Key Insights

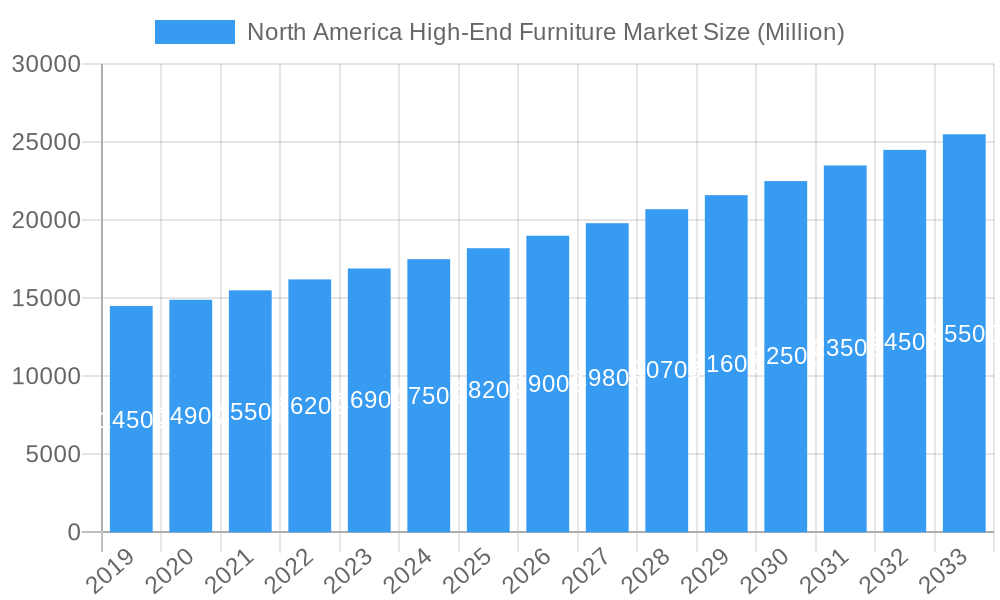

The North America High-End Furniture Market is projected for substantial expansion, expected to reach a market size of $8.75 billion by the base year 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 13.86% through 2033. This growth is fueled by rising disposable incomes and a heightened demand for luxury and bespoke living spaces. Key growth factors include a rising appreciation for superior craftsmanship, premium materials, and distinctive design aesthetics. The market is experiencing a significant trend towards customization, with consumers increasingly personalizing furniture to match their specific preferences and spatial needs. This trend is amplified by the influence of interior designers and the growing online presence of luxury brands, enhancing the accessibility and aspirational appeal of high-end furniture. Emerging trends like the integration of smart technology and sustainable materials are also catering to the evolving desires of affluent consumers.

North America High-End Furniture Market Market Size (In Billion)

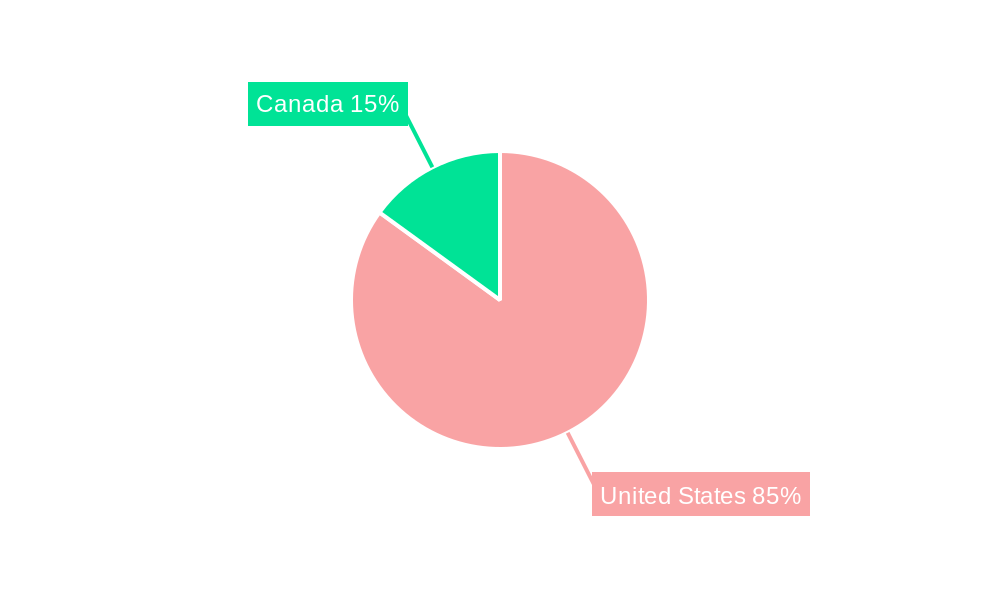

While the market outlook is positive, potential restraints include the inherent high price point of luxury furniture, which can limit market reach, and the impact of economic downturns on discretionary spending. Complex supply chains for premium materials and skilled craftsmanship may also pose logistical challenges. The market is segmented by product type, with seating and tables holding significant shares due to their pivotal role in both residential and commercial interiors. Distribution channels are dominated by designer studios and specialty furniture stores, emphasizing the value of curated experiences and expert guidance in high-end furniture purchases. The United States is anticipated to lead the market share, supported by its significant affluent population and a mature luxury goods sector, with Canada also contributing to sustained growth.

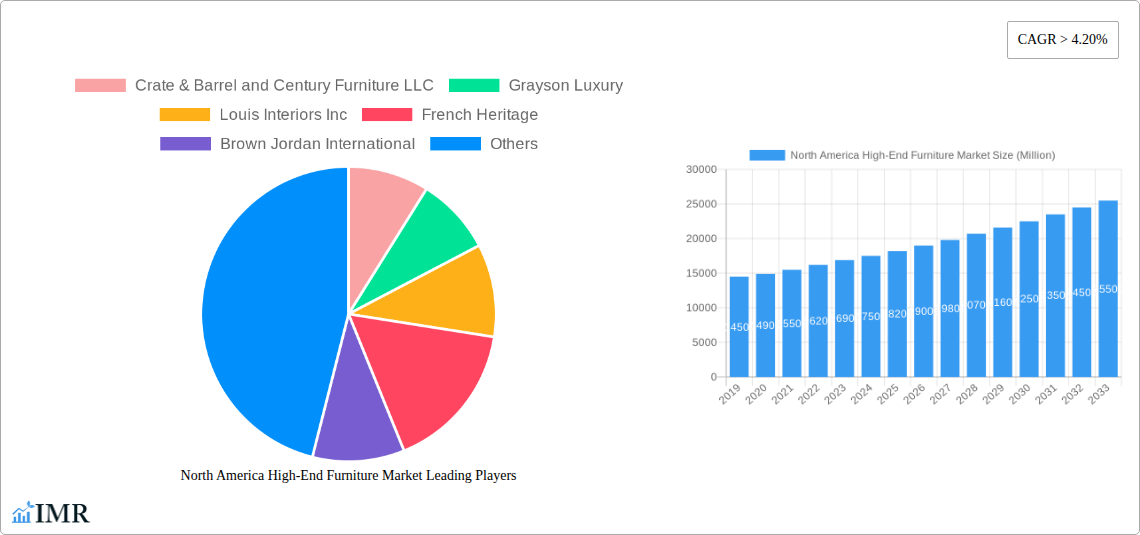

North America High-End Furniture Market Company Market Share

This report provides a comprehensive, SEO-optimized overview of the North America High-End Furniture Market, detailing market size, growth, and forecasts for immediate utilization.

North America High-End Furniture Market: Dynamics, Trends, and Future Outlook (2019-2033)

This in-depth market research report provides a comprehensive analysis of the North America High-End Furniture Market, covering historical data, current trends, and future projections from 2019 to 2033. With a base year of 2025 and an estimated year of 2025, the report offers critical insights into market size, growth drivers, challenges, and key player strategies. We explore the nuanced landscape of luxury furniture, including designer furniture, bespoke furniture, luxury seating, high-end dining tables, and premium beds, across key segments like residential furniture and commercial furniture. The report meticulously examines distribution channels, including designer studios, furniture specialty stores, and the rapidly growing online furniture market. Discover critical industry developments and market opportunities shaping the future of this lucrative sector.

North America High-End Furniture Market Market Dynamics & Structure

The North America High-End Furniture Market exhibits a moderate level of concentration, with established brands like RH (Restoration Hardware) and Pottery Barn maintaining significant market share. Technological innovation is primarily driven by advancements in material science, sustainable manufacturing processes, and the integration of smart technologies within furniture. Regulatory frameworks, while generally supportive of luxury goods, can introduce complexities related to import/export regulations and environmental standards, particularly concerning sustainable sourcing. Competitive product substitutes include mid-tier furniture that offers similar aesthetics at lower price points, and the increasing demand for vintage and antique pieces. End-user demographics are characterized by high-net-worth individuals (HNWIs) and a growing segment of affluent millennials and Gen Z who prioritize design, quality, and brand storytelling. Mergers and acquisitions (M&A) activity is present, though often focused on niche acquisitions to expand product portfolios or market reach rather than outright consolidation.

- Market Concentration: Moderate, with key players holding substantial market share.

- Technological Innovation: Focus on sustainable materials, smart furniture, and advanced manufacturing.

- Regulatory Frameworks: Impact on import/export and environmental compliance.

- Competitive Substitutes: Mid-tier furniture, vintage/antique pieces.

- End-User Demographics: HNWIs, affluent millennials and Gen Z prioritizing design and quality.

- M&A Trends: Niche acquisitions for portfolio expansion.

North America High-End Furniture Market Growth Trends & Insights

The North America High-End Furniture Market is projected for robust growth, driven by increasing disposable incomes, a rising preference for aesthetically superior and durable home furnishings, and the growing influence of interior design trends. The luxury furniture market is expanding at an estimated Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This growth is fueled by consumers' willingness to invest in statement pieces that reflect their personal style and status. Adoption rates for high-end furniture are steadily increasing, particularly within the residential furniture segment, as homeowners prioritize creating sophisticated and comfortable living spaces. Technological disruptions, such as 3D visualization tools and augmented reality (AR) for furniture placement, are enhancing the customer experience and driving online sales. Consumer behavior shifts indicate a growing demand for personalized and customizable furniture, along with an increasing emphasis on sustainability and ethical sourcing. The market penetration of bespoke and artisan furniture is also on an upward trajectory. The online furniture market is a significant growth catalyst, offering wider accessibility to luxury brands and a seamless purchasing experience. The commercial furniture sector, encompassing luxury hospitality and corporate spaces, also contributes significantly to market expansion, driven by the demand for distinctive and durable furnishings that enhance brand image.

Dominant Regions, Countries, or Segments in North America High-End Furniture Market

The United States stands as the dominant country within the North America High-End Furniture Market, accounting for an estimated XX% of the total market value. This dominance is attributed to its larger affluent population, higher disposable incomes, and a deeply ingrained culture of appreciating luxury goods and sophisticated interior design. Within the United States, major metropolitan areas such as New York, Los Angeles, Miami, and San Francisco are key hubs for high-end furniture consumption.

In terms of product segments, Seating Products (Chairs, Armchairs, Sofas) consistently leads the market, representing approximately XX% of sales. This is due to the integral role seating plays in living rooms, dining areas, and commercial lounges, where comfort, style, and craftsmanship are paramount. Tables (Dining Tables, Reception Tables, etc.) follow closely, driven by the importance of dining experiences and the desire for statement pieces in both residential and commercial settings.

The Residential end-user segment is the primary driver of market growth, accounting for an estimated XX% of the total market. Homeowners are increasingly investing in their living spaces, seeking to create personalized sanctuaries that reflect their success and aesthetic sensibilities. This trend is amplified by the prevalence of luxury real estate and a strong demand for high-quality, durable, and aesthetically pleasing furniture.

Regarding distribution channels, Designer Studios and Furniture Specialty Stores continue to hold significant sway, offering personalized consultations, curated selections, and a tactile experience that online channels cannot fully replicate. However, the Online distribution channel is experiencing rapid growth, projected to capture a larger market share due to its convenience, accessibility, and the increasing sophistication of e-commerce platforms for luxury goods.

- Dominant Country: United States (XX% Market Share)

- Key Hubs: New York, Los Angeles, Miami, San Francisco.

- Drivers: High affluent population, disposable income, appreciation for luxury and design.

- Dominant Product Segment: Seating Products (Chairs, Armchairs, Sofas) (XX% Market Share)

- Significance: Integral to living and dining spaces, focus on comfort, style, and craftsmanship.

- Dominant End-User Segment: Residential (XX% Market Share)

- Drivers: Investment in home spaces, desire for personalized sanctuaries, demand for quality and aesthetics.

- Dominant Distribution Channels: Designer Studios & Furniture Specialty Stores (Traditional strength, personalized experience)

- Emerging Strength: Online (Convenience, accessibility, platform sophistication).

North America High-End Furniture Market Product Landscape

The North America High-End Furniture Market is characterized by a diverse product landscape where Seating Products such as plush sofas, bespoke armchairs, and intricately designed chairs are paramount. Tables, including opulent dining tables, executive reception tables, and artisanal coffee tables, showcase superior craftsmanship and premium materials like exotic woods, marble, and fine metals. Beds, featuring luxurious frames, high-thread-count linens, and ergonomic designs, contribute significantly to the residential segment. The innovation lies in the integration of sustainable materials, smart technologies for enhanced comfort, and unique design aesthetics that cater to discerning tastes.

Key Drivers, Barriers & Challenges in North America High-End Furniture Market

Key Drivers:

- Rising Disposable Incomes: Increased wealth among the affluent population directly fuels demand for luxury goods.

- Growing Appreciation for Design & Craftsmanship: Consumers are increasingly valuing unique styles, quality materials, and artisanal construction.

- Home Improvement & Renovation Trends: A strong emphasis on creating sophisticated and comfortable living and working spaces.

- Influence of Interior Designers and Media: High-end furniture is frequently featured in lifestyle magazines, television shows, and social media, driving aspirational purchasing.

- Sustainability & Ethical Sourcing: A growing segment of consumers prioritizes environmentally friendly and ethically produced furniture.

Barriers & Challenges:

- High Price Points: The premium cost of high-end furniture limits its accessibility to a broader consumer base.

- Economic Downturns & Recessions: Luxury spending is often discretionary and susceptible to economic volatility.

- Supply Chain Disruptions: Global events and logistics challenges can impact the availability and cost of raw materials and finished products.

- Counterfeit Products: The presence of counterfeit luxury furniture can dilute brand value and impact sales.

- Intense Competition: The market features both established luxury brands and emerging designers, creating a competitive landscape.

- Changing Consumer Preferences: Rapidly evolving design trends require manufacturers to be agile and innovative.

Emerging Opportunities in North America High-End Furniture Market

Emerging opportunities within the North America High-End Furniture Market center around the growing demand for sustainable and eco-friendly luxury furniture, as consumers become more environmentally conscious. The increasing digitalization of the furniture industry presents significant opportunities for brands to enhance their online presence, leverage virtual reality (VR) and augmented reality (AR) for immersive customer experiences, and personalize online shopping journeys. Customization and personalization services, allowing consumers to tailor designs, materials, and finishes, are gaining traction. Furthermore, the expansion of the luxury hospitality sector and the demand for high-end office furniture in a hybrid work environment offer substantial growth avenues. The integration of smart home technology into furniture, offering enhanced comfort and connectivity, is another promising area.

Growth Accelerators in the North America High-End Furniture Market Industry

Several catalysts are accelerating the growth of the North America High-End Furniture Market. Technological breakthroughs in material science are enabling the creation of more durable, lightweight, and sustainable furniture components. Strategic partnerships between furniture manufacturers and high-end interior designers are crucial for co-creating innovative collections and reaching target audiences. Market expansion strategies, including the opening of flagship showrooms in prime urban locations and targeted digital marketing campaigns, are vital for increasing brand visibility and customer engagement. The increasing disposable income of affluent demographics, coupled with a rising aspirational consumer base, continues to fuel demand. Furthermore, the growing emphasis on home as a sanctuary and a reflection of personal status reinforces the value proposition of premium furniture.

Key Players Shaping the North America High-End Furniture Market Market

- Crate & Barrel

- Century Furniture LLC

- Grayson Luxury

- Louis Interiors Inc

- French Heritage

- Brown Jordan International

- Barrymore Furniture

- RH (Restoration Hardware)

- Pottery Barn

- Nella Vetrina

- Bradington-Young

- Koket

Notable Milestones in North America High-End Furniture Market Sector

- 2021/2022: RH (Restoration Hardware) launches new collections emphasizing sustainable materials and artisanal craftsmanship, boosting its market appeal.

- 2022/2023: Brown Jordan International focuses on outdoor luxury furniture, expanding its reach in premium residential and hospitality sectors.

- 2023: Century Furniture LLC invests in advanced manufacturing technologies to enhance customization capabilities and production efficiency.

- 2023/2024: Pottery Barn expands its online presence with enhanced virtual consultations and personalized shopping experiences.

- 2024: Grayson Luxury partners with emerging designers to introduce innovative, trend-forward pieces, attracting a younger affluent demographic.

- Ongoing: Companies like French Heritage and Barrymore Furniture continue to emphasize traditional craftsmanship and timeless design, maintaining a loyal customer base.

In-Depth North America High-End Furniture Market Market Outlook

The North America High-End Furniture Market is poised for sustained growth, driven by an increasing consumer emphasis on quality, design, and experiential luxury. Key growth accelerators include the ongoing trend of home renovation and personalization, the expansion of online retail channels offering greater accessibility, and the growing demand for sustainable and ethically sourced products. Strategic partnerships between established brands and emerging designers will continue to shape product innovation, while technological advancements in digital visualization and smart furniture will enhance customer engagement. The market outlook remains highly positive, with significant opportunities for companies that can effectively cater to the evolving preferences of affluent consumers, adapt to digital transformation, and maintain a strong commitment to craftsmanship and sustainability. The projected market size of $XX Billion by 2033 underscores the significant potential and enduring appeal of the high-end furniture sector.

North America High-End Furniture Market Segmentation

-

1. Product

- 1.1. Seating Products (Chairs, Armchairs, Sofas)

- 1.2. Cabinets and Entertainment Units

- 1.3. Tables (Dining Tables, Reception Tables, etc.,)

- 1.4. Beds

- 1.5. Other Products

-

2. Distribution Channel

- 2.1. Designer Studios

- 2.2. Furniture Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

-

3. End-User

- 3.1. Residential

- 3.2. Commerical

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America High-End Furniture Market Segmentation By Geography

- 1. United States

- 2. Canada

North America High-End Furniture Market Regional Market Share

Geographic Coverage of North America High-End Furniture Market

North America High-End Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolving Home Décor Concepts; Rapid Growth in Residential Buildings to Drive Market

- 3.3. Market Restrains

- 3.3.1. High Initial Cost; Limited Distribution Channels

- 3.4. Market Trends

- 3.4.1. Multi-Functional and Highly Durable Furniture are Helping in Market Expansion

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America High-End Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Seating Products (Chairs, Armchairs, Sofas)

- 5.1.2. Cabinets and Entertainment Units

- 5.1.3. Tables (Dining Tables, Reception Tables, etc.,)

- 5.1.4. Beds

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Designer Studios

- 5.2.2. Furniture Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commerical

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America High-End Furniture Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Seating Products (Chairs, Armchairs, Sofas)

- 6.1.2. Cabinets and Entertainment Units

- 6.1.3. Tables (Dining Tables, Reception Tables, etc.,)

- 6.1.4. Beds

- 6.1.5. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Designer Studios

- 6.2.2. Furniture Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Residential

- 6.3.2. Commerical

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America High-End Furniture Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Seating Products (Chairs, Armchairs, Sofas)

- 7.1.2. Cabinets and Entertainment Units

- 7.1.3. Tables (Dining Tables, Reception Tables, etc.,)

- 7.1.4. Beds

- 7.1.5. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Designer Studios

- 7.2.2. Furniture Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Residential

- 7.3.2. Commerical

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Crate & Barrel and Century Furniture LLC

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Grayson Luxury

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Louis Interiors Inc

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 French Heritage

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Brown Jordan International

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Barrymore Furniture

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 RH (Restoration Hardware)

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Pottery Barn

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Nella Vetrina

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Bradington-Young

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 Koket

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.1 Crate & Barrel and Century Furniture LLC

List of Figures

- Figure 1: North America High-End Furniture Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America High-End Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: North America High-End Furniture Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: North America High-End Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: North America High-End Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America High-End Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America High-End Furniture Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: North America High-End Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: North America High-End Furniture Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America High-End Furniture Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: North America High-End Furniture Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: North America High-End Furniture Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: North America High-End Furniture Market Revenue billion Forecast, by Product 2020 & 2033

- Table 12: North America High-End Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 13: North America High-End Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America High-End Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America High-End Furniture Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 16: North America High-End Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 17: North America High-End Furniture Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: North America High-End Furniture Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: North America High-End Furniture Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: North America High-End Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: North America High-End Furniture Market Revenue billion Forecast, by Product 2020 & 2033

- Table 22: North America High-End Furniture Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 23: North America High-End Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: North America High-End Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 25: North America High-End Furniture Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: North America High-End Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 27: North America High-End Furniture Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: North America High-End Furniture Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: North America High-End Furniture Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: North America High-End Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America High-End Furniture Market?

The projected CAGR is approximately 13.86%.

2. Which companies are prominent players in the North America High-End Furniture Market?

Key companies in the market include Crate & Barrel and Century Furniture LLC, Grayson Luxury, Louis Interiors Inc, French Heritage, Brown Jordan International, Barrymore Furniture, RH (Restoration Hardware), Pottery Barn, Nella Vetrina, Bradington-Young, Koket.

3. What are the main segments of the North America High-End Furniture Market?

The market segments include Product, Distribution Channel, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.75 billion as of 2022.

5. What are some drivers contributing to market growth?

Evolving Home Décor Concepts; Rapid Growth in Residential Buildings to Drive Market.

6. What are the notable trends driving market growth?

Multi-Functional and Highly Durable Furniture are Helping in Market Expansion.

7. Are there any restraints impacting market growth?

High Initial Cost; Limited Distribution Channels.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America High-End Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America High-End Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America High-End Furniture Market?

To stay informed about further developments, trends, and reports in the North America High-End Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence