Key Insights

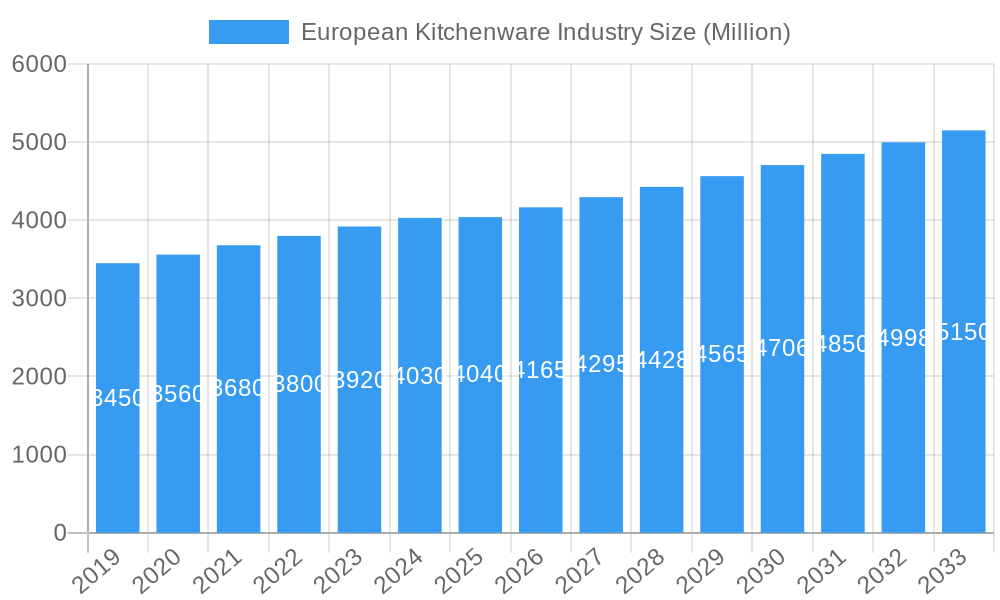

The European kitchenware market is poised for steady expansion, projected to reach approximately USD 4.04 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.17% expected through 2033. This growth is primarily fueled by a burgeoning interest in home cooking and culinary exploration across the continent, exacerbated by shifting lifestyle trends and a growing emphasis on healthy eating habits. Consumers are increasingly investing in high-quality, durable, and aesthetically pleasing kitchen tools that enhance their cooking experience and elevate their home decor. The demand for innovative and multi-functional cookware, such as pressure cookers and specialized microwave cookware, is also on the rise as busy households seek to optimize their time in the kitchen without compromising on meal quality. Furthermore, a growing awareness of sustainable living is driving preferences towards eco-friendly and long-lasting kitchenware materials, such as recycled stainless steel and durable glass.

European Kitchenware Industry Market Size (In Billion)

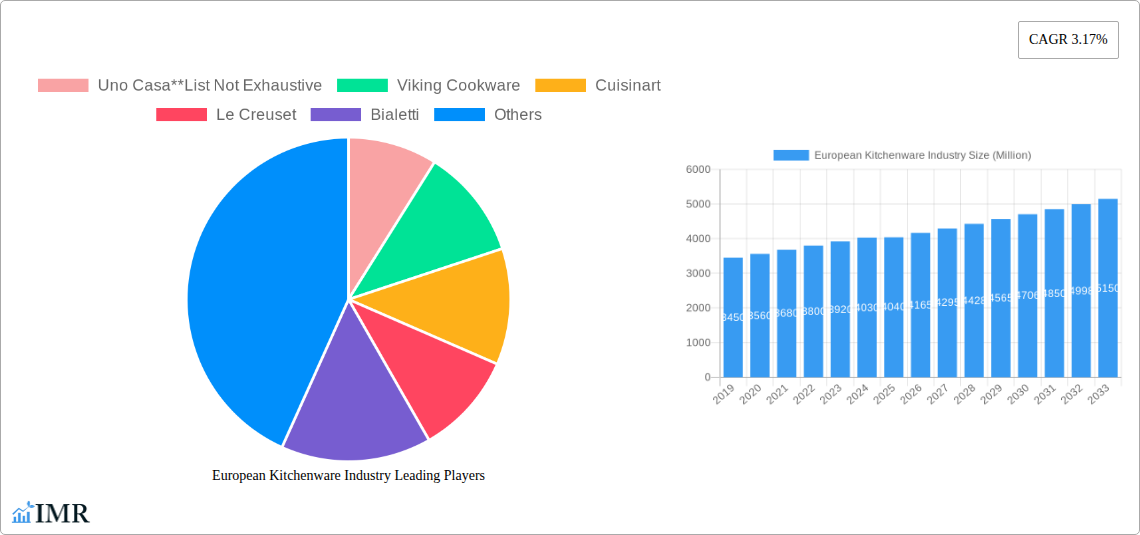

The market is witnessing a significant diversification in product offerings and distribution channels to cater to evolving consumer needs. The "Pots and Pans" segment continues to dominate, but "Cooking Tools" and "Microwave Cookware" are demonstrating robust growth. Stainless steel and aluminum remain the most popular materials due to their versatility and affordability, however, there's a discernible trend towards premium materials like cast iron and advanced non-stick coatings. Distribution channels are also evolving, with online retail experiencing remarkable penetration, offering convenience and a wider selection to consumers. Hypermarkets and supermarkets still hold a significant share, but specialty stores are carving out a niche by offering curated selections and expert advice. Leading brands like Cuisinart, Le Creuset, and Calphalon are investing in product innovation and strategic marketing to capture market share amidst intensifying competition, with significant opportunities present across all European regions, particularly in larger economies like Germany, France, and the United Kingdom, and also in emerging markets.

European Kitchenware Industry Company Market Share

European Kitchenware Industry Report: Market Dynamics, Growth Trends, and Key Players (2019-2033)

This comprehensive report offers an in-depth analysis of the European kitchenware market, a dynamic sector driven by evolving consumer lifestyles, technological advancements, and a growing emphasis on sustainable and premium products. Covering the study period of 2019–2033, with the base and estimated year of 2025, this report provides critical insights for industry professionals, investors, and stakeholders seeking to navigate and capitalize on market opportunities. Explore the intricate market structure, growth trends, dominant regions, product landscape, and key players shaping the future of kitchenware in Europe. This report examines pots and pans, cooking racks, cooking tools, microwave cookware, and pressure cookers, with a detailed breakdown by material (stainless steel, aluminium, glass, other materials) and distribution channel (hypermarkets, supermarkets, specialty stores, online).

European Kitchenware Industry Market Dynamics & Structure

The European kitchenware industry is characterized by a moderate to high market concentration, with a few dominant players holding significant market share, particularly in premium segments. Technological innovation is a key driver, with advancements in materials science leading to more durable, energy-efficient, and aesthetically pleasing products. Regulatory frameworks, primarily focused on consumer safety and environmental impact, are increasingly influencing product design and manufacturing processes. Competitive product substitutes, such as disposable cookware and shared kitchen appliances, present a constant challenge, yet the demand for high-quality, long-lasting kitchenware remains robust. End-user demographics showcase a growing preference among younger consumers for smart, multifunctional, and eco-friendly kitchen solutions, while established households continue to prioritize durability and brand reputation. Mergers and acquisitions (M&A) trends indicate a strategic consolidation, with larger companies acquiring innovative smaller players to expand their product portfolios and market reach.

- Market Concentration: Dominated by a mix of established global brands and strong regional players, with a growing presence of direct-to-consumer (DTC) brands.

- Technological Innovation Drivers: Focus on non-stick coatings, induction-compatible bases, ergonomic designs, smart kitchen integration, and sustainable material development.

- Regulatory Frameworks: Compliance with EU directives on food contact materials, energy efficiency, and waste management is crucial.

- Competitive Product Substitutes: Rise of meal kit services, subscription boxes for cookware, and the increasing adoption of shared kitchen spaces.

- End-User Demographics: Shifting preferences towards health-conscious cooking, home entertaining, and the demand for visually appealing kitchenware that complements interior design.

- M&A Trends: Strategic acquisitions aimed at gaining access to new technologies, expanding product lines, and enhancing distribution networks.

European Kitchenware Industry Growth Trends & Insights

The European kitchenware market size is projected for substantial growth, driven by a confluence of factors including rising disposable incomes, an increasing interest in home cooking and culinary exploration, and a growing awareness of health and wellness. The adoption rates for innovative kitchenware, such as induction-ready pots and pans and advanced pressure cookers, are steadily increasing. Technological disruptions, like the integration of smart features and the development of advanced, eco-friendly materials, are redefining product offerings and consumer expectations. Consumer behavior shifts are evident in the move towards multi-functional cookware, the growing demand for sustainable and ethically sourced products, and a greater appreciation for craftsmanship and durability. The European kitchenware market forecast indicates a Compound Annual Growth Rate (CAGR) of approximately XX% between 2025 and 2033, with market penetration deepening across various product categories and distribution channels. The market for pots and pans is expected to remain a cornerstone, supported by consistent demand for quality cookware, while niche segments like microwave cookware and advanced cooking tools are poised for accelerated expansion due to technological advancements and evolving cooking habits.

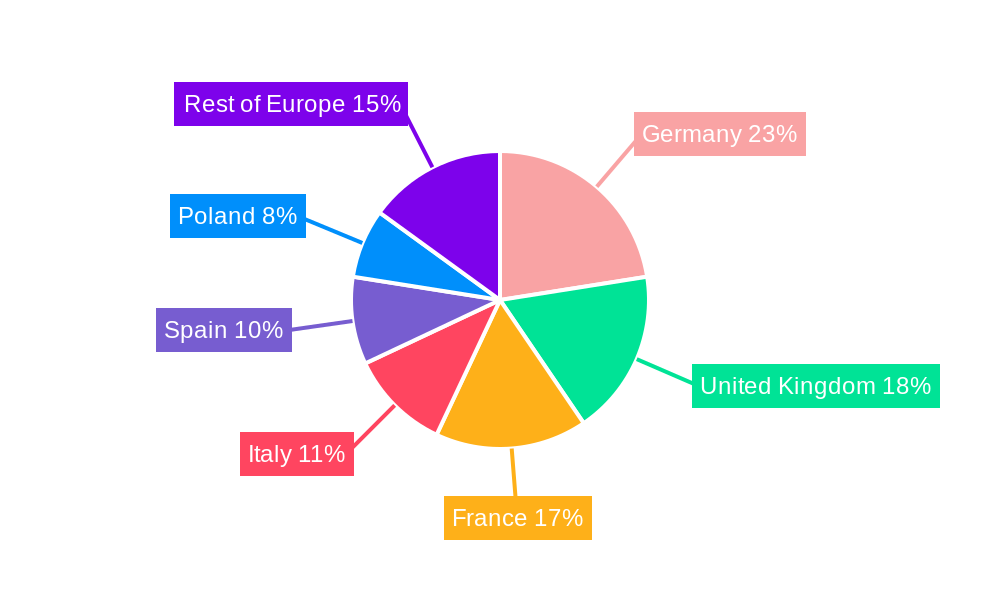

Dominant Regions, Countries, or Segments in European Kitchenware Industry

The European kitchenware industry is not monolithic, with distinct regional and sectoral dynamics influencing its growth trajectory. Among the product segments, Pots and Pans consistently hold the largest market share, driven by their fundamental role in daily cooking. Within this category, Stainless Steel remains the dominant material due to its durability, excellent heat conductivity, and resistance to corrosion. However, there is a notable and increasing demand for Aluminium cookware, especially hard-anodized variants, for their lightweight properties and even heat distribution. The Online distribution channel is experiencing the most rapid growth, reflecting the broader e-commerce trend across Europe, offering convenience and a wider selection to consumers.

Geographically, Germany and the United Kingdom are the largest national markets within Europe, characterized by a strong consumer base with high purchasing power and a sophisticated understanding of quality kitchenware. France and Italy also represent significant markets, with a deep-rooted culinary culture influencing demand for premium and specialized cookware.

- Dominant Product Segment: Pots and Pans – essential for everyday cooking, offering consistent demand.

- Dominant Material: Stainless Steel – favored for its longevity, hygiene, and performance across various cooking methods. Aluminium is gaining traction for its affordability and heat distribution properties.

- Dominant Distribution Channel: Online – rapid growth fueled by convenience, wider product availability, and competitive pricing. Hypermarkets and Supermarkets maintain a strong presence for everyday purchases.

- Key Regional Drivers:

- Germany: High disposable income, strong emphasis on quality and durability, and a growing interest in energy-efficient appliances.

- United Kingdom: Evolving culinary trends, a significant online retail presence, and a demand for innovative and aesthetically pleasing kitchenware.

- France & Italy: Deep culinary heritage, driving demand for specialized and high-end cookware.

European Kitchenware Industry Product Landscape

The European kitchenware product landscape is rapidly evolving, marked by significant innovations focused on enhanced performance, user convenience, and sustainability. Pots and Pans are seeing advancements in multi-layer constructions for superior heat distribution and retention, alongside the introduction of advanced non-stick coatings that are PFOA-free and more durable. Cooking Tools are becoming more ergonomic, made from sustainable materials like bamboo and recycled plastics, and integrated with features like heat resistance and easy cleaning. Microwave Cookware is being redesigned for greater versatility, allowing for browning and crisping capabilities. Pressure Cookers are incorporating smart features, offering precise temperature control and pre-programmed cooking cycles for a wide range of dishes, significantly reducing cooking times. The use of advanced Aluminium alloys and reinforced Stainless Steel is prevalent, offering a balance of performance and affordability.

Key Drivers, Barriers & Challenges in European Kitchenware Industry

The European kitchenware industry is propelled by several key drivers. An increasing focus on home cooking, driven by health consciousness and a desire for culinary experiences, fuels demand for quality cookware. Technological advancements in materials and manufacturing processes lead to more innovative, durable, and user-friendly products. Furthermore, growing environmental awareness is fostering a demand for sustainable and eco-friendly kitchenware options.

- Key Drivers:

- Rising trend of home cooking and culinary exploration.

- Technological innovations in materials and design.

- Growing consumer preference for sustainable and eco-friendly products.

- Increasing disposable incomes in key European markets.

However, the industry faces significant barriers and challenges. Intense competition from both established brands and emerging DTC players exerts pressure on pricing and margins. Fluctuations in raw material costs, particularly for stainless steel and aluminium, can impact profitability. Stringent regulatory requirements related to product safety and environmental impact necessitate continuous investment in compliance and R&D. Supply chain disruptions, exacerbated by global events, can lead to production delays and increased logistics costs.

- Key Barriers & Challenges:

- Intense market competition and price sensitivity.

- Volatility in raw material prices.

- Navigating complex and evolving regulatory frameworks.

- Supply chain disruptions and geopolitical uncertainties.

- Counterfeiting and intellectual property protection.

Emerging Opportunities in European Kitchenware Industry

Emerging opportunities within the European kitchenware industry lie in the growing demand for smart kitchen appliances that integrate with smart home ecosystems, offering enhanced convenience and control. The significant growth of the online channel presents an avenue for direct-to-consumer (DTC) brands to thrive, bypassing traditional retail intermediaries. Furthermore, the increasing consumer emphasis on sustainability is opening doors for kitchenware made from recycled materials, biodegradable components, and those designed for longevity and repairability. The rise of specialized cooking techniques and dietary trends also creates niches for innovative cookware solutions.

- Untapped Markets: Direct-to-consumer (DTC) e-commerce models, subscription services for cookware, and catering to specific dietary needs (e.g., gluten-free baking accessories).

- Innovative Applications: Smart cookware with integrated sensors and connectivity, multi-functional cookware for space-saving solutions, and aesthetically designed kitchenware that doubles as decorative elements.

- Evolving Consumer Preferences: Demand for ethically sourced materials, repairable products, and brands with transparent sustainability practices.

Growth Accelerators in the European Kitchenware Industry Industry

The European kitchenware industry is experiencing significant growth acceleration driven by several key catalysts. Technological breakthroughs, such as advanced non-stick coatings and energy-efficient designs, are enhancing product appeal and performance. Strategic partnerships between cookware manufacturers and technology companies are leading to the integration of smart features, further differentiating products. Moreover, market expansion strategies, including the development of products tailored to specific regional tastes and culinary traditions, are broadening consumer reach. The increasing adoption of online retail channels by manufacturers and retailers alike is also a major growth accelerator, providing wider accessibility to a diverse customer base across the continent.

Key Players Shaping the European Kitchenware Industry Market

- Uno Casa

- Viking Cookware

- Cuisinart

- Le Creuset

- Bialetti

- Abbio

- Calphalon

- All-Clad

Notable Milestones in European Kitchenware Industry Sector

- February 2023: Crucible Cookware, a leading manufacturer and supplier of high-quality kitchenware, announced it had signed a contract with DHL for shipping its products within the European Union (EU). DHL is one of the leading logistics companies. This new partnership will allow Crucible Cookware to provide its customers with faster and more efficient shipping options for their orders.

- February 2023: A new range of bakeware with a reduced environmental impact is launched by market leader Guardini. They partnered with ArcelorMittal, one of the leading steel and mining companies, coated steel manufacturer Cooper Coated Coil (CCC), and coatings manufacturer ILAG.

In-Depth European Kitchenware Industry Market Outlook

The European kitchenware industry market outlook is exceptionally positive, driven by sustained consumer interest in home cooking and a continuous drive for product innovation. Growth accelerators such as the integration of smart technologies, the increasing demand for sustainable and eco-friendly products, and the expanding reach of e-commerce channels will continue to fuel market expansion. Strategic opportunities lie in catering to niche culinary trends, developing modular and space-saving kitchenware, and reinforcing brand narratives around quality, durability, and responsible manufacturing. The industry is poised for robust growth, offering significant potential for both established players and innovative newcomers.

European Kitchenware Industry Segmentation

-

1. Product

- 1.1. Pots and Pans

- 1.2. Cooking Racks

- 1.3. Cooking Tools

- 1.4. Microwave Cookware

- 1.5. Pressure Cookers

-

2. Material

- 2.1. Stainless Steel

- 2.2. Aluminium

- 2.3. Glass

- 2.4. Other Materials

-

3. Distribution Channel

- 3.1. Hypermarkets and Supermarkets

- 3.2. Specialty Store

- 3.3. Online

- 3.4. Other Distribution Channels

European Kitchenware Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Poland

- 5. Italy

- 6. Rest of Europe

European Kitchenware Industry Regional Market Share

Geographic Coverage of European Kitchenware Industry

European Kitchenware Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators

- 3.3. Market Restrains

- 3.3.1. Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues

- 3.4. Market Trends

- 3.4.1. Non-Stick Cookware is Dominating the Cookware Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Pots and Pans

- 5.1.2. Cooking Racks

- 5.1.3. Cooking Tools

- 5.1.4. Microwave Cookware

- 5.1.5. Pressure Cookers

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Stainless Steel

- 5.2.2. Aluminium

- 5.2.3. Glass

- 5.2.4. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarkets and Supermarkets

- 5.3.2. Specialty Store

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Poland

- 5.4.5. Italy

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Pots and Pans

- 6.1.2. Cooking Racks

- 6.1.3. Cooking Tools

- 6.1.4. Microwave Cookware

- 6.1.5. Pressure Cookers

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Stainless Steel

- 6.2.2. Aluminium

- 6.2.3. Glass

- 6.2.4. Other Materials

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hypermarkets and Supermarkets

- 6.3.2. Specialty Store

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. United Kingdom European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Pots and Pans

- 7.1.2. Cooking Racks

- 7.1.3. Cooking Tools

- 7.1.4. Microwave Cookware

- 7.1.5. Pressure Cookers

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Stainless Steel

- 7.2.2. Aluminium

- 7.2.3. Glass

- 7.2.4. Other Materials

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hypermarkets and Supermarkets

- 7.3.2. Specialty Store

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. France European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Pots and Pans

- 8.1.2. Cooking Racks

- 8.1.3. Cooking Tools

- 8.1.4. Microwave Cookware

- 8.1.5. Pressure Cookers

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Stainless Steel

- 8.2.2. Aluminium

- 8.2.3. Glass

- 8.2.4. Other Materials

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hypermarkets and Supermarkets

- 8.3.2. Specialty Store

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Poland European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Pots and Pans

- 9.1.2. Cooking Racks

- 9.1.3. Cooking Tools

- 9.1.4. Microwave Cookware

- 9.1.5. Pressure Cookers

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Stainless Steel

- 9.2.2. Aluminium

- 9.2.3. Glass

- 9.2.4. Other Materials

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hypermarkets and Supermarkets

- 9.3.2. Specialty Store

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Italy European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Pots and Pans

- 10.1.2. Cooking Racks

- 10.1.3. Cooking Tools

- 10.1.4. Microwave Cookware

- 10.1.5. Pressure Cookers

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Stainless Steel

- 10.2.2. Aluminium

- 10.2.3. Glass

- 10.2.4. Other Materials

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hypermarkets and Supermarkets

- 10.3.2. Specialty Store

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Europe European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Pots and Pans

- 11.1.2. Cooking Racks

- 11.1.3. Cooking Tools

- 11.1.4. Microwave Cookware

- 11.1.5. Pressure Cookers

- 11.2. Market Analysis, Insights and Forecast - by Material

- 11.2.1. Stainless Steel

- 11.2.2. Aluminium

- 11.2.3. Glass

- 11.2.4. Other Materials

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Hypermarkets and Supermarkets

- 11.3.2. Specialty Store

- 11.3.3. Online

- 11.3.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Uno Casa**List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Viking Cookware

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cuisinart

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Le Creuset

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bialetti

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Abbio

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Calphalon

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 All-Clad

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Uno Casa**List Not Exhaustive

List of Figures

- Figure 1: European Kitchenware Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Kitchenware Industry Share (%) by Company 2025

List of Tables

- Table 1: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 3: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: European Kitchenware Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 6: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 7: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 10: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 11: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 14: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 15: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 18: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 19: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 22: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 23: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 26: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 27: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Kitchenware Industry?

The projected CAGR is approximately 3.17%.

2. Which companies are prominent players in the European Kitchenware Industry?

Key companies in the market include Uno Casa**List Not Exhaustive, Viking Cookware, Cuisinart, Le Creuset, Bialetti, Abbio, Calphalon, All-Clad.

3. What are the main segments of the European Kitchenware Industry?

The market segments include Product, Material, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators.

6. What are the notable trends driving market growth?

Non-Stick Cookware is Dominating the Cookware Industry.

7. Are there any restraints impacting market growth?

Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues.

8. Can you provide examples of recent developments in the market?

February 2023: Crucible Cookware, a leading manufacturer and supplier of high-quality kitchenware, announced it had signed a contract with DHL for shipping its products within the European Union (EU). DHL is one of the leading logistics companies. This new partnership will allow Crucible Cookware to provide its customers with faster and more efficient shipping options for their orders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Kitchenware Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Kitchenware Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Kitchenware Industry?

To stay informed about further developments, trends, and reports in the European Kitchenware Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence