Key Insights

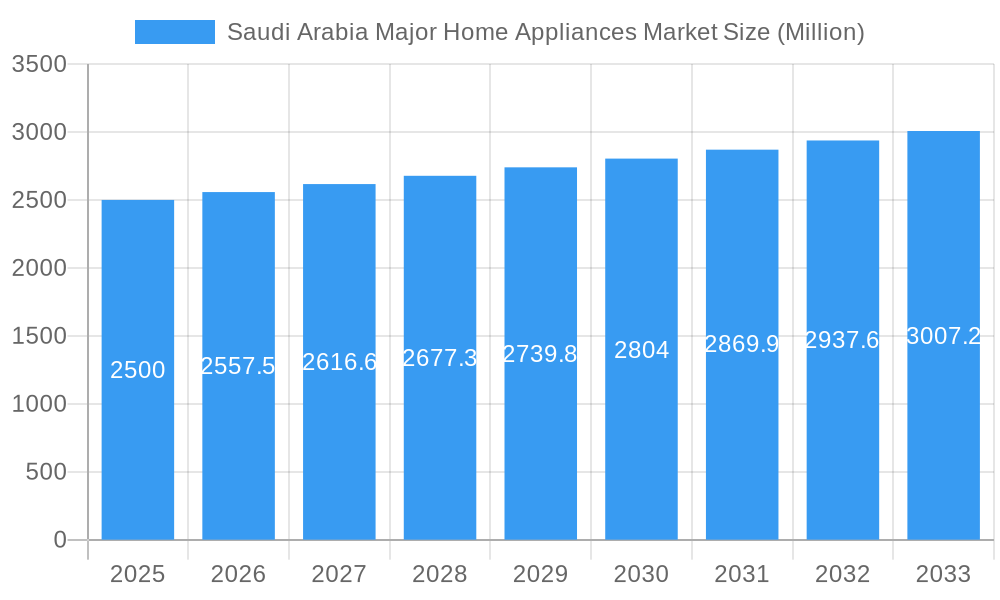

The Saudi Arabian major home appliances market, valued at approximately $2.17 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.63% from 2025 to 2033. Key growth drivers include rising disposable incomes, increasing urbanization, and government infrastructure initiatives. Consumers are increasingly favoring energy-efficient appliances due to rising energy costs and environmental consciousness. The market is segmented by product type (refrigerators, freezers, dishwashers, washing machines, ovens, air conditioners, etc.) and distribution channels (hypermarkets, specialty stores, online retailers, etc.). Leading international and domestic brands compete for significant market share.

Saudi Arabia Major Home Appliances Market Market Size (In Billion)

Potential market constraints include fluctuations in oil prices impacting consumer spending and susceptibility to global economic trends. However, the long-term outlook is positive, supported by Saudi Arabia's economic diversification and Vision 2030. The expansion of e-commerce offers significant growth opportunities, alongside the development of innovative appliances to meet evolving consumer preferences. Regional market demand variations necessitate targeted marketing and customized product offerings.

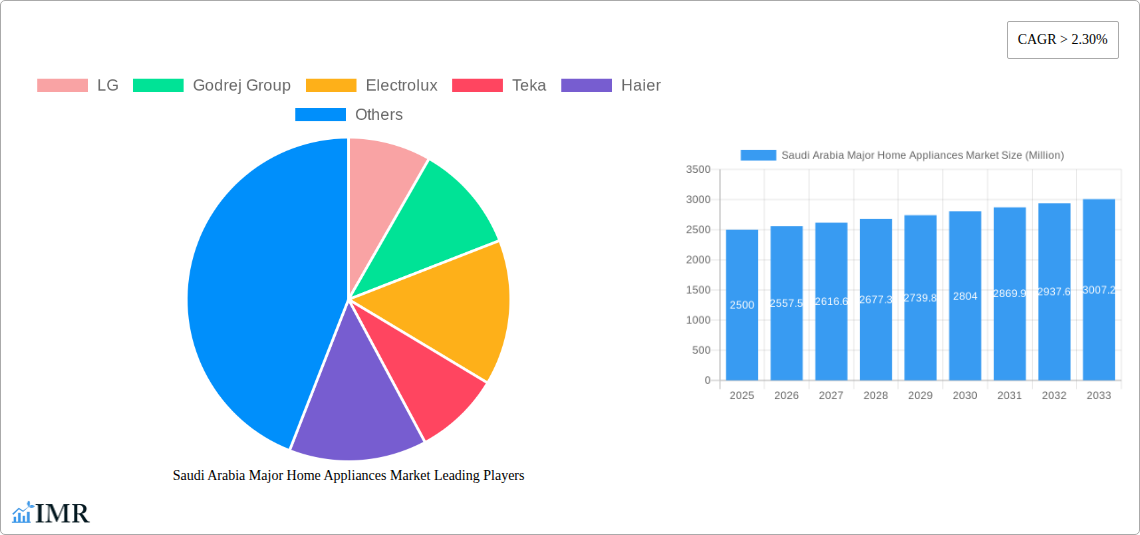

Saudi Arabia Major Home Appliances Market Company Market Share

Saudi Arabia Major Home Appliances Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia major home appliances market, covering the period 2019-2033. It offers invaluable insights into market dynamics, growth trends, dominant segments, and key players, equipping industry professionals with the knowledge needed to navigate this dynamic landscape. The report segments the market by product (refrigerators, freezers, dishwashing machines, washing machines, ovens, air conditioners, other major appliances) and distribution channel (supermarkets & hypermarkets, specialty stores, online, other channels). Market size is presented in Million Units.

Saudi Arabia Major Home Appliances Market Dynamics & Structure

The Saudi Arabian major home appliances market is characterized by a moderately concentrated landscape, with key players like Samsung, LG, and Electrolux holding significant market share. Technological innovation, driven by the increasing adoption of smart home appliances and energy-efficient models, is a key driver. Government regulations promoting energy efficiency and product safety also shape the market. The market faces competition from substitute products, particularly in the air conditioning segment, where alternative cooling solutions are emerging. The end-user demographic is diverse, ranging from young urban professionals to large families in suburban areas. M&A activity is moderate, with strategic partnerships and acquisitions aimed at expanding market reach and technological capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Strong focus on smart appliances, energy efficiency (e.g., Inverter technology), and connected home integration.

- Regulatory Framework: Regulations focusing on energy efficiency standards and safety compliance are influential.

- Competitive Substitutes: Alternative cooling solutions and other energy-saving technologies pose competition, particularly in air conditioning.

- End-User Demographics: Diverse, with significant growth in urban and suburban households fueling demand.

- M&A Trends: Moderate activity, focusing on strategic partnerships and technology acquisitions (xx deals in the last 5 years).

Saudi Arabia Major Home Appliances Market Growth Trends & Insights

The Saudi Arabia major home appliances market witnessed robust growth during the historical period (2019-2024), driven by rising disposable incomes, increasing urbanization, and government initiatives promoting housing development. The market is expected to continue expanding during the forecast period (2025-2033), with a projected CAGR of xx%. This growth is fueled by the increasing adoption of advanced features, such as smart connectivity and energy-efficient technologies. Consumer behavior is shifting towards premium appliances and personalized customization options, creating new opportunities for manufacturers. The market penetration rate for major appliances is estimated at xx% in 2024, expected to reach xx% by 2033. Technological disruptions, such as the introduction of IoT-enabled appliances and sustainable manufacturing practices, are further shaping market dynamics.

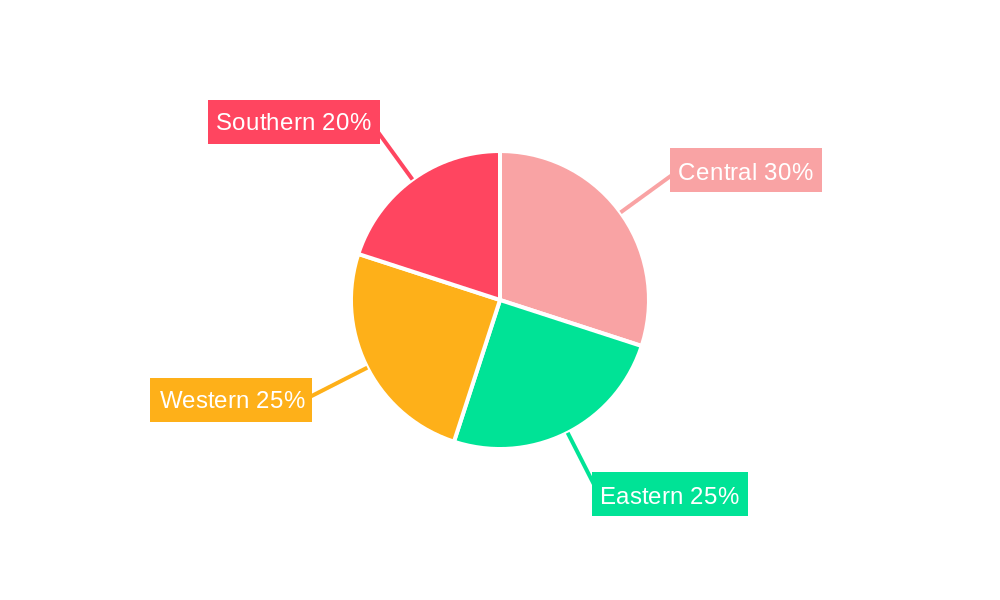

Dominant Regions, Countries, or Segments in Saudi Arabia Major Home Appliances Market

The Riyadh and Jeddah regions are the dominant markets for major home appliances in Saudi Arabia, driven by higher population density, increased disposable incomes, and robust infrastructure. Within the product segments, refrigerators and air conditioners account for the largest market share, followed by washing machines. Supermarkets and hypermarkets remain the primary distribution channels, although online sales are experiencing rapid growth.

- Leading Regions: Riyadh and Jeddah dominate due to higher population concentration and economic activity.

- Leading Product Segments: Refrigerators (xx Million Units in 2024), Air Conditioners (xx Million Units in 2024), and Washing Machines (xx Million Units in 2024) lead the market.

- Leading Distribution Channels: Supermarkets and hypermarkets continue to dominate, but online sales are growing rapidly.

- Growth Drivers: Rising disposable incomes, increasing urbanization, and government initiatives promoting housing development.

Saudi Arabia Major Home Appliances Market Product Landscape

The Saudi Arabian major home appliances market showcases a diverse product landscape, with a growing emphasis on smart, energy-efficient, and customizable models. Refrigerators with advanced features like smart connectivity and precise temperature control are gaining traction. Washing machines with improved wash cycles and enhanced hygiene features are also popular. Dishwashers are witnessing increased adoption, driven by convenience and improved efficiency. Air conditioners with advanced cooling technologies and inverter compressors are highly sought after. The market is witnessing a trend towards modular and customizable designs, allowing consumers to personalize their appliances to match their kitchen aesthetics.

Key Drivers, Barriers & Challenges in Saudi Arabia Major Home Appliances Market

Key Drivers:

Rising disposable incomes, increasing urbanization, government initiatives supporting housing development, and the growing preference for technologically advanced appliances drive market expansion.

Challenges:

- Supply Chain Disruptions: Global supply chain issues impacting component availability and costs. (estimated xx% impact on market growth in 2024)

- Regulatory Hurdles: Stricter energy efficiency standards and safety regulations can increase manufacturing costs.

- Competitive Pressure: Intense competition among international and domestic brands.

Emerging Opportunities in Saudi Arabia Major Home Appliances Market

The growing adoption of smart home technology presents a significant opportunity for manufacturers to offer connected appliances with features like remote control, energy monitoring, and voice assistants. The rising demand for energy-efficient appliances creates opportunities for manufacturers to develop and market eco-friendly products. Additionally, increasing consumer awareness of health and hygiene is driving demand for appliances with enhanced cleaning and sanitization capabilities.

Growth Accelerators in the Saudi Arabia Major Home Appliances Market Industry

Technological advancements, strategic partnerships, and expansion into underserved regions are key growth catalysts. The development of innovative technologies, such as AI-powered appliances and advanced energy-saving features, will drive market expansion. Strategic alliances between manufacturers and retailers can enhance market reach and distribution networks. Focusing on untapped markets beyond major urban areas will unlock further growth potential.

Notable Milestones in Saudi Arabia Major Home Appliances Market Sector

- June 2021, Riyadh: Samsung partners with Veda Holding to launch Samsung Experience Stores, enhancing brand visibility and customer engagement.

- 2021: Samsung launches bespoke refrigeration appliances, catering to the growing demand for customized kitchen solutions.

In-Depth Saudi Arabia Major Home Appliances Market Market Outlook

The Saudi Arabia major home appliances market is poised for sustained growth over the forecast period, driven by positive economic indicators, rising consumer spending, and continuous technological advancements. Strategic investments in research and development, coupled with effective marketing and distribution strategies, will be crucial for players seeking to capitalize on the market's potential. The focus on smart appliances, energy efficiency, and customization will continue to shape the market landscape.

Saudi Arabia Major Home Appliances Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Saudi Arabia Major Home Appliances Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Major Home Appliances Market Regional Market Share

Geographic Coverage of Saudi Arabia Major Home Appliances Market

Saudi Arabia Major Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Quick Food Preparation in Hotels & Restaurants; Energy efficient and Space saving Appliances

- 3.3. Market Restrains

- 3.3.1. Limitations in Cooking Complex Dishes

- 3.4. Market Trends

- 3.4.1. Refrigerator Segment is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Major Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Godrej Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Electrolux

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Teka

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Haier

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bosch**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Whirlpool

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hisense Middle East

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Midea

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LG

List of Figures

- Figure 1: Saudi Arabia Major Home Appliances Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Major Home Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Major Home Appliances Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Saudi Arabia Major Home Appliances Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Saudi Arabia Major Home Appliances Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Saudi Arabia Major Home Appliances Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Saudi Arabia Major Home Appliances Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Saudi Arabia Major Home Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Major Home Appliances Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Saudi Arabia Major Home Appliances Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Saudi Arabia Major Home Appliances Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Saudi Arabia Major Home Appliances Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Saudi Arabia Major Home Appliances Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Saudi Arabia Major Home Appliances Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Major Home Appliances Market?

The projected CAGR is approximately 4.63%.

2. Which companies are prominent players in the Saudi Arabia Major Home Appliances Market?

Key companies in the market include LG, Godrej Group, Electrolux, Teka, Haier, Bosch**List Not Exhaustive, Whirlpool, Hisense Middle East, Midea, Samsung.

3. What are the main segments of the Saudi Arabia Major Home Appliances Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.17 billion as of 2022.

5. What are some drivers contributing to market growth?

Quick Food Preparation in Hotels & Restaurants; Energy efficient and Space saving Appliances.

6. What are the notable trends driving market growth?

Refrigerator Segment is Dominating the Market.

7. Are there any restraints impacting market growth?

Limitations in Cooking Complex Dishes.

8. Can you provide examples of recent developments in the market?

Riyadh, June 2021 - Samsung today announced a partnership with Veda Holding, a business incubator based in Riyadh, Saudi Arabia. Samsung Experience Store is a destination for consumers to play, learn, and solve problems. They can find the most recent line-up of products and learn how to make their daily lives more enjoyable and creative.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Major Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Major Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Major Home Appliances Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Major Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence