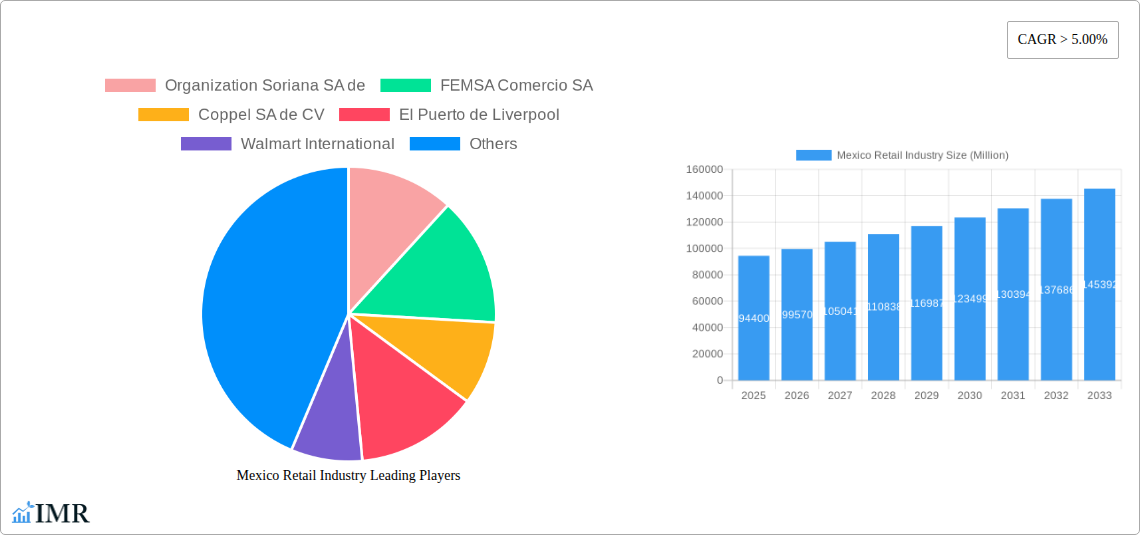

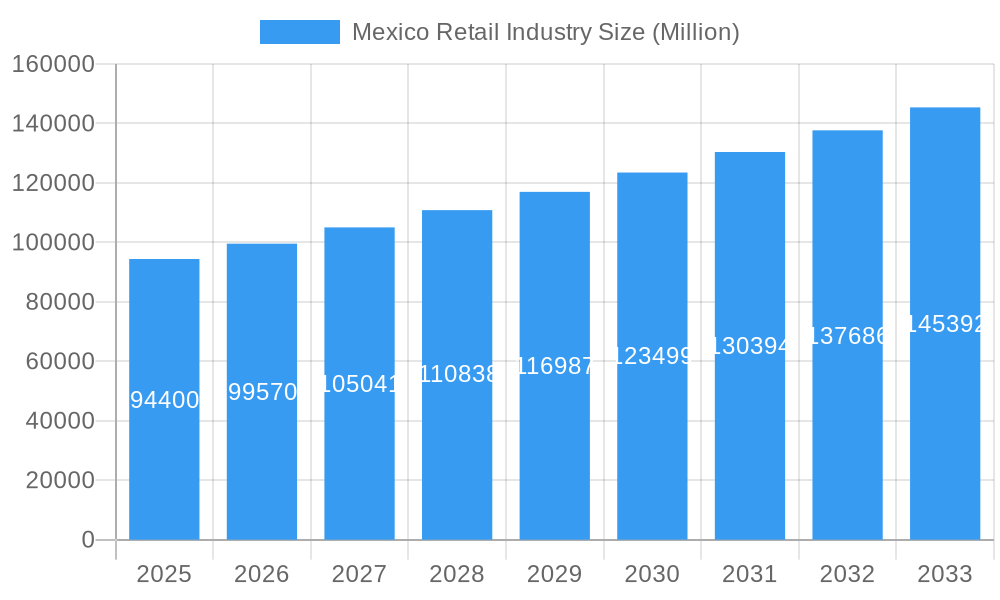

The Mexican retail industry, valued at $94.40 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by several key factors. A burgeoning middle class with increasing disposable income is driving consumer spending, particularly on apparel, electronics, and groceries. The rise of e-commerce and omnichannel strategies is transforming the retail landscape, with major players like Walmart International, Soriana, and FEMSA Comercio investing heavily in digital platforms and logistics to enhance customer experience and reach broader markets. Furthermore, Mexico's strategic location facilitates trade with the US and other Latin American countries, contributing to market growth. However, challenges remain, including economic volatility, fluctuating exchange rates, and increasing competition from both domestic and international players. Successfully navigating these obstacles requires retailers to adopt agile strategies, focusing on personalized customer experiences, efficient supply chains, and innovative pricing models.

Mexico Retail Industry Market Size (In Billion)

The competitive landscape is fiercely contested, with established players like Walmart International and Soriana facing competition from smaller, more agile businesses catering to niche markets. The ongoing expansion of organized retail, particularly in smaller cities and towns, indicates significant untapped potential. The industry's future hinges on adaptation to evolving consumer preferences, incorporating sustainable practices, and leveraging technological advancements to streamline operations and improve efficiency. A focus on data analytics to understand consumer behavior and tailor offerings accordingly will be crucial for success in this dynamic market. Key segments within the industry include grocery, apparel, electronics, and home improvement, each exhibiting unique growth trajectories and competitive dynamics. Continuous innovation and strategic investment are essential for maintaining a competitive edge in this rapidly evolving market.

Mexico Retail Industry Company Market Share

Mexico Retail Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico retail industry, encompassing market dynamics, growth trends, key players, and future opportunities. With a focus on the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this study is essential for industry professionals, investors, and strategic planners seeking to navigate this dynamic market. The report leverages extensive data and analysis to deliver actionable insights across various retail segments, including grocery, apparel, electronics, and more. High-growth parent markets like convenience stores (with child markets like coffee shops) and department stores are examined in detail.

Mexico Retail Industry Market Dynamics & Structure

The Mexican retail landscape is characterized by a blend of established multinational players and dynamic local businesses. Market concentration is moderate, with a few dominant players holding significant market share, but ample space for smaller businesses to thrive in niche segments. Technological innovation, particularly in e-commerce and omnichannel strategies, is a key driver, although infrastructure limitations in certain regions pose a challenge. Regulatory frameworks are constantly evolving, impacting pricing strategies and operational efficiency. Consumers are increasingly discerning, seeking both value and convenience, leading to intensified competition and the emergence of innovative product substitutes. M&A activity remains robust, with larger players seeking to expand their reach and market dominance.

- Market Concentration: Walmart, FEMSA Comercio, and Soriana hold a combined market share of approximately xx%.

- Technological Innovation: E-commerce penetration is growing at a CAGR of xx%, driven by increased smartphone adoption and improved logistics.

- Regulatory Framework: Recent regulations on pricing and consumer protection continue to shape competition.

- M&A Activity: An estimated xx M&A deals were recorded in the retail sector between 2019 and 2024.

- End-User Demographics: The growing middle class and young population fuels demand for diverse retail offerings.

Mexico Retail Industry Growth Trends & Insights

The Mexican retail market has exhibited consistent growth over the past five years, driven by a robust economy and rising consumer spending. The market size reached xx million units in 2024 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx%. E-commerce adoption is accelerating, although physical stores remain dominant. Consumer behavior is shifting towards omnichannel shopping, emphasizing convenience and personalized experiences. Technological disruptions, including the rise of mobile payments and data-driven personalization, are significantly influencing the industry's trajectory. Changes in consumer preferences toward sustainability and ethical sourcing are also impacting product offerings and sourcing practices.

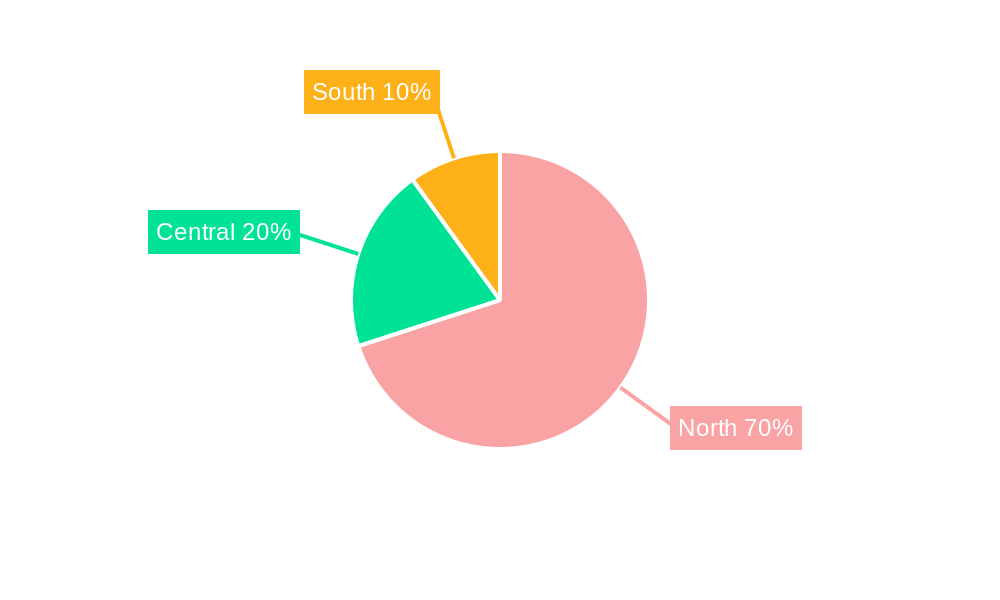

Dominant Regions, Countries, or Segments in Mexico Retail Industry

The largest retail markets are concentrated in major metropolitan areas like Mexico City, Guadalajara, and Monterrey, benefiting from high population density and strong purchasing power. Growth in these regions is fueled by robust economic activity, improved infrastructure, and higher disposable incomes. The convenience store segment (parent market), encompassing chains like OXXO, showcases strong growth potential driven by increasing urbanization and demand for on-the-go consumption. Within this segment, coffee shops (child market) are also demonstrating significant expansion.

- Key Drivers: Strong economic growth in major urban centers, improving infrastructure, rising disposable incomes.

- Market Share: Mexico City accounts for approximately xx% of total retail sales.

- Growth Potential: Smaller cities and rural areas present untapped opportunities for expansion.

Mexico Retail Industry Product Landscape

The Mexican retail market offers a diverse range of products, catering to a broad spectrum of consumer needs and preferences. Product innovation focuses on enhancing convenience, quality, and customization. Technological advancements, including AI-powered inventory management and personalized recommendations, are being integrated into retail operations. Unique selling propositions emphasize value for money, brand reputation, and superior customer service.

Key Drivers, Barriers & Challenges in Mexico Retail Industry

Key Drivers:

- Increasing disposable incomes and rising consumer spending

- Growing e-commerce penetration

- Expansion of retail infrastructure in underserved areas

Key Challenges:

- Economic volatility and inflation impacting consumer spending

- Intense competition from both domestic and international players

- Supply chain disruptions impacting product availability and pricing.

- Regulatory changes and compliance costs.

Emerging Opportunities in Mexico Retail Industry

- Untapped Markets: Expanding into smaller cities and rural areas offers significant growth opportunities.

- Innovative Applications: The adoption of technologies like AI and blockchain can enhance efficiency and customer experience.

- Evolving Consumer Preferences: Catering to growing demand for sustainable and ethically sourced products presents an opportunity.

Growth Accelerators in the Mexico Retail Industry Industry

Technological advancements, strategic partnerships, and targeted market expansion strategies are key drivers of long-term growth. Investments in logistics and supply chain optimization are crucial for improving efficiency and reducing costs. The development of omnichannel strategies and leveraging data analytics for personalized customer experiences are vital for enhancing competitiveness.

Key Players Shaping the Mexico Retail Industry Market

- Organization Soriana SA de

- FEMSA Comercio SA

- Coppel SA de CV

- El Puerto de Liverpool

- Walmart International

- El Palacio de Hierro

- Superama

- Sears Operadora Mexico SA De CV

- Auchan

- Carrefour

Notable Milestones in Mexico Retail Industry Sector

- January 2023: FEMSA launched Andretti Drive, a new drive-thru coffee shop concept.

- March 2023: Walmart opened 22 new stores in Nuevo Leon.

In-Depth Mexico Retail Industry Market Outlook

The Mexican retail industry is poised for continued growth, driven by a young and expanding population, increasing urbanization, and rising disposable incomes. Strategic investments in technology, sustainable practices, and omnichannel strategies will be critical for success. The potential for further market consolidation and increased foreign direct investment presents both opportunities and challenges for existing and new players. The focus on convenience, digitalization, and personalization will continue shaping the sector.

Mexico Retail Industry Segmentation

-

1. Product

- 1.1. Food and Beverage and Tobacco Products

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

-

2. Distribution Channel

- 2.1. Hypermarkets

- 2.2. Supermarkets

- 2.3. Convenience Stores

- 2.4. Department Stores

- 2.5. Specialty Stores

Mexico Retail Industry Segmentation By Geography

- 1. Mexico

Mexico Retail Industry Regional Market Share

Geographic Coverage of Mexico Retail Industry

Mexico Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Easy Shopping Experience Drives The Market; Greater Inventory Options Drives The Market

- 3.3. Market Restrains

- 3.3.1. Easy Shopping Experience Drives The Market; Greater Inventory Options Drives The Market

- 3.4. Market Trends

- 3.4.1. Growth of E-commerce Sector Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverage and Tobacco Products

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets

- 5.2.2. Supermarkets

- 5.2.3. Convenience Stores

- 5.2.4. Department Stores

- 5.2.5. Specialty Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Organization Soriana SA de

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FEMSA Comercio SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coppel SA de CV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 El Puerto de Liverpool

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Walmart International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 El Palacio de Hierro

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Superama

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sears Operadora Mexico SA De CV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Auchan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Carrefour**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Organization Soriana SA de

List of Figures

- Figure 1: Mexico Retail Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Retail Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Retail Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Mexico Retail Industry Volume Billion Forecast, by Product 2020 & 2033

- Table 3: Mexico Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Mexico Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Mexico Retail Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Mexico Retail Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Mexico Retail Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Mexico Retail Industry Volume Billion Forecast, by Product 2020 & 2033

- Table 9: Mexico Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Mexico Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Mexico Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Mexico Retail Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Retail Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Mexico Retail Industry?

Key companies in the market include Organization Soriana SA de, FEMSA Comercio SA, Coppel SA de CV, El Puerto de Liverpool, Walmart International, El Palacio de Hierro, Superama, Sears Operadora Mexico SA De CV, Auchan, Carrefour**List Not Exhaustive.

3. What are the main segments of the Mexico Retail Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 94.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Easy Shopping Experience Drives The Market; Greater Inventory Options Drives The Market.

6. What are the notable trends driving market growth?

Growth of E-commerce Sector Drives the Market.

7. Are there any restraints impacting market growth?

Easy Shopping Experience Drives The Market; Greater Inventory Options Drives The Market.

8. Can you provide examples of recent developments in the market?

March 2023 - Walmart opened 22 new stores across the state of Nuevo Leon as a part of an investment in the region’s infrastructure. Walmart made the decision during its 12th anniversary in Monterrey.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Retail Industry?

To stay informed about further developments, trends, and reports in the Mexico Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence