Key Insights

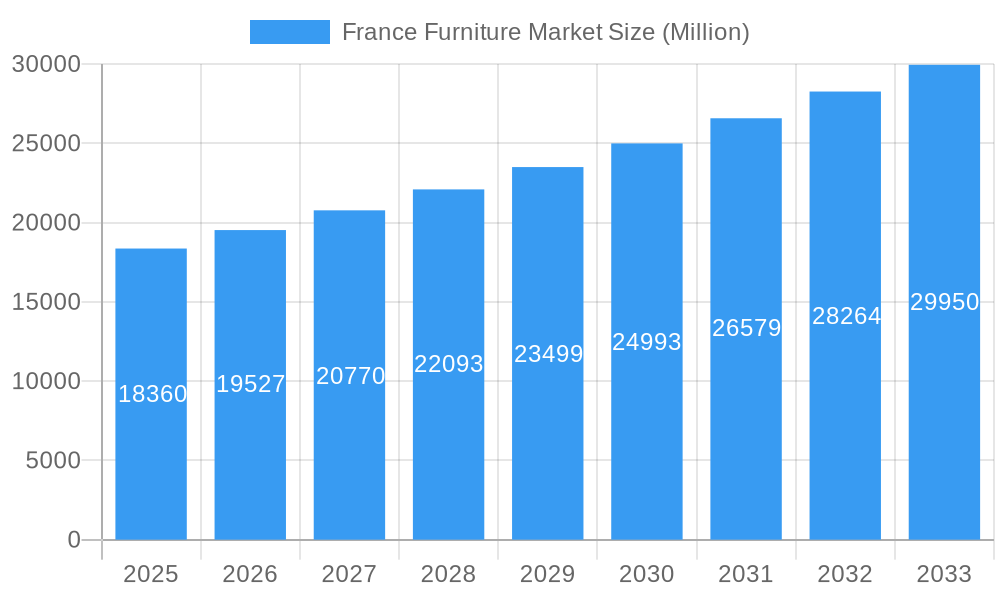

The France Furniture Market is poised for robust growth, projected to reach approximately €18.36 billion with a Compound Annual Growth Rate (CAGR) of 6.25% from 2025 to 2033. This significant expansion is driven by a confluence of factors, including a rising disposable income, a strong demand for home renovation and interior design services, and an increasing consumer preference for sustainable and aesthetically pleasing furniture. The market is witnessing a pronounced trend towards smart and modular furniture solutions that cater to evolving living spaces and the demand for multi-functional items. Furthermore, an emphasis on eco-friendly materials and ethical sourcing is shaping consumer purchasing decisions, pushing manufacturers to innovate in their product development and supply chains. The rise of e-commerce platforms has also democratized access to a wider range of furniture options, further fueling market dynamism.

France Furniture Market Market Size (In Billion)

However, the market is not without its challenges. Supply chain disruptions, escalating raw material costs, and intense competition from both domestic and international players present significant restraints. The economic uncertainties and inflation rates could also impact consumer spending on discretionary items like furniture. Despite these headwinds, the underlying demand for quality, stylish, and functional furniture remains strong. Key segments showing particular traction include production and consumption analysis, with a growing focus on import and export dynamics as global trade patterns evolve. Analysis of price trends indicates a potential for increased pricing due to rising input costs, but also opportunities for premiumization in certain product categories. Prominent companies like IKEA, Roche Bobois SA, and Herman Miller are actively navigating these trends, investing in innovation and expanding their market reach.

France Furniture Market Company Market Share

This in-depth report provides a meticulous examination of the France furniture market, offering critical insights into its structure, growth trajectory, and future potential. Covering the Study Period: 2019–2033, with a Base Year and Estimated Year of 2025, and a Forecast Period of 2025–2033, this analysis delves into the historical context of 2019–2024. We dissect parent and child market segments, incorporating high-traffic keywords such as "French furniture," "European furniture market," "home furnishings France," "office furniture France," "luxury furniture France," "sustainable furniture France," "furniture manufacturing France," "furniture retail France," "furniture import export France," and "interior design trends France" to maximize search engine visibility. All quantitative data is presented in Million units.

France Furniture Market Market Dynamics & Structure

The French furniture market exhibits a dynamic interplay of competition, innovation, and evolving consumer preferences. Market concentration varies across segments, with established heritage brands and global giants coexisting alongside agile independent designers. Technological innovation drivers are pushing boundaries in material science, sustainable production, and smart furniture integration. Regulatory frameworks, particularly those concerning environmental standards and consumer protection, significantly shape market entry and operational strategies. Competitive product substitutes, ranging from DIY solutions to high-end bespoke creations, necessitate continuous differentiation. End-user demographics, characterized by an aging population and a growing segment of environmentally conscious millennials, are profoundly influencing product design and purchasing decisions. Mergers & Acquisitions (M&A) trends reveal a strategic consolidation to gain market share, expand product portfolios, and enhance operational efficiencies.

- Market Concentration: Moderately fragmented, with key players holding significant shares in specific niches.

- Technological Innovation: Focus on sustainable materials (e.g., recycled plastics, bamboo), smart home integration in furniture, and advanced manufacturing techniques (e.g., 3D printing).

- Regulatory Frameworks: Stringent EU regulations on eco-design, emissions, and material sourcing, alongside national building and safety codes.

- Competitive Product Substitutes: High-quality mass-produced furniture, bespoke artisanal pieces, and the growing influence of online marketplaces offering diverse price points.

- End-User Demographics: Influenced by an increasing demand for durable, eco-friendly, and aesthetically pleasing furniture from a diverse consumer base.

- M&A Trends: Strategic acquisitions aimed at expanding product offerings, gaining access to new distribution channels, and integrating sustainable practices. For instance, the acquisition of Halcon by Steelcase in May 2022 highlights a trend towards bolstering portfolios through strategic takeovers.

France Furniture Market Growth Trends & Insights

The France furniture market is poised for robust growth, driven by a confluence of economic recovery, evolving lifestyle trends, and increasing consumer spending on home improvement and office redesign. Market size evolution is characterized by a steady upward trajectory, with significant adoption rates for innovative and sustainable furniture solutions. Technological disruptions are not only transforming manufacturing processes but also redefining the consumer shopping experience through augmented reality (AR) visualization and personalized online platforms. Consumer behavior shifts are leaning towards prioritizing functionality, durability, and aesthetic appeal, with a growing emphasis on ethical sourcing and eco-friendly production. The French furniture market is witnessing a surge in demand for multi-functional furniture that optimizes space, particularly in urban environments. Furthermore, the increasing trend of remote work and hybrid office models is spurring demand for comfortable and ergonomic home office furniture. The focus on interior design trends, influenced by social media and design publications, is driving consumer interest in unique and statement pieces, creating opportunities for both mass-market and luxury segments. The anticipated CAGR for the forecast period is projected to be robust, reflecting these underlying market forces. Market penetration of smart furniture is expected to increase, offering consumers enhanced convenience and connectivity. The overall market sentiment is positive, indicating a healthy expansion driven by both domestic demand and international interest in French design.

Dominant Regions, Countries, or Segments in France Furniture Market

The France furniture market's dominance is shaped by distinct regional strengths and segment performances.

Production Analysis: The Grand Est region often emerges as a significant production hub, benefiting from established industrial infrastructure and a skilled workforce in furniture manufacturing. Historically, this region has been a cornerstone for French furniture production, with numerous SMEs specializing in various furniture types. The presence of suppliers for raw materials and components further bolsters its production capacity.

Consumption Analysis: Île-de-France, encompassing Paris and its surrounding areas, represents the largest consumption market. This is driven by a higher population density, greater disposable income, and a strong demand for both residential and commercial furniture, including high-end and designer pieces. The influence of interior design trends is particularly potent here, fueling demand for stylish and contemporary furnishings.

Import Market Analysis (Value & Volume): France is a significant importer of furniture, with demand for specific categories often met by international manufacturers.

- Value: High-value imports are often sourced from countries renowned for their craftsmanship and design, such as Italy and Scandinavian nations, particularly for luxury and designer furniture.

- Volume: Bulk imports, especially for more standardized and cost-effective furniture, tend to originate from countries with lower manufacturing costs. The Import Market Analysis (Value & Volume) indicates a complex global supply chain influencing the availability and pricing of furniture within France.

Export Market Analysis (Value & Volume): France is also a notable exporter of furniture, particularly those reflecting French design heritage and craftsmanship.

- Value: High-value exports are dominated by luxury furniture brands and unique design pieces, catering to international markets appreciative of French aesthetics.

- Volume: Exports in terms of volume may include a broader range of furniture, reflecting the diverse manufacturing capabilities within the country. The Export Market Analysis (Value & Volume) highlights France's role as a purveyor of distinct furniture styles globally.

Price Trend Analysis: Price trends in the France furniture market are influenced by material costs, manufacturing complexity, brand positioning, and import/export dynamics. The Price Trend Analysis reveals a bifurcated market with a growing demand for both affordable, mass-produced items and premium, bespoke furniture. Inflationary pressures on raw materials and energy costs have a direct impact on pricing strategies.

France Furniture Market Product Landscape

The France furniture market product landscape is characterized by a rich tapestry of innovation and application. From the iconic designs of Roche Bobois SA and Ligne Roset to the functional excellence of Herman Miller and Steelcase, product diversity is a key strength. We are observing a surge in demand for sustainable furniture, utilizing recycled materials and eco-friendly manufacturing processes, aligning with evolving consumer values. Applications span residential, commercial (office, hospitality), and contract sectors, each with unique performance metrics and design considerations. Technological advancements are evident in the integration of smart features, ergonomic designs, and modular systems that enhance functionality and user experience. Unique selling propositions often lie in superior craftsmanship, timeless design, and a commitment to environmental responsibility. The product landscape is continuously evolving to meet the demands for comfort, style, and sustainability in the French interior design context.

Key Drivers, Barriers & Challenges in France Furniture Market

Key Drivers:

- Growing Demand for Home Renovation and Improvement: A sustained interest in enhancing living spaces drives consistent demand for new furniture.

- Rise of Interior Design Trends and Social Media Influence: Consumers are increasingly inspired by design aesthetics, leading to a desire for updated and stylish furnishings.

- Focus on Sustainable and Eco-Friendly Furniture: Growing environmental consciousness fuels demand for products made from recycled, recyclable, and sustainably sourced materials.

- Growth of the E-commerce Furniture Sector: Online platforms offer convenience and a wider selection, expanding accessibility and purchasing opportunities.

- Increased Investment in Office Redesigns and Hybrid Workspaces: The evolving nature of work necessitates comfortable, ergonomic, and aesthetically pleasing office furniture solutions.

Key Barriers & Challenges:

- Supply Chain Disruptions and Rising Raw Material Costs: Global supply chain volatility and increasing costs of wood, metal, and textiles impact manufacturing costs and product pricing. For example, an estimated increase of 5-10% in raw material costs can significantly affect profit margins.

- Intense Competition from International and Online Retailers: The market faces strong competition from both established international brands and agile online-only retailers, leading to price pressures.

- Stringent Environmental Regulations and Compliance Costs: Adhering to increasingly strict EU and French environmental regulations can add to production costs and complexity.

- Economic Uncertainty and Consumer Spending Fluctuations: Potential economic slowdowns or recessions can lead to reduced consumer discretionary spending on non-essential items like furniture.

- Skilled Labor Shortages in Manufacturing: A potential shortage of skilled artisans and manufacturing professionals can impact production capacity and quality.

Emerging Opportunities in France Furniture Market

Emerging opportunities in the France furniture market lie in the growing demand for customized and personalized furniture solutions, catering to individual tastes and space constraints. The sustainable furniture segment continues to expand, offering significant potential for brands committed to eco-friendly practices and transparent sourcing. The increasing adoption of smart home technology presents opportunities for integrated furniture solutions that offer enhanced convenience and connectivity. Furthermore, the renovation of older properties and the development of new residential projects create a continuous demand for stylish and functional furnishings. The French furniture market is also ripe for innovation in modular and space-saving furniture, addressing the needs of urban dwellers. The rise of experiential retail and design showrooms that offer immersive customer experiences is another promising avenue.

Growth Accelerators in the France Furniture Market Industry

Growth accelerators in the France furniture market are primarily driven by technological advancements in manufacturing, leading to increased efficiency and the creation of novel designs. The sustained interest in interior design and home personalization fuels a consistent demand for aesthetically pleasing and functional furniture. Strategic partnerships between furniture manufacturers and interior designers are creating unique product offerings that resonate with target demographics. The expanding e-commerce channel continues to democratize access to furniture, accelerating market reach and sales. Furthermore, government initiatives promoting sustainable production and circular economy principles are acting as catalysts for innovation and market transformation. The global appeal of French design also contributes to export growth, further accelerating the industry.

Key Players Shaping the France Furniture Market Market

- Roche Bobois SA

- La Chance

- Cappelin

- Herman Miller

- Nobilia

- Steelcase

- USM Modular Furniture

- Conforama

- Pierre Yovanovitch

- IKEA

- BoConcept

- Guatier Furniture

- POPUS EDITIONS

- Cassina

- Ligne Roset

- Cinna

Notable Milestones in France Furniture Market Sector

- February 2023: Ligne Roset, the French heritage furniture brand, returned to Houston, opening its new showroom. The company brought its iconic contemporary furnishings and accessories to an appointed showroom in BeDesign, making it the first French brand to join the sleek emporium of Italian brands. This signifies international expansion and renewed focus on high-end markets.

- May 2022: Steelcase Inc. agreed to buy Halcon, a Minnesota-based designer and manufacturer of precision-tailored wood furniture for the workplace. The acquisition expanded on earlier growth acquisitions by delivering a broad array of goods, including Viccarbe, Orangebox, AMQ, and Smith System acquisitions, bolstering a leading portfolio and offering additional choice and value to Steelcase consumers worldwide. This highlights strategic consolidation and portfolio enhancement within the global office furniture sector impacting the French market through increased competition and expanded product availability.

In-Depth France Furniture Market Market Outlook

The France furniture market is projected to experience sustained growth, propelled by a strong emphasis on sustainable design, smart home integration, and personalized consumer experiences. The "Made in France" label continues to hold significant value, driving demand for domestically produced, high-quality furniture. Continued investment in e-commerce and omnichannel strategies will be crucial for market players to enhance customer reach and engagement. The evolving needs of remote and hybrid workers will also present ongoing opportunities for innovative office and home office furniture solutions. Strategic acquisitions and collaborations are expected to further shape the competitive landscape, as companies seek to expand their product portfolios and market presence. The market's outlook is positive, driven by a blend of traditional craftsmanship and forward-thinking innovation, ensuring its continued relevance and appeal.

France Furniture Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

France Furniture Market Segmentation By Geography

- 1. France

France Furniture Market Regional Market Share

Geographic Coverage of France Furniture Market

France Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Water Conservation and Sustainability Drives The Market; Smart Integration with Home Systems Drives The Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation; Technical Difficulties Impedes Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Office Furniture is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. France

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roche Bobois SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 La Chance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cappelin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Herman Miller

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nobilia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Steelcase

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 USM Modular Furniture

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Conforama

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pierre Yovanovitch

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IKEA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BoConcept

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Guatier Furniture

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 POPUS EDITIONS - Products

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Cinna**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Cassina

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Ligne Roset

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Roche Bobois SA

List of Figures

- Figure 1: France Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: France Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: France Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: France Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: France Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: France Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: France Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: France Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: France Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: France Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: France Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: France Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: France Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: France Furniture Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Furniture Market?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the France Furniture Market?

Key companies in the market include Roche Bobois SA, La Chance, Cappelin, Herman Miller, Nobilia, Steelcase, USM Modular Furniture, Conforama, Pierre Yovanovitch, IKEA, BoConcept, Guatier Furniture, POPUS EDITIONS - Products, Cinna**List Not Exhaustive, Cassina, Ligne Roset.

3. What are the main segments of the France Furniture Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Water Conservation and Sustainability Drives The Market; Smart Integration with Home Systems Drives The Market.

6. What are the notable trends driving market growth?

Increasing Demand for Office Furniture is Driving the Market.

7. Are there any restraints impacting market growth?

High Cost of Installation; Technical Difficulties Impedes Market Growth.

8. Can you provide examples of recent developments in the market?

February 2023: Ligne Roset, the French heritage furniture brand, returned to Houston, opening its new showroom. The company brought its iconic contemporary furnishings and accessories to an appointed showroom in BeDesign, making it the first French brand to join the sleek emporium of Italian brands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Furniture Market?

To stay informed about further developments, trends, and reports in the France Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence