Key Insights

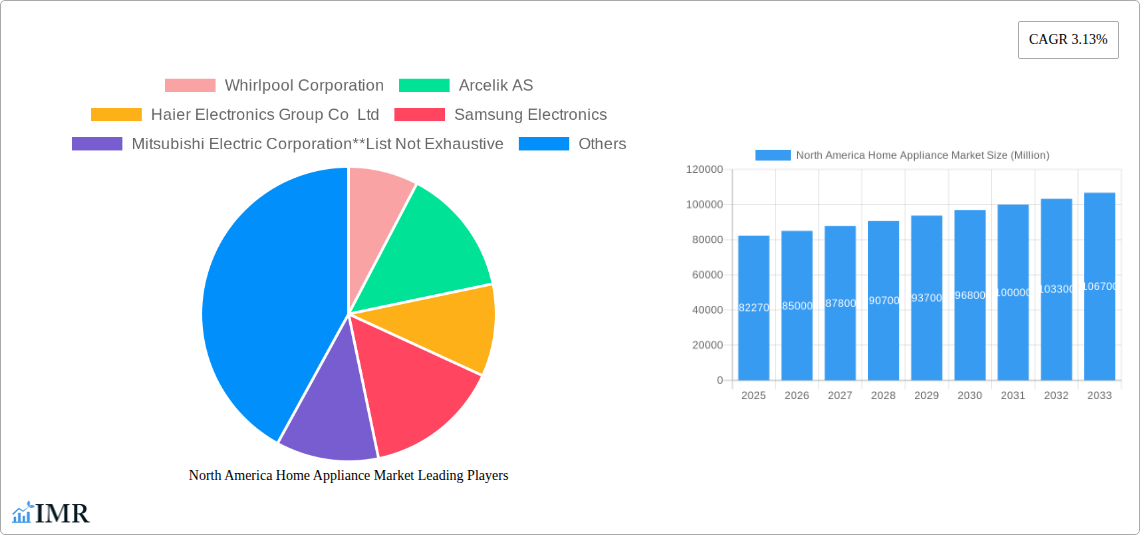

The North American home appliance market, valued at $82.27 billion in 2025, is projected to experience steady growth, driven by several key factors. Rising disposable incomes, coupled with increasing urbanization and the preference for modern, convenient living, are fueling demand for both small and major appliances. The segment encompassing small kitchen appliances, like toasters and grills, and personal care items such as hair dryers and clippers, is witnessing significant growth due to evolving consumer lifestyles and a focus on convenience. Simultaneously, the major appliance segment, including refrigerators, washing machines, and dishwashers, is experiencing growth propelled by technological advancements, such as smart home integration and energy-efficient models. E-commerce channels are playing an increasingly crucial role in distribution, providing consumers with a wider selection and enhanced convenience. However, factors such as economic fluctuations and supply chain disruptions could potentially restrain market growth in the forecast period. Competition amongst established players like Whirlpool, Samsung, and LG, alongside emerging brands, is intensifying, leading to innovation in product features and design. Furthermore, increasing consumer awareness of sustainability and energy efficiency is driving demand for eco-friendly appliances.

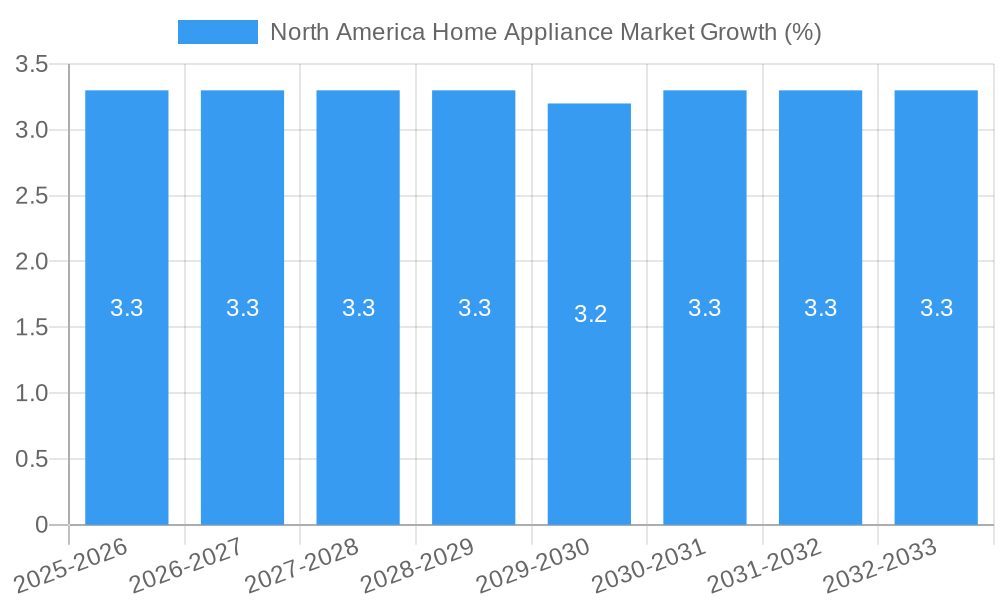

The forecast period (2025-2033) anticipates sustained growth, albeit at a moderate pace. The 3.13% CAGR suggests a gradual expansion, influenced by macroeconomic conditions and technological innovation. While the market faces potential challenges like fluctuating raw material prices and potential economic slowdowns, the underlying demand for home appliances, fueled by demographic trends and technological advancements, is expected to remain robust. The continued rise of e-commerce alongside the ongoing focus on product innovation will shape the competitive landscape and drive the market's trajectory. Specific regional variations within North America (United States, Canada, and Mexico) may exist, with potential differences in growth rates and consumer preferences. However, the overall market outlook remains positive, underpinned by strong fundamental drivers.

North America Home Appliance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America home appliance market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, dominant segments, and key players, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report forecasts a market size of XX million units by 2033, presenting a detailed breakdown by major appliances (refrigerators, freezers, dishwashers, washing machines, cookers, ovens) and small appliances (vacuum cleaners, small kitchen appliances, hair clippers, irons, toasters, grills & roasters, hair dryers). The analysis encompasses various distribution channels, including supermarkets/hypermarkets, specialty stores, and e-commerce platforms.

North America Home Appliance Market Dynamics & Structure

This section analyzes the competitive landscape, encompassing market concentration, technological advancements, regulatory influences, and prevalent M&A activities within the North American home appliance market. The study period (2019-2024) reveals a market characterized by [Insert quantitative data on market concentration, e.g., a Herfindahl-Hirschman Index (HHI) value and interpretation]. Technological innovation, driven by factors such as [mention specific examples like smart home integration, energy efficiency improvements, and material advancements], significantly influences market dynamics.

- Market Concentration: [Insert data on market share of top 3-5 players. Example: Whirlpool holds approximately X% market share, followed by Samsung at Y%].

- Technological Innovation: Key drivers include advancements in energy efficiency, smart home integration (e.g., Wi-Fi connectivity and app control), and sustainable material usage. Barriers to innovation include high R&D costs and complexities in integrating new technologies across various product lines.

- Regulatory Framework: [Discuss relevant regulations and standards influencing appliance manufacturing and sales. Example: Energy efficiency standards and safety regulations impact product design and manufacturing costs.]

- Competitive Substitutes: [Discuss substitutes like renting appliances or using shared services. Quantify their market impact, if possible.]

- M&A Activity: The period 2019-2024 witnessed [Insert number] major mergers and acquisitions, with a notable example being Exertis' acquisition of Almo Corp. in January 2022, expanding its North American distribution network. This activity signifies consolidation and strategic expansion within the sector.

- End-User Demographics: [Discuss key demographic trends shaping demand. Example: Growing urbanization and changing consumer preferences towards convenience and smart appliances.]

North America Home Appliance Market Growth Trends & Insights

Utilizing comprehensive market research data, this section analyzes the market's size evolution, adoption rates of new technologies, and shifts in consumer behavior. The historical period (2019-2024) demonstrates a [Insert CAGR value]% Compound Annual Growth Rate (CAGR) for the overall market. This growth is attributable to [explain factors: e.g., rising disposable incomes, increased urbanization, and the adoption of smart home technologies]. The estimated market size for 2025 is XX million units, indicating a [Insert description: e.g., continued upward trajectory]. Forecast data (2025-2033) projects a CAGR of [Insert CAGR value]%, driven by factors including [explain factors contributing to the projected future growth]. Specific market penetration rates for key appliances will also be detailed. Consumer behavior analysis reveals a preference shift toward [Explain consumer trends e.g., energy-efficient appliances, smart home integration, and premium features].

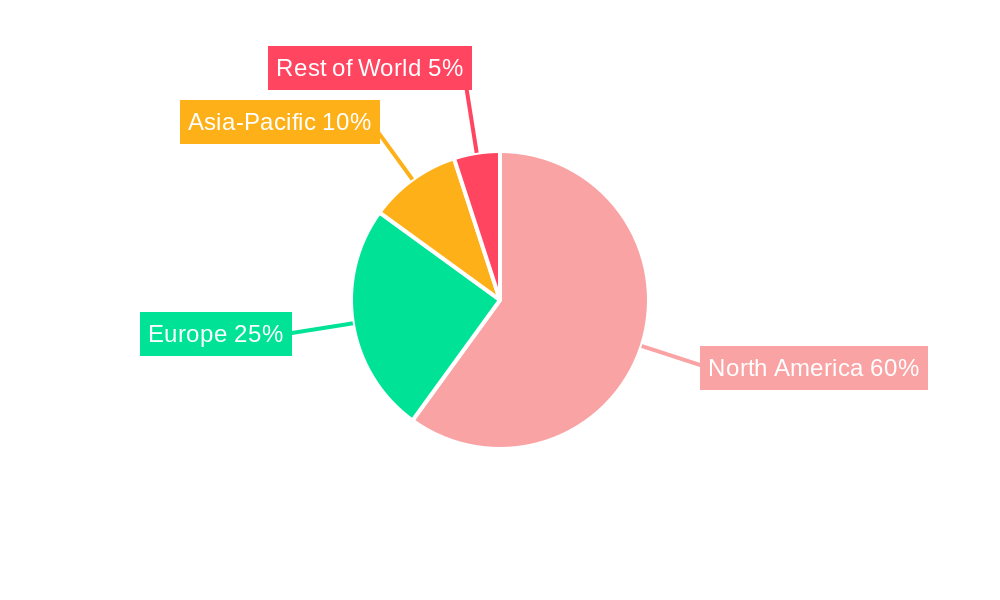

Dominant Regions, Countries, or Segments in North America Home Appliance Market

This section pinpoints the leading regions, countries, and segments within the North American home appliance market, driving overall growth. [Insert which region is dominant and provide data to support the claim. Example: The [Region Name] region dominated the market, accounting for X% of total sales in 2024. This dominance can be attributed to factors including higher disposable incomes, greater urbanization, and robust infrastructure supporting distribution networks.]

- By Major Appliances: Refrigerators and washing machines represent the largest segments, with [Insert market share data for each major appliance category].

- By Small Appliances: Small kitchen appliances like blenders and toasters demonstrate significant growth potential due to rising consumer demand for convenience and time-saving solutions.

- By Distribution Channel: E-commerce platforms are witnessing increasing adoption, with [Insert projected growth rate or market share data for this channel]. Supermarkets and hypermarkets remain significant channels.

North America Home Appliance Market Product Landscape

The North American home appliance market exhibits significant product innovation, encompassing advancements in energy efficiency, connectivity features, and improved design aesthetics. Smart appliances equipped with Wi-Fi and app integration are witnessing growing popularity. Unique selling propositions encompass features like voice control, remote monitoring, and customized settings. Technological advancements include improvements in motor technology, insulation, and materials leading to enhanced durability and energy conservation.

Key Drivers, Barriers & Challenges in North America Home Appliance Market

Key Drivers: Rising disposable incomes, increased urbanization, technological advancements (smart appliances, energy efficiency), and government initiatives promoting energy conservation contribute to market growth.

Key Challenges & Restraints: Supply chain disruptions, increasing raw material costs, stringent regulatory standards (energy efficiency and safety), and intense competition from both domestic and international players pose significant challenges. These challenges collectively impact manufacturing costs and market profitability. For example, the [Mention a specific example of a supply chain disruption and its market impact].

Emerging Opportunities in North America Home Appliance Market

Emerging opportunities arise from increasing consumer demand for smart home integration, the growing adoption of subscription-based appliance maintenance services, and the potential for expansion in underserved rural markets. Additionally, eco-conscious consumers are driving demand for energy-efficient and sustainable appliances.

Growth Accelerators in the North America Home Appliance Market Industry

Long-term growth hinges on technological breakthroughs such as AI-powered appliance control, the development of sustainable materials and manufacturing processes, and strategic partnerships between appliance manufacturers and smart home technology providers. Expanding into untapped markets and offering tailored appliance solutions for niche consumer segments also represent significant growth opportunities.

Key Players Shaping the North America Home Appliance Market Market

- Whirlpool Corporation

- Arcelik AS

- Haier Electronics Group Co Ltd

- Samsung Electronics

- Mitsubishi Electric Corporation

- Gorenje Group

- BSH Hausgeräte GmbH

- Electrolux AB

- Panasonic Corporation

- LG Electronics

Notable Milestones in North America Home Appliance Market Sector

- April 2023: Frigidaire partnered with Ossify to enter the Indian market, indicating potential expansion strategies for North American appliance manufacturers.

- January 2022: Exertis' acquisition of Almo Corp. expanded its North American distribution network, highlighting industry consolidation.

In-Depth North America Home Appliance Market Outlook

The North American home appliance market holds significant long-term growth potential. Strategic partnerships, technological innovation in smart home integration and sustainability, and expansion into underserved markets will drive future growth. The market’s trajectory indicates continued expansion, with [mention key factors driving this expansion]. Opportunities for manufacturers lie in offering innovative, energy-efficient, and connected appliance solutions that meet evolving consumer preferences.

North America Home Appliance Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Home Appliance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Home Appliance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization is Driving the Market; Rising Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1 Price Sensitivity of Consumers is Restraining the Market; Saturation of the Market

- 3.3.2 with Availability of Wide Range of Brands and Products

- 3.4. Market Trends

- 3.4.1. Small Appliances are Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Home Appliance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Home Appliance Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Home Appliance Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Home Appliance Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Home Appliance Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Whirlpool Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Arcelik AS

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Haier Electronics Group Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Samsung Electronics

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mitsubishi Electric Corporation**List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Gorenje Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BSH Hausgeräte GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Electrolux AB

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Panasonic Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 LG Electronics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Whirlpool Corporation

List of Figures

- Figure 1: North America Home Appliance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Home Appliance Market Share (%) by Company 2024

List of Tables

- Table 1: North America Home Appliance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Home Appliance Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: North America Home Appliance Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: North America Home Appliance Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: North America Home Appliance Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: North America Home Appliance Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: North America Home Appliance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Home Appliance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Home Appliance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Home Appliance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Home Appliance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Home Appliance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Home Appliance Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: North America Home Appliance Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: North America Home Appliance Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: North America Home Appliance Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: North America Home Appliance Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: North America Home Appliance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Home Appliance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Home Appliance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Home Appliance Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Home Appliance Market?

The projected CAGR is approximately 3.13%.

2. Which companies are prominent players in the North America Home Appliance Market?

Key companies in the market include Whirlpool Corporation, Arcelik AS, Haier Electronics Group Co Ltd, Samsung Electronics, Mitsubishi Electric Corporation**List Not Exhaustive, Gorenje Group, BSH Hausgeräte GmbH, Electrolux AB, Panasonic Corporation, LG Electronics.

3. What are the main segments of the North America Home Appliance Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 82.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization is Driving the Market; Rising Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Small Appliances are Dominating the Market.

7. Are there any restraints impacting market growth?

Price Sensitivity of Consumers is Restraining the Market; Saturation of the Market. with Availability of Wide Range of Brands and Products.

8. Can you provide examples of recent developments in the market?

April 2023: To enter the Indian market, American consumer electronics manufacturer Frigidaire partnered with Indian consumer electronics company Ossify.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Home Appliance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Home Appliance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Home Appliance Market?

To stay informed about further developments, trends, and reports in the North America Home Appliance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence